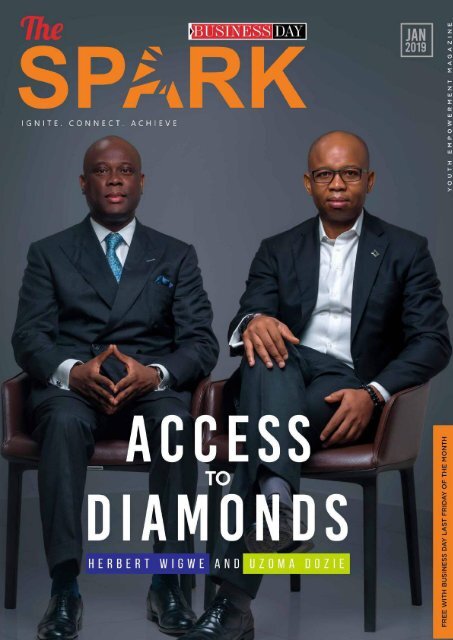

Access To Diamonds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

@thesparkng<br />

01

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

02<br />

@thesparkng

Published By<br />

From Our<br />

Guest Editor<br />

Stronger <strong>To</strong>gether<br />

Publisher<br />

Frank Aigbogun<br />

Head of Business Development & Client Services<br />

Ikenna Onuorah<br />

Head of Marketing<br />

Akintunde Marinho<br />

Head of Business & Growth<br />

Oghenevwoke Ighure<br />

Editor<br />

Patrick Atuanya<br />

Head of Operations<br />

Fabian Akagha<br />

Head of Advertising & Sales<br />

Rerhe Idonije<br />

Guest Editor<br />

Lehlé Baldé<br />

Managing Editor<br />

Ogechukwu Modebelu<br />

Creative Director<br />

Segun Adekoye<br />

Happy New Year to all the talented The Spark readers. I’m delighted to be guest editor<br />

for this edition which focuses on mergers, strategic partnerships and financial inclusion.<br />

With my profession in strategy and partnerships at BusinessDay, I am interested in<br />

seeing how the Diamond Bank and <strong>Access</strong> Bank merger would be communicated and received<br />

by the Nigerian public and other banking stakeholders. You can flip the pages to find out more<br />

about the strategy behind the most talked about merger of 2019.<br />

Similarly, as the anchor of the first radio show focused on financial inclusion in Africa - Financial<br />

Inclusion - <strong>To</strong>day, I’m happy to see people taking interest in the possibilities of financial and<br />

economic inclusion for Nigeria.<br />

On the cover, we have Herbert Wigwe and Uzoma Dozie. In this edition you will get to know<br />

these two men who represent the true African business excellence and discover how these<br />

powerhouses have merged two of Nigeria’s most successful banking institutions to create one<br />

banking powerhouse. This strategic move demonstrates that partnership is not only possible<br />

but often necessary.<br />

In my work, I aspire to use the stretchability of the media to shed light on important issues that<br />

affect the masses in Africa. For we cannot boast about living in Africa’s largest economy when<br />

so many people are left behind in the socio-economic sphere.<br />

As young people, we are more powerful than we think. Once we begin to realize the power of<br />

our voices, monumental things will happen.<br />

As the 2019 elections draw near, it is vital that all candidates think about implementation<br />

strategies for economic and financial inclusion. Conversations around wealth creation and<br />

economic prosperity become mundane, when as of December 2018, 36.8% of the Nigerian<br />

population is still financially excluded.<br />

I believe that numerous stakeholders would have to work in concert in order to reach the 80%<br />

Financial Inclusion goal by the year 2020. There is a long way to go but change is possible and<br />

ongoing. The theme for me this year is ‘all lives have equal value’, and I hope you take that with<br />

