2019CorporateGovernance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Corporate Governance Master Class<br />

For Board & Senior Management<br />

21 - 22 February, 2019 | Hotel des Mille Collines | Kigali, Rwanda<br />

Program Descriptors<br />

Corporate Governance Program<br />

IFC Advisory Services, Rwanda

International Finance Corporation (IFC) Advisory Services East Africa Corporate Governance Program<br />

2<br />

Background<br />

IFC AS Corporate Governance (CG) Program goal<br />

is to improve corporate governance in the East<br />

Africa region. Towards this goal, the program has<br />

the following objectives: (i) build the business case<br />

for good corporate governance among companies<br />

and companies; (ii) assist investors in improving<br />

corporate governance practices of investee<br />

companies; (iii) segment the market and focus on<br />

small and medium enterprises and Family-Owned<br />

Enterprises; (iv) further develop and foster training<br />

capacity; and (v) help corporate governance<br />

institutes/institutes of directors on their path to<br />

viability.<br />

International Finance Corporations (IFC) and the<br />

Institute of Certified Public Accountants of Rwanda<br />

(ICPAR) have jointly organized a CG Workshop for<br />

companies to strengthen the expertise and skills of<br />

directors and senior management in terms of good<br />

corporate governance in the country. It is intended<br />

that this training will give insights to the business<br />

society and helping board members and senior<br />

management of companies to understand corporate<br />

governance and its value for their institutions.<br />

Corporate Governance is essential in the financial<br />

sector to instill good risk management practices<br />

and controls. In turn this will improve the quality of<br />

the business and management structures, which will<br />

increase decision making capacity and strengthen<br />

operational efficiency that are prerequisites to<br />

an industry in a certain country to becoming<br />

competitive in the global industry.<br />

Program Overview<br />

The Corporate Governance Workshop is being<br />

offered by IFC through carefully selected<br />

institutions in the East Africa region. The Training<br />

program will educate companies on specific issuesrelated<br />

Corporate Governance topics, including risk<br />

management, compliance and audit, to help them<br />

improve their Corporate Governance practices and<br />

strengthen their control environments. The program<br />

will cover the principles enhancing CG for companies,<br />

including International Corporate Governance<br />

trends and developments, integrating good CG<br />

practices in companies, assigning responsibilities<br />

within an institution, building a high-performance<br />

board, and director duties and liabilities.

Also, the program will tackle the effective control<br />

and management environment of the company,<br />

particularly focusing on the audit committee,<br />

risk procedure and compliance requirements, the<br />

importance of a strong internal audit function,<br />

purpose and function of the audit committee,<br />

insider lending, conflict of interests, good Corporate<br />

Governance practices coming from a stronger<br />

regulated and bureaucratic environment, and the<br />

role of the supervisors.<br />

Who Should Attend<br />

The CG Workshop is designed for board chairs,<br />

board members, directors, senior executive officers,<br />

and top management of companies and financial<br />

institutions in Rwanda.<br />

Program Structure<br />

The whole program consists of eleven related<br />

modules to be delivered in two days training period.<br />

This program will also feature a panel discussion and<br />

be delivered in English.<br />

Module Descriptors<br />

PART I<br />

Introduction to<br />

Corporate Governance<br />

PART II<br />

Global Financial Crisis<br />

- Business case for CG<br />

PART III<br />

Building an effective<br />

and efficient Board<br />

PART IV<br />

CG Regulatory<br />

overview<br />

PART V<br />

Risk Giovernance and<br />

Control Environment<br />

PART VI<br />

Board Committees<br />

PART VII<br />

Minority shareholdres<br />

protection<br />

PART VIII<br />

Communication,<br />

disclosure & transparency<br />

PART IX<br />

Looking behind the<br />

numbers<br />

PART X<br />

Integration<br />

Corporate Governance Program Descriptors www.ifc.org/corporategovernance<br />

3

International Finance Corporation (IFC) Advisory Services East Africa Corporate Governance Program<br />

Agenda<br />

MODULE 1: INTRODUCTION TO CORPORATE GOVERNANCE<br />

09:45 - 11:00 am<br />

Purpose: To explain the concept of and business case for good corporate governance for firms.<br />

Outline:<br />

• Introduction to Corporate Governance<br />

• Unique nature of governance at<br />

companies<br />

• Regulatory views on Corporate<br />

governance<br />

• Corporate governance practices in<br />

Rwanda<br />

• Recipe for the implementation of a<br />

Corporate Governance program<br />

• Troubleshooting guide for directors<br />

ARRIVAL AND REGISTRATION<br />

08:00 – 09:00 am<br />

WELCOME REMARKS<br />

09:00 – 09:45 am<br />

Outcomes:<br />

• Understand the unique nature of Governance at<br />

companies<br />

• Understand the regulatory views on Corporate<br />

Governance practices at companies<br />

• Agree that corporate governance can add value<br />

• Understand the main steps to be undertaken to<br />

implement a Corporate Governance program at a<br />

company<br />

• See some of the critical issues you may face along the<br />

way<br />

Coffee Break 11:00 - 11:15 am<br />

4

MODULE 2:GLOBAL FINANCIAL CRISIS AND IMPLICATIONS – BUSINESS CASE FOR CORPORATE<br />

GOVERNANCE<br />

11:15 am – 12:30 pm<br />

Purpose: To explain the reasons for the financial crisis and the lessons learnt in Corporate Governance and<br />

