MEF MINUTE Quarterly Issue 1

News, events, and insight for the members of the Mobile Ecosystem Forum.

News, events, and insight for the members of the Mobile Ecosystem Forum.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INSIGHT<br />

transfers for up to 50 percent of their<br />

business customers. And though e-<br />

invoicing solutions have been popularized<br />

in developed markets, there is a<br />

significant emerging market demand for<br />

efficient digital solutions that can digitize<br />

and simplify B2B billing processes. As<br />

providers of these services seek<br />

partnerships, traditional banks are well<br />

positioned to provide optimal<br />

distribution of these services since they<br />

already have the benefits of pre-existing<br />

corporate relationships — as well as<br />

brand recognition and customer loyalty.<br />

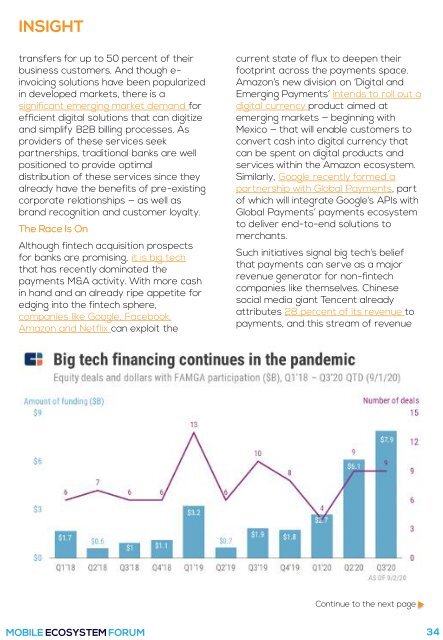

The Race Is On<br />

Although fintech acquisition prospects<br />

for banks are promising, it is big tech<br />

that has recently dominated the<br />

payments M&A activity. With more cash<br />

in hand and an already ripe appetite for<br />

edging into the fintech sphere,<br />

companies like Google, Facebook,<br />

Amazon and Netflix can exploit the<br />

current state of flux to deepen their<br />

footprint across the payments space.<br />

Amazon’s new division on ‘Digital and<br />

Emerging Payments’ intends to roll out a<br />

digital currency product aimed at<br />

emerging markets — beginning with<br />

Mexico — that will MM/YYYYY enable customers | ISSUE to NO. XX<br />

convert cash into digital currency that<br />

can be spent on digital products and<br />

services within the Amazon ecosystem.<br />

Similarly, Google recently formed a<br />

partnership with Global Payments, part<br />

of which will integrate Google’s APIs with<br />

Global Payments’ payments ecosystem<br />

to deliver end-to-end solutions to<br />

merchants.<br />

Such initiatives signal big tech’s belief<br />

that payments can serve as a major<br />

revenue generator for non-fintech<br />

companies like themselves. Chinese<br />

social media giant Tencent already<br />

attributes 28 percent of its revenue to<br />

payments, and this stream of revenue<br />

TITLE HERE<br />

TITLE HERE<br />

TITLE HERE<br />

Continue to the next page<br />

MOBILE ECOSYSTEM FORUM<br />

34