you everywhere you go in 2019.<br />

Have a great year ahead!<br />

God bless.<br />

#<strong>To</strong>getherWeCan #BeTheSpark<br />

Lehlé Baldé<br />

Art director<br />

Kola Oshalusi<br />

Advert Manager<br />

Adeola Ajewole<br />

Advertising<br />

Linda Ochugbua<br />

ED, Strategy & Planning<br />

Bankole Jamgbadi<br />

ED, Innovation & Marketing<br />

Damilola Oyewusi<br />

ED, Growth<br />

Lanre Solarin<br />

Chief People Officer<br />

Lehlé Baldé<br />

Associate Editor<br />

John Iyoha<br />

Ass. Managing Editor<br />

Ayandola Ayanleke<br />

Specialist Editor<br />

Lucy Onuorah<br />

Digital Communications<br />

Opeolu Adeyemi<br />

CSR Administrator<br />

Precious Aligba<br />

Design | Illustration<br />

Sodeinde Oladapo<br />

In-house Graphics<br />

Ralph Ifie<br />

In-house Photographer<br />

James Otihi<br />

IT Team<br />

Andre Udegbe<br />

Michael Aworoghene<br />

Address:<br />

The Spark: 21, Military Street,<br />

Off King George V Street, Lagos Island.<br />

BusinessDay Media Ltd: 6 Point Rd, Apapa, Lagos.<br />

Enquiries:<br />

+2348123183458, +2347030951270, +2348182799268<br />

Email: info@thesparkng.com Website: www.thesparkng.com<br />

Social media:<br />

@thesparkng

CONTRIBUTORS<br />

Oluwatosin<br />

Olaseinde<br />

Joseph<br />

Iruafemi<br />

Aderinsola<br />

Fagbure<br />

Oluwatosin Olaseinde is a chartered accountant with over 9<br />

years of experience spanning across accounting, audit, financial<br />

management and taxation. She is the Founder/CEO of Money<br />

Africa, a platform that enhances financial literacy and wealth<br />

management coaching. Prior to Money Africa, Oluwatosin was<br />

a commercial finance manager at British American <strong>To</strong>bacco,<br />

providing commercial & financial advice on capital investment<br />

and managing marketing investment budget in the 14 different<br />

markets across West Africa.<br />

Joseph Iruafemi is enthusiastic about using technology to<br />

improve the efficiency of people and businesses. He sits<br />

well at the intersection of business and technology. He is<br />

comfortable at translating business strategies/ideas into<br />

software products or finding the business in a software<br />

product. He is the founder of Now Showing (www.<br />

nowshowing.com.ng), a digital technology startup focused on<br />

enhancing the experience of moviegoers. He is also founder<br />

of Kobotrack, an application that helps people manage their<br />

money.<br />

Aderinsola Fagbure is a Corporate lawyer with special interest<br />

in corporate governance. She is a Senior Associate in the<br />

Transaction and Business Support Practice of Esher and<br />

Makarios. She is a graduate of Igbinedion University and<br />

has a Master’s Degree in Corporate Law from University<br />

College London. She is a member of the African Society of<br />

Crowdfunding. Her column “in black and white “which is<br />

published in Thisday Law discusses innovations in corporate<br />

governance and finance. Derin is passionate about advising<br />

small businesses with a view to ensuring that they outlive<br />

their founders. An active bar member, she currently serves as<br />

the Chairman of the Young Lawyers’ Forum of the NBA Lagos<br />

Branch.<br />

Lanre<br />

Olusola<br />

Lai<br />

Labode<br />

Tunde<br />

Kehinde<br />

Lanre Olusola, also known as The Catalyst, is recognized as a<br />

premier Life, Mind, Emotions and Behavioral Change Coach<br />

working with individuals and organizations to transition from<br />

where they are, to where they desire and are designed to be.<br />

Connect with The Catalyst on social media @lanreolusola for a<br />

more transformational post focusing on the critical areas of the<br />

human life. Contact: info@olcang.com // 08077077000<br />

Lai Labode is the Founder and Managing Director of CeLD<br />

innovations Limited. Lai is a Principal partner at FisshBone &<br />

LESTR Limited, a technology and business consulting firm. Lai<br />

is a business logic expert with a very extensive knowledge<br />

of the African emerging markets. Lai studied Corporate<br />

Restructuring, Mergers and Acquisitions from Harvard<br />

Business School in Boston, USA , Strategic Innovation from<br />

the prestigious Imperial College , London and holds a degree<br />

in Accounting and diploma in Law from University of Abuja,<br />

Nigeria. He is happily married to the love of his life Ijeoma,<br />

they are blessed with two wonderful boys, Salt & Einstein and<br />

an angel named Rhodium.<br />

Tunde Kehinde is the Co-Founder Lidya (www.lidya.co), the<br />

future of finance for small businesses in frontier markets.<br />

Tunde is a seasoned emerging markets entrepreneur who<br />

Co-Founded, Africa Courier Express, the leading last-mile<br />

eCommerce delivery company in Nigeria and Jumia Nigeria,<br />

the leading eCommerce platform in Nigeria. Tunde has prior<br />

experience as a business development executive with Diageo<br />

in London and as an Investment Banking professional with<br />

Wachovia Securities in North Carolina and New York City. Tunde<br />

holds a degree in Finance with honors from Howard University<br />

and an MBA Harvard Business School.<br />

Mayowa<br />

Owolabi<br />

Eigbe-<br />

Akindele<br />

Edmund<br />

Olotu<br />

Mayowa Owolabi is a serial entrepreneur with a passion for<br />

technology and business development. He is a graduate of<br />

Electronics and Electrical Engineering from the prestigious<br />

Obafemi Awolowo University, Ile-Ife and He has over 16 years<br />

experience in technology business development and the<br />

use of ICT in deploying enterprise services and solutions. He<br />

co-founded one of the first e-commerce stores in 2011 – www.<br />

buynownow.com and sold to shoppi.ng in 2013 and exited<br />

his first mobile financial services company – dudupay in 2014.<br />

He is the COO at duduMobile, also one of the co- founders/<br />

conveners of Mobile Monday (www.momonigeria.org) in<br />

Nigeria and is a member of the Nigerian Economic Summit<br />

Group (NESG – www.nesgroup.org)<br />

Ehime Eigbe-Akindele is the Founder and Managing Director<br />

of Sweet Kiwi Frozen Yogurt, Africa’s biggest yogurt company<br />

which recently expanded into the United States. She has a BA<br />

(Honors) from London Metropolitan University in Business<br />

Information Technology and International Relations. She<br />

began her career with Amnesty International then moved to<br />

Citigroup in Dallas, Texas in their legal banking group. Ehime<br />

completed an Entrepreneur Management Program from the<br />

Enterprise Development Centre of Pan-Atlantic University in<br />

Lagos. She has a certification in Brand Design as a strategic<br />

management tool. She is a WIMBIZ (Women in Business and<br />

management) associate, a Goldman Sachs 10,000 Women<br />

awardee and a British Council Alumni Award finalist. She is<br />

a public speaker and has taken part in several motivational<br />

speaking events to inspire youths and women. She founded<br />

the Brand Identity Global company in 2015 and held its first<br />

brand conference in 2015 in collaboration with the Global<br />

Entrepreneurship Network. Ehime is passionate about<br />

branding and brand design.<br />

Edmund Olotu has founded and financed several Technology<br />

companies in Nigeria and the USA. US Companies include<br />

Novira Therapeutics Inc. and Generate4Schools LLC. His<br />

payment application development company, TechAdvance<br />

Ltd. founded in 2009, develops collections, aggregation and<br />

transaction data analytics platforms for multiple industry<br />

verticals. Amongst his other ventures, is SuperGeeks Ltd.- a<br />

personal consumer electronics after-sales service and gadget<br />

insurance company featured on CNN as one of Nigeria’s most<br />

innovative start-ups; Reydious Ltd, an agric technology R&D<br />

company and West Africa Mining Corporation operating<br />

several gold and diamond mining acreage in Sierra Leone<br />

and Liberia. Edmund has a Bachelor’s degree in Mechanical<br />

engineering with Business from Manchester University, a<br />

Master’s degree in Science and Technology entrepreneurship<br />

with distinction from Nottingham University Business School<br />

and a Master’s degree in Management Finance and Control<br />

from Harvard University.<br />

Deji<br />

Kurunmi<br />

Endurance<br />

Okafor<br />

Ololade<br />

Akinmurele<br />

Deji Kurunmi has spent the last decade advising business<br />

leaders and helping them solve complex problems. He now<br />

leads the Financial Advisory team of Enzo Krypton and<br />

Company where they help high growth businesses raise the<br />

capital to fund their long term strategy. Deji is a detailed and<br />

diligent negotiator and very creative with deal structuring.<br />

Endurance Okafor is a financial analyst at BusinessDay and<br />

analyst on financial inclusion today- a radio programme that<br />

creates awareness on inclusion for Nigerians.<br />

Ololade Akinmurele is a senior finance analyst at<br />

BusinessDay, West Africa’s most authoritative financial<br />

newspaper. Ololade is a Bloomberg award-winning financial<br />

journalist and a fellow of the Bloomberg Media Initiative<br />

Africa. He is passionate about financial inclusion and has<br />

produced over 200 articles on the subject matter. He joined<br />

BusinessDay in January 2016, after obtaining a Bachelor of<br />

Science degree in Political science from the University of<br />

Lagos.<br />

Mayowa Kuyoro<br />

“Mayowa Kuyoro is an Associate Partner<br />

at McKinsey & Company and<br />

based in the firm’s Nigeria Office.”<br />

Copyright © 2019 The Spark. All rights reserved. No part of this publication may be reproduced, stored in a<br />

retrieval system or be transmitted in any form or by any means, electronic or mechanical, without prior permission<br />

of The Spark.<br />

We do not endorse any products or services mentioned in any of the articles and are not responsible for the<br />

outcome of using such products or services.

