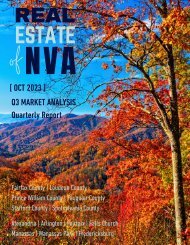

2020-08 -- Real Estate of Northern Virginia Market Report - August 2020 Market Trends - Michele Hudnall

This is a monthly report of the Northern Virginia Real Estate market. Weekly I post a video of current market conditions on Tuesday's and will post the monthly report by the 10th of each month as the numbers finalize in the MLS (Bright). The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

This is a monthly report of the Northern Virginia Real Estate market. Weekly I post a video of current market conditions on Tuesday's and will post the monthly report by the 10th of each month as the numbers finalize in the MLS (Bright).

The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

- TAGS

- falls-church-virginia

- alexandria-virginia

- manassas-virginia

- arlington-virginia

- fauquier-county

- real-estate-of-nva

- michele-hudnall

- nva-real-estate-trends

- nova-real-estate-trends

- northern-virginia-home-trends

- northern-virginia-home-prices

- fairfax-county

- prince-william-county

- northern-virginia-real-estate

- northern-virginia

- loudoun-county

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AUGUST <strong>2020</strong> MARKET REPORT<br />

FAIRFAX – LOUDOUN – PRINCE WILLIAM<br />

ALEXANDRIA – ARLINGTON - FAIRFAX – FALLS CHURCH<br />

Overview<br />

In March <strong>2020</strong>, we faced a historic disruption with the COVID-19 pandemic. There were and are still many<br />

questions for businesses, as well as daily life during these days <strong>of</strong> disruption. It took only a couple <strong>of</strong><br />

weeks before we understood how to best protect ourselves and others and continue life. Some<br />

businesses (e.g., real estate) are considered essential, where others (e.g., entertainment) were not due<br />

to nature <strong>of</strong> large gatherings but how business is conducted has changed.<br />

It was at this time that I went back to my pr<strong>of</strong>essional roots as an analyst and market strategist to<br />

answer the questions posed regarding the real estate market in the <strong>Northern</strong> <strong>Virginia</strong> area and the<br />

disruption. I have access to the market data, so I continually work to organize it in a meaningful report<br />

for you based upon your continuous feedback.<br />

The Route 7 Corridor <strong>Report</strong> (Fairfax & Loudoun) was created to tell the current market story<br />

accompanied with a monthly video and a weekly update video keeping up with the current market. This<br />

month the report has evolved again to be more complete in representing the <strong>Northern</strong> <strong>Virginia</strong> market<br />

based upon your feedback!<br />

Join the conversation and tune-in on Facebook and YouTube!

|| NORTHERN VIRGINIA OVERVIEW ........................................................................................................... 1<br />

|| MARKET VALUE AND DEMAND .......................................................................................................................................................... 2<br />

|| MARKET AND NEGOTIABILITY ............................................................................................................................................................. 3<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................... 4<br />

|| SUMMARY .................................................................................................................................................................................................. 5<br />

THE CITIES OF THE ........................................................................................................................................ 7<br />

NORTHERN VIRGINIA MARKET.................................................................................................................. 7<br />

|| ALEXANDRIA CITY OVERVIEW ............................................................................................................ 9<br />

|| MARKET VALUE AND DEMAND ..................................................................................................................................................... 10<br />

|| MARKET AND NEGOTIABILITY........................................................................................................................................................ 10<br />

|| INVENTORY SUPPLY .......................................................................................................................................................................... 11<br />

|| STRUCTURE TYPES ............................................................................................................................................................................ 12<br />

|| ARLINGTON CITY OVERVIEW .............................................................................................................. 15<br />

|| MARKET VALUE AND DEMAND ..................................................................................................................................................... 16<br />

|| MARKET AND NEGOTIABILITY........................................................................................................................................................ 16<br />

|| INVENTORY SUPPLY ......................................................................................................................................................................... 17<br />

|| STRUCTURE TYPES ............................................................................................................................................................................ 18<br />

|| FAIRFAX CITY OVERVIEW .................................................................................................................... 21<br />

|| MARKET VALUE AND DEMAND .................................................................................................................................................... 22<br />

|| MARKET AND NEGOTIABILITY....................................................................................................................................................... 22<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................ 23<br />

|| STRUCTURE TYPES ........................................................................................................................................................................... 24<br />

|| FALLS CHURCH CITY OVERVIEW ..................................................................................................... 27<br />

|| MARKET VALUE AND DEMAND .................................................................................................................................................... 28<br />

|| MARKET AND NEGOTIABILITY....................................................................................................................................................... 28<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................ 29<br />

|| STRUCTURE TYPES ........................................................................................................................................................................... 30

THE COUNTIES OF THE .............................................................................................................................. 33<br />

