RUSH June 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>RUSH</strong><br />

tax reform law 101:<br />

all you need to know<br />

President Rodrigo Duterte signed into<br />

law the Tax Reform for Acceleration and<br />

Inclusion (TRAIN) on December 19, 2017.<br />

The tax reform, which took effect at the<br />

start of <strong>2018</strong>, is expected to generate almost P150<br />

billion in revenues, which will be used for various<br />

infrastructure projects and social services.<br />

Among the implemented revenue enhancing<br />

measures were adjusting the excise taxes on fuel and<br />

automobiles and the broadening of the value-added<br />

tax base. Particularly for the oil and gas industry, the<br />

new law also included the tax administration reform<br />

called the mandatory fuel marking program.<br />

Slated to start within five years of the<br />

implementation of TRAIN, the fuel marking program<br />

calls for all petroleum products imported to or<br />

manufactured in the Philippines, to carry an official<br />

fuel marking technology that will ensure the<br />

payment of duties and taxes laid out in the TRAIN<br />

law. The program aims to curb oil smuggling,<br />

which is a rampant problem in the Philippines. The<br />

Department of Finance (DOF) expects the system to<br />

be in place by the second half of <strong>2018</strong>.<br />

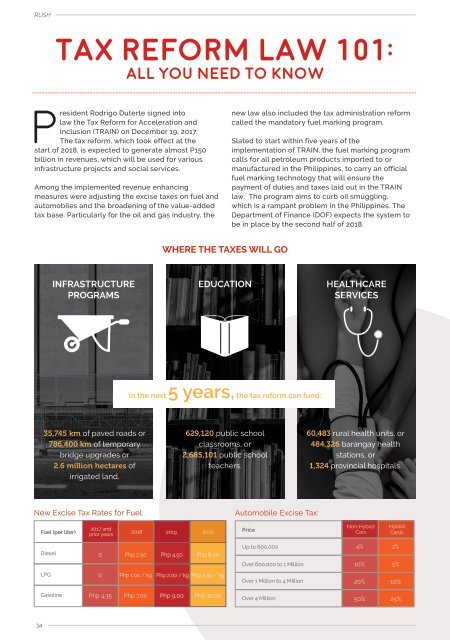

WHERE THE TAXES WILL GO<br />

INFRASTRUCTURE<br />

PROGRAMS<br />

EDUCATION<br />

HEALTHCARE<br />

SERVICES<br />

In the next 5 years, the tax reform can fund:<br />

35,745 km of paved roads or<br />

786,400 km of temporary<br />

bridge upgrades or<br />

2.6 million hectares of<br />

irrigated land.<br />

629,120 public school<br />

classrooms, or<br />

2,685,101 public school<br />

teachers.<br />

60,483 rural health units, or<br />

484,326 barangay health<br />

stations, or<br />

1,324 provincial hospitals.<br />

New Excise Tax Rates for Fuel:<br />

Automobile Excise Tax:<br />

Fuel (per liter)<br />

2017 and<br />

prior years<br />

<strong>2018</strong> 2019 2020<br />

Price<br />

Non-Hybrid<br />

Cars<br />

Hybrid<br />

Cards<br />

Diesel<br />

0<br />

Php 2.50<br />

Php 4.50 Php 6.00<br />

Up to 600,000<br />

Over 600,000 to 1 Million<br />

4%<br />

10%<br />

2%<br />

5%<br />

LPG<br />

0<br />

Php 1.00 / kg<br />

Php 2.00 / kg Php 3.00 / kg<br />

Over 1 Million to 4 Million<br />

20%<br />

10%<br />

Gasoline<br />

Php 4.35<br />

Php 7.00 Php 9.00 Php 10.00<br />

Over 4 Million 50% 25%<br />

34