2020-09 -- Real Estate of Northern Virginia Market Report - September 2020 Market Trends - Michele Hudnall

This is a monthly report of the Northern Virginia Real Estate market. Weekly I post a video of current market conditions and will post the monthly report between the 10th and 15th of each month as the numbers finalize in the MLS (Bright). The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

This is a monthly report of the Northern Virginia Real Estate market. Weekly I post a video of current market conditions and will post the monthly report between the 10th and 15th of each month as the numbers finalize in the MLS (Bright).

The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

- TAGS

- manassas-virginia

- falls-church-virginia

- alexandria-virginia

- arlington-virginia

- fauquier-county

- loudoun-county

- northern-virginia

- northern-virginia-real-estate

- prince-william-county

- fairfax-county

- northern-virginia-home-prices

- northern-virginia-home-trends

- nova-real-estate-trends

- nva-real-estate-trends

- michele-hudnall

- real-estate-of-nva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SEPTEMBER <strong>2020</strong> MARKET REPORT<br />

Fairfax – Loudoun – Prince William – Fauquier Counties<br />

Alexandria – Arlington - Fairfax – Falls Church<br />

Manassas – Manassas Park Cities<br />

Overview<br />

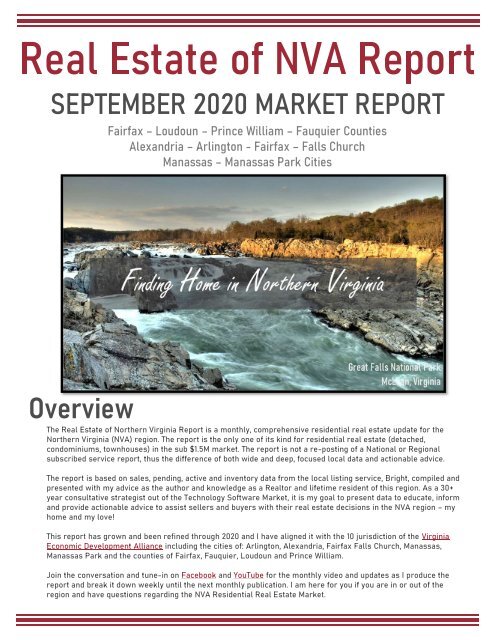

The <strong>Real</strong> <strong>Estate</strong> <strong>of</strong> <strong>Northern</strong> <strong>Virginia</strong> <strong>Report</strong> is a monthly, comprehensive residential real estate update for the<br />

<strong>Northern</strong> <strong>Virginia</strong> (NVA) region. The report is the only one <strong>of</strong> its kind for residential real estate (detached,<br />

condominiums, townhouses) in the sub $1.5M market. The report is not a re-posting <strong>of</strong> a National or Regional<br />

subscribed service report, thus the difference <strong>of</strong> both wide and deep, focused local data and actionable advice.<br />

The report is based on sales, pending, active and inventory data from the local listing service, Bright, compiled and<br />

presented with my advice as the author and knowledge as a <strong>Real</strong>tor and lifetime resident <strong>of</strong> this region. As a 30+<br />

year consultative strategist out <strong>of</strong> the Technology S<strong>of</strong>tware <strong>Market</strong>, it is my goal to present data to educate, inform<br />

and provide actionable advice to assist sellers and buyers with their real estate decisions in the NVA region – my<br />

home and my love!<br />

This report has grown and been refined through <strong>2020</strong> and I have aligned it with the 10 jurisdiction <strong>of</strong> the <strong>Virginia</strong><br />

Economic Development Alliance including the cities <strong>of</strong>: Arlington, Alexandria, Fairfax Falls Church, Manassas,<br />

Manassas Park and the counties <strong>of</strong> Fairfax, Fauquier, Loudoun and Prince William.<br />

Join the conversation and tune-in on Facebook and YouTube for the monthly video and updates as I produce the<br />

report and break it down weekly until the next monthly publication. I am here for you if you are in or out <strong>of</strong> the<br />

region and have questions regarding the NVA Residential <strong>Real</strong> <strong>Estate</strong> <strong>Market</strong>.

OVERVIEW OF THE ......................................................................................................................................... 1<br />

NORTHERN VIRGINIA MARKET................................................................................................................... 1<br />

|| NORTHERN VIRGINIA OVERVIEW ........................................................................................................... 1<br />

|| MARKET VALUE AND DEMAND .......................................................................................................................................................... 2<br />

|| MARKET AND NEGOTIABILITY ............................................................................................................................................................. 3<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................... 4<br />

|| SUMMARY .................................................................................................................................................................................................. 5<br />

THE CITIES OF THE ....................................................................................................................................... 19<br />

NORTHERN VIRGINIA MARKET................................................................................................................. 19<br />

|| ALEXANDRIA CITY OVERVIEW .............................................................................................................. 21<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 23<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 23<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 24<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 25<br />

|| ARLINGTON CITY OVERVIEW ................................................................................................................ 29<br />

|| MARKET VALUE AND DEMAND ......................................................................................................................................................... 31<br />

|| MARKET AND NEGOTIABILITY ............................................................................................................................................................ 31<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 32<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 33<br />

|| FAIRFAX CITY OVERVIEW ...................................................................................................................... 37<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 39<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 39<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 40<br />

|| STRUCTURE TYPES ................................................................................................................................................................................ 41<br />

|| FALLS CHURCH CITY OVERVIEW ........................................................................................................ 45<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 47<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 47<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 48<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 49

|| MANASSAS CITY OVERVIEW ................................................................................................................ 53<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 55<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 55<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 56<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 57<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 57<br />

|| MANASSAS PARK CITY OVERVIEW ..................................................................................................... 61<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 63<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 63<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 64<br />

|| STRUCTURE TYPES ............................................................................................................................................................................... 65<br />

THE COUNTIES OF THE .............................................................................................................................. 69<br />

NORTHERN VIRGINIA MARKET................................................................................................................ 69<br />

|| FAIRFAX COUNTY OVERVIEW ................................................................................................................ 71<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 73<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 73<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 74<br />

|| STRUCTURE TYPES & CITIES ............................................................................................................................................................. 75<br />

|| LOUDOUN COUNTY OVERVIEW ............................................................................................................. 81<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 83<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 83<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 84<br />

|| STRUCTURE TYPES & CITIES ............................................................................................................................................................. 85<br />

|| PRINCE WILLIAM COUNTY OVERVIEW ............................................................................................... 91<br />

|| MARKET VALUE AND DEMAND ........................................................................................................................................................ 93<br />

|| MARKET AND NEGOTIABILITY ........................................................................................................................................................... 93<br />

|| INVENTORY SUPPLY ............................................................................................................................................................................. 94<br />

|| STRUCTURE TYPES & CITIES ............................................................................................................................................................. 95<br />

|| FAUQUIER COUNTY OVERVIEW .......................................................................................................... 101<br />

|| MARKET VALUE AND DEMAND ...................................................................................................................................................... 103<br />

|| MARKET AND NEGOTIABILITY ......................................................................................................................................................... 103<br />

|| INVENTORY SUPPLY ........................................................................................................................................................................... 104<br />

|| STRUCTURE TYPES & CITIES ........................................................................................................................................................... 105