NORTHERN VIRGINIA MARKET................................................................................................................ 33<br />

|| FAIRFAX COUNTY OVERVIEW ........................................................................................................... 35<br />

|| MARKET VALUE AND DEMAND .................................................................................................................................................... 36<br />

|| MARKET AND NEGOTIABILITY....................................................................................................................................................... 36<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................ 37<br />

|| STRUCTURE TYPES & CITIES ......................................................................................................................................................... 38<br />

|| LOUDOUN COUNTY OVERVIEW ......................................................................................................... 45<br />

|| MARKET VALUE AND DEMAND .................................................................................................................................................... 46<br />

|| MARKET AND NEGOTIABILITY....................................................................................................................................................... 46<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................ 47<br />

|| STRUCTURE TYPES & CITIES ......................................................................................................................................................... 48<br />

|| PRINCE WILLIAM COUNTY OVERVIEW ........................................................................................... 55<br />

|| MARKET VALUE AND DEMAND .................................................................................................................................................... 56<br />

|| MARKET AND NEGOTIABILITY....................................................................................................................................................... 56<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................ 57<br />

|| STRUCTURE TYPES & CITIES ......................................................................................................................................................... 58

|| NORTHERN VIRGINIA OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 567,250<br />

3818 16<br />

41% YoY 20% YoY 13% YoY 28% YoY<br />

EXTERNAL DEMAND DRIVER AND INDICATOR<br />

HISTORICALLY LOW INTEREST TRATES | MORTGAGE APPLICATIONS<br />

34% YoY 39% YoY 4% YoY 32% YoY<br />

- 1 -

|| NORTHERN VIRGINIA OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

20% 4% 100% 28% 118% 12%<br />

$567,250<br />

3,818<br />

- 2 -

AUGUST <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

|| NORTHERN VIRGINIA OVERVIEW AUGUST <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-5% -41% 65% 20% 118% 12% 126% 32%<br />

- 4 -

AUGUST <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

|| SUMMARY<br />

NORTHERN VIRGINIA MARKET REVIEW<br />

DEMAND – SUPPLY – MARKET – VALUE<br />

MoM – YTD – YoY CHANGE<br />

NORTHERN VIRGINIA<br />

Active Listings 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 395 324 515 420 -18% 30% 6%<br />

Arlington, VA 478 312 625 538 -14% 72% 13%<br />

Fairfax City, VA 147 90 82 57 -30% -37% -61%<br />

Fairfax, VA 4,200 2,568 3,452 2,465 -29% -4% -41%<br />

Falls Church City, VA 28 15 38 17 -55% 13% -39%<br />

Loudoun, VA 2,120 1,302 1,667 1,172 -30% -10% -45%<br />

Prince William, VA 2,343 1,403 1,685 1,069 -37% -24% -54%<br />

New Listings 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 186 188 336 314 -7% 67% 69%<br />

Arlington, VA 227 178 399 350 -12% 97% 54%<br />

Fairfax City, VA 55 23 49 32 -35% 39% -42%<br />

Fairfax, VA 1,578 1,092 2,028 1,832 -10% 68% 16%<br />

Falls Church City, VA 10 7 22 21 -5% 200% 110%<br />

Loudoun, VA 698 546 958 818 -15% 50% 17%<br />

Prince William, VA 771 539 980 868 -11% 61% 13%<br />

Sold Listings 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 204 128 266 260 -2% 103% 27%<br />

Arlington, VA 235 138 257 269 5% 95% 14%<br />

Fairfax City, VA 42 15 39 35 -10% 133% -17%<br />

Fairfax, VA 1,456 771 1,748 1,624 -7% 111% 12%<br />

Falls Church City, VA 16 4 22 27 23% 575% 69%<br />

Loudoun, VA 667 310 852 766 -10% 147% 15%<br />

Prince William, VA 775 387 919 837 -9% 116% 8%<br />

Pending Listings 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 173 129 217 246 13% 91% 42%<br />

Arlington, VA 162 113 210 229 9% 103% 41%<br />

Fairfax City, VA 38 18 30 32 7% 78% -16%<br />

Fairfax, VA 1,145 713 1,350 1,376 2% 93% 20%<br />

Falls Church City, VA 9 2 11 17 55% 750% 89%<br />

Loudoun, VA 493 309 618 657 6% 113% 33%<br />

Prince William, VA 571 377 771 771 0% 105% 35%<br />

EOM 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 116 111 307 306 0% 176% 164%<br />

Arlington, VA 147 94 378 416 10% 343% 183%<br />

Fairfax City, VA 41 19 49 37 -24% 95% -10%<br />

Fairfax, VA 1,385 799 1,853 1,800 -3% 125% 30%<br />

Falls Church City, VA 11 8 20 15 -25% 88% 36%<br />

Loudoun, VA 648 354 960 843 -12% 138% 30%<br />

Prince William, VA 776 449 777 720 -7% 60% -7%<br />

AVG Median Sales Price2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA $ 505,500 $ 470,000 $ 616,500 $ 585,000 -5% 24% 16%<br />

Arlington, VA $ 582,500 $ 530,000 $ 681,500 $ 645,000 -5% 22% 11%<br />

Fairfax City, VA $ 582,450 $ 461,988 $ 632,000 $ 550,000 -13% 19% -6%<br />

Fairfax, VA $ 520,000 $ 515,000 $ 605,000 $ 570,000 -6% 11% 10%<br />

Falls Church City, VA $ 731,000 $ 475,000 $ 795,000 $ 635,000 -20% 34% -13%<br />

Loudoun, VA $ 515,000 $ 497,284 $ 561,750 $ 559,250 0% 12% 9%<br />

Prince William, VA $ 400,000 $ 365,000 $ 420,000 $ 426,500 2% 17% 7%<br />

AVG Months <strong>of</strong> Inventory 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 0.50 0.60 1.30 1.10 -15% 83% 120%<br />

