Al Mal eyes promising outlook for UAE equities to build on 15-year outperformance

Leading fund manager marks 15-year track record of outperforming peers and indices in UAE equities Fund aims to leverage reforms that offer scope for domestic growth and expat influx Fund is up year to date while paying a 4.5% dividend to shareholders UAE, November 24 2020 (Arab Newswire) – Al Mal Capital (“AMC”) aims to continue the stellar performance in its UAE Equity Fund due to the growing diversity in the domestic economy and with the reforms that are expected to attract more foreign investors. Following the launch 15 years ago, the fund has created a consistent alpha by outperforming peers and indices alike. Even amid the economic challenges for the UAE in 2020 due to COVID-19 and the collapse in oil prices, the fund is up 3.3% year to date. This is particularly notable given the Dubai index has lost 11% and the Abu Dhabi index is up 3% over the same period. Commenting on the Fund’s performance, Naser Al Nabulsi, Vice Chairman and CEO of Al Mal Capital said: “The investment landscape in 2020 was challenging across the region and globally. However, our asset management team’s stellar performance proves that active portfolio management with a skillful team, clear strategies, consistent application of investment policy and processes can outperform in challenging times.”

Leading fund manager marks 15-year track record of outperforming peers and indices in UAE equities

Fund aims to leverage reforms that offer scope for domestic growth and expat influx

Fund is up year to date while paying a 4.5% dividend to shareholders

UAE, November 24 2020 (Arab Newswire) – Al Mal Capital (“AMC”) aims to continue the stellar performance in its UAE Equity Fund due to the growing diversity in the domestic economy and with the reforms that are expected to attract more foreign investors.

Following the launch 15 years ago, the fund has created a consistent alpha by outperforming peers and indices alike. Even amid the economic challenges for the UAE in 2020 due to COVID-19 and the collapse in oil prices, the fund is up 3.3% year to date. This is particularly notable given the Dubai index has lost 11% and the Abu Dhabi index is up 3% over the same period.

Commenting on the Fund’s performance, Naser Al Nabulsi, Vice Chairman and CEO of Al Mal Capital said: “The investment landscape in 2020 was challenging across the region and globally. However, our asset management team’s stellar performance proves that active portfolio management with a skillful team, clear strategies, consistent application of investment policy and processes can outperform in challenging times.”

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g> <str<strong>on</strong>g>eyes</str<strong>on</strong>g> <str<strong>on</strong>g>promising</str<strong>on</strong>g> <str<strong>on</strong>g>outlook</str<strong>on</strong>g> <str<strong>on</strong>g>for</str<strong>on</strong>g> <str<strong>on</strong>g>UAE</str<strong>on</strong>g> <str<strong>on</strong>g>equities</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>build</str<strong>on</strong>g><br />

<strong>on</strong> <strong>15</strong>-<strong>year</strong> outper<str<strong>on</strong>g>for</str<strong>on</strong>g>mance<br />

Dubai, United Arab Emirates (Arab Newswire)<br />

• Leading fund manager marks <strong>15</strong>-<strong>year</strong> track record of outper<str<strong>on</strong>g>for</str<strong>on</strong>g>ming peers and indices in<br />

<str<strong>on</strong>g>UAE</str<strong>on</strong>g> <str<strong>on</strong>g>equities</str<strong>on</strong>g><br />

• Fund aims <str<strong>on</strong>g>to</str<strong>on</strong>g> leverage re<str<strong>on</strong>g>for</str<strong>on</strong>g>ms that offer scope <str<strong>on</strong>g>for</str<strong>on</strong>g> domestic growth and expat influx<br />

• Fund is up <strong>year</strong> <str<strong>on</strong>g>to</str<strong>on</strong>g> date while paying a 4.5% dividend <str<strong>on</strong>g>to</str<strong>on</strong>g> shareholders<br />

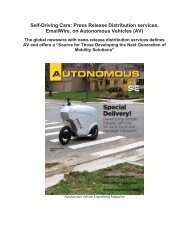

Figure 1 <str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g> Capital Team: Naser Nabulsi (left) and Sherif El-Haddad (right)<br />

