NUS Investment Society Year Book 2018

Established in 2003, National University of Singapore Investment Society (“NUS Invest”) is the only conglomeration of student investment enthusiasts throughout the faculties of the university. NUS Invest is a student initiative that provides the key platform for NUS students and other student investment enthusiasts to unite and expand their financial and investment knowledge. NUS Invest aims to provide the key platform that facilitates exchange of knowledge and provide growth opportunities for the development of students dedicated to pursuing a career in the business world. Understanding that the finance and investment world is ever-evolving and that knowledge is boundless, it is the Society’s emphasis to nurture dedicated students who are determined to excel in this industry by empowering them with the relevant skills and knowledge valued by qualified professionals as well as providing the opportunities to build connections.

Established in 2003, National University of Singapore Investment Society (“NUS Invest”) is the only conglomeration of student investment enthusiasts throughout the faculties of the university. NUS Invest is a student initiative that provides the key platform for NUS students and other student investment enthusiasts to unite and expand their financial and investment knowledge.

NUS Invest aims to provide the key platform that facilitates exchange of knowledge and provide growth opportunities for the development of students dedicated to pursuing a career in the business world. Understanding that the finance and investment world is ever-evolving and that knowledge is boundless, it is the Society’s emphasis to nurture dedicated students who are determined to excel in this industry by empowering them with the relevant skills and knowledge valued by qualified professionals as well as providing the opportunities to build connections.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR/USD<br />

The dovesagainstthe hawks<br />

The othernoteworthy consideration isthe stance ofthe European CentralBank<br />

(ECB) over the coming weeks. Given their prior intentions to terminate the<br />

quantitative easing,most analysts and traders do not expect any deviation in<br />

termsofthe ECB’sprevailing monetarypolicy.Thisisfurthersupported byGermany’s<strong>2018</strong><br />

1stquarterinflation data which showed a modestYoY increase to<br />

1.2% .Forreference,core inflation wasstuck around 1% formostoflastyear.<br />

As inflation has remained wellbelow the ECB’s inflation targetofaround 2% ,<br />

the ECB does not need to tighten its accommodative monetary policy and the<br />

wind up ofthe QE isexpected to carryon asperschedule tillSeptember.Moreover,Mario<br />

Draghi,PresidentoftheECB,recentlysaid thattheoutlookon inflation<br />

rising was positive butthatthere were uncertainties which “warrantpatience,persistence<br />

and prudence”.Hence,rate hikes are also unlikely before<br />

the end of<strong>2018</strong>.<br />

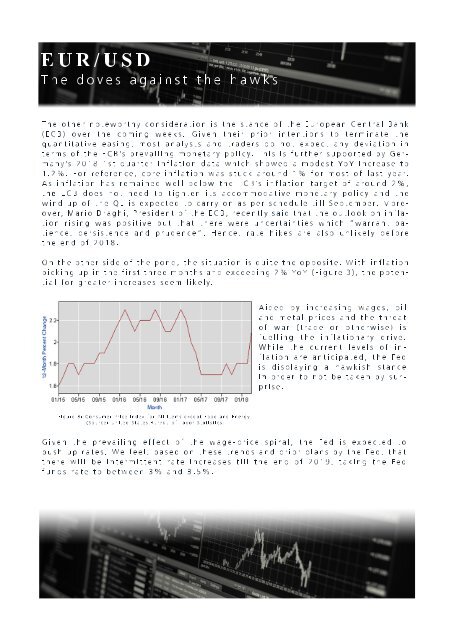

On theothersideofthepond,thesituation isquitetheopposite.W ith inflation<br />

picking up in thefirstthreemonthsand exceeding 2% YoY (Figure3),thepotentialforgreaterincreasesseem<br />

likely.<br />

Aided by increasing wages, oil<br />

and metalpricesand the threat<br />

of war (trade or otherwise) is<br />

fuelling the inflationary drive.<br />

W hile the current levels of inflation<br />

are anticipated,the Fed<br />

is displaying a hawkish stance<br />

inin orderto notbe taken bysurprise.<br />

Figure 3:ConsumerPrice IndexforAllItemsexceptFood and Energy<br />

(Source:United StatesBureau ofLaborStatistics)<br />

Given the prevailing effect of the wage-price spiral,the Fed is expected to<br />

push up rates.W e feel,based on these trendsand priorplansbythe Fed,that<br />

there willbe intermittentrate increases tillthe end of2019,taking the Fed<br />

fundsrate to between 3% and 3.5% .