Arlington, VA 0.60 0.50 1.70 1.60 -6% 220% 167%<br />

Fairfax City, VA 1.00 0.60 1.20 0.90 -25% 50% -10%<br />

Fairfax, VA 0.80 0.70 1.20 1.00 -17% 43% 25%<br />

Falls Church City, VA 0.50 0.80 2.20 0.70 -68% -13% 40%<br />

Loudoun, VA 0.80 0.70 1.30 1.00 -23% 43% 25%<br />

Prince William, VA 0.90 0.80 1.00 0.80 -20% 0% -11%<br />

AVG DOM 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 17 31 15 12 -20% -61% -29%<br />

Arlington, VA 17 30 13 15 15% -50% -12%<br />

Fairfax City, VA 32 18 25 26 4% 44% -19%<br />

Fairfax, VA 22 33 17 15 -12% -55% -32%<br />

Falls Church City, VA 36 25 11 17 55% -32% -53%<br />

Loudoun, VA 23 35 20 16 -20% -54% -30%<br />

Prince William, VA 26 39 17 14 -18% -64% -46%<br />

AVG Median Sales<br />

Price to Orig List 2019/<strong>08</strong> <strong>2020</strong>/01 <strong>2020</strong>/07 <strong>2020</strong>/<strong>08</strong> MoM CHGYTD CHG YoY CHG<br />

Price<br />

Alexandria City, VA 105% 97% 116% 115% -1% 19% 10%<br />

Arlington, VA 100% 87% 109% 102% -6% 17% 2%<br />

Fairfax City, VA 101% 88% 113% 92% -18% 5% -9%<br />

Fairfax, VA 96% 90% 105% 104% -2% 16% 8%<br />

Falls Church City, VA 107% 63% 139% 85% -39% 34% -21%<br />

Loudoun, VA 97% 90% 102% 102% 0% 12% 5%<br />

Prince William, VA 103% 91% 99% 102% 3% 11% -1%<br />

- 5 -

|| NORTHERN VIRGINIA OVERVIEW AUGUST <strong>2020</strong><br />

- 6 -

THE CITIES OF THE<br />

NORTHERN VIRGINIA MARKET<br />

- 7 -

- 8 -

|| ALEXANDRIA CITY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 585,000<br />

260 12<br />

6% YoY 69% YoY 27% YoY 42% YoY<br />

29% YoY 120% YoY 16% YoY 164% YoY<br />

- 9 -

|| ALEXANDRIA CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

24% 16% 91% 42% 103% 27%<br />

$585,000<br />

260<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

30% 6% 67% 69% 103% 27% 176% 164%<br />

- 11 -

|| ALEXANDRIA CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES<br />

ALEXANDRIA CITY<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 111 15 $ 719.55 $ 375,819 $ 376,445 100%<br />

BEDS<br />

106 15 $ 372.27 $ 353,740 $ 354,486 100%<br />

5 3 $ 9,748.75 $ 843,900 $ 841,980 100%<br />

81%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$7,367 25%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

55% 57% 55% 57%<br />

- 12 -

AUGUST <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

ALEXANDRIA CITY<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 47 15 $ 561.83 $ 1,<strong>08</strong>2,611 $ 1,098,262 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

2 15 $ 520.46 $ 705,500 $ 748,500 94%<br />

14 11 $ 582.36 $ 956,804 $ 958,129 100%<br />

31 17 $ 555.23 $ 1,163,756 $ 1,184,113 98%<br />

73%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 6,341 33%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-42% 13% -17% 152%<br />

- 13 -

|| ALEXANDRIA CITY OVERVIEW AUGUST <strong>2020</strong><br />

ALEXANDRIA CITY<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 106 15 $ 498.87 $ 786,356 $ 783,096 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

32 11 $ 570.51 $ 637,295 $ 627,480 102%<br />

59 14 $ 483.25 $ 811,197 $ 810,950 100%<br />

15 31 $ 412.27 $ 1,006,647 $ 1,005,519 100%<br />

82%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$6,326 22%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-28% -5% 66% 42%<br />

- 14 -

|| ARLINGTON CITY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 645,000<br />

269 15<br />

12% YoY 54% YoY 14% YoY 41% YoY<br />

12% YoY 166% YoY 11% YoY 183% YoY<br />

- 15 -

|| ARLINGTON CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

22% 11% 103% 41% 95% 14%<br />

$645,000<br />

269<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

72% 13% 97% 54% 95% 14% 343% 183%<br />

- 17 -

|| ARLINGTON CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

ARLINGTON CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 115 15 $ 480.32 $ 458,760 $ 464,0<strong>08</strong> 99%<br />

BEDS<br />

111 14 $ 475.58 $ 425,539 $ 427,148 100%<br />

4 54 $ 611.65 $ 1,380,625 $ 1,486,875 93%<br />

CONDOMINIUM<br />

DOM % <strong>of</strong> SALES<br />

61 4%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$4,390 22%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

0% 33% 0% 33%<br />

- 18 -

AUGUST <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

ARLINGTON CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 102 17 $ 554.43 $ 1,099,297 $ 1,097,074 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