OVERVIEW OF THE<br />

NORTHERN VIRGINIA MARKET

|| NORTHERN VIRGINIA OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$519,638<br />

PAST DEMAND<br />

SOLD<br />

3,828<br />

SUPPLY<br />

ACTIVE<br />

5,897<br />

MARKETING<br />

DAYS ON MARKET<br />

19<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

1.20<br />

CURRENT DEMAND<br />

PENDING<br />

3,255<br />

NEW SUPPLY<br />

NEW<br />

4,735<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

100.37%<br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

45% YoY 25% YoY 32% YoY 38% YoY<br />

8% YoY 33% YoY 10% YoY<br />

37% YoY 1% YoY<br />

- 1 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| MARKET VALUE AND DEMAND<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

84% 38% 106% 32%<br />

3,255 3,828<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD<br />

CHG YoY<br />

20% 8%<br />

$519,638<br />

- 2 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

NEGOTIABILITY<br />

MARKET PACE<br />

DAYS ON MARKET SALE TO ORIG LIST PRICE AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-44% -37% 1% 1% 41% 10%<br />

19 100.37%<br />

1.20<br />

CONDOMINIUM<br />

TOWNHOUSE<br />

DETACHED<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

% <strong>of</strong> SALES WITH<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

AVG CONCESSION<br />

CONCESSIONS<br />

CONCESSIONS<br />

CONCESSIONS<br />

$4,616 34%<br />

$5,243<br />

31.33%<br />

$7,380 27.22%<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-2% 9% -9% -1% -17% -12% -37.28% -39% -9% -9% -47% -45%<br />

- 3 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-11% -45% 73% 25% 84% 38% 106% 32%<br />

5,897 4,735 3,255 3,828<br />

- 4 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

|| SUMMARY<br />

NORTHERN VIRGINIA MARKET REVIEW<br />

DEMAND – SUPPLY – MARKET – VALUE<br />

MoM – YTD – YoY CHANGE<br />

Active Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 463 325 547 443 -19.01% 36.31% -4.32%<br />

Arlington, VA 534 315 667 612 -8.25% 94.29% 14.61%<br />

Fairfax City, VA 134 90 73 57 -21.92% -36.67% -57.46%<br />

Fairfax, VA 4327 2589 3342 2446 -26.81% -5.52% -43.47%<br />

Falls Church City, VA 36 16 29 23 -20.69% 43.75% -36.11%<br />

Fauquier, VA 617 412 357 268 -24.93% -34.95% -56.56%<br />

Loudoun, VA 2106 1315 1580 993 -37.15% -24.49% -52.85%<br />

Manassas City, VA 194 120 131 74 -43.51% -38.33% -61.86%<br />

Manassas Park City, VA 93 51 37 21 -43.24% -58.82% -77.42%<br />

Prince William, VA 2283 14<strong>09</strong> 1571 960 -38.89% -31.87% -57.95%<br />

New Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 268 188 314 345 9.87% 83.51% 28.73%<br />

Arlington, VA 277 178 351 428 21.94% 140.45% 54.51%<br />

Fairfax City, VA 33 23 32 49 53.13% 113.04% 48.48%<br />

Fairfax, VA 1550 1<strong>09</strong>2 1832 1945 6.17% 78.11% 25.48%<br />

Falls Church City, VA 22 7 20 25 25.00% 257.14% 13.64%<br />

Fauquier, VA 142 108 147 144 -2.04% 33.33% 1.41%<br />

Loudoun, VA 667 546 819 792 -3.30% 45.05% 18.74%<br />

Manassas City, VA 73 46 74 83 12.16% 80.43% 13.70%<br />

Manassas Park City, VA 34 14 19 20 5.26% 42.86% -41.18%<br />

Prince William, VA 710 539 868 904 4.15% 67.72% 27.32%<br />

Sold Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 178 128 262 260 -0.76% 103.13% 46.07%<br />

Arlington, VA 185 138 269 241 -10.41% 74.64% 30.27%<br />

Fairfax City, VA 31 15 35 31 -11.43% 106.67% 0.00%<br />

Fairfax, VA 1168 771 1635 1490 -8.87% 93.26% 27.57%<br />

Falls Church City, VA 13 4 27 14 -48.15% 250.00% 7.69%<br />

Fauquier, VA 104 65 117 129 10.26% 98.46% 24.04%<br />

Loudoun, VA 573 310 782 780 -0.26% 151.61% 36.13%<br />

Manassas City, VA 33 28 81 71 -12.35% 153.57% 115.15%<br />

Manassas Park City, VA 30 16 30 19 -36.67% 18.75% -36.67%<br />

Prince William, VA 590 387 839 793 -5.48% 104.91% 34.41%<br />

Pending Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 158 129 247 215 -12.96% 66.67% 36.08%<br />

Arlington, VA 170 113 223 197 -11.66% 74.34% 15.88%<br />

Fairfax City, VA 21 18 30 30 0.00% 66.67% 42.86%<br />

Fairfax, VA 976 713 1353 1265 -6.50% 77.42% 29.61%<br />

Falls Church City, VA 15 2 17 12 -29.41% 500.00% -20.00%<br />

Fauquier, VA 79 61 101 127 25.74% 108.20% 60.76%<br />

Loudoun, VA 406 3<strong>09</strong> 643 604 -6.07% 95.47% 48.77%<br />

Manassas City, VA 47 34 44 74 68.18% 117.65% 57.45%<br />

Manassas Park City, VA 23 14 15 22 46.67% 57.14% -4.35%<br />

Prince William, VA 467 377 731 7<strong>09</strong> -3.01% 88.06% 51.82%<br />

EOM Inv 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 177 111 307 370 20.52% 233.33% 1<strong>09</strong>.04%<br />

Arlington, VA 176 94 419 528 26.01% 461.70% 200.00%<br />

Fairfax City, VA 42 19 37 49 32.43% 157.89% 16.67%<br />

Fairfax, VA 1450 799 1801 1979 9.88% 147.68% 36.48%<br />

Falls Church City, VA 13 8 15 21 40.00% 162.50% 61.54%<br />

Fauquier, VA 207 125 241 225 -6.64% 80.00% 8.70%<br />

Loudoun, VA 640 354 841 800 -4.88% 125.99% 25.00%<br />

Manassas City, VA 83 36 73 61 -16.44% 69.44% -26.51%<br />

Manassas Park City, VA 35 19 19 19 0.00% 0.00% -45.71%<br />

Prince William, VA 775 449 717 733 2.23% 63.25% -5.42%<br />

NORTHERN VIRGINIA<br />

Avg Months <strong>of</strong><br />

Inventory<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 0.90 0.60 1.10 1.40 27.27% 133.33% 55.56%<br />

