NCFA Fintech Confidential October 2021 (Issue 4)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 4, FINTECH CONFIDENTIAL, a digital pop-up of the 7th annual 2021 Fintech & Financing Conference and Expo (FFCON21) held virtually from May 11-13 and co-hosted by NCFA and Toronto Finance International (TFI). As global economies strive to contain the latest Covid outbreak and recover fragile sectors, fintech innovators continue to ‘BREAK BARRIERS’, the main theme of this year’s conference, and the second year in partnership with TFI, reflecting the growth and emerging challenges that the Canadian Fintech industry must navigate to achieve mass adoption and scale. It’s been another unprecedented year with covid accelerating trends such as bitcoin’s institutionalization, the growing power of retail investors, the 2nd round of Open Banking consultations and the advisory committee’s recommendations to the federal government, payment modernization efforts, adoption of harmonized Crowdfunding regulation, AI roadmap, emergence of digital identity as a ‘right’ and core data infrastructure (ie., vaccine passports), growing support for Purpose (not just shareholder profit), green finance solutions tackling shared global problems such as SDGs and climate change, EDI (equality, diversity and inclusion), and regulatory push back and a firm ‘line in the sand’ for Big Tech. FFCON21 was a successful event attracting over 100+ thought leaders, 75 partners, 500+ attendees, an NFT charity fundraiser in partnership with CanadaHelps for front line workers, and our second annual 2021 Fintech Draft competition -- a pitching event inspired by sports league drafts and designed to identity emerging high growth fintech ventures. A hearty congratulations to the winners: Agryo (Overall) and Copia Wealth Studios (People’s Choice)! Thank you to all the partners, speakers, attendees, volunteers, and the entire organizing team for making ‘Breaking Barriers’ an impactful and amazing online experience and for being part of Canada’s fintech and funding community. We hope you enjoy reading this special edition of Fintech Confidential.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 4, FINTECH CONFIDENTIAL, a digital pop-up of the 7th annual 2021 Fintech & Financing Conference and Expo (FFCON21) held virtually from May 11-13 and co-hosted by NCFA and Toronto Finance International (TFI).

As global economies strive to contain the latest Covid outbreak and recover fragile sectors, fintech innovators continue to ‘BREAK BARRIERS’, the main theme of this year’s conference, and the second year in partnership with TFI, reflecting the growth and emerging challenges that the Canadian Fintech industry must navigate to achieve mass adoption and scale.

It’s been another unprecedented year with covid accelerating trends such as bitcoin’s institutionalization, the growing power of retail investors, the 2nd round of Open Banking consultations and the advisory committee’s recommendations to the federal government, payment modernization efforts, adoption of harmonized Crowdfunding regulation, AI roadmap, emergence of digital identity as a ‘right’ and core data infrastructure (ie., vaccine passports), growing support for Purpose (not just shareholder profit), green finance solutions tackling shared global problems such as SDGs and climate change, EDI (equality, diversity and inclusion), and regulatory push back and a firm ‘line in the sand’ for Big Tech.

FFCON21 was a successful event attracting over 100+ thought leaders, 75 partners, 500+ attendees, an NFT charity fundraiser in partnership with CanadaHelps for front line workers, and our second annual 2021 Fintech Draft competition -- a pitching event inspired by sports league drafts and designed to identity emerging high growth fintech ventures. A hearty congratulations to the winners: Agryo (Overall) and Copia Wealth Studios (People’s Choice)!

Thank you to all the partners, speakers, attendees, volunteers, and the entire organizing team for making ‘Breaking Barriers’ an impactful and amazing online experience and for being part of Canada’s fintech and funding community. We hope you enjoy reading this special edition of Fintech Confidential.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

