Space Propulsion System Market Trends

The introduction of advanced space propulsion systems is anticipated to bring about radical changes in the satellite and launch vehicle manufacturing business. Ongoing efforts by the industry players to develop high end propulsion systems for future applications (example, deep space missions) is expected to boost this industry. Furthermore, given the huge growth in the small satellites and advancement towards reusable launch vehicles, it is expected that the space propulsion system market will observe large number of key strategic developments happening during the forecast period.

The introduction of advanced space propulsion systems is anticipated to bring about radical changes in the satellite and launch vehicle manufacturing business. Ongoing efforts by the industry players to develop high end propulsion systems for future applications (example, deep space missions) is expected to boost this industry. Furthermore, given the huge growth in the small satellites and advancement towards reusable launch vehicles, it is expected that the space propulsion system market will observe large number of key strategic developments happening during the forecast period.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

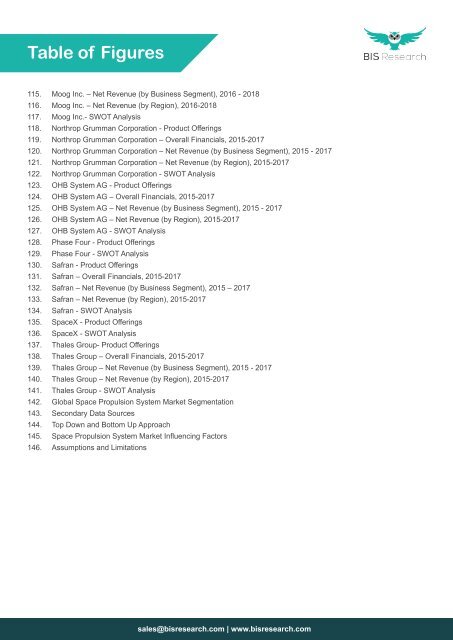

Table of Figures<br />

115. Moog Inc. – Net Revenue (by Business Segment), 2016 - 2018<br />

116. Moog Inc. – Net Revenue (by Region), 2016-2018<br />

117. Moog Inc.- SWOT Analysis<br />

118. Northrop Grumman Corporation - Product Offerings<br />

119. Northrop Grumman Corporation – Overall Financials, 2015-2017<br />

120. Northrop Grumman Corporation – Net Revenue (by Business Segment), 2015 - 2017<br />

121. Northrop Grumman Corporation – Net Revenue (by Region), 2015-2017<br />

122. Northrop Grumman Corporation - SWOT Analysis<br />

123. OHB <strong>System</strong> AG - Product Offerings<br />

124. OHB <strong>System</strong> AG – Overall Financials, 2015-2017<br />

125. OHB <strong>System</strong> AG – Net Revenue (by Business Segment), 2015 - 2017<br />

126. OHB <strong>System</strong> AG – Net Revenue (by Region), 2015-2017<br />

127. OHB <strong>System</strong> AG - SWOT Analysis<br />

128. Phase Four - Product Offerings<br />

129. Phase Four - SWOT Analysis<br />

130. Safran - Product Offerings<br />

131. Safran – Overall Financials, 2015-2017<br />

132. Safran – Net Revenue (by Business Segment), 2015 – 2017<br />

133. Safran – Net Revenue (by Region), 2015-2017<br />

134. Safran - SWOT Analysis<br />

135. <strong>Space</strong>X - Product Offerings<br />

136. <strong>Space</strong>X - SWOT Analysis<br />

137. Thales Group- Product Offerings<br />

138. Thales Group – Overall Financials, 2015-2017<br />

139. Thales Group – Net Revenue (by Business Segment), 2015 - 2017<br />

140. Thales Group – Net Revenue (by Region), 2015-2017<br />

141. Thales Group - SWOT Analysis<br />

142. Global <strong>Space</strong> <strong>Propulsion</strong> <strong>System</strong> <strong>Market</strong> Segmentation<br />

143. Secondary Data Sources<br />

144. Top Down and Bottom Up Approach<br />

145. <strong>Space</strong> <strong>Propulsion</strong> <strong>System</strong> <strong>Market</strong> Influencing Factors<br />

146. Assumptions and Limitations<br />

sales@bisresearch.com | www.bisresearch.com