Indian Refractories Market - Steelworld

Indian Refractories Market - Steelworld

Indian Refractories Market - Steelworld

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Focus<br />

<strong>Indian</strong> <strong>Refractories</strong> <strong>Market</strong><br />

New Growth Opportunities<br />

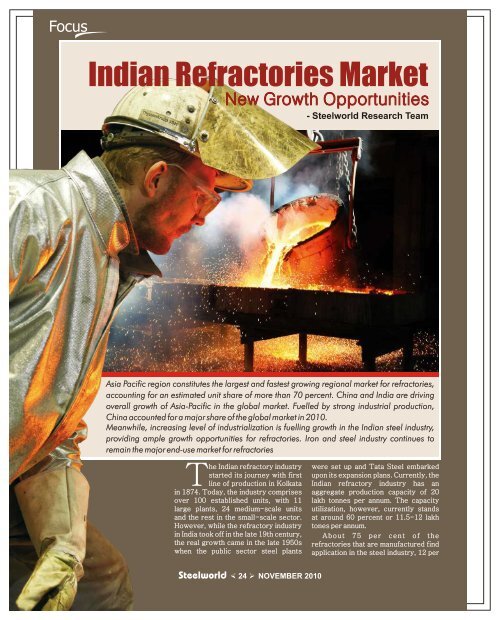

Asia Pacific region constitutes the largest and fastest growing regional market for refractories,<br />

accounting for an estimated unit share of more than 70 percent. China and India are driving<br />

overall growth of Asia-Pacific in the global market. Fuelled by strong industrial production,<br />

China accounted for a major share of the global market in 2010.<br />

Meanwhile, increasing level of industrialization is fuelling growth in the <strong>Indian</strong> steel industry,<br />

providing ample growth opportunities for refractories. Iron and steel industry continues to<br />

