Top 3 Lenders to Avail Personal Loan in Bangalore

Choose your personal loan from the top personal loan lenders in India. And if you are a Bangalorean, you have many options to choose from for your personal loan lender. Blog: https://www.wallstep.com/blog/10632/top-3-lenders-to-avail-personal-loan-in-bangalore/

Choose your personal loan from the top personal loan lenders in India. And if you are a Bangalorean, you have many options to choose from for your personal loan lender.

Blog: https://www.wallstep.com/blog/10632/top-3-lenders-to-avail-personal-loan-in-bangalore/

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

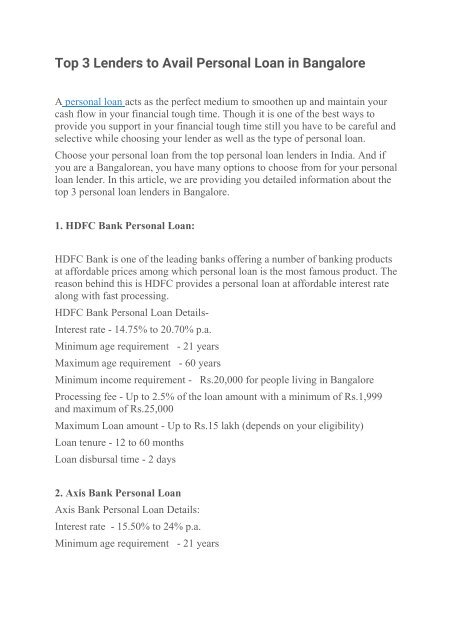

<strong>Top</strong> 3 <strong>Lenders</strong> <strong>to</strong> <strong>Avail</strong> <strong>Personal</strong> <strong>Loan</strong> <strong>in</strong> <strong>Bangalore</strong><br />

A personal loan acts as the perfect medium <strong>to</strong> smoothen up and ma<strong>in</strong>ta<strong>in</strong> your<br />

cash flow <strong>in</strong> your f<strong>in</strong>ancial <strong>to</strong>ugh time. Though it is one of the best ways <strong>to</strong><br />

provide you support <strong>in</strong> your f<strong>in</strong>ancial <strong>to</strong>ugh time still you have <strong>to</strong> be careful and<br />

selective while choos<strong>in</strong>g your lender as well as the type of personal loan.<br />

Choose your personal loan from the <strong>to</strong>p personal loan lenders <strong>in</strong> India. And if<br />

you are a <strong>Bangalore</strong>an, you have many options <strong>to</strong> choose from for your personal<br />

loan lender. In this article, we are provid<strong>in</strong>g you detailed <strong>in</strong>formation about the<br />

<strong>to</strong>p 3 personal loan lenders <strong>in</strong> <strong>Bangalore</strong>.<br />

1. HDFC Bank <strong>Personal</strong> <strong>Loan</strong>:<br />

HDFC Bank is one of the lead<strong>in</strong>g banks offer<strong>in</strong>g a number of bank<strong>in</strong>g products<br />

at affordable prices among which personal loan is the most famous product. The<br />

reason beh<strong>in</strong>d this is HDFC provides a personal loan at affordable <strong>in</strong>terest rate<br />

along with fast process<strong>in</strong>g.<br />

HDFC Bank <strong>Personal</strong> <strong>Loan</strong> Details-<br />

Interest rate - 14.75% <strong>to</strong> 20.70% p.a.<br />

M<strong>in</strong>imum age requirement - 21 years<br />

Maximum age requirement - 60 years<br />

M<strong>in</strong>imum <strong>in</strong>come requirement - Rs.20,000 for people liv<strong>in</strong>g <strong>in</strong> <strong>Bangalore</strong><br />

Process<strong>in</strong>g fee - Up <strong>to</strong> 2.5% of the loan amount with a m<strong>in</strong>imum of Rs.1,999<br />

and maximum of Rs.25,000<br />

Maximum <strong>Loan</strong> amount - Up <strong>to</strong> Rs.15 lakh (depends on your eligibility)<br />

<strong>Loan</strong> tenure - 12 <strong>to</strong> 60 months<br />

<strong>Loan</strong> disbursal time - 2 days<br />

2. Axis Bank <strong>Personal</strong> <strong>Loan</strong><br />

Axis Bank <strong>Personal</strong> <strong>Loan</strong> Details:<br />

Interest rate - 15.50% <strong>to</strong> 24% p.a.<br />

M<strong>in</strong>imum age requirement - 21 years

Maximum age requirement - 60 years<br />

M<strong>in</strong>imum <strong>in</strong>come requirement - Rs.15,000<br />

<strong>Loan</strong> amount - Rs.50,000 <strong>to</strong> Rs.15 lakh<br />

<strong>Loan</strong> tenure - 12 <strong>to</strong> 60 months<br />

3. Bajaj F<strong>in</strong>serv <strong>Personal</strong> <strong>Loan</strong>:<br />

Bajaj F<strong>in</strong>serv is a lead<strong>in</strong>g NBFC that offers a wide range of f<strong>in</strong>ancial products<br />

among which personal loan is the <strong>to</strong>p sell<strong>in</strong>g product.<br />

Interest rate - 13.99%<br />

M<strong>in</strong>imum age requirement<br />

- 25 years<br />

Maximum age requirement - 58 years<br />

M<strong>in</strong>imum <strong>in</strong>come requirement - Rs.40,000; Rs.35,000; and Rs.30,000<br />

<strong>Loan</strong> amount - Up <strong>to</strong> Rs.25 lakh<br />

<strong>Loan</strong> tenure - 12 <strong>to</strong> 60 months<br />

<strong>Loan</strong> disbursal time - 24 hours<br />

You can apply for a personal loan through these lenders onl<strong>in</strong>e. The process<strong>in</strong>g<br />

is completely only and the amount disbursal is very fast.<br />

Tips for choos<strong>in</strong>g the best personal loan for you<br />

• Check your credit report before apply<strong>in</strong>g for a personal loan.<br />

• Make your budget and stick <strong>to</strong> it for a better f<strong>in</strong>ancial life.<br />

• Borrow as much you need, don't be greedy.<br />

• Have knowledge of APR(Annual Percentage Rate) i.e. How much the loan<br />

would cost <strong>in</strong> <strong>in</strong>terest per year.<br />

• Check for all the repayment options available and opt for the best-suited one<br />

for you.<br />

• Know the risks <strong>in</strong>volved <strong>in</strong> unsecured loans.<br />

• Always borrow accord<strong>in</strong>g <strong>to</strong> your repayment capacity.