7 10 $ 642.76 $ 721,629 $ 683,400 106%<br />

30 15 $ 601.89 $ 879,130 $ 863,633 102%<br />

65 19 $ 523.02 $ 1,241,584 $ 1,249,366 99%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 6%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 5,794 16%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-32% -38% 71% -51%<br />

- 19 -

|| ARLINGTON CITY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

ARLINGTON CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 46 8 $ 494.27 $ 806,063 $ 1,053,161 77%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

18 7 $ 507.73 $ 643,550 $ 636,756 101%<br />

21 9 $ 495.20 $ 894,762 $ 1,439,609 62%<br />

7 7 $ 456.87 $ 957,857 $ 964,571 99%<br />

TOWNHOUSE<br />

DOM % <strong>of</strong> SALES<br />

61 2%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$4,895 22%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

20% 8% 57% 475%<br />

- 20 -

|| FAIRFAX CITY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 550,000<br />

35 26<br />

61% YoY 42% YoY 16% YoY 16% YoY<br />

19% YoY 10% YoY 6% YoY 10% YoY<br />

- 21 -

|| FAIRFAX CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

19% -6% 78% -16% 133% -17%<br />

$550,000<br />

35<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-37% -61% 39% -42% 133% -17% 95% -10%<br />

- 23 -

|| FAIRFAX CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

CONDOMINIUM<br />

FAIRFAX CITY DOM % <strong>of</strong> SALES<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 8 21 $ 320.15 $ 371,844 $ 375,298 99%<br />

BEDS<br />

8 21 $ 320.15 $ 371,844 $ 375,298 99%<br />

61 0%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$6,041 78%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

101% 142% 101% 142%<br />

- 24 -

AUGUST <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 18 34 $ 334.70 $ 733,019 $ 726,583 101%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

0 0 $ - $ - $ - #DIV/0!<br />

3 4 $ 434.32 $ 519,333 $ 485,000 107%<br />

15 40 $ 314.77 $ 775,756 $ 774,900 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 5%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 6,292 29%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-21% -25% 156% 133%<br />

- 25 -

|| FAIRFAX CITY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 7 20 $ 281.32 $ 648,000 $ 651,371 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

1 20 $ 293.98 $ 366,000 $ 365,000 100%<br />

5 15 $ 283.79 $ 687,000 $ 684,940 100%<br />

1 42 $ 256.28 $ 735,000 $ 769,900 95%<br />

TOWNHOUSE<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 33%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$7,500 33%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

275% -6% #DIV/0! 88%<br />

- 26 -

|| FALLS CHURCH CITY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 635,000<br />

27 17<br />

39% YoY 110% YoY 69% YoY 89% YoY<br />

52% YoY 40% YoY 13% YoY 36% YoY<br />

- 27 -

|| FALLS CHURCH CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

34% -13% 750% 89% 575% 69%<br />

$635,000<br />

27<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> FALLS CHURCH CITY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

13% -39% 200% 110% 575% 69% 88% 36%<br />

- 29 -

|| FALLS CHURCH CITY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

FALLS CHURCH CITY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 3 11 $ 409.23 $ 368,933 $ 368,100 100%<br />

BEDS<br />

3 11 $ 409.23 $ 368,933 $ 368,100 100%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$1,317 27%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

778% -65% 778% -65%<br />

- 30 -

AUGUST <strong>2020</strong> FALLS CHURCH CITY OVERVIEW ||<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

FALLS CHURCH CITY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 14 13 $ 517.30 $ 1,014,860 $ 1,025,750 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

0 0 $ - $ - $ - #DIV/0!<br />

6 12 $ 557.86 $ 810,000 $ 843,300 96%<br />

8 13 $ 486.88 $ 1,168,505 $ 1,162,588 101%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 25%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 9,950 13%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

#DIV/0! 8% #DIV/0! 375%<br />

- 31 -

|| FALLS CHURCH CITY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

FALLS CHURCH CITY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 7 8 $ 483.76 $ 782,621 $ 767,686 102%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

0 0 $ - $ - $ - #DIV/0!<br />

5 9 $ 533.18 $ 709,670 $ 696,760 102%<br />

2 5 $ 360.23 $ 965,000 $ 945,000 102%<br />

TOWNHOUSE<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$600 14%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-90% -92% 0% -89%<br />

- 32 -

THE COUNTIES OF THE<br />

NORTHERN VIRGINIA MARKET<br />

- 33 -

- 34 -

|| FAIRFAX COUNTY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 570,000<br />

1624 15<br />

41% YoY 16% YoY 12% YoY 20% YoY<br />

32% YoY 25% YoY 10% YoY 30% YoY<br />

- 35 -

|| FAIRFAX COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

11% 10% 93% 20% 111% 12%<br />

$570,000<br />

1,624<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> FAIRFAX COUNTY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-4% -41% 68% 16% 111% 12% 125% 30%<br />

- 37 -

|| FAIRFAX COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES & CITIES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 262 17 $ 298.80 $ 316,449 $ 318,261 99%<br />

BEDS<br />

224 16 $ 306.50 $ 307,474 $ 309,107 99%<br />

38 22 $ 253.39 $ 369,355 $ 372,221 99%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 7%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$4,027 30%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-16% 2% -16% 2%<br />

