Northern Cape Business 2019/20 edition

Since its launch in 2009, Northern Cape Business has established itself as the premier business and investment guide to the Northern Cape Province. The 2019/20 edition is officially supported and used by the Northern Cape Department of Economic Development and Tourism. Northern Cape Business is unique as a business and investment guide that focuses exclusively on the province. In addition to comprehensive overviews of sectors of the economy, this publication has a particular focus on specific, packaged investment opportunities. The massive potential represented by the Square Kilometre Array radio telescope project and the rapid progress being made by Sol Plaatje University are also highlighted in this edition.

Since its launch in 2009, Northern Cape Business has established itself as the premier business and investment guide to the Northern Cape Province. The 2019/20 edition is officially supported and used by the Northern Cape Department of Economic Development and Tourism.

Northern Cape Business is unique as a business and investment guide that focuses exclusively on the province. In addition to comprehensive overviews of sectors of the economy, this publication has a particular focus on specific, packaged investment opportunities.

The massive potential represented by the Square Kilometre Array radio telescope project and the rapid progress being made by Sol Plaatje University are also highlighted in this edition.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NORTHERN CAPE<br />

BUSINESS<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN THE NORTHERN CAPE PROVINCE<br />

<strong><strong>20</strong>19</strong>/<strong>20</strong> EDITION<br />

RTHERN CAPE<br />

SINESS<br />

E TO BUSINESS AND INVESTMENT<br />

ORTHERN CAPE PROVINCE<br />

<strong>20</strong>17/18 EDITION<br />

JOIN US ONLINE<br />

WWW.GLOBALAFRICANETWORK.COM | WWW.NORTHERNCAPEBUSINESS.CO.ZA<br />

ONLINE<br />

WWW.NORTHERNCAPEBUSINESS.CO.ZA

Physical: Metlife Towers,<br />

13th Fl, Cnr Stead & Knight Sts, Kimberley, 8309<br />

Postal: Private Bag X6108, Kimberley, 8300<br />

Tel: 053 839 4000 | Fax: 053 832 6805<br />

Web: http://economic.ncape.gov.za<br />

Email: dedat@ncpg.gov.za

CONTENTS<br />

CONTENTS<br />

<strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong> <strong><strong>20</strong>19</strong>/<strong>20</strong> Edition<br />

Introduction<br />

Foreword4<br />

The <strong>Northern</strong> <strong>Cape</strong>’s unique guide to business and investment.<br />

Special features<br />

Regional overview 6<br />

Major infrastructure is under construction in the <strong>Northern</strong><br />

<strong>Cape</strong> – or it will be soon – as the province prepares to move<br />

its economy into top gear.<br />

A competitive destination 10<br />

A trade and foreign direct investment (FDI) profile for the<br />

<strong>Northern</strong> <strong>Cape</strong>.<br />

Investment projects 12<br />

A wide range of investment opportunities are available for<br />

potential investors in the province.<br />

Upington Special Economic Zone 26<br />

More than 500 hectares of prime land is availible for investors.<br />

Tourism sector boom 28<br />

Adventure tourism continues to grow, and investors are sought<br />

for a steam train revival.<br />

Education creating opportunity 30<br />

Sol Plaatje University is reaching for the stars as the world’s<br />

biggest telescope project ramps up in the <strong>Northern</strong> <strong>Cape</strong>.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

2

Economic sectors<br />

CONTENTS<br />

Agriculture40<br />

Agri-processing is set to drive economic growth.<br />

Grapes and wine 44<br />

Record harvests are being recorded.<br />

Mining48<br />

A huge zinc project near Pofadder could lead to the <strong>Northern</strong><br />

<strong>Cape</strong> acquiring a smelter and a refinery.<br />

Water56<br />

Water projects are stimulating economic growth.<br />

Renewable energy 58<br />

Technical innovation comes to the <strong>Northern</strong> <strong>Cape</strong>.<br />

Banking and finance 60<br />

New banks are targeting niche markets.<br />

Development finance and SMME support 61<br />

An industrial park at Kathu will boost SMMEs.<br />

References<br />

Key sector contents 38<br />

Index64<br />

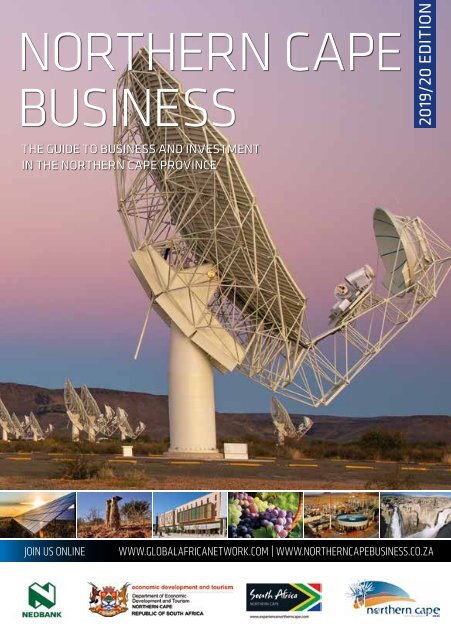

ABOUT THE COVER:<br />

Credit: NRF|SARAO. The MeerKAT radio telescope in the Karoo<br />

region of South Africa comprises 64 antennas and is currently<br />

the largest radio telescope in the world. MeerKAT is the precursor<br />

to the giant international project, the Square Kilometre Array<br />

(SKA) radio telescope. When the prototype Karoo Array Telescope<br />

(KAT) was expanded, the name for the expanded telescope was<br />

adopted to reflect the fact that more receptors were to be built<br />

(“meer” in Afrikaans) and to call to mind the much-loved animal<br />

that roams the Karoo.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

FOREWORD<br />

CREDITS<br />

Publisher: Chris Whales<br />

Publishing director: Robert Arendse<br />

Editor: John Young<br />

Online editor: Christoff Scholtz<br />

Art director: Brent Meder<br />

Design: Tyra Martin<br />

Production: Lizel Olivier<br />

Ad sales: Shiko Diala, Sandile Koni,<br />

Gavin van der Merwe, Sam Oliver,<br />

Gabriel Venter, Vanessa Wallace,<br />

Jeremy Petersen and Reginald<br />

Motsoahae<br />

Managing director: Clive During<br />

Administration & accounts:<br />

Charlene Steynberg and<br />

Natalie Koopman<br />

Distribution & circulation<br />

manager: Edward MacDonald<br />

Printing: FA Print<br />

<strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong><br />

A unique guide to business and investment in the<br />

<strong>Northern</strong> <strong>Cape</strong>.<br />

The <strong><strong>20</strong>19</strong>/<strong>20</strong> <strong>edition</strong> of <strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong> is the ninth<br />

issue of this highly successful publication that has, since its<br />

launch in <strong>20</strong>09, established itself as the premier business<br />

and investment guide for the <strong>Northern</strong> <strong>Cape</strong> Province.<br />

Officially supported and used by the <strong>Northern</strong> <strong>Cape</strong> Department<br />

of Economic Development and Tourism, <strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong> is<br />

unique as a business and investment guide that focuses exclusively<br />

on the province. In addition to comprehensive overviews of sectors<br />

of the economy, this publication has a particular focus on specific,<br />

packaged investment opportunities<br />

The massive potential represented by the Square Kilometre Array<br />

radio telescope project and the rapid progress being made by Sol<br />

Plaatje University are also highlighted in this <strong>edition</strong>.<br />

To complement the extensive local, national and international<br />

distribution of the print <strong>edition</strong>, the full content can also be viewed<br />

online at www.globalafricanetwork.com under e-books. Updated<br />

information on the <strong>Northern</strong> <strong>Cape</strong> is also available through our monthly<br />

e-newsletter, which you can subscribe to online at www.gan.co.za, in<br />

addition to our complementary business-to-business titles that cover<br />

all nine provinces as well as our flagship South African <strong>Business</strong> title.<br />

Chris Whales<br />

Publisher, Global Africa Network Media<br />

Email: chris@gan.co.za<br />

DISTRIBUTION<br />

<strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong> is distributed internationally on outgoing<br />

and incoming trade missions, through trade and investment<br />

agencies; to foreign offices in South Africa’s main trading partners<br />

around the world; at top national and international events;<br />

through the offices of foreign representatives in South Africa;<br />

as well as nationally and regionally via chambers of commerce,<br />

tourism offices, trade and investment agencies, provincial government<br />

departments, municipalities and companies.<br />

Member of the Audit Bureau<br />

of Circulations<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No: <strong>20</strong>04/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal address: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6<strong>20</strong>0 | Fax: +27 21 674 6943<br />