Arlington, VA 0.70 0.50 1.60 2.00 25.00% 300.00% 185.71%<br />

Fairfax City, VA 1.00 0.60 0.90 1.40 55.56% 133.33% 40.00%<br />

Fairfax, VA 1.00 0.70 1.00 1.20 20.00% 71.43% 20.00%<br />

Falls Church City, VA 0.80 0.80 0.70 0.80 14.29% 0.00% 0.00%<br />

Fauquier, VA 1.80 1.60 1.50 1.90 26.67% 18.75% 5.56%<br />

Loudoun, VA 0.90 0.70 1.00 1.00 0.00% 42.86% 11.11%<br />

Manassas City, VA 1.30 0.60 1.00 0.80 -20.00% 33.33% -38.46%<br />

Manassas Park City, VA 1.50 1.60 0.70 0.60 -14.29% -62.50% -60.00%<br />

Prince William, VA 1.00 0.80 0.80 0.90 12.50% 12.50% -10.00%<br />

Avg Median Sales<br />

Price<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA $ 496,000 $ 470,000 $ 587,500 $ 503,000 -14.38% 7.02% 1.41%<br />

Arlington, VA $ 575,000 $ 530,000 $ 645,000 $ 665,000 3.10% 25.47% 15.65%<br />

Fairfax City, VA $ 520,000 $ 461,988 $ 550,000 $ 602,888 9.62% 30.50% 15.94%<br />

Fairfax, VA $ 499,450 $ 515,000 $ 570,000 $ 575,000 0.88% 11.65% 15.13%<br />

Falls Church City, VA $ 735,000 $ 475,000 $ 635,000 $ 754,250 18.78% 58.79% 2.62%<br />

Fauquier, VA $ 402,000 $ 375,000 $ 470,000 $ 415,000 -11.70% 10.67% 3.23%<br />

Loudoun, VA $ 505,000 $ 497,284 $ 560,000 $ 549,995 -1.79% 10.60% 8.91%<br />

Manassas City, VA $ 375,000 $ 317,500 $ 371,500 $ 317,000 -14.67% -0.16% -15.47%<br />

Manassas Park City, VA $ 307,500 $ 317,500 $ 322,500 $ 391,000 21.24% 23.15% 27.15%<br />

Prince William, VA $ 381,000 $ 367,000 $ 428,000 $ 423,250 -1.11% 15.33% 11.<strong>09</strong>%<br />

Avg DOM 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 18 31 13 14 7.69% -54.84% -22.22%<br />

Arlington, VA 21 30 15 16 6.67% -46.67% -23.81%<br />

Fairfax City, VA 23 18 26 22 -15.38% 22.22% -4.35%<br />

Fairfax, VA 23 33 15 15 0.00% -54.55% -34.78%<br />

Falls Church City, VA 56 25 17 17 0.00% -32.00% -69.64%<br />

Fauquier, VA 59 66 37 50 35.14% -24.24% -15.25%<br />

Loudoun, VA 27 35 16 16 0.00% -54.29% -40.74%<br />

Manassas City, VA 32 34 12 10 -16.67% -70.59% -68.75%<br />

Manassas Park City, VA 16 28 13 18 38.46% -35.71% 12.50%<br />

Prince William, VA 27 39 14 13 -7.14% -66.67% -51.85%<br />

Avg Sale to Orig<br />

Price Ratio<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 100.00% 100.00% 100.00% 100.00% 0.00% 0.00% 0.00%<br />

Arlington, VA 100.00% 100.00% 100.00% 100.00% 0.00% 0.00% 0.00%<br />

Fairfax City, VA 99.50% 99.10% 100.00% 100.20% 0.20% 1.11% 0.70%<br />

Fairfax, VA 100.00% 99.30% 100.00% 100.00% 0.00% 0.70% 0.00%<br />

Falls Church City, VA 98.00% 96.70% 100.00% 101.40% 1.40% 4.86% 3.47%<br />

Fauquier, VA 97.10% 97.80% 100.00% 100.00% 0.00% 2.25% 2.99%<br />

Loudoun, VA 99.60% 99.40% 100.00% 100.00% 0.00% 0.60% 0.40%<br />

Manassas City, VA 98.40% 98.30% 100.20% 100.00% -0.20% 1.73% 1.63%<br />

Manassas Park City, VA 100.00% 100.00% 100.00% 101.30% 1.30% 1.30% 1.30%<br />

Prince William, VA 99.40% 99.00% 100.00% 100.80% 0.80% 1.82% 1.41%<br />

- 5 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

CURRENT MARKET SUPPLY – MARKET SHIFT INDICATOR<br />

Active Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 463 325 547 443 -19.01% 36.31% -4.32%<br />

Arlington, VA 534 315 667 612 -8.25% 94.29% 14.61%<br />

Fairfax City, VA 134 90 73 57 -21.92% -36.67% -57.46%<br />

Fairfax, VA 4327 2589 3342 2446 -26.81% -5.52% -43.47%<br />

Falls Church City, VA 36 16 29 23 -20.69% 43.75% -36.11%<br />

Fauquier, VA 617 412 357 268 -24.93% -34.95% -56.56%<br />

Loudoun, VA 2106 1315 1580 993 -37.15% -24.49% -52.85%<br />

Manassas City, VA 194 120 131 74 -43.51% -38.33% -61.86%<br />

Manassas Park City, VA 93 51 37 21 -43.24% -58.82% -77.42%<br />

Prince William, VA 2283 14<strong>09</strong> 1571 960 -38.89% -31.87% -57.95%<br />

ACTIVE LISTINGS:<br />

This is the indicator that will predict shift from the Seller’s <strong>Market</strong> to a Balanced or Buyer’s <strong>Market</strong>.<br />

The cities <strong>of</strong> Alexandria, Arlington and Falls Church are the only Cities/Counties that are up YTD with Arlington being the only<br />

one <strong>of</strong> the 10 jurisdictions that is up YoY and the only one with a single digit MoM change. These Sellers are benefiting from the<br />

market, while these markets start to cool.<br />

- 6 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

NEW SUPPLY – THE FUEL FOR THE MARKET<br />

New Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 268 188 314 345 9.87% 83.51% 28.73%<br />

Arlington, VA 277 178 351 428 21.94% 140.45% 54.51%<br />

Fairfax City, VA 33 23 32 49 53.13% 113.04% 48.48%<br />

Fairfax, VA 1550 1<strong>09</strong>2 1832 1945 6.17% 78.11% 25.48%<br />

Falls Church City, VA 22 7 20 25 25.00% 257.14% 13.64%<br />

Fauquier, VA 142 108 147 144 -2.04% 33.33% 1.41%<br />

Loudoun, VA 667 546 819 792 -3.30% 45.05% 18.74%<br />

Manassas City, VA 73 46 74 83 12.16% 80.43% 13.70%<br />

Manassas Park City, VA 34 14 19 20 5.26% 42.86% -41.18%<br />

Prince William, VA 710 539 868 904 4.15% 67.72% 27.32%<br />

NEW LISTINGS:<br />

This is the fuel to the current market as these New Listings are sold as fast as they come to market without improving the<br />

inventory situation.<br />

The interesting point to note from this chart is the upward trend <strong>of</strong> new listings that began in May after the pandemic dip during<br />

March/April and continues currently. This is the time <strong>of</strong> year when the market begins to cool from the spring / summer market,<br />

however, this chart proves the shift <strong>of</strong> the spring / summer market to late summer and fall. The boundaries <strong>of</strong> school years are<br />

not impacting the market this season with folks working and learning from home.<br />

