(Business Process Outsourcing) in - Index of

(Business Process Outsourcing) in - Index of

(Business Process Outsourcing) in - Index of

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The potential <strong>of</strong> BPO (<strong>Bus<strong>in</strong>ess</strong> <strong>Process</strong> <strong>Outsourc<strong>in</strong>g</strong>) <strong>in</strong><br />

the current Spanish pre-recessive frame<br />

M. Monterrey 1 , D. De La Fuente 1 , N. Garcia 1 and J. Lozano 1<br />

1 Department <strong>of</strong> <strong>Bus<strong>in</strong>ess</strong> Management, University <strong>of</strong> Oviedo, Gijón, Asturias, Spa<strong>in</strong><br />

Abstract - The present research is aimed at analyz<strong>in</strong>g the<br />

current outsourc<strong>in</strong>g situation <strong>in</strong> European companies and,<br />

particularly, <strong>in</strong> the Spanish ones, and at establish<strong>in</strong>g the bases<br />

to be able to understand the foreseen transition to more<br />

developed practices such as the <strong>Bus<strong>in</strong>ess</strong> <strong>Process</strong> <strong>Outsourc<strong>in</strong>g</strong><br />

(BPO). The current macroeconomic frame, especially adverse<br />

<strong>in</strong> the case <strong>of</strong> Spa<strong>in</strong>, makes this k<strong>in</strong>d <strong>of</strong> methodologies have a<br />

warm welcome among companies, either public or private<br />

ones, s<strong>in</strong>ce they are seen as hav<strong>in</strong>g important chances to save<br />

money. The aim is def<strong>in</strong>itely to take some measures to cut not<br />

only general costs <strong>in</strong> the usual outsourc<strong>in</strong>g field, but also<br />

operation and core processes costs, follow<strong>in</strong>g mostly the<br />

modern BPO. Moreover, a new economic activity is generated<br />

around BPO, which can be <strong>in</strong>terest<strong>in</strong>g for the Spanish<br />

strategic consultancy firms. At this time, the limited<br />

development <strong>of</strong> BPO can be determ<strong>in</strong>ed, to a certa<strong>in</strong> extent, by<br />

the little confidence clients have giv<strong>in</strong>g “sovereignty” when<br />

they make their strategic decisions. Anyway, this k<strong>in</strong>d <strong>of</strong> <strong>in</strong>itial<br />

reluctances are hoped to be saved as time goes by and with<br />

the generalization <strong>of</strong> this sort <strong>of</strong> practices <strong>in</strong> all sectors and<br />

geographic environments. Some aspects like economies <strong>of</strong><br />

scale and the consequent obta<strong>in</strong><strong>in</strong>g <strong>of</strong> m<strong>in</strong>or costs or the<br />

know-how <strong>of</strong> the companies which provide this k<strong>in</strong>d <strong>of</strong><br />

services that could even produce an <strong>in</strong>crease <strong>in</strong> the chapter <strong>of</strong><br />

<strong>in</strong>comes based on economies <strong>of</strong> scope make that BPO clients<br />

th<strong>in</strong>k at least <strong>of</strong> the possibility <strong>of</strong> <strong>in</strong>clud<strong>in</strong>g them <strong>in</strong> some <strong>of</strong><br />

their processes and sub-processes. F<strong>in</strong>ally, this research<br />

makes a brief observation about the relation between BPO<br />

and the so-called Offshor<strong>in</strong>g, by which grow<strong>in</strong>g companies or<br />

simply those eager to enhance their <strong>in</strong>come statement<br />

accounts, can relocate their productive processes by means <strong>of</strong><br />

costs.<br />

Keywords: <strong>Outsourc<strong>in</strong>g</strong> <strong>Process</strong>, Subcontract<strong>in</strong>g, <strong>Bus<strong>in</strong>ess</strong><br />

<strong>Process</strong> <strong>Outsourc<strong>in</strong>g</strong>, Core <strong>Bus<strong>in</strong>ess</strong>, Offshor<strong>in</strong>g<br />

1 Introduction<br />

S<strong>in</strong>ce the crisis at the beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> the 90s, the Spanish<br />

economy has had a decade <strong>of</strong> growth <strong>in</strong> an environment <strong>of</strong><br />

susta<strong>in</strong>ed expansion. However, s<strong>in</strong>ce 2008, the country has<br />

been suffer<strong>in</strong>g from an important worsen<strong>in</strong>g <strong>in</strong> its<br />

macroeconomic <strong>in</strong>dexes, to give way to a long period <strong>of</strong><br />

recession (2008-2010), followed by a weak growth stage with<br />

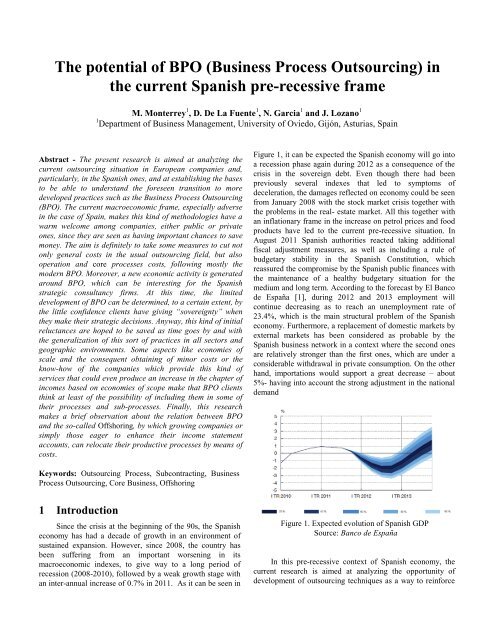

an <strong>in</strong>ter-annual <strong>in</strong>crease <strong>of</strong> 0.7% <strong>in</strong> 2011. As it can be seen <strong>in</strong><br />