Email: info@gan.co.za | Website: www.gan.co.za<br />

ISSN <strong>20</strong>74-0654<br />

COPYRIGHT | <strong>Northern</strong> <strong>Cape</strong> <strong>Business</strong> is an independent publication<br />

published by Global Africa Network Media (Pty) Ltd. Full copyright to<br />

the publication vests with Global Africa Network Media (Pty) Ltd. No part<br />

of the publication may be reproduced in any form without the written<br />

permission of Global Africa Network Media (Pty) Ltd.<br />

PHOTO CREDITS | Pictures supplied by: Abengoa Solar; Aurecon;<br />

Flicker/SA Tourism; Industrial Development Corporation; iStock; Kumba<br />

Iron Ore; Murray and Dickson Construction; Noblesfontien Wind Farm;<br />

NRF|SARAO; Kevin Wright and Vedanta Zinc International; Robertson<br />

Ventilation Industries (RVI); Savage + Dodd architects; Sedibeng Water.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong> 4<br />

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd, has<br />

used all reasonable efforts to ensure that the information contained in <strong>Northern</strong><br />

<strong>Cape</strong> <strong>Business</strong> is accurate and up-to-date, the publishers make no representations<br />

as to the accuracy, quality, timeliness, or completeness of the information.<br />

Global Africa Network will not accept responsibility for any loss or damage<br />

suffered as a result of the use of or any reliance placed on such information.

The Black Management Forum<br />

The BMF is a thought leadership organisation founded in<br />

1976, with the main purpose of influencing socio-economic<br />

transformation of our country, in pursuit of socio-economic<br />

justice, fairness and equity.<br />

The organisation stands for the development and<br />

empowerment of managerial leadership amongst black people<br />

within organisations and the creation of managerial structures<br />

and processes, which reflect the demographics, and<br />

value of the wider society.<br />

For detailed information on how to become a member, please contact<br />

Thulisile Simelane. Email: thulisile@bmfonline.co.za<br />

www.bmfonline.co.za BMFNational@ BMFNational @BMFNational

SPECIAL FEATURE<br />

A REGIONAL OVERVIEW OF THE<br />

NORTHERN<br />

CAPE PROVINCE<br />

By John Young<br />

Major infrastructure is under construction in the <strong>Northern</strong> <strong>Cape</strong> —or it will be soon<br />

— as the province prepares to move its economy into top gear. Water schemes, an<br />

economic development zone, a railways logistics hub, a Special Economic Zone at<br />

Upington Airport, a new harbour and a new university are among the infrastructure<br />

projects underway or under consideration in South Africa’s largest province.<br />

The planned Special Economic Zone<br />

(linked to the Upington International<br />

Airport) is intended as a site for solarrelated<br />

manufacturing. The Industrial<br />

Development Corporation has spent R11.4-<br />

billion of its commitment to renewable energy<br />

so far in the <strong>Northern</strong> <strong>Cape</strong>. Part of the IDC’s<br />

role has been to take up a <strong>20</strong>% stake in projects<br />

on behalf of local communities.<br />

Provincial assets<br />

The <strong>Northern</strong> <strong>Cape</strong> is South Africa’s<br />

largest province at 372 889km², covering<br />

30% of the country’s landmass on the dry<br />

western side of the country bordering the<br />

Atlantic Ocean, Namibia and Botswana.<br />

The Sishen-Saldanha ore export railway<br />

line is one of the mechanical wonders of<br />

the world. The line extends 860km and the<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

6

SPECIAL FEATURE<br />

trains sometimes extend beyond 3 500 metres<br />

and carry a load exceeding 41 000 tons.<br />

The <strong>Northern</strong> <strong>Cape</strong> produces more than 84%<br />

of South Africa’s iron ore. Kumba Iron Ore is the<br />

country’s biggest iron-ore miner with two large<br />

two mines (Sishen and Kolomela) in the province.<br />

The Kalahari Basin contains 80% of the<br />

world’s manganese reserve, but only 15% of<br />

global production comes from this area so there<br />

is enormous scope for development. Several new<br />

black-owned manganese projects are underway.<br />

The world receives 7% of its diamonds from the<br />

<strong>Northern</strong> <strong>Cape</strong>, and exports of zinc and lead<br />

from the province account for 13% of global<br />

demand.<br />

Vedanta Zinc International started work in<br />

<strong>20</strong>15 on its huge new Gamsberg Zinc project.<br />

The new mine is near to Vedanta’s existing Black<br />

Mountain mine and is the biggest current new<br />

project underway The flotation area of the mine<br />

is shown here in a photograph by Kevin Wright.<br />

The province also has copper, lead, zinc,<br />

mineral sands, gypsum, granite, asbestos,<br />

fluorspar, semi-precious stones and marble.<br />

The <strong>Northern</strong> <strong>Cape</strong> is a big contributor to<br />

the national basket of exports in minerals and<br />

in agricultural products such as table grapes<br />

and raisins. About 45 000 people are employed<br />

in agriculture, which represents approximately<br />

16% of employment. The province supports<br />

livestock farming (mainly goats and sheep<br />

with cattle in the north), table grapes, dates,<br />

cotton and cereal crops and vineyards along<br />

the banks of the Orange River, large varieties of<br />

crops including cotton, groundnuts, wheat and<br />

maize on irrigated lands. Pecan nuts are a major<br />

new crop. Thoroughbred horses are bred in the<br />

south-eastern parts of the province, especially<br />

around Colesberg.<br />

The <strong>Northern</strong> <strong>Cape</strong> is home to six national parks<br />