- 7 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

PAST DEMAND – PREVIOUS 45-60 DAYS PENDINGS<br />

Sold Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 178 128 262 260 -0.76% 103.13% 46.07%<br />

Arlington, VA 185 138 269 241 -10.41% 74.64% 30.27%<br />

Fairfax City, VA 31 15 35 31 -11.43% 106.67% 0.00%<br />

Fairfax, VA 1168 771 1635 1490 -8.87% 93.26% 27.57%<br />

Falls Church City, VA 13 4 27 14 -48.15% 250.00% 7.69%<br />

Fauquier, VA 104 65 117 129 10.26% 98.46% 24.04%<br />

Loudoun, VA 573 310 782 780 -0.26% 151.61% 36.13%<br />

Manassas City, VA 33 28 81 71 -12.35% 153.57% 115.15%<br />

Manassas Park City, VA 30 16 30 19 -36.67% 18.75% -36.67%<br />

Prince William, VA 590 387 839 793 -5.48% 104.91% 34.41%<br />

SOLD LISTINGS:<br />

This indicator is the lagging indicator to New Listings. Like New Listings, Sold Listings continue to rise into the Fall Season and<br />

is thus much higher regarding Year over Year change percentages.<br />

Sold Listings did dip a little but that is driven by the New Listing dip in July and August – You cannot sell what is not on the<br />

market.<br />

- 8 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

CURRENT BUYER DEMAND AND STRENGTH<br />

Pending Listings 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 158 129 247 215 -12.96% 66.67% 36.08%<br />

Arlington, VA 170 113 223 197 -11.66% 74.34% 15.88%<br />

Fairfax City, VA 21 18 30 30 0.00% 66.67% 42.86%<br />

Fairfax, VA 976 713 1353 1265 -6.50% 77.42% 29.61%<br />

Falls Church City, VA 15 2 17 12 -29.41% 500.00% -20.00%<br />

Fauquier, VA 79 61 101 127 25.74% 108.20% 60.76%<br />

Loudoun, VA 406 3<strong>09</strong> 643 604 -6.07% 95.47% 48.77%<br />

Manassas City, VA 47 34 44 74 68.18% 117.65% 57.45%<br />

Manassas Park City, VA 23 14 15 22 46.67% 57.14% -4.35%<br />

Prince William, VA 467 377 731 7<strong>09</strong> -3.01% 88.06% 51.82%<br />

PENDING LISTINGS:<br />

This is the Current Demand indicator and it continues to rise along with New Listings. The Year over Year Change is higher than<br />

previous years but is illustrating a downward trend. Again, there are no signs <strong>of</strong> the summer season slowing down.<br />

The interesting change for this year is the percentage <strong>of</strong> change in the more rural Counties <strong>of</strong> Fauquier, Loudoun, Prince<br />

William and Manassas as Current Demand.<br />

- 9 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

SUPPLY TREND<br />

EOM Inv 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 177 111 307 370 20.52% 233.33% 1<strong>09</strong>.04%<br />

Arlington, VA 176 94 419 528 26.01% 461.70% 200.00%<br />

Fairfax City, VA 42 19 37 49 32.43% 157.89% 16.67%<br />

Fairfax, VA 1450 799 1801 1979 9.88% 147.68% 36.48%<br />

Falls Church City, VA 13 8 15 21 40.00% 162.50% 61.54%<br />

Fauquier, VA 207 125 241 225 -6.64% 80.00% 8.70%<br />

Loudoun, VA 640 354 841 800 -4.88% 125.99% 25.00%<br />

Manassas City, VA 83 36 73 61 -16.44% 69.44% -26.51%<br />

Manassas Park City, VA 35 19 19 19 0.00% 0.00% -45.71%<br />

Prince William, VA 775 449 717 733 2.23% 63.25% -5.42%<br />

END OF MONTH INVENTORY:<br />

New Listings are acting as “Fuel” to keep up with current Demand requirements, however as seen here, the descrepancies in<br />

Listings to Demand are covered by the backlog <strong>of</strong> inventory. The region has been in a downward errosion <strong>of</strong> inventory for the<br />

past 5 years with slight improvement in <strong>2020</strong> but not enough to come close to balancing the market.<br />

- 10 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

SELLER – BALANCED – BUYER MARKET ?<br />

BUYERS<br />

MARKET<br />

BALANCED<br />

MARKET<br />

SELLERS<br />

MARKET<br />

Avg Months <strong>of</strong><br />

Inventory<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08<strong>2020</strong>/<strong>09</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 0.90 0.60 1.10 1.40 27.27% 133.33% 55.56%<br />

Arlington, VA 0.70 0.50 1.60 2.00 25.00% 300.00% 185.71%<br />

Fairfax City, VA 1.00 0.60 0.90 1.40 55.56% 133.33% 40.00%<br />

Fairfax, VA 1.00 0.70 1.00 1.20 20.00% 71.43% 20.00%<br />

Falls Church City, VA 0.80 0.80 0.70 0.80 14.29% 0.00% 0.00%<br />

Fauquier, VA 1.80 1.60 1.50 1.90 26.67% 18.75% 5.56%<br />

Loudoun, VA 0.90 0.70 1.00 1.00 0.00% 42.86% 11.11%<br />

Manassas City, VA 1.30 0.60 1.00 0.80 -20.00% 33.33% -38.46%<br />

Manassas Park City, VA 1.50 1.60 0.70 0.60 -14.29% -62.50% -60.00%<br />

Prince William, VA 1.00 0.80 0.80 0.90 12.50% 12.50% -10.00%<br />

MONTHS OF INVENTORY:<br />

This metric is also called Absorption Rate meaning the number <strong>of</strong> months it would take to sell everything that is on the market.<br />

Across the region we see only about a Month <strong>of</strong> Inventory and 2 Months in Arlington and Fauquier but that still leaves all <strong>of</strong> the<br />

region in a 5 year Sellers <strong>Market</strong>.<br />

A Sellers <strong>Market</strong> is considerd 0 to 4 Months – Balanced <strong>Market</strong> is 4 to 6 Months – Buyers <strong>Market</strong> is 6+ Months. The NVA region<br />

has not seen a balanced market in greater than 5 years. The Active Listings metric is the one to watch. As Active Listings begin<br />

to rise and thus End <strong>of</strong> Month Inventory, only then will we see the Absorption Rate rise and shift the market.<br />

- 11 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

PRICE APPRECIATION SPEED<br />

Avg Median Sales<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Price<br />

Alexandria City, VA $ 496,000 $ 470,000 $ 587,500 $ 503,000 -14.38% 7.02% 1.41%<br />

Arlington, VA $ 575,000 $ 530,000 $ 645,000 $ 665,000 3.10% 25.47% 15.65%<br />

Fairfax City, VA $ 520,000 $ 461,988 $ 550,000 $ 602,888 9.62% 30.50% 15.94%<br />

Fairfax, VA $ 499,450 $ 515,000 $ 570,000 $ 575,000 0.88% 11.65% 15.13%<br />

Falls Church City, VA $ 735,000 $ 475,000 $ 635,000 $ 754,250 18.78% 58.79% 2.62%<br />

