India Inc Goes Abroad - MAPE Advisory Group

India Inc Goes Abroad - MAPE Advisory Group

India Inc Goes Abroad - MAPE Advisory Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Industry Context<br />

Healthcare Sector<br />

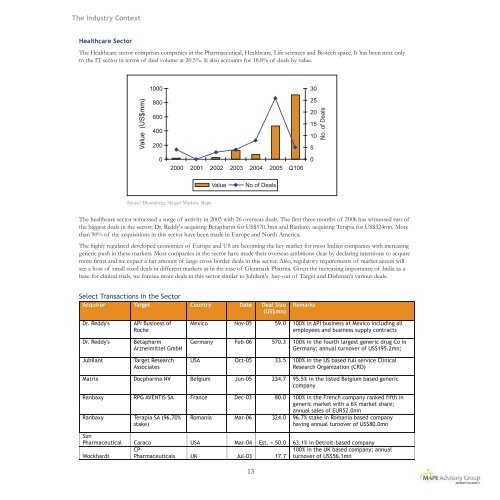

The Healthcare sector comprises companies in the Pharmaceutical, Healthcare, Life sciences and Biotech space. It has been next only<br />

to the IT sector in terms of deal volume at 20.5%. It also accounts for 18.8% of deals by value.<br />

Value (US$mm)<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Source: Bloomberg, Merger Markets, Mape<br />

2000 2001 2002 2003 2004 2005 Q106<br />

The healthcare sector witnessed a surge of activity in 2005 with 26 overseas deals. The first three months of 2006 has witnessed two of<br />

the biggest deals in the sector; Dr. Reddy's acquiring Betapharm for US$570.3mn and Ranbaxy acquiring Terapia for US$324mn. More<br />

than 90% of the acquisitions in this sector have been made in Europe and North America.<br />

The highly regulated developed economies of Europe and US are becoming the key market for most <strong>India</strong>n companies with increasing<br />

generic push in these markets. Most companies in the sector have made their overseas ambitions clear by declaring intentions to acquire<br />

more firms and we expect a fair amount of large cross border deals in this sector. Also, regulatory requirements of market access will<br />

see a host of small sized deals in different markets as in the case of Glenmark Pharma. Given the increasing importance of <strong>India</strong> as a<br />

base for clinical trials, we foresee more deals in this sector similar to Jubilant's buy-out of Target and Dishman's various deals.<br />

Select Transactions in the Sector<br />

Value No of Deals<br />

Acquirer Target Country Date Deal Size<br />

(US$mn)<br />

Dr. Reddy's API Business of<br />

Roche<br />

Dr. Reddy's Betapharm<br />

Arzneimittel GmbH<br />

Jubilant Target Research<br />

Associates<br />

13<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Remarks<br />

Mexico Nov-05 59.0 100% in API business at Mexico including all<br />

employees and business supply contracts<br />

Germany Feb-06 570.3 100% in the fourth largest generic drug Co in<br />

Germany; annual turnover of US$195.2mn;<br />

USA Oct-05 33.5 100% in the US based full service Clinical<br />

Research Organization (CRO)<br />

Matrix Docpharma NV Belgium Jun-05 234.7 95.5% in the listed Belgium based generic<br />

company<br />

Ranbaxy RPG AVENTIS SA France Dec-03 80.0 100% in the French company ranked fifth in<br />

generic market with a 6% market share;<br />

Ranbaxy Terapia SA (96.70%<br />

stake)<br />

No. of Deals<br />

annual sales of EUR52.0mn<br />

Romania Mar-06 324.0 96.7% stake in Romania based company<br />

having annual turnover of US$80.0mn<br />

Sun<br />

Pharmaceutical Caraco USA Mar-04 Est. < 50.0 63.1% in Detroit-based company<br />

CP<br />

100% in the UK based company; annual<br />

Wockhardt Pharmaceuticals UK Jul-03 17.7 turnover of US$56.1mn