Home+Away+From+Home_7079

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Guide for Foreign Property Investor in Malaysia<br />

Next MYR 500,000 – 2%<br />

Next MYR 5,000,001 and above – 3%<br />

Malaysia Real Property Gain Tax (RPGT)<br />

for Foreigner<br />

Real Property Gains Tax (RPGT) is a form<br />

of Capital Gains Tax that is imposed on<br />

the disposal of property in Malaysia.<br />

Based on the Real Property Gains Tax<br />

Act 1976, RPGT is a tax on chargeable<br />

gains derived from disposal of property.<br />

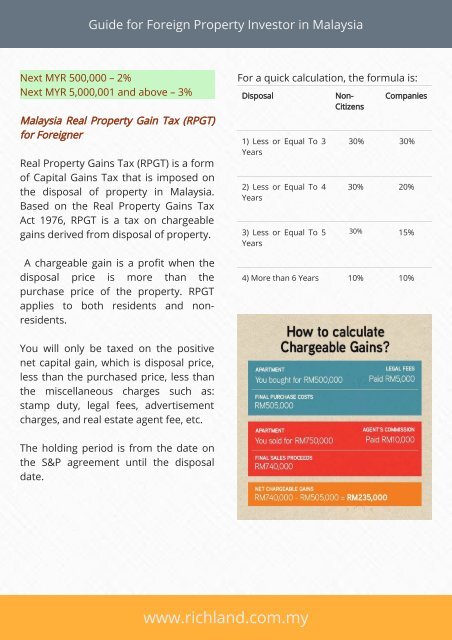

For a quick calculation, the formula is:<br />

Disposal<br />

1) Less or Equal To 3<br />

Years<br />

2) Less or Equal To 4<br />

Years<br />

3) Less or Equal To 5<br />

Years<br />

A chargeable gain is a pro t when the<br />

disposal price is more than the<br />

purchase price of the property. RPGT<br />

applies to both residents and nonresidents.<br />

Non-<br />

Citizens<br />

Companies<br />

30% 30%<br />

30% 20%<br />

30% 15%<br />

4) More than 6 Years 10% 10%<br />

You will only be taxed on the positive<br />

net capital gain, which is disposal price,<br />

less than the purchased price, less than<br />

the miscellaneous charges such as:<br />

stamp duty, legal fees, advertisement<br />

charges, and real estate agent fee, etc.<br />

The holding period is from the date on<br />

the S&P agreement until the disposal<br />

date.<br />

www.richland.com.my