Fauquier, VA $ 402,000 $ 375,000 $ 470,000 $ 415,000 -11.70% 10.67% 3.23%<br />

Loudoun, VA $ 505,000 $ 497,284 $ 560,000 $ 549,995 -1.79% 10.60% 8.91%<br />

Manassas City, VA $ 375,000 $ 317,500 $ 371,500 $ 317,000 -14.67% -0.16% -15.47%<br />

Manassas Park City, VA $ 307,500 $ 317,500 $ 322,500 $ 391,000 21.24% 23.15% 27.15%<br />

Prince William, VA $ 381,000 $ 367,000 $ 428,000 $ 423,250 -1.11% 15.33% 11.<strong>09</strong>%<br />

AVERAGE MEDIAN SALES PRICE:<br />

As Inventory declines, Median Sales Prices continue to rise steadily. Falls Church appears to be the most erradic but it<br />

represents lower volume, however, it is clear there is a slow and steady rise without significant change. This trend will continue<br />

until the inventory situation improves. The only balance to this rise will be when Supply improves to meet Demand.<br />

- 12 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

SELLER CONDITION & PRICE – BUYER PREPARATION<br />

Avg DOM 2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 18 31 13 14 7.69% -54.84% -22.22%<br />

Arlington, VA 21 30 15 16 6.67% -46.67% -23.81%<br />

Fairfax City, VA 23 18 26 22 -15.38% 22.22% -4.35%<br />

Fairfax, VA 23 33 15 15 0.00% -54.55% -34.78%<br />

Falls Church City, VA 56 25 17 17 0.00% -32.00% -69.64%<br />

Fauquier, VA 59 66 37 50 35.14% -24.24% -15.25%<br />

Loudoun, VA 27 35 16 16 0.00% -54.29% -40.74%<br />

Manassas City, VA 32 34 12 10 -16.67% -70.59% -68.75%<br />

Manassas Park City, VA 16 28 13 18 38.46% -35.71% 12.50%<br />

Prince William, VA 27 39 14 13 -7.14% -66.67% -51.85%<br />

AVERAGE DAYS ON MARKET:<br />

The time to market a property has also been on a steady decline for greater than 5 years. Properties that do not sell within the<br />

first 20 days or less are either not in a condition that presents well and / or the price is not set to match the market. Just<br />

because it is a Sellers <strong>Market</strong> does not mean that Buyers are being wreckless with their <strong>of</strong>fers also indicating we are not<br />

setting up for a crash like that <strong>of</strong> 2008-20<strong>09</strong>.<br />

The decline <strong>of</strong> Days On <strong>Market</strong> also indicates strong Coming Soon campaigns with <strong>of</strong>fers coming as soon as a property goes<br />

Active on the market. These are savvy buyers with pr<strong>of</strong>essional representation to drive a strategy to win. Chasing the market by<br />

waiting for properties to hit the market and syndicate across advertising platorms is chasing strategy. Buyers <strong>of</strong>ten wonder<br />

how a property sells in 4 or less days. It is because it was presented as a Coming Soon for up to a month garnering interest and<br />

preparation from those buyers well represented, committed to buying and being ready to write the <strong>of</strong>fer at the time the<br />

property goes active and / or prior to it going active sight unseen.<br />

- 13 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

BIDDING WARS ?<br />

Avg Sale to Orig<br />

Price Ratio<br />

2019/<strong>09</strong> <strong>2020</strong>/01 <strong>2020</strong>/08 <strong>2020</strong>/<strong>09</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 100.00% 100.00% 100.00% 100.00% 0.00% 0.00% 0.00%<br />

Arlington, VA 100.00% 100.00% 100.00% 100.00% 0.00% 0.00% 0.00%<br />

Fairfax City, VA 99.50% 99.10% 100.00% 100.20% 0.20% 1.11% 0.70%<br />

Fairfax, VA 100.00% 99.30% 100.00% 100.00% 0.00% 0.70% 0.00%<br />

Falls Church City, VA 98.00% 96.70% 100.00% 101.40% 1.40% 4.86% 3.47%<br />

Fauquier, VA 97.10% 97.80% 100.00% 100.00% 0.00% 2.25% 2.99%<br />

Loudoun, VA 99.60% 99.40% 100.00% 100.00% 0.00% 0.60% 0.40%<br />

Manassas City, VA 98.40% 98.30% 100.20% 100.00% -0.20% 1.73% 1.63%<br />

Manassas Park City, VA 100.00% 100.00% 100.00% 101.30% 1.30% 1.30% 1.30%<br />

Prince William, VA 99.40% 99.00% 100.00% 100.80% 0.80% 1.82% 1.41%<br />

AVERAGE SALES PRICES TO ORIGINAL LIST PRICE RATIO:<br />

This metric describes the Negotiability <strong>of</strong> properties. When a buyer asks about making an <strong>of</strong>fer below list price, I present this<br />

metric and trend line. It has been more than 5 years since a buyer can negotiate a properties price down. Properties are coming<br />

to market well priced keeping a steady 100% Ratio for the region.<br />

This metric also indicates that there are not “bidding” wars per se. Yes, there are multiple contracts on properties but price is<br />

not the deciding factor. The seller is looking for <strong>of</strong>fers with the least amount <strong>of</strong> risk as well as the best value and this metric<br />

indicates reasonable pricing and closing prices.<br />

- 14 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

EXTERNAL DRIVERS<br />

DEMAND – SUPPLY – MARKET – VALUE<br />

The external drivers indicating demand are the mortgage interest rates and the mortgage applications. Interest rates continue<br />

to stay low and are predicted to stay low over the next 3 years. Mortgage applications are up 38% year over year <strong>September</strong>.<br />

They did drop 5% month over month between August and <strong>September</strong>, however, continue to stay ahead <strong>of</strong> this month’s 2019 pace.<br />

The market is a pure Demand versus Supply market favoring the Sellers currently and over the past 5 years. Even though the<br />

market favors the Seller, it is important for Sellers to understand who their buyer is, their characteristics, requirements and<br />

purchasing preferences.<br />

Millennials are the largest buying force in the market<br />

First-time buyers driving demand based on size and price<br />

accordingly<br />

Millennials are ready to grow their family<br />

Millennials grew up leveraging technology and are using it at<br />

a high level – photos, videos, and property presentation<br />

matter regardless <strong>of</strong> it being a Sellers’ <strong>Market</strong><br />

Millennials seek move-in ready – not interested in inheriting<br />

projects, again regardless <strong>of</strong> it being a Sellers’ <strong>Market</strong><br />

COVID has accelerated the decision to purchase<br />

Remote working has added to the savings account<br />

Serious Buyers expect competition, are creating a strategy,<br />

preparing via online viewing and Coming Soon campaigns<br />

with their pr<strong>of</strong>essional agent along with added savings<br />

- 15 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

NORTHERN VIRGINIA<br />

CURRENT MONTH’S METRICS<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-11% -45% 73% 25% 84% 38% 106% 32%<br />

5,897 4,735 3,255 3,828<br />

VALUE<br />

MEDIAN SALES PRICE<br />

YoY YTD METRICS<br />

74,187 37,174 25,379 29,148<br />

-22.12% -3.29% 3.10% -1.83%<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