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

CONTENT<br />

04<br />

BOTTOM LINE<br />

• Achieving your Financial Goals<br />

06<br />

WIRED IN<br />

6<br />

• Your Finance Butler<br />

4<br />

08<br />

PRO BONO<br />

• The Rules of a Merger<br />

• 10 Financial Apps for Small Businesses<br />

11<br />

VITAL SIGNS<br />

• Bouncing Back<br />

11<br />

13<br />

FEATURES<br />

• On Loyalty and Rewards<br />

16<br />

• Banking the Unbanked<br />

• <strong>Access</strong> to Finance<br />

SPARK EFFECT<br />

8<br />

13<br />

• <strong>Access</strong> to <strong>Diamonds</strong>: Herbert Wigwe<br />

• The Connect<br />

• <strong>Access</strong> to <strong>Diamonds</strong>: Uzoma Dozie<br />

24<br />

SPECIAL FEATURES<br />

• Oluseyi Kumapayi: The Finance Guru<br />

• Amaechi Okobi on The New Brand<br />

Identity<br />

• Robert Giles on Retail, Tech and<br />

Innovation<br />

24<br />

29<br />

FEATURES<br />

• Mergers & Acquisitions in Nigeria<br />

• The Rise of Payment Solutions<br />

• MSME Lending<br />

• 10 Organisations that drive financial<br />

Inclusion<br />

• Branding for Mergers and Acquisitions<br />

• Scramble for the Financially-Excluded<br />

• The Mobile Money Landscape<br />

16<br />

37<br />

WHAT NEXT<br />

26<br />

29<br />

@thesparkng<br />

3

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

BOTTOM LINE<br />

Achieving your Financial Goals<br />

Make better financial decisions this 2019 to achieve your financial goals.<br />

By Oluwatosin Olaseinde<br />

A<br />

new year is an opportunity to set new financial goals and<br />

achieve them. Initially, it might seem daunting, or there might<br />

even be thoughts along the line of “but I set some goals last<br />

year and didn’t achieve it.”<br />

You don’t have to take that journey alone without guidance; we have<br />

put together a few tips to help you achieve your financial goals in the<br />

New Year.<br />

4<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

Write it down<br />

Writing down goals serves two purposes:<br />

Firstly, to make them more real to you. It’s not<br />

enough to think up your goals in your head,<br />

write them out, boldly. Secondly, writing<br />

your goals help to remind you of them. While<br />

writing out your goals, make them simple,<br />

straightforward and achievable. For instance,<br />

don’t write “Save/Invest money” write “Save<br />

N20,000 monthly in a mutual funds account.”<br />

It’s okay to start small, don’t attempt to save<br />

90% of your income on your first trial.<br />

Build an emergency fund<br />

An emergency fund is that amount of money<br />

you have saved for unexpected expenses that<br />

must be urgently attended to. I added “... that<br />

must be urgently attended to” because an<br />

unexpected expense may not be urgent and<br />

in that case, you can provide for it in your<br />

next budget. We usually recommend that<br />

you have at least six months worth of your<br />

monthly expenses in your emergency fund.<br />

That is, if you spend about N50,000 monthly,<br />

you should build an emergency fund of at<br />

least N300,000.<br />

Read books on finance<br />

If you’re serious about reaching your<br />

financial goals, then you must stay motivated<br />

and enlightened. There are a good number<br />

of books you can read to keep you informed<br />

about money, savings, investments, stocks,<br />

etc. Here’s a list of my top three, thank me<br />

later.<br />

Intelligent Investor by Benjamin Graham,<br />

Rich Dad Poor Dad by Robert Kiyosaki, You<br />

are a badass at making money by Jen Sincero<br />

Invest in a mutual fund<br />

A mutual fund is a pool of money from<br />

different individuals invested and managed<br />

by a Fund manager for profit. What<br />

distinguishes a mutual fund is what it invests<br />

in. For instance, we have the Money market<br />

mutual fund, equity mutual fund, real estate<br />

mutual fund, amongst others. There are<br />

many mutual fund managers in Nigeria today<br />

that offer investment opportunities for as low<br />

as N5000. Make sure to acquire information<br />

about interest rates and redemption policies<br />

before you invest.<br />

Build a stock portfolio<br />

Diversification is a key feature in investing<br />

as it helps to reduce risks. A stock portfolio<br />

means that you have invested in more than<br />

one kind of stock. This is to make sure that<br />

your risks are mitigated; if one stock is not<br />

performing as expected, others might. You<br />

should do your research before you decide<br />

which stocks are best for you to invest.<br />

Find a profitable side hustle<br />

The term “side hustle” is parlance for an<br />

extra stream of earned income. That skill or<br />

talent you have can be developed to earn<br />

you more money. Don’t dull in 2019, make a<br />

profit from your passion. Even if it’s not your<br />

passion, if it’s legal and profitable, you can<br />

make plans to monetise it.<br />

Draw a budget<br />

Budgeting can never be overemphasised.<br />

You can’t control what you don’t track.<br />

Make sure to keep track of your expenses<br />

every day and draw up budgets before you<br />

start spending. This will help you have more<br />

control over how much money goes out of<br />

your wallet or bank account. Several mobile<br />

apps can help you with this. It’s not enough<br />

to draw up the budget, be disciplined about<br />

keeping to it. You might have to say no to<br />

some hangouts or “Aso-Ebis” if you were<br />

not pre-informed. You don’t owe anyone<br />

an explanation besides “I cannot afford that<br />

now.”<br />

Learn a new skill<br />

About that side hustle, certain skills are<br />

currently on demand that can bring in some<br />

more cash for you. More interestingly, you<br />

can acquire most of them for free by taking<br />

courses online. Even if you have to pay,<br />

consider it an investment. By all means, keep<br />

learning and keep earning.<br />

Get an insurance cover<br />

No one likes to spend money on<br />

insurance, but it is one of the smartest<br />

things that you can do on your road to<br />

financial independence. If the unexpected<br />

circumstance happens, you do not have to<br />

spend the money out of your pocket. It is a<br />

hedge against an unforeseeable event, and it<br />

is a wise investment decision to get one<br />

Join an Online Community<br />

One of the best ways to push you further<br />

towards your goals is by learning and<br />

accountability, a community does this for<br />

you. Of course, Money Africa is one of the<br />

best personal finance platforms you can be<br />

a part of. Let us help you earn more, invest<br />

more and grow sustainable wealth.<br />

Follow us on all social media platforms @<br />

moneyafrica.<br />

“A new year is a new<br />

opportunity to set new<br />

financial goals and<br />

achieve them.”<br />

@thesparkng<br />

5

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

WIRED IN<br />

Your Finance Butler<br />

What if you had someone else to worry about<br />

budgeting, savings, and investment while leaving<br />

you to focus on making more money?<br />

By Joseph Iruafemi<br />

<strong>To</strong>day had turned out to be one of<br />

those days for Segun. From the driver<br />

who rammed into his bumper earlier<br />

in the morning, to the impromptu<br />

lunch to appease a client and then his cousin<br />

who wanted N25,000 for his school project,<br />

he had bled out in unexpected expenses.<br />

As he turned the key to unlock the door to<br />

his flat, he smiled, knowing that Tracly would<br />

show him reds and still be kind enough to let<br />

him know how he could shape up in the next<br />

few days to make up for the dent the day had<br />

made in his pocket.<br />

You see, Tracly is Segun’s financial butler, a<br />

trusted ally that manages all of his money.<br />

The two had met at a time Segun could<br />

not seem to get out of debt. He was always<br />

financially tight despite earning N200,000<br />

monthly from his job for 2 years. Frustrated<br />

about the bleakness of his financial future, he<br />

complained to Soji his colleague at work.<br />

“Soji, I can’t seem to make head or tail of<br />

my money. It is like an evil spirit is taking my<br />

money.”<br />

Soji had asked if he used an excel for tracking.<br />

He did. It was simple enough to open an excel<br />

sheet but remembering to update it regularly<br />

was a pain for his tight schedule.<br />

“Well, I should introduce you to Tracly then”,<br />

Soji replied.<br />

And so it started, 1453 days ago, that Tracly<br />

took over the management of Segun’s<br />

finances. All he needed to do was to give<br />

Tracly access to his account statement, and<br />

the butler would handle the rest.<br />

In the beginning, Tracly had put Segun in the<br />

“Getting out of debt category” and helped<br />

him create a tight budget. The budget focused<br />

on covering his basics - bills, transportation,<br />

feeding, grooming and the rest went into<br />

paying his debts. Immediately his salary got<br />

paid into his account; the Butler fanned the<br />

leftover into the accounts of his creditors.<br />

Tracly then told him who he had paid and<br />

6<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

“It all seemed so novel<br />

to him at the time but<br />

working with the butler<br />

made him realize he<br />

had been spending way<br />

too much on coffee,<br />

entertaining himself and<br />

also not cashing out his<br />

loyalty points.”<br />

what was left to be paid. Those months had<br />

been gruesome on him, but he knew it was<br />

a price he had to pay for financial freedom.<br />

It all seemed so novel to him at the time but<br />

working with the butler made him realize he<br />

had been spending way too much on coffee,<br />

entertaining himself and also not cashing out<br />

his loyalty points. The butler had helped him<br />

cut the overspend. He had recommended<br />

some hangout venue around his workplace<br />

and home where loyalty points could be<br />

earned on purchases. This was how Segun<br />

found his regular hangout spot at Sailors<br />

because of their cashback program. The<br />