Risk Management<br />

Outline:<br />

• What went wrong? – Reasons for the<br />

global financial crisis<br />

• Response to the crisis – Regulatory and<br />

Industry response<br />

• Crisis as a lesson in Corporate<br />

governance – Lessons on the Role<br />

of the Board/Senior management,<br />

Remuneration, Risk disclosures and Role<br />

of Shareholders<br />

• Crisis as a lesson in risk management<br />

Outcomes:<br />

• Understand the role played by the regulators, companies,<br />

rating agencies and funds in the crisis<br />

• Understand both the industry and regulatory responses<br />

to the financial crisis<br />

• Derive Corporate and Risk Governance lessons from the<br />

crisis<br />

• Derive lessons on risk management from the crisis<br />

Lunch Break 12:30 – 01:30 pm<br />

MODULE 3: THE ROLE OF REGULATORS AND FIRMS TO BUILD SUSTAINABLE PRVATE SECTORS<br />

01:30 – 02:45 pm<br />

Purpose: To explain some of the key areas under local regulations, provide a regulatory overview of<br />

Corporate Governance and address regulatory compliance<br />

Corporate Governance Program Descriptors www.ifc.org/corporategovernance<br />

5

International Finance Corporation (IFC) Advisory Services East Africa Corporate Governance Program<br />

6<br />

Outline:<br />

• Regulatory overview of Corporate<br />

governance<br />

• Regulatory compliance – Approach and<br />

roles and responsibilities<br />

Outcomes:<br />

• Understand the key disclosure requirements<br />

• Understand more about the regulation and how it affects<br />

corporate governance<br />

• Understand regulatory compliance at a company, the<br />

approach and corresponding roles and responsibilities<br />

Coffee Break 02:45 – 03:00 pm<br />

MODULE 4: BUILDING AN EFFECTIVE AND EFFICIENT BOARD OF DIRECTORS<br />

03:00 – 04:30 pm<br />

Purpose: To make boards more effective and dynamic<br />

Outline:<br />

• Introduction: Understanding the role of<br />

the Board<br />

• Understanding the Board composition<br />

– Structure, Operating models, and<br />

Functionaries<br />

• Understanding the Board composition<br />

• ‘Fit and proper’ criteria<br />

• Roles and responsibilities of key Board<br />

members<br />

• Board level committees and composition<br />

• Board performance assessment<br />

• Other vital issues – Board size, meeting<br />

frequency, quorum and remuneration<br />

Outcomes:<br />

• Understand what the board’s responsibilities are<br />

• Understand the composition of the Board – Key<br />

functionaries, Director independence, Chairman/CEO<br />

separation<br />

• Understand the structure of the board committees and<br />

their composition<br />

• Understand the key requirements for a Board member –<br />

Qualifications, time commitment<br />

• Understand how to measure directors’ effectiveness/<br />

success criteria<br />

• Understand some of the problems along the way<br />

Day-1 Evaluation; End of Day-1 Program 04:30 - 04:45 pm

Arrival and Registration<br />

08:00 – 09:00 am<br />

MODULE 6: SETTING UP BOARD AUDIT COMMITTEE – ROLES AND RESPONSIBILITIES<br />

09:00 – 10:15 am<br />

Purpose: To explain the importance and the functions of the audit committee in supporting Corporate<br />

Governance<br />

Outline:<br />

• Audit committee – Introduction and composition<br />

• Where does it fit in the corporate governance<br />

picture?<br />

• Regulatory views on the Audit committee<br />

• Roles and responsibilities of the Audit committee<br />

• Implementation: Building an effective audit<br />

committee<br />

• Establishing Audit committee interactions<br />

• Troubleshooting guide for board members<br />

Outcomes:<br />

• Understand the importance of the<br />

audit committee’s role in corporate<br />

governance<br />

• Understand the organization and<br />

composition of the Audit committee<br />

• Appreciate and understand how<br />

internal audit contributes to Corporate<br />

Governance<br />

• Understand the role Compliance and<br />

External audit play in the Internal<br />

control architecture<br />

• Understand its relationship with internal<br />

and external audit, risk management<br />

and compliance<br />

Corporate Governance Program Descriptors www.ifc.org/corporategovernance<br />

Coffee Break 10:15 - 10:30 am<br />

7

International Finance Corporation (IFC) Advisory Services East Africa Corporate Governance Program<br />