20% 8% -44% -37% 1% 1% 41% 10%<br />

$519,638<br />

19 100.37%<br />

YoY YTD METRICS<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

$506,367 22 99.93% 1.33<br />

3.35% -24.03% 0.42% -0.33%<br />

1.20<br />

YoY YTD<br />

YoY YTD<br />

YoY YTD<br />

VALUE PAST DEMAND SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

SUPPLY<br />

NEW LISTINGS<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

5% 4% 79% 23% 50% 11% 85% 67% -46% 2% 2% 0%<br />

$284,<strong>09</strong>5 626 1,482<br />

VALUE<br />

PAST DEMAND<br />

SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

993 20<br />

$285,614 4,538<br />

12,659<br />

6,484 21<br />

-25.10% -8.58%<br />

4.55%<br />

12.34%<br />

-23.44%<br />

SUPPLY<br />

NEW LISTINGS<br />

MARKETING<br />

DAYS ON MARKET<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

7% 13% 111% 31% -29% -58% 64% 13% -55% -55% 12% 2%<br />

$702,594<br />

$664,389<br />

7.36%<br />

1,772 2,644<br />

VALUE PAST DEMAND SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

2,117 18<br />

SUPPLY<br />

NEW LISTINGS<br />

100%<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

12% 16% 110% 38% -11% -45% 75% 24% -49% -29% 2% 1%<br />

$497,675<br />

$469,475<br />

1.51%<br />

14,277<br />

-1.01%<br />

1,383 1,703<br />

10,036<br />

0.30%<br />

1,562<br />

MARKETING<br />

DAYS ON MARKET<br />

15<br />

99.32%<br />

0.75%<br />

101%<br />

39,274<br />

17,865<br />

25<br />

98.96%<br />

-30.22% -9.90%<br />

-25.10%<br />

-0.28%<br />

21,616<br />

-17.48%<br />

12,428<br />

-0.38%<br />

18<br />

-19.86%<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

101%<br />

99.01%<br />

-0.73%<br />

- 16 -

SEPTEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

NORTHERN<br />

VIRGINIA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

AVG DOM<br />

Avg<br />

Price/SqFt<br />

Avg Sale<br />

to Orig<br />

List Price<br />

Ratio<br />

Avg Close<br />

Price<br />

YoY<br />

SALES<br />

YoY DOM<br />

YoY $ /<br />

SQFT<br />

YoY $<br />

RATIO<br />

YoY<br />

CLOSE<br />

2019 29,053 24 $ 378.13 87.20% $ 531,855<br />

<strong>2020</strong> 29,451 20 $ 333.96 99.40% $ 570,656 1.37% -18.39% -11.68% 13.98% 7.30%<br />

2019 4,989 22 $ 312.03 98.75% $ 324,015<br />

<strong>2020</strong> 4,7<strong>09</strong> 18 $ 341.41 98.98% $ 351,666 -5.61% -18.95% 9.42% 0.24% 8.53%<br />

2019 14,042 30 $ 408.59 80.67% $ 663,765<br />

<strong>2020</strong> 14,343 24 $ 362.04 99.18% $ 7<strong>09</strong>,821 2.14% -18.25% -11.39% 22.95% 6.94%<br />

2019 10,022 18 $ 368.53 99.70% $ 450,629<br />

<strong>2020</strong> 10,399 15 $ 291.76 99.99% $ 477,877 3.76% -18.35% -20.83% 0.29% 6.05%<br />

The traditional measures looking at change on a YTD basis to see how the year is going and on a YoY basis for the same month<br />

as the previous year are not comparing apples to apples currently. Even with the disruption this year, these have been fair<br />

measures until <strong>September</strong>. The market is still very active over <strong>September</strong> <strong>of</strong> previous years when the market tends to cool but<br />

with folks working and learning from home, the market continues to be very active <strong>September</strong> <strong>2020</strong> creating what I would call<br />

“hype news” regarding percentages <strong>of</strong> change.<br />

I have added a YoY YTD measure <strong>of</strong> change to compare the current year to the previous year that you will only find in this report.<br />

The YoY YTD measure is a comparison <strong>of</strong> January – <strong>September</strong> 2019 to January – <strong>September</strong> <strong>2020</strong> to check the year as a whole<br />

against the previous year given the shifting, seasonal market time frames. This keeps away from “hype news” like the 16% YoY<br />

Median Sales price change for Townhomes when the YoY YTD change is really a reasonable 6%.<br />

- 17 -

|| NORTHERN VIRGINIA OVERVIEW SEPTEMBER <strong>2020</strong><br />

- 18 -

THE CITIES OF THE<br />

NORTHERN VIRGINIA MARKET

|| ALEXANDRIA CITY OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$503,000<br />

PAST DEMAND<br />

SOLD<br />

260<br />

SUPPLY<br />

ACTIVE<br />

443<br />

MARKETING<br />

DAYS ON MARKET<br />

14<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

1.40<br />

CURRENT DEMAND<br />

PENDING<br />

215<br />

NEW SUPPLY<br />

NEW<br />

345<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

100.00%<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

Alexandria<br />

City, VA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 1,838 19 $ 804.39 99.28% $ 569,363<br />

<strong>2020</strong> 1,848 0.54% 16 -17.12% $ 453.83 -43.58% 99.29% 0.01% $ 621,819 9.21%<br />

2019 833 19 $ 320.34<br />

98.95% $ 323,113<br />

<strong>2020</strong> 818 -1.80% 16 -18.16% $ 402.47 25.64% 98.69% -0.26% $ 361,628 11.92%<br />

2019 300 19 $ 485.91<br />

98.59% $ 894,140<br />

<strong>2020</strong> 304 1.33% 18 -6.72% $ 519.69 6.95% 98.92% 0.34% $ 1,006,788 12.60%<br />

2019 705 19 $ 1,513.50<br />

99.82% $ 722,119<br />

<strong>2020</strong> 726 2.98% 15 -20.37% $ 483.29 -68.07% 99.82% 0.00% $ 753,782 4.38%<br />

- 21 -

|| ALEXANDRIA CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

4% YoY 29% YoY 46% YoY 36% YoY<br />

1% YoY 1<strong>09</strong>% YoY 56% YoY<br />

22% YoY 0% YoY<br />

- 22 -

SEPTEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

|| MARKET VALUE AND DEMAND<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

7% 1% 67% 36% 103% 46%<br />

$503,000<br />

215 260<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

NEGOTIABILITY<br />

MARKET PACE<br />

DAYS ON MARKET SALE TO ORIG LIST PRICE AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-55% -22% 0% 0% 133% 56%<br />

14 100.00%<br />

1.40<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,960 24%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-21% 3% -32% -31%<br />

- 23 -

|| ALEXANDRIA CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

36% -4% 84% 29% 67% 36% 103% 46%<br />

443 345 215 260<br />

- 24 -

SEPTEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

ALEXANDRIA CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 122 14 $ 360.75 $ 368,454 $ 371,913 99%<br />

BEDS<br />

111 14 $ 361.07 $ 338,299 $ 342,965 99%<br />

11 16 $ 357.47 $ 672,736 $ 664,026 101%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 2%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$4,353 32%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-8% -27% -2% 29%<br />