butler put the extras he cranked out of the<br />

spending cut and loyalty points into his small<br />

tickets savings for things like birthday gifts.<br />

Since paying off his debts, he had moved<br />

from “Getting out of debt” category to the<br />

“Savings category” and then to the “investing<br />

category.”<br />

The butler had been a different kind of animal<br />

during the different categories. Tracly moved<br />

from auto-saving to auto-saving and auto<br />

investing his money for him.<br />

During his saving phase, Tracly had been<br />

aggressive, pushing just about anything<br />

that was not going into his essentials into<br />

his emergency funds record. The butler had<br />

continued this regime until he had over six<br />

months of his salary in that record.<br />

Now, the butler split the money into two,<br />

invests a part and saves the other part.<br />

Although he wasn’t having as much fun as he<br />

would have loved to, the idea of increasing<br />

his emergency fund while investing for the<br />

future was exciting.<br />

Tracly’s dexterity with numbers never ceased<br />

to amaze Segun. The butler could reduce or<br />

stop allocating money to a specific financial<br />

goal depending on the severity of a new<br />

goal that he shared. When Segun told the<br />

butler he planned to travel for a holiday in<br />

6 months, Tracly recommended he made<br />

this ten months so he could still be in good<br />

standing for saving for his house. And the<br />

butler went ahead to adjust every other part<br />

of his finances accordingly.<br />

“Tracly, what is today’s status?” Segun said to<br />

his Amazon Echo as he walked into the room.<br />

“Hello Segun, today, you overspent by 300%.<br />

Your DSTV subscription will be due in the<br />

next five days, but if you renew today, you<br />

will get a 15% discount. Would you like me to<br />

renew your subscription now?”<br />

“Yes please,” Segun replied.<br />

“Can I afford to hang out with the boys this<br />

Friday?” Segun went on to ask.<br />

“No, you cannot” Tracly responded. “You<br />

cannot afford to pay for your hangout for<br />

the next 2 Fridays if you want to keep things<br />

going smoothly.”<br />

“What a guy,” said Segun to himself as he<br />

walked away from the device to his bedroom.<br />

He will be fine. Tracly got him.<br />

@thesparkng<br />

7

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

PRO BONO<br />

The Rules of a Merger<br />

Mergers are not only for the big boys, but the small boys can also<br />

employ mergers as a strategy for growth.<br />

By Aderinsola Fagbure<br />

The term merger is more often than<br />

not associated with multinationals<br />

and global conglomerates, with big<br />

shots like Time Warner, <strong>To</strong>tal Fina,<br />

Elf Acquitaine, Cadbury and Kraft coming to<br />

mind. A better understanding of the concept<br />

of mergers can be sought from a simplified<br />

definition of the term.<br />

There are several technical definitions of<br />

mergers, but I have chosen to describe a<br />

merger as an economic marriage with the<br />

aims of increasing revenue, opening up new<br />

markets/ frontiers, developing new products<br />

and services and expanding client base for<br />

both parties (in this instance entities).<br />

The reason for proposing consolidation<br />

transactions are numerous, thus making<br />

them attractive to forward-looking business<br />

managers, professional advisers, and<br />

investors. Mergers and Acquisitions may or<br />

may not be industry specific.<br />

Locally, the announcement of the N25 billion<br />

minimum capitalization requirement by the<br />

Central Bank of Nigeria in 2005, brought<br />

about heightened talks of possible mergers<br />

and acquisitions (henceforth, M & As) among<br />

bank directors and managers who were<br />

passionate about their companies’ survival.<br />

The need for compliance with the directive<br />

saw a new wave of consolidation activities in<br />

the Nigerian world of finance and law.<br />

A similar flurry of activities occurred about<br />

the same time in the Insurance Industry,<br />

due to regulatory requirements. Hence M &<br />

As can be a precursor to stronger industries<br />

as we have witnessed in our banking and<br />

insurance industries. So, are M & As only for<br />

big entities, or just for any business entity?<br />

M & As are recommended for almost any<br />

business entity.<br />

In reality, any two incorporated companies can<br />

voluntarily embark on a merger, irrespective<br />

of employee size or capital structure. Startups<br />

and small scaled businesses are therefore<br />

not excluded from the merger equation.<br />

Meanwhile, it is most unfortunate that a large<br />

number of entrepreneurs see mergers as a<br />

deceptive form of liquidation.<br />

The benefits of M & As are rewarding<br />

regardless of whether or not the entities<br />

involved belong to the same industry or<br />

cut across different industries. One of such<br />

benefits is synergy, which is one of the most<br />

talked about reasons for a merger. Often<br />

times, a business will attempt to merge with<br />

another business which has complementary<br />

strengths and weaknesses. Of course,<br />

amalgamating businesses leads to increased<br />

revenue and reduced business running cost,<br />

where the merger procedure is properly<br />

managed.<br />

Another benefit related to synergy is the<br />

increased efficiency resulting in improved<br />

share value, which has further been given as<br />

one of the incentives of mergers. Research<br />

shows that on average the share value<br />

of the combining entities improves upon<br />

consolidation. The Nigerian example in which<br />

the banking consolidation exercise gave birth<br />

to a number of institutions strong enough<br />

to compete internationally shows how M &<br />

As can significantly improve on the profile,<br />

reputation, and competitive strength of the<br />

resultant entities.<br />

Another benefit of M & As is that companies<br />

can enlarge their product range and supply<br />

chain by considering business combination<br />

options. For instance, the deal negotiated by<br />

Cadbury Plc and Kraft Foods Inc. opened up<br />

new opportunities for the resulting entity by<br />

creating new markets for Kraft Foods Inc. in<br />

Africa and Asia. Such access to these markets<br />

would not have been possible without the<br />

two companies coming together to become<br />

a stronger single entity.<br />

Hence, the need to increase production<br />

scales and reduce competition was also<br />

given as an argument in favor of M & As.<br />

In other words, mergers provide acquiring<br />

companies an opportunity to boost their<br />

market share without necessarily improving<br />

their marketing strategy. Relatedly, a large or<br />

medium-sized law firm may acquire a small<br />

practice in order to expand its client-base<br />

and technical capacity.<br />

8<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

Another benefit of M & As is the opportunity<br />

to take advantage of international<br />

partnership which allows for a global<br />

presence Global market pressures have led<br />

to a rise in cross-border merger transactions.<br />

For instance, Nigerian brands are sought<br />

after internationally, with a number of<br />

them partnering with global retail brands<br />

and stores. Such international partnerships<br />

could be strengthened through possible<br />

mergers, particularly those within the African<br />

continents of which Ghana and South Africa<br />

are examples of emerging frontiers.<br />

As we are all aware, technological innovations<br />

are recorded daily of which the industry giant,<br />

Apple continuously reminds consumers<br />

about the limitless world of computers, by<br />

unveiling new products regularly. Hence, the<br />

demand for whizkid Chief Executive Officers<br />

has skyrocketed and been recognized as a<br />

major consideration for several cross-border<br />

corporate mergers.<br />

A vibrant market for corporate control also<br />

improves the statistics of mergers and<br />

acquisitions. The possibility of successful<br />

bidders replacing poorly performing<br />

executive directors in order to enhance the<br />

profitability of corporations augurs well for<br />

any economy, thus encouraging dynamic<br />

business arrangements.<br />

One cannot mention M & As deals without<br />

discussing the complications that accompany<br />

this procedure. As with marriages between<br />

human beings, divorces of corporate entities<br />

are not unheard of. <strong>To</strong> sustain M & A deals,<br />

great responsibility is therefore placed on<br />

deal advisers particularly lawyers, ensuring<br />

not only the success of birthing a new entity<br />

but also of sustainability.<br />

Business experts believe that no two M &<br />

A deals are alike, which implies that high<br />

degree of legal expertise and innovation is<br />

required on the part of (Nigerian) solicitors<br />

dealing with business intricacies of M & As.<br />

More importantly, in a transactional setting,<br />

lawyers should carefully analyze all available<br />

and relevant data including the statutes and<br />

professionally advise clients on how best to<br />

structure their business affairs in a bid to<br />

comply with relevant provisions.<br />

The deal flow of all acquisitions is standard,<br />

notwithstanding the uniqueness of<br />

each bargain. The process starts with an<br />

introduction, followed by the negotiation,<br />

then the due diligence (D.D) process which<br />

if successful leads to the obtainment of the<br />

board, shareholder as well as regulatory<br />

approvals. A well carried out due-diligence<br />

exercise is a prerequisite for a successful<br />

merger, hence the need for advisers to ask<br />

the right questions from the onset. The D.D<br />

process can be likened to an inspection<br />

carried out by a mechanic prior to the<br />

purchase of a car, an exercise aimed at<br />

determining whether the vehicle is worth its<br />

asking price. In essence, due diligence before<br />

a merger is like a courtship before marriage.<br />

