VSO 2021-22 Annual Report

Once again, our work at VSO this year was dominated by the impact of COVID-19. Around the world, closure of schools, pressure on health systems and economic hardship have made life even more difficult for those who were already very vulnerable.

Once again, our work at VSO this year was dominated by the impact of COVID-19. Around the world, closure of schools, pressure on health systems and economic hardship have made life even more difficult for those who were already very vulnerable.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

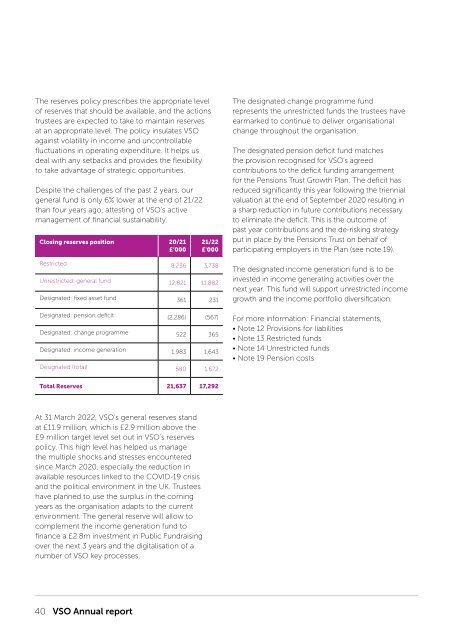

The reserves policy prescribes the appropriate level<br />

of reserves that should be available, and the actions<br />

trustees are expected to take to maintain reserves<br />

at an appropriate level. The policy insulates <strong>VSO</strong><br />

against volatility in income and uncontrollable<br />

fluctuations in operating expenditure. It helps us<br />

deal with any setbacks and provides the flexibility<br />

to take advantage of strategic opportunities.<br />

Despite the challenges of the past 2 years, our<br />

general fund is only 6% lower at the end of 21/<strong>22</strong><br />

than four years ago, attesting of <strong>VSO</strong>’s active<br />

management of financial sustainability.<br />

Closing reserves position 20/21<br />

£’000<br />

21/<strong>22</strong><br />

£'000<br />

Restricted 8,236 3,738<br />

Unrestricted: general fund 12,821 11,882<br />

Designated: fixed asset fund 361 231<br />

Designated: pension deficit (2,286) (567)<br />

Designated: change programme 5<strong>22</strong> 365<br />

Designated: income generation 1,983 1,643<br />

Designated (total) 580 1,672<br />

The designated change programme fund<br />

represents the unrestricted funds the trustees have<br />

earmarked to continue to deliver organisational<br />

change throughout the organisation.<br />

The designated pension deficit fund matches<br />

the provision recognised for <strong>VSO</strong>’s agreed<br />

contributions to the deficit funding arrangement<br />

for the Pensions Trust Growth Plan. The deficit has<br />

reduced significantly this year following the triennial<br />

valuation at the end of September 2020 resulting in<br />

a sharp reduction in future contributions necessary<br />

to eliminate the deficit. This is the outcome of<br />

past year contributions and the de-risking strategy<br />

put in place by the Pensions Trust on behalf of<br />

participating employers in the Plan (see note 19).<br />

The designated income generation fund is to be<br />

invested in income generating activities over the<br />

next year. This fund will support unrestricted income<br />

growth and the income portfolio diversification.<br />

For more information: Financial statements,<br />

• Note 12 Provisions for liabilities<br />

• Note 13 Restricted funds<br />

• Note 14 Unrestricted funds<br />

• Note 19 Pension costs<br />

Total Reserves 21,637 17,292<br />

At 31 March 20<strong>22</strong>, <strong>VSO</strong>’s general reserves stand<br />

at £11.9 million, which is £2.9 million above the<br />

£9 million target level set out in <strong>VSO</strong>’s reserves<br />

policy. This high level has helped us manage<br />

the multiple shocks and stresses encountered<br />

since March 2020, especially the reduction in<br />

available resources linked to the COVID-19 crisis<br />

and the political environment in the UK. Trustees<br />

have planned to use the surplus in the coming<br />

years as the organisation adapts to the current<br />

environment. The general reserve will allow to<br />

complement the income generation fund to<br />

finance a £2.8m investment in Public Fundraising<br />

over the next 3 years and the digitalisation of a<br />

number of <strong>VSO</strong> key processes.<br />

40 <strong>VSO</strong> <strong>Annual</strong> report