Figure 1, it can be expected the Spanish economy will go <strong>in</strong>to<br />

a recession phase aga<strong>in</strong> dur<strong>in</strong>g 2012 as a consequence <strong>of</strong> the<br />

crisis <strong>in</strong> the sovereign debt. Even though there had been<br />

previously several <strong>in</strong>dexes that led to symptoms <strong>of</strong><br />

deceleration, the damages reflected on economy could be seen<br />

from January 2008 with the stock market crisis together with<br />

the problems <strong>in</strong> the real- estate market. All this together with<br />

an <strong>in</strong>flationary frame <strong>in</strong> the <strong>in</strong>crease on petrol prices and food<br />

products have led to the current pre-recessive situation. In<br />

August 2011 Spanish authorities reacted tak<strong>in</strong>g additional<br />

fiscal adjustment measures, as well as <strong>in</strong>clud<strong>in</strong>g a rule <strong>of</strong><br />

budgetary stability <strong>in</strong> the Spanish Constitution, which<br />

reassured the compromise by the Spanish public f<strong>in</strong>ances with<br />

the ma<strong>in</strong>tenance <strong>of</strong> a healthy budgetary situation for the<br />

medium and long term. Accord<strong>in</strong>g to the forecast by El Banco<br />

de España [1], dur<strong>in</strong>g 2012 and 2013 employment will<br />

cont<strong>in</strong>ue decreas<strong>in</strong>g as to reach an unemployment rate <strong>of</strong><br />

23.4%, which is the ma<strong>in</strong> structural problem <strong>of</strong> the Spanish<br />

economy. Furthermore, a replacement <strong>of</strong> domestic markets by<br />

external markets has been considered as probable by the<br />

Spanish bus<strong>in</strong>ess network <strong>in</strong> a context where the second ones<br />

are relatively stronger than the first ones, which are under a<br />

considerable withdrawal <strong>in</strong> private consumption. On the other<br />

hand, importations would support a great decrease – about<br />

5%- hav<strong>in</strong>g <strong>in</strong>to account the strong adjustment <strong>in</strong> the national<br />

demand<br />

Figure 1. Expected evolution <strong>of</strong> Spanish GDP<br />

Source: Banco de España<br />

In this pre-recessive context <strong>of</strong> Spanish economy, the<br />

current research is aimed at analyz<strong>in</strong>g the opportunity <strong>of</strong><br />

development <strong>of</strong> outsourc<strong>in</strong>g techniques as a way to re<strong>in</strong>force

the competitive position <strong>of</strong> Spanish companies or, <strong>in</strong> some<br />

cases, to make even their own survival easier. Even though<br />

these practices have been applied for some decades <strong>in</strong><br />

different ways, authors consider that the current approach to<br />

shared facilities, the act <strong>of</strong> mak<strong>in</strong>g strategic decisions together<br />

with specialized companies, the know-how pr<strong>of</strong>it which these<br />

ones can contribute and def<strong>in</strong>itely cost-cutt<strong>in</strong>g and <strong>in</strong>come<br />

<strong>in</strong>creas<strong>in</strong>g that the outsourc<strong>in</strong>g produces, will make some <strong>of</strong><br />

these companies be able to get competitive positions that<br />

strengthen their future for a medium and long term.<br />

On the other hand, outsourc<strong>in</strong>g is evolv<strong>in</strong>g fast to<br />

processes where each time it is necessary to have a greater<br />

specific knowledge as well as hav<strong>in</strong>g the support <strong>of</strong> more<br />

sophisticated technological tools. In short, we might be<br />

witnesses <strong>of</strong> an <strong>in</strong>crease <strong>in</strong> the value <strong>of</strong> these services <strong>in</strong><br />

relation to their costs. Obviously, the outsourc<strong>in</strong>g bus<strong>in</strong>ess is<br />

still far from be<strong>in</strong>g well structured, as it is still <strong>in</strong> the start<strong>in</strong>g<br />

phases <strong>of</strong> settlement as a product. It needs to grow<br />

quantitatively and qualitatively not only on the supply – to<br />

companies multi-specialized <strong>in</strong> more and more processes and<br />

to more and more core processes- but also on the demand – to<br />

smaller companies, <strong>in</strong> a wider environment and <strong>in</strong> more varied<br />

sectors<br />

2 Current <strong>Outsourc<strong>in</strong>g</strong> approaches: to<br />

Core <strong>Process</strong>es Subcontract<strong>in</strong>g<br />

In the Global <strong>Outsourc<strong>in</strong>g</strong> Survey 2007 [2],<br />

