Gauteng Business 2020/21 edition

The 2020/21 edition of Gauteng Business is the 12th issue of this highly successful publication that has established itself as the premier business and investment guide for the Gauteng Province. In addition to the regular articles providing insight into each of the key economic sectors of the province, there are special features on infrastructure investment programmes and plans for the establishment of Special Economic Zones (SEZs) as a means to boost economic growth. Another feature on construction and property underlines the importance of spatial planning in the region’s future. Ambitious plans for the City of Johannesburg are outlined, both in the journal's editorial pages and by the Johannesburg Development Agency (JDA).

The 2020/21 edition of Gauteng Business is the 12th issue of this highly successful publication that has established itself as the premier business and investment guide for the Gauteng Province. In addition to the regular articles providing insight into each of the key economic sectors of the province, there are special features on infrastructure investment programmes and plans for the establishment of Special Economic Zones (SEZs) as a means to boost economic growth. Another feature on construction and property underlines the importance of spatial planning in the region’s future. Ambitious plans for the City of Johannesburg are outlined, both in the journal's editorial pages and by the Johannesburg Development Agency (JDA).

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GAUTENG<br />

BUSINESS<br />

SPECIAL FOCUS: INFRASTRUCTURE<br />

INVESTMENT IN GAUTENG<br />

<strong>2020</strong>/<strong>21</strong> EDITION<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN THE GAUTENG PROVINCE<br />

JOIN US ONLINE<br />

WWW.GLOBALAFRICANETWORK.COM | WWW.GAUTENGBUSINESSGUIDE.CO.ZA

Excellent service in<br />

your time of need<br />

matters to us.<br />

Metropolitan has been awarded the leader classification for the<br />

fourth year in a row by the South African Customer Satisfaction<br />

Index (SACSI). Furthermore, we have also been recognised<br />

by Ask Afrika as the 2019 Industry Winner in their<br />

Orange Index for Service Excellence.<br />

For your trust and continued partnership in<br />

helping us achieve what matters to you,<br />

we say thank you!<br />

Find out more at<br />

metropolitan.co.za<br />

Winner of multiple awards for<br />

service excellence.<br />

2016<br />

2017<br />

2018<br />

2019<br />

2018<br />

2019<br />

Metropolitan is part of Momentum Metropolitan Life Limited, an authorised

financial services (FSP 44673) and registered credit provider (NCRCP173).<br />

23595/E BLACK RIVER F.C.

CONTENTS<br />

CONTENTS<br />

<strong>Gauteng</strong> <strong>Business</strong> <strong>2020</strong>/<strong>21</strong> Edition<br />

Introduction<br />

Foreword 5<br />

A unique guide to business and investment in <strong>Gauteng</strong>.<br />

Special features<br />

Regional overview of <strong>Gauteng</strong> 6<br />

Special Economic Zones and expanded infrastructure are<br />

central elements to the strategies being devised to grow<br />

the <strong>Gauteng</strong> economy.<br />

Spatial planning and infrastructure<br />

underpin <strong>Gauteng</strong>’s growth plans 10<br />

GDP growth is directly related to infrastructure investment.<br />

Builing mega-cities 16<br />

Ambitious construction plans are afoot in <strong>Gauteng</strong>.<br />

Economic sectors<br />

Agriculture 26<br />

A major starch business is changing hands.<br />

Mining 27<br />

AngloGold Ashanti has sold its last South African asset.<br />

Energy 28<br />

Companies are generating their own power.<br />

Oil and gas 29<br />

Various types of gas are available as fuels.<br />

Transport and logistics 34<br />

Achieving ambitious export goals will boost the logistics sector.<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

2

Africa Biomass Company<br />

Your caring family trading as world leaders in the wood chipping industry.<br />

WP CHIPPER HIRE & SALES trading<br />

as Africa Biomass Company (ABC)<br />

is a wood chipping company that<br />

provides wood recycling services,<br />

supplying biomass according to specification.<br />

ABC is one of the best go-to wood chipper<br />

equipment sales and services agents.<br />

Buy your own Bandit wood chipper<br />

or hire us to deal with your biomass<br />

Bandit the only logical choice for wood chippers in<br />

Africa, which are now fitted on SABS-approved trailers.<br />

For more information on the Bandit, see page 8<br />

ABC understands wood recycling<br />

With a comprehensive understanding<br />

Company<br />

of the operational<br />

challenges of wood recycling in South Africa,<br />

Slogan<br />

Wood chipper services<br />

ABC has established state-of-the-art facilities to service,<br />

repair and rebuild wood chipper equipment of<br />

• Agricultural: orchard / vineyard A small selection recycling of Bandit and wood chippers any brand (from left and to right): size. Model ABC’s 75XP facilities Engine; Model are 65XP operated PTO by a<br />

mulch spreading<br />

and the Intimidator 12XPC. remarkable team of very experienced and suitably<br />

• Biomass for generation<br />

Company<br />

of heat or electricity qualified engineers, technicians and artisans.<br />

Slogan<br />

• Site clearing and preparation<br />

An equally remarkable team of field-service<br />

• River rehabilitation in riparian Africa zones Biomass Company is the authorised technicians dealer deliver<br />

Become<br />

repairs,<br />

an<br />

maintenance<br />

owner of a Bandit<br />

and<br />

chipper<br />

parts<br />

for Bandit Industries in Southern Africa.<br />

All existing and new customers are welcome<br />

• Workshop, field services, parts ABC and has built spares up a substantial to fleet clients’ of Bandit sites to optimise uptime and efficiency.<br />

to contact us if they want to become the<br />

• Operator training services: wood SETA-certified<br />

chippers for use by the company as part owner of the top-class range of Bandit<br />

• Manufacturing workshop of our wood recycling services, The but most ABC also experienced<br />

equipment. Bandit Industries have delivered<br />

offers a whole range of Bandit wood chippers successful recycling solutions to basically<br />

to clients who want to invest in the Bandit<br />

chips<br />

range.<br />

producer Africa<br />

every corner of the planet.<br />

The X-factor in wood chippers Bandit chippers are designed with quality,<br />

production and longevity in mind. Dimensional Hand-fed wood A commitment chips are produced to support by the removal<br />

ABC is the authorised dealer for Bandit chippers wood are mounted chippers on custom-built, of alien invasive SABSapproved<br />

trailers. Owning a Bandit wood Africa Biomass Company is fully equipped<br />

trees in riparian zones, previously<br />

in Africa. Bandit combines first-world chipper technology will always put and you in deemed the front seat as of impossible. and stocked ABC, to service however, and repair now any has Bandit<br />

experience with third-world functionality. reliable wood This chipping makes operations. the knowledge machine and technology anywhere in South to get Africa. the We job own<br />

In many cases, the Bandit wood chipper sets a fully-equipped parts warehouse (650m²),<br />

done. These wood chips are then used<br />

the benchmark for other brands in the wood manufacturing department as well as field<br />

chipping industry. We are ready to supply the in agri-industrial services to ensure applications that parts are as always a greener<br />

alternative available and to our coal own, for as either well as heat our clients’ or<br />

readily<br />

right Bandit wood chipping solution with advice<br />

and aftercare to your doorstep. All existing and Bandit wood chippers are not out of commission<br />

