Dental (Indemnity or PPO) - ArlenGroup

Dental (Indemnity or PPO) - ArlenGroup

Dental (Indemnity or PPO) - ArlenGroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

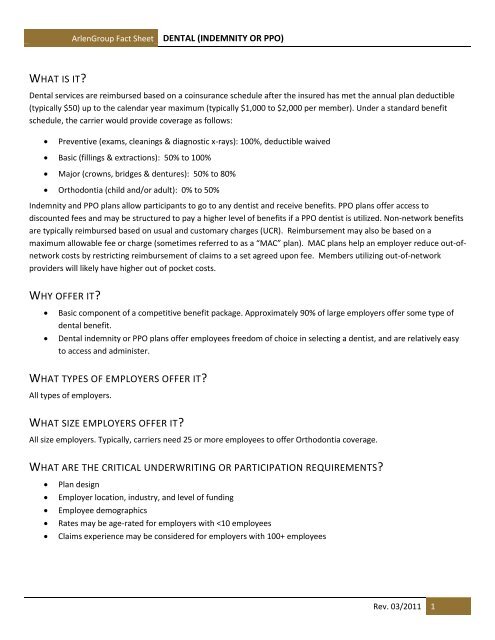

WHAT IS IT?<br />

<strong>ArlenGroup</strong> Fact Sheet DENTAL (INDEMNITY OR <strong>PPO</strong>)<br />

<strong>Dental</strong> services are reimbursed based on a coinsurance schedule after the insured has met the annual plan deductible<br />

(typically $50) up to the calendar year maximum (typically $1,000 to $2,000 per member). Under a standard benefit<br />

schedule, the carrier would provide coverage as follows:<br />

� Preventive (exams, cleanings & diagnostic x-rays): 100%, deductible waived<br />

� Basic (fillings & extractions): 50% to 100%<br />

� Maj<strong>or</strong> (crowns, bridges & dentures): 50% to 80%<br />

� Orthodontia (child and/<strong>or</strong> adult): 0% to 50%<br />

<strong>Indemnity</strong> and <strong>PPO</strong> plans allow participants to go to any dentist and receive benefits. <strong>PPO</strong> plans offer access to<br />

discounted fees and may be structured to pay a higher level of benefits if a <strong>PPO</strong> dentist is utilized. Non-netw<strong>or</strong>k benefits<br />

are typically reimbursed based on usual and customary charges (UCR). Reimbursement may also be based on a<br />

maximum allowable fee <strong>or</strong> charge (sometimes referred to as a “MAC” plan). MAC plans help an employer reduce out-ofnetw<strong>or</strong>k<br />

costs by restricting reimbursement of claims to a set agreed upon fee. Members utilizing out-of-netw<strong>or</strong>k<br />

providers will likely have higher out of pocket costs.<br />

WHY OFFER IT?<br />

� Basic component of a competitive benefit package. Approximately 90% of large employers offer some type of<br />

dental benefit.<br />

� <strong>Dental</strong> indemnity <strong>or</strong> <strong>PPO</strong> plans offer employees freedom of choice in selecting a dentist, and are relatively easy<br />

to access and administer.<br />

WHAT TYPES OF EMPLOYERS OFFER IT?<br />

All types of employers.<br />

WHAT SIZE EMPLOYERS OFFER IT?<br />

All size employers. Typically, carriers need 25 <strong>or</strong> m<strong>or</strong>e employees to offer Orthodontia coverage.<br />

WHAT ARE THE CRITICAL UNDERWRITING OR PARTICIPATION REQUIREMENTS?<br />

� Plan design<br />

� Employer location, industry, and level of funding<br />

� Employee demographics<br />

� Rates may be age-rated f<strong>or</strong> employers with

<strong>ArlenGroup</strong> Fact Sheet DENTAL (INDEMNITY OR <strong>PPO</strong>)<br />

WHAT'S NEW IN THIS AREA?<br />

<strong>Dental</strong> <strong>PPO</strong> netw<strong>or</strong>ks have grown considerably over the past few years and continue to develop. Many carriers now<br />

offer a "passive <strong>PPO</strong>" plan which offers employees access to netw<strong>or</strong>k discounts without plan design incentive to use<br />

these providers. Some carriers also offer “Freedom of Choice” <strong>or</strong> “Swing” plans in which employees select between an<br />

HMO and a <strong>PPO</strong> and may change their election each month. To combine the dental plan with a medical consumer<br />

directed plan, some providers also offer consumer directed dental plans.<br />

HOW MUCH DOES IT COST?<br />

Average 2010 monthly premium costs (source: Radf<strong>or</strong>d Benefit Survey)<br />

� <strong>Indemnity</strong>: $49 Employee only; $138 Family<br />

<strong>PPO</strong>: $47 Employee only; $156 Family<br />

INFORMATIONAL LINK(S)<br />

DENTAL PROVIDERS:<br />

� Delta <strong>Dental</strong><br />

� MetLife <strong>Dental</strong><br />

� Assurant <strong>Dental</strong><br />

� Guardian Life<br />

� American <strong>Dental</strong> Association<br />

� E-dental<br />

PROS AND CONS<br />

PROS<br />

CONS<br />

� Aids in retention and recruiting<br />

� Compared to dental HMOs, employees have greater flexibility and provider choice<br />

� <strong>Dental</strong> <strong>PPO</strong>s are typically m<strong>or</strong>e expensive than dental HMOs<br />

� “Swing plans” require additional administration and communication<br />

Rev. 03/2011 2

NOTES<br />

<strong>ArlenGroup</strong> Fact Sheet DENTAL (INDEMNITY OR <strong>PPO</strong>)<br />

When considering various dental plan proposals, employers should carefully review the covered benefits and plan<br />

provisions. Imp<strong>or</strong>tant details that often get overlooked are:<br />

� Does the plan impose a waiting period on Maj<strong>or</strong> and/<strong>or</strong> Orthodontic services?<br />

� Are there age limitations on particular services such as Orthodontia?<br />

� Are there late entrant restrictions?<br />

� Does the insurer allow f<strong>or</strong> an annual open enrollment period?<br />

� How are periodontics and endodontics covered (under Basic <strong>or</strong> Maj<strong>or</strong> services)?<br />

� At what percentage of usual and customary charges will out of netw<strong>or</strong>k services be reimbursed?<br />

This Fact Sheet is designed to provide a general overview of the benefit program, service, <strong>or</strong><br />

regulat<strong>or</strong>y act it describes. The inf<strong>or</strong>mation included in this document is not a substitute f<strong>or</strong> legal<br />

<strong>or</strong> professional opinion relative to a plan spons<strong>or</strong>’s particular fact pattern. Your <strong>ArlenGroup</strong><br />

consultant can answer m<strong>or</strong>e specific questions relative to its application f<strong>or</strong> your <strong>or</strong>ganization.<br />

Rev. 03/2011 3