A merger, if well-coordinated, is expected<br />

to expand business opportunities. However,<br />

before embarking on this exercise, taking<br />

note of the number of employees the<br />

merging partner has is important, what<br />

risks has the business been exposed to, the<br />

legal and financial structure as well as the<br />

debt exposure of the relevant business. No<br />

entrepreneur wants to pay for a shell or end<br />

up like the lady who thought her husband<br />

was a billionaire but soon found out after<br />

marriage that he was living a borrowed life.<br />

The merger transaction is rounded up by<br />

signing and closing. As soon as negotiations<br />

are launched, legal and financial advisers<br />

are engaged in structuring the deal and<br />

determining a fair price for the sale. The<br />

target has a vested interest in ensuring that<br />

it receives the best selling price while the<br />

bidder’s management is keen on a transaction<br />

that is indeed value for money.<br />

In arriving at the true worth of a company,<br />

therefore, advisers should not only protect<br />

the interest of their clients but also ensure<br />

that the valuation results give an accurate<br />

and fair view of the firm’s worth and that<br />

the due diligence is conducted ethically.<br />

Legal advisers particularly have a role to play<br />

in drafting water-tight agreements which<br />

will stand the test of time in balancing the<br />

interests of the buyer and that of the seller.<br />

It must be mentioned that having examined<br />

the incentives for business combinations<br />

certain factors inhibit the growth of such<br />

transactions in these parts of the world.<br />

Culturally, we hold on to investments<br />

irrespective of how logical it is to do so and in<br />

consequence would rather be the sole owner<br />

of a tottering business than be a part owner<br />

of a bigger cake.<br />

The notion of “it’s my business”, I started<br />

it and must not allow anyone to share<br />

in my business successes”, must change.<br />

Another reason for the slow growth of M &<br />

As activities in Nigeria is that the relevant<br />

regulatory system is underdeveloped.<br />

The financial industry is also lagging in its<br />

response to credit requests, a situation which<br />

impedes the process of negotiations.<br />

A merger is not just the coming together of<br />

two businesses. It is the amalgamation of<br />

corporate cultures. The culture and structure<br />

of Business A should be similar to Business<br />

B and should be synergized sufficiently to<br />

ensure a smooth running of the resultant<br />

entity. This is why it is important for startups<br />

founders to be clear about the mission and<br />

vision of their companies because, in reality,<br />

you cannot give what you do not have.<br />

Equally, the management and employees of<br />

the merging entities must be carried along<br />

in the process. It can be scary to be asked<br />

to be part of new business as an employee.<br />

Therefore, it is the responsibility of the parties<br />

negotiating the deal to ensure that staff<br />

welfare is paramount. Realistically, however,<br />

only the best hands and the brightest brains<br />

can be retained in a change of structure<br />

transaction.<br />

The customers of both entities must not<br />

be overlooked, also. Hence the customer<br />

enlightening sessions being carried out by<br />

the relevant entities in the proposed Diamond<br />

Bank Plc and <strong>Access</strong> Bank Plc merger is<br />

laudable because it has to a large extent<br />

helped in assuaging the fears of concerned<br />

customers.<br />

The result of a merger is a bigger and<br />

stronger brand. The shortcomings of megasized<br />

brands have been identified mainly<br />

as the inefficiency of size and variations in<br />

corporate culture among merging entities.<br />

These challenges do not overshadow the<br />

economies of scale associated with globally<br />

competitive businesses.<br />

It is, therefore, evident that under the<br />

philosophy of the survival of the fittest,<br />

Mergers and Acquisitions will continue to<br />

thrive. Africa will do well to join in the trend<br />

actively. Nigeria can take the lead, particularly<br />

with the recognition given to some Nigerian<br />

companies recently by the London Stock<br />

Exchange.<br />

These nominations evidence the fact that the<br />

small brand of today has the potentials to<br />

become an international brand if corporate<br />

governance and accountability are given<br />

priority. A good way to end this piece is by<br />

celebrating all the companies that were listed<br />

as part of the Companies to Inspire Africa,<br />

as compiled by the London Stock Exchange.<br />

Indeed, Mergers and Acquisitions are for big<br />

and small companies.<br />

“A merger is not<br />

just the coming<br />

together of two<br />

businesses. It is the<br />

amalgamation of<br />

corporate cultures.”<br />

@thesparkng<br />

9

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

10 Financial<br />

Apps for Small<br />

Businesses<br />

Need financial apps that can help<br />

with productivity? Look no more,<br />

find below apps to help you<br />

organize your business and make<br />

your life better.<br />

By Ayandola Ayanleke<br />

The world is experiencing technological advancements and innovations in practically every aspect of<br />

life. Life is increasingly going digital, and work has been made easier to accomplish using technology.<br />

One of the strategies of success in the labour market, experts would say, is working smarter and not<br />

necessarily harder. The movers of the economy have discovered this and the earlier you key into this<br />

too, the better.<br />

Working smarter would entail taking advantage of what technology has made available to make your<br />

work easier and ensure higher productivity. The apps mentioned below are some of the financial<br />

apps that can make you get ahead as a small business owner.<br />

As an entrepreneur, it cannot be overemphasized<br />

that you need financial<br />

discipline and that includes imbibing<br />

a savings culture. You don’t have to<br />

worry about this because Digit is at<br />

your service to help you save money<br />

that you might have otherwise spent<br />

carelessly. It does this by analyzing your<br />

spending habit and keeps a percentage<br />

of your capital into a no-interest<br />

savings account.<br />

This is an app that can help you track<br />

high-quality invoices efficiently. It is<br />

popular for being very organized. The<br />

free version allows you up to 5 clients<br />

per month. But for more features, like<br />

syncing to PayPal, sending an unlimited<br />

amount of invoices and recurring<br />

payment, you will need to pay.<br />

This app gives you comprehensive<br />

information about your finances by<br />

pulling data from the bank account(s)<br />

you sync it with. So it gives you a<br />

snapshot of all transactions; what you<br />

spend, when you paid, product or<br />

service paid. It also provides you with<br />

your business’ financial analyses and<br />

forecasts based on data pulled.<br />

Gusto helps you organize your<br />

company’s payroll, taxes and benefit,<br />

new hire reporting, employee records,<br />

and track sick leave and vacation. It<br />

enables you to achieve specific HR<br />

duties if you cannot afford to hire help<br />

and so, you can concentrate on being<br />

useful in other parts of your businesses.<br />

Launched in 2012, Wave is an<br />

accounting app for small business<br />

owners with nine or fewer employees.<br />

With over 2 million users, wave serves<br />

as a go-to app to manage accounts,<br />

payrolls and invoicing. The app goes for<br />

free, and it can be downloaded on both<br />

Android and iOS phones as well as on<br />

a desktop.<br />

If you need help creating a business<br />

plan and track your plans to monitor<br />

your progress, then this is the app for<br />

you. The app helps you build business<br />

plan as well as infographics to track<br />

your revenue and expenditure so you<br />

can monitor your progress and have<br />

enough data to make changes, where<br />

necessary<br />

Free to download, Freshbooks help<br />

small businesses monitor their<br />

invoices, and other cash flow on as<br />

well as offline. Available for Android<br />

phones and iPhones, the app is easy to<br />

navigate. You can create a customized<br />

invoice that fits the look of your<br />

business, send to clients and receive<br />

payment at a go.<br />

QuickBooks is a mobile accountant. It<br />

does all the job of an accountant for<br />

a small business owner seamlessly;<br />

it manages inventory, sales, payroll,<br />

bills, taxes, track invoices, revenue,<br />

and even gives profit analysis. The app<br />

also connects to all accounts, including<br />

banks, PayPal and credit card accounts<br />

and uploads data from them all.<br />

You want to be free of the tedious and<br />

boring work of dealing with employee<br />

expenses, Expensify is here for you. The<br />

app helps you by handling business<br />

trip expenses. You can do this by either<br />

linking the app to your preferred card<br />

payments credit and debit card or you<br />

can take a picture of your receipt to<br />

scan on the system. The app will work<br />

with the relevant information to create<br />

an expense report.<br />

Zoho Books does it all, sales, marketing,<br />

recruiting and even writing reports.<br />

The best part is that Zoho works with<br />

Google Apps, which makes it easy<br />

to use and it also has other Officelike<br />

suites that can be synced with<br />

Microsoft Office.<br />

This list is by no means exhaustive,<br />

but the apps listed here will go a long<br />

way in helping you track and monitor<br />

your finances in order to improve<br />

productivity.<br />

10<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

VITAL SIGNS<br />

Bouncing Back<br />

Financial setback, in the face of the economic instability in Nigeria, while not shocking has led to<br />

the prevalence of mental breakdown in individuals. But all hope is not lost, there is a solution.<br />

