Oxbow NWR Final CCP - U.S. Fish and Wildlife Service

Oxbow NWR Final CCP - U.S. Fish and Wildlife Service

Oxbow NWR Final CCP - U.S. Fish and Wildlife Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Refuge Sign: Staff photo<br />

Chapter 3: Refuge <strong>and</strong> Resource Descriptions<br />

Chapter 3: Refuge <strong>and</strong> Resource Descriptions<br />

Socioeconomic Setting<br />

The Refuge Revenue Sharing Act of June 15, 1935, as amended, provides<br />

annual payments to taxing authorities, based on acreage <strong>and</strong> value of<br />

refuge l<strong>and</strong>s located within their jurisdiction. Money for these payments<br />

comes from the sale of oil <strong>and</strong> gas leases, timber sales, grazing fees, the<br />

sale of other Refuge System resources, <strong>and</strong> from Congressional<br />

appropriations. The Congressional appropriations are intended to make up<br />

the difference between the net receipts from the Refuge Revenue Sharing<br />

Fund <strong>and</strong> the total amount due to local taxing authorities. The actual<br />

Refuge Revenue Sharing Payment does vary from year to year, because<br />

Congress may or may not appropriate sufficient funds to make full<br />

payment.<br />

The Refuge Revenue Sharing Payments are based on one of three<br />

different formulas, whichever results in the highest payment to the<br />

local taxing authority. In Massachusetts, the payments are based on<br />

three-quarters of one percent of the appraised market value. The<br />

purchase price of a property is considered its market value until the<br />

property is reappraised. The <strong>Service</strong> reappraises the value of refuge<br />

l<strong>and</strong>s every five years, <strong>and</strong> the appraisals are based on the l<strong>and</strong>’s<br />

“highest <strong>and</strong> best use”. On wetl<strong>and</strong>s <strong>and</strong> formerly farml<strong>and</strong>-assessed<br />

properties, the full entitlement Refuge Revenue Sharing Payments<br />

sometimes exceeds the real estate tax. In other cases, Refuge Revenue<br />

Sharing payments may be less than the local real estate tax.<br />

The fact that refuges put little dem<strong>and</strong> on the infrastructure of a<br />

municipality, must be considered in assessing the financial impact on the<br />

municipality. For example, there is no extra dem<strong>and</strong> placed on the school<br />

system <strong>and</strong> little extra dem<strong>and</strong> on roads, utilities, police <strong>and</strong> fire protection,<br />

etc. Additionally, local communities may receive benefits, such as increased<br />

tourism revenues from visitors. The owner of l<strong>and</strong> adjacent to refuge l<strong>and</strong>,<br />

or with acquisition boundary, retains any <strong>and</strong> all the rights, privileges, <strong>and</strong><br />

responsibilities of private l<strong>and</strong> ownership. The refuge controls uses only on<br />

the properties it owns.<br />

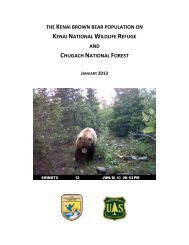

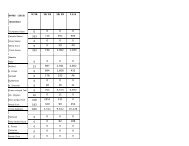

Table 3-1: Revenue Sharing Payments for Towns Associated with <strong>Oxbow</strong> <strong>NWR</strong><br />

Ayer Harvard Lancaster Shirley<br />

2003 $918 $16,677 $6 $748<br />

2002 $956 $17,351 $7 $778<br />

2001 $1,023 $17,328 $7 $833<br />

2000 $1,002 $5,193 $7 $816<br />

Comprehensive Conservation Plan<br />

- 17 -