electricity production.<br />

new customers are welcome to contact us to longer than they have to be.<br />

become the owner of Bandit equipment. www.abc.co.za<br />

Geographical footprint<br />

9 WESTERN CAPE BUSINESS <strong>2020</strong><br />

ABC is located in Worcester (Western<br />

Cape), Kirkwood (Eastern Cape),<br />

Nelspruit (Mpumalanga) and Upington<br />

(Northern Cape).<br />

We operate in all nine provinces in<br />

South Africa and also across the<br />

borders into Sub-Saharan Africa, including<br />

Namibia, Botswana, Zimbabwe,<br />

Mozambique, Zambia, Malawi,<br />

Tanzania, Kenya and Nigeria. ■<br />

www.abc.co.za<br />

Head Office: 023 342 1<strong>21</strong>2<br />

Area Manager: Christian de Wet | 078 683 4209 | cdewet@abc.co.za

CONTENTS<br />

Manufacturing 36<br />

The OR Tambo Aerotropolis is attracting manufacturing.<br />

Tourism 38<br />

Tourism operators are determined to rise again.<br />

ICT 40<br />

Financial services is leading the way in ICT investment.<br />

Banking and financial services 41<br />

Banks are looking at insurance and funeral policies.<br />

Development finance and SMME support 44<br />

Government pledges to spend R4-billion with SMMEs annually.<br />

Education and training 46<br />

Skills training is a public and private priority.<br />

References<br />

Key sector contents 24<br />

Overviews of the main economic sectors of <strong>Gauteng</strong>.<br />

Index 48<br />

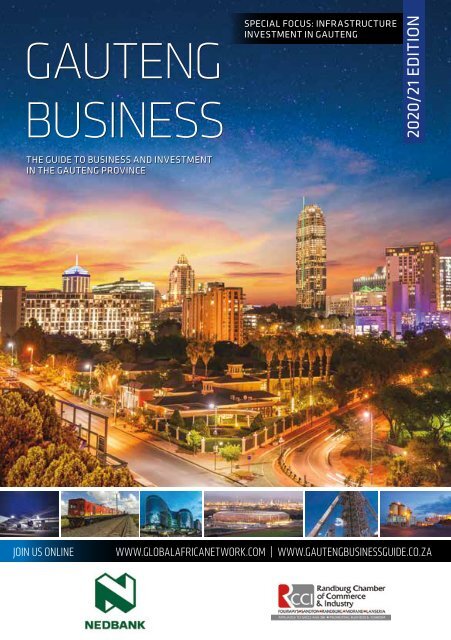

ABOUT THE COVER:<br />

Arnold Petersen/iStock by Getty Images.<br />

Sandton at night. With the Liberty Group<br />

among the financiers, Sandton City shopping<br />

centre, with 50 000m² of lettable space,<br />

opened in 1973 and sparked fantastically fast<br />

growth around it, transforming farmland to<br />

the richest square mile in Africa. Several new<br />

corporate headquarters have been built in<br />

recent years in the town that drew its name<br />

from two of its well-known suburbs, Sandown<br />

and Bryanston.<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

4

<strong>Gauteng</strong> <strong>Business</strong><br />

A unique guide to business and investment in <strong>Gauteng</strong>.<br />

FOREWORD<br />

Credits<br />

Publishing director:<br />

Chris Whales<br />

Editor: John Young<br />

Managing director: Clive During<br />

Online editor: Christoff Scholtz<br />

Designer: Simon Lewis<br />

Production: Lizel Olivier<br />

Ad sales:<br />

Gavin van der Merwe<br />

Sam Oliver<br />

Jeremy Petersen<br />

Gabriel Venter<br />

Vanessa Wallace<br />

Shiko Diala<br />

Administration & accounts:<br />

Charlene Steynberg<br />

Kathy Wootton<br />

Printing: FA Print<br />

The <strong>2020</strong>/<strong>21</strong> <strong>edition</strong> of <strong>Gauteng</strong> <strong>Business</strong> is the 12th issue<br />

of this highly successful publication that has established<br />

itself as the premier business and investment guide for the<br />

<strong>Gauteng</strong> Province.<br />

In addition to the regular articles providing insight into each<br />

of the key economic sectors of the province, there are special<br />

features on infrastructure investment programmes and plans for<br />

the establishment of Special Economic Zones (SEZs) as a means<br />

to boost economic growth. Another feature on construction and<br />

property underlines the importance of spatial planning in the<br />

region’s future.<br />

Ambitious plans for the City of Johannesburg are outlined,<br />

both in the journal’s editorial pages and by the Johannesburg<br />

Development Agency (JDA).<br />

To complement the extensive local, national and international<br />

distribution of the print <strong>edition</strong>, the full content can also be viewed<br />

online at www.globalafricanetwork.com under e-books. Updated<br />

information on <strong>Gauteng</strong> is also available through our monthly<br />

e-newsletter, which you can subscribe to online at www.gan.co.za,<br />

in addition to our complementary business-to-business titles that<br />

cover all nine provinces as well as our flagship South African <strong>Business</strong><br />

title and the new addition to our list of titles, African <strong>Business</strong>, which<br />

was launched in <strong>2020</strong>. ■<br />

Chris Whales<br />

Publisher, Global Africa Network Media | Email: chris@gan.co.za<br />

DISTRIBUTION<br />

<strong>Gauteng</strong> <strong>Business</strong> is distributed internationally on outgoing<br />

and incoming trade missions, through trade and investment<br />

agencies; to foreign offices in South Africa’s main trading<br />

partners around the world; at top national and international<br />

events; through the offices of foreign representatives in<br />

South Africa; as well as nationally and regionally via chambers<br />

of commerce, tourism offices, airport lounges, provincial<br />

government departments, municipalities and companies.<br />

Member of the Audit Bureau<br />

of Circulations<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal address: PO Box 292, Newlands 7701<br />

Tel: +27 <strong>21</strong> 657 6200 | Fax: +27 <strong>21</strong> 674 6943<br />

Email: info@gan.co.za | Website: www.gan.co.za<br />

ISSN 1990-06<strong>21</strong><br />

COPYRIGHT | <strong>Gauteng</strong> <strong>Business</strong> is an independent publication<br />

published by Global Africa Network Media (Pty) Ltd. Full copyright to the<br />

publication vests with Global Africa Network Media (Pty) Ltd. No part<br />

of the publication may be reproduced in any form without the written<br />

permission of Global Africa Network Media (Pty) Ltd.<br />

PHOTO CREDITS | Arnold Petersen/iStock by Getty Images, ACSA,<br />

Boogertman and Partners, Coega Development Corporation (CDC), Diesel<br />

Electric Services, Commvault, CNG Holdings, 5M2T, Harmony, Knight<br />

Piésold, Marriott International, Mark Hillary/Flickr, <strong>Gauteng</strong> Partnership<br />

5<br />

Fund (GPF), Johannesburg Development Agency (JDA), Tongaat Hulett,<br />

Venter Consulting Engineers, Wits <strong>Business</strong> School.<br />

DISCLAIMER | While the publisher, Global Africa Network Media (Pty)<br />

Ltd, has used all reasonable efforts to ensure that the information<br />

contained in <strong>Gauteng</strong> <strong>Business</strong> is accurate and up-to-date, the publishers<br />

make no representations as to the accuracy, quality, timeliness, or<br />

completeness of the information. Global Africa Network will not accept<br />

responsibility for any loss or damage suffered as a result of the use of or<br />

any reliance placed on such information.<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

A REGIONAL OVERVIEW OF<br />

GAUTENG<br />

Special Economic Zones and expanded infrastructure are<br />

central elements to the strategies being devised to grow<br />

the <strong>Gauteng</strong> economy.<br />

By John Young<br />

One of the plans to boost <strong>Gauteng</strong>,<br />

“Growing <strong>Gauteng</strong> Together” (GGT<br />

2030) prioritises the economy, jobs and<br />

infrastructure, with the manufacturing<br />

sector earmarked as a key driver.<br />

<strong>Gauteng</strong> accounts for 45% of the South Africa’s<br />

manufacturing capacity, so the province is wellplaced<br />

to expand an already strong and diverse<br />

sector. Manufacturing makes up 14.5% of formal<br />

sector output in <strong>Gauteng</strong>, making it the fourthlargest<br />

sector. One in nine jobs in the province are<br />

created in the sector. According to the <strong>Gauteng</strong><br />

Growth Development Agency (GGDA), six out<br />

of 10 foreign direct investment (FDI) projects in<br />

<strong>Gauteng</strong> have flowed to the manufacturing sector<br />

and its subsectors.<br />

In the five years to 2019, the <strong>Gauteng</strong> City-<br />

Region attracted 447 FDI projects valued at<br />

R264-billion, which created more than 69 000<br />

jobs (FDI Markets).<br />

The GGDA is an implementing agency which<br />

aims to facilitate business enablement, develop<br />

small, medium and micro-enterprises (SMMEs)<br />

and to promote investment and job creation.<br />

Focussed support for these specific subsectors is<br />

intended to spur other investments: automotive<br />

sector, mineral beneficiation, capital equipment,<br />

agro-processing, pharmaceuticals and tertiary<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