By Lanre Olusola, The Catalyst<br />

In today’s economic climate, personal<br />

bankruptcy has reached an alarming<br />

rate. I will be using data from the US<br />

and the UK to buttress my points as<br />

we can’t find proper data in Nigeria.<br />

Studies show that more than 1.5 million<br />

people file for bankruptcy every year In<br />

the US alone. Every day in the UK, about<br />

300 people are declared bankrupt or<br />

insolvent, i.e. one person every 5 mins<br />

5 secs.<br />

Another 25,000 lose their homes<br />

through repossession each year. Millions<br />

are living on the edge of financial<br />

meltdown as they struggle to make<br />

ends meet, meaning that the numbers<br />

may continue to rise. A few years ago,<br />

the Citizens Advice Bureau reported<br />

that they deal with 6500 new debt cases<br />

every working day. That’s a staggering<br />

1.7 million people facing problems<br />

which they simply can’t cope with.<br />

Most significantly, nearly 97% of<br />

bankruptcy filings are made by<br />

individuals, not by businesses. In<br />

Nigeria, the situation is worse I am sure.<br />

With Nigeria being declared the poverty<br />

capital of the world, it is no secret that<br />

people are becoming poorer and more<br />

businesses are shutting down as they<br />

struggle to stay afloat. The reality is<br />

that more than ever, more people face<br />

serious financial difficulty today.<br />

In our society today, some of the<br />

most common reasons why people<br />

experience financial setbacks include<br />

medical expenses, job loss or business<br />

failure, credit and debt, unbudgeted<br />

expenses and overspending, divorce,<br />

separation and more.<br />

Being in debt, broke, and unemployed<br />

can lead to major financial stress that<br />

ultimately culminates into depression<br />

and other mental health challenges.<br />

However, the converse is also true:<br />

depression can precipitate a financial<br />

meltdown.<br />

If you’re suffering from a serious<br />

financial setback, the first thing you<br />

need to realize is that you are not alone<br />

and that there is no setback you cannot<br />

recover from.<br />

“A bucket can only contain the quantity<br />

of water it can, irrespective of the<br />

amount of water in the universe; Likewise<br />

your hands can only hold the amount of<br />

money your mind can hold, irrespective<br />

of the amount of money available in the<br />

universe” - The Catalyst, Lanre Olusola<br />

Bouncing back from financial challenges<br />

is the first to mind over matter. You need<br />

to understand that failure is a natural<br />

phenomenon for successful people.<br />

I always say, failure is the gateway to<br />

success. Learn from every failure so that<br />

you can become emotionally intelligent.<br />

Failure learned from is not failure; but<br />

advantage and feedback on how to do<br />

things better.<br />

Many things are responsible for why<br />

people find themselves in trouble<br />

financially and if you know and avoid<br />

these mistakes going forward; things will<br />

begin to look better for you financially.<br />

I’d share a few of these mistakes and<br />

some recommendations.<br />

Many fail to set and live on a budget.<br />

This should be common sense. But<br />

you find that not many people create<br />

realistic budgets around their income<br />

and needs. <strong>To</strong> maintain a balanced<br />

and healthy financial life, you must<br />

learn to practice budgeting and living<br />

within your budget. Start budgeting by<br />

tracking your everyday expenses, to the<br />

last dime.<br />

Based on your historical spending<br />

pattern of previous months, differentiate<br />

your critical immediate daily needs from<br />

your monthly needs and finally from<br />

your wants. Color-code these three<br />

in Red, Yellow and Black respectively.<br />

Then to budget for subsequent months<br />

eliminate the black wants (expenses)<br />

and set the limits of what you can spend,<br />

and write a list of what you need to<br />

spend on, month in month out. It is a<br />

very simple practice that can save your<br />

life and stop you from further digging a<br />

debt hole for yourself.<br />

Failing to put an emergency fund in<br />

place<br />

An emergency fund is money that will<br />

help you live your life without lack in<br />

times of difficulty if, for example, you<br />

lose your job or your business is going<br />

through a dark patch. The rule of thumb<br />

is to have up to 6-12 months of expenses<br />

saved up. Having an emergency fund<br />

is one of the most important financial<br />

habits that can tide you over when<br />

you face financial difficulties which can<br />

happen to anyone at any time.<br />

Living and Spending Beyond Your<br />

Means.<br />

You have to learn to abase and abound<br />

- cut your coat according to your cloth<br />

and not according to someone else’s<br />

specifications, expectations, cloth or size.<br />

Now, this is particularly a very bad habit<br />

for black people because we are always<br />

trying to keep up with the Joneses and<br />

@thesparkng<br />

11

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

outdo each other. We don’t live our own<br />

lives, walk our own path and run our<br />

own race. We daily try to live the life<br />

that we see other people living failing to<br />

recognize that we are all different and<br />

going to different destinations.<br />

It’s ok to own a comfortable 4 bedroom<br />

home that you worked very hard for and<br />

bought with your own sweat money (not<br />

a big 10 bedroom mansion that your<br />

friend inherited from his father who<br />

inherited it from his father).<br />

Not having proper insurance on<br />

possessions, health, and life.<br />

Make sure you update the value of<br />

your possessions such as your car,<br />

house, watches etc. and insure them<br />

for their replacement, not purchased<br />

value, because the whole essence of<br />

an insurance is to be able to replace<br />

what you lose on the date you need to<br />

replace it with the money the insurance<br />

company gives you after their financial<br />

adjustment exercise.<br />

Especially in this season when the<br />

exchange rate of the dollar to the Naira<br />

has tripled in the last couple of years so<br />

what you bought for $50,000 a year ago<br />

at an exchange rate of 160 Naira to 1<br />

dollar will give you slightly less than half<br />

of the value today at an exchange rate of<br />

363 Naira to 1 dollar. Hence, you won’t<br />

be able to replace the same possession<br />

even if the insurance company pays you.<br />

Protect yourself from any unforeseen<br />

circumstances such as fire, theft, accident<br />

etc. You never know what might happen<br />

in the future.<br />

Tip: Do your due diligence on the<br />

various top insurance companies. Know<br />

their history and products and try to<br />

use a single insurer so that your cover is<br />

total and discounted<br />

Procrastinating and waiting for the<br />

perfect opportunity or time to save<br />

and invest.<br />

There will never be the perfect time to<br />

save or invest. If you don’t develop the<br />

attitude and habit with the little you<br />

have today, you will never do it with the<br />

plenty you get tomorrow.<br />

Many people are cheated from doing the<br />

right thing because of procrastination,<br />

wrong advice or fear. When you get any<br />

inflow, ensure that you first pay yourself<br />

a percentage that goes into securing<br />

your financial future. There is no amount<br />

of money too small or too big to put<br />

away but the key is consistency.<br />

Getting into the habit of buying every<br />

latest or new thing.<br />

There is nothing new that you buy that<br />

once you pay for it and leave the shop<br />

with it, it doesn’t begin to depreciate;<br />

especially cars, electronics, phones etc.<br />

These things are really not assets but<br />

liabilities or consumables, as their value<br />

depreciates after purchase. Why not<br />

invest your money in instruments and<br />

things that the value increases, even<br />

after purchase?<br />

Living only for today<br />

Yes, you may have made some bad<br />

financial decisions that led you to<br />

experience setbacks but your tomorrow<br />