Pricewaterhouse Coopers has reached the conclusion that for<br />

a wide majority <strong>of</strong> clients – 87% <strong>of</strong> respondents-, outsourc<strong>in</strong>g<br />

gets the expected benefits totally or partially. 31% th<strong>in</strong>k the<br />

aims have been completely achieved, which is important<br />

consider<strong>in</strong>g the complexity and uncerta<strong>in</strong>ty they face before<br />

contract<strong>in</strong>g these services. As regards f<strong>in</strong>ancial <strong>in</strong>stitutions,<br />

the degree <strong>of</strong> total satisfaction reaches 46%. On the other<br />

hand, 91% <strong>of</strong> the respondents either satisfied or not with the<br />

results, say they will contract outsourc<strong>in</strong>g services aga<strong>in</strong>.<br />

The ma<strong>in</strong> reasons companies give to outsource processes<br />

are the follow<strong>in</strong>g ones:<br />

� Lower costs (an important or very important factor for<br />

76% <strong>of</strong> respondents).<br />

� Gett<strong>in</strong>g access to know-how (70%).<br />

� Offer<strong>in</strong>g services others can do better (63%).<br />

� Increas<strong>in</strong>g the flexibility <strong>in</strong> bus<strong>in</strong>ess (56%).<br />

� Improv<strong>in</strong>g the relationship with clients (42%).<br />

� Develop<strong>in</strong>g new products or services (37%).<br />

� Geographic expansion (33%).<br />

Many <strong>of</strong> the respondents (53%) stated that they<br />

outsourced processes considered as core. Obviously, the<br />

def<strong>in</strong>ition <strong>of</strong> activity or core process was up to the<br />

respondents and it can have different mean<strong>in</strong>gs for each <strong>of</strong><br />

them. An evolution can be noticed from the external r<strong>in</strong>g, (see<br />

figure 2) where no-core processes are situated, to a second<br />

r<strong>in</strong>g <strong>of</strong> essentials no-core activities. For <strong>in</strong>stance, <strong>in</strong> the<br />

f<strong>in</strong>ance function, this can be understood as an evolution from<br />

the outsourc<strong>in</strong>g <strong>of</strong> payrolls and accounts payable to the<br />

technical support <strong>in</strong> the annual budget calculation, <strong>in</strong><br />

forecast<strong>in</strong>g and management control.<br />

Figure 2. Core vs Non-core <strong>in</strong> the F<strong>in</strong>ance Function<br />

Source: Pricewaterhouse Coopers<br />

ICT services are still the most widely outsourced activity for<br />

57% <strong>of</strong> the respondents. In general, 70% <strong>of</strong> them outsource<br />

one or more activities which are <strong>in</strong>tr<strong>in</strong>sically strategic:<br />

� 53% outsource the production or delivery <strong>of</strong> core<br />

products or services.<br />

� 33% outsource sales and market<strong>in</strong>g (<strong>in</strong>clud<strong>in</strong>g third<br />

party distribution channels)<br />

� 32% outsource <strong>in</strong>novation, research and development.<br />

Figure 3. <strong>Outsourc<strong>in</strong>g</strong> is <strong>in</strong>tensify<strong>in</strong>g. Source:Pricewaterhouse<br />

Coopers Global <strong>Outsourc<strong>in</strong>g</strong> Survey 2007<br />

F<strong>in</strong>ancial <strong>in</strong>stitutions, with 40%, are especially prone to<br />

outsource sales and market<strong>in</strong>g – for <strong>in</strong>stance, to <strong>in</strong>surance<br />

brokers and f<strong>in</strong>ancial agents. Civil eng<strong>in</strong>eer<strong>in</strong>g, mass media<br />

and ICT firms are less <strong>in</strong>cl<strong>in</strong>ed to outsource core activities<br />

although nearly 40% <strong>of</strong> them do it. Companies that operate <strong>in</strong>

mature, medium markets like Australia, Canada and New<br />

Zealand, are especially aggressive contract<strong>in</strong>g outsourc<strong>in</strong>g for<br />

strategic activities (up to 71%). 48% <strong>of</strong> respondents outsource<br />

sales and market<strong>in</strong>g. Grow<strong>in</strong>g companies from these countries<br />

have small domestic markets, which can cause the necessary<br />

pressure to force them to contract strategic capacities which<br />

enable their growth abroad. Over the last years there has been<br />

a phenomenon which affects a small number <strong>of</strong> big clients:<br />

outsourc<strong>in</strong>g customer service by contract<strong>in</strong>g call centers <strong>in</strong><br />

emerg<strong>in</strong>g countries with low salary costs. In some cases, this<br />

option has found a serious competitor <strong>in</strong> the switchboard<br />

managed by an ICT company and without enough staff.<br />

<strong>Outsourc<strong>in</strong>g</strong> is spread<strong>in</strong>g <strong>in</strong> a dynamic way to areas like R+D<br />

from much more static positions <strong>in</strong> a long term, with contracts<br />

between a provider company and a client company. The<br />

freedom each one had to act was very limited. At present, as<br />

we go <strong>in</strong>to the second era <strong>of</strong> outsourc<strong>in</strong>g with many mature<br />