- 38 -

AUGUST <strong>2020</strong> FAIRFAX COUNTY OVERVIEW ||<br />

FS<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale<br />

to Orig List<br />

Price Ratio<br />

Fairfax, VA 1610 15 $ 342.24 $ 619,726 $ 620,269 100%<br />

Condominium 328 18 $ 3<strong>08</strong>.90 $ 335,325 $ 338,424 99%<br />

Alexandria 56 12 $ 282.29 $ 291,272 $ 290,412 100%<br />

Annandale 19 12 $ 234.87 $ 221,284 $ 223,168 99%<br />

Burke 4 4 $ 254.<strong>08</strong> $ 259,750 $ 257,200 101%<br />

Centreville 9 7 $ 246.97 $ 266,261 $ 267,300 100%<br />

Chantilly 1 89 $ 243.31 $ 300,000 $ 320,000 94%<br />

Clifton 2 3 $ 294.40 $ 256,000 $ 254,950 100%<br />

Fairfax 54 16 $ 341.86 $ 411,870 $ 412,206 100%<br />

Falls Church 50 16 $ 307.15 $ 297,972 $ 299,132 100%<br />

Herndon 23 24 $ 294.22 $ 323,373 $ 324,952 100%<br />

Lorton 8 9 $ 260.78 $ 298,500 $ 295,850 101%<br />

Mclean 30 34 $ 389.63 $ 431,450 $ 445,443 97%<br />

Oakton 6 11 $ 268.72 $ 301,417 $ 295,150 102%<br />

Reston 49 28 $ 312.<strong>08</strong> $ 349,240 $ 360,258 97%<br />

Springfield 5 6 $ 277.12 $ 249,478 $ 245,858 101%<br />

Vienna 12 8 $ 360.50 $ 428,867 $ 430,233 100%<br />

- 39 -

|| FAIRFAX COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 893 20 $ 361.15 $ 803,330 $ 804,405 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

11 14 $ 469.19 $ 589,355 $ 587,236 100%<br />

134 15 $ 423.53 $ 638,142 $ 630,009 101%<br />

748 21 $ 348.38 $ 836,069 $ 838,841 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 7%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 7,951 26%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

1% 5% -423% -252%<br />

- 40 -

AUGUST <strong>2020</strong> FAIRFAX COUNTY OVERVIEW ||<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale<br />

to Orig List<br />

Price Ratio<br />

Fairfax, VA 1610 15 $ 342.24 $ 619,726 $ 620,269 100%<br />

Detached 750 17 $ 370.51 $ 823,953 $ 827,724 100%<br />

Alexandria 125 20 $ 403.73 $ 759,528 $ 759,788 100%<br />

Annandale 36 19 $ 415.62 $ 717,531 $ 7<strong>08</strong>,418 101%<br />

Burke 23 10 $ 356.05 $ 672,444 $ 663,503 101%<br />

Centreville 40 17 $ 259.96 $ 752,848 $ 763,995 99%<br />

Chantilly 9 7 $ 294.38 $ 768,667 $ 780,931 98%<br />

Clifton 12 13 $ 294.35 $ 827,475 $ 831,425 100%<br />

Dunn Loring 1 5 $ 462.78 $ 858,000 $ 840,000 102%<br />

Fairfax 83 12 $ 349.61 $ 743,772 $ 737,521 101%<br />

Fairfax Station 34 13 $ 309.27 $ 862,387 $ 857,353 101%<br />

Falls Church 56 10 $ 441.44 $ 815,945 $ 807,701 101%<br />

Great Falls 27 13 $ 373.49 $ 1,315,388 $ 1,326,735 99%<br />

Herndon 59 14 $ 332.52 $ 709,482 $ 709,492 100%<br />

Lorton 21 28 $ 265.87 $ 676,619 $ 684,662 99%<br />

Mclean 31 37 $ 471.02 $ 1,476,043 $ 1,507,990 98%<br />

Oak Hill 8 18 $ 301.87 $ 871,938 $ 909,738 96%<br />

Oakton 17 27 $ 339.79 $ 1,<strong>08</strong>7,512 $ 1,096,493 99%<br />

Reston 29 18 $ 343.78 $ 771,803 $ 773,534 100%<br />

Springfield 71 12 $ 373.64 $ 621,520 $ 632,268 98%<br />

Vienna 68 26 $ 417.52 $ 997,716 $ 1,014,794 98%<br />

- 41 -

|| FAIRFAX COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 515 13 $ 329.25 $ 525,389 $ 521,046 101%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

59 7 $ 341.75 $ 385,161 $ 380,610 101%<br />

364 14 $ 327.49 $ 519,750 $ 515,874 101%<br />

92 14 $ 328.16 $ 637,628 $ 631,573 101%<br />

TOWNHOUSE<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 2%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$4,693 29%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-21% -10% -1689% -156%<br />

- 42 -

AUGUST <strong>2020</strong> FAIRFAX COUNTY OVERVIEW ||<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale<br />

to Orig List<br />

Price Ratio<br />

Fairfax, VA 1610 15 $ 342.24 $ 619,726 $ 620,269 100%<br />

Townhouse 532 10 $ 322.95 $ 507,157 $ 501,574 101%<br />

Alexandria 1<strong>08</strong> 8 $ 322.43 $ 5<strong>08</strong>,029 $ 500,946 101%<br />

