VSO 2021-22 Annual Report

Once again, our work at VSO this year was dominated by the impact of COVID-19. Around the world, closure of schools, pressure on health systems and economic hardship have made life even more difficult for those who were already very vulnerable.

Once again, our work at VSO this year was dominated by the impact of COVID-19. Around the world, closure of schools, pressure on health systems and economic hardship have made life even more difficult for those who were already very vulnerable.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

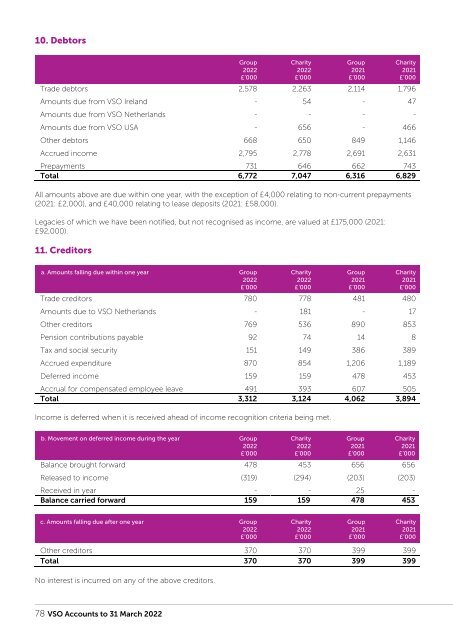

10. Debtors<br />

Group Charity Group Charity<br />

20<strong>22</strong> 20<strong>22</strong> <strong>2021</strong> <strong>2021</strong><br />

£’000 £’000 £’000 £’000<br />

Trade debtors 2,578 2,263 2,114 1,796<br />

Amounts due from <strong>VSO</strong> Ireland - 54 - 47<br />

Amounts due from <strong>VSO</strong> Netherlands - - - -<br />

Amounts due from <strong>VSO</strong> USA - 656 - 466<br />

Other debtors 668 650 849 1,146<br />

Accrued income 2,795 2,778 2,691 2,631<br />

Prepayments 731 646 662 743<br />

Total 6,772 7,047 6,316 6,829<br />

All amounts above are due within one year, with the exception of £4,000 relating to non-current prepayments<br />

(<strong>2021</strong>: £2,000), and £40,000 relating to lease deposits (<strong>2021</strong>: £58,000).<br />

Legacies of which we have been notified, but not recognised as income, are valued at £175,000 (<strong>2021</strong>:<br />

£92,000).<br />

11. Creditors<br />

a. Amounts falling due within one year Group Charity Group Charity<br />

20<strong>22</strong> 20<strong>22</strong> <strong>2021</strong> <strong>2021</strong><br />

£’000 £’000 £’000 £’000<br />

Trade creditors 780 778 481 480<br />

Amounts due to <strong>VSO</strong> Netherlands - 181 - 17<br />

Other creditors 769 536 890 853<br />

Pension contributions payable 92 74 14 8<br />

Tax and social security 151 149 386 389<br />

Accrued expenditure 870 854 1,206 1,189<br />

Deferred income 159 159 478 453<br />

Accrual for compensated employee leave 491 393 607 505<br />

Total 3,312 3,124 4,062 3,894<br />

Income is deferred when it is received ahead of income recognition criteria being met.<br />

b. Movement on deferred income during the year Group Charity Group Charity<br />

20<strong>22</strong> 20<strong>22</strong> <strong>2021</strong> <strong>2021</strong><br />

£’000 £’000 £’000 £’000<br />

Balance brought forward 478 453 656 656<br />

Released to income (319) (294) (203) (203)<br />

Received in year - - 25 -<br />

Balance carried forward 159 159 478 453<br />

c. Amounts falling due after one year Group Charity Group Charity<br />

20<strong>22</strong> 20<strong>22</strong> <strong>2021</strong> <strong>2021</strong><br />

£’000 £’000 £’000 £’000<br />

Other creditors 370 370 399 399<br />

Total 370 370 399 399<br />

No interest is incurred on any of the above creditors.<br />

78 <strong>VSO</strong> Accounts to 31 March 20<strong>22</strong>