FOCUS OREGON - V1 Issue 3

Oregon Professional Photographers Association quarterly magazine

Oregon Professional Photographers Association quarterly magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

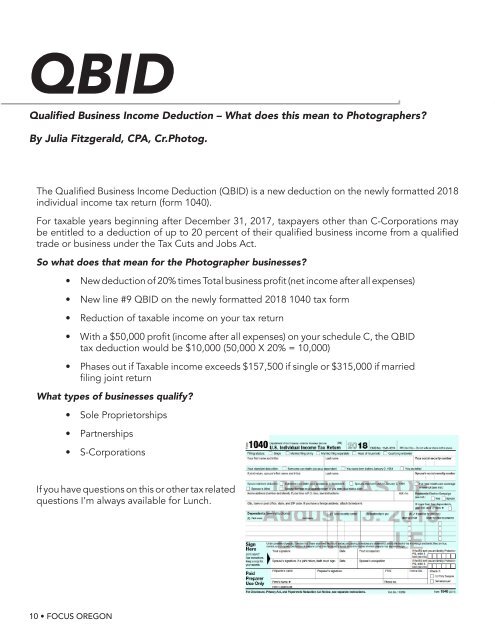

QBID<br />

FREE MONEY!<br />

Qualified Business Income Deduction – What does this mean to Photographers?<br />

By Julia Fitzgerald, CPA, Cr.Photog.<br />

The Qualified Business Income Deduction (QBID) is a new deduction on the newly formatted 2018<br />

individual income tax return (form 1040).<br />

For taxable years beginning after December 31, 2017, taxpayers other than C-Corporations may<br />

be entitled to a deduction of up to 20 percent of their qualified business income from a qualified<br />

trade or business under the Tax Cuts and Jobs Act.<br />

So what does that mean for the Photographer businesses?<br />

• New deduction of 20% times Total business profit (net income after all expenses)<br />

• New line #9 QBID on the newly formatted 2018 1040 tax form<br />

• Reduction of taxable income on your tax return<br />

D id you know that OPPA offers multiple scholarships to members who have been with us<br />

for at least 2 years? If you’ve been a member for 2+ years (must be two full years), you<br />

can go to the website and download the application and apply for one of our scholarships<br />

to attend any professional or artistic photography or business training. Thinking about going<br />

to IUSA this year but not feeling like you have the extra cash to make it happen? Or maybe<br />

WPPI is more your kind of thing. Or you’d like to visit our neighbors to the north and attend<br />

their conference this spring. Or go to a special workshop or Texas School? There are dozens—<br />

probably hundreds—of educational opportunities waiting for you and OPPA can help get you<br />

there.<br />

Last year, Brian Pasko won a $250 scholarship which he used to attend<br />

IUSA last January. “As a small business owner, it’s sometimes difficult to<br />

justify the cost of in-person photographic education. OPPA’s scholarship<br />

provided the incentive I needed to gain additional skills that are helping<br />

me to grow my business, “ says Pasko about how he used his scholarship.<br />

• With a $50,000 profit (income after all expenses) on your schedule C, the QBID<br />

tax deduction would be $10,000 (50,000 X 20% = 10,000)<br />

• Phases out if Taxable income exceeds $157,500 if single or $315,000 if married<br />

filing joint return<br />

What types of businesses qualify?<br />

• Sole Proprietorships<br />

Julie Countryman also won a $250 scholarship. She also chose to use<br />

her scholarship to attend IUSA. “As a first year member of PPA, I already<br />

had a ticket to attend IUSA for free, winning the scholarship made my<br />

decision easy, I had to attend IUSA. The knowledge that I gained at<br />

IUSA was amazing and motivational.”<br />

• Partnerships<br />

• S-Corporations<br />

If you have questions on this or other tax related<br />

questions I’m always available for Lunch.<br />

Applications for scholarships are available on our website: oregonppa.org/Scholarship.<br />

All judging is blind—the scholarship committee does not know who the applicants are to<br />

make it more equitable. Applications are due November 15th by 5pm.<br />

did you know?<br />

10 • <strong>FOCUS</strong> <strong>OREGON</strong><br />

FALL 2018 <strong>FOCUS</strong> <strong>OREGON</strong> • 11