GORDON SILVER GERALD M. GORDON, ESQ. Nevada Bar No ...

GORDON SILVER GERALD M. GORDON, ESQ. Nevada Bar No ...

GORDON SILVER GERALD M. GORDON, ESQ. Nevada Bar No ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

'3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

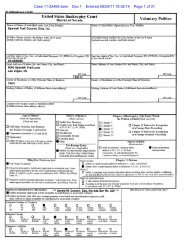

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 1 of 15<br />

<strong>GORDON</strong> <strong>SILVER</strong><br />

<strong>GERALD</strong> M. <strong>GORDON</strong>, <strong>ESQ</strong>.<br />

<strong>Nevada</strong> <strong>Bar</strong> <strong>No</strong>. 229<br />

E-mail: ggordon@gordonsilver.com<br />

GREGORY E. GARMAN, <strong>ESQ</strong>.<br />

<strong>Nevada</strong> <strong>Bar</strong> <strong>No</strong>. 6654<br />

E-mail: ggarman@gordonsilver.com<br />

CANDACE C. CLARK, <strong>ESQ</strong>.<br />

<strong>Nevada</strong> <strong>Bar</strong> <strong>No</strong>. 11539<br />

E-mail: cclark@gordonsilver.com<br />

3960 Howard Hughes Pkwy., 9th Floor<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

Telephone (702) 796-5555<br />

Facsimile (702) 369-2666<br />

[Proposed] Attorneys for Debtor<br />

UNITED STATES BANKRUPTCY COURT<br />

FOR THE DISTRICT OF NEVADA<br />

In re: Case <strong>No</strong>.: 11-23466-BAM<br />

Chapter 11<br />

SPANISH TRAIL COUNTRY CLUB, INC.,<br />

a <strong>Nevada</strong> non-profit corporation.<br />

Debtor. Date: OST Pending<br />

Time: OST Pending<br />

OMNIBUS DECLARATION OF FARHANG ROHANI IN SUPPORT OF DEBTOR'S<br />

FIRST DAY MOTIONS<br />

I, Farhang Rohani, hereby declare as follows:<br />

1. I am over the age of 18 and am mentally competent. I make this declaration in<br />

support of Debtor's Emergency Motion Pursuant to 11 U.S.C. 105(a) and 366 for an Order<br />

Determining that Adequate Assurance Has Been Provided to the Utility Companies (the "Utility<br />

Motion), Emergency Motion for Order Permitting Debtor to Honor Customer Deposits and<br />

Member Credits (the "Deposits Motion"), Emergency Motion for Order Authorizing Debtor<br />

Spanish Trail Other Employee<br />

Obligations (the "Wages Motion"), and Emergency Motion For Entry of an Interim Order<br />

Pursuant to Bankruptcy Rule 4001(b) and LR 4001(b): (1) Preliminarily Determining Extent of<br />

Cash Collateral and Authorizing Interim Use of Cash Collateral by Debtor; and (2) Scheduling a<br />

103089-001/13032542.doc

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

Final Hearing to Determine Extent of Cash Collateral And Authorizing Use of Cash Collateral<br />

by Debtor (the "Cash Collateral Motion," collectively, the "First Day Motions"). 1<br />

2. Debtor in this Chapter 11 Case is Spanish Trail Country Club, Inc., a <strong>Nevada</strong> non-<br />

profit corporation (the "Debtor") incorporated on September 13, 1983, for the purpose of owning<br />

and operating a prestigious, private country club and golf course, which filed its petition for<br />

relief under Chapter 11 of the Bankruptcy Code on August 24, 2011 (the "Petition Date").<br />

3. I am the General Manager and Chief Operating Officer ("GM/COO") of Debtor,<br />

and have served in that capacity since March 2009. As the leader of the overall management<br />

team for the Debtor, I am responsible for managing its day-to-day operations, including, but not<br />

limited to, oversight of financial analysis, budgeting, reviewing corporate tax filings, cash<br />

management of corporate funds, management of employee benefit plans, negotiation of all<br />

contracts, and insurance risk management. As the GM/COO, I supervise fifty-two employees; I<br />

am also responsible for the management of the following departments: membership, purchasing,<br />

receiving, accounting, finance, food and beverage, and golf course maintenance.<br />

4. Prior to my employment with Debtor, from 1998 to 2009, I served as general<br />

manager of the three golf courses then owned and operated by Lake Las Vegas ("Lake Las<br />

Vegas") located in Henderson, <strong>Nevada</strong>. Before accepting the position with Lake Las Vegas, I<br />

had worked with Debtor as its Clubhouse Manager from 1986 to 1998. As my experience in the<br />

golf course industry extends the length of my entire career of approximately twenty-five years, I<br />

am familiar with and have an understanding of the golf course industry in the Las Vegas Valley<br />

as it has developed and evolved over the course of such time.<br />

5. In my capacity as GM/COO, I am familiar with Debtor's daily business,<br />

operations, and financial affairs. Except as otherwise indicated, all of the facts set forth in this<br />

Declaration are based upon my personal knowledge of Debtor's operations and finances,<br />

information learned from my review of relevant documents, and information supplied to me by<br />

27 1 All capitalized, undefined terms shall have the meaning ascribed to them in the applicable Motion.<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 2 of 15<br />

103089-001/1303254_2.doc

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 3 of 15<br />

other members of Debtor's management and Debtor's business and legal advisors. If called<br />

upon to testify as to the content of this Declaration, I could and would do so.<br />

6. Attached hereto as Exhibit "1" is a summary of projected income and expenses<br />

for the thirteen weeks following the Petition Date (the "Budget"), which concludes on <strong>No</strong>vember<br />

21, 2011. Each expense included within the Budget is a necessary expense to maintain, preserve,<br />

Debtor's operations.<br />

A. Debtor's Operations.<br />

1. The Club.<br />

7. Debtor owns and operates Spanish Trail Country Club (the "Club"), one of the<br />

oldest and most prestigious, private, not-for-profit, golf and country clubs in Las Vegas,<br />

<strong>Nevada</strong>. 2 Situated within the Spanish Trail Master Association (the "Master Association"),<br />

which is a master-planned luxury residential community located west of Rainbow Avenue and<br />

south of Tropicana Avenue in Las Vegas, <strong>Nevada</strong>, the Club sits on a 249.110-acre site, more<br />

specifically identified as APNs: 163-27-115-004, 163-28-119-001, 163-27-116-001, 163-27-<br />

116-003, 163-28-216-001, 163-28-522-001, 163-28-522-001, and 163-28-701-001 (the "Real<br />

Property").<br />

8. The vast majority of the Real Property has been developed to provide a<br />

masterpiece 27-hole golf course (the "Golf Course") designed by the legendary golf course<br />

architect, Robert Trent Jones, Jr., which touts tree-lined fairways, undulating hills, fifteen lakes<br />

with streams and waterfalls, 120 bunkers, and sweeping mountain vistas to create a unique golf<br />

experience.<br />

9. In addition to the Golf Course, the ancillary improvements to the Real Property<br />

include an approximately 57,000 square-foot clubhouse (the "Clubhouse"), which includes a<br />

restaurant, a lounge, snack bar, banquet rooms, designated areas for players' locker rooms, and<br />

administrative offices.<br />

2 When Debtor acquired the Real Property, Debtor agreed to maintain and use the Real Property solely for operation<br />

of a private golf and country club. Should Debtor cease to maintain the Real Property for this purpose, the Real<br />

Property shall revert immediately to the grantor.<br />

103089-001/13032542.doc<br />

3

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 4 of 15<br />

10. Also located on the Real Property are the 5,000 square-foot cart storage ("Cart<br />

Storage") used for the storage and maintenance of the golf carts leased by Debtor and made<br />

available for use on the Golf Course, and approximately 14,000 square feet allocated for<br />

maintenance facilities (the "Maintenance Facilities"), which facility houses the equipment and<br />

supplies necessary to maintain the Golf Course.<br />

11. In connection with the Golf Course, the Club also provides a driving range,<br />

chipping green, practice bunker, and putting green (collectively, the "Practice Greens,"<br />

collectively, with the Golf Course, Clubhouse, Cart Storage, and Maintenance Facilities, the<br />