ICT contracts, clients admit that the new approaches present a<br />

rich variety <strong>of</strong> opportunities. Nowadays, the senior<br />

management team <strong>of</strong> a company must take <strong>in</strong>to account<br />

culture, structures and processes attached to the geographic<br />

and sectorial markets they compete <strong>in</strong>. For this reason, they<br />

must be eager to establish alliances and collaborations which<br />

enable them to design an <strong>in</strong>novative bus<strong>in</strong>ess model. They are<br />

important factors when bus<strong>in</strong>ess people start th<strong>in</strong>k<strong>in</strong>g about<br />

outsourc<strong>in</strong>g new functions and the jo<strong>in</strong>t management <strong>of</strong><br />

shared services like human resources and accountancy.<br />

Depend<strong>in</strong>g on their bus<strong>in</strong>ess activity, geographical sett<strong>in</strong>g or<br />

size, between 27% and 55% <strong>of</strong> the respondents showed their<br />

<strong>in</strong>terest to widen their current outsourc<strong>in</strong>g levels with<strong>in</strong> five<br />

years later than the survey was made (2007). There is still a<br />

marg<strong>in</strong> to grow the ICT outsourc<strong>in</strong>g services: 55% <strong>of</strong> the<br />

present clients <strong>of</strong> these services hope to <strong>in</strong>crease their<br />

outsourc<strong>in</strong>g levels. The key po<strong>in</strong>ts <strong>in</strong> the outsourc<strong>in</strong>g growth<br />

would be the follow<strong>in</strong>g ones:<br />

� For big mature markets: purchases (53%), call centers and<br />

customer services (45%) and f<strong>in</strong>ancial and accountancy<br />

activities (44%).<br />

� For emerg<strong>in</strong>g markets: Worldwide, the highest forecast<br />

growth is based on contract<strong>in</strong>g call centers and customer<br />

service centers (56%), core products and services (54%)<br />

and delivery /logistic (53%). The relocation strategy is<br />

l<strong>in</strong>ked to these answers to a certa<strong>in</strong> extent.<br />

� F<strong>in</strong>ancial services: core products and services (56%), call<br />

centers customer service centers (46%) and<br />

sales/market<strong>in</strong>g (40%).<br />

� Mass media/telecommunications/ICT: R+D (64%), call<br />

centers and customer service centers (73%) and<br />

f<strong>in</strong>ances/accountancy (50%). In these so highly<br />

competitive sectors, companies are especially pressured<br />

<strong>in</strong>to tak<strong>in</strong>g on new <strong>in</strong>itiatives.<br />

3 The potential <strong>of</strong> BPO as a<br />

competitiveness alternative <strong>in</strong> times<br />

<strong>of</strong> crisis.<br />

The constant improvements <strong>in</strong> Information &<br />

Communication Technologies (ICT), together with the global<br />

availability <strong>of</strong> skilled labor and the reduction <strong>of</strong> <strong>in</strong>ternational<br />

bus<strong>in</strong>ess barriers have caused the value services supply has<br />

been broken <strong>of</strong>f ([3], [4] and [5]). Many companies have gone<br />

from an asset ownership strategy to one <strong>of</strong> outsourc<strong>in</strong>g a part<br />

or all the components <strong>of</strong> a service for cost-cutt<strong>in</strong>g, to enhance<br />

the cycle times and to get <strong>in</strong>novation capacity [6]. In this<br />

context, <strong>Bus<strong>in</strong>ess</strong> <strong>Process</strong> <strong>Outsourc<strong>in</strong>g</strong> (BPO) means a further<br />

step <strong>in</strong> the strategy <strong>of</strong> outsourc<strong>in</strong>g organizations. It consists <strong>of</strong><br />

<strong>in</strong>tegrat<strong>in</strong>g several processes, even key or core processes <strong>in</strong><br />

organizational structures unconnected with their own ones. So,<br />

<strong>in</strong> this way a new economic activity <strong>of</strong> companies specialized<br />

<strong>in</strong> mak<strong>in</strong>g processes for third parties arises. Obviously, a great<br />

part <strong>of</strong> the competitive advantage <strong>of</strong> these companies, either<br />

back <strong>of</strong>fice or front <strong>of</strong>fice <strong>of</strong> their activity, lies on the<br />

economy <strong>of</strong> scale that is reached and, therefore, on the<br />

optimum competitive position that means to <strong>of</strong>fer lower unit<br />

costs.<br />

It is worth to mention the traditional purchas<strong>in</strong>g centers,<br />

which are based on the jo<strong>in</strong>t realization <strong>of</strong> the purchas<strong>in</strong>g<br />

process by several companies. Obviously, the management <strong>of</strong><br />

this purchas<strong>in</strong>g method can be outsourced to only one<br />

company, such as it is the case <strong>of</strong> Fortia. This company is<br />

founded as a way to adjust the great consumers to the<br />

disappearance <strong>of</strong> <strong>in</strong>dustrial electricity charges <strong>in</strong> Spa<strong>in</strong>. It is<br />

formed by 17 bus<strong>in</strong>ess parties <strong>of</strong> different economic sectors<br />

and it develops a service that benefits all the parties <strong>in</strong>volved<br />

and the economy <strong>in</strong> general, ensur<strong>in</strong>g competitiveness <strong>of</strong> the<br />