and five provincial parks and nature reserves. The<br />

Richtersveld Cultural and Botanical Landscape is<br />

a World Heritage Site and the Namaqualand spring<br />

flower display draws many visitors.<br />

Most of the province falls into the category<br />

of semi-arid (apart from the coastal strip) and it<br />

receives relatively little rainfall. Summers are hot<br />

and winters are cold.<br />

District municipalities<br />

Frances Baard District Municipality<br />

Towns: Kimberley, Barkly West, Warrenton,<br />

Hartswater, Jan Kempdorp.<br />

This district accounts for 40.3% of the province’s<br />

economic activity. It is the smallest but with a population<br />

of approximately 325 500, it is the most<br />

densely populated. Although Kimberley is historically<br />

7<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

SPECIAL FEATURE<br />

renowned for diamond mining, its economy is now<br />

driven by its role as the administrative headquarters<br />

of the province. Strategically located and with good<br />

infrastructure, Kimberley is the leading centre in<br />

the province for retail, financial services, education,<br />

commerce and light industry.<br />

The Mittah Seperepere Convention Centre and<br />

the Sol Plaatje University are in Kimberley. Mining<br />

and agriculture are found in rural municipalities.<br />

Agriculture in the region comprises crop cultivation<br />

and stock and game farming. The Vaalharts Water<br />

Scheme is the largest irrigation project of its kind<br />

in the southern hemisphere.<br />

Investment opportunities:<br />

• Sol Plaatje University<br />

• Kimberley International Diamond and<br />

Jewellery Academy (KIDJA)<br />

• Mining: diamonds and precious stones<br />

• Manufacturing: textiles, agri-processing.<br />

John Taolo Gaetsewe District Municipality<br />

Towns: Kuruman, Kathu, Hotazel.<br />

Kuruman is the headquarters of local government<br />

in this region and contributes 19.7% to the<br />

province’s economy. The local spring produces<br />

<strong>20</strong>-million litres of water every day.<br />

Most of the district is situated on the Ghaap<br />

Plateau, over 1 000 metres above sea-level and<br />

can experience extreme temperatures. Most<br />

agricultural activity is limited to grazing and<br />

boer goats are a popular breed among farmers,<br />

although game hunting is growing.<br />

Kathu has a well-developed CBD with shopping<br />

malls that arose when iron demand was high.<br />

The Sishen iron ore mine outside Kathu is a vast<br />

undertaking, providing employment for thousands<br />

of people. Samancor’s Mamatwan and Wessels<br />

manganese mines and plants are situated at Hotazel.<br />

Investment opportunities:<br />

• Kathu Industrial Park (IDC involvement)<br />

• Eco-tourism and hunting<br />

• Boesmansput diving resort<br />

• Gamagara Mining Corridor (housing,<br />

infrastructure)<br />

• Goat commercialisation<br />

• Agri-processing: olives, grains, pecan<br />

nuts, medicinal plants.<br />

Namakwa District Municipality<br />

Towns: Springbok, Calvinia, Niewoudtville,<br />

Garies, Williston, Fraserburg, Sutherland,<br />

Pofadder, Okiep, Port Nolloth, Alexander Bay.<br />

The Namakwa District stretches from the northwestern<br />

corner of the province, and the country,<br />

bordering Namibia and the Atlantic Ocean to<br />

the southern border of the province with the<br />

Western <strong>Cape</strong> Province. It includes the famous<br />

star-gazing town of Sutherland on its southern<br />

edge. The district is sparsely populated, and<br />

predominantly rural. It contributes 11.1% to<br />

economic activity in the province.<br />

A major new investment has been undertaken<br />

in zinc at the Gamsberg project.<br />

The mining and agricultural sectors provide<br />

most employment, while tourism and small-scale<br />

manufacturing are also present. There are plans<br />

to upgrade the harbour at Port Nolloth.<br />

The region’s economy gets a great boost<br />

every spring when tourists flock to see the veld<br />

in bloom. The climate and soil support certain<br />

niche crops, and the sites and sights are unique<br />

to the region, offering opportunities in agriculture<br />

and tourism. Niewoudtville is the site of a rooibos<br />

tea factory.<br />

The /Ai/Ais/Richtersveld Transfrontier Park,<br />

the Namakwa National Park and the Tankwa<br />

Karoo National Park have the potential to grow<br />

as travel destinations, as does the western<br />

coastline.<br />

Investment opportunities:<br />

• Development of Port Nolloth and smaller<br />

harbours<br />

• Hondeklip Fish Factories<br />

• Abalone and hake<br />

• Kelp processing and export<br />

• Game and nature reserve infrastructure<br />

• Rooibos tea<br />

• Calvinia: sheep and goat processing.<br />

Pixley Ka Seme District Municipality<br />

Towns: De Aar, Hanover, Carnarvon, Douglas,<br />

Marydale, Prieska, Hopetown, Richmond,<br />

Noupoort, Norvalspont, Colesberg.<br />

The district covers 102 000 square kilometres<br />

in the central Karoo and contributes 11.3% of<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

8

SPECIAL FEATURE<br />

the economic activity of the province. It has four<br />

national roads passing through it. De Aar, the<br />

site of the municipal headquarters, has national<br />

significance as a railway junction. The provincial<br />

government has published plans to create a<br />

logistics hub at De Aar.<br />

Star-gazing is Carnarvon’s great claim to<br />

fame, and it will now host the Square Kilometre<br />

Array (SKA) radio telescope.<br />

The district is home to three of South Africa’s<br />

major dams. Agricultural production includes<br />

wheat, maize, peanuts, grapes, beans, potatoes,<br />

nuts and sheep farming. Pixley Ka Seme is the<br />

largest wool-producing district in South Africa,<br />

but most of what is produced is processed in<br />

the Eastern <strong>Cape</strong>, so opportunities exist for the<br />

establishment of a cotton mill, a tannery and a<br />

facility to add value to semi-precious stones.<br />

Horse breeding is a valuable contributor to the<br />

regional economy.<br />

Investment opportunities:<br />

• De Aar rail cargo hub and workshops<br />

• SKA engineering, science, logistics<br />

support and education<br />

• Douglas holiday resort<br />

• Booktown Richmond festivals<br />

• Wool, pistachio nuts and venison<br />

processing<br />

• Water tourism activities on dams.<br />

ZF Mgcawu District Municipality<br />

Towns: Upington, Kakamas, Kenhardt,<br />

Groblershoop, Postmasberg.<br />

The Orange River supports a thriving<br />

agricultural sector and a growing tourism<br />

sector. The investment climate is ripe for<br />

tourism along the Orange River and around<br />

unique physical attractions such as the<br />

Augrabies Falls.<br />

Upington is already a busy town with<br />

processing facilities for agricultural products.<br />

The planned development of a Special<br />

Economic Zone (SEZ) in the town and next<br />

to Upington International Airport will boost<br />

manufacturing. The main targeted sectors at<br />

this stage are in the renewable energy sector,<br />

for example, solar panels.<br />

Most of the population of the //Khara Hais<br />

Local Municipality lives in Upington. Agriculture<br />

is a prominent feature of the local economy,<br />

as well as wholesale and retail services in<br />

and around the town. Various kinds of highspeed<br />

car racing and testing takes place on<br />

the roads, tracks and airport runway in or near<br />

the town.<br />

The processing of wine and dried fruit is<br />

one of the biggest manufacturing activities in<br />

the province. Mining activities take place in<br />

Kgatelopele, where diamonds and lime are<br />

found. Together with sheep and cattle farming,<br />

mining provides most of the employment to<br />

be found in Siyanda. The diamond mine at<br />

Finsch is Petra Diamonds’ newest and largest<br />

acquisition.<br />

Investment opportunities:<br />

• Upington Special Economic Zone<br />

• Upington Cargo and Electronics hub: SKA,<br />

renewable energy and aircraft storage<br />

• Upington International Airport<br />

• Orange River Smallholder Farmer<br />

Settlement and Development Programme<br />

• Tourism: wine tours, adventure and hunting<br />

• Upington vehicle testing site<br />

• <strong>Business</strong> Process Outsourcing (BPO).<br />

9 NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

SPECIAL FEATURE<br />

A competitive destination<br />

A trade and foreign direct investment (FDI) profile for the <strong>Northern</strong> <strong>Cape</strong>.<br />

SPECIAL FEATURE<br />

A competitive destination<br />

A trade and foreign direct investment (FDI) profile for the <strong>Northern</strong> <strong>Cape</strong><br />

Between January <strong>20</strong>11 and March <strong>20</strong>16, a total of 486 FDI projects were recorded. These projects<br />

represent a total capital investment of ZAR365.63 which is an average investment of ZAR752.23<br />

m per project. During the period, a total of 68,533 jobs were created.<br />

Aggregate Annual Figures<br />

Between January <strong>20</strong>11 and<br />

March <strong>20</strong>16, a total of 486 FDI<br />

projects were recorded. These<br />

projects represent a total capital<br />

investment of ZAR365.63-billion<br />

which is an average investment of<br />

ZAR752.23m per project. During<br />

the period, a total of 68 533 jobs<br />

were created.<br />

Year Projects <strong>Cape</strong>x Avg <strong>Cape</strong>x Jobs Created Avg Jobs Companies<br />

<strong>20</strong>16 15 31 689.9 2112.6 4 062 270 15<br />

<strong>20</strong>15 80 53 080.6 663.2 11 <strong>20</strong>9 140 73<br />

<strong>20</strong>14 73 37 979.7 5<strong>20</strong>.2 6 747 92 70<br />

<strong>20</strong>13 100 74 883.7 748.7 12 981 129 87<br />

<strong>20</strong>12 101 46 718.2 462.8 13 328 131 93<br />

<strong>20</strong>11 117 121 273.9 1037.0 <strong>20</strong> <strong>20</strong>6 172 103<br />

Total 486 365 626.0 752.2 68 533 141 397<br />

Notes:<br />

1) © fDi Intelligence, from the Financial Times Ltd <strong>20</strong>16. Data subject to terms and conditions of use<br />

2) All <strong>Cape</strong>x figures shown in the table are in ZAR - South Africa Rand millions<br />

3) <strong>Cape</strong>x data includes estimated values Financial Times Ltd takes no responsibility for the accuracy or otherwise of this data.<br />

4) Jobs data includes estimated values Financial Times Ltd takes no responsibility for the accurac y or otherwise of this data.<br />

Top 10 Export Countries: <strong>20</strong>17<br />

Country<br />

Export value (R)<br />

Aggregate Annual Figures Botswana 6,890,685,954<br />

China 2,221,952,600<br />

Projects Created Avg Destination State <strong>Cape</strong>x Avg <strong>Cape</strong>x Jobs Jobs Companies<br />

India<br />

129<br />

1,069,547,234<br />

Gauteng 197 113 130.5 574.1 28 142 190<br />

Western <strong>Cape</strong> 86 26 092.7 303.5 7 154 83 84<br />

KwaZulu-Natal<br />

Japan<br />

49 27 887.8 569.4 5 694<br />

715,242,337<br />

116 40<br />

Eastern <strong>Cape</strong> 28 28 097.5 1003.0 7 043 251 25<br />

<strong>Northern</strong> <strong>Cape</strong> South Korea 27 82 577.1 3058.2 4 314 696,539,853 159 17<br />