"Facilities").3<br />

12. In addition to the foregoing assets, Debtor also has constructed on the Real<br />

Property a tower (the "Cell Tower"), which it leases from time to time for the purpose of<br />

providing mobile/wireless communications services.<br />

13. In 2007, Debtor completed a large scale renovation of the Clubhouse and the Golf<br />

Course (the "Renovation"). The Clubhouse renovation included a complete remodel of the<br />

interior, exterior, and kitchen. The Golf Course renovation included a new irrigation system,<br />

landscape upgrades, water feature, and improvement of the tees and greens on the Canyon Nine,<br />

which represents one of the Golf Course's three nine-hole courses.<br />

2. The Club Members.<br />

14. As a private country club and golf course, the Club extends the following<br />

discretionary memberships (collectively, the "Members"): (1) Full Members: Full or regular<br />

members are proprietary, voting members having a beneficial interest in the Club and having<br />

complete use of all of the Golf Course and Facilities; (2) Founder Members: Founder members<br />

are those individuals holding the same rights and privileges as a Full Member who purchased<br />

one of the initial memberships designated as Founder memberships by the Board; (3) Lifetime<br />

Members: Lifetime members are those individuals holding the same rights and privileges as a<br />

3 It should be noted that the amenities available to the Members include access to twelve tennis courts and full<br />

swimming pool facilities, which facilities are neither owned nor operated by the Club, but rather by the Master<br />

Association, which has agreed to provide the Members access to their property in exchange for a monthly fee<br />

payable by the Club.<br />

103089-001/13032542.doc<br />

4

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 5 of 15<br />

Full Member who in exchange for no monthly membership dues purchased a lifetime<br />

membership; (4) Social Members: Social members are proprietary, voting members having a<br />

beneficial interest in the Club and having complete use of all of the Club's Facilities except the<br />

Golf Course; 4 (5) Associate Members: Associate members are non-proprietary, non-voting<br />

members who have a principal residence outside of Clark County, <strong>Nevada</strong>, who are permitted to<br />

use all of the Club's Facilities, but not permitted to participate in Club organized golf or social<br />

events; (6) Junior Members: Junior members are non-voting, non-transferable memberships<br />

available to individuals between the ages of 21 and 40 years; and (7) Honorary Members:<br />

Honorary members are those individuals extended the privilege of membership at the discretion<br />

of the Board who hold non-voting, non-proprietary, and non-transferable memberships.<br />

15. As of the Petition Date, the Club's member roster was comprised of<br />

approximately 220 Full Members; 5 Founder Members; 12 Lifetime Members; 110 Social<br />

Members; 35 Associate Members; 40 Junior Members; and 4 Honorary Members for a total of<br />

approximately 426 total Members. Initiation fees and monthly membership dues vary by voting<br />

and non-voting categories, and are adjusted periodically to certain annual increase restrictions.<br />

3. The Club Management.<br />

16. Debtor's business and affairs are controlled by its Board of Directors (the<br />

"Board"), comprised of only Club Members elected by the Club Membership s for an initial term<br />

of three (3) years, and serving no longer than two (2) successive terms for a total of six (6) years.<br />

As of the Petition Date, the Board consisted of the following individuals: Mark Hedge ("Mr.<br />

Hedge"), Bob King ("Mr. King"), Guyan Long ("Mr. Long"), Art Carll, Olga Lyles, Chris<br />

Publow, and Ben Hamilton. The members of the Board receive no compensation for their<br />

services.<br />

17. The Board has five committees: (1) the House Committee, which has the<br />

responsibility for management and control of the Clubhouse; (2) the Greens Committee, which<br />

4 Full Members each have four votes for electing the Club's Board of Directors compared to one vote for Social<br />

Members.<br />

5 The Full Members and the Social Members collectively comprise the "Club Membership."<br />

103089-001/1303254_2.doc<br />

5

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 6 of 15<br />

has the responsibility for the management and control of the Golf Course and the grounds of the<br />

Club; (3) the Finance Committee, which has the responsibility of oversight of the Club's<br />

financial affairs; (4) Golf Committee, which has the responsibility for the management and<br />

direction of all matters related to the play of golf, golf tournaments and golf handicaps; and the<br />

(5) Membership Committee, which has the responsibility for reviewing and making<br />

determinations as to the qualifications of all persons proposed for membership to the Club.<br />

18. As appointed by the Board, the Club's officers include Mr. Hedge as the President<br />

and Chief Executive Officer, appointed in June 2011; Mr. King as Vice President, appointed in<br />

June 2011; and Mr. Long as Treasurer and Secretary, appointed in June 2011. In connection<br />

with the services rendered by the foregoing individuals in their official capacities, none are<br />

entitled to receive compensation.<br />

B. Debtor's Secured Loan Obligation.<br />

19. In connection with the Renovation, a Loan Agreement ("Loan Agreement") was<br />

entered into between Debtor and Jackson National Life Insurance Company, a Michigan<br />

corporation (the "Original Lender"), 6 effective as of April 30, 2007, pursuant to which Lender<br />

agreed to lend Debtor the maximum amount of $15 Million (the "Loan"). A true and correct<br />

copy of the Loan Agreement is attached hereto as Exhibit "2."<br />

20. Consistent therewith, Debtor executed a Fixed Rate Promissory <strong>No</strong>te (the "<strong>No</strong>te)<br />

dated April 30, 2007, in favor of Lender, through which Debtor promised to pay Lender the<br />

principal sum of $15 Million, and interest at a fixed rate of 6.52 percent (6.52%). A true and<br />

correct copy of the <strong>No</strong>te is attached hereto as Exhibit "3."<br />

21. As security for the performance of the Debtor's obligations pertaining to the<br />

Loan, Debtor also executed a Collateral Assignment of Contracts, Licenses and Permits (the<br />

"Collateral Assignment") dated April 30, 2007, in favor of Lender, through which Debtor<br />

agreed to assign to Lender all of Debtor's rights, title, and interest in and to any and all contracts,<br />

6 Based on Debtor's information and belief, on or about August 27, 2010, the Original Lender assigned its beneficial<br />

interest in the Loan Agreement, and related documents to Hermitage Management, LLC. Thus, for clarity, the term<br />

Lender as used herein shall refer to Hermitage as successor in interest to Original Lender.<br />

103089-001/13032542.doc<br />

6

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 7 of 15<br />

licenses, and permits (collectively, the "Contracts"), 7 then existing or thereafter entered into or<br />

obtained, relating to Debtor's operations at or in connection with the property 8 and the<br />

improvements then or thereafter constructed thereon. A true and correct copy of the <strong>No</strong>te is<br />

attached hereto as Exhibit "4."<br />

22. Additionally, Debtor executed a Pledge, Assignment and Security Agreement (the<br />

"Pledge Agreement") dated April 30, 2007, in favor of Lender, thereby granting, pledging,<br />

transferring and assigning to Lender a continuing security interest in and right of set-off against<br />

the following, whether then existing or thereafter acquired or arising: all of Debtor's right, title<br />

and interest in, to and under (i) all accounts and revenues of Debtor; (ii) all business assets of<br />

Debtor; and (iii) all books and records of Debtor (collectively, the "Pledged Collateral"). A true<br />

and correct copy of the <strong>No</strong>te is attached hereto as Exhibit "5."<br />

23. Further, Debtor executed the First Lien Deed of Trust, Security Agreement and<br />

Financing Statement dated April 30, 2007 (the "Deed of Trust") in favor of Lender, which<br />

encumbers, among other property, Debtor's real and personal property (collectively,<br />