Annandale 10 6 $ 331.03 $ 458,050 $ 450,632 102%<br />

Burke 25 9 $ 325.58 $ 454,272 $ 445,118 102%<br />

Centreville 76 10 $ 297.28 $ 420,251 $ 417,536 101%<br />

Chantilly 9 23 $ 264.83 $ 472,855 $ 475,091 100%<br />

Clifton 5 5 $ 315.89 $ 425,120 $ 413,500 103%<br />

Dunn Loring 1 135 $ 300.24 $ 1,010,000 $ 1,050,000 96%<br />

Fairfax 76 10 $ 330.41 $ 547,448 $ 542,1<strong>08</strong> 101%<br />

Falls Church 27 7 $ 390.21 $ 592,456 $ 584,140 101%<br />

Fort Belvoir 1 4 $ 258.25 $ 595,000 $ 610,000 98%<br />

Herndon 26 10 $ 273.02 $ 499,456 $ 503,613 99%<br />

Lorton 21 13 $ 290.75 $ 451,567 $ 448,490 101%<br />

Mclean 2 25 $ 493.22 $ 990,000 $ 999,444 99%<br />

Oak Hill 1 15 $ 268.52 $ 435,000 $ 437,900 99%<br />

Oakton 8 10 $ 353.20 $ 669,688 $ 667,212 100%<br />

Reston 60 15 $ 338.74 $ 543,958 $ 540,396 101%<br />

Springfield 59 5 $ 312.96 $ 465,882 $ 451,643 103%<br />

Vienna 17 9 $ 394.31 $ 653,518 $ 649,150 101%<br />

- 43 -

|| FAIRFAX COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

- 44 -

|| LOUDOUN COUNTY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 559,250<br />

766 16<br />

45% YoY 17% YoY 15% YoY 33% YoY<br />

30% YoY 25% YoY 9% YoY 30% YoY<br />

- 45 -

|| LOUDOUN COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

12% 9% 113% 33% 147% 15%<br />

$559,250<br />

766<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST LOUDOUN COUNTY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-10% -45% 50% 17% 147% 15% 138% 30%<br />

- 47 -

|| LOUDOUN COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES & CITIES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

LOUDOUN COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 62 23 $ 246.53 $ 295,348 $ 301,585 98%<br />

BEDS<br />

56 24 $ 250.16 $ 295,305 $ 301,693 98%<br />

6 17 $ 212.62 $ 295,750 $ 300,571 98%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 10%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$3,983 29%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-14% 4% -14% 4%<br />

- 48 -

AUGUST LOUDOUN COUNTY OVERVIEW ||<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale<br />

to Orig List<br />

Price Ratio<br />

Loudoun, VA 732 16 $ 244.43 $ 597,925 $ 600,179 100%<br />

Condominium 49 19 $ 249.81 $ 314,485 $ 316,805 99%<br />

Aldie 1 9 $ 162.59 $ 425,000 $ 425,000 100%<br />

Ashburn 19 30 $ 265.14 $ 349,582 $ 352,892 99%<br />

Brambleton 3 5 $ 262.91 $ 251,300 $ 247,933 101%<br />

Leesburg 19 14 $ 238.95 $ 281,363 $ 283,673 99%<br />

Sterling 7 11 $ 244.53 $ 320,414 $ 322,842 99%<br />

- 49 -

|| LOUDOUN COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

LOUDOUN COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 384 26 $ 251.48 $ 738,215 $ 745,653 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

3 66 $ 359.93 $ 448,000 $ 441,267 102%<br />

51 22 $ 287.36 $ 525,016 $ 525,113 100%<br />

330 26 $ 244.89 $ 773,802 $ 782,503 99%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 9%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 7,615 32%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

1% 8% -44% -150%<br />

- 50 -

AUGUST LOUDOUN COUNTY OVERVIEW ||<br />

Detached 347 20 $ 254.73 $ 737,583 $ 743,079 99%<br />

Aldie 33 21 $ 239.30 $ 852,174 $ 852,361 100%<br />

Ashburn 59 11 $ 254.16 $ 846,343 $ 844,197 100%<br />

Bluemont 4 12 $ 248.86 $ 582,500 $ 582,225 100%<br />

Brambleton 10 13 $ 249.<strong>08</strong> $ 809,495 $ 807,473 100%<br />

Broadlands 5 10 $ 244.13 $ 753,200 $ 746,980 101%<br />

Chantilly 23 10 $ 252.74 $ 731,978 $ 728,148 101%<br />

Great Falls 1 3 $ 234.62 $ 610,000 $ 600,000 102%<br />

Hamilton 12 31 $ 244.72 $ 706,6<strong>08</strong> $ 709,634 100%<br />

Hillsboro 4 40 $ 274.47 $ 759,688 $ 781,075 97%<br />

Leesburg 75 30 $ 241.76 $ 768,582 $ 794,938 97%<br />

Lovettsville 16 14 $ 215.14 $ 550,443 $ 546,437 101%<br />

Middleburg 6 66 $ 359.28 $ 1,<strong>08</strong>9,667 $ 1,125,833 97%<br />

Paeonian Springs 1 149 $ 224.38 $ 1,165,000 $ 1,245,000 94%<br />

Potomac Falls 4 110 $ 288.96 $ 994,500 $ 993,000 100%<br />

Purcellville 15 12 $ 238.77 $ 597,992 $ 598,038 100%<br />

Round Hill 12 11 $ 226.12 $ 581,292 $ 577,601 101%<br />

Sterling 63 12 $ 290.15 $ 598,140 $ 597,543 100%<br />

Waterford 4 17 $ 237.10 $ 742,750 $ 726,188 102%<br />

- 51 -

|| LOUDOUN COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

LOUDOUN COUNTY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 361 13 $ 229.46 $ 478,107 $ 477,548 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