Mpumalanga 9 5 586.7 621.0 1 471 163 9<br />

Limpopo Hong Kong 6 7 938.3 1322.9 499599,381,645<br />

83 4<br />

Free State 5 18 979.3 3796.3 2 676 535 5<br />

North West Spain 4 1 160.0 290.6 569528,724,330<br />

142 4<br />

Not Specified 75 54 177.3 722.9 10 984 146 71<br />

Total Netherlands 486 365 626.0 752.2 68 533 468,907,925 141 397<br />

Notes:<br />

Russia 444,756,156<br />

1) © fDi Intelligence, from the Financial Times Ltd <strong>20</strong>16. Data subject to terms and conditions of use<br />

Namibia<br />

the table are<br />

380,498,692<br />

2) All <strong>Cape</strong>x figures shown in in ZAR - South Africa Rand millions<br />

3) <strong>Cape</strong>x data includes estimated values Financial Times Ltd takes no responsibility for the accuracy or otherwise of this data.<br />

Source: IHS Markit Regional eXplorer version 1570<br />

4) Jobs data includes estimated values Financial Times Ltd takes no responsibility for the accurac y or otherwise of this data.<br />

Between January <strong>20</strong>11 and March <strong>20</strong>16 a total of 27 FDI projects were recorded in the <strong>Northern</strong><br />

Top 10 Export Countries: <strong>20</strong>17<br />

Top 10 Export Products: <strong>20</strong>17<br />

<strong>Cape</strong>. These projects represent a total capital investment of ZAR82.57 which is an average<br />

Country<br />

Export value (R)<br />

Product<br />

Export value (R)<br />

investment of ZAR3058.2 m per project. During the period, a total of 4 314 jobs were created.<br />

Botswana 6,890,685,954<br />

Other mining and quarrying 6,868,457,598<br />

China 2,221,952,600<br />

India 1,069,547,234<br />

Japan 715,242,337<br />

South Korea 696,539,853<br />

Hong Kong 599,381,645<br />

Spain 528,724,330<br />

Netherlands 468,907,925<br />

Russia 444,756,156<br />

Namibia 380,498,692<br />

Source: IHS Markit Regional eXplorer version 1570<br />

Mining of metal ores 6,774,758,037<br />

Agriculture and hunting 2,662,038,128<br />

Furniture and other items NEC and recycling 435,389,857<br />

Metal products, machinery and household appliances 312,717,558<br />

Food, beverages and tobacco products 235,931,643<br />

Transport equipment 170,557,<strong>20</strong>6<br />

Fuel, petroleum, chemical and rubber products 54,817,748<br />

Electrical machinery and apparatus 53,095,740<br />

Wood and wood products 34,282,962<br />

Source: IHS Markit Regional eXplorer version 1570<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

Top 10 Export Products: <strong>20</strong>17<br />

Product<br />

Export value (R)<br />

10<br />

Other mining and quarrying 6,868,457,598<br />

Mining of metal ores 6,774,758,037

All FDI into <strong>Northern</strong> <strong>Cape</strong>, South Africa<br />

Data for companies from source countries investing in <strong>Northern</strong> <strong>Cape</strong> in activities between January <strong>20</strong>11 and March <strong>20</strong>16<br />

Project Date Investing<br />

NO<br />

Company<br />

Mar-15 Enel Green<br />

1<br />

Power<br />

Jan-15 ACWA Power<br />

2<br />

International<br />

3<br />

Jan-15 Engie (GDF SUEZ)<br />

(Gaz de France<br />

Parent<br />

Company<br />

Source<br />

Country<br />

Source City Capital<br />

Investment<br />

Sub-Sector<br />

Enel Italy Rome 2557.833087 Solar electric<br />

power<br />

ACWA Saudi Arabia Riyadh 14060.46589 Solar electric<br />

Power<br />

power<br />

International<br />

Engie (GDF France Paris 2557.833087 Solar electric<br />

SUEZ) (Gaz<br />

power<br />

de France<br />

Industry<br />

Activity<br />

Electricity<br />

Electricity<br />

Electricity<br />

Jan-15 Sonnedix Solar Sonnedix Netherlands Amsterdam 2568.378436 Solar electric Electricity<br />

4<br />

Solar<br />

power<br />

Nov-14 Sesa Sterlite Vendanta UK London 7381.744593 Copper,<br />

Electricity<br />

5<br />

Resources<br />

lead,nickel,zinc<br />

Nov-13 Sunpower Total France Paris 2343.410982 Solar electric Electricity<br />

6<br />

power<br />

Oct-13 Mainstream Mainstream Ireland Dublin 2568.378436 Wind electric Electricity<br />

7<br />

Renewable Renewable<br />

power<br />

Power<br />

Power<br />

Oct-13 Mainstream<br />

8<br />

Renewable<br />

Power<br />

Oct-13 Mainstream<br />

9<br />

Renewable<br />

Power<br />

Mainstream<br />

Renewable<br />

Power<br />

Mainstream<br />

Renewable<br />

Power<br />

Ireland Dublin 2568.378436 Wind electric<br />

power<br />

Ireland Dublin 2568.378436 Wind electric<br />

power<br />

Electricity<br />

Electricity<br />

Sep-13 Acciona Acciona Spain Alcobendas 2441.834243 Solar electric Electricity<br />

10<br />

power<br />

Sep-13 ACWA Power ACWA Saudi Arabia Riyadh 6151.453828 Solar electric Electricity<br />

11<br />

International Power<br />

power<br />

International<br />

May-13 Scatec Solar Scatec AS Norway Oslo 2348.449316 Solar electric Electricity<br />

12<br />

power<br />

Feb-13 Globeleq<br />

Globeleq South East UK London 2568.378436 Solar electric Electricity<br />

13<br />

Generation Generation<br />

power<br />

Nov-14 Mainstream 17 Mainstream<br />

Jan-12 Powerway Ireland Powerway Dublin China 2568.378436 Foshan 0.23434109 Solar electric Steel products Electricity Manufacturin<br />

14<br />

Renewable Renewable Renewable Renewable Energy<br />

8 power<br />

g<br />

Power<br />

Power Energy<br />

Nov-12 Mainstream Mainstream Ireland Dublin 82.01938437 Solar electric Electricity<br />

15 18 Jan-12 Powerway Powerway<br />

China Foshan 0.23434109 Other<br />

Manufacturin<br />

Renewable Renewable<br />

power<br />

Renewable Renewable Energy<br />

8<br />

fabricated g<br />

Power<br />

Power<br />

Energy<br />

metal pro<br />

Jan-12 Powerway<br />

Powerway China Foshan 0.234341098 Other<br />

Education &<br />

16<br />

Renewable 19 Renewable<br />

Jan-12 Powerway Powerway<br />

China Foshan 0.23434109 fabricated Coating, Training heat Manufacturin<br />

Energy<br />

Energy Renewable Renewable Energy<br />

8 metal prds treating ,etc g<br />

Jan-12 Powerway<br />

Powerway Energy China Foshan 0.234341098 Steel products Manufacturing<br />

17<br />

Renewable Renewable<br />

Energy<br />

No Energy Projec Investing<br />

Parent Company Source Source City Capital Sub-Sector Industry<br />

Jan-12 Powerway<br />

Powerway<br />

t Date Company China Foshan Country 0.234341098 Investment Other<br />

Manufacturing Activity<br />

18<br />

Renewable Renewable<br />

fabricated<br />

Energy<br />

<strong>20</strong> Energy Dec-11 Abengoa Abengoa Spain Seville 2283.65400 metal pro Solar electric Electricity<br />

2<br />

power<br />

Jan-12 Powerway<br />

Powerway China Foshan 0.234341098 Coating, heat Manufacturing<br />

19<br />

Renewable Renewable<br />

treating ,etc<br />

21 Dec-11 Abengoa Abengoa Spain Seville 2283.65400 Solar electric Electricity<br />

Energy<br />

Energy<br />

2<br />

power<br />

Dec-11 Abengoa Abengoa Spain Seville 2283.654002 Solar electric Electricity<br />

<strong>20</strong><br />

22 Dec-11 Anglo American Anglo American UK London 11717.0549 power Iron ore mining Extraction<br />

Dec-11 Abengoa Abengoa Spain Seville 2283.654002 1 Solar electric Electricity<br />

21<br />

power<br />

Dec-11 Anglo American 23 Anglo Dec-11 Scatec Solar UK Scatec AS London Norway 11717.05491 Oslo 3091.31059 Iron ore Solar Extraction<br />

electric Electricity<br />

22<br />

American<br />

7 mining power<br />

Dec-11 Scatec Solar Scatec AS Norway Oslo 3091.310597 Solar electric Electricity<br />

