Debt Reduction & Debt Relief

Debt Reduction & Debt Relief

Debt Reduction & Debt Relief

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Criticism<br />

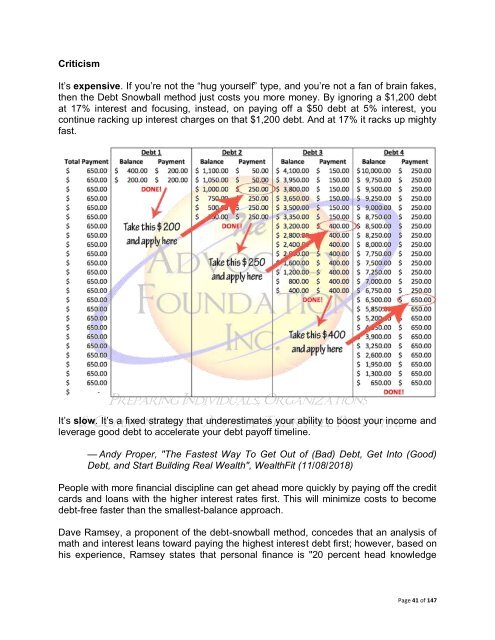

It’s expensive. If you’re not the “hug yourself” type, and you’re not a fan of brain fakes,<br />

then the <strong>Debt</strong> Snowball method just costs you more money. By ignoring a $1,200 debt<br />

at 17% interest and focusing, instead, on paying off a $50 debt at 5% interest, you<br />

continue racking up interest charges on that $1,200 debt. And at 17% it racks up mighty<br />

fast.<br />

It’s slow. It’s a fixed strategy that underestimates your ability to boost your income and<br />

leverage good debt to accelerate your debt payoff timeline.<br />

— Andy Proper, "The Fastest Way To Get Out of (Bad) <strong>Debt</strong>, Get Into (Good)<br />

<strong>Debt</strong>, and Start Building Real Wealth", WealthFit (11/08/2018)<br />

People with more financial discipline can get ahead more quickly by paying off the credit<br />

cards and loans with the higher interest rates first. This will minimize costs to become<br />

debt-free faster than the smallest-balance approach.<br />

Dave Ramsey, a proponent of the debt-snowball method, concedes that an analysis of<br />

math and interest leans toward paying the highest interest debt first; however, based on<br />

his experience, Ramsey states that personal finance is "20 percent head knowledge<br />

Page 41 of 147