CIFA Annual Review 2020

Cyprus Investment Funds Association Annual Review 2020

Cyprus Investment Funds Association Annual Review 2020

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cyprus Investment Funds Association (<strong>CIFA</strong>)<br />

<strong>Annual</strong> <strong>Review</strong> <strong>2020</strong> 13<br />

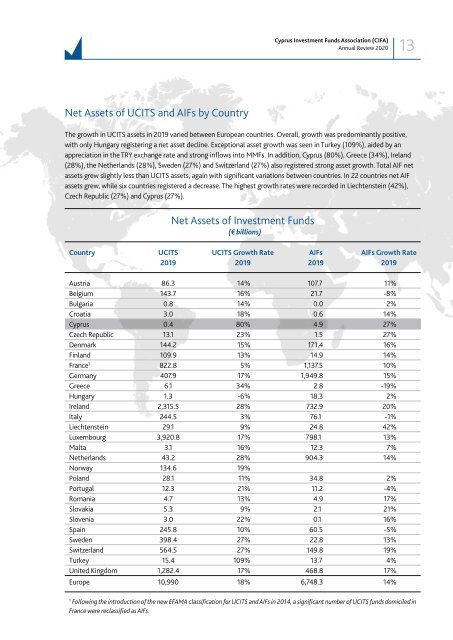

Net Assets of UCITS and AIFs by Country<br />

The growth in UCITS assets in 2019 varied between European countries. Overall, growth was predominantly positive,<br />

with only Hungary registering a net asset decline. Exceptional asset growth was seen in Turkey (109%), aided by an<br />

appreciation in the TRY exchange rate and strong inflows into MMFs. In addition, Cyprus (80%), Greece (34%), Ireland<br />

(28%), the Netherlands (28%), Sweden (27%) and Switzerland (27%) also registered strong asset growth. Total AIF net<br />

assets grew slightly less than UCITS assets, again with significant variations between countries. In 22 countries net AIF<br />

assets grew, while six countries registered a decrease. The highest growth rates were recorded in Liechtenstein (42%),<br />

Czech Republic (27%) and Cyprus (27%).<br />

Net Assets of Investment Funds<br />

(€ billions)<br />

Country UCITS UCITS Growth Rate AIFs AIFs Growth Rate<br />

2019 2019 2019 2019<br />

Austria 86.3 14% 107.7 11%<br />

Belgium 143.7 16% 21.7 -8%<br />

Bulgaria 0.8 14% 0.0 2%<br />

Croatia 3.0 18% 0.6 14%<br />

Cyprus 0.4 80% 4.9 27%<br />

Czech Republic 13.1 23% 1.5 27%<br />

Denmark 144.2 15% 171.4 16%<br />

Finland 109.9 13% 14.9 14%<br />

France 1 822.8 5% 1,137.5 10%<br />

Germany 407.9 17% 1,949.8 15%<br />

Greece 6.1 34% 2.8 -19%<br />

Hungary 1.3 -6% 18.3 2%<br />

Ireland 2,315.5 28% 732.9 20%<br />

Italy 244.5 3% 76.1 -1%<br />

Liechtenstein 29.1 9% 24.8 42%<br />

Luxembourg 3,920.8 17% 798.1 13%<br />

Malta 3.1 16% 12.3 7%<br />

Netherlands 43.2 28% 904.3 14%<br />

Norway 134.6 19%<br />

Poland 28.1 11% 34.8 2%<br />

Portugal 12.3 21% 11.2 -4%<br />

Romania 4.7 13% 4.9 17%<br />

Slovakia 5.3 9% 2.1 21%<br />

Slovenia 3.0 22% 0.1 16%<br />

Spain 245.8 10% 60.5 -5%<br />

Sweden 398.4 27% 22.8 13%<br />

Switzerland 564.5 27% 149.8 19%<br />

Turkey 15.4 109% 13.7 4%<br />

United Kingdom 1,282.4 17% 468.8 17%<br />

Europe 10,990 18% 6,748.3 14%<br />

1<br />

Following the introduction of the new EFAMA classification for UCITS and AIFs in 2014, a significant number of UCITS funds domiciled in<br />

France were reclassified as AIFs.