23<br />

24 Dec-11 Solar Reserve Solar Reserve United Santa 2568.37843 power Solar electric Electricity<br />

States Monica 6<br />

power<br />

Dec-11 Solar Reserve Solar<br />

United States Santa Monica 2568.378436 Solar electric Electricity<br />

24<br />

Reserve<br />

power<br />

25 Jul-11 David Brown Clyde Blowers UK East 58.5852745 General Maintenance<br />

Jul-11 David Brown Clyde<br />

UK East Kilbridge 58.58527455 General<br />

Maintenance<br />

25 Group<br />

Kilbridge 5<br />

purpose & Service<br />

Group<br />

Blowers<br />

purpose machinery & Service<br />

machinery<br />

May-11 Diana Group 26 Diana May- Group Diana France Group Diana Not Group specified France 326.905832 Not<br />

326.905832 Paints, Paints, Manufacturing<br />

26<br />

Manufacturin<br />

(Groupe Diana) (Groupe 11 (Groupe Diana) (Groupe Diana)<br />

specified coatings& coatings& g<br />

Diana)<br />

adhesive adhesive<br />

May-11 Diana Group Diana Group France Not specified 326.905832 Paints,<br />

Manufacturing<br />

26<br />

(Groupe Diana) 27 (Groupe Feb-11 Jupiter Mines Jupiter Mines Australia Perth 2343.41098 coatings& Nonmetallic Extraction<br />

Diana)<br />

2 adhesive mineral mining<br />

Feb-11 Jupiter Mines Jupiter Australia Perth 2343.410982 Nonmetallic Extraction<br />

27<br />

Mines<br />

mineral mining<br />

Source: Investment South Africa (ISA) the dti

FOCUS<br />

Investment<br />

Opportunities<br />

<strong>Northern</strong> <strong>Cape</strong> economic potential and investment.<br />

Several locations within the <strong>Northern</strong><br />

<strong>Cape</strong> are being developed to be catalysts<br />

for investment into the province.<br />

These include the Upington Special<br />

Economic Zone, the Kathu Industrial Park,<br />

the De Aar Logistics Hub and the Boegoebaai<br />

Port Project.<br />

Other sites attracting different kinds of investment<br />

include the Square Kilometre Array radio<br />

telescope project near Carnarvon and the Sol<br />

Plaatje University in Kimberley.<br />

The competitive and comparative advantages<br />

of the <strong>Northern</strong> <strong>Cape</strong> can be summarised as<br />

follows:<br />

• mineral resources<br />

• climate<br />

• open spaces and distances<br />

• astronomy<br />

• air quality<br />

• coastline.<br />

To realise the socio-economic priorities of the<br />

<strong>Northern</strong> <strong>Cape</strong> Province, there is a focus on the<br />

following key economic sectors:<br />

• agriculture and agro-processing<br />

• fishing and aquaculture<br />

• mining and mineral processing<br />

• manufacturing<br />

• tourism<br />

• knowledge economy<br />

• energy sector.<br />

The following investment opportunities are<br />

described in detail in the pages that follow:<br />

Investment opportunity Sectors Location Value<br />

Kathu Industrial Park<br />

Upington SEZ Agri-hub<br />

Aviation Aircraft<br />

Development<br />

Maintenance repair and<br />

operations (MRO)<br />

Mining, renewable energy,<br />

service, logistics<br />

manufacturing<br />

Kathu<br />

R530-million (1st phase)<br />

Agricultural processing and Upington<br />

R570-million<br />

logistics<br />

Aeronautical Upington SEZ R340-million<br />

Aeronautical Upington SEZ R800-million<br />

<strong>Northern</strong> <strong>Cape</strong> Renewable<br />

Renewable energy,<br />

Upington<br />

R23-million, R240-million or<br />

Energy Incubator<br />

manufacturing<br />

R500-million (options)<br />

Solar Farm, power for SEZ Renewable energy Upington SEZ R270-million<br />

Fibre Optics Manufacturing ICT broadband Upington SEZ R228-million<br />

Nyaniso Healthcare<br />

Latex condom<br />

Colesberg<br />

R150-million<br />

manufacturing<br />

Versa Chemicals, Paint and<br />

Detergent Manufacturing<br />

Manufacturing Kimberley R100-million<br />

Promethean Waterfront Tourism and heritage Barkly West R800-million<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

12

Fibre Optics<br />

Manufacturing<br />

Broadband services.<br />

Project location<br />

The project’s physical address is 24 Schroeder<br />

Street, Upington, in the ZF Mgcawu District.<br />

Targeted sectors<br />

ICT broadband.<br />

FOCUS<br />

Project description<br />

The investor is a fibre optic manufacturing and<br />

broadband solutions company. It is a black<br />

and female-owned company managed and<br />

supported by a team of experts in engineering,<br />

marketing and financial disciplines. The<br />

company intends to contribute to the<br />

infrastructural broadband development in<br />

South Africa and other African countries.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist,<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email:<br />

bmbobo@upington-sez.co.za<br />

Mr E Ntoba, Dawid Kruiper Local Municipality<br />

Tel: +27 54 338 5000<br />

Email: entoba@dkm.gov.za<br />

Project background<br />

The investor is a fibre optic ICT broadband<br />

organisation that specialises in infrastructure<br />

services, facilitating all light infrastructure<br />

needs for cloud computing and data centres.<br />

It distributes passive fibre optic materials.<br />

Key facts<br />

Investment value: R228-million<br />

Job creation: 169 jobs<br />

Mr T Klassen, Department of Trade and<br />

Industry<br />

Tel: +27 12 394 1482<br />

Finance<br />

The project will be financed by the investor<br />

with the government providing enabling<br />

infrastructure.<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

13<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

FOCUS<br />

Kathu Industrial Park (KIP)<br />

A catalyst for economic growth.<br />

Targeted sectors<br />

The KIP targets all economic sectors requiring<br />

serviced industrial space in the region,<br />

but with the major portion of the initial tenant<br />

makeup (study phase) primarily serving the<br />

established mining sector, by virtue of the<br />

KIP’s central proximity to the Postmasburg-<br />

Hotazel iron-ore/manganese belt. The KIP is<br />

also well positioned to serve the emerging<br />

REIPPPP sector in the region. In addition to<br />

the ongoing development of business opportunities<br />

within the tenant supply chains,<br />

it will be the role of the KIP business incubator<br />

to expand coverage of the KIP into<br />

other sectors.<br />

Study phase tenant engagement and<br />

commitment to the project has been concluded<br />

on a “first come, first served” basis<br />

and has covered all possible prospective<br />

tenants, regardless of size or level of development.<br />

The KIP development caters for all<br />

nature of tenant facilities, from large customised<br />

facilities through to smaller, economically<br />

efficient mini-factories.<br />

Project location<br />

Farm Sekgame, 461 Kuruman Road, Gamagara<br />

Local Municipality, Kathu. GPS coordinates:<br />

S27° 42’ 52.5” E23° 02’ 33.8”<br />

Job creation<br />

During development: 1 300 (direct), 805<br />

(indirect) and 2 273 (induced).<br />

During operations: 2 240 (direct), 3 137<br />

(indirect) and 3 446 (induced).<br />

Project description<br />

The KIP development comprises the following:<br />

• Central hub: This will comprise various<br />

facilities and the associated infrastructure<br />

network supporting KIP management<br />

structures. The scope of facilities<br />

is envisaged to include: central administration<br />

offices; conferencing facilities;<br />

an auditorium; a security office; a restaurant;<br />

and other social facilities. These<br />

are to be located in a hub within the park<br />

in a centrally located single-level building,<br />

with visitor parking and appropriate<br />

landscaping.<br />

• A central logistics facility.<br />

• A <strong>Business</strong> Incubation Centre and<br />

Training Centre.<br />

• Customised warehouses and industrial<br />

buildings and (standard specification)<br />

mini-factories.<br />

• Security fencing and lighting.<br />

• Additional infrastructure envisaged for<br />

the functionality of the KIP includes:<br />

internal roads (tarred and paved), a<br />

storm-water system and an internal<br />

water reticulation system.<br />

Project status<br />

Feasibility Study, Project Development Plan,<br />

<strong>Business</strong> Plan and Environmental Impact<br />

Assessment Study completed. Currently in<br />

the process of finalising KIP Shareholders<br />

Agreement, with involvement in the project<br />

currently secured from: IDC, Kumba, SIOC-<br />

CDT, Assmang and with engagement still<br />

underway with South32. Partnerships are in<br />

place with the private sector, the Industrial<br />

Development Corporation, provincial<br />

government and local government.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong><br />

