CIFA Annual Review 2020

Cyprus Investment Funds Association Annual Review 2020

Cyprus Investment Funds Association Annual Review 2020

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52<br />

Cyprus Investment Funds Association (<strong>CIFA</strong>)<br />

Financial Statements for the year ended 31 December 2019<br />

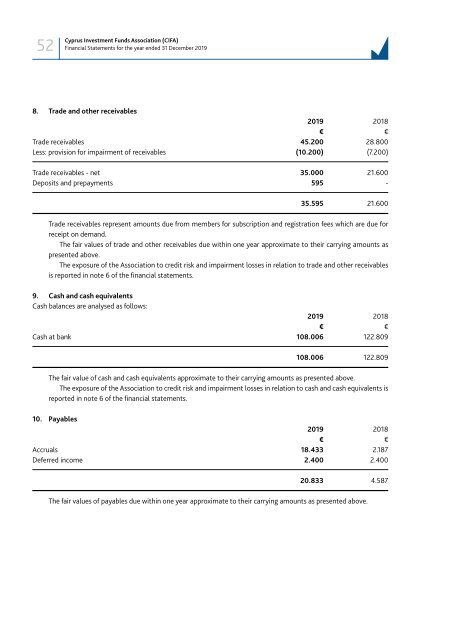

8. Trade and other receivables<br />

2019 2018<br />

€ €<br />

Trade receivables 45.200 28.800<br />

Less: provision for impairment of receivables (10.200) (7.200)<br />

Trade receivables - net 35.000 21.600<br />

Deposits and prepayments 595 -<br />

35.595 21.600<br />

Trade receivables represent amounts due from members for subscription and registration fees which are due for<br />

receipt on demand.<br />

The fair values of trade and other receivables due within one year approximate to their carrying amounts as<br />

presented above.<br />

The exposure of the Association to credit risk and impairment losses in relation to trade and other receivables<br />

is reported in note 6 of the financial statements.<br />

9. Cash and cash equivalents<br />

Cash balances are analysed as follows:<br />

2019 2018<br />

€ €<br />

Cash at bank 108.006 122.809<br />

108.006 122.809<br />

The fair value of cash and cash equivalents approximate to their carrying amounts as presented above.<br />

The exposure of the Association to credit risk and impairment losses in relation to cash and cash equivalents is<br />

reported in note 6 of the financial statements.<br />

10. Payables<br />

2019 2018<br />

€ €<br />

Accruals 18.433 2.187<br />

Deferred income 2.400 2.400<br />

20.833 4.587<br />

The fair values of payables due within one year approximate to their carrying amounts as presented above.