MODULE 8: COMMUNICATION, DISCLOSURE AND TRANSAPRENCY<br />

10:30am – 12:00noon<br />

Purpose: To explain the importance of communication, transparency and disclosure in delivering and<br />

demonstrating sound Corporate Governance<br />

Outline:<br />

• Communication and Corporate governance – Where<br />

does it fit?<br />

• Disclosure and Transparency – Regulatory views<br />

• Internal communication at listed companies –<br />

Vehicles, Stakeholders and Roles and responsibilities<br />

• External communication at listed companies –<br />

Vehicles, Stakeholders and Roles and responsibilities<br />

• Financial information communication<br />

• Disclosure requirements at Indonesian capital<br />

market<br />

• Troubleshooting guide for board members<br />

Outcomes:<br />

Lunch Break 12:00 – 01:00 pm<br />

• Understand the importance managing<br />

internal and external communication<br />

• Understand the internal and external<br />

interactions of a company<br />

• The need for experts to manage<br />

dialogue with press, markets and<br />

investors<br />

• Understand the regulatory views on<br />

disclosure and transparency<br />

8

MODULE 5: RISK GOVERNANCE AND CONTROL ENVIRONMENT FOR COMPANIES<br />

01:00 – 02:30pm<br />

Purpose:To explain the importance and role of management control environment in supporting Corporate<br />

Governance<br />

Outline:<br />

• Introduction to risk governance and the 3 lines of<br />

defense framework<br />

• Risk governance in Indonesia<br />

• Recipe for the development of a risk governance<br />

framework at a company<br />

• Role of the CRO<br />

• Risk management related roles and responsibilities<br />

• Introduction to Management control<br />

• Key elements of management control – Internal audit,<br />

External audit, Compliance, Internal controls<br />

• Role of ‘Internal Controls’ at a company – Key<br />

components of Internal controls<br />

• Internal audit and Corporate governance<br />

• Introduction to the Compliance function<br />

• External audit<br />

• Planning and monitoring function<br />

Outcomes:<br />

Coffee Break 02:30 – 02:45 pm<br />

• Understand the key functionaries of a<br />

company’s risk governance framework<br />

• Understand the considerations in<br />

developing the risk governance structure<br />

• Understand the implementation steps<br />

• Understand the key concepts involved in<br />

the 3 lines of defense framework<br />

• Understand the role of the CRO and the<br />

reporting lines of the CRO<br />

• Understand risk management related roles<br />

and responsibilities<br />

• Understand the key elements of<br />

management control and their role in<br />

Corporate governance<br />

• Understand the components of internal<br />

controls and its framework<br />

• Understand the role Risk management<br />

plays in Internal controls<br />

Corporate Governance Program Descriptors www.ifc.org/corporategovernance<br />

9

International Finance Corporation (IFC) Advisory Services East Africa Corporate Governance Program<br />

MODULE 7: MINORITY SHAREHOLDERS PROTECTION<br />

02:45 – 04:00 pm<br />

Purpose:To help directors understand the rights of shareholders, particularly minority shareholders<br />

Outline:<br />

• Introduction to shareholders’ rights and<br />

responsibilities<br />

• Mechanism of organizing General Meeting of<br />

Shareholders<br />

• Company information that needs to be shared to all<br />

shareholders<br />

• Shareholder practices and interaction<br />

• Troubleshooting guide for board members<br />

Outcomes:<br />

An Overview of IFC CG Excellence Program in Rwanda<br />

04:00 – 04:30 pm<br />

Day-2 Evaluation; Closing Remarks<br />

End of the Program<br />

04:30 - 05:00 pm<br />

• Understand how to setup proper<br />

shareholder practices in a publicly-listed<br />

company<br />

• Understand the rights and responsibilities<br />

of shareholders<br />

• Understand best practices in organizing<br />

General Meeting of Shareholders<br />

• Understand the stakeholders’ interests<br />

10

Training Methodology<br />

Instructors: IFC experts on corporate governance issues will deliver the course in an interactive manner to<br />

allow and encourage peer discussions among the participants. Course materials will comprise of PowerPoint<br />

presentations, background materials (e.g. articles and papers), case studies and global best practices.<br />

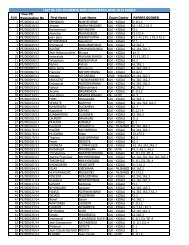

Your Investment:<br />

Your investment: Rwf. 200,000 for members and Rwf. 230,000 for Non-members (VAT inclusive). Fees are<br />

payable to Bank of Kigali A/C No: 00040-0335616-29 or Ecobank A/C No: 110-04413101-72.<br />

Save a 5 % early bird discount by paying by or before 13 th February 2019.<br />

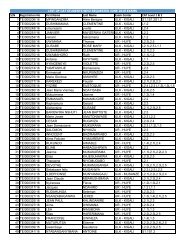

Certificates<br />

Certificates of attendance will be awarded to all participants who attend and participate in all sessions of the<br />

workshop. For members, Fourteen (14) CPD – Continuous Professional Development hours will be awarded as<br />

per the IFAC requirements.<br />

For further inquiries please contact:<br />

Sunday.kalisa@icparwanda.com/ yahya.hassani@icparwanda.com<br />

or call on +250 788 302 441 | +250 788 306 881.<br />

Corporate Governance Program Descriptors www.ifc.org/corporategovernance<br />

11

For more information<br />

www.icparwanda.com