Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Developrnenl: of the Gmup<br />

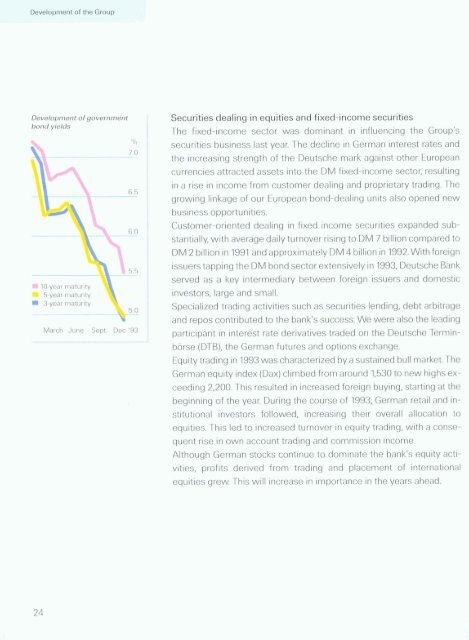

Development of governrnent<br />

bond yields<br />

Securities dealing in equities and fixed-income securities<br />

The fixed-income sector was dominant in influencing the Group's<br />

securities business last year. The decline in German interest rates and<br />

the increasing strength of the <strong>Deutsche</strong> mark against other European<br />

currencies attracted assets into the DM fixed-income sector, resulting<br />

in a rise in income from customer dealing and proprietary trading. The<br />

growing linkage of our European bond-dealing units also opened new<br />

business opportunities.<br />

Customer-oriented dealing in fixed income securities expanded sub-<br />

stantially, with average daily turnover rising to DM 7 billion compared to<br />

DM 2 billion in 1991 and approximately DM 4 billion in 1992, With foreign<br />

issuers tapping the DM bond sector extensively in 1993, <strong>Deutsche</strong> <strong>Bank</strong><br />

served as a key intermediary between foreign issuers and domestic<br />

investors, large and small.<br />

Specialized trading activities such as securities lending, debt arbitrage<br />

and repos contributed to the bank's success. We were also the leading<br />

participant in interest rate <strong>der</strong>ivatives traded on the <strong>Deutsche</strong> Termin-<br />

börse (DTB), the German futures and options exchange.<br />

Equity trading in 1993 was characterized by a sustained bull market. The<br />

German equity index (Dax) climbed from around 1,530 to new highs ex-<br />

ceeding 2,200. This resulted in increased foreign buying, starting at the<br />

beginning of the year. During the Course of 1993, German retail and in-<br />

stitutional investors followed, increasing their overall allocation to<br />

equities. This led to increased turnover in equity trading, with a conse-<br />

quent rise in own account trading and commission income.<br />

Although German stocks continue to dominate the bank's equity acti-<br />

vities, profits <strong>der</strong>ived from trading and placement of international<br />

equities grew. This will increase in importance in the years ahead.