"Encumbered Property," collectively, with the Contracts and the Pledged Collateral, the<br />

"Collateral") as described in Exhibits A and B to the Deed of Trust. A true and correct copy of<br />

the Deed of Trust is attached hereto as Exhibit "6."<br />

24. On the Petition Date, the outstanding obligation on the <strong>No</strong>te was approximately<br />

$13,471,948 (the "Secured Debt").<br />

C. The Events Necessitating the Bankruptcy Filing.<br />

25. When planning for the Renovation, Debtor's projections were premised upon a<br />

strong economic climate. In connection with the general decline of the Las Vegas economy as a<br />

result of the global recession, the golf course industry in Las Vegas suffered from reduced play<br />

and dramatic membership attrition. 9 Specifically, since 2008, to account for reduced play at<br />

7 The Collateral Assignment identifies Contracts to include, but does not limit them to, those matters designated on<br />

Exhibit B to the Collateral Assignment.<br />

8 The property identified in the Collateral Assignment is that which is described on Exhibit A to the Collateral<br />

Assignment.<br />

9 During my tenure with Lake Las Vegas from 1998 to 2009, as set forth above, I managed the golf courses at the<br />

103089-001/13032542.doc<br />

7

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 8 of 15<br />

public courses and membership attrition at private courses, revenue among Las Vegas'<br />

approximately forty-five golf courses is estimated to be down twenty-five to thirty percent.<br />

26. Debtor similarly has experienced a decline in revenues over the last three years<br />

due to the significant loss of its Members. Since the commencement of my employment, Debtor<br />

has instituted appropriate cost cuts while ensuring that the outstanding integrity of the Golf<br />

Course is maintained.<br />

27. <strong>No</strong>twithstanding Debtor's efforts to improve cash flow and reduce expenses,<br />

which included two increases in membership dues since Renovation, thereby making the Club's<br />

membership dues one of the highest in the Las Vegas area, in or about July 2010, Debtor became<br />

incapable of fully servicing its monthly payment obligations under the <strong>No</strong>te. Prior to such time,<br />

however, Debtor remained current on its monthly payment obligations and reduced its principal<br />

debt obligation by $1.4 Million.<br />

28. As such, in or about July 2010, Debtor commenced negotiations with the Lender<br />

seeking a modification of the terms of the Loan. Despite such efforts, in or about December<br />

2010, Lender sent Debtor a Default <strong>No</strong>tice Letter (the "Default <strong>No</strong>tice Letter"), a true and<br />

correct copy of which is attached hereto as Exhibit "7," advising Debtor that events of default<br />

("Events of Default") had occurred.<br />

29. On or about May 12, 2011, Lender recorded with the Clark County Recorder its<br />

<strong>No</strong>tice of Breach and Election to Sell Under Deed of Trust ("<strong>No</strong>tice of Breach and Election to<br />

Sell"). A true and correct copy of the <strong>No</strong>tice of Breach and Election to Sell is attached hereto as<br />

Exhibit "8."<br />

30. Subsequent to the recordation of the <strong>No</strong>tice of Breach and Election to Sell, on or<br />

about August 16, 2011, Lender recorded its <strong>No</strong>tice of Trustee's Sale ("<strong>No</strong>tice of Sale"), which<br />

thereby advised that the date of September 7, 2011, had been established for the trustee sale<br />

pursuant to the Deed of Trust (the "Sale"). A true and correct copy of the <strong>No</strong>tice of Sell is<br />

attached hereto as Exhibit "9."<br />

(continued)<br />

commencement and throughout the course of the Lake Las Vegas bankruptcy.<br />

103089-001/1303254_2.doc<br />

8

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 9 of 15<br />

31. During that same week, however, Lender also filed an application for the<br />

appointment of a receiver with the Eighth Judicial District Court of Clark County, <strong>Nevada</strong> (the<br />

"District Court"), which seeks the appointment of a receiver and further requests such<br />

application to be heard on shortened time. On August 15, 2011, the District Court entered its<br />

order shortening time to hear such application, thereby setting the hearing (the "Hearing") for<br />

August 24, 2011.1°<br />

D. Debtor's Current Financial Condition.<br />

32. Debtor derives its revenue from the following sources: (1) monthly membership<br />

dues ("Membership Dues"), which are those fees collected from all Members, except Founder,<br />

Lifetime, and Honorary Members, on a monthly basis for the continued use of the Club's<br />

amenities, in particular the Golf Course;" (2) greens fees from Club guests, cart fees for the use<br />

of the golf carts, and retail sales (collectively, the "Golf Shop Revenue"); (3) food and beverage<br />

sales ("Food & Beverage Revenue"), which are those revenues derived from the dining facilities<br />

at the Clubhouse, as well as events and catering services; and (4) rent revenue from the lease of<br />

the Cell Tower ("Rents," collectively with the foregoing, the "Revenue Sources").<br />

33. Debtor's operations are currently cash flow positive prior to debt service, and<br />

Debtor presently has approximately $124,180.48 either in cash on hand or in its bank accounts as<br />

of the Petition Date.<br />

34. For the period of January through July 2011, Debtor's income exceeded its<br />

operating expenses by $355,668. Further from the Petition Date through the end of the fiscal<br />

year ending December 31, 2011, Debtor anticipates that its revenue will exceed its operating<br />

expenses by approximately $176,483.<br />

E. The Utility Motion.<br />

35. In the ordinary course of its business, Debtor incurs utility expenses for<br />

telecommunications, electricity, sewer, water, waste management, internet, cable, and gas.<br />

I ° On August 23, 2011, Debtor received notice that the District Court had continued the hearing to August 31, 2011.<br />

11 The amount of Membership Dues, as established by the Board, varies in accordance with the each Member's<br />

utilization of the Facilities. To illustrate, the amount of Membership Dues for Social Members reflects the nonutilization<br />

of the Golf Course.<br />

103089-001/13032542.doc<br />

9

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 10 of 15<br />

These utility services are provided by the Utility Providers including, but not limited to those<br />

listed on Exhibit "2" that is attached to the Utilities Motion (the "Utility Service List").12<br />

36. On average, Debtor spends approximately $96,390 each month on utility<br />

costs. 13 Due to the nature of Debtor's operations, however, Debtor's reliance on water for the<br />

purpose of maintaining the Golf Course, and electricity for the Clubhouse, cause wide<br />

fluctuations in the monthly utility costs as the costs incurred for water during the summer months<br />

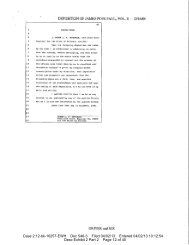

exceed those incurred during the winter months by a minimum of $100,000. The following table<br />

provides a detailed illustration of the costs incurred for water and electricity for the period of<br />