36 12 $ 261.79 $ 337,917 $ 336,496 100%<br />

238 12 $ 225.76 $ 466,419 $ 465,543 100%<br />

87 16 $ 226.42 $ 568,091 $ 568,756 100%<br />

TOWNHOUSE<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 2%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,247 31%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-17% 0% -77% -109%<br />

- 52 -

AUGUST LOUDOUN COUNTY OVERVIEW ||<br />

Townhouse 336 11 $ 233.04 $ 495,030 $ 493,926 100%<br />

Aldie 29 5 $ 202.44 $ 467,077 $ 462,599 101%<br />

Ashburn 86 11 $ 247.01 $ 513,649 $ 513,436 100%<br />

Brambleton 29 22 $ 217.26 $ 540,717 $ 543,978 99%<br />

Broadlands 8 7 $ 220.22 $ 520,438 $ 516,813 101%<br />

Chantilly 40 9 $ 219.28 $ 514,340 $ 511,624 101%<br />

Dulles 1 1 $ 217.93 $ 684,519 $ 594,990 115%<br />

Hamilton 1 6 $ 220.59 $ 300,000 $ 289,000 104%<br />

Leesburg 67 12 $ 221.66 $ 523,569 $ 522,920 100%<br />

Potomac Falls 4 17 $ 227.98 $ 650,000 $ 654,850 99%<br />

Purcellville 8 6 $ 223.46 $ 437,125 $ 431,154 101%<br />

Sterling 62 12 $ 260.96 $ 411,235 $ 410,969 100%<br />

Stone Ridge 1 4 $ 158.39 $ 536,000 $ 545,000 98%<br />

- 53 -

|| LOUDOUN COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

- 54 -

|| PRINCE WILLIAM COUNTY OVERVIEW<br />

MEDIAN SALES PRICE SOLD DAYS ON MKT<br />

$ 426,500<br />

837 14<br />

54% YoY 13% YoY 8% YoY 35% YoY<br />

46% YoY 11% YoY 11% YoY 7% YoY<br />

- 55 -

|| PRINCE WILLIAM COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

VALUE DEMAND DEMAND<br />

MEDIAN SALES PRICE PENDING LISTINGS CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

17% 7% 105% 35% 116% 8%<br />

$426,500<br />

837<br />

|| MARKET AND NEGOTIABILITY<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

AVERAGE % OF<br />

HOMES SOLD

AUGUST <strong>2020</strong> PRINCE WILLIAM COUNTY OVERVIEW ||<br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

DEMAND<br />

CLOSED LISTINGS<br />

END OF MONTH<br />

INVENTORY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-24% -54% 61% 13% 116% 8% 60% -7%<br />

- 57 -

|| PRINCE WILLIAM COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

|| STRUCTURE TYPES & CITIES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

PRINCE WILLIAM COUNTY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 24 21 $ 203.<strong>08</strong> $ 254,517 $ 258,1<strong>08</strong> 99%<br />

BEDS<br />

21 21 $ 205.89 $ 245,186 $ 248,604 99%<br />

3 25 $ 183.42 $ 319,833 $ 324,633 99%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 7%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$3,940 37%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-10% -15% -10% -15%<br />

- 58 -

AUGUST <strong>2020</strong> PRINCE WILLIAM COUNTY OVERVIEW ||<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale<br />

to Orig List<br />

Price Ratio<br />

Prince William, VA 805 14 $ 233.80 $ 444,473 $ 441,556 101%<br />

Condominium 30 15 $ 201.54 $ 256,863 $ 257,212 100%<br />

Dumfries 1 3 $ 110.95 $ 156,000 $ 155,000 101%<br />

Manassas 7 7 $ 2<strong>08</strong>.03 $ 226,400 $ 225,700 100%<br />

Woodbridge 19 9 $ 201.16 $ 255,532 $ 254,824 100%<br />

Occoquan 1 4 $ 204.68 $ 350,000 $ 345,000 101%<br />

Haymarket 2 111 $ 226.15 $ 380,000 $ 397,400 96%<br />

- 59 -

|| PRINCE WILLIAM COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

PRINCE WILLIAM COUNTY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 513 18 $ 238.50 $ 525,350 $ 525,776 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

16 15 $ 255.71 $ 415,566 $ 413,984 100%<br />

91 16 $ 283.85 $ 420,950 $ 422,048 100%<br />

406 18 $ 227.70 $ 553,076 $ 553,431 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 6%<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

CONCESSIONS<br />

$ 7,448 40%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-16% -8% 19% -886%<br />

