11052021 - Insecurity: Bandits attack Katsina mosque, abduct 10

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Metering: FG takes delivery of 656,752 prepaid meters<br />

By Udeme Akpan<br />

THE Federal Government has<br />

taken delivery of 656,752<br />

prepaid meters, under the phase<br />

0 of the Central Bank of Nigeriafunded<br />

National Mass Metering<br />

Programme, NMMP.<br />

This represents almost 85<br />

percent of the one million meters<br />

to be provided to Nigerians,<br />

whose bills are still based on<br />

estimation.<br />

However, of the 656,752 prepaid<br />

meters, 305,962 have already been<br />

installed for consumers, according<br />

to the Special Adviser to the<br />

President on Infrastructure, Mr.<br />

Ahmad Zakari.<br />

In an interview with Vanguard,<br />

weekend, he said: "The major<br />

problem faced by the indigenous<br />

producers and Meter Asset<br />

Providers, MAPs is the pace of<br />

ramp-up of available personnel for<br />

installation. Another problem is<br />

the lack of a vital plastic component<br />

as one of the two major global<br />

suppliers (based in Germany) had<br />

shut down during the<br />

Coronavirus pandemic, resulting<br />

in pressure to the value chain.<br />

"However, disbursement has<br />

been made for 656,752 meters,<br />

with the Discos already in receipt<br />

of almost 85% of the funded<br />

meters. Based on the current<br />

trend, all Phase 0 installations<br />

should be completed by the end<br />

of June, 2021."<br />

According to him, the nation<br />

would start its phase one and later<br />

Vanguard, TUESDAY, MAY 11, 2021 — 21<br />

phase two of the NMMP.<br />

Previously, the Chairman,<br />

Nigerian Electricity Regulatory<br />

Commission, NERC, Engr.<br />

Sanusi Garba, had said in an<br />

interview with Vanguard that, "The<br />

Nigerian Electricity Supply<br />

Industry, NESI, had what we call<br />

the Meter Asset Provider, MAP.<br />

That scheme was a regulation we<br />

issued in 2018 and it took effect in<br />

2019, involving third-party<br />

businessmen. We gave them<br />

permits, and they went to the<br />

DisCos and got contracts to<br />

supply, install and maintain<br />

meters for them.<br />

"So, they are the ones that have<br />

a responsibility to install meters for<br />

every DisCo in Nigeria. That<br />

system is still working as we speak.<br />

However, what happened was<br />

that when we gave the permits to<br />

those MAPs, and then they got<br />

the contract with the Disco's, each<br />

of them was given quantities of<br />

meters to supply."<br />

TUESDAY, MAY 11, 2021<br />

Nigeria’s oil output drops by 30% in four years<br />

—Investigation<br />

By Udeme Akpan<br />

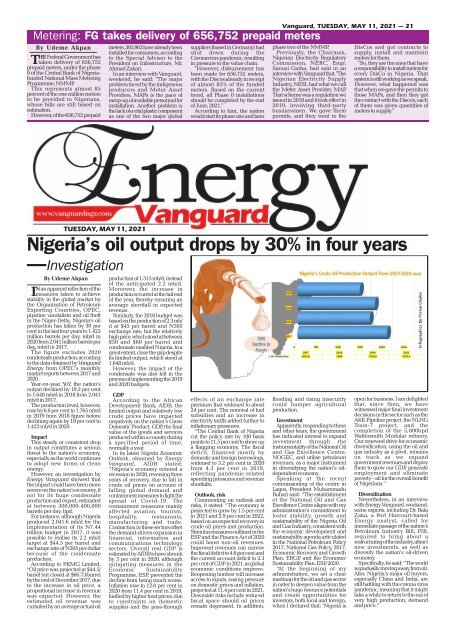

IN an apparent reflection of the<br />

measures taken to achieve<br />

stability in the global market by<br />

the Organisation of Petroleum<br />

Exporting Countries, OPEC,<br />

pipeline vandalism and oil theft<br />

in the Niger-Delta, Nigeria’s oil<br />

production has fallen by 30 per<br />

cent in the last four years to 1.423<br />

million barrels per day, mb/d in<br />

2020 from 2.041 million barrels per<br />

day, mb/d in 2017.<br />

The figure excludes 2020<br />

condensate production, according<br />

to the data obtained by Vanguard<br />

Energy from OPEC’s monthly<br />

market reports between 2017 and<br />

2020.<br />

Year-on-year, YoY, the nation’s<br />

output declined by 19.3 per cent<br />

to 1.648 mb/d in 2018 from 2.041<br />

mb/d in 2017.<br />

The production level, however,<br />

rose by 6.6 per cent to 1.765 mb/d<br />

in 2019 from 2018 figure before<br />

declining again by 19 per cent to<br />

1.423 mb/d in 2020.<br />

Impact<br />