6

SPECIAL FEATURE<br />

Tech SEZ (Tshwane), the Vaal SEZ (Sedibeng), and<br />

the Tshwane Automotive SEZ.<br />

The National Department of Trade, Industry and<br />

Competition (dtic) is the lead agent in the creation of<br />

SEZs, which are part of the national Industrial Policy<br />

Action Plan (IPAP). SEZs are designed to attract<br />

investment, create jobs and boost exports.<br />

The Provincial Government of <strong>Gauteng</strong><br />

has identified 10 “high-growth” sectors where<br />

it intends concentrating its efforts to build<br />

infrastructure and to attract public and private<br />

sector investment:<br />

• Energy: new technologies and a diverse<br />

Transportation and logistics.<br />

• ICT, media and digital services.<br />

• Tourism and hospitality.<br />

• Agricultural value chain.<br />

• Construction and infrastructure.<br />

• Automotive, aerospace and defence.<br />

• Financial services.<br />

• Cultural and creative industries.<br />

• Industrialisation of cannabis.<br />

Credit: ACSA<br />

services such as the BPO, ICT services, tourism<br />

and the knowledge economy.<br />

GGDA subsidiaries include The Innovation<br />

Hub (technology), the Automotive Industry<br />

Development Centre (AIDC), which manages<br />

the Automotive Supplier Park (ASP) and InvestSA<br />

<strong>Gauteng</strong> (red tape remover for investors).<br />

The Johannesburg Development Agency<br />

(JDA) plays a similar role as the City of<br />

Johannesburg’s development agency. JDA’s<br />

focus is on helping create resilient, sustainable<br />

and liveable urban areas in identified transit<br />

nodes and corridors. In 15 years, 387 projects<br />

have been implemented.<br />

Special Economic Zones (SEZs) are being<br />

created and expanded across the province to<br />

support manufacturers, providing them with the<br />

necessary infrastructure and access to related<br />

businesses. This has seen the expansion of the<br />

OR Tambo International Airport (ORTIA) SEZ<br />

(Ekurhuleni) and the establishment of the High-<br />

These priorities were announced before the onset<br />

of the Covid-19 global pandemic, so obviously<br />

there will be some major adjustments, especially<br />

with regard to tourism and hospitality which<br />

has suffered major setbacks during the local and<br />

international lockdowns.<br />

It could be that the focus shifts more strongly<br />

to another one of the priorities of local and regional<br />

government, affordable housing. Much has been<br />

done to provide housing since the dawn of the<br />

democratic era in 1994, but much more needs<br />

to be done in response to rapid urbanisation.<br />

<strong>Gauteng</strong> Province has pledged to provide 100 000<br />

service stands to qualifying <strong>Gauteng</strong> residents who<br />

want to and are able build their own homes and<br />

it wants an additional 250 000 people to be able<br />

to recent “decent accommodation” over the next<br />

five to 10 years. This is in addition to facilitating the<br />

development of mega-cities, one to the west of<br />

Lanseria and the other to the south of Vereeniging.<br />

Vaal River City will span the Orange River and<br />

eventually link up with Sasolburg in the Free State,<br />

according to the blueprint.<br />

Another housing initiative will see provincial<br />

funds ring-fenced to formalise informal settlements<br />

7 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

SPECIAL FEATURE<br />

and to upgrade hostels into family units. All of<br />

these programmes should provide a boost to the<br />

construction and property sector and to small<br />

businesses in both sectors.<br />

15 Alice Lane Annex. Image: Andrew Bell/Paragon Architects<br />

Overview of the province<br />

<strong>Gauteng</strong> is South Africa’s smallest province in<br />

terms of landmass but in every other respect it is<br />

a giant. The province is the nation’s key economic<br />

growth engine.<br />

At 18 176km², the province makes up just 1.5%<br />

of South Africa’s territory, but even that aspect<br />

showed growth in 2018 when the territory<br />

of Ekangala was formally transferred from<br />

Mpumalanga Province to <strong>Gauteng</strong> Province.<br />

Theland had previously been part of the<br />

KwaNdebele homeland.<br />

The 14.3-million people living in <strong>Gauteng</strong> in<br />

2017 generated a gross domestic product of R1.59-<br />

trillion, about a third of South Africa’s GDP (StatsSA).<br />

<strong>Gauteng</strong> shares borders with four provinces, the<br />

Free State, North West, Limpopo and<br />

Mpumalanga. The southern border of<br />

the province is the Vaal River and most of<br />

the province is located on the Highveld.<br />

The Witwatersrand, which runs through<br />

Johannesburg, marks the continental<br />

divide: rivers running to the north drain<br />

into the Indian Ocean, rivers running<br />

south drain into the Atlantic Ocean via<br />

the Vaal into the Orange River. <strong>Gauteng</strong><br />

draws its water from a series of interconnected<br />

river transfer systems. A major<br />

source of water is the Lesotho Water<br />

Highlands Project.<br />

The Witwatersrand was the source of<br />

the gold that drew so many thousands of<br />

people to the area in the late 19th century<br />

and was the origin of the word for South<br />

Africa’s currency, the “rand”.<br />

<strong>Gauteng</strong> is a leader in a wide range of economic<br />

sectors: finance, manufacturing, commerce, IT and<br />

media among them. The Bureau of Market Research<br />

(BMR) has shown that <strong>Gauteng</strong> accounts for 35% of<br />

total household consumption in South Africa.<br />

The leading economic sectors are finance, real<br />

estate and business, manufacturing, government<br />

services and wholesale, retail, motor trade<br />

and accommodation. The creative industries<br />

(including advertising and the film sector) employ<br />

upwards of 180 000 people and contribute more<br />

than R3.3-billion to the provincial economy. This<br />

BANDIT – EXPERIENCE THE BEST OF BOTH WORLDS<br />

First-world technology and quality combined SABS-approved roadworthy trailers built at Africa<br />

with African simplicity. The main woodchipper Biomass Company in Worcester, South Africa.<br />

unit is manufactured by Bandit Industries, Inc. Engine-powered woodchippers are fitted<br />

with 35-plus years’ experience with Tier 3, South African standard, diesel or<br />

in innovation and international petrol engines, depending on the woodchippers’<br />

research. These units specification or clients’ preference. Electric and PTO<br />