remain the major end-use market for refractories<br />

he <strong>Indian</strong> refractory industry<br />

started its journey with first<br />

Tline of production in Kolkata<br />

in 1874. Today, the industry comprises<br />

over 100 established units, with 11<br />

large plants, 24 medium-scale units<br />

and the rest in the small-scale sector.<br />

However, while the refractory industry<br />

in India took off in the late 19th century,<br />

the real growth came in the late 1950s<br />

when the public sector steel plants<br />

� 24 � NOVEMBER 2010<br />

were set up and Tata Steel embarked<br />

upon its expansion plans. Currently, the<br />

<strong>Indian</strong> refractory industry has an<br />

aggregate production capacity of 20<br />

lakh tonnes per annum. The capacity<br />

utilization, however, currently stands<br />

at around 60 percent or 11.5-12 lakh<br />

tones per annum.<br />

About 75 per cent of the<br />

refractories that are manufactured find<br />

application in the steel industry, 12 per

cent in the cement industry, 5-6 per<br />

cent in non-ferrous industries, three<br />

per cent in the glass industry and the<br />

b a l a n c e i n o t h e r i n d u s t r i e s .<br />

Necessarily, refractories are used<br />

either where high temperature or high<br />

rate of abrasion/corrosion/erosion is<br />

involved. Traditionally, refractories<br />

are made of naturally-occurring<br />

minerals, such as bauxite, kyanite,<br />

magnesite, fireclay, chrome ore, etc.<br />

Lately, however, the industry has been<br />

using man-made raw materials, such as<br />

brown-fused alumina, tabular alumina,<br />

fused magnesia, silicon carbide,<br />

magnesia alumina, etc.<br />

Refractory plays a dynamic role not<br />

only for metallurgical but also for<br />

s h a p i n g u p c h e m i c a l a n d<br />

petrochemical, glass, ceramic, cement<br />

and limestone industries. Major<br />

research work has so far been<br />

concentrated for the development of<br />

new refractory and also for its<br />

reduction in consumption for steel<br />

industries. But, the industry's efforts<br />

have so far proved futile as no major<br />

breakthrough has been achieved.<br />

<strong>Indian</strong> refractory industry, meanwhile,<br />

is required to upgrade their operations<br />

with global technologies which need<br />

huge investment. But, in the long run,<br />

the investment is bound to fetch higher<br />

returns too.<br />

Scope for Growth<br />

The size of the <strong>Indian</strong> refractory<br />

industry has been pegged at Rs 2,300<br />

crore and it is stated to be growing at<br />

8-10 per cent per annum. Although the<br />

specific consumption of refractories<br />

has gone down from 30 kg per tonne of<br />

steel about 20 years ago to 12-13 kg on<br />

an average for the steel industry as a<br />

whole and as low as 7-8 kg in the case<br />

of some more efficient steel units, the<br />

scope for growth is good in view of the<br />

continuing growth in the <strong>Indian</strong><br />

economy and the government's focus<br />

on infrastructure development.<br />

Despite downturn in steel sector,<br />

the domestic refractory industry that<br />

supplies raw materials to steel plants<br />

and industries, posted 21 percent<br />

growth in turnover at Rs 4,480 crore in<br />

2009-10 against Rs 3,640 crore in<br />

2008-09, when the growth was 16<br />

percent over 2007-08. The capacity<br />

utilization of the industry was 65<br />

percent.<br />

In 2009-10, the import of<br />

refractories was down 11 percent to Rs<br />

1,277 crore, according to <strong>Indian</strong><br />

Refractory Makers Association (IRMA)<br />

chairman, A K Chattopadhyay. This<br />

was largely due to drop in the imports<br />

of fireclay and high alumina bricks<br />

mostly under OEM contracts. But, then,<br />

the exports during the period also<br />

declined to Rs 446 crore mainly due to<br />

the meltdown in European and the<br />

American markets.<br />

Crude steel production in 2010-11<br />

is expected to rise to 72 million tonnes<br />

despite the slide in the first quarter. In<br />

2009-10, the crude steel production<br />

was 64.88 million tonne. Out of total<br />

production of 64.88 million tonne in<br />

2009-10, 29.33 million tonne was<br />

produced through the oxygen route,<br />

another 15.69 million tonne through the<br />

EAF route, and the balance through the<br />

induction furnace route. Cautioning<br />

against the frenzy to sign MoUs to set<br />

up steel plants 53 in Karnataka, 71 in<br />

Jharkhand and several dozens each in<br />

O r i s s a a n d W e s t B e n g a l ,<br />

Chattopadhyay said that infrastructure<br />

bottlenecks could throttle these<br />

ambitious plans. The production of 100<br />

million tonnes of crude steel would<br />

mean transportation of 350 tonnes of<br />

raw materials.<br />

According to Dr J.J. Irani, Director<br />

of Tata Sons and Former Managing<br />

Director of Tata Steel, “With the<br />

government aiming to invest more and<br />

more on infrastructure development,<br />

the steel industry in the country is<br />

slated to grow to, possibly, 120 million<br />

� 25 � NOVEMBER 2010<br />

Focus<br />

Refractory plays a dynamic<br />

role not only for metallurgical<br />

but also for shaping up<br />

chemical and petrochemical,<br />

glass, ceramic, cement and<br />