- 25 -

|| ALEXANDRIA CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 32 9 $ 567.46 $ 1,028,237 $ 1,030,734 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ALEXANDRIA CITY<br />

1 35 $ 634.33 $ 850,000 $ 885,000 96%<br />

15 7 $ 560.61 $ 844,703 $ 844,113 100%<br />

16 9 $ 569.70 $ 1,211,439 $ 1,214,800 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$15,305 13%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

39% 106% -77% -69%<br />

- 26 -

SEPTEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 97 13 $ 466.46 $ 747,145 $ 747,168 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ALEXANDRIA CITY<br />

28 7 $ 544.57 $ 583,071 $ 574,271 102%<br />

57 15 $ 436.71 $ 764,761 $ 767,141 100%<br />

12 16 $ 423.06 $ 1,046,313 $ 1,055,722 99%<br />

DOM<br />

TOWNHOUSE<br />

% <strong>of</strong> SALES<br />

61 4%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$7,541 16%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-15% 50% -40% -62%<br />

- 27 -

|| ALEXANDRIA CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

- 28 -

|| ARLINGTON CITY OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$665,000<br />

PAST DEMAND<br />

SOLD<br />

241<br />

SUPPLY<br />

ACTIVE<br />

612<br />

MARKETING<br />

DAYS ON MARKET<br />

16<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

2.00<br />

CURRENT DEMAND<br />

PENDING<br />

197<br />

NEW SUPPLY<br />

NEW<br />

428<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

100.00%<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

Arlington, VA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 2,044 23 $ 479.63 99.44% $ 677,618<br />

<strong>2020</strong> 1,874 -8.32% 17 -23.41% $ 508.57 6.03% 98.78% -0.66% $ 737,924 8.90%<br />

2019 993 23 $ 456.69<br />

99.31% $ 433,455<br />

<strong>2020</strong> 850 -14.40% 17 -26.95% $ 477.48 4.55% 99.03% -0.28% $ 470,856 8.63%<br />

2019 740 25 $ 516.20<br />

99.07% $ 1,015,559<br />

<strong>2020</strong> 680 -8.11% 21 -16.22% $ 551.07 6.76% 99.70% 0.63% $ 1,087,201 7.05%<br />

2019 311 15 $ 465.88<br />

101.11% $ 653,107<br />

<strong>2020</strong> 344 10.61% 11 -25.90% $ 501.25 7.59% 95.74% -5.31% $ 707,400 8.31%<br />

- 29 -

|| ARLINGTON CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

15% YoY 55% YoY 30% YoY 66% YoY<br />

16% YoY 200% YoY 186% YoY<br />

24% YoY 0% YoY<br />

- 30 -

SEPTEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

|| MARKET VALUE AND DEMAND<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY<br />

25% 16%<br />

$665,000<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

74% 16% 75% 30%<br />

197 241<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

NEGOTIABILITY<br />

MARKET PACE<br />

DAYS ON MARKET SALE TO ORIG LIST PRICE AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-47% -24% 0% 0% 300% 186%<br />

16 100.00%<br />

2.00<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,119 19%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-6% -10% -12% -28%<br />

- 31 -

|| ARLINGTON CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

94% 15% 140% 55% 74% 16% 75% 30%<br />

612 428 197 241<br />

- 32 -

SEPTEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

ARLINGTON CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 113 20 $ 499.42 $ 518,765 $ 535,203 97%<br />

BEDS<br />

106 19 $ 497.23 $ 476,986 $ 482,832 99%<br />

7 36 $ 532.59 $ 1,151,414 $ 1,328,257 87%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 8%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$4,226 24%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-4% -1% 21% 3%<br />

- 33 -

|| ARLINGTON CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 101 19 $ 565.91 $ 1,124,351 $ 1,116,735 101%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ARLINGTON CITY<br />

7 7 $ 720.45 $ 798,286 $ 783,129 102%<br />

30 15 $ 626.01 $ 936,521 $ 918,110 102%<br />

64 23 $ 520.84 $ 1,248,059 $ 1,246,329 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 10%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$9,000 13%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

5% 34% -36% -55%<br />

- 34 -

SEPTEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 40 11 $ 495.60 $ 699,480 $ 695,618 101%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ARLINGTON CITY<br />

22 9 $ 508.73 $ 562,605 $ 554,293 101%<br />

13 17 $ 464.43 $ 9<strong>09</strong>,607 $ 918,506 99%<br />

5 6 $ 512.67 $ 755,400 $ 737,940 102%<br />

DOM<br />

TOWNHOUSE<br />

% <strong>of</strong> SALES<br />

61 3%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$1,356 18%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-67% -81% -30% -35%<br />

- 35 -

|| ARLINGTON CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

- 36 -

|| FAIRFAX CITY OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$602,888<br />

PAST DEMAND<br />

SOLD<br />

31<br />

SUPPLY<br />

ACTIVE<br />

57<br />

MARKETING<br />

DAYS ON MARKET<br />

22<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

1.40<br />

CURRENT DEMAND<br />

PENDING<br />

30<br />

NEW SUPPLY<br />

NEW<br />

49<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

100.20%<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

Fairfax City, VA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 287 31 $ 322.46 98.27% $ 553,797<br />

<strong>2020</strong> 260 -9.41% 25 -20.51% $ 326.64 1.30% 99.99% 1.76% $ 570,533 3.02%<br />

2019 47 35 $ 262.17<br />

96.03% $ 289,161<br />

<strong>2020</strong> 52 10.64% 18 -49.57% $ 278.13 6.<strong>09</strong>% 98.95% 3.05% $ 293,932 1.65%<br />

2019 181 30 $ 352.39<br />

98.35% $ 606,962<br />

<strong>2020</strong> 152 -16.02% 26 -14.48% $ 356.99 1.30% 100.40% 2.<strong>09</strong>% $ 654,125 7.77%<br />

2019 59 31 $ 278.65<br />

98.90% $ 601,510<br />

<strong>2020</strong> 56 -5.08% 29 -8.28% $ 289.30 3.82% 99.27% 0.38% $ 600,484 -0.17%<br />

- 37 -

|| FAIRFAX CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

57% YoY 48% YoY 0% YoY 43% YoY<br />

16% YoY 17% YoY 40% YoY<br />

4% YoY 1% YoY<br />

- 38 -

SEPTEMBER <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

|| MARKET VALUE AND DEMAND<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD<br />

CHG YoY<br />

30% 16%<br />

$602,888<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

67% 43% 107% 0%<br />

30 31<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

22% -4% 1% 1% 133% 40%<br />

22 100.20%<br />

1.40<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$6,986 32%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

61% 32% 50% -4%<br />

- 39 -

|| FAIRFAX CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-37% -57% 113% 48% 67% 43% 107% 0%<br />

57 49 30 31<br />

- 40 -

SEPTEMBER <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 2 18 $ 316.48 $ 342,500 $ 362,450 94%<br />

BEDS<br />

2 18 $ 316.48 $ 342,500 $ 362,450 94%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$0 0%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-100% -100% -100% -100%<br />

- 41 -

|| FAIRFAX CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 18 11 $ 381.61 $ 633,628 $ 629,293 101%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