August 2010 through July 2011.<br />

l' k BIT I. Paymen ts for NN ater and Electricity<br />

Monthrik:.u.■,',. ,1 I t: r<br />

Aug- 10 $ 140,168.06 $<br />

Sep-10 $ 117,828.17 $<br />

kun.,,u,.t 2010 through July 2011<br />

Pov,cr \lorithl I otal<br />

36,283.65 $ 176,451.71<br />

34,577.26 $ 152,405.43<br />

Oct-10 $ 47,349.40 $ 28,326.46 $ 75,675.86<br />

<strong>No</strong>v-10 $ 33,544.23 $ 23,333.02 $ 56,877.25<br />

Dec-10 $ 13,731.11 $ 20,046.31 $ 33,777.42<br />

Jan-11 $ 17,803.25 $ 18,611.67 $ 36,414.92<br />

Feb-11 $ 21,896.19 $ 16,768.59 $ 38,664.78<br />

Mar-11 $ 48,417.49 $ 17,354.58 $ 65,772.07<br />

Apr-11 $ 86,765.69 $ 18,660.88 $ 105,426.57<br />

May-11 $ 98,634.45 $ 20,707.80 $ 119,342.25<br />

Jun-11 $ 128,343.58 $ 24,176.46 $ 152,520.04<br />

Jul-11 $ 121,365.23 $ 31,729.36 $ 153,094.59<br />

Monthly Average $ 72,987.24 $ 24,214.67<br />

37. Historically, Debtor has consistently made timely payments to its Utility<br />

Providers. As of the Petition Date, however, Debtor holds outstanding obligations for water and<br />

electricity for the amounts due and owing in August 2011.<br />

12 Although Debtor believes that the Utility Service List includes all of its Utility Providers, Debtor reserves the<br />

right, without the need for further order of the Court, to supplement the Utility Service List if any Utility Provider<br />

has been omitted. Additionally, the listing of an entity on the Utility Service List is not an admission that such entity<br />

is a utility within the meaning of Section 366, and Debtor reserves the right to contest any such characterization in<br />

the future. To the extent any of the Utility Providers identified on the Utility Service List provide services to a nondebtor<br />

entity, Debtor does not anticipate that the procedures set forth in this Motion would be applicable.<br />

13 To calculate the approximate monthly expenditure for utility costs, Debtor determined the average costs based on<br />

actual costs over twelve-month period.<br />

103089-001/13032542.doc<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 11 of 15<br />

38. Preserving utility services on an uninterrupted basis is essential to Debtor's<br />

ongoing operations and, therefore, to the success of its reorganization. Any interruption of utility<br />

services, even for a brief period of time, would disrupt Debtor's ability to continue servicing its<br />

Members, thereby negatively affecting Member relationships, revenues, and profits. Such a<br />

result could jeopardize Debtor's reorganization efforts and, ultimately, Debtor's value and<br />

creditor recoveries. It is therefore critical that utility services continue uninterrupted during this<br />

Chapter 11 Case.<br />

39. Debtor intends to pay the postpetition obligations owed to the Utility Providers in<br />

a timely manner. Debtor expects that it will have ample liquidity, based upon cash on hand and<br />

cash flow from operations, to pay its postpetition obligations to Utility Providers.<br />

40. To provide additional assurance of payment for future services to the Utility<br />

Providers, Debtor proposes to deposit $125,000, a sum that far exceeds Debtor's average<br />

monthly estimated cost of its average monthly utility consumption, or alternatively, exceeds the<br />

combined total for water and power for eight months out of the year (the "Proposed Adequate<br />

Assurance") into a separate, interest-bearing account (the "Utility Deposit Account"). The<br />

Utility Deposit Account will provide still further assurance of future payment, over and above<br />

Debtor's ability to pay for future utility services in the ordinary course of business based upon<br />

their existing cash on hand and cash flow from operations.<br />

F. The Deposits Motion.<br />

41. A significant source of revenue derived from Clubhouse operations relates to<br />

Debtor's Food and Beverage Revenue, which includes events and catering services that Debtor<br />

makes available for the benefit of its Members, as well as the public at-large.<br />

42. In connection with such Events Services, in advance of scheduled events as a<br />

means to secure the obligations in exchange for reserving a particular date and time and making<br />

advance preparations, Debtor typically collects security deposits (the "Security Deposits"),<br />

which amounts are applied to the total financial obligations incurred at the time of the events.<br />

43. As of the Petition Date, Debtor had collected Security Deposits for its Events<br />

Services of approximately $950.<br />

103089-001/13032542.doc<br />

11

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 12 of 15<br />

44. Additionally, Debtor runs various promotions for its Members, which, for<br />

example, provide a member the option to prepay membership dues ("Prepaid Dues" and together<br />

with the Security Deposits, the "Deposits") in exchange for Green Fees for their guests.<br />

45. As of the Petition Date, Debtor estimates that it currently holds Prepaid Dues of<br />

approximately $130,589.38.<br />

46. Maintaining the satisfaction and goodwill of the Members and the public at-large<br />

that have engaged Debtor and placed Security Deposits in anticipation of hosting their events at<br />

the Clubhouse is imperative to the success of any reorganization by Debtor. Furthermore,<br />

Debtor must honor the Prepaid Dues of those Members who have paid their dues in advance, as<br />

the failure to do so would likely trigger a detrimental effect on the morale of the collective body<br />

of Members. As such, if Debtor is unable to honor the Deposits, its operations will be severely<br />

affected.<br />

G. The Wages Motion.<br />

47. As of the Petition Date, Debtor employed approximately fifty-three full and part-<br />

time employees ("Employees") in the ordinary course of its business. Continued service by the<br />

Employees is vital to Debtor's ongoing operations.<br />

48. As of the Petition Date, the Employees were owed or had accrued in their favor,<br />

various sums from Debtor for wages and salaries incurred in the ordinary course of Debtor's<br />

business, including any prepetition compensation (collectively, the "Wage Obligations"). The<br />

total estimated amount of Wage Obligations that will have accrued, but remain unpaid, as of the<br />

Petition Date, is approximately $9,010.00. Debtor pays its Employees on a bi-weekly payroll<br />

cycle with the last pay period ending August 21, 2011.<br />

49. In addition, on behalf of certain of the Employees, Debtor collects various<br />

amounts related to gratuities for services rendered (the "Gratuities") by such Employees. The<br />

total estimated amount of Gratuities that Debtor will have collected, but remain undistributed, as<br />

of the Petition Date, is approximately $9,418.91.<br />

50. Debtor is required by law to withhold from its Employees' wages amounts related<br />

to federal, state, and local income taxes, as well as social security and Medicare taxes and to<br />

103089-001/13032542.doc<br />

12

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 13 of 15<br />

remit the same to the appropriate taxing authorities. To the extent Debtor has deducted funds<br />

from the Employees' paychecks sufficient to pay prepetition taxes, withholding taxes and FICA<br />

contributions attributable to Wage Obligations and Gratuities, which are due but have not been<br />

paid yet to any governmental entity, Debtor seeks authorization to continue to deduct these funds<br />

and pay them to such governmental entities in the ordinary course of business.<br />

51. In addition, Debtor is required to make matching payments from its own funds on<br />

account of social security and Medicare taxes, and to pay, based on a percentage of gross payroll<br />

(and subject to state-imposed limits), additional amounts to the taxing authorities for, among<br />

other things, state and federal unemployment insurance. Debtor seeks authorization to continue<br />

to pay these funds in the ordinary course of business.<br />

52. In addition, in the ordinary course of its business, the Club has accrued amounts<br />

for contributions to 401(k) retirement plans, health and benefit programs, and voluntary<br />

insurance plans pertaining to services rendered by the Employees prior to the Petition Date<br />

(collectively, the "Employee Benefit Plans"). These benefits include health plans (i.e. medical,<br />

dental, vision, and life insurance), flexible spending accounts for healthcare and dependent care,<br />

various welfare plans (i.e. life insurance, disability insurances, accidental death and<br />

dismemberment insurance, long-term care, and critical illness insurance), and other employee<br />

assistance programs. These employee benefit contributions (the "Employee Benefit<br />

Contributions") are an integral part of the compensation to which the Employees are entitled.<br />

The amount of Employee Benefit Contributions which will have accrued, but will remain unpaid,<br />

prior to the Petition Date are estimated to be $2,907.33.<br />

53. If Debtor is unable to take the necessary steps to ensure that wages and taxes are<br />

paid for the pay period commencing immediately prior to the Petition Date and concluding post-<br />

petition, there is a significant risk that large numbers of essential Employees will resign and that<br />

those Employees that remain will be discontented and demoralized. If the relief requested herein<br />

is not granted, the success of Debtor's reorganization will be placed in substantial jeopardy.<br />

