Automotive Telematics Market: Size, Share, Growth Drivers, Trends & Challenges

According to Goldstein Research global automotive telematics market report; about 28% of new car customers prioritize car connectivity features over other conventional car features such as engine power or fuel efficiency, and 13%in developed countries would not even buy a car that is not connected to the internet today.“Global Automotive Telematics Market Outlook, 2016-2024” covers the present ground scenario and future opportunity prospects for the market players to analyze the target markets across the globe.

According to Goldstein Research global automotive telematics market report; about 28% of new car customers prioritize car connectivity features over other conventional car features such as engine power or fuel efficiency, and 13%in developed countries would not even buy a car that is not connected to the internet today.“Global Automotive Telematics Market Outlook, 2016-2024” covers the present ground scenario and future opportunity prospects for the market players to analyze the target markets across the globe.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Copyright All Rights Reserved, Goldstein Research www.goldsteinresearch.com<br />

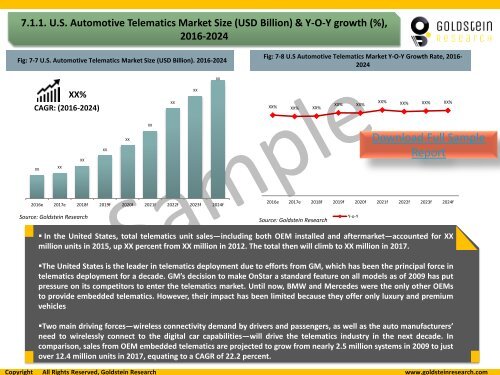

7.1.1. U.S. <strong>Automotive</strong> <strong>Telematics</strong> <strong>Market</strong> <strong>Size</strong> (USD Billion) & Y-O-Y growth (%),<br />

2016-2024<br />

Fig: 7-7 U.S. <strong>Automotive</strong> <strong>Telematics</strong> <strong>Market</strong> <strong>Size</strong> (USD Billion). 2016-2024<br />

Fig: 7-8 U.S <strong>Automotive</strong> <strong>Telematics</strong> <strong>Market</strong> Y-O-Y <strong>Growth</strong> Rate, 2016-<br />

2024<br />

XX<br />

XX%<br />

CAGR: (2016-2024)<br />

XX<br />

XX<br />

XX% XX% XX%<br />

XX%<br />

XX%<br />

XX% XX% XX% XX%<br />

XX<br />

XX<br />

XX<br />

XX<br />

Download Full Sample<br />

Report<br />

XX<br />

XX<br />

2016e 2017e 2018f 2019f 2020f 2021f 2022f 2023f 2024f<br />

2016e 2017e 2018f 2019f 2020f 2021f 2022f 2023f 2024f<br />

Source: Goldstein Research<br />

Source: Goldstein Research<br />

Y-o-Y<br />

• In the United States, total telematics unit sales—including both OEM installed and aftermarket—accounted for XX<br />

million units in 2015, up XX percent from XX million in 2012. The total then will climb to XX million in 2017.<br />

•The United States is the leader in telematics deployment due to efforts from GM, which has been the principal force in<br />

telematics deployment for a decade. GM’s decision to make OnStar a standard feature on all models as of 2009 has put<br />

pressure on its competitors to enter the telematics market. Until now, BMW and Mercedes were the only other OEMs<br />

to provide embedded telematics. However, their impact has been limited because they offer only luxury and premium<br />

vehicles<br />

•Two main driving forces—wireless connectivity demand by drivers and passengers, as well as the auto manufacturers’<br />

need to wirelessly connect to the digital car capabilities—will drive the telematics industry in the next decade. In<br />

comparison, sales from OEM embedded telematics are projected to grow from nearly 2.5 million systems in 2009 to just<br />

over 12.4 million units in 2017, equating to a CAGR of 22.2 percent.