Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Deutsche Bank - Historische Gesellschaft der Deutschen Bank e.V.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Development of the Group<br />

Mortgage <strong>Bank</strong>ing<br />

Mortgage banks are<br />

Germany's third-largest<br />

group of banks<br />

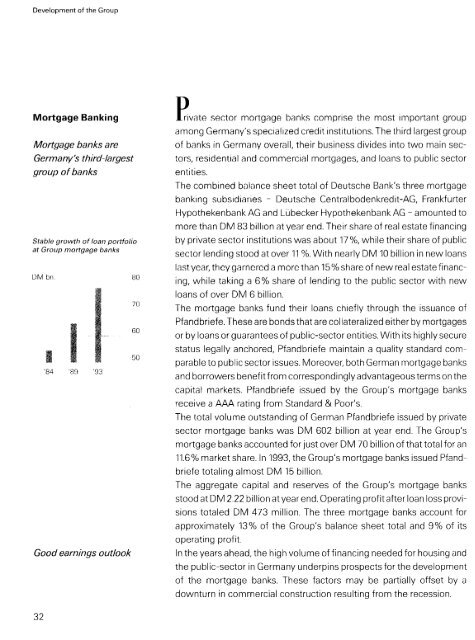

Stable growtti of loall portfolio<br />

at Gro~ip mortgage banks<br />

Good earnings outlook<br />

P rivate sector mortgage banks comprise the most important group<br />

arnong Germany's specialized credit institutions. The third largest group<br />

of banks in Germnny overnll, their busincss divides into two main sectors,<br />

residential and commercial mortgages, and loans to public sector<br />

en ti ties.<br />

The combined balance sheet total of <strong>Deutsche</strong> <strong>Bank</strong>'s three mortgage<br />

banking subsidiaries - <strong>Deutsche</strong> Centralbodenkredit-AG, Frankfurter<br />

Hypothekenbank AG and Lübecker Hypothekenbank AG - amounted to<br />

more than DM 83 billion at year end. Their share of real estate financing<br />

by private sector institutions was about 17%, while their share of public<br />

sector lending stood at over 11 %. With nearly DM 10 billion in new loans<br />

last ycar, thcy garncrcd a morc than 15%share of new real estatefinanc-<br />

ing, while taking a 6% share of lending to the public sector with new<br />

loans of over DM 6 billion.<br />

The mortgage banks fund their loans chiefly through the issuance of<br />

Pfandbriefe. These are bonds that are collateralized either by mortgages<br />

or by loans or guarantees of public-sector entities. With its highly secure<br />

status legally anchored, Pfandbriefe maintain a quality standard com-<br />

parable to public sector issues. Moreover, both German mortgage banks<br />

and borrowers benefitfrom correspondingly advantageous terms on the<br />

capital markets. Pfandbriefe issued by the Group's mortgage banks<br />

receive a AAA rating from Standard & Poor's.<br />

The total volume outstanding of German Pfandbriefe issued by private<br />

sector mortgage banks was DM 602 billion at year end. The Group's<br />

mortgage banks accounted for just over DM 70 billion of that total for an<br />

11.6% market share. In 1993, the Group's mortgage banks issued Pfand-<br />

briefe totaling almost DM 15 billion.<br />

The aggregate capital and reserves of the Group's mortgage banks<br />

stood at DM 2.22 billion at year end. Operating profit after loan loss provi-<br />

sions totaled DM 473 million. The three mortgage banks account for<br />

approximately 13% of the Group's balance sheet total and 9% of its<br />

operating profit.<br />

In the years ahead, the high volume of financing needed for housing 2nd<br />

the public-sector in Germany un<strong>der</strong>pins prospects for the development<br />

of the mortgage banks. These factors may be partially offset by a<br />

downturn in commercial construction resulting from the recession.