are shipped to options are also available in various Bandit models.<br />

South Africa The add-ons are specifically handpicked to give<br />

where they are you the best set-up and will provide you with a<br />

fitted onto well-balanced woodchipper that will outperform<br />

most other chippers in Africa.<br />

www.abc.co.za

sector is seen as a driver of future growth.<br />

In Johannesburg, financial services and<br />

commerce predominate. The JSE, Africa’s largest<br />

stock exchange, is in Sandton and several new stock<br />

exchanges have recently received licences.<br />

Tshwane (which includes Pretoria) is home<br />

to many government services and is the base<br />

of the automotive industry and many research<br />

institutions. The Ekurhuleni metropole has the largest<br />

concentration of manufacturing concerns, ranging<br />

from heavy to light industry, in the country. The<br />

western part of the province is concerned mainly<br />

with mining and agriculture, while the south has a<br />

combination of maize farming, tobacco production<br />

and the heavy industrial work associated with steel<br />

and iron-ore workings.<br />

Individually, the biggest <strong>Gauteng</strong> cities<br />

contribute to the national GDP as follows:<br />

Johannesburg (15%), Tshwane (9%) and<br />

Ekurhuleni (7%).<br />

<strong>Gauteng</strong> is not just an important centre of<br />

economic activity it is also an important launching<br />

pad for local and international businesses to enter<br />

Nelson Mandela Bridge at night. Image: SA Tourism<br />

the African market. The country’s biggest airport,<br />

OR Tambo International Airport, is at the core of the<br />

province’s logistical network. Other airports include<br />

Rand Airport (Germiston), Wonderboom (Pretoria)<br />

Lanseria and Grand Central (Midrand).<br />

The <strong>Gauteng</strong> Division of the High Court of<br />

South Africa (which has seats in Pretoria and<br />

Johannesburg) is a superior court with general<br />

jurisdiction over the province. Johannesburg is also<br />

home to the Constitutional Court, South Africa’s<br />

highest court, and to a branch of the Labour Court<br />

and the Labour Appeal Court.<br />

The province has several outstanding universities,<br />

and the majority of South Africa’s research takes place<br />

at well-regarded institutions such as the Council for<br />

Scientific and Industrial Research (CSIR), the South<br />

African Bureau of Standards (SABS), Mintek, the<br />

South African Nuclear Energy Corporation (NECSA),<br />

the Human Sciences Research Council (HSRC) and<br />

several sites where the work of the Agricultural<br />

Research Council (ARC) is done. ■<br />

9 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

SPECIAL FEATURE<br />

Spatial planning and infrastructure<br />

underpin <strong>Gauteng</strong>’s growth plans<br />

GDP growth is directly related to infrastructure investment.<br />

Credit: Coega Development Corporation<br />

Infrastructure spending and areas dedicated to<br />

specific kinds of manufacturing are intended<br />

to drive economic growth in the <strong>Gauteng</strong><br />

Province.<br />

Both concepts fall within broader national plans<br />

to boost industrialisation through various kinds of<br />

Special Economic Zones (SEZs) and infrastructural<br />

initiatives. A number of national and provincial<br />

planning frameworks inform the planning of<br />

<strong>Gauteng</strong>’s economic future. These include the<br />

National Development Plan, Growing <strong>Gauteng</strong><br />

Together (GGT 2030), <strong>Gauteng</strong> 2055 Vision and<br />

the City of Johannesburg’s Growth Development<br />

Strategy and Spatial Development Framework.<br />

The <strong>Gauteng</strong> Provincial Government will<br />

spend R60-billion on building and maintaining<br />

infrastructure in the five years to 2025. The<br />

provincial authorities further estimate that about<br />

R100-billion will be spent on infrastructure<br />

projects in the province by a variety of stateowned<br />

enterprises (SOEs) and national<br />

departments in the next decade. The overall<br />

estimate for the injection of capital related to<br />

infrastructure, including private initiatives, is<br />

calculated at R760-billion in the period to 2030.<br />

A 15-year <strong>Gauteng</strong> Infrastructure Master<br />

Plan has been adopted but multiple sources<br />

of funding are needed for the plan to succeed<br />

in areas such as the provision of water,<br />

logistics, broadband connectivity, public<br />

transport, energy and the reshaping of cities to<br />

accommodate citizens in a better way than was<br />

the case under apartheid. A World Bank report<br />

has shown that a 10% increase in infrastructure<br />

spending results in a 1% growth in GDP.<br />

<strong>Gauteng</strong> began laying the groundwork for<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

10

SPECIAL FEATURE<br />

creating a research base for urban planning as<br />

far back as 2008 when the <strong>Gauteng</strong> City-Region<br />

Observatory (GCRO) was established. A partnership<br />

between the University of Johannesburg (UJ), the<br />

University of the Witwatersrand, Johannesburg<br />

(Wits) and the <strong>Gauteng</strong> Provincial Government,<br />

the GCRO does research on which planners can<br />

base their projections.<br />

A Township Economic Development Bill is to be<br />

introduced in the provincial legislature to reduce<br />

the amount of red tape faced by small businesses.<br />

Growth strategies are to be integrated to ensure<br />

that township SMMEs and black industrialists are<br />

considered when programmes such as the focus<br />

on 10 “high-growth sectors” are implemented. Youth<br />

employment will be factored in to plans to support<br />

those sectors.<br />

Corridors and SEZs<br />

Five corridors have been identified for development<br />

purposes. Each has core existing economic activities<br />

which will be supported and expanded. In addition,<br />

new activities will be encouraged to diversify the<br />

area’s economic potential and create jobs.<br />

The <strong>Gauteng</strong> City-Region will have three fully<br />

operating Special Economic Zones (SEZs) by<br />

2025. These will be based in Ekurhuleni, Tshwane<br />

and Sedibeng with an additional Special Agro-<br />

Processing Zone located in the West Rand. The<br />

province intends reviving 15 industrial parks and<br />

creating 12 agri-parks and five agro-processing<br />

facilities across the province.<br />

By 2030, <strong>Gauteng</strong> will have the biggest inland<br />

logistics hub and dry port in Africa – the Transnet<br />

Tambo-Springs Logistics Gateway.<br />

These area-based infrastructure and logistics<br />

projects are expected to contribute to giving the<br />

province a competitive edge in the 10 economic<br />

sectors that have been identified as “high-growth”.<br />

This in turn will create opportunities for small,<br />

medium and micro-enterprises (SMMEs) and<br />

township businesses.<br />

The Tshwane Automotive Special Economic<br />

Zone (TASEZ) (pictured) is a key project within the<br />

Northern Corridor. It is a project of the <strong>Gauteng</strong><br />

Province, the Department of Trade, Industry<br />

and Competition, and the City of Tshwane. The<br />

implementing agent is the Coega Development<br />

Corporation (CDC), the developer and operator of<br />

the Coega Special Economic Zone (SEZ).<br />

The TASEZ, branded as “Africa’s First Automotive<br />

City”, has a mandate to promote economic<br />

participation for SMMEs and create employment<br />

in the region. Sectors targeted include security, ICT<br />

maintenance, facility maintenance, construction,<br />

automotive supply chain, marketing and<br />

advertising, catering and events.<br />

The benefits that arise from clustering of<br />

businesses in related sectors is a key element of an<br />

SEZ. Both the Nissan and BMW plants are expanding<br />

and Ford is investing in Silverton. An Incubation<br />

Centre for SMMEs has been launched at Nissan’s<br />

assembly plant in Rosslyn. The facility supports<br />

small enterprises through subsidised rental and<br />

mentorship and training. Management of the centre<br />

is done by the Automotive Industry Development<br />

Centre (AIDC), a subsidiary of the <strong>Gauteng</strong> Growth<br />

and Development Agency (GGDA). The Jobs Fund<br />

contributes to financing the project.<br />

Other focus sectors in this corridor include<br />

agriculture and agro-processing, defence, the<br />

aerospace and aviation industries together with<br />

the innovation, research and development cluster<br />

anchored around the <strong>Gauteng</strong> Innovation Hub,<br />

universities and research institutes.<br />

The OR Tambo SEZ is at the centre of the Eastern<br />

Corridor, which underscores Ekurhuleni’s strengths<br />

in manufacturing and logistics. The OR Tambo<br />

SEZ has launched the biggest food processing<br />

operation in the southern hemisphere (and the<br />

world’s second-largest refrigeration plant). With<br />

a special focus on export-oriented value-added<br />

industry, the OR Tambo SEZ leverages its connection<br />

to the country’s busiest airport. The focus of this SEZ<br />

is on agro-processing, jewellery manufacturing and<br />

mineral beneficiation as well as the development<br />

of hydrogen fuel cell technology. This is another<br />

subsidiary of the GGDA.<br />

Other Eastern Corridor sectors include rail and<br />

bus manufacturing (including the PRASA-Gibela<br />

rail manufacturing hub in Nigel), defence and<br />

aerospace and food and beverages.<br />

The Western Corridor encompasses the<br />

economy of the West Rand and has been targeted<br />

11 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

SPECIAL FEATURE<br />

Credit: Mark Hillary/Flickr<br />

for the creation of new zones for development,<br />

housing, and industry. The aim is to diversify away<br />

from mining towards renewable energy, tourism,<br />

bus manufacturing and agro-processing. The<br />

release of 30 000 hectares of land by Sibanye Gold<br />

has unlocked the potential for major investment<br />

projects. A Smart City is envisaged for Lanseria<br />

and the area to its west.<br />

Where steel used to be the anchor industry in<br />

the Southern Corridor, today the aim is to build<br />

new industries through an SEZ that will cover<br />

both sides of the Vaal River and thus extend into<br />

the Free State Province. Among the investments<br />

that will create impetus are the Savannah City<br />

development, Vaal River City development, a<br />

cargo airport and logistics hub, the AB InBev<br />

investment project, the <strong>Gauteng</strong> Highlands<br />

water project, the Vaal Marina development and<br />

logistics and mining investments in the Lesedi<br />

Local Municipality, which includes Heidelberg<br />

and Nigel.<br />

Metropolitan drivers<br />

The Central Development Corridor revolves around<br />

the City of Johannesburg as the hub the of financial<br />

services, information and communication technology,<br />

services and pharmaceutical sectors.<br />

New investments are planned for the Joburg<br />

Inner-City and the South, from Soweto, N12<br />

which includes Masingita City, Southern Farms to<br />

Orange Farm.<br />

The City of Johannesburg has recently<br />

completed a review of its policy of nodal<br />

development with a view to creating a fairer<br />

spatial framework for the city than that created<br />

by the racist planning laws of the apartheid era.<br />

As Member of the Mayoral Committee<br />

Lawrence Khoza puts it, “Nowhere is the legacy<br />

of our painful past expressed more vividly than<br />

in the racially divided spatial character of South<br />

Africa’s cities.”<br />

Johannesburg has designated eight zones:<br />

Inner-city: high-intensity use.<br />

Metropolitan: mix of land uses which currently<br />

includes Sandton and Rosebank and will expand<br />

to include parts of Soweto.<br />

General urban: designed to be transformative,<br />

mix of economic and residential use.<br />

Local economic development: interventions<br />

planned to create economic opportunities in<br />

areas with poor facilities (Zandspruit, Orange<br />

Farm, parts of Soweto).<br />

Suburban: lower density with local mixing of<br />

land use (homes, offices, offices, shops).<br />

Dark green: a limit of 8% coverage of buildings.<br />

Peri-urban/agriculture: low density.<br />

Another transformative initiative being<br />

undertaken in Johannesburg is the use of<br />

Transit-Oriented Development (TOD) to drive<br />

investment and development. Implemented by<br />

the Johannesburg Development Agency (JDA),<br />

the TODs are another attempt to improve the lives<br />

of people living in previously neglected areas.<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