Thus, the relief request in this Motion is in the best interests of the Debtor, the Estate and<br />

creditors.<br />

103089-001/13032542.doc<br />

13

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

Gordon Silver<br />

Attorneys At Law<br />

Ninth Floor<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

H. The Cash Collateral Motion.<br />

54. On the Petition Date, Debtor had cash and cash equivalents located on the<br />

Property as of the Petition Date (the "Cash on Hand") and cash in its bank account as of the<br />

Petition Date (the "Deposit Accounts") in the approximate aggregate sum of $124,180.48. As of<br />

the Petition Date, none of the Cash on Hand was under the control of the Lender (the<br />

"Unencumbered Cash").<br />

55. In addition, commencing on the Petition Date and each day thereafter, as set forth<br />

in the Budget, Debtor will generate post-petition Membership Dues, Golf Shop Revenue, Food &<br />

Beverage Revenue, and Rents (the "Post-Petition Cash").<br />

56. Debtor cannot meet its ongoing post-petition obligations unless it has the<br />

immediate ability to use its Unencumbered Cash and the Post-Petition Cash. In the absence of<br />

such use, immediate and irreparable harm will result to Debtor, its estate, and its creditors, and<br />

will render an effective and orderly reorganization of Debtor's business impossible.<br />

57. An integral aspect of maintaining Debtor's business operations is Debtor's ability<br />

to use its Unencumbered Cash and its Post-Petition Cash to maintain a sufficient level of<br />

working capital in order to pay ordinary course obligations such as those to its vendors, utilities,<br />

taxing authorities, insurance, and to pay for necessary ordinary course property maintenance,<br />

especially the continued maintenance of the 27-hole Golf Course, the Club's most valuable asset,<br />

which, due to its fragility and perishability, requires extraordinary efforts by skilled technicians<br />

on a daily basis for its preservation.<br />

58. As set forth in the Budget, Debtor has sufficient cash to meet its operating<br />

expenses, including the resources to meet the demands of the Golf Course. As such, Debtor<br />

asserts that the continued management of the Club, and the Golf Course, in particular, protects<br />

Lender's interests, and serves to mitigate the risk of diminution in value that could result in a few<br />

days' time if the Golf Course were to be left unattended.<br />

/ / /<br />

/ / /<br />

28 ///<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 14 of 15<br />

103089-001/13032542.doc<br />

14

Gordon Silver<br />

Attorneys At Law<br />

Ninth Flo-or<br />

3960 Howard Hughes Pkwy<br />

Las Vegas, <strong>Nevada</strong> 89169<br />

(702) 796-5555<br />

Case 11-23466-bam Doc 10 Entered 08/25/11 15:03:48 Page 15 of 15<br />

I declare under penalty of perjury of the laws of the United States that these facts are true<br />

to the best of my knowledge and belief,<br />

DATED this 25th day of August, 2011.<br />

103089-001/1303254 2.doc<br />

15<br />

FARHANG ROHANI

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 1 of 50<br />

EXHIBIT<br />

1<br />

EXHIBIT<br />

1

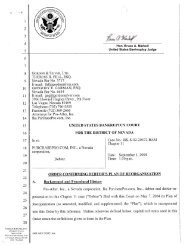

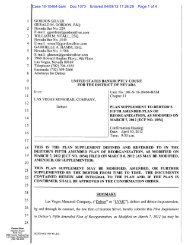

Spanish Trail Country Club<br />

2011<br />

Projected 13 Week Budget Summary<br />

8/24/2011 8/31/2011 9/6/2011 9/13/2011 9/20/2011 9/27/2011 10/4/2011 10/11/2011 10/18/2011 10/25/2011 11/1/2011 11/8/2011 11/15/2011 13 week<br />

Week 1 I Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 TOTAL<br />

Revenue:<br />

Membership Dues $ 75,000 ' $ 75,000 $ 73,000 $ 73,000 $ 73,000 $ 73,000 $ 71,000 $ 71,000 $ 71,000 $ 71,000 $ 71,000 $ 71,000 $ 71,000 $ 939,000<br />

Golf Shop $ 32,500 $ 35,000 $ 40,000 $ 47,000 $ 40,000 $ 52,000 $ 45,000 $ 47,500 $ 47,500 $ 53,500 $ 45,000 $ 40,000 $ 42,250 $ 567,250<br />

Food & Beverage<br />

Miscellaneous<br />

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 2 of 50<br />

$ 20,527 $ 26,439 $ 15,665 $ 17,739 $ 19,151 $ 21,639 $ 29,599 $ 31,069 $ 27,269 $ 28,909 $ 34,946 $ 29,946 $ 32,846 $ 393,252<br />

$ - $ 4,000 $ - $ - $ 4,130 $ - $ - $ 4,000 $ 500 $ - $ $ 14,280<br />

$<br />

Total Revenue $ 128,027 $ 140,439 $ 129,205 $ 137,739 $ 132,151 $ 150,769 $ 146,099 $ 149,569 $ 145,769 $ 157,409 $ 151,446 $ 140,946 $ 146,096 $ 1,855,664<br />

$<br />

Expenses: $<br />

Golf Course $ 116,042 $ 116,042 $ 116,042 $ 116,042 $ 116,042 $ 696,252<br />

Golf Shop $ 15,020 $ 15,020 $ 25,579 $ 8,324 $ 25,579 $ 8,324 $ 27,815 $ 9,985 $ 27,815 $ 9,985 $ 26,467 $ 8,627 $ 26,467 $ 260,012<br />

Food & Beverage $ 12,412 $ 13,694 $ 47,478 $ 13,694 $ 47,478 $ 13,694 $ 66,194 $ 20,884 $ 66,194 $ 20,884 $ 61,151 $ 17,491 $ 61,151 $ 483,283<br />

Clubhouse $ 3,750 $ 3,750 $ 17,728 $ 3,750 $ 17,728 $ 3,750 $ 17,728 $ 3,750 $ 17,728 $ 3,750 $ 17,728 $ 3,750 $ 17,728 $ 132,618<br />

G&A $ 51,100 $ 15,520 $ 11,700 $ 50,200 $ 11,700 $ - $ 11,700 $ 50,200 $ 11,700 $ 11,700 $ 225,520<br />

Proposed Utility Deposit $125,000 $ 125,000<br />

$ -<br />

Total Expenses $ 31,182 $ 83,564 $ 231,305 $ 141,810 $ 102,485 $ 192,010 $ 123,437 $ 150,661 $ 123,437 $ 200,861 $ 117,046 $ 145,910 $ 117,046 $ 1,922,685<br />

$ -<br />

$<br />

$ -<br />

Net Operating Income $ 96,845 $ 56,875 $ (102,100) $ (4,071) $ 29,666 $ (41,241) $ 22,662 $ (1,092) $ 22,332 $ (43,452) $ 34,400 $ (4,964) $ 29,050 $ 94,910<br />

$ -<br />

$ -<br />

Income Prior $ -<br />

to Debt/Capital Purchases, $ 96,845 $ 56,875 $ (102,100) $ (4,071) $ 29,666 $ (41,241) $ 22,662 $ (1,092) $ 22,332 $ (43,452) $ 34,400 $ (4,964) $ 29,050 $ 94,910<br />

$ -<br />

Less Debt: $ -<br />

Leases-Copiers $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 2,775 $ 36,075<br />

Capital Purchases $ -<br />

$ -<br />

Net $ 94,070 $ 54,100 $ 104,875 $ 6,846 $ 26,891 $ 44,016 $ 19,887 $ 3,867 $ 19,557 $ 46,227 $ 31,625 $ 7,739 $ 26,275 $ 58,835