14

FOCUS<br />

Finance<br />

KIP is a strategic Social Economic<br />

Development (SED) project with extensive<br />

short- and long-term benefits which also provides<br />

a key point of integration supporting<br />

the <strong>Northern</strong> <strong>Cape</strong> Share Value Initiative (a<br />

strategic initiative recently launched by the<br />

<strong>Northern</strong> <strong>Cape</strong> Mining Leadership Forum).<br />

Government commitment: bulk<br />

infrastructure contribution. <br />

Private sector investment required: Phase<br />

1 estimated R152-million (to crowd out<br />

Project Summary<br />

Industrial Development Corporation equity<br />

1. Kathu Industrial Park<br />

contribution).<br />

Project Location<br />

District:Gamagara Local Municipality<br />

Physical address: Farm Sekgame, 461 Kuruman Road<br />

Key facts<br />

GPS Coordinates: S27° 42’ 52.5” E23° 02’ 33.8”<br />

Project Name and background<br />

City/Town: Kathu<br />

Kathu Industrial Park. Sishen Iron Ore Company (Pty) Ltd (“SIOC”) and the Industrial Development<br />

Investment Corporation (“IDC”) have funded value: various studies to R530-million assess the feasibility of developing an (Phase industrial 1<br />

park to stimulate sustainable long-term economic development for the <strong>Northern</strong> <strong>Cape</strong> region. The<br />

estimate)<br />

envisaged development will attract all nature of tenants delivering industrial goods and services, to<br />

an environment leveraging economy of scale from centralized facilities and complemented by a<br />

business incubation and training complex. With the mining industry being the largest real economic<br />

sector in the <strong>Northern</strong> <strong>Cape</strong> economy (based on contribution to GDP), the town of Kathu - located in<br />

the Gamagara Local Municipality (“GLM”) - is the preferred location due to its central proximity to<br />

the Postmasburg – Hotazel iron-ore/manganese belt and various established and pending REIPP<br />

To discuss this opportunity, contact<br />

Mr Stuart Dangerfield, Project Lead, Anglo<br />

American<br />

Tel: +27 11 679 2181 <br />

Mobile: 083 455 2862<br />

Email:<br />

stuart.dangerfield@angloamerican.com <br />

Mr Mehmood Ahmed, KIP Director<br />

Tel: +27 53 807 1050 <br />

Mobile: 078 801 4081<br />

Email: Mehmooda@idc.co.za<br />

Project background<br />

Sishen Iron Ore Company (Pty) Ltd (SIOC)<br />

and the Industrial Development Corporation<br />

(IDC) have funded various studies to assess<br />

the feasibility of developing an industrial park<br />

to stimulate sustainable long-term economic<br />

development for the <strong>Northern</strong> <strong>Cape</strong> region.<br />

The envisaged development will attract varied<br />

tenants delivering industrial goods and<br />

services to an environment leveraging economies<br />

of scale from centralised facilities and<br />

complemented by a business incubation and<br />

training complex.<br />

With the mining industry being the largest<br />

real economic sector in the <strong>Northern</strong><br />

<strong>Cape</strong> economy, the town of Kathu is the<br />

preferred location due to its central proximity<br />

to the Postmasburg-Hotazel iron-ore/<br />

manganese belt and various established and<br />

pending Renewable Energy Power Producer<br />

Procurement Programme (REIPPPP) projects.<br />

It is envisaged that the KIP serve as a<br />

catalyst for accelerated growth of other economic<br />

sectors. The feasibility study has not<br />

only confirmed extensive interest from businesses<br />

with a vested interest in the <strong>Northern</strong><br />

<strong>Cape</strong> region (ie potential tenants) but has<br />

also confirmed the support of various key<br />

stakeholders as well as the commitment of a<br />

number of investors. There has been interest<br />

from financial institutions.<br />

This development, located on the R380,<br />

is easily accessible from the N14 highway, a<br />

major service route between Johannesburg,<br />

the West Coast of South Africa and Botswana,<br />

and the Kathu airport. The study process has<br />

included an assessment of infrastructural<br />

requirements and has confirmed integration<br />

with Gamagara Local Municipality planning.<br />

15 NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

FOCUS<br />

Aircraft Development<br />

Aviation potential.<br />

Project location<br />

The project’s physical address is 24 Schroeder<br />

Street, Upington, in the ZF Mgcawu District. The<br />

GPS coordinates are: S28°25’51.96”; 21E°14’04.71”.<br />

Project description<br />

The investor intends to develop a new aircraft<br />

and to initiate a bone-yard recycling operation<br />

in Upington for other aircraft types.<br />

Targeted sectors<br />

Aeronautical.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist.<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email:<br />

bmbobo@upington-sez.co.za<br />

Mr E Ntoba, Dawid Kruiper Local Municipality<br />

Tel: +27 54 338 5000<br />

Email: entoba@dkm.gov.za<br />

Mr T Klassen, Department of Trade and<br />

Industry<br />

Tel: +27 12 3941482<br />

Finance<br />

The project will be financed by the private<br />

sector with the government providing<br />

enabling infrastructure.<br />

Project background<br />

The investor is poised to initiate the<br />

development of a local aircraft development<br />

group with a specific focus on helicopter<br />

manufacturing, bone-yard recycling<br />

operations and a new training academy for<br />

commercial pilots, technicians and engineers.<br />

The aim is to manufacture a new-age aircraft<br />

with lighter frames, a green end-to-end eco<br />

system, with energy and fuel efficiency and<br />

the ability to migrate to electric engines or<br />

hybrid technologies.<br />

Key facts<br />

Investment value: R340-million<br />

Job creation: 3 538 jobs<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong> 16

Maintenance Repair<br />

and Operations<br />

Aviation park for MRO.<br />

FOCUS<br />

Project location<br />

The project’s physical address is 24 Schroeder<br />

Street, Upington, in the ZF Mgcawu District.<br />

Targeted sectors<br />

Aeronautics.<br />

Project description<br />

The investor intends to develop an aviation park<br />

to accommodate Maintenance, Repairs and<br />

Overhaul (MRO) of aircraft and research and<br />

development. Activities will also include airline<br />

storage, dismantling, scrapping, painting, and<br />

internal refurbishment.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist.<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email: bmbobo@upington-sez.co.za<br />

Mr E Ntoba, Dawid Kruiper Local Municipality<br />

Tel: +27 54 338 5000<br />

Email: entoba@dkm.gov.za<br />

Mr T Klassen, Department of Trade and<br />

Industry<br />

Tel: +27 12 3941482<br />

Finance<br />

The project will be financed by the investor<br />

with the government providing enabling<br />

infrastructure. Partnerships will be pursued<br />

with the private sector, provincial government,<br />

local government and the <strong>Northern</strong> <strong>Cape</strong><br />

Development Agency.<br />

Key facts<br />

Investment value: R800-million<br />

Job creation: 400 jobs<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

17 NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>

FOCUS<br />

<strong>Northern</strong> <strong>Cape</strong> Renewable Energy<br />

Incubator<br />

Renewable energy hub.<br />

Project location<br />

The incubator will be located within the town of<br />

Upington in the ZF Mgcawu District.<br />

Targeted sectors<br />

Primary: renewable energy (utilities).<br />

Secondary: manufacturing, construction,<br />

transport, services, trade and ICT.<br />

Investment value<br />

Three options: R23-million, R240-million and<br />

R500-million.<br />

Project description<br />

South Africa’s Renewable Energy Independent<br />

Power Producer Procurement Programme<br />

(REIPPPP) has been successful in attracting<br />

billions of rands in investment. The <strong>Northern</strong><br />

<strong>Cape</strong> has been the leading solar power<br />

province and intends to further leverage its<br />

many advantages in this field. The renewable<br />

energy sector has the potential to unlock<br />

other sectors such as manufacturing and<br />

construction. The Renewable Energy Incubator<br />

will provide local SMMEs opportunities to<br />

participate in the localisation programme.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist,<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email: bmbobo@upington-sez.co.za<br />