12

SPECIAL FEATURE<br />

One such TOD is the Jabulani TOD in Soweto<br />

where a seven-phase project is underway that<br />

includes a multi-purpose hall, a library, counselling<br />

facilities, sports facilities, offices and meeting rooms.<br />

A pedestrian bridge over a railway line and new<br />

roads underscore the transport element, with the<br />

facilities near the Bus Rapid Transport (BRT) route<br />

that runs through Soweto to central Johannesburg.<br />

TODs are designed to attract further investment and<br />

are supported by the Neighbourhood Development<br />

Partnership Grant from National Treasury.<br />

Other projects undertaken by the JDA range<br />

from the upgrading of Constitution Hill, the Faraday<br />

Station precinct, work on the Fashion District and<br />

pavements of the inner city, renovation of the Drill<br />

Hall and the big Newtown make-over.<br />

Johannesburg has been the focus of a major<br />

tax incentive initiative, the Urban Development<br />

Zone (UDZ). The inner city of Johannesburg,<br />

comprising just less than 18km², is the largest<br />

UDZ in South Africa and it is expanding its<br />

footprint in response to significant successes that<br />

have been achieved.<br />

The Johannesburg Social Housing Company<br />

(Joshco) has plans to provide affordable rental<br />

accommodation in 12 inner-city buildings that<br />

were recently identified for that purpose. But the<br />

main target for the UDZ is private investors.<br />

The City of Johannesburg has identified the<br />

following nodes for development:<br />

• Carlton Precinct: Johannesburg’s tallest<br />

building attracts tourists; undergoing revamp;<br />

Sky Rink TV and film studio being developed;<br />

conference centre planned.<br />

• Park Station: intermodal node catering for<br />

cars, buses, rail commuters and taxis; Gautrain<br />

link to OR Tambo International Airport; wide<br />

variety of users.<br />

• Central park: JDA has worked on greening and<br />

community engagement and wants the park to<br />

be a symbol of the successful city.<br />

• Doornfontein/Ellis Park railroad corridor:<br />

planned retail hub and student village.<br />

• Fordsburg: interior design focus; more offices<br />

and accommodation can be built.<br />

• Newtown: cultural precinct with the potential<br />

to cater to students and university departments<br />

with specialised offices and spaces.<br />

• Hillbrow, Berea, Parktown, Bellvue,<br />

Yeoville: creation of new public open<br />

space; opportunities for office and hotel<br />

developments.<br />

National Infrastructure boost<br />

An Investment and Infrastructure Office has<br />

been created in the Presidency. It is headed<br />

by the former <strong>Gauteng</strong> MEC for Economic<br />

Development, Dr Kgosientso Ramokgopa. In <strong>2020</strong>,<br />

51 infrastructure projects with a total investment<br />

value of more than R340-billion were gazetted.<br />

Ten of the 18 affordable housing projects<br />

listed are located in <strong>Gauteng</strong>. These include<br />

Malibongwe Ridge, Green Creek, Mooikloof<br />

Mega Residential City, Fochville Extension 11<br />

and Germiston Ext 4 Social Housing Project. A<br />

large project is underway in Tshwane, Salvokop<br />

Precinct, to house government<br />

departments and commercial<br />

buildings.<br />

The energy projects identified<br />

by national government will<br />

have an impact on <strong>Gauteng</strong>,<br />

the country’s biggest consumer<br />

of energy. Priorities include<br />

embedded generation and<br />

the huge water supply project,<br />

Phase 2 of the Lesotho Highlands<br />

Water Project, will create many<br />

opportunities. ■<br />

13 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

FOCUS<br />

Selby Bus Rapid Transit depot<br />

is taking shape<br />

The Johannesburg Development Agency (JDA) is building infrastructure<br />

to make the city more resilient, liveable and sustainable.<br />

Selby BRT depot, which will service two Rea<br />

Vaya BRT operating companies, will be utilised<br />

for major and minor maintenance of<br />

buses for maintaining in-service buses and<br />

out-of-service buses. The centrally-located depot<br />

will minimise dead mileage as well as minimise the<br />

time lost by buses in traffic congestion between<br />

depots and route starting points.<br />

The JDA is a wholly-owned area-based<br />

development agency of the City of Johannesburg<br />

with an emphasis on the development of resilient,<br />

sustainable and liveable urban areas in identified<br />

transit nodes and corridors. This means that as an<br />

area-based development agency, we are more<br />

than just a project management agency or an<br />

economic development agency.<br />

The JDA operates within the context of the<br />

spatial transformation of South African cities<br />

to correct the spatial and systemic inequalities<br />

created by past regimes of segregation. This<br />

is the foremost goal of urban development<br />

in the coming years. A more equitable, more<br />

just city is one that extends access to a range<br />

of opportunities and services to all of its<br />

citizens. This is aligned to the City of Johannesburg’s<br />

Growth and Development Strategy<br />

(GDS) 2040.<br />

One of the GDS 2040 outcomes is to<br />

provide a resilient, liveable and sustainable<br />

urban environment – underpinned by smart<br />

infrastructure supportive of a low-carbon<br />

economy. The JDA is currently revamping the<br />

existing Selby bus depot in the Johannesburg<br />

inner city, to turn it into a state-of-the-art Rea<br />

Vaya Bus Rapid Transit (BRT) depot for Phase 1B<br />

and Phase 1C operations.<br />

The JDA, on behalf of the City of<br />

Johannesburg’s Department of Transport, is<br />

undertaking the construction of the Selby BRT<br />

in three phases, namely phase 2A, phase 2B and<br />

phase 2C.<br />

The Selby BRT depot, which will service two<br />

Rea Vaya BRT operating companies, will be utilised<br />

for major and minor maintenance of buses by<br />

maintaining in-service buses and out-of-service<br />

buses. The centrally-located depot will minimise<br />

dead mileage, as well as minimise the time lost by<br />

buses in traffic congestion between depots and<br />

route starting points.<br />

An Intelligent Transport System monitors traffic via<br />

multiple screens.<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

14

FOCUS<br />

In 2013, the JDA developed the first depot<br />

in Meadowlands in Soweto. The Selby BRT<br />

depot is being revamped to be on par with the<br />

Meadowlands depot, which is environmentally<br />

friendly and custom-made for Rea Vaya buses.<br />

Phase 2B, covering the construction of the<br />

bus depot workshops and refuelling garages and<br />

Phase 2C, which involves the construction of the<br />

administration building, are currently underway.<br />

The scope of work for Phase 2B includes<br />

extensive alterations, refurbishments and additions<br />

to an existing workshop building. This includes<br />

the construction of a new refuelling building,<br />

a new double-volume wash-bay building, two<br />

new refuse buildings, a new gate house, civil<br />

works, stormwater infrastructure, concrete paving<br />

panels with layerworks, and mechanical and<br />

electrical installations.<br />

This construction also plays a role in job creation<br />

and skills development, with 30% of the contract<br />

value being awarded to SMMEs.<br />

Environmentally-friendly features include lights<br />

controlled by sensors, a robust, mild-steel sheeting<br />

for the roof, cladding to help with climate control,<br />

and a noise-wall barrier erected around the<br />

premises. The roof structures will also allow direct<br />

sunlight into the building to reduce the need for<br />

artificial lighting. Water is recycled for reuse in the<br />

buildings and the wash bay.<br />

Work planned for Phase 2C includes the<br />

redevelopment and refurbishment of an existing<br />

administration building. This comprises demolition<br />

works to various areas, the refurbishment of<br />

workshop areas, construction of a new canteen<br />

and gymnasium, the construction of new<br />

offices, administration rooms, boardrooms and<br />

storerooms, the construction of a new main foyer<br />

and reception areas and the refurbishment of<br />

courtyard spaces.<br />

The construction of additional toilet blocks,<br />

new lifts to aid accessibility, service ducts, new<br />

pedestrian and vehicular access with security<br />

offices, external works and the installation of<br />

electrical and mechanical infrastructure will also<br />

be undertaken.<br />

Phase 2A, now complete,<br />

entailed the construction<br />

of the perimeter fence, bus<br />

parking area platform, site<br />

access road, main parking<br />

area driveway upgrade and<br />

the construction of the main<br />

entrance road into the depot<br />

(along the Pat Mbatha Road<br />

intersection with Ignatius<br />

Street).<br />

Once completed, the<br />

Selby BRT depot, which was<br />

formerly used by Putco Bus<br />

Company, will accommodate<br />

up to 270 buses and feature an administration<br />

building, maintenance building, washing and<br />

refuelling bays and an Intelligent Transport System<br />

(ITS) control centre. The administration block<br />

features ablution facilities, a canteen, offices and<br />

staff and visitors parking.<br />

Contact details<br />

Physical address: The Bus Factory No 3, Helen<br />

Joseph Street Newtown, Johannesburg<br />

Postal address: PO Box 61877, Marshalltown <strong>21</strong>07<br />

Tel: + 27 11 688 7851 | Fax: +27 11 688 7899<br />

Email: info@jda.org.za | Web: www.jda.org.za<br />

15 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

SPECIAL FEATURE<br />

Building mega-cities<br />

Ambitious construction plans are afoot in <strong>Gauteng</strong>.<br />

Housing at Fleurhof Ext 2, sponsored by the Madulamoho Housing<br />

Association. CREDIT: <strong>Gauteng</strong> Partnership Fund<br />

The fourth quarter of <strong>2020</strong> and the first half of 20<strong>21</strong> must<br />

be growth periods for the construction and property sectors<br />

– for the simple reason that they barely functioned<br />

during the lockdown caused by the global pandemic.<br />

South Africa is fortunate in that it is emerging from the<br />

lockdown at the same time as summer days lengthen and the<br />

national government is getting down to brass tacks with its<br />

long-awaited infrastructure programme. With a dedicated unit<br />

within the Presidency, a conference has been held and more than<br />

200 hundred possible projects have been whittled down to 51<br />

projects that have been gazetted.<br />

By 2030 <strong>Gauteng</strong> will have two huge new cities, socially<br />

diverse, digitally connected and ecologically responsible and<br />

sustainable. That’s if the Provincial Government of <strong>Gauteng</strong> brings<br />

to fruition its plans for the west (Lanseria to Haartbeespoort<br />

Dam) and in the south, where Vaal River City will stretch from<br />

Vereeniging to Sasolburg in the Free State.<br />

In the 25 years since South Africa has been a democracy,<br />

more than 1.2-million subsidised houses have been built by<br />

government in <strong>Gauteng</strong>. Provincial government has pledged to<br />