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 3 of 50<br />

EXHIBIT<br />

2<br />

EXHIBIT<br />

2

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 4 of 50<br />

LOAN AGREEMENT<br />

by and between<br />

JACKSON NATIONAL LIFE INSURANCE COMPANY, as Lender<br />

Date: As of April 2L0 , 2007<br />

and<br />

Spanish Trail Country Club, Inc., as Borrower<br />

PROPERTY:<br />

SPANISH TRAIL GOLF AND COUNTRY CLUB<br />

LAS VEGAS, NEVADA<br />

PPM Loan <strong>No</strong>. 06-06401<br />

Page 1 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 5 of 50<br />

LOAN AGREEMENT<br />

This Loan Agreement is dated April30 2007, by and SPANISH TRAIL COUNTRY<br />

CLUB, INC., a <strong>Nevada</strong> non-profit corporation ("Borrower"), and JACKSON NATIONAL<br />

LIFE INSURANCE COMPANY, a Michigan corporation ("Lender").<br />

RECITALS<br />

A. Borrower is a <strong>Nevada</strong> not-for-profit membership organization which has its<br />

principal place of business at 5050 Spanish Trail Lane, Las Vegas, <strong>Nevada</strong> 89113. Its current<br />

membership list (as of March 2007) is set forth on Schedule "A" hereto.<br />

B. Borrower is the owner of certain real estate located in the City of Las Vegas,<br />

County of Clark, State of <strong>Nevada</strong>, consisting of approximately 240 acres, and legally described in<br />

Exhibit "A" hereto (the "Land"), which is improved with the Improvements (the<br />

"Improvements") described on Exhibit "A-1" hereto.<br />

C. Borrower has applied to Lender for a loan (the "Loan") in the maximum amount<br />

of Fifteen Million ($15,000,000.00) Dollars and Lender has agreed to make the Loan on the<br />

terms and conditions contained herein.<br />

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein<br />

contained, the parties hereto agree as follows:<br />

1. DEFINED TERMS. The following terms as used herein shall have the following<br />

meanings:<br />

Agreement: This Loan Agreement, as originally executed or as may be hereafter<br />

supplemented or amended from time to time in writing.<br />

Application/Commitment: Collectively, the "Application" to PPM Finance, Inc.<br />

for the Loan dated February 1, 2007, and the acceptance thereof as a commitment dated<br />

March 2, 2007.<br />

Appraisal: An appraisal prepared by a member of a national appraisal<br />

organization that has adopted the Uniform Standards of Professional Appraisal Practice<br />

(USPAP) established by the Appraisal Standards Board of the Appraisal Foundation. The<br />

appraiser shall use assumptions and limiting conditions established by Lender, and the<br />

appraisal shall be in conformity with Lender's appraisal guidelines and the requirements<br />

of the Application/Commitment.<br />

Borrower: The meaning set forth in the introductory paragraph of this Agreement.<br />

Building Laws: All federal, state and local laws, statutes, regulations, codes,<br />

ordinances, orders, rules and requirements applicable to the development, construction,<br />

Page 2 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 6 of 50<br />

use, operation, management and maintenance of the Project, including without limitation,<br />

all access, building, zoning, planning, subdivision, fire, traffic, safety, health, labor,<br />

discrimination, environmental, air quality, wetlands, shoreline, flood plain laws,<br />

regulations and ordinances, including, without limitation, all applicable requirements of<br />

the Fair Housing Act of 1988, as amended, the Americans with Disabilities Act of 1990,<br />

as amended, and all orders or decrees of any court adopted or enacted with respect thereto<br />

applicable to the Project, as any of the same may from time to time be amended, modified<br />

or supplemented.<br />

Deed of Trust: The Deed of Trust, described in section 2.2 of this Agreement, as<br />

originally executed or as may be hereafter supplemented or amended from time to time in<br />

writing.<br />

Default: Any event, which, if it were to continue uncured, would, with notice or<br />

lapse of time or both, constitute an Event of Default (as such term is defined in<br />

Section 7.1 of this Agreement).<br />

Default Rate: The default interest rate specified in the <strong>No</strong>te.<br />

Environmental Indemnity Agreement: The Environmental Indemnity Agreement<br />

described in Section 2.2 of this Agreement, executed by Borrower, as originally executed<br />

or as may be hereafter supplemented or amended from time to time in writing.<br />

Executive Order and Patriot Act: Executive Order <strong>No</strong>. 13224 on Terrorist<br />

Financing, effective September 24, 2001 (the "Executive Order") and Public Law 107-56,<br />

known as the Uniting and Strengthening America by Providing Appropriate Tools<br />

Required to Intercept and Obstruct Terrorism Act of 2001 (the "Patriot Act").<br />

ERISA: Employee Retirement Income Security Act of 1974, as amended, and the<br />

regulations promulgated thereunder from time to time.<br />

Governmental Approvals: The meaning set forth in Section 4.11 of this<br />

Agreement.<br />

Governmental Authority: Any federal, state, county or municipal government, or<br />

political subdivision thereof, any governmental or quasi-governmental agency, authority,<br />

board, bureau, commission, department, instrumentality, or public body, or any court,<br />

administrative tribunal, or public utility.<br />

Improvements: The meaning set forth in Recital B of this Agreement.<br />

Indemnification Agreement: The indemnification agreement described in<br />

Section 2.2 of this Agreement, executed by Indemnitor, as originally executed or as may<br />

be hereafter supplemented or amended from time to time in writing.<br />

Page 3 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 7 of 50<br />

Include or including: Including but not limited to.<br />

Internal Revenue Code: The Internal Revenue Code of 1986, as amended, and the<br />

regulations promulgated thereunder from time to time.<br />

Knowledge: When used to modify a representation or warranty, actual knowledge<br />

or such knowledge as a reasonable person under the circumstances should have after<br />

diligent inquiry and investigation.<br />

Land: The land legally described in Exhibit A hereto.<br />

Laws: Collectively, all federal, state and local laws, statutes, codes, ordinances,<br />

orders, rules and regulations, including judicial opinions or precedential authority in the<br />

applicable jurisdiction, as any of the same may from time to time be amended, modified<br />

or supplemented.<br />

Lender: The Mortgagee and PPM Finance, Inc., on behalf of and acting as the<br />

investment advisor and authorized representative for the Mortgagee.<br />

Loan: The meaning set forth in Recital C of this Agreement.<br />

Loan Documents: This Agreement, the Environmental Indemnity, the<br />

Indemnification Agreement, the Deed of Trust, the <strong>No</strong>te, the other documents and<br />

instruments listed in Section 2.2 of this Agreement, and all other documents and<br />

instruments given to Lender from time to time in connection with or to secure the Loan,<br />

as originally executed or as any of the same may be hereafter supplemented or amended<br />

from time to time, in writing.<br />

Loan Maturity: Maturity Date (as defined in the <strong>No</strong>te).<br />

Loan Opening Date: The date of the initial disbursement of the Loan.<br />

Members: All members of Borrower in accordance with the provisions of <strong>Nevada</strong><br />

law applicable to non-profit cooperative corporations.<br />

Mortgage: The mortgage, deed of trust, security deed, and deed to secure debt or<br />

similar instrument described in Section 2.2 of this Agreement, as originally executed or as<br />

may be hereafter supplemented or amended from time to time in writing.<br />

Mortgage Correspondent: As of the closing Date of the Loan, the Mortgage<br />

Correspondent is Bonneville Realty Capital and their address is: 777 N. Rainbow<br />

Boulevard, Suite 325, Las Vegas, <strong>Nevada</strong> 89107. Lender retains the right to change the<br />

Mortgage Correspondent at any time during the term of the Loan. Borrower hereby<br />

acknowledges that Lender may utilize Mortgage Correspondent or other outside third<br />

parties selected by Lender in any aspects of the Loan, including but not limited to, the<br />

Page 4 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 8 of 50<br />

servicing, administration and monitoring of the Loan. For purposes of this Loan<br />

Agreement, where it is referenced that information will be provided to "Mortgage<br />