<strong>Northern</strong> <strong>Cape</strong> Department of Economic<br />

Development and Tourism<br />

Mr Riaan Warie, Senior Manager<br />

Tel: +27 53 830 4058<br />

Mobile: 079 877 2828<br />

Email: rwarie@ncpg.gov.za<br />

Finance<br />

Funding for top structure and three years of<br />

operations through government incentives<br />

and contributions from IPPs.<br />

Key facts<br />

Incubator staff jobs: 15-25<br />

SMME jobs: 150-250<br />

Construction jobs: about 500<br />

Project status<br />

<strong>Business</strong> plan and implementation plan<br />

completed. Partnerships are envisaged<br />

with national government departments (dti<br />

and Small <strong>Business</strong> Development), provincial<br />

government and IPPs.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong> 18

Solar Farm<br />

Solar energy for SEZ.<br />

Project description<br />

The main focus for the investor will be the<br />

construction of a solar farm. There are<br />

possibilities for other opportunities such as<br />

the manufacture of solar panels and a silicon<br />

smelter.<br />

Targeted sectors<br />

Renewable energy.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist,<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email: bmbobo@upington-sez.co.za<br />

FOCUS<br />

Project location<br />

The project’s physical address is 24 Schroeder<br />

Street, Upington in the ZF Mgcawu District in<br />

Upington.<br />

Project background<br />

The investor intends to establish a solar farm<br />

on 75ha of land to supply power to tenants of<br />

the Upington Special Economic Zone (SEZ).<br />

The anticipated power to be harnessed will be<br />

23MW-50MW depending on the technology.<br />

Mr E Ntoba, Dawid Kruiper Local Municipality<br />

Tel: +27 54 338 5000<br />

Email: entoba@dkm.gov.za<br />

Mr T Klassen, Department of Trade and<br />

Industry<br />

Tel: +27 12 3941482<br />

<strong>Northern</strong> <strong>Cape</strong> Department of Economic<br />

Development and Tourism<br />

Mr Riaan Warie, Senior Manager<br />

Tel: +27 53 830 4058<br />

Mobile: 079 877 2828<br />

Email: rwarie@ncpg.gov.za<br />

Finance<br />

The project will be financed by the investor<br />

with the government providing enabling<br />

infrastructure.<br />

Key facts<br />

Investment value: R270-million<br />

Job creation: 1 000 part-time and 30 fulltime<br />

jobs<br />

Project status<br />

The business case and feasibility studies<br />

have been completed. The Environmental<br />

Impact Assessment and the Geotechnical<br />

Study Investigation are complete.<br />

19 NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

FOCUS<br />

Nyaniso<br />

Healthcare<br />

Latex condom manufacturing.<br />

Project location<br />

The project is situated at the old Colesberg<br />

Hospital in the Pixley Ka Seme District in<br />

Colesberg.<br />

Targeted sectors<br />

Medical and health sector.<br />

To discuss this opportunity, contact<br />

Mr Choaro Timothy, Project Promoter,<br />

Nyaniso Healthcare (Pty) Ltd<br />

Tel: 064 070 9534<br />

Email: choaro.timothy@gmail.com<br />

<strong>Northern</strong> <strong>Cape</strong> Department of Economic<br />

Development and Tourism<br />

Mr Riaan Warie, Senior Manager<br />

Tel: +27 53 830 4058<br />

Mobile: 079 877 2828<br />

Email: rwarie@ncpg.gov.za<br />

Project description<br />

Nyaniso Healthcare will produce male latex<br />

condoms using German technology from the<br />

technical partner, CPR GmBH. The plant in<br />

Colesberg will produce 60-million condoms<br />

annually. The plan is also to later produce<br />

latex gloves, and thus create meaningful<br />

employment for the local community. The<br />

condoms produced will be sold to government,<br />

private markets and for export markets in Africa<br />

and globally.<br />

Project background<br />

The project name is Nyaniso Healthcare<br />

Male Latex Condoms & Latex Gloves<br />

Manufacturing. The founder and CEO of<br />

Nyaniso Healthcare first thought of starting<br />

a condom manufacturing plant in <strong>20</strong>07<br />

when the country was producing only 5%<br />

of the condoms used in South Africa. The<br />

HIV/Aids pandemic and the high infection<br />

rate influenced the decision to assist the<br />

government in reducing the infection rate<br />

and promoting safe sex among youth.<br />

Key facts<br />

Investment value: R150-million<br />

Job creation: 100 direct jobs<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

Finance<br />

The project will be financed by private investor/s<br />

with the government providing enabling infrastructure<br />

and various incentives as part of the<br />

project support. Partnerships will be pursued<br />

with the private sector, provincial government<br />

and local government.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong> <strong>20</strong>

Promethean<br />

Waterfront<br />

A tourism node for Barkly West.<br />

Project location<br />

The project is located on the banks of the Vaal<br />

River in the town of Barkly West in the Dikgatlong<br />

Local Municipality.<br />

Project background<br />

Barkly West has been earmarked for a<br />

multifaceted development project with<br />

the potential to bolster the local economy.<br />

Promethean Property, a local investment<br />

company, in conjunction with SIZA Architects<br />

& Project Managers, has teamed up as<br />

the developers of the project. Dikgatlong<br />

Municipality will be engaged through the<br />

multi-year lease for the land.<br />

FOCUS<br />

Project description<br />

An entertainment resort that compromises:<br />

waterpark; arcade games and fun rides; food<br />

court; wave pool; chalets; upmarket selfcatering<br />

riverside accommodation; people’s<br />

park (outdoor events with permanent stage);<br />

picnic/braai area; lifestyle centre; retail and<br />

commercial outlets; regional mall; middleincome<br />

housing; government subsidised<br />

housing; residential estate; apartments; hotel<br />

and conference centre; casino (depending on<br />

legislation) and office park.<br />

To discuss this opportunity, contact<br />

Thabo Makweya, Director, Promethean<br />

Property<br />

Tel: +27 53 831 2336<br />

Mobile: +27 81 337 8492<br />

Email: makweyat@me.com<br />

Richard Poulton, Project Director<br />

Tel: +27 53 831 2336<br />

Mobile: +27 81 446 5297<br />

Email: richard@prometheangroup.co.za<br />

Finance<br />

The project is being developed in terms of<br />

the Public-Private-Partnership Project Cycle<br />

in terms of the Treasury Regulation 16 of<br />

the Public Finance Management Act, Act<br />

1 of 1999.<br />

Targeted sectors<br />

Tourism and heritage.<br />

Key facts<br />

Investment value: Overall R2.5-billion,<br />

including bulk infrastructure. Phase 1<br />

(Waterpark and chalets): R800-million<br />

Job creation: 6 743 jobs<br />

Project status<br />

The project is at the start of the feasibility and<br />

business case phase. A detailed feasibility<br />

study will cost about R12-million.<br />

21<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

FOCUS<br />

Versa Chemicals<br />

Paint and detergent manufacturing.<br />

Project location<br />

The project is situated in the Pixley Ka Seme<br />

District Municipality in Kimberley.<br />

Targeted sectors<br />

Paint; protective<br />

coatings; household<br />

detergents; industrial<br />

cleaning chemicals.<br />

Project description<br />

The paint plant will produce water-based and<br />

solvent-based paints or coatings serving<br />

various markets across South Africa and Sub-<br />

Saharan Africa. The focus of the products will<br />

be on architectural or decorative coatings and<br />

on protective and industrial paints. The factory<br />

will run three shifts, five days a week. Versa<br />

has a partnership agreement with a leading<br />

French road-marking paint manufacturer; SAR<br />

France, to distribute their products and later<br />

manufacture these products.<br />

To discuss this opportunity, contact<br />

Mr Choaro Timothy, Project Promoter,<br />

Versa Chemicals (Pty) Ltd<br />

Tel: 064 070 9534<br />

Email: choaro.timothy@gmail.com<br />

<strong>Northern</strong> <strong>Cape</strong> Department of Economic<br />

Development and Tourism:<br />

Mr Riaan Warie, Senior Manager<br />

Tel: +27 53 830 4058<br />

Mobile: 079 877 2828<br />

Email: rwarie@ncpg.gov.za<br />

Project background<br />

The name of the project is Versa Chemicals,<br />

Paint and Detergent Manufacturing. The idea<br />

is to create a sustainable paint and chemicals<br />

company that can compete with multinational<br />

companies in the chemical sector.<br />

Key facts<br />

Investment value: R100-million<br />

Job creation: 100 direct jobs<br />

Finance<br />

The project will be financed by a private<br />

investor/s with the government providing<br />

enabling infrastructure and various incentives.<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong> 22