release 10 000 serviced stands as part of its Rapid Land Release<br />

programme and it intends<br />

finishing incomplete housing<br />

projects in Alexandra, Evaton,<br />

Kliptown, Bekkersdal and<br />

Winterveldt.<br />

Bodies such as the National<br />

Housing Finance Corporation,<br />

Indlu and Umastandi (social<br />

capital entrepreneurs) are<br />

working together with<br />

provincial authorities to find<br />

ways to formalise and monetise<br />

the township market so that<br />

sustainable incomes can be<br />

generated and affordable<br />

housing and rental stock<br />

becomes more readily available.<br />

An important concept for<br />

developers in Johannesburg<br />

is the tax incentive that<br />

accompanies the Urban<br />

Development Zone (UDZ).<br />

The City of Johannesburg and<br />

the South African Property<br />

Owners Association (SAPOA)<br />

have developed a database<br />

for all UDZ properties.<br />

Information about the owner<br />

of the plot, the valuation and<br />

zoning rights is available for<br />

every stand.<br />

Various “improvement<br />

districts” have also been created,<br />

for example the RID (Retail<br />

Improvement District) where<br />

businesses in a designated area<br />

pay levies to secure improved<br />

cleaning and security services.<br />

The Johannesburg City<br />

Improvement District Forum<br />

shares information among<br />

the CIDs. Expenditure by CIDs<br />

GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong><br />

16

SPECIAL FEATURE<br />

collectively on supplementary<br />

public space safety, cleaning and<br />

maintenance is estimated to be<br />

about R61-million annually.<br />

The <strong>Gauteng</strong> Partnership<br />

Fund (GPF) has attracted more<br />

than R3.5-billion in private<br />

sector funding for affordable<br />

housing in the province since<br />

2012. The Brickfields housing<br />

and rental development in<br />

Newtown was funded by the<br />

GPF and implemented by<br />

the Johannesburg Housing<br />

Company (JHC) as one of the<br />

first inner-city rejuvenation<br />

projects. JHC is a leader in<br />

converting bad buildings to<br />

useable rental space.<br />

The Johannesburg<br />

Development Agency (JDA)<br />

projects range broadly across<br />

many areas within the city, and<br />

include plans to use transport<br />

hubs to improve the lives of<br />

residents living in previously<br />

neglected areas.<br />

Private developer<br />

Indluplace Properties<br />

has purchased nine large<br />

apartment blocks, taking<br />

its total buildings in central<br />

Johannesburg CBD, Berea and<br />

Hillbrow to 23: 33% of the units<br />

are bachelor pads, 22% are<br />

two-bedroomed flats. The listed<br />

company (its major shareholder<br />

is Arrowhead) intends to<br />

“aggressively grow its portfolio”<br />

of high-yielding properties as it<br />

believes the rental market has<br />

huge potential.<br />

Property developments<br />

Quite what the future of office space will be remains to<br />

be seen in the wake of Covid-19. Investment and pension<br />

funds are heavily invested in commercial and residential<br />

property so this is something that will be closely<br />

monitored in the early <strong>2020</strong>s.<br />

The hugely successful Sandton model of office and<br />

accommodation development is being replicated across<br />

the province. Sandton’s 10 000 businesses and 300 000<br />

residents are spoilt for accommodation choices, but<br />

city-like developments are springing up in other parts of<br />

<strong>Gauteng</strong> as well.<br />

The newest is Castle Gate Lifestyle Centre, which is being<br />

built in Pretoria as the first phase in a multi-use development<br />

that will eventually comprise offices, medical facilities, a hotel<br />

along with a retail centre and more than 1 000 residential<br />

units. The R6-billion project is being undertaken by Atterbury<br />

and the Carl Erasmus Trust.<br />

The biggest is Menlyn Maine in the eastern suburbs of Pretoria.<br />

Not only is this a huge multi-use project, it also aims to be South<br />

Africa’s first “Green Precinct”. Professional services and consulting<br />

firm PwC has chosen the Waterfall City estate near Midrand as<br />

the site for its R1.5-billion headquarters, housing 3 500 employees<br />

with a total of 40 000m² of lettable space. The building is owned<br />

by Attacq and developed by Atterbury.<br />

Rosebank’s popularity as an office node continues to<br />

grow and Melrose Arch has proved a popular development,<br />

but none of this has stopped Sandton continue to expand<br />

and it remains first choice as the national base for several<br />

large companies. Recent new headquarters have been<br />

constructed for Discovery and Sasol.<br />

The trend called “semigration” has been having a<br />

downward effect on <strong>Gauteng</strong>’s residential property prices<br />

for some time. Semigration refers to people moving within<br />

the country – not quite emigrating – to the Western Cape.<br />

Pam Golding Properties CEO Andrew Golding told the<br />

Sunday Times in November 2019 that the Cape drought<br />

had led to other areas such as the Garden Route and the<br />

north coast of KwaZulu-Natal becoming more popular as<br />

destinations. ■<br />

17 GAUTENG BUSINESS <strong>2020</strong>/<strong>21</strong>

10 REASONS<br />

WHY YOU SHOULD INVEST IN SOUTH AFRICA<br />

01.<br />

HOT EMERGING<br />

MARKET<br />

Growing middle class, affluent consumer<br />

base, excellent returns on investment.<br />

02.<br />

MOST DIVERSIFIED<br />

ECONOMY IN AFRICA<br />

South Africa (SA) has the most industrialised economy in Africa.<br />

It is the region’s principal manufacturing hub and a leading<br />

services destination.<br />

LARGEST PRESENCE OF MULTINATIONALS<br />

ON THE AFRICAN CONTINENT<br />

SA is the location of choice of multinationals in Africa.<br />

03.<br />

Global corporates reap the benefits of doing business in<br />

SA, which has a supportive and growing ecosystem as a<br />

hub for innovation, technology and fintech.<br />

05.<br />

FAVOURABLE ACCESS TO<br />

GLOBAL MARKETS<br />

ADVANCED FINANCIAL SERVICES<br />

& BANKING SECTOR<br />

SA has a sophisticated banking sector with a major<br />

footprint in Africa. It is the continent’s financial hub,<br />

with the JSE being Africa’s largest stock exchange by<br />

market capitalisation.<br />

The African Continental Free Trade Area will boost<br />

intra-African trade and create a market of over one<br />

billion people and a combined gross domestic product<br />

(GDP) of USD2.2-trillion that will unlock industrial<br />

development. SA has several trade agreements in<br />

place as an export platform into global markets.<br />