Correspondent and Lender", unless designated otherwise by Lender, the information shall<br />

be provided to Mortgage Correspondent, who will provide the same to Lender. Lender<br />

may, at any time, request that the information be provided to both Mortgage<br />

Correspondent and Lender or to another third party in place of Mortgage Correspondent.<br />

Mortgagee: Jackson National Life Insurance Company, an affiliate of PPM<br />

Finance, Inc.<br />

<strong>No</strong>te: The mortgage note described in Section 2.2 of this Agreement, as originally<br />

executed or as may be hereafter supplemented or amended from time to time in writing.<br />

Permitted Exceptions: Those matters to which the interest of Borrower in the<br />

Real Property may be subject and approved by Lender.<br />

PPM Finance, Inc.: The investment advisor and authorized representative and<br />

affiliate of Mortgagee.<br />

Project: The Land together with the Improvements and any and all other<br />

buildings, structures and improvements located or to be located thereon and all rights,<br />

privileges, easements, hereditaments and appurtenances, thereunto relating or<br />

appertaining, including parking for at least 220 vehicles, which includes 6 handicap<br />

spaces, but in any event parking in compliance with any applicable zoning ordinances and<br />

agreements to which Borrower is a party, and all personal property, fixtures and<br />

equipment required or used (or to be used) for the operation thereof.<br />

Real Property: That portion of the Project constituting real property.<br />

Title Insurer: Lawyers Title Insurance Corporation or such other title insurance<br />

company licensed in the State of <strong>Nevada</strong>, as may be approved by Lender in connection with the<br />

Loan.<br />

Defined terms may be used in the singular or the plural. When used in the singular preceded by<br />

"a", "an", or "any", such term shall be taken to indicate one or more members of the relevant<br />

class. When used in the plural, such term shall be taken to indicate all members of the relevant<br />

class.<br />

2. TERMS OF LOAN AND DOCUMENTS.<br />

2.1 Agreement to Borrow and Lend. Subject to all of the terms, provisions and<br />

conditions set forth in this Agreement, Lender agrees to make and Borrower agrees to accept the<br />

Loan. Borrower agrees to pay all indebtedness evidenced and secured by the Loan Documents in<br />

accordance with the terms thereof.<br />

Page 5 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 9 of 50<br />

2.2 Loan Documents. In consideration of Lender's entry into this Agreement and<br />

Lender's agreement to make the Loan, Borrower agrees that it will, in sufficient time for review<br />

by Lender and its counsel prior to the Loan Opening Date, execute and deliver or cause to be<br />

executed and delivered to Lender the following documents and instruments in form and<br />

substance acceptable to Lender:<br />

(a) A promissory note from Borrower payable to the order of Lender in the<br />

original principal amount of Fifteen Million ($15,000,000.00) Dollars;<br />

(b) A first deed of trust on Borrower's fee simple estate in the Project securing<br />

the <strong>No</strong>te, subject only to the Permitted Exceptions;<br />

(c) An assignment to Lender of all rents, income, issues and profits of, and all<br />

leases, licenses, concessions and other similar agreements relating to or connected with<br />

the Project which shall be a present first priority absolute assignment of all present and<br />

future leases of all or any part of the Project, all guarantees thereof and all rents and other<br />

sums payable thereunder;<br />

(d) A security agreement granting Lender a security interest in all personal<br />

property, tangible and intangible, owned or hereafter acquired by Borrower and relating to<br />

operation or maintenance of the Project, including bank accounts, accounts receivable, all<br />

escrow, impound or reserve accounts required in the Loan Documents, and other<br />

intangible property, which agreement may be combined with the Mortgage;<br />

(e) Uniform Commercial Code financing statements as required by, and in<br />

accordance with, the Uniform Commercial Code as adopted by the State of <strong>Nevada</strong>;<br />

(f) An indemnity agreement with respect to certain matters including<br />

environmental covenants (the "Environmental Indemnity");<br />

(g) A guaranty of completion of the "New Improvements" as described on<br />

Exhibit "B" hereto;<br />

(h) A borrower's affidavit containing certain warranties and representations by<br />

Borrower (the "Borrower's Certificate")<br />

(i) A certificate regarding personal property containing certain warranties and<br />

representations by Borrower regarding the personal property included in the Project;<br />

(j) Any other documents required by the Application/Commitment; and<br />

(k) Such other matters and documents as may be required by this Agreement<br />

or as Lender may reasonably require.<br />

Page 6 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 10 of 50<br />

2.3 Terms of the Loan. The Loan will bear interest for the period and at the rate or<br />

rates set forth in the <strong>No</strong>te, and be payable in accordance with the terms of the <strong>No</strong>te. The<br />

outstanding principal balance, all accrued and unpaid interest and all other sums due and payable<br />

under the <strong>No</strong>te or other Loan Documents, if not sooner paid, shall be paid in full at Loan<br />

Maturity.<br />

2.4 Prepayments. Borrower shall have no right to make prepayments of the Loan in<br />

whole except in accordance with the terms of the <strong>No</strong>te.<br />

2.5 Conditions to Disbursement. Borrower agrees to perform and satisfy all<br />

conditions precedent to the disbursement of the Loan set forth in the Application/Commitment,<br />

including those set forth in Sections 2.4 (Third Party Reports) and 3 (The Closing) thereof.<br />

2.6 Sources and Uses. Borrower shall use the proceeds of the Loan solely for the<br />

purposes set forth in Exhibit C hereto and incorporated herein. This sources and uses statement<br />

must be in substantial accordance with the sources and uses statement attached to the<br />

Application/Commitment.<br />

2.7 Staged Funding. The Loan shall be advanced by Lender in accordance with<br />

Exhibit D hereto, provided that Borrower is in compliance with all provisions hereof and no<br />

Event of Default exists. As soon as available, Borrower shall provide Lender with final<br />

construction budgets for all components of the New Improvements, together with copies of all<br />

contracts executed in connection therewith. The budgets shall be in material conformance with<br />

the estimates included in Exhibit "C" hereto.<br />

3. BORROWER'S COVENANTS. Borrower further covenants and agrees with Lender as<br />

follows:<br />

3.1 Deposits. (a) Borrower shall deposit monthly with Lender or Mortgage<br />

Correspondent a sum equal to one-twelfth (1/12th) of the amount estimated by Lender or<br />

Mortgage Correspondent to be required to pay, at least thirty (30) days prior to their respective<br />

due dates, property taxes, assessments, and insurance premiums for the Project (the "Special<br />

Account"). Lender shall not pay interest on or segregate the Special Account unless required to<br />

do so under applicable law. If Lender is required to segregate the Special Account, Borrower<br />

shall (1) execute such documents as Lender, in its sole discretion, deems necessary to perfect its<br />

security interest in the Special Account and (2) pay the costs of setting-up and maintaining the<br />

Special Account. At Closing, Lender will determine the amount of the initial deposit that must be<br />

made by the Borrower to the Special Account at Closing; and<br />

(b) The Special Account is hereby pledged as additional security for the Loan and<br />

shall be held to be irrevocably applied for the purposes for which made hereunder and shall not<br />

be subject to the direction or control of Borrower; provided, however, that Mortgage<br />

Correspondent shall apply to the payment of taxes, assessments or insurance premiums any<br />

amount so deposited unless (i) there shall exist a Default or Event of Default hereunder or under<br />

any of the Loan Documents, (ii) there are not sufficient funds in the Special Account to pay the<br />

Page 7 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 11 of 50<br />

particular taxes, assessments or insurance premiums and (iii) following payment of such taxes,<br />

assessments or insurance premiums, the Special Account will not be "in balance" in the<br />

reasonable opinion of Lender. In any such events, Borrower shall (aa) either deposit the required<br />

additional funds with the Mortgage Correspondent or Lender or (bb) make all required payments.<br />