<str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g> Capital (“AMC”) aims <str<strong>on</strong>g>to</str<strong>on</strong>g> c<strong>on</strong>tinue the stellar per<str<strong>on</strong>g>for</str<strong>on</strong>g>mance in its <str<strong>on</strong>g>UAE</str<strong>on</strong>g> Equity Fund due <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

the growing diversity in the domestic ec<strong>on</strong>omy and with the re<str<strong>on</strong>g>for</str<strong>on</strong>g>ms that are expected <str<strong>on</strong>g>to</str<strong>on</strong>g> attract<br />

more <str<strong>on</strong>g>for</str<strong>on</strong>g>eign inves<str<strong>on</strong>g>to</str<strong>on</strong>g>rs.

Following the launch <strong>15</strong> <strong>year</strong>s ago, the fund has created a c<strong>on</strong>sistent alpha by outper<str<strong>on</strong>g>for</str<strong>on</strong>g>ming<br />

peers and indices alike. Even amid the ec<strong>on</strong>omic challenges <str<strong>on</strong>g>for</str<strong>on</strong>g> the <str<strong>on</strong>g>UAE</str<strong>on</strong>g> in 2020 due <str<strong>on</strong>g>to</str<strong>on</strong>g> COVID-<br />

19 and the collapse in oil prices, the fund is up 3.3% <strong>year</strong> <str<strong>on</strong>g>to</str<strong>on</strong>g> date. This is particularly notable given<br />

the Dubai index has lost 11% and the Abu Dhabi index is up 3% over the same period.<br />

Commenting <strong>on</strong> the Fund’s per<str<strong>on</strong>g>for</str<strong>on</strong>g>mance, Naser <str<strong>on</strong>g>Al</str<strong>on</strong>g> Nabulsi, Vice Chairman and CEO of <str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g><br />

Capital said: “The investment landscape in 2020 was challenging across the regi<strong>on</strong> and globally.<br />

However, our asset management team’s stellar per<str<strong>on</strong>g>for</str<strong>on</strong>g>mance proves that active portfolio<br />

management with a skillful team, clear strategies, c<strong>on</strong>sistent applicati<strong>on</strong> of investment policy and<br />

processes can outper<str<strong>on</strong>g>for</str<strong>on</strong>g>m in challenging times.”<br />

Being selective breeds success<br />

“The real estate and financial sec<str<strong>on</strong>g>to</str<strong>on</strong>g>rs have been under pressure this <strong>year</strong>, the fund – which has<br />

exposure of nearly 60% <str<strong>on</strong>g>to</str<strong>on</strong>g> these industries – has benefited from a combinati<strong>on</strong> of its allocati<strong>on</strong><br />

<str<strong>on</strong>g>to</str<strong>on</strong>g> defensive sec<str<strong>on</strong>g>to</str<strong>on</strong>g>rs and by taking an active approach in investing in oversold names”, reveals<br />

AMC’s Head of Asset Management, Sherif El Haddad.<br />

The fund has also benefitted from M&A activity in the <str<strong>on</strong>g>UAE</str<strong>on</strong>g> and c<strong>on</strong>tinues <str<strong>on</strong>g>to</str<strong>on</strong>g> be positi<strong>on</strong>ed in<br />

businesses with good management where the firm sees str<strong>on</strong>g growth potential.<br />

Laying foundati<strong>on</strong>s <str<strong>on</strong>g>for</str<strong>on</strong>g> the future<br />