Spanish basic <strong>in</strong>dustries. The previously mentioned groups <strong>of</strong><br />

companies employ 40,000 workers directly <strong>in</strong> 70 factories all<br />

over the country. They have a jo<strong>in</strong>t turnover <strong>of</strong> about € 15,000<br />

millions, which stands for 12% <strong>of</strong> the Spanish <strong>in</strong>dustrial<br />

electricity consumption. The structure <strong>of</strong> Fortia is divided <strong>in</strong>to<br />

iron and steel (47,2%), cement (25,8%), metallurgical<br />

(20,8%), gas fitter (6,20%) and paper (0,07%) <strong>in</strong>dustries.<br />

Therefore, Fortia is <strong>in</strong> charge <strong>of</strong> another part more <strong>of</strong> the<br />

activities <strong>of</strong> the specialized companies <strong>in</strong> BPO, where the<br />

purchas<strong>in</strong>g process- generally no core component or services –<br />

is outsourced.<br />

In Spa<strong>in</strong>, there is a second example <strong>of</strong> purchas<strong>in</strong>g center,<br />

but with some specific features that make it different from<br />

Fortia. It is a private consultancy- Compras58, placed <strong>in</strong><br />

Valencia, whose ma<strong>in</strong> features are the follow<strong>in</strong>g ones :<br />

� It is a transversal purchas<strong>in</strong>g center dedicated to the<br />

negotiation <strong>of</strong> contracts <strong>of</strong> any type <strong>of</strong> purchases, either<br />

raw or auxiliary material or services. It is not like Fortia,<br />

whose purchase is focused on energy.

� Its potential clients are sectorial bus<strong>in</strong>ess associations and,<br />

even more, those which operate regionally. Therefore, the<br />

Compras58 activity is ma<strong>in</strong>ly aimed at <strong>in</strong>dustrial clusters.<br />

� Compras58 cannot be said to be strictly a BPO company,<br />

s<strong>in</strong>ce as it has been mentioned before, it only deals with<br />

purchas<strong>in</strong>g process and, <strong>in</strong>deed, contract negotiation. In<br />

short, it is a classic sub-process outsourc<strong>in</strong>g- contract<br />

negotiation.<br />

From the previously mentioned aspects, it can be<br />

deduced that the only competence the Compras 58 client<br />

clusters subcontract – the renegotiation <strong>of</strong> contracts- will be<br />

for a short time and it will f<strong>in</strong>ish when the new purchas<strong>in</strong>g<br />

contracts are signed. This does not stay <strong>in</strong>tegrated <strong>in</strong><br />

processes and sub-processes series that their client companies<br />

make, which, for <strong>in</strong>stance, elim<strong>in</strong>ates logistic part concern<strong>in</strong>g<br />

provision<strong>in</strong>g, which is an habitual purchas<strong>in</strong>g process. The<br />

competitive tool used <strong>in</strong> this case is the economy <strong>of</strong> scale,<br />

obta<strong>in</strong><strong>in</strong>g a bigger purchas<strong>in</strong>g power as a result <strong>of</strong> an <strong>in</strong>crease<br />

<strong>in</strong> the purchas<strong>in</strong>g volume. There is also a reduction <strong>in</strong> the<br />

number <strong>of</strong> providers and, therefore, a greater efficiency <strong>in</strong> the<br />

contract negotiation management. F<strong>in</strong>ally, the number <strong>of</strong><br />

purchas<strong>in</strong>g references is reduced, which makes Compras58 –<br />

on behalf <strong>of</strong> its clients- become a preferential client for its<br />

providers. Accord<strong>in</strong>g to the last data obta<strong>in</strong>ed (year 2007),<br />

Compras58 owns a client portfolio with 300 client companies,<br />

grouped <strong>in</strong> 12 clusters from 6 Spanish regions. These clusters<br />

belong to the follow<strong>in</strong>g sectors: textile, automobile <strong>in</strong>dustry,<br />

plastics and ma<strong>in</strong>tenance. The closed negotiations dur<strong>in</strong>g 2012<br />

appear <strong>in</strong> this Table:<br />

Table 1. Sav<strong>in</strong>gs achieved <strong>in</strong> 2010. Source : Compras58.<br />

Item<br />

Negotiated<br />

amount (€)<br />

Sav<strong>in</strong>gs (€) Sav<strong>in</strong>gs (%)<br />

Telephony 3,815,968 772,828 20%<br />

National courier 368,637 113,075 31%<br />

Electricity 29,965,668 2,647,355 9%<br />

Office supplies 382,658 86,568 23%<br />

International courier 899,651 196,975 22%<br />

Lab supplies 434,422 111,579 26%<br />

Road transport 2,341,805 131,425 6%<br />

Fuel 185,092 7,154 4%<br />

Natural gas 1,980,454 184,130 9%<br />

Insurance 98,064 8,562 9%<br />

Waste Management 7,372 601,000 8%<br />

TOTAL 40,479,794 4,260,257 11%<br />

Accord<strong>in</strong>g to the above description, then BPO companies<br />

could be classified <strong>in</strong> two types:<br />

� Companies which exploit benefits <strong>of</strong> economies <strong>of</strong> scale<br />

applied to a k<strong>in</strong>d <strong>of</strong> process (ICT, Purchas<strong>in</strong>g,<br />