3.2 Payment of Taxes. Borrower shall pay all real estate taxes, assessments and<br />

charges of every kind upon the Project before the same become delinquent; provided, however,<br />

that Borrower shall have the right to pay any such tax, assessment or charge under protest or to<br />

otherwise contest any such tax, assessment or charge but only if (i) such contest has the effect of<br />

preventing the collection of such tax, assessment or charge so contested and also preventing the<br />

sale or forfeiture of the Project or any part thereof or any interest therein, (ii) Borrower has<br />

notified Lender in writing in advance of its intent to contest such tax, assessment or charge, and<br />

(iii) Borrower has deposited security in form and amount satisfactory to Lender, in its sole<br />

judgment, and increases the amount of such security so deposited promptly after Lender's request<br />

therefor. If Borrower shall fail to commence such contest or, having commenced such contest,<br />

and having deposited such security required by Lender for its full amount, shall thereafter fail to<br />

prosecute such contest in good faith or with due diligence, or, upon adverse conclusion of any<br />

such contest, shall fail to pay the tax, assessment or charge so contested, Lender may at its<br />

election (but shall not be required to), pay and discharge any such tax, assessment or charge, and<br />

any interest or penalty thereon, and any amounts so expended by Lender shall be deemed to<br />

constitute disbursements of the Loan proceeds hereunder (even if the total amount of<br />

disbursements would exceed the face amount of the <strong>No</strong>te), and shall bear interest from the date<br />

expended at the Default Rate and be payable with such interest upon demand. Lender in making<br />

any payment hereby authorized relating to any tax, assessment or charge, may do so according to<br />

any bill, statement or estimate procured from the appropriate public office without inquiry into<br />

the accuracy of such bill, statement or estimate or into the validity of any tax, assessment, charge,<br />

sale, forfeiture, tax lien or title or claim thereof.<br />

3.3 Maintenance of Insurance.<br />

(a) Insurance Coverage Requirements: Borrower shall maintain insurance<br />

coverage as contained on Exhibit D to the Application/Commitment and as attached hereto and<br />

made a part hereof as Exhibit E.<br />

(b) <strong>No</strong> Other Insurance. Borrower shall not take out separate insurance<br />

concurrent in form or contributing in the event of loss with that required to be maintained<br />

hereunder unless Lender is included thereon under a standard, non-contributory Lender clause<br />

acceptable to Lender. Borrower shall immediately notify Lender whenever any such separate<br />

insurance is taken out and shall promptly deliver to Lender the original policy or policies of such<br />

insurance.<br />

(c) Lender's Right to Obtain Insurance: <strong>No</strong>twithstanding this Section 3.3, in<br />

the Event of a Default under this Agreement or a Default under any of the other Loan<br />

Documents, Lender or Mortgage Correspondent shall have the right (but not the obligation) to<br />

place and maintain insurance required to be placed and maintained by Borrower hereunder, and<br />

use funds on deposit in the Special Account for the payment of insurance to pay for same. Any<br />

Page 8 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 12 of 50<br />

additional amounts expended therefor shall constitute additional disbursements of Loan proceeds<br />

(even if the total amount of disbursements would exceed the face amount of the <strong>No</strong>te), and shall<br />

bear interest from the date expended at the Default Rate and be payable together with such<br />

interest upon demand.<br />

3.4 Mechanics' Liens and Contest Thereof. Borrower will not suffer or permit any<br />

mechanics' lien claims to be filed or otherwise asserted against the Project and will promptly<br />

discharge the same if any claims for lien or any proceedings for the enforcement thereof are filed<br />

or commenced; provided, however, that Borrower shall have the right to contest in good faith and<br />

with due diligence the validity of any such lien or claim upon furnishing to the Title Insurer such<br />

security or indemnity as it may require to induce the Title Insurer to insure against all such<br />

claims, liens or proceedings; and provided further that Lender will not be required to make any<br />

further disbursements of the Loan proceeds unless (a) any mechanics' lien claims shown by any<br />

title insurance commitments or interim binders or certifications have been released or insured<br />

against by the Title Insurer or (b) Borrower shall have provided Lender with such other security<br />

with respect to such claim as may be acceptable to Lender, in its sole discretion.<br />

3.5 Settlement of Mechanics' Lien Claims. If Borrower shall fail promptly to<br />

discharge any mechanics' lien claim filed or otherwise asserted or to contest any such claims and<br />

give security or indemnity in the manner provided in Section 3.4 hereof, or, having commenced<br />

to contest the same, and having given such security or indemnity, shall thereafter fail to prosecute<br />

such contest in good faith or with due diligence, or fail to maintain such indemnity or security so<br />

required by the Title Insurer for its full amount, or, upon adverse conclusion of any such contest,<br />

shall fail to cause any judgment or decree to be satisfied and lien to be promptly released, then,<br />

and in any such event, Lender may, at its election, but shall not be required to, (i) procure the<br />

release and discharge of any such claim and any judgment or decree thereon, without inquiring<br />

into or investigating the amount, validity or enforceability of such lien or claim and (ii) effect any<br />

settlement or compromise of the same, or may furnish such security or indemnity to the Title<br />

Insurer, and any amounts expended by Lender in doing so, including premiums paid or security<br />

furnished in connection with the issuance of any surety company bonds, shall be deemed to<br />

constitute disbursements of the Loan proceeds hereunder (even if the total amount of<br />

disbursements would exceed the face amount of the <strong>No</strong>te), and shall bear interest from the date<br />

expended at the Default Rate and be payable together with such interest upon demand.<br />

3.6 Maintenance, Repair and Restoration of Improvements. Borrower shall<br />

(i) promptly repair, restore or rebuild any Improvements, which may become damaged or be<br />

destroyed; and (ii) keep the Improvements in good condition and repair, without waste.<br />

3.7 Membership and Membership Reports. Borrower shall not modify, amend,<br />

waive, terminate or cancel any material provisions of the Bylaws without the prior written<br />

consent of Lender. Within fifteen (15) days following the end of each year, Borrower shall<br />

deliver to Lender and Mortgage Correspondent a report showing the status of all Memberships.<br />

Such report shall be in the form previously approved by Lender. Any modification of the Bylaws<br />

without the consent of Lender shall be deemed by Lender, in its sole discretion, as an Event of<br />

Default.<br />

Page 9 of 52

Case 11-23466-bam Doc 10-1 Entered 08/25/11 15:03:48 Page 13 of 50<br />

3.8 Compliance With Laws. Borrower shall promptly comply with all applicable<br />

Laws of any Governmental Authority having jurisdiction over Borrower or the Project, and shall<br />

take all actions necessary to bring the Project into compliance with all applicable Laws, including<br />

without limitation all Building Laws (whether now existing or hereafter enacted).<br />

3.9 Alterations/New Improvements. Without the prior written consent of Lender,<br />

which consent shall not be unreasonably withheld, except as set forth in Exhibit B, Borrower<br />

shall not (i) make any material alterations to the Project or (ii) construct any Improvements of<br />

any kind on the Land.<br />

3.10 Personal Property. All of Borrower's personal property, fixtures, furnishings,<br />

furniture, attachments and equipment located on or used in connection with the Project, shall<br />

always be located at the Project and shall also be kept free and clear of all chattel mortgages,<br />

conditional vendor's liens and all other liens, encumbrances and security interests of any kind<br />

whatever. Borrower will be the absolute owner of said personal property, fixtures, furnishings,<br />

furniture, attachments and equipment. Borrower shall, from time to time, furnish Lender with<br />

evidence of such ownership satisfactory to Lender, including searches of applicable public<br />

records. Upon request, Borrower shall provide Lender with copies of all such leases and financial<br />

documents.<br />

Anything in the foregoing to the contrary notwithstanding, Borrower shall, in the ordinary<br />

course of business, be permitted to enter into leases for, or obtain financing of, machines and<br />

equipment (including, but not limited to, golf carts, golf course maintenance equipment,<br />