PC NMS October 2012 clean version CSSF 3010 pour VISA FINAL

PC NMS October 2012 clean version CSSF 3010 pour VISA FINAL

PC NMS October 2012 clean version CSSF 3010 pour VISA FINAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

more than 25% of such Sub-Fund’s assets are invested in debt claims (such Sub-Funds, hereafter "Affected<br />

Sub-Funds").<br />

The applicable withholding tax will be at a rate of 35% from 1 July, 2011 onwards.<br />

Consequently, if in relation to an Affected Sub-Fund a Luxembourg paying agent makes a payment of dividends<br />

or redemption proceeds directly to a Shareholder who is an individual resident or deemed resident for tax<br />

purposes in another EU Member State or certain of the above mentioned dependent or associated territories,<br />

such payment will, subject to the next paragraph below, be subject to withholding tax at the rate indicated<br />

above.<br />

No withholding tax will be withheld by the Luxembourg paying agent if the relevant individual either<br />

• has expressly authorised the paying agent to report information to the tax authorities in accordance with<br />

the provisions of the Law or<br />

• has provided the paying agent with a certificate drawn up in the format required by the Law by the<br />

competent authorities of his State of residence for tax purposes.<br />

The Fund reserves the right to reject any application for Shares if the information provided by any prospective<br />

investor does not meet the standards required by the Law as a result of the Directive.<br />

The foregoing is only a summary of the implications of the Directive and the Law, is based on the current<br />

interpretation thereof and does not purport to be complete in all respects. It does not constitute investment<br />

or tax advice and investors should therefore seek advice from their financial or tax adviser on the full<br />

implications for themselves of the Directive and the Law.<br />

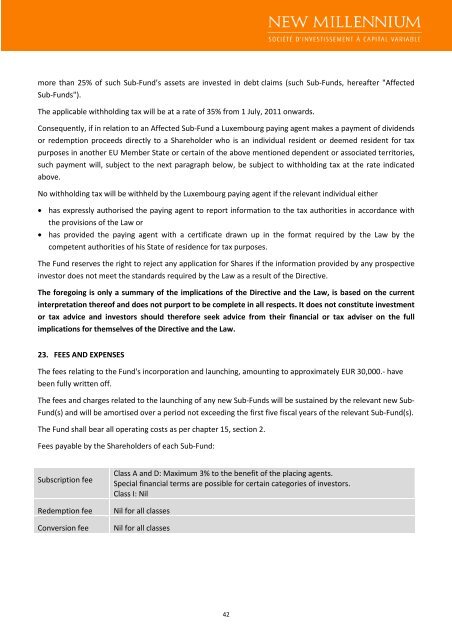

23. FEES AND EXPENSES<br />

The fees relating to the Fund's incorporation and launching, amounting to approximately EUR 30,000.- have<br />

been fully written off.<br />

The fees and charges related to the launching of any new Sub-Funds will be sustained by the relevant new Sub-<br />

Fund(s) and will be amortised over a period not exceeding the first five fiscal years of the relevant Sub-Fund(s).<br />

The Fund shall bear all operating costs as per chapter 15, section 2.<br />

Fees payable by the Shareholders of each Sub-Fund:<br />

Subscription fee<br />

Redemption fee Nil for all classes<br />

Con<strong>version</strong> fee Nil for all classes<br />

Class A and D: Maximum 3% to the benefit of the placing agents.<br />

Special financial terms are possible for certain categories of investors.<br />

Class I: Nil<br />

42