is based on the decisions and actions<br />

you take today. There are 3 dimensions<br />

of financial focus: Short, Medium and<br />

Long Term.<br />

One of the greatest financial mistakes<br />

anyone can make is to permanently<br />

be myopic i.e. focus exclusively, living<br />

for and financial planning for the short<br />

term. This attitude causes wasteful and<br />

foolish spending habits. People like<br />

these, unfortunately, attract their kind<br />

and therefore surround themselves with<br />

similar foolish people.<br />

As we know, “He who walks with the wise<br />

shall be wise but the companion of fools<br />

shall be destroyed” (Proverbs 13:20).<br />

Investing in a Pyramid scheme<br />

A major cause of financial setback<br />

in Nigeria is get-rich-quick schemes.<br />

Recently, many people who invested in<br />

financial pyramid schemes like MMM,<br />

Swiss Golden, etc have had their fingers<br />

severely burnt. Months or years after,<br />

the schemes go burst. So many others<br />

have come and gone the same way.<br />

Don’t get carried away when a particular<br />

investment is going good, human nature<br />

tends to think this good streak will go<br />

on forever, so we sink even more money<br />

into it.<br />

Seek help from a professional<br />

financial advisor<br />

Not having a personal professional<br />

financial advisor and getting financial<br />

advice from just anyone If you go to a<br />

doctor when you need medical advice,<br />

so also you need to get financial<br />

advice from a proven and time tested<br />

professional financial advisor. Without<br />

a proper advisor, you could be heading<br />

for financial oblivion. A professional<br />

financial advisor will first assess your<br />

financial wellness status by diagnosing<br />

any financial illness before he prescribes<br />

any intervention<br />

Don’t take financial advice from your<br />

pastor, imam, traditional ruler etc. if they<br />

don’t have a financial background and<br />

experience. They’re there to give you<br />

spiritual guidance. Financial and spiritual<br />

guidance are on two different divides;<br />

“One is Godly, the other Worldly” and as<br />

such, the principles will vary as far as the<br />

heavens are from the earth.<br />

Not managing your emotions around<br />

money<br />

“If you cannot manage your emotions,<br />

you cannot manage your money”<br />

- Warren Buffett.<br />

Did you know that:<br />

Your psychology, perception, values,<br />

and convictions about money based on<br />

your background and past experiences,<br />

make money a critical source of stress,<br />

tension and emotional trauma for you.<br />

Research now states that 85% of success<br />

is dependent on how emotionally<br />

intelligent you are. Master your emotions<br />

and you can master your success. Search<br />

yourself before you wreck your life<br />

because of money.<br />

So my challenge for you is:<br />

What’s your relationship with money?<br />

The genuine answer to this question<br />

gives you an indication of where you are<br />

with your emotions around money.<br />

<strong>To</strong> help you for free within the next 10<br />

days, download our digital coaching<br />

app, “CoachMe Online” from your<br />

App store. We have scores of certified<br />

coaches in different specialized fields<br />

who are waiting to coach you in your<br />

desired area for free. These coaches will<br />

work with you in real time to transition<br />

from where you are currently now, to<br />

where you would love to be.<br />

This is the abridged version. Find the<br />

complete article on our website www.<br />

thesparkng.com/category/catch-up<br />

“With Nigeria being declared<br />

the poverty capital of the world,<br />

the reality is that more than<br />

ever, more people face serious<br />

financial difficulty today.”<br />

12<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

FEATURES<br />

On Loyalty and Rewards<br />

“The most potent idea is that which effortlessly invokes hope and<br />

advantage in the average consumer”<br />

-Lai Labode BLE.CRMA, Harvard<br />

By Lai Labode<br />

There are three key problems with the<br />

African Customer Loyalty Space;<br />

●<br />

●<br />

●<br />

Profound Copy-Cat Syndrome<br />

Poor or Patently Subjective Data<br />

Interpretation<br />

Poor Conversion of Interpreted<br />

Data to Innovative Customer<br />

Loyalty & Reward Products<br />

In the boldest bid to re-invent the African<br />

Customer Loyalty and Reward Industry,<br />

CeLD Innovations Limited commissioned<br />

the most important consumer management<br />

research in decades; the company christened<br />

the research ‘The Patronage Optimization<br />

Research’, the study focused on how best<br />

to find the MOST POTENT EMOTIONAL<br />

DISPOSITION of the average African<br />

Consumer and how to sustainably and<br />

effectively develop CONSUMER EMOTIONAL<br />

EQUITY.<br />

One of the fascinating things about the<br />

research was its methodology; the research<br />

coverage of all social classes, the depth of its<br />

iterations and the very deliberate non-use<br />

or acceptance of ‘yes’ and ‘no’ answers to<br />

its multi-directional questions. All responses<br />

were conversational to ensure that the sets<br />

of answers extracted the core emotional<br />

dispositions of the respondents. The collected<br />

answers were processed for consistencies, use<br />

of language, insinuations and inconsistencies;<br />

which were further tested against real life and<br />

practical outcomes before conclusions and<br />

hypothesis were established.<br />

The Result found that “WHAT THE AVERAGE<br />

AFRICAN CONSUMER REALLY WANTS, IS AN<br />

OPPORTUNITY FOR LIFE-CHANGING CASH<br />

REWARD AT THE POINT OF PATRONAGE.”<br />

While the ‘REALLY” in summary symbolized<br />

the depth of the emotion of the consumer,<br />

the LIFE-CHANGING’ element firmly<br />

described what kind of ‘CASH REWARD’<br />

the consumer most desired, “THE POINT<br />

OF PATRONAGE” in the summary result<br />

emphasized the point where and when the<br />

customer wants his or her ‘LIFE CHANGING<br />

OPPORTUNITY’, it emphatically establishes<br />

the reality of the feeling of entitlement of<br />

the average consumer whenever they were<br />

bringing out their cash to pay for a good or<br />

service. The point of patronage is the point<br />

where customers feel most entitled and want<br />

to be treated in the best possible way.<br />

Two key questions emerged from the result<br />

of ‘The Patronage Optimization Research’:<br />

(a) How could any company offer ‘LIFE-<br />

CHANGING CASH OPPORTUNITIES every<br />

time it is patronized?<br />

(b) How would a company be able to sustain<br />

such offers?<br />

The required answers led to the creation of<br />

AFRICA’S MOST INNOVATIVE CUSTOMER<br />

LOYALTY & CELEBRATORY GIFT COMMODITY<br />

called THE CASHTOKEN. The Cash<strong>To</strong>ken is an<br />

electronic Customer Loyalty & Celebratory<br />

Gift Commodity that offers life-changing<br />

cash opportunities to consumers at the point<br />

of patronage. The Product connects every<br />

purchase, gift or tax paid to life-changing<br />

cash opportunities of Five Thousand (₦5,000)<br />

to One Hundred Million (₦100,000,000) in<br />

a multi-industry National Consumer Draw<br />

every week while offering Guaranteed cash<br />

for Insurance, Pension or Savings for every<br />

customer.<br />

The Cash<strong>To</strong>ken offers businesses and<br />

governments a performance-based loyalty<br />

and reward commodity that best fits their<br />

“What the average<br />

African consumer<br />

really wants, is<br />

an opportunity<br />

for life-changing<br />

cash rewards<br />

at the point of<br />

patronage.”<br />

growth visions. The product doesn’t only<br />

provide the best opportunity to develop<br />

emotional consumer equity. It provides the<br />

most practical way to optimize customer<br />

loyalty investments while primarily improving<br />

sales.<br />

THE CASHTOKEN is by every means a<br />

revolutionary product that ushers in a new<br />

era of HYPER CONSUMER CENTRICITY and<br />

a New Innovative era for connections to<br />

CONSUMER EMOTIONS. , and Alexander<br />

Forbes audits its National Consumer Draws.<br />

The Cash<strong>To</strong>ken in its early days has already<br />