Upington SEZ<br />

Agri-Hub<br />

Agricultural processing and logistics.<br />

Project location<br />

The project’s physical address is 24 Schroeder<br />

Street, Upington, in the ZF Mgcawu District. The<br />

GPS coordinates are: S28°25’51.96”; E21°14’04.71”.<br />

Targeted sectors<br />

Agriculture.<br />

FOCUS<br />

Project description<br />

The Agri-Hub will consist of various facilities:<br />

Retail, Mechanisation, Packaging, Quality<br />

Control, Agri-Processing, Training Centre,<br />

Research and Development, Logistics and<br />

Transport, Agricultural Inputs and Distribution,<br />

Silos, Abattoir, Feedstock, Aquaculture and<br />

Agri-Tourism and Greenhouse.<br />

To discuss this opportunity, contact<br />

Ms Babalwa Mbobo, Sector Specialist,<br />

Upington SEZ<br />

Tel: +27 54 333 1136<br />

Mobile: 071 016 5813<br />

Email: bmbobo@upington-sez.co.za<br />

Mr E Ntoba, Dawid Kruiper Local Municipality<br />

Tel: +27 54 338 5000<br />

Email: entoba@dkm.gov.za<br />

Mr T Klassen, Department of Trade and<br />

Industry<br />

Tel: +27 12 3941482<br />

Finance<br />

The main financing for the project will be<br />

provided by the private sector. The SEZ and<br />

municipality will provide incentives.<br />

Investment value<br />

Three options: R23-million, R240-million and<br />

R500-million.<br />

Key facts<br />

Investment value: R570-million<br />

Job creation: 1 <strong>20</strong>0 jobs<br />

Project status<br />

The business case and feasibility studies<br />

have been completed.<br />

23<br />

NORTHERN CAPE BUSINESS <strong><strong>20</strong>19</strong>/<strong>20</strong>

Key stakeholders<br />

Transaction advisor<br />

Technical consultants<br />

Boegoebaai<br />

Port, Rail and Infrastructure Development Project.<br />

Project location<br />

Boegoebaai is approximately 60km<br />

north of Port Nolloth and <strong>20</strong>km south<br />

of othe border between Namibia and<br />

South o Africa in the Richtersveld Local<br />

o Services base for oil, gas and offshore mining<br />

Municipality area.<br />

Project background<br />

The Reducing <strong>Northern</strong> cost <strong>Cape</strong> of moving Province cargo has the<br />

<br />

volumes of commodities to warrant a<br />

system<br />

deep-sea Stimulating commercial regional socio-economic port, specifically<br />

development<br />

as a<br />

Securing<br />

result<br />

a competitive<br />

of mining<br />

advantage<br />

and agricultural<br />

regionally for SA<br />

ports<br />

activities. The Boegoebaai site has<br />

all the advantages for the potential<br />

Volume<br />

development of a deep-sea (mtpa) port,<br />

namely: the <strong>20</strong>-metre contour is 250m<br />

offshore and it is a greenfield site owned<br />

by the people of the Richtersveld, the<br />

Community Property Association (CPA).<br />

Key facts<br />

Transnet, National Department of Transport, Department of Public Enterprises, Treasury<br />

TM and Nelutha Consulting JV (TM)<br />

PRDW, PSP Logistics, NAKO ILISO<br />

Project status The project is in FEL2 phase. Finalisation of FEL2 is planned for December <strong>20</strong>18.<br />

CAPEX Port = ~R6 billion +/-40% accuracy. Rail = ~R9 billion +/-50%<br />

Estimated jobs to be created<br />

3 000 permanent and 18 000 indirect jobs<br />

Project status PPP Feasibility study at FEL 2 level to be completed end of April <strong><strong>20</strong>19</strong><br />

PROJECT DESCRIPTION<br />

A greenfield, deep water port. Two berths; one dry bulk export<br />

berth and one break bulk berth supported by a rail line (550<br />

kilometers). The port has the potential to accommodate<br />

<strong>Cape</strong>size vessels.<br />

Primary drivers for the development include:<br />

Capitalizes on new economy, including:<br />

o Iron ore from junior miners, creates a catalyst for<br />

junior / development miners currently constrained<br />

by high transportation costs and exclusion from<br />

larger logistic solutions i.e. Sishen-Saldanha line<br />

Provides a more efficient logistic manganese route<br />

Strategically positioned to capitalize on gas fields<br />

industry<br />

o Potential of an Oil Refinery to be constructed close<br />

to the port<br />

Economic catalyst for the <strong>Northern</strong> <strong>Cape</strong> Province and<br />

specifically the Richtersveld Community<br />

Optimizing the cargo distribution within the SA port<br />

PROJECT COMMODITY MIX<br />

Commodity<br />

Dry bulk – iron ore 5-10 New volume from junior miners<br />

Dry bulk – manganese 2-5 Lower cost logistic solution<br />

Dry bulk – lead and zinc 1-2 Closest port to mines<br />

Comment<br />

Break bulk 0.5 Multi-purpose commodities, agricultural, mining and low container volumes<br />

FUNDING MODEL<br />

Project description<br />

Deep-water port development comprising two berths: one<br />

dry bulk export berth and one breakbulk berth, supported<br />

by a 550km railway line, bulk services and associated social<br />

infrastructure.<br />

Finance<br />

The project is being developed in terms of the PPP Project<br />

Cycle in terms of the Treasury Regulation 16 of the Public<br />

Finance Management Act, 1999. The development of a<br />

<strong>Northern</strong> <strong>Cape</strong> Provincial SEZ Establishment Framework will<br />

Targeted sectors<br />

Finance be used for a Special Economic Zone as economic growth<br />

Exporting bulk commodities, breakbulk and development instrument to attract new local and foreign<br />

The project is being developed in terms of the PPP Project Cycle in terms of the Treasury<br />

and container staging. Oil refinery. Ship investment.<br />

recycling.<br />

Regulation 16 of the Public Finance Management Act, 1999. The development of a <strong>Northern</strong><br />

<strong>Cape</strong> Provincial SEZ Establishment Framework will be used for a Special Economic Zone as<br />

economic growth and development instrument to attract new local and foreign investment.<br />

Project status<br />

Project status Finalisation of phase FEL2 is planned for 31 May <strong><strong>20</strong>19</strong>. <strong>Business</strong><br />

Investment value: Seaside: R4.2-billion. case and feasibility studies will be completed and submitted<br />

Finalisation of phase FEL2 is planned for 31 May <strong><strong>20</strong>19</strong>. <strong>Business</strong> case and feasibility<br />

Railway Boegoebaai: line from Upington Port, Rail & Infrastructure to Boegoebaai: Development studies will Project<br />

be at completed end of the and May submitted <strong><strong>20</strong>19</strong>. at Several end of the relevant May <strong><strong>20</strong>19</strong>. studies Several relevant are available studies are<br />

R12.6-billion. Project Location A total of 10 000 jobs are available for for potential investors investors study, to including study, a including transport investors a transport report investors and a port<br />

expected to be created.<br />

competitor analysis.<br />

The Boegoebaai Port, Rail & Infrastructure Development Project is situated approximately 60km report north of and Port<br />

a port competitor analysis.<br />

Nolloth and <strong>20</strong>km south of the border between Namibia and South Africa in the Richtersveld Local Municipality area.<br />

The figure below shows the position of Boegoebaai.<br />

Project contacts Person Tel Mobile email<br />

Dept of Transport,<br />

Safety and Liaison<br />

Dept of Transport,<br />

Safety and Liaison<br />

National Dept of<br />

Transport<br />

Transnet Ports<br />

Authority<br />

TM Nelutha<br />

Consultants<br />

Mr MP Dichaba + 27 53 839 1743 082 675 1933 Lntobela@ncpg.gov.za<br />

Mr P Mguza, Project +27 53 807 4812 079 694 3254<br />

PMguza@ncpg.gov.za<br />

Promoter<br />

Mr Clement<br />

Manyungwana<br />

+27 12 309 3408 083 679 9662 manyungc@dot.gov.za<br />

Mr H Nxumalo +27 31 361 8821 083 299 7966 Hamilton.nxumalo@transnet.net<br />

Mr P Maneza +27 53 833 1010 082 889 3685 Info@manzholdings.co.za

De Aar Logistics Hub<br />

PROJECT INFORMATION<br />

Project<br />

CAPEX<br />

<br />

Project Estimated project description<br />

De Aar Logistics Hub<br />

The Estimated development Vehicle jobs Storage be created Yard. of a Logistics<br />

Project<br />

Hub<br />

statusin<br />

the<br />

PROJECT<br />

town<br />

DESCRIPTION<br />

of De Aar that will offer CAPEX the following<br />

<br />

infrastructure to identified Estimated tenants: project<br />

freight/products by small miners and farmers<br />

• the following Container infrastructure Terminal to identified which tenants: will act<br />

<strong>Northern</strong> <strong>Cape</strong><br />

as a Trans-Shipment Inland (Dry)<br />

Revitalize the rail line to and from De Aar<br />