Ma<strong>in</strong>tenance, etc.), that is, the classic outsourc<strong>in</strong>g.<br />

� Companies which, <strong>in</strong> a way, are <strong>in</strong>tegrated vertically <strong>in</strong>to<br />

their client companies from a more strategic position.<br />

These companies are still very <strong>in</strong>cipient and cover any<br />

k<strong>in</strong>d <strong>of</strong> process susceptible <strong>of</strong> be<strong>in</strong>g outsourced. This is<br />

called BPO.<br />

When BPO activities are placed <strong>in</strong> a specific<br />

geographical frame and, particularly, when the relocation <strong>of</strong><br />

processes from developed countries <strong>in</strong>to emerg<strong>in</strong>g economies<br />

takes place, we have a k<strong>in</strong>d <strong>of</strong> BPO known as <strong>of</strong>fshor<strong>in</strong>g. This<br />

practice has attracted a considerable public attention over the<br />

last years [7]. Companies which manage this type <strong>of</strong> BPO play<br />

an important role, allow<strong>in</strong>g their clients to specialize <strong>in</strong> their<br />

core competences and they are used as extension <strong>of</strong> them [8].<br />

Without detriment to the possible sav<strong>in</strong>gs reached, many<br />

companies are unable to value BPO advantages. Alster [9]<br />

foretold that 60% <strong>of</strong> the BPO companies would face the client<br />

desertion and the appearance <strong>of</strong> hidden costs that could cancel<br />

the sav<strong>in</strong>gs between 2005 and 2008. Aron and S<strong>in</strong>gh [8] claim<br />

that half <strong>of</strong> the companies which dealt with <strong>of</strong>fshor<strong>in</strong>g<br />

processes have not been able to generate the expected<br />

benefits. Rob<strong>in</strong>son et al. [10] states that most <strong>of</strong> 75% <strong>of</strong> BPO<br />

providers believe their clients were not prepared enough for<br />

the <strong>in</strong>itiative and lacked <strong>of</strong> a very well developed strategy<br />

when fac<strong>in</strong>g how outsourc<strong>in</strong>g could work. These anecdotic<br />

f<strong>in</strong>d<strong>in</strong>gs state that the BPO companies’ management is still not<br />

<strong>in</strong> accordance with their clients expectations. An important<br />

reason for this problem could be the <strong>in</strong>ability <strong>of</strong> service<br />

providers and clients to handle with <strong>in</strong>terdependences <strong>of</strong><br />

processes, which leads to failure ([11] and [8]). The effective<br />

<strong>in</strong>tegration process between the service provider and its client<br />

should be made strongly and decisively <strong>in</strong> the highest<br />

collaboration frame. We must remember that BPO provid<strong>in</strong>g<br />

companies are usually strategic consultancy firms which do<br />

not <strong>of</strong>fer a generalist view but a multi-specialist one <strong>in</strong><br />

contrast with the only specialization <strong>of</strong> the classic outsourc<strong>in</strong>g<br />

companies. The problem lies on the fact that on almost any<br />

occasion there is a distrust by the senior management team <strong>of</strong><br />

the client company to the BPO provider requirements about<br />

“giv<strong>in</strong>g sovereignty” when mak<strong>in</strong>g organizational and<br />

strategic decisions that affect the company as a whole.<br />

Anyway, these problems that rise systematically <strong>in</strong> BPO<br />

projects are determ<strong>in</strong>ed by the bus<strong>in</strong>ess immaturity and its still<br />

scarce visibility by potential clients. The break-even po<strong>in</strong>t will<br />

be determ<strong>in</strong>ed by the component <strong>of</strong> the corporate strategy that<br />

the senior management team <strong>of</strong> the client company will be<br />

will<strong>in</strong>g not to transfer, but to share with its BPO provider.<br />

Obviously, the opposite po<strong>in</strong>t is found <strong>in</strong> keep<strong>in</strong>g the brand<br />

name by the client, hav<strong>in</strong>g outsourced the majority <strong>of</strong><br />

processes, either core or not. There is an <strong>in</strong>terest<strong>in</strong>g debate<br />

concern<strong>in</strong>g this, which accepts op<strong>in</strong>ions <strong>in</strong> all senses, without<br />

any solution <strong>of</strong> cont<strong>in</strong>uity.