been adopted by Large Retail Businesses,<br />

Financial Institutions and Key Players in the<br />

Hospitality Industry. The entry of a major<br />

mobile network and four top Nigerian banks<br />

is imminent.<br />

It is expected that in Two (2) to Three (3) years,<br />

Nigerians will find it difficult to buy a good<br />

or service without collecting Cash<strong>To</strong>kens<br />

as rewards. As at today, almost a million<br />

Nigerians have been gifted Cash<strong>To</strong>kens and<br />

testimonies abound of how the cash rewards<br />

impacted lives positively.<br />

A new age of HYPER CONSUMER POWER is<br />

upon us!<br />

@thesparkng<br />

13

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

Banking the Unbanked<br />

What does CBN’s Payment Service Banks mean for<br />

Nigeria’s financial inclusion?<br />

By Endurance Okafor<br />

The Central Bank of Nigeria (CBN) on<br />

the 5th of October 2018 released an<br />

exposure draft guideline in which<br />

it proposed Payment Service Banks<br />

(PSB), aimed at deepening financial inclusion<br />

in a country where only half of its total adult<br />

population is included into the financial cycle.<br />

What is PSB?<br />

PSBs is a payment service initiative proposed<br />

by CBN in which Banking agents, Mobile<br />

Money Operators (MMOs), Retail chains<br />

(Supermarkets), Telecommunications<br />

companies (Telcos) who are able to present<br />

an initial capital of N5 billion will be given<br />

license to operate under the structures<br />

and guideline specified by the apex bank,<br />

with the motive but not limited to ensuring<br />

access to financial services for the unbanked<br />

rural segments of the society.<br />

Financial inclusion<br />

The CBN, in collaboration with stakeholders,<br />

launched the National Financial Inclusion<br />

Strategy on October 23, 2012, aimed at<br />

further reducing the financial exclusion rate<br />

of adult population from about 53 percent in<br />

2008 to 20 percent by 2020.<br />

Several policies and initiatives have been<br />

introduced by Nigeria’s apex bank to ensure<br />

that the target is met. The CBN introduced<br />

the cash-less policy in 2012 as part of efforts<br />

to reduce the cost of banking services<br />

(including the cost of credit) and drive<br />

financial inclusion by providing more efficient<br />

transaction options and greater reach.<br />

In collaboration with other key financial sector<br />

regulators, the CBN in 2006 conceptualized<br />

the Financial System Strategy 2020. Also to<br />

further ensure that the financial inclusion<br />

target is met, the CBN, in 2017, inaugurated<br />

the Financial Inclusion State Steering<br />

Committee ( FISSCO) as well as the Financial<br />

Inclusion State Steering Committee (FISSCO).<br />

Despite several initiatives including the<br />

introduction of Microfinance banking,<br />

Agents Banking, Tiered Know-Your-Customer<br />

requirement and Mobile Money Operation<br />

(MMO) in pursuit of this objective, financial<br />

inclusion rate remains below expectation,<br />

hence the proposed PSBs.<br />

Why the proposed PS Banks<br />

The proposed initiative allows banking agents,<br />

Mobile Money Operators (MMOs), Retail<br />

chains (Supermarkets), Telecommunications<br />

companies (Telcos) to leverage on their<br />

already existing customer base to include<br />

more Nigeria adults, specifically those in<br />

the remote areas to have access to financial<br />

products and services, considering the lack<br />

of proximity to, and availability of, financial<br />

service points (FSPs) — bank branches or<br />

agents which are meant to provide account<br />

opening and other customer service activities<br />

are the major barriers preventing rural<br />

inhabitants from accessing financial services.<br />

The project seeks to deepen financial<br />

inclusion in Nigeria through an integrated<br />

ecosystem with strong regulatory oversight,<br />

consumer protection and interoperable<br />

payment systems with limited concentration<br />

risk.<br />

The various agents that will be given the<br />

license will, therefore, have the right to<br />

carry out the following services; maintain<br />

savings accounts and accept deposits from<br />

individuals and small businesses, which shall<br />

be covered by the deposit insurance scheme;<br />

carry out payments and remittance (including<br />

cross-boarder personal remittance) services<br />

through various channels within Nigeria;<br />

issue debit and pre-paid cards; and operate<br />

electronic purse.<br />

What Nigerians stands to benefit from the<br />

proposed PSBs<br />

It has the likelihood of increasing the<br />

country’s financial inclusion rate, as it will<br />

help include more Nigerians into the financial<br />

cycle; owing to the fact that it will be able to<br />

provide financial services to the grass root<br />

communities, who have in the past spent a lot<br />

of time and money to travel out of the town<br />

in search of financial services<br />

“The CBN, in<br />

collaboration with<br />

stakeholders, launched<br />

the National Financial<br />

Inclusion Strategy<br />

on October 23, 2012,<br />

aimed at further<br />

reducing the financial<br />

exclusion rate of adult<br />

population from about<br />

53 percent in 2008 to<br />

20 percent by 2020.”<br />

14<br />

@thesparkng

www.thesparkng.com<br />

The Spark | Ignite/Connect/Achieve<br />

<strong>Access</strong> to Finance<br />

Entrepreneurs across Africa are often faced with the<br />

challenge of accessing finance<br />

By Mayowa Kuyoro<br />

<strong>Access</strong> to finance is often quoted<br />

as one of the biggest challenges<br />

entrepreneurs face today across<br />

Africa. In fact, some reports show<br />

that 85% of small businesses are largely<br />

underfunded with no access to finance. In<br />

2014, a poll that was conducted by the U.S.<br />

State Department showed that 37% of the<br />

entrepreneurs surveyed, responded that<br />

funding was the biggest challenge they faced.<br />

This challenge arises from an availability<br />

and an access issue. Availability, because<br />

historically, there hasn’t been a lot of money<br />

floating around to fund young entrepreneurs<br />

outside of the usual route of friends and<br />

family. <strong>Access</strong> for two reasons – some people<br />

are not aware of the offerings available, and<br />

sometimes the conditions required to get<br />

these funds are not easy to meet – the funds<br />

often come with a heavy price tag attached.<br />

The landscape is, however, changing for<br />

entrepreneurs today, especially those in<br />

the early stage. Increasingly, governments,<br />

foundations and even the private sector<br />

are turning their focus on how to fund and<br />

incubate young entrepreneurs. In less than<br />

15 years, Africa will have the largest working<br />

force population in the world who need to be<br />

gainfully employed. Thus, ensuring that our<br />

entrepreneurs today can flourish is critical.<br />

As a young entrepreneur, there are a few<br />

sources of funding that are available. Firstly,<br />

you have the government and other public<br />

sector lenders who can provide concessional<br />

financing e.g. the Lagos State Employment<br />

Trust Fund which not only disburses loans<br />

at 5% interest but also provides training and<br />

business support to the awardees of its funds.<br />

Another government entity trying to provide<br />

access to finance is the Bank of Industry which<br />

has schemes for entrepreneurs across various<br />

sectors from Adire, to Nollywood – and what<br />

got me excited – a graduate entrepreneurship<br />

fund which provides up to 2M to individuals<br />

on the NYSC program.<br />

Increasingly in this space today, we are seeing<br />

philanthropic foundations step in to provide<br />

access to finance to young entrepreneurs. You<br />

have foundations such as the <strong>To</strong>ny Elumelu<br />

Foundation, the Dangote Foundation, and<br />

even some international donors who provide<br />

funding to entrepreneurs in Africa.<br />

Other sources of finance include angel<br />

investors, venture capital groups and impact<br />

funds, where we are seeing increased activity.<br />

These have been around for a while and<br />

have helped to drive funding, especially<br />