FAIRFAX CITY<br />

0 0 $ - $ - $ - #DIV/0!<br />

7 9 $ 434.28 $ 519,702 $ 504,214 103%<br />

11 13 $ 348.<strong>09</strong> $ 706,126 $ 708,889 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 6%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$7,339 39%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-8% 22% 94% 23%<br />

- 42 -

SEPTEMBER <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

FAIRFAX CITY<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 8 50 $ 285.15 $ 613,936 $ 630,773 97%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

0 0 $ - $ - $ - #DIV/0!<br />

8 50 $ 285.15 $ 613,936 $ 630,773 97%<br />

DOM<br />

TOWNHOUSE<br />

% <strong>of</strong> SALES<br />

61 25%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,750 25%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

188% -23% -25% -38%<br />

- 43 -

|| FAIRFAX CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

- 44 -

|| FALLS CHURCH CITY OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$754,250<br />

PAST DEMAND<br />

SOLD<br />

14<br />

SUPPLY<br />

ACTIVE<br />

23<br />

MARKETING<br />

DAYS ON MARKET<br />

17<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

0.80<br />

CURRENT DEMAND<br />

PENDING<br />

12<br />

NEW SUPPLY<br />

NEW<br />

25<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

101.40%<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

Falls Church<br />

City, VA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 146 30 $ 448.19 99.20% $ 858,124<br />

<strong>2020</strong> 133 -8.90% 13 -55.70% $ 471.58 5.22% 100.32% 1.13% $ 814,286 -5.11%<br />

2019 30 28 $ 388.00<br />

98.37% $ 490,290<br />

<strong>2020</strong> 37 23.33% 12 -58.10% $ 408.42 5.26% 100.24% 1.90% $ 428,349 -12.63%<br />

2019 94 33 $ 474.51<br />

99.17% $ 998,731<br />

<strong>2020</strong> 70 -25.53% 16 -51.16% $ 497.08 4.76% 100.03% 0.87% $ 1,068,984 7.03%<br />

2019 22 18 $ 417.77<br />

100.08% $ 758,941<br />

<strong>2020</strong> 26 18.18% 7 -59.84% $ 493.77 18.19% 101.60% 1.52% $ 677,776 -10.69%<br />

- 45 -

|| FALLS CHURCH CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

36% YoY 14% YoY 8% YoY 20% YoY<br />

3% YoY 62% YoY 0% YoY<br />

70% YoY 3% YoY<br />

- 46 -

SEPTEMBER <strong>2020</strong> FALLS CHURCH CITY OVERVIEW ||<br />

|| MARKET VALUE AND DEMAND<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD<br />

CHG YoY<br />

59% 3%<br />

$754,250<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

500% -20% 250% 8%<br />

12 14<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

NEGOTIABILITY<br />

MARKET PACE<br />

DAYS ON MARKET SALE TO ORIG LIST PRICE AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-32% -70% 5% 3% 0% 0%<br />

17 101.40%<br />

0.80<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$1,167 19%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-60% -77% -72% -19%<br />

- 47 -

|| FALLS CHURCH CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

|| INVENTORY SUPPLY<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

44% -36% 257% 14% 500% -20% 250% 8%<br />

23 25 12 14<br />

- 48 -

SEPTEMBER <strong>2020</strong> FALLS CHURCH CITY OVERVIEW ||<br />

|| STRUCTURE TYPES<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

FALLS CHURCH CITY<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 6 23 $ 385.50 $ 372,482 $ 372,348 100%<br />

BEDS<br />

6 23 $ 385.50 $ 372,482 $ 372,348 100%<br />

CONDOMINIUM<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 17%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$2,100 17%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

1300% #DIV/0! -67% #DIV/0!<br />

- 49 -

|| FALLS CHURCH CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 9 14 $ 506.51 $ 1,217,889 $ 1,216,433 100%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

FALLS CHURCH CITY<br />

0 0 $ - $ - $ - #DIV/0!<br />

2 5 $ 632.10 $ 795,500 $ 777,000 102%<br />

7 17 $ 470.63 $ 1,338,571 $ 1,341,986 100%<br />

DOM<br />

DETACHED<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$700 22%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

#DIV/0! -86% #DIV/0! -44%<br />

- 50 -

SEPTEMBER <strong>2020</strong> FALLS CHURCH CITY OVERVIEW ||<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

Avg<br />

Days on<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

TOTALS / AVGS 1 5 $ 579.17 $ 695,000 $ 640,000 1<strong>09</strong>%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

FALLS CHURCH CITY<br />

0 0 $ - $ - $ - #DIV/0!<br />

1 5 $ 579.17 $ 695,000 $ 640,000 1<strong>09</strong>%<br />

DOM<br />

TOWNHOUSE<br />

% <strong>of</strong> SALES<br />

61 0%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$0 0%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-100% -100% -100% -100%<br />

- 51 -

|| FALLS CHURCH CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

- 52 -

|| MANASSAS CITY OVERVIEW<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$317,000<br />

PAST DEMAND<br />

SOLD<br />

71<br />

SUPPLY<br />

ACTIVE<br />

74<br />

MARKETING<br />

DAYS ON MARKET<br />

10<br />

MARKET PACE<br />

MONTHS OF INVENTORY<br />

0.80<br />

CURRENT DEMAND<br />

PENDING<br />

74<br />

NEW SUPPLY<br />

NEW<br />

83<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST<br />

100.00%<br />

YTD YoY COMPARISON TO PREVIOUS YEAR<br />

Manassas City,<br />

VA<br />

YEAR TO DATE<br />

SEPTEMBER<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 468 25 $ 2<strong>09</strong>.02 98.40% $ 323,270<br />

<strong>2020</strong> 491 4.91% 19 -26.21% $ 213.02 1.92% 99.58% 1.19% $ 351,346 8.68%<br />

2019 56 31 $ 181.85<br />

97.13% $ 192,745<br />

<strong>2020</strong> 49 -12.50% 21 -32.31% $ 188.19 3.49% 98.45% 1.36% $ 202,539 5.08%<br />

2019 202 27 $ 226.75<br />

98.24% $ 404,724<br />

<strong>2020</strong> 197 -2.48% 18 -34.23% $ 225.89 -0.38% 99.69% 1.48% $ 448,794 10.89%<br />

2019 210 22 $ 199.11<br />

98.88% $ 279,726<br />

<strong>2020</strong> 245 16.67% 19 -14.21% $ 207.58 4.26% 99.60% 0.73% $ 302,751 8.23%<br />

- 53 -

|| MANASSAS CITY OVERVIEW SEPTEMBER <strong>2020</strong><br />

5 YEAR YoY COMPARISON TO CURRENT MONTH<br />

62% YoY 14% YoY 115% YoY 57% YoY<br />

15% YoY 27% YoY 38% YoY<br />

69% YoY 2% YoY<br />

- 54 -

SEPTEMBER <strong>2020</strong> MANASSAS CITY OVERVIEW ||<br />

|| MARKET VALUE AND DEMAND<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD<br />

CHG YoY<br />

0% -15%<br />

$317,000<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

118% 57% 154% 115%<br />

74 71<br />

|| MARKET AND NEGOTIABILITY<br />

MARKETING<br />

NEGOTIABILITY<br />

MARKET PACE<br />