YOUNG, EAGER LABOUR FORCE<br />

09.<br />

SA has a number of world-class universities and colleges<br />

producing a skilled, talented and capable workforce. It<br />

boasts a diversified skills set, emerging talent, a large pool<br />

of prospective workers and government support for training<br />

and skills development.<br />

07.<br />

04.<br />

06.<br />

08.<br />

PROGRESSIVE<br />

CONSTITUTION<br />

& INDEPENDENT<br />

JUDICIARY<br />

SA has a progressive Constitution and an independent judiciary. The<br />

country has a mature and accessible legal system, providing certainty<br />

and respect for the rule of law. It is ranked number one in Africa for the<br />

protection of investments and minority investors.<br />

ABUNDANT NATURAL<br />

RESOURCES<br />

SA is endowed with an abundance of natural resources. It is the leading producer<br />

of platinum-group metals (PGMs) globally. Numerous listed mining companies<br />

operate in SA, which also has world-renowned underground mining expertise.<br />

WORLD-CLASS<br />

INFRASTRUCTURE<br />

AND LOGISTICS<br />

A massive governmental investment programme in infrastructure development<br />

has been under way for several years. SA has the largest air, ports and logistics<br />

networks in Africa, and is ranked number one in Africa in the World Bank’s<br />

Logistics Performance Index.<br />

10.<br />

SA offers a favourable cost of living, with a diversified cultural, cuisine and<br />

sports offering all year round and a world-renowned hospitality sector.<br />

EXCELLENT QUALITY<br />

OF LIFE<br />

Page | 2<br />

19<br />

SOUTH AFRICAN BUSINESS <strong>2020</strong>

Sectoral strengths of of<br />

South South African provinces<br />

SECTORAL SECTORAL STRENGTHS STRENGTHS OF OF<br />

SOUTH SOUTH AFRICA’S AFRICA’S PROVINCES PROVINCES<br />

A wide A wide variety variety of investments of investments are available. are available.<br />

FOCUS FOCUS<br />

Mpumalanga: Mpumalanga:<br />

<strong>Gauteng</strong>: <strong>Gauteng</strong>:<br />

• Mining • Mining<br />

• Financial • Financial and business and business services services<br />

• Tourism • Tourism<br />

• Information • Information and communications<br />

and communications<br />

• Forestry, • Forestry, paper and paper paper and paper<br />

technology technology<br />

products, products, wood and wood wood and wood<br />

• Transport • Transport and logistics and logistics<br />

products products<br />

• Basic • iron Basic and iron steel, and steel steel, products steel products Limpopo: Limpopo: • Agriculture • Agriculture and agroprocessinprocessing<br />

and agro-<br />

• Fabricated • Fabricated metal products metal products • Mining • Mining<br />

• Motor • vehicles, Motor vehicles, parts and parts accessories and accessories • Fertilisers • Fertilisers • Metal • products Metal products<br />

• Appliances • Appliances<br />

• Tourism • Tourism<br />

• Machinery • Machinery and equipment and equipment • Agriculture • Agriculture<br />

• Chemical • Chemical products, products, pharmaceuticals pharmaceuticals • Agro-processing • Agro-processing<br />

• Agro-processing • Agro-processing • Energy, • including Energy, including<br />

North West: North West:<br />

renewables renewables (solar) (solar)<br />

• Mining • Mining<br />

• Agriculture • Agriculture and agro-processing<br />

and agro-processing<br />

KwaZulu-Natal: KwaZulu-Natal:<br />

• Tourism • Tourism<br />

• Transport • Transport and logistics and logistics<br />

• Metal • products Metal products<br />

• Tourism • Tourism<br />

• Machinery • Machinery and equipment and equipment<br />

• Motor • vehicles, Motor vehicles, parts and parts and<br />

• Renewable • Renewable energy (solar) energy (solar)<br />

accessories accessories<br />

• Petrochemicals • Petrochemicals<br />

• Aluminium • Aluminium<br />

• Clothing • Clothing and textiles and textiles<br />

• Machinery • Machinery and equipment and equipment<br />

• Agriculture • Agriculture and agroprocessinprocessing<br />

and agro-<br />

Northern Northern Cape: Cape:<br />

• Mining • Mining<br />

• Forestry, • Forestry, pulp and pulp paper, and paper,<br />

• Agriculture • Agriculture and agro-processing<br />

and agro-processing<br />

wood and wood wood and products wood products<br />

• Fisheries • Fisheries and aquaculture and aquaculture<br />

• Renewable • Renewable energy (solar, energy wind) (solar, wind)<br />

• Jewellery • Jewellery manufacturing manufacturing<br />

Eastern Eastern Cape: Cape:<br />

Western Western Cape: Cape:<br />

•<br />

• Motor vehicles, parts and<br />

Tourism •<br />

• Motor vehicles, parts and<br />

Tourism<br />

accessories accessories<br />

• Financial • Financial and business and business services services<br />

•<br />

• Forestry, wood and wood products<br />

Transport •<br />

• Forestry, wood and wood products<br />

Transport and logistics and logistics<br />

•<br />

• Clothing and textiles<br />

ICT• • Clothing and textiles<br />

ICT<br />

Free State: Free State:<br />

•<br />

• Pharmaceuticals<br />

Agriculture •<br />

• Pharmaceuticals<br />

Agriculture and agro-processing<br />

and agro-processing<br />

• Agriculture • Agriculture and agro-processing<br />

and agro-processing<br />

•<br />

• Leather and leather products<br />

Fisheries •<br />

• Leather and leather products<br />

Fisheries and aquaculture and aquaculture<br />

• Mining • Mining<br />

•<br />

• Tourism<br />

Petrochemicals •<br />

• Tourism<br />

Petrochemicals<br />

• Petrochemicals • Petrochemicals<br />

•<br />

• Renewable energy (wind)<br />

Basic •<br />

• Renewable energy (wind)<br />

iron Basic and iron steel and steel<br />

• Machinery • Machinery and equipment and equipment<br />

• Clothing • Clothing and textiles and textiles<br />

• Tourism • Tourism<br />

• Renewable • Renewable energy (solar, energy wind) (solar, wind)<br />

FOCUS<br />

Source: Industrial Source: Industrial Development Development Corporation Corporation (IDC); The (IDC); Case The for Case<br />

Source: Industrial Development Corporation (IDC)<br />

Investing for Investing South in Africa, South Africa, Executive Executive Summary Summary<br />

Source: Industrial Development Corporation (IDC)<br />

(South African (South Investment African Investment Conference, Conference, 2018). 2018).<br />

(South African Investment Conference, 2018).<br />

Page | 40 Page | 40<br />

19<br />

23 23 SOUTH SOUTH GAUTENG<br />

AFRICAN AFRICAN BUSINESS<br />

BUSINESS BUSINESS <strong>2020</strong>/<strong>21</strong><br />

<strong>2020</strong> <strong>2020</strong>

ADVERTORIAL<br />

see money differently<br />

RELATIONSHIPS AND<br />

UNDERSTANDING CLIENT<br />

NEEDS ARE KEY, SAYS EXPERT<br />

Pedro Rhode, Nedbank’s Provincial General Manager for <strong>Gauteng</strong><br />

