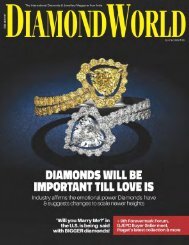

Diamond World (DW) May - June 2020

Why Covid-19 will make people fall in love with diamonds all over again | Ban is good - Industry welcomes ban on rough imports | Hong Kong jewellery industry show mettle| An Irrevocable Loss - Arun R. Mehta, Rosy Blue Group

Why Covid-19 will make people fall in love with diamonds all over again | Ban is good - Industry welcomes ban on rough imports | Hong Kong jewellery industry show mettle| An Irrevocable Loss - Arun R. Mehta, Rosy Blue Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Round & About<br />

Retail and ecommeRce<br />

Forevermark diamonds stands by its<br />

commitment to protect the environment<br />

at the heart of a<br />

Forevermark diamond<br />

lies a continuing<br />

commitment to integrity.<br />

Forevermark’s promise of<br />

beautiful, rare and responsibly<br />

sourced diamonds goes a lot<br />

deeper than just ensuring the<br />

diamonds are conflict free.<br />

De Beers Group is running a<br />

ground-breaking, multimilliondollar<br />

research programme<br />

focused on using kimberlite rock<br />

to capture carbon dioxide from<br />

the atmosphere and establish a<br />

carbonneutral mine. “Every day<br />

Forevermark and the De Beers<br />

Group commits to protecting<br />

the natural world and positively<br />

impacting the countries<br />

where our natural diamonds<br />

are sourced. A Forevermark<br />

diamond is a lifelong reflection<br />

of the beauty, perfection and<br />

infinite variety of nature,”<br />

said Sachin Jain, President,<br />

Forevermark India.<br />

Tiffany-LVMH deal on the rocks<br />

the LVMH board met<br />

on <strong>June</strong> 2 to discuss its<br />

takeover of Tiffany & Co.<br />

It’s said that the $16.2 billion<br />

deal was less certain than before<br />

Covid-19.<br />

The panel of directors<br />

“focused its attention on the<br />

development of the pandemic<br />

and its potential impact on<br />

the results and perspectives of<br />

Tiffany & Co. with respect<br />

to the agreement that links the<br />

two groups,” LVMH said in a brief<br />

statement on <strong>June</strong> 5.<br />

LVMH had agreed in November<br />

last year to buy the New Yorkbased<br />

jeweller for $135 per share.<br />

Directors of LVMH also<br />

expressed concerns about<br />

Tiffany’s ability to cover all<br />

its debts by the time the<br />

transaction closed, which was<br />

due to happen in mid-<strong>2020</strong>.<br />

Meanwhile, Bernard<br />

Arnault, LVMH’s CEO and<br />

chairman, is exploring ways of<br />

pressuring Tiffany to lower the<br />

selling price, Reuters reported on<br />

<strong>June</strong> 4. As per recent reports the<br />

takeover is uncertain as of now.<br />

32 | may-june <strong>2020</strong> | DiamonD WorlD