NCFA Fintech Confidential October 2021 (Issue 4)

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 4, FINTECH CONFIDENTIAL, a digital pop-up of the 7th annual 2021 Fintech & Financing Conference and Expo (FFCON21) held virtually from May 11-13 and co-hosted by NCFA and Toronto Finance International (TFI). As global economies strive to contain the latest Covid outbreak and recover fragile sectors, fintech innovators continue to ‘BREAK BARRIERS’, the main theme of this year’s conference, and the second year in partnership with TFI, reflecting the growth and emerging challenges that the Canadian Fintech industry must navigate to achieve mass adoption and scale. It’s been another unprecedented year with covid accelerating trends such as bitcoin’s institutionalization, the growing power of retail investors, the 2nd round of Open Banking consultations and the advisory committee’s recommendations to the federal government, payment modernization efforts, adoption of harmonized Crowdfunding regulation, AI roadmap, emergence of digital identity as a ‘right’ and core data infrastructure (ie., vaccine passports), growing support for Purpose (not just shareholder profit), green finance solutions tackling shared global problems such as SDGs and climate change, EDI (equality, diversity and inclusion), and regulatory push back and a firm ‘line in the sand’ for Big Tech. FFCON21 was a successful event attracting over 100+ thought leaders, 75 partners, 500+ attendees, an NFT charity fundraiser in partnership with CanadaHelps for front line workers, and our second annual 2021 Fintech Draft competition -- a pitching event inspired by sports league drafts and designed to identity emerging high growth fintech ventures. A hearty congratulations to the winners: Agryo (Overall) and Copia Wealth Studios (People’s Choice)! Thank you to all the partners, speakers, attendees, volunteers, and the entire organizing team for making ‘Breaking Barriers’ an impactful and amazing online experience and for being part of Canada’s fintech and funding community. We hope you enjoy reading this special edition of Fintech Confidential.

The National Crowdfunding & Fintech Association of Canada (NCFA) and partners are excited to present Vol. 1 Issue 4, FINTECH CONFIDENTIAL, a digital pop-up of the 7th annual 2021 Fintech & Financing Conference and Expo (FFCON21) held virtually from May 11-13 and co-hosted by NCFA and Toronto Finance International (TFI).

As global economies strive to contain the latest Covid outbreak and recover fragile sectors, fintech innovators continue to ‘BREAK BARRIERS’, the main theme of this year’s conference, and the second year in partnership with TFI, reflecting the growth and emerging challenges that the Canadian Fintech industry must navigate to achieve mass adoption and scale.

It’s been another unprecedented year with covid accelerating trends such as bitcoin’s institutionalization, the growing power of retail investors, the 2nd round of Open Banking consultations and the advisory committee’s recommendations to the federal government, payment modernization efforts, adoption of harmonized Crowdfunding regulation, AI roadmap, emergence of digital identity as a ‘right’ and core data infrastructure (ie., vaccine passports), growing support for Purpose (not just shareholder profit), green finance solutions tackling shared global problems such as SDGs and climate change, EDI (equality, diversity and inclusion), and regulatory push back and a firm ‘line in the sand’ for Big Tech.

FFCON21 was a successful event attracting over 100+ thought leaders, 75 partners, 500+ attendees, an NFT charity fundraiser in partnership with CanadaHelps for front line workers, and our second annual 2021 Fintech Draft competition -- a pitching event inspired by sports league drafts and designed to identity emerging high growth fintech ventures. A hearty congratulations to the winners: Agryo (Overall) and Copia Wealth Studios (People’s Choice)!

Thank you to all the partners, speakers, attendees, volunteers, and the entire organizing team for making ‘Breaking Barriers’ an impactful and amazing online experience and for being part of Canada’s fintech and funding community. We hope you enjoy reading this special edition of Fintech Confidential.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

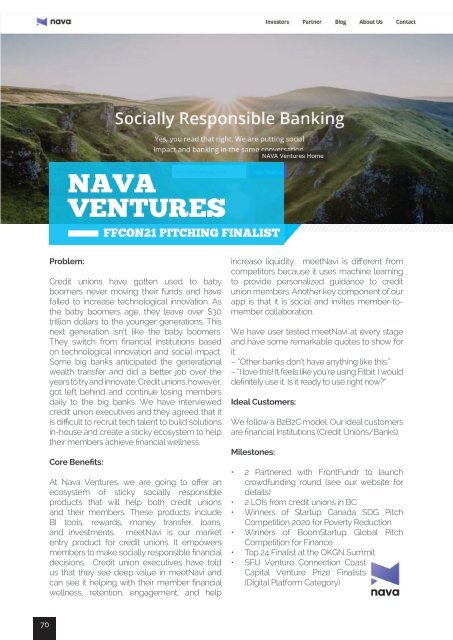

NAVA<br />

VENTURES<br />

FFCON21 PITCHING FINALIST<br />

Problem:<br />

Credit unions have gotten used to baby<br />

boomers never moving their funds and have<br />

failed to increase technological innovation. As<br />

the baby boomers age, they leave over $30<br />

trillion dollars to the younger generations. This<br />

next generation isn’t like the baby boomers.<br />

They switch from financial institutions based<br />

on technological innovation and social impact.<br />

Some big banks anticipated the generational<br />

wealth transfer and did a better job over the<br />

years to try and innovate. Credit unions, however,<br />

got left behind and continue losing members<br />

daily to the big banks. We have interviewed<br />

credit union executives and they agreed that it<br />

is difficult to recruit tech talent to build solutions<br />

in-house and create a sticky ecosystem to help<br />

their members achieve financial wellness.<br />

Core Benefits:<br />

At Nava Ventures, we are going to offer an<br />

ecosystem of sticky socially responsible<br />

products that will help both credit unions<br />

and their members. These products include<br />

BI tools, rewards, money transfer, loans,<br />

and investments. meetNavi is our market<br />

entry product for credit unions. It empowers<br />

members to make socially responsible financial<br />

decisions. Credit union executives have told<br />

us that they see deep value in meetNavi and<br />

can see it helping with their member financial<br />

wellness, retention, engagement, and help<br />

increase liquidity. meetNavi is different from<br />

competitors because it uses machine learning<br />

to provide personalized guidance to credit<br />

union members. Another key component of our<br />

app is that it is social and invites member-tomember<br />

collaboration.<br />

We have user tested meetNavi at every stage<br />

and have some remarkable quotes to show for<br />

it:<br />

– “Other banks don’t have anything like this.”<br />

– “I love this! It feels like you’re using Fitbit. I would<br />

definitely use it. Is it ready to use right now?”<br />

Ideal Customers:<br />

We follow a B2B2C model. Our ideal customers<br />

are financial Institutions (Credit Unions/Banks).<br />

Milestones:<br />

• 2 Partnered with FrontFundr to launch<br />

crowdfunding round (see our website for<br />

details)<br />

• 2 LOIs from credit unions in BC<br />

• Winners of Startup Canada SDG Pitch<br />

Competition 2020 for Poverty Reduction<br />

• Winners of BoomStartup Global Pitch<br />

Competition for Finance<br />

• Top 24 Finalist at the OKGN Summit<br />

• SFU Venture Connection Coast<br />

Capital Venture Prize Finalists<br />

(Digital Platform Category)<br />

70