Mendip Living Oct - Nov 2021

The Autumn edition is here - filled with amazing goodies. We've got an interview with legendary baker Richard Bertinet, lots of delicious recipes, advice on redecorating the guest bedroom and of course our amazing competition page.

The Autumn edition is here - filled with amazing goodies. We've got an interview with legendary baker Richard Bertinet, lots of delicious recipes, advice on redecorating the guest bedroom and of course our amazing competition page.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ON YOUR SIDE...<br />

AT YOUR SIDE<br />

Mogers Drewett is a leading South West<br />

law firm that takes pride in building longterm<br />

client relationships. Our experts are<br />

pleased to answer your questions…<br />

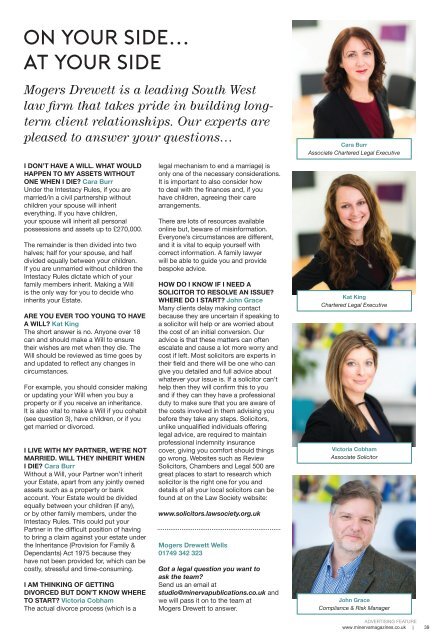

Cara Burr<br />

Associate Chartered Legal Executive<br />

I DON’T HAVE A WILL. WHAT WOULD<br />

HAPPEN TO MY ASSETS WITHOUT<br />

ONE WHEN I DIE? Cara Burr<br />

Under the Intestacy Rules, if you are<br />

married/in a civil partnership without<br />

children your spouse will inherit<br />

everything. If you have children,<br />

your spouse will inherit all personal<br />

possessions and assets up to £270,000.<br />

The remainder is then divided into two<br />

halves; half for your spouse, and half<br />

divided equally between your children.<br />

If you are unmarried without children the<br />

Intestacy Rules dictate which of your<br />

family members inherit. Making a Will<br />

is the only way for you to decide who<br />

inherits your Estate.<br />

ARE YOU EVER TOO YOUNG TO HAVE<br />

A WILL? Kat King<br />

The short answer is no. Anyone over 18<br />

can and should make a Will to ensure<br />

their wishes are met when they die. The<br />

Will should be reviewed as time goes by<br />

and updated to reflect any changes in<br />

circumstances.<br />

For example, you should consider making<br />

or updating your Will when you buy a<br />

property or if you receive an inheritance.<br />

It is also vital to make a Will if you cohabit<br />

(see question 3), have children, or if you<br />

get married or divorced.<br />

I LIVE WITH MY PARTNER, WE’RE NOT<br />

MARRIED. WILL THEY INHERIT WHEN<br />

I DIE? Cara Burr<br />

Without a Will, your Partner won’t inherit<br />

your Estate, apart from any jointly owned<br />

assets such as a property or bank<br />

account. Your Estate would be divided<br />

equally between your children (if any),<br />

or by other family members, under the<br />

Intestacy Rules. This could put your<br />

Partner in the difficult position of having<br />

to bring a claim against your estate under<br />

the Inheritance (Provision for Family &<br />

Dependants) Act 1975 because they<br />

have not been provided for, which can be<br />

costly, stressful and time-consuming.<br />

I AM THINKING OF GETTING<br />

DIVORCED BUT DON’T KNOW WHERE<br />

TO START? Victoria Cobham<br />

The actual divorce process (which is a<br />

legal mechanism to end a marriage) is<br />

only one of the necessary considerations.<br />

It is important to also consider how<br />

to deal with the finances and, if you<br />

have children, agreeing their care<br />

arrangements.<br />

There are lots of resources available<br />

online but, beware of misinformation.<br />

Everyone’s circumstances are different,<br />

and it is vital to equip yourself with<br />

correct information. A family lawyer<br />

will be able to guide you and provide<br />

bespoke advice.<br />

HOW DO I KNOW IF I NEED A<br />

SOLICITOR TO RESOLVE AN ISSUE?<br />

WHERE DO I START? John Grace<br />

Many clients delay making contact<br />

because they are uncertain if speaking to<br />

a solicitor will help or are worried about<br />

the cost of an initial conversion. Our<br />

advice is that these matters can often<br />

escalate and cause a lot more worry and<br />

cost if left. Most solicitors are experts in<br />

their field and there will be one who can<br />

give you detailed and full advice about<br />

whatever your issue is. If a solicitor can’t<br />

help then they will confirm this to you<br />

and if they can they have a professional<br />

duty to make sure that you are aware of<br />

the costs involved in them advising you<br />

before they take any steps. Solicitors,<br />

unlike unqualified individuals offering<br />

legal advice, are required to maintain<br />

professional indemnity insurance<br />

cover, giving you comfort should things<br />

go wrong. Websites such as Review<br />

Solicitors, Chambers and Legal 500 are<br />

great places to start to research which<br />

solicitor is the right one for you and<br />

details of all your local solicitors can be<br />

found at on the Law Society website:<br />

www.solicitors.lawsociety.org.uk<br />

Mogers Drewett Wells<br />

01749 342 323<br />

Got a legal question you want to<br />

ask the team?<br />

Send us an email at<br />

studio@minervapublications.co.uk and<br />

we will pass it on to the team at<br />

Mogers Drewett to answer.<br />

Kat King<br />

Chartered Legal Executive<br />

Victoria Cobham<br />

Associate Solicitor<br />

John Grace<br />

Compliance & Risk Manager<br />

ADVERTISING FEATURE<br />

www.minervamagazines.co.uk | 39