limestone industries. Major<br />

research work has so far been<br />

concentrated for the<br />

development of new<br />

refractory and also for its<br />

reduction in consumption for<br />

steel industries.<br />

tonnes or even up to 150 million tonnes<br />

by 2015. According to most reports, the<br />

cement, aluminium and other industries<br />

are also to grow to unprecedented<br />

heights. This should be good news for<br />

refractory producers in India.”<br />

Challenges For Industry<br />

“The Refractory Industry must<br />

upgrade itself to take benefit of<br />

increased business from the steel<br />

industry,” stated R K Vijayvergia,<br />

Executive Director-Operations, SAIL,<br />

at a recently held conference. In his<br />

special address, Vijayvergia said,<br />

“Steel industry forms the major enduse<br />

segment for refractories<br />

consuming around 70 percent of its<br />

total annual production. The Refractory<br />

Industry has to keep pace with steel<br />

industry with regard to quality and<br />

quantity demands. Meanwhile, with the<br />

changed business scenario more and<br />

more customers are looking forward to<br />

total refractory management which<br />

encompasses creation of value added<br />

service, responsive supply chain<br />

network and understanding of<br />

customers' requirement.”<br />

The major <strong>Indian</strong> refractory<br />

manufactures need to gear up to cater

Focus<br />

It would also be important<br />

for <strong>Indian</strong> refractory<br />

manufacturers to focus on<br />

their raw materials security.<br />

Industry insiders do<br />

acknowledge that raw<br />

materials security is a concern<br />

especially with China<br />

imposing quantitative<br />

restrictions on export of raw<br />

materials and also jacking up<br />

prices over the last year or so.<br />

the need of steel industry. World<br />

leaders in refractories like RHI from<br />

Austria, Vesuvius from Belgium,<br />

French giant Calderys, Pohang from<br />

South Korea etc have also made their<br />

presence in India, which is a good sign<br />

for the industry. Recently SAIL has<br />

taken over Bharat <strong>Refractories</strong> Ltd<br />

which is now named as SAIL<br />

Refractorry Unit (SRU). SAIL is in the<br />

process of augmenting and upgrading<br />

the facilities at SRU for higher<br />

production to meet the quality<br />

requirement of SAIL.<br />

Recycling and reuse of refractory is<br />

another area of utmost important. In<br />

order to reduce the volume of waste<br />

refractories, it is necessary to cut down<br />

their consumption by prolonging life<br />

furnace lining. In the field of refractory<br />

major technological development in the<br />

world have taken place in the area of<br />

monolithic and carbon containing<br />

refractories. Currently the share of<br />

monolithic in India is around 25 percent<br />

of total refractory consumption which<br />

is less than Japan where it is more than<br />

50 percent. Economic volatility and<br />

risks, information and communications,<br />

climate change, domestic reforms,<br />

inclusiveness and low cost innovations<br />

are the key influencing factors for the<br />

strategic direction of the business<br />

standards.<br />

Refractory producers in India have<br />

to rise to the occasion by providing<br />

ready, regular, speedy and consistent<br />

supplies, Irani said. It would also be<br />

important for <strong>Indian</strong> refractory<br />

manufacturers to focus on their raw<br />

materials security. Industry insiders do<br />

acknowledge that raw materials<br />

security is a concern especially with<br />

C h i n a i m p o s i n g q u a n t i t a t i v e<br />

restrictions on export of raw materials<br />

and also jacking up prices over the last<br />

year or so. Cheaper refractory imports<br />

from China are also putting a pressure<br />

on the industry's margins. Hiring and<br />

retaining skilled manpower is a major<br />

challenge that the <strong>Indian</strong> refractory<br />

industry has to cope with.<br />

Phenomenal Growth in Global<br />

<strong>Market</strong>s<br />

With the staggering recovery from<br />

last year's downturn in steel industry,<br />

the global refractories market will<br />

reach 59 million tonnes and $31 billion<br />

by 2015. Key market drivers include<br />

growing use in metal and non-metallic<br />

mineral products production; emerging<br />

markets such as China and India; and<br />

increased preference for lighter and<br />

stronger refractory materials.<br />

New and advanced products, as well<br />

as installation/repair practices, are also<br />

expected to spur global demand for<br />

refractories in the next few years.<br />

Global demand for refractories<br />

declined during late 2008 and into 2009<br />

as a result of the economic crisis and<br />

declining steel production and<br />

consumption. Steel use contracted by<br />

� 26 � NOVEMBER 2010<br />

6.2 percent in 2009. Nevertheless, with<br />

the economy gradually rebounding<br />

from recession and global steel<br />

production beginning to recoup,<br />

demand for refractories is forecast to<br />

increase starting in late 2010.<br />

Asia-Pacific constitutes the largest<br />

and fastest growing regional market for<br />

refractories, accounting for an<br />