Other reas<strong>on</strong>s <str<strong>on</strong>g>for</str<strong>on</strong>g> optimism from a macro perspective, with proactive re<str<strong>on</strong>g>for</str<strong>on</strong>g>ms and initiatives <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

drive growth going <str<strong>on</strong>g>for</str<strong>on</strong>g>ward, comprise off the Dubai’s government’s AED500 milli<strong>on</strong> ec<strong>on</strong>omic<br />

stimulus package <str<strong>on</strong>g>to</str<strong>on</strong>g> support various business sec<str<strong>on</strong>g>to</str<strong>on</strong>g>rs across the ec<strong>on</strong>omy, with the package<br />

targeted <str<strong>on</strong>g>to</str<strong>on</strong>g> shore up SMEs, through a set of rent reducti<strong>on</strong>s and fee exempti<strong>on</strong>s and also the Abu<br />

Dhabi government’s roll out of the anticipated FDI license, allowing <str<strong>on</strong>g>for</str<strong>on</strong>g>eign inves<str<strong>on</strong>g>to</str<strong>on</strong>g>rs <str<strong>on</strong>g>to</str<strong>on</strong>g> hold<br />

100% ownership of their businesses within the emirate<br />

“In line with these trends and growth prospects, the fund plans <str<strong>on</strong>g>to</str<strong>on</strong>g> c<strong>on</strong>tinue <str<strong>on</strong>g>to</str<strong>on</strong>g> pay shareholders<br />

a dividend of 4.5% of the fund’s NAV.” added El Haddad.<br />

###<br />

ABOUT AL MAL CAPITAL<br />

<str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g> Capital is a diversified, multi-line investment instituti<strong>on</strong>, licensed and regulated by the<br />

Central Bank of the United Arab Emirates and headquartered in Dubai. The Company commits<br />

<str<strong>on</strong>g>to</str<strong>on</strong>g> uphold the highest levels of service quality, integrity and corporate governance standards, and<br />

places a str<strong>on</strong>g emphasis <strong>on</strong> the company's principles in c<strong>on</strong>ducting business. <str<strong>on</strong>g>Al</str<strong>on</strong>g> <str<strong>on</strong>g>Mal</str<strong>on</strong>g> Capital

offers a wide range of investment products and services <str<strong>on</strong>g>for</str<strong>on</strong>g> instituti<strong>on</strong>s, banks and HNWI’s,<br />

encompassing Asset Management, Investment Banking, Direct Investments and Capital Markets.<br />

PR c<strong>on</strong>tact in<str<strong>on</strong>g>for</str<strong>on</strong>g>mati<strong>on</strong>:<br />

Insight Discovery<br />

+97<strong>15</strong>5 8809676<br />

silli<str<strong>on</strong>g>to</str<strong>on</strong>g>e@insight-discovery.com<br />

www.insight-discovery.com<br />

This press release was issued through ArabNewswire.com – a newswire with press release distributi<strong>on</strong><br />

services <str<strong>on</strong>g>to</str<strong>on</strong>g> Middle East and North Africa (MENA) and the Arab World. For more in<str<strong>on</strong>g>for</str<strong>on</strong>g>mati<strong>on</strong>, go <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

https://arabnewswire.com/al-mal-<str<strong>on</strong>g>eyes</str<strong>on</strong>g>-<str<strong>on</strong>g>promising</str<strong>on</strong>g>-<str<strong>on</strong>g>outlook</str<strong>on</strong>g>-<str<strong>on</strong>g>for</str<strong>on</strong>g>-uae-<str<strong>on</strong>g>equities</str<strong>on</strong>g>-<str<strong>on</strong>g>to</str<strong>on</strong>g>-<str<strong>on</strong>g>build</str<strong>on</strong>g>-<strong>on</strong>-<strong>15</strong>-<strong>year</strong>outper<str<strong>on</strong>g>for</str<strong>on</strong>g>mance/<br />

Press release distributi<strong>on</strong> services provided by EmailWire.com: http://www.emailwire.com.<br />

Press Release Distributi<strong>on</strong> with Guaranteed Results<br />

Teleph<strong>on</strong>e: +1 281-645-4086 WhatsApp: +1 832-716-2363. Chat <strong>on</strong> Skype: groupwebmedia<br />

Arab Newswire, EmailWire.Com and EmailWireClip are trademarks of GroupWeb Media LLC.<br />

© 2020 GroupWeb Media LLC