Although some researchers have expressed their need <strong>of</strong><br />

a close relationship between the members <strong>of</strong> the supply cha<strong>in</strong><br />

[12], only recently has the possibility <strong>of</strong> suggest<strong>in</strong>g a<br />

systematic approach to study the supply cha<strong>in</strong> <strong>in</strong>tegration been<br />

raised. The current competitiveness <strong>in</strong> <strong>in</strong>dustrial and service<br />

markets has made several companies reconsider the need <strong>of</strong><br />

establish<strong>in</strong>g cooperation alliances, mutual benefit and jo<strong>in</strong>t<br />

improvement <strong>of</strong> transversal processes, which have become a<br />

high priority [13]. At this po<strong>in</strong>t we should mention the<br />

comakership techniques, which have worked so well <strong>in</strong> sectors<br />

like automobile, where the <strong>in</strong>termediate marg<strong>in</strong> cutt<strong>in</strong>g has<br />

reached very high po<strong>in</strong>ts. The capacity to <strong>in</strong>tegrate different<br />

processes <strong>in</strong>to different contexts can provide BPO companies<br />

with unique competitive and irreplaceable positions that will<br />

allow those companies which contract their services to reduce<br />

failure risks <strong>in</strong> the process to improve the client service levels<br />

and performance. Given this, it is assumed that BPO can<br />

mean not only cost sav<strong>in</strong>gs by cost-cutt<strong>in</strong>g and by economies<br />

<strong>of</strong> scale, but also an <strong>in</strong>crease <strong>in</strong> <strong>in</strong>comes as a consequence <strong>of</strong><br />

economies <strong>of</strong> scope, which the new core processes a BPO<br />

company can do for its client <strong>in</strong>volve.<br />

BPO range <strong>of</strong> services (ma<strong>in</strong>tenance, legal services,<br />

purchas<strong>in</strong>g, market<strong>in</strong>g logistics, etc..) is as wide as varied the<br />

functional division <strong>of</strong> the company is, obviously assum<strong>in</strong>g<br />

<strong>in</strong>termediate proposals <strong>of</strong> outsourc<strong>in</strong>g <strong>of</strong> areas, sections or<br />

hierarchically less important units <strong>in</strong> a traditional organization.<br />

Clients can only contract one BPO supplier, provide him with<br />

work specifications or procedures and wait for a good supply<br />

[8]. The provider will make more mistakes and will work<br />

more <strong>in</strong>efficiently than the client company employees, until he<br />

can manage these tasks easily. This fact must be considered<br />

and quantified <strong>in</strong> ROI terms when th<strong>in</strong>k<strong>in</strong>g <strong>of</strong> a BPO project.<br />

Obviously, this situation is produced when the outsourced<br />

processes belong to core bus<strong>in</strong>ess and this is usually the<br />

reason that makes organizations not contract BPO companies<br />

for this k<strong>in</strong>d <strong>of</strong> processes. This also means discouragement for<br />

the senior management team <strong>of</strong> companies plann<strong>in</strong>g to<br />

relocate a great part <strong>of</strong> its key processes, which must be<br />

considered when they decide whether mak<strong>in</strong>g the project with<br />

their own means - through expatriate - or with other’s - by<br />

contract<strong>in</strong>g an <strong>of</strong>fshor<strong>in</strong>g company. There are other failure<br />

risks for BPO companies related to the contractual obligations<br />

that they have with their clients. The effective <strong>in</strong>tegration can<br />

make these problems disappear. The lack <strong>of</strong> effective<br />

<strong>in</strong>tegration <strong>in</strong> a service environment can lead to a deficient<br />

performance, so this is an important area to explore. Many <strong>of</strong><br />

BPO tasks have complex knowledge components [14].<br />

Therefore, tasks can vary the complexity grade and so the<br />

result <strong>of</strong> the execution. The quality <strong>of</strong> these services can <strong>of</strong>ten<br />

depend on the coord<strong>in</strong>ation between different processes and<br />

sub-processes with<strong>in</strong> the same process. Consider that part <strong>of</strong><br />

the sub-processes or processes are made by BPO companies<br />

and other part by the client company. The most convenient<br />

th<strong>in</strong>g might be to make a maximalist approach when<br />

contract<strong>in</strong>g BPO companies, that is, to outsource no core<br />

complete processes. In this way, <strong>in</strong>tegration problems and<br />

start<strong>in</strong>g up costs would be avoided and a less payback <strong>of</strong> the<br />

<strong>in</strong>vestment <strong>in</strong> reduc<strong>in</strong>g staff to outsource it would be obta<strong>in</strong>ed.<br />

The border <strong>of</strong> BPO with the simple employment <strong>of</strong> workers,<br />

outsourced to a temporary work agency, can mean a sign that<br />

the BPO project has not been completely understood.<br />

4 Conclusions<br />

In the current work, the <strong>in</strong>tention has been to make an<br />

analysis <strong>of</strong> the different aspects <strong>of</strong> the classic outsourc<strong>in</strong>g and<br />

the promis<strong>in</strong>g future <strong>of</strong> the BPO variant <strong>in</strong> a pre-recessive<br />

context such as the present one <strong>in</strong> Spa<strong>in</strong>. It has been seen that<br />

the motivations that make companies outsource their process<br />

and sub-processes are different. The satisfaction that the<br />

application <strong>of</strong> these techniques <strong>in</strong> the different productive<br />