estimated unit share of more than 70<br />

percent, according to the report. China<br />

and India are driving overall growth of<br />

Asia-Pacific in the global market.<br />

Fuelled by strong industrial production,<br />

China accounted for a major share of<br />

the global market in 2010.<br />

Meanwhile, an increasing level of<br />

industrialization is fueling growth in the<br />

<strong>Indian</strong> steel industry, providing ample<br />

growth opportunities for refractories.<br />

Iron and steel remains the major enduse<br />

market for refractories. However,<br />

the declining steel industry usage of<br />

refractories bodes well for the growth<br />

of refractories in other end-use<br />

sectors. Growth in the production of<br />

cement, ceramics and other mineral<br />

products is expected to complement<br />

this growing trend in the coming years.<br />

In addition, an upsurge in the use of<br />

refractories in metal and non-metallic<br />

mineral products' production is<br />

expected to widen the market's growth<br />

prospects.<br />

In terms of material, clay<br />

refractories represent the largest and<br />

fastest growing segment. The market is<br />

projected to grow at a CAGR of 6.6<br />

percent over the analysis period. The<br />

market for non-clay refractories is<br />

projected to reach 19.6 million metric<br />

tons by 2012. By form type, bricks and<br />

shapes represent the leading segment,<br />

while monolithics and others are<br />

projected to surpass $10.34 billion by<br />

2012.<br />

Growth prospects are high for<br />

monolithic castables and preformed<br />

shapes that feature higher performance<br />

and flexibility than other refractory<br />

forms. Significant growth potential is<br />

expected in zircon/zirconia, silicon<br />

carbide extra-high alumina, and other<br />

more specialized refractory materials<br />

that offer strong performance in<br />

specific applications. In addition, an

Focus<br />

above average growth is foreseen in<br />

the case of cost-effective refractory<br />

materials, including silica, highalumina,<br />

ceramic fibers, and insulating<br />

types.<br />

Recovery In Global Demand<br />

Global demand for refractories<br />

declined during late 2008 and in 2009,<br />

as a result of the economic crisis, and<br />

declining production and consumption<br />

of steel, the largest end-use market for<br />

refractories. Steel use contracted by<br />

6.2 per cent in 2009. Nevertheless,<br />

with the economy gradually rebounding<br />

from recession and the global steel<br />

production beginning to recoup,<br />

demand for refractories is forecast to<br />

increase starting from late 2010.<br />

Asia pacific constitutes the largest<br />

and fastest growing regional market for<br />

refractories, accounting for an<br />

estimated unit share of more than 70<br />

percent. China and India are driving<br />

overall growth of Asia-Pacific in the<br />

global market. Fuelled by strong<br />

industrial production, China accounted<br />

for a major share of the global market in<br />

2010.<br />

Growth Opportunities<br />

Meanwhile, increasing level of<br />

industrialization is fuelling growth in<br />

the <strong>Indian</strong> steel industry, providing<br />

ample growth opportunities for<br />

refractories. Iron and steel remains the<br />

major end-use market for refractories.<br />

However, the declining steel industry<br />

usage of refractories of late bodes well<br />

for the growth of refractories in other<br />

end-use sectors. Growth in production<br />

of cement, ceramics, as well as other<br />

mineral products is expected to<br />

complement this growing trend in the<br />

coming years. In addition, an upsurge in<br />

the use of refractories in metal and<br />

non-metallic mineral products<br />

production is expected to widen the<br />

market's growth prospects.<br />

In terms of material, clay<br />

refractories represent the largest and<br />

fastest growing segment. The market is<br />

projected to grow at a CAGR of 6.6<br />

percent over the next two years. The<br />

market of non-clay refractories is<br />

projected to reach 19.6 million tonnes<br />

by 2012. By form type, bricks and<br />

shapes represent the leading segment,<br />

while monolithics and others are<br />

projected to cross $10.34 billion by<br />

2012. Growth prospects are high for<br />

monolithic castables and preformed<br />

shapes that feature high performance<br />

and flexibility than other refractory<br />

forms. Significant growth potential is<br />

witnessed in zircon/zirconia, silicon<br />

carbide extra-high alumina, and other<br />

� 28 �<br />

NOVEMBER 2010<br />

Asia Pacific constitutes the<br />

largest and fastest growing<br />

regional market for refractories,<br />

accounting for an estimated<br />

unit share of more than 70<br />

percent. China and India are<br />

driving overall growth of<br />

Asia-Pacific in the global<br />

market. Fuelled by strong<br />

industrial production, China<br />

accounted for a major share<br />

of the global market in 2010.<br />

more specialised refractory materials<br />

that offer strong performance in<br />

specific applications. Besides, an above<br />

average growth is foreseen in the case<br />

of cost-effective refractory materials,<br />

including silica, high-alumina, ceramic<br />

fibres, and insulating types.