East, explains how brand values built on the bank’s expertise can<br />

benefit Nedbank clients, especially in what is now ‘the new normal’.<br />

Our client-centred strategy and digital<br />

innovation enabled us to continue<br />

serving clients in the comfort of their<br />

homes through the Covid-19 lockdown. It<br />

brought convenience to clients and helped<br />

them to comply with lockdown regulations,'<br />

he says.<br />

Rhode says that for small- and mediumsized<br />

business clients, Nedbank continues to<br />

deliver end-to-end solutions through a<br />

dedicated business manager. ‘Our biggerpicture<br />

business approach ensures that<br />

we are able to take a holistic view of each<br />

business by understanding the vision,<br />

cashflow cycle, and transactional and<br />

capital expenditure needs. This way, we<br />

become trusted advisors to the business<br />

owners who strive to grow their business.’<br />

Small businesses often lack formalisation, as<br />

shown by many not qualifying for Covid-19<br />

assistance due to out-of-date records and<br />

not meeting regulatory requirements.<br />

Rhode says that Nedbank’s experts are<br />

available to provide all the support small<br />

businesses need, beyond affordable<br />

banking solutions. ‘We offer value-added<br />

services to get and keep your business<br />

going, such as our free-to-join networking<br />

‘<br />

helps clients with debt<br />

consolidation to ease their<br />

financial difficulties …<br />

’<br />

portal, SimplyBiz.co.za, The Essential Guide<br />

for Small-business Owners, business<br />

registration services and free smallbusiness<br />

seminars.’<br />

Rhode adds that the current economic<br />

climate has highlighted low financial literacy<br />

levels among South Africans who find<br />

themselves highly indebted. 'Nedbank Retail<br />

Banking helps clients with debt consolidation<br />

to ease their financial difficulties, and<br />

financial literacy programmes and tailormade<br />

solutions to empower them to save<br />

and make better financial decisions for the<br />

future.'<br />

‘<br />

Nedbank Retail Banking<br />

To take your financial wellness to the next<br />

level or for more information about Nedbank’s<br />

specialised service offering, email<br />

Pedro Rhode at pedror@nedbank.co.za or<br />

visit www.nedbank.co.za/business.

ADVERTORIAL<br />

see money differently<br />

NEDBANK OFFERS<br />

SPECIALIST SUPPORT<br />

IN POST COVID-19<br />

ENVIRONMENT<br />

Brigitte Ryder, Nedbank’s Provincial<br />

General Manager for <strong>Gauteng</strong> North,<br />

says that Nedbank believes that<br />

clients need a flexible, resilient financial<br />

partner who understands their<br />

circumstances and aspirations, and provides<br />

relevant solutions and a banking experience<br />

that is hassle-free.<br />

Ryder says that, as South Africa progresses<br />

through the various stages of Covid-19,<br />

Nedbank is working through recovery<br />

scenarios with its clients and prospective<br />

clients while staying true to its brand promise,<br />

which is to use its financial expertise to do<br />

good for individuals, families, businesses and<br />

communities in which it operates.<br />

‘Through the Covid-19 pandemic, we have<br />

elevated our client engagement and<br />

extended tailor-made relief assistance to<br />

many of our clients, equipping and enabling<br />

them to benefit from the various digital and<br />

remote solutions available. This ensures<br />

uninterrupted transactional and<br />

informational access while not<br />

compromising on security,’ says Ryder.<br />

Ryder says that <strong>Gauteng</strong> North <strong>Business</strong><br />

Banking has, over the years, established<br />

‘<br />

Through the Covid-19<br />

pandemic, we have elevated<br />

our client engagement and<br />

extended tailor-made relief<br />

assistance to many of our<br />

clients …<br />

’<br />

itself as a leader in providing banking<br />

solutions to various sectors. ‘These include<br />

the professional services industry, which<br />

values our bespoke funding, investment and<br />

transactional solutions, large manufacturing<br />

concerns covering various sub-sectors, and<br />

the information technology industry. As a<br />

result, we have been shielded from specific<br />

industry slowdowns, while adding to the<br />

financial and business acumen and ‘street<br />

cred’ of our frontline sales and service staff.’<br />

To find out more about how Nedbank can<br />

partner with your business togrowa<br />

greater South Africa, please email<br />

Brigitte Ryder at brigitter@nedbank.co.za<br />

or visit www.nedbank.co.za/business.

ADVERTORIAL<br />

see money differently<br />

SOLUTIONS AIMED AT<br />

CREATING JOBS AND<br />

GROWING THE ECONOMY<br />

Nedbank’s Provincial General Manager for <strong>Gauteng</strong> West,<br />

Mawande Shugu, explains how Nedbank is committed to<br />

partnering with businesses and the youth for growth.<br />

‘<br />

Small businesses are the mainstay of<br />

the economy. Nedbank has, over the<br />

years, instituted various interventions<br />

aimed at giving support to the smallbusiness<br />

sector. Over and above our Small<br />

<strong>Business</strong> Services solutions, we provide<br />

small-business owners with support that<br />

goes beyond banking – freeing up their time<br />

to truly focus on running their businesses,’<br />

he says.<br />

Nedbank has built a solid reputation as a<br />

bank for small businesses through initiatives<br />

such as its free-to-join networking portal,<br />

SimplyBiz.co.za, The Essential Guide for<br />

Small-business Owners, business<br />

registration services and free smallbusiness<br />

seminars – all geared to support<br />

small- and medium-sized enterprises.<br />

Shugu is passionate about supporting<br />

South Africa’s youth. ‘I believe it is important<br />

for the business community to invest in our<br />

youth as they are our future. Investing in this<br />

market is crucial for the sustainability of any<br />

business and requires an extensive investment<br />

in agile technological development. At<br />

Nedbank we pride ourselves in developing<br />

products that provide lifestyle benefits and<br />

offerings that enable the financial<br />

‘<br />

I believe it is important for<br />

the business community to<br />

invest in our youth as they<br />

are our future …<br />

’<br />

aspirations of our youth market. For<br />

example, our Unlock.Me Account offers a<br />

zero monthly maintenance fee, with<br />

additional lifestyle benefits perfect for<br />

clients between the ages of 16 and 26,’<br />

he says.<br />

Shugu says that, through an evolving and<br />

agile digital strategy supported by the<br />

Nedbank Money app and the Nedbank<br />

Contact Centre, Nedbank remains<br />

committed to bringing convenience to its<br />

clients by making essential banking services<br />

available 24 hours, seven days a week.<br />

If you wish to tap into our expertise to reach<br />

your personal and business goals, please<br />

email Mawande Shugu at<br />

mawandes@nedbank.co.za or visit<br />

www.nedbank.co.za.

ADVERTORIAL<br />

see money differently<br />

MONEY EXPERTS SERVING<br />

THE TSHWANE BUSINESS<br />

COMMUNITY<br />

Mohammed Salim Kadoo, Nedbank’s Provincial General Manager for<br />

Tshwane and North West, says that a deep commitment to partnership<br />

is what underlies the team's personal and professional values.<br />

‘<br />

Our bigger-picture banking approach<br />

enables us not only to provide you …<br />

with the banking solutions you need,<br />

but also to give you a holistic view of how<br />

our products are connected to create a<br />

framework that yields maximum impact<br />

across every facet of your business and<br />

beyond. We know that success in business is<br />

about partnerships, so we put the building<br />

of deep, lasting, value-adding relationships<br />

at the centre of everything we do. This<br />

means your goals are our goals, your vision<br />

is our vision, and your success is our success<br />

– while you rely on our additional support<br />

that is most needed in times of change and<br />

uncertainty,’ he says.<br />

The bank caters for all industries, but the<br />

Tshwane team has many clients in the<br />

franchising and agricultural sectors. 'The<br />

banking products and services tailored<br />

specifically for these sectors and designed<br />

to achieve overall business efficiency,<br />

profitability and sustainability make Nedbank<br />

one of the most franchise-friendly banks in<br />

South Africa and one of the market-leading<br />

banks in the agricultural space,' says Kadoo.<br />

Nedbank’s highly competitive pricing is<br />

structured to the needs and individual risk<br />

‘<br />

business efficiency, profitability<br />

and sustainability make Nedbank<br />

one of the most franchise-friendly<br />