- 60 -

AUGUST <strong>2020</strong> PRINCE WILLIAM COUNTY OVERVIEW ||<br />

Prince William, VA 805 14 $ 233.80 $ 444,473 $ 441,556 101%<br />

Detached 446 15 $ 240.11 $ 521,669 $ 518,213 101%<br />

Dumfries 41 19 $ 238.31 $ 493,509 $ 491,253 100%<br />

Triangle 10 38 $ 183.87 $ 486,335 $ 489,292 99%<br />

Gainesville 49 11 $ 218.57 $ 579,543 $ 572,291 101%<br />

Manassas 88 21 $ 246.57 $ 535,049 $ 533,638 100%<br />

Catharpin 2 14 $ 215.02 $ 865,000 $ 912,000 95%<br />

Woodbridge 160 10 $ 257.36 $ 458,673 $ 452,828 101%<br />

Nokesville 13 10 $ 256.49 $ 599,609 $ 601,900 100%<br />

Bristow 50 9 $ 211.79 $ 551,174 $ 547,618 101%<br />

Haymarket 32 26 $ 225.69 $ 655,747 $ 654,853 100%<br />

Manassas Park 1 31 $ 210.98 $ 630,000 $ 649,000 97%<br />

- 61 -

|| PRINCE WILLIAM COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

PRINCE WILLIAM COUNTY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 352 14 $ 221.07 $ 352,221 $ 350,787 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

29 15 $ 221.60 $ 295,003 $ 294,593 100%<br />

270 15 $ 220.94 $ 353,372 $ 352,459 100%<br />

53 9 $ 221.41 $ 377,664 $ 373,017 101%<br />

TOWNHOUSE<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 3%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,283 43%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-26% -18% 26% -194%<br />

- 62 -

AUGUST <strong>2020</strong> PRINCE WILLIAM COUNTY OVERVIEW ||<br />

Prince William, VA 805 14 $ 233.80 $ 444,473 $ 441,556 101%<br />

Townhouse 329 12 $ 228.19 $ 356,932 $ 354,447 101%<br />

Dumfries 33 13 $ 235.89 $ 344,765 $ 337,562 102%<br />

Triangle 5 28 $ 188.94 $ 319,700 $ 327,758 98%<br />

Gainesville 40 14 $ 229.65 $ 388,584 $ 386,997 100%<br />

Manassas 51 12 $ 231.19 $ 341,596 $ 338,766 101%<br />

Woodbridge 143 11 $ 227.25 $ 340,829 $ 338,453 101%<br />

Bristow 26 8 $ 230.83 $ 383,<strong>08</strong>5 $ 381,323 100%<br />

Occoquan 5 10 $ 277.84 $ 522,900 $ 520,980 100%<br />

Haymarket 26 10 $ 210.42 $ 391,422 $ 390,763 100%<br />

- 63 -

|| PRINCE WILLIAM COUNTY OVERVIEW AUGUST <strong>2020</strong><br />

- 64 -

<strong>Michele</strong> <strong>Hudnall</strong><br />

<strong>Market</strong> Mentor - <strong>Real</strong>tor - <strong>Market</strong> Strategist<br />

Deep Roots for Smart Moves!<br />

Your <strong>Market</strong> Strategy Mentor with Deep Roots in <strong>Northern</strong> <strong>Virginia</strong> for Smart Moves! Technology and<br />

Go-to-<strong>Market</strong> Strategy is my passion, let's put it to use for your real estate moves!<br />

<strong>Northern</strong> <strong>Virginia</strong> area has always been home for me and has much to <strong>of</strong>fer as your lifestyle<br />

requirements move forward. My consultative background in market analysis, go-to-market strategy<br />

and leading change for the technology companies is what I bring to my clients for their real estate<br />

transactions.<br />

My mission is to help you with the service, technology and marketing strategy you should expect and<br />

demand from a <strong>Real</strong>tor. This is why I am partnered with the best in the industry - Keller Williams<br />

<strong>Real</strong>ty. The real estate market is evolving technically which is very exciting. I am not learning, I am<br />

applying technology for clients.<br />

As I have watched <strong>Northern</strong> <strong>Virginia</strong> grow and evolve, I am also a Purple Bleeding, James Madison<br />

University alumni, home town sports fan, foodie and a fitness fanatic who is here to serve you in<br />

making your next move.<br />

<strong>Michele</strong> <strong>Hudnall</strong><br />

<strong>Real</strong> <strong>Estate</strong> <strong>of</strong> <strong>Northern</strong> <strong>Virginia</strong><br />

License #0225241222<br />

(703) 867-3436<br />

michele@realestate<strong>of</strong>nva.com<br />

calendly.com/mhudnall<br />

realestate<strong>of</strong>nva.com<br />

f – t – ig – in – yt<br />

@<strong>Real</strong><strong>Estate</strong>OfNVA<br />

.<br />

- 65 -

- 66 -

KW Reston<br />

License Number: #0226007362<br />

Office: (703) 679-1700<br />

11700 Plaza America Drive; Suite 150<br />

Reston, VA 20190<br />

The data used in this report comes from the MLS (Bright) with opinions provided being solely my own.<br />

Copyright <strong>2020</strong> <strong>Real</strong> <strong>Estate</strong> <strong>of</strong> <strong>Northern</strong> <strong>Virginia</strong> | <strong>Michele</strong> <strong>Hudnall</strong> – Do not reproduce without permission.<br />

- 67 -