This steady or consistent drop<br />

in output constitutes a serious<br />

threat to the nation’s economy,<br />

especially as the world continues<br />

to adopt new forms of clean<br />

energy.<br />

However, an investigation by<br />

Energy Vanguard showed that<br />

the impact could have been more<br />

severe on the nation’s economy, if<br />

not for its huge condensate<br />

production and export, estimated<br />

at between 300,000-400,000<br />

barrels per day, bpd.<br />

For instance, although Nigeria<br />

produced 2.041.6 mb/d for the<br />

implementation of its N7.44<br />

trillion budget in 2017, it was<br />

possible to realise its 2.2 mb/d<br />

target at $44.5 per barrel and<br />

exchange rate of N305 per dollar<br />

because of the condensate<br />

production.<br />

According to PKMG Limited,<br />

“Oil price was projected at $44.5/<br />

barrel but closed at $66.73/barrel<br />

by the end of December 2017, due<br />

to the increase in oil price, a<br />

proportional increase in revenue<br />

was expected. However, the<br />

estimated oil revenue was<br />

curtailed by an average actual oil<br />

production of 1.515 mb/d, instead<br />

of the anticipated 2.2 mb/d.<br />

Moreover, the increase in<br />

production occurred at the tail end<br />

of the year, thereby ensuring an<br />

average shortfall in expected<br />

revenue.<br />

Similarly, the 2018 budget was<br />

based on the production of 2.3 mb/<br />

d at $45 per barrel and N305<br />

exchange rate, but the relatively<br />

high price, which stood at between<br />

$50 and $60 per barrel and<br />

condensate enabled Nigeria, to a<br />

great extent, close the gap despite<br />

its limited output, which stood at<br />

1.648 mb/d.<br />

However, the impact of the<br />

condensate was also felt in the<br />

process of implementing the 2019<br />

and 2020 budgets.<br />

GDP<br />

According to the African<br />

Development Bank, AfDB, the<br />

limited output and relatively low<br />

crude prices have impacted<br />

negatively on the nation’s Gross<br />

Domestic Product, GDP, the final<br />

value of the goods and services<br />

produced within a country during<br />

a specified period of time,<br />

normally a year.<br />

In its latest Nigeria Economic<br />

Outlook, obtained by Energy<br />

Vanguard, AfDB stated:<br />

“Nigeria’s economy entered a<br />

recession in 2020, reversing three<br />

years of recovery, due to fall in<br />

crude oil prices on account of<br />

falling global demand and<br />

containment measures to fight the<br />

spread of Covid-19. The<br />

containment measures mainly<br />

affected aviation, tourism,<br />

hospitality, restaurants,<br />

manufacturing and trade.<br />

Contraction in these sectors offset<br />

the demand-driven expansion in<br />

financial, information and<br />

communications technology<br />

sectors. Overall real GDP is<br />

estimated by AfDB to have shrunk<br />

by 3 per cent in 2020, although<br />

mitigating measures in the<br />

Economic Sustainability<br />

Programme, ESP, prevented the<br />

decline from being much worse.<br />

Inflation rose to 12.8 per cent in<br />

2020 from 11.4 per cent in 2019,<br />

fuelled by higher food prices, due<br />

to constraints on domestic<br />

supplies and the pass-through<br />

effects of an exchange rate<br />

premium that widened to about<br />

24 per cent. The removal of fuel<br />

subsidies and an increase in<br />

electricity tariffs added further to<br />

inflationary pressures.<br />

“The Central Bank of Nigeria<br />

cut the policy rate by <strong>10</strong>0 basis<br />

points to 11.5 per cent to shore up<br />

a flagging economy. The fiscal<br />

deficit, financed mostly by<br />

domestic and foreign borrowings,<br />