sectors, <strong>in</strong> different geographic contexts and <strong>in</strong> companies and<br />

public capital organizations generates <strong>in</strong> contrast to the private<br />

capital ones have also been analyzed. The attitude <strong>of</strong><br />

companies to give or, <strong>in</strong> all case, to share some <strong>of</strong> the strategic<br />

decisions with companies specialized <strong>in</strong> BPO seems to be very<br />

far. This fact can be sharply seen <strong>in</strong> small and medium size<br />

companies, where BPO has entered less than <strong>in</strong> big<br />

corporations.<br />

As addition to the current work, the possibility <strong>of</strong><br />

establish<strong>in</strong>g an <strong>Outsourc<strong>in</strong>g</strong>/BPO observatory <strong>in</strong> Spa<strong>in</strong> is<br />

proposed here. It will allow to evaluate the <strong>in</strong>tegration degree<br />

<strong>of</strong> these techniques <strong>in</strong> the Spanish company and to feature it<br />

accord<strong>in</strong>g to several parameters like the region where they are<br />

placed, sector they belong to, size or company ownership. The<br />

aforementioned observatory will have a department<br />

responsible for the characterization and evaluation <strong>of</strong> the<br />

services demand. In short, it means to quantify and know the<br />

evolution <strong>of</strong> this economic activity <strong>in</strong> detail.<br />

5 References<br />

[1] Banco de España (2012): “Informe de proyecciones de<br />

la economía española”. January, 2012, pp. 2-7.<br />

[2] “Pricewaterhouse Coopers Global <strong>Outsourc<strong>in</strong>g</strong> Survey”.<br />

Pricewaterhouse Coopers (2007), pp. 7-10.<br />

[3] Apte U.M., Mason R.O. (1995): “Global disaggregation<br />

<strong>of</strong> <strong>in</strong>formation-<strong>in</strong>tensive services”. Management Science, 41<br />

(7), pp. 1250–1262.<br />

[4] Metters R. (2008): “A typology <strong>of</strong> <strong>of</strong>fshor<strong>in</strong>g and<br />

outsourc<strong>in</strong>g <strong>in</strong> electronically transmitted services”. Journal <strong>of</strong><br />

Operations Management, 26 (2), pp. 198–211.<br />

[5] Mithas, S. and Whitaker, J. (2007): “Is the world flat or<br />

spiky? Information <strong>in</strong>tensity, skills and global service<br />

disaggregation”. Information Systems Research, 18 (3), pp.<br />

237–259.

[6] Kulkarni, V. (2008): “Offshore to w<strong>in</strong> not shr<strong>in</strong>k”. J.M.<br />

Swam<strong>in</strong>athan (Ed.), Indian Economic Superpower Fiction or<br />

Future?, World Scientific Publish<strong>in</strong>g Company.<br />

[7] Metters, R. and Verma, R. (2008): “History <strong>of</strong><br />

<strong>of</strong>fshor<strong>in</strong>g knowledge services”. Journal <strong>of</strong> Operations<br />

Management, 26 (2), pp. 141–147.<br />

[8] Aron, R. and S<strong>in</strong>gh, J.V. (2005): “Gett<strong>in</strong>g <strong>of</strong>fshor<strong>in</strong>g<br />

right”. Harvard <strong>Bus<strong>in</strong>ess</strong> Review, pp. 135–143.<br />

[9] Alster, N. (2005): “Customer disservice”. CFO, 21 (13),<br />

pp. 40–44.<br />

[10] Rob<strong>in</strong>son, P.; Lowes, P.; Loughran, C.; Moller, P.;<br />

Shields, G. and Kle<strong>in</strong>, E. (2008): “Why Settle For Less?”.<br />

Deloitte Consult<strong>in</strong>g Report.<br />

[11] Mani, D.; Barua, A. and Wh<strong>in</strong>ston, A. (2007): “A model<br />

<strong>of</strong> cont<strong>in</strong>gent governance choice and performance <strong>in</strong> bus<strong>in</strong>ess<br />

process outsourc<strong>in</strong>g: the effects <strong>of</strong> relational and process<br />

uncerta<strong>in</strong>ty”. International DSI Conference and APDSI<br />

Conference, Bangkok, Thailand.<br />

[12] Armistead, C. and Mapes, J. (1993): “The impact <strong>of</strong><br />

supply cha<strong>in</strong> <strong>in</strong>tegration on operat<strong>in</strong>g performance”. Logistics<br />

Information Management, 6 (4), pp. 9–14.<br />

[13] Zhao, X.; Huo, B.; Flynn, B.B. and Yeung, J. (2008):<br />

“The impact <strong>of</strong> power and relationship commitment on the<br />

<strong>in</strong>tegration between manufacturers and customers <strong>in</strong> a supply<br />

cha<strong>in</strong>”. Journal <strong>of</strong> Operations Management, 26 (3), pp. 368–<br />

388.<br />

[14] Youngdahl, W. and Ramaswamy, K. (2008):<br />

“Offshor<strong>in</strong>g knowledge and service work: a conceptual model<br />

and research agenda”. Journal <strong>of</strong> Operations Management, 26<br />

(2), pp. 212–221.