we distilled four personality traits using<br />

advanced psychometric tools: Zeal, Inhibition,<br />

Conventionality, and Swag. These traits can<br />

be used to comprehensively describe the<br />

psychological individuality of investors.<br />

• Zealous investors tend to be enthusiastic<br />

and can become overly excited and<br />

sometimes even carried away by new<br />

opportunities;<br />

• Inhibited investors tend to be risk-averse,<br />

easily lose confidence, and often feel<br />

intimidated by the stock market;<br />

• Conventional investors more readily<br />

follow the advice of others, they trust “the<br />

experts”;<br />

• Swaggy investors tend to believe they<br />

know more about investing than they<br />

actually do and that they are immune to<br />

experiencing negative financial events.<br />

These FIPI traits characterize the psychological<br />

landscape of self-directed investors. Our<br />

research shows that the FIPI traits are reliably<br />

related to key demographic variables like age<br />

and level of education, differentially related<br />

to economic and financial knowledge, and<br />

predict financial behaviors and consequential<br />

outcomes like the amount of trades that<br />

investors execute, their levels of decision<br />

paralysis, and their degree of impulsive<br />

decision making. We presented some of this<br />

research at the 7 th Biennial Meeting of the<br />

Association for Research in Personality, which<br />

took place in June, <strong>2021</strong>.<br />

Curious? Try our Discovery Survey for<br />

FREE! It’s a miniature FIPI, powered by the<br />

same psychometric insights but delivered<br />

in abbreviated form. It will give you a broad<br />

overview of your investing personality that is<br />

equal parts informative and playful.<br />

The complete FIPI feedback expands on the<br />

micro-version. The feedback is longer, more<br />

detailed, and offers many actionable insights.<br />

It is reference material that - with the passage<br />

of time - may aid in the development of deeper<br />

self-understanding each time it is read anew.<br />

It provides an objective viewpoint from which<br />

investors can learn about their strengths,<br />

identify their blind spots, and evaluate the<br />

way they make investment-related decisions.<br />

The goal isn’t to change investors’ personalities.<br />

Rather, the purpose of FIPI’s feedback is<br />

to help investors become more mindful<br />

of their emotional tendencies so that they<br />

can more easily stay focused and rationally<br />

pursue their investment goals. For example,<br />

Zealous investors are reminded about their<br />

tendencies to bullishly rush into new positions;<br />

Inhibited investors are reminded that risks<br />

may be necessary to meet their objectives;<br />

Conventional investors are encouraged to<br />

crystallize their own opinions so that they<br />

can hold their positions with more conviction;<br />

and Swaggy investors are encouraged to<br />

learn. The feedback is personal. The platform<br />

is interactive. The insights are real.<br />

Investors want high-quality, personalized<br />

insight and they want to be able to access<br />

it 24/7. The power of psychometrics can<br />

be harnessed to deliver this more optimal<br />

experience. So take a moment and give our<br />

Discovery Survey a try.<br />

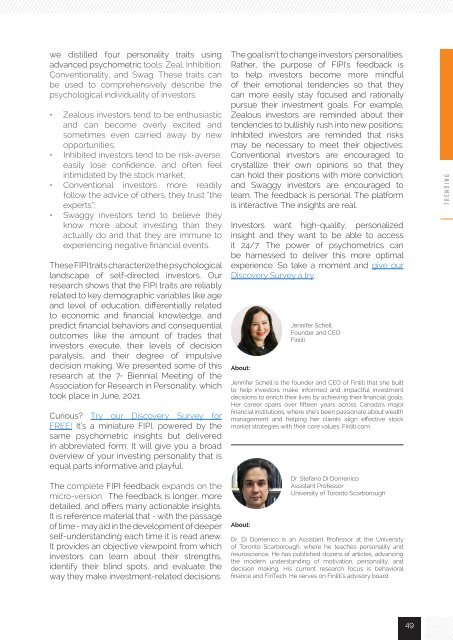

About:<br />

Jennifer Schell is the founder and CEO of Finliti that she built<br />

to help investors make informed and impactful investment<br />

decisions to enrich their lives by achieving their financial goals.<br />

Her career spans over fifteen years across Canada’s major<br />

financial institutions, where she’s been passionate about wealth<br />

management and helping her clients align effective stock<br />

market strategies with their core values. Finliti.com<br />

About:<br />

Jennifer Schell<br />

Founder and CEO<br />

Finliti<br />

Dr. Stefano Di Domenico<br />

Assistant Professor<br />

University of Toronto Scarborough<br />

Dr. Di Domenico is an Assistant Professor at the University<br />

of Toronto Scarborough, where he teaches personality and<br />

neuroscience. He has published dozens of articles, advancing<br />

the modern understanding of motivation, personality, and<br />

decision making. His current research focus is behavioral<br />

finance and FinTech. He serves on Finliti’s advisory board.<br />

TRENDING<br />

49