widened to 5.2 per cent in 2020<br />

from 4.3 per cent in 2019,<br />

reflecting pandemic-related<br />

spending pressures and revenue<br />

shortfalls.<br />

Outlook, risk<br />

Commenting on outlook and<br />

risks, it stated: “The economy is<br />

projected to grow by 1.5 per cent<br />

in 2021 and 2.9 per cent in 2022,<br />

based on an expected recovery in<br />

crude oil prices and production.<br />

Stimulus measures outlined in the<br />

ESP and the Finance Act of 2020<br />

could boost non-oil revenues.<br />

Improved revenues can narrow<br />

the fiscal deficit to 4.6 per cent and<br />

the current account deficit to 2.3<br />

per cent of GDP in 2021, as global<br />

economic conditions improve.<br />

Reopening borders will increase<br />

access to inputs, easing pressure<br />

on domestic prices and inflation,<br />

projected at 11.4 per cent in 2021.<br />

Downside risks include reduced<br />

fiscal space should oil prices<br />

remain depressed. In addition,<br />

flooding and rising insecurity<br />

could hamper agricultural<br />

production.<br />

Investment<br />

Apparently, responding to these<br />

and other fears, the government<br />

has indicated interest to expand<br />

investment through the<br />

instrumentality of the National Oil<br />

and Gas Excellence Centre,<br />

NOGEC, and utilise petroleum<br />

revenues, as a major instrument<br />

in diversifying the nation’s oildependent<br />

economy.<br />

Speaking at the recent<br />

commissioning of the centre in<br />

Lagos, President Muhammadu<br />

Buhari said: “The establishment<br />

of the National Oil and Gas<br />

Excellence Centre aligns with my<br />

administration’s commitment to<br />

foster stability, growth and<br />

sustainability of the Nigeria Oil<br />

and Gas Industry, consistent with<br />

the economic development and<br />

sustainability agenda articulated<br />

in the National Petroleum Policy<br />

2017, National Gas Policy, 2017,<br />

Economic Recovery and Growth<br />

Plan, ERGP, and the Economic<br />

Sustainability Plan, ESP, 2020.<br />

“At the beginning of my<br />

administration, we set a clear<br />

roadmap for the oil and gas sector<br />

in order to deepen value from the<br />

nation’s huge resource potentials<br />

and create opportunities for<br />

investors, both local and foreign,<br />

when I declared that: ‘Nigeria is<br />

open for business. I am delighted<br />

that, since then, we have<br />

witnessed major final investment<br />

decisions in the sector such as the<br />

AKK Pipeline project, the NLNG<br />

Train-7 project, and the<br />

completion of the 5,000bpd<br />

Waltersmith Modular refinery.<br />

Our renewed drive for economic<br />

diversification, using the oil and<br />

gas industry as a pivot, remains<br />

on track as we expand<br />

government revenues and deploy<br />

them to grow our GDP, generate<br />

employment and eliminate<br />

poverty – all for the overall benefit<br />

of Nigerians.”<br />

Diversification<br />

Nevertheless, in an interview<br />

with Energy Vanguard, weekend,<br />

some experts, including Dr. Bala<br />

Zaka, a Port Harcourt-based<br />

Energy analyst, called for<br />

immediate passage of the nation’s<br />

Petroleum Industry Bill, PIB,<br />

required to bring about a<br />

restructuring of the industry, attract<br />

new investments, as well as<br />

diversify the nation’s oil-driven<br />

economy.<br />

Specifically, he said: “The world<br />

is gradually moving away from oil.<br />

Also, Nigeria’s major oil buyers,<br />

especially China and India, are<br />

still battling with the corona virus<br />

pandemic, meaning that it might<br />

take a while to return to the era of<br />

very high production, demand<br />

and price.”