initial coverages - PSI Group ASA

initial coverages - PSI Group ASA

initial coverages - PSI Group ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

!<br />

!<br />

!<br />

!<br />

Initiating'coverage'<br />

<strong>PSI</strong> <strong>Group</strong>: The Cash King from<br />

Rælingen<br />

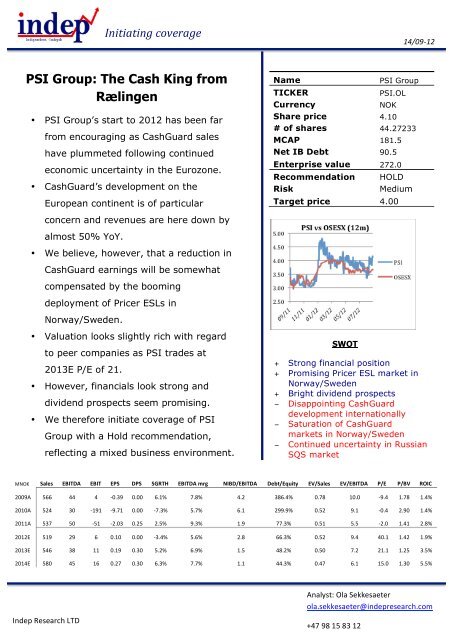

• <strong>PSI</strong> <strong>Group</strong>’s start to 2012 has been far<br />

from encouraging as CashGuard sales<br />

have plummeted following continued<br />

economic uncertainty in the Eurozone.<br />

• CashGuard’s development on the<br />

European continent is of particular<br />

concern and revenues are here down by<br />

almost 50% YoY.<br />

• We believe, however, that a reduction in<br />

CashGuard earnings will be somewhat<br />

compensated by the booming<br />

deployment of Pricer ESLs in<br />

Norway/Sweden.<br />

• Valuation looks slightly rich with regard<br />

to peer companies as <strong>PSI</strong> trades at<br />

2013E P/E of 21.<br />

• However, financials look strong and<br />

dividend prospects seem promising.<br />

• We therefore initiate coverage of <strong>PSI</strong><br />

<strong>Group</strong> with a Hold recommendation,<br />

reflecting a mixed business environment.<br />

Q3/11 earnings Q3/10 Q2/11 Q2/11!<br />

SWOT<br />

!<br />

14/09'12!<br />

+ Strong financial position<br />

+ Promising Pricer ESL market in<br />

Norway/Sweden<br />

+ Bright dividend prospects<br />

− Disappointing CashGuard<br />

development internationally<br />

− Saturation of CashGuard<br />

markets in Norway/Sweden<br />

− Continued uncertainty in Russian<br />

SQS market<br />

!<br />

MNOK! Sales& EBITDA& EBIT& EPS& DPS& SGRTH& EBITDA&mrg& NIBD/EBITDA& Debt/Equity& EV/Sales& EV/EBITDA& P/E& P/BV& ROIC&<br />

2009A! 566! 44! 4! -0.39! 0.00! 6.1%! 7.8%! 4.2! 386.4%! 0.78! 10.0! -9.4! 1.78! 1.4%!<br />

2010A! 524! 30! -191! -9.71! 0.00! -7.3%! 5.7%! 6.1! 299.9%! 0.52! 9.1! -0.4! 2.90! 1.4%!<br />

2011A! 537! 50! -51! -2.03! 0.25! 2.5%! 9.3%! 1.9! 77.3%! 0.51! 5.5! -2.0! 1.41! 2.8%!<br />

2012E! 519! 29! 6! 0.10! 0.00! -3.4%! 5.6%! 2.8! 66.3%! 0.52! 9.4! 40.1! 1.42! 1.9%!<br />

2013E! 546! 38! 11! 0.19! 0.30! 5.2%! 6.9%! 1.5! 48.2%! 0.50! 7.2! 21.1! 1.25! 3.5%!<br />

2014E! 580! 45! 16! 0.27! 0.30! 6.3%! 7.7%! 1.1! 44.3%! 0.47! 6.1! 15.0! 1.30! 5.5%!<br />

Indep!Research!LTD!<br />

Name <strong>PSI</strong> <strong>Group</strong><br />

TICKER <strong>PSI</strong>.OL<br />

Currency NOK<br />

Share price 4.10<br />

# of shares 44.27233<br />

MCAP 181.5<br />

Net IB Debt 90.5<br />

Enterprise value 272.0<br />

Recommendation HOLD<br />

Risk Medium<br />

Target price 4.00<br />

Analyst:!Ola!Sekkesaeter!<br />

ola.sekkesaeter@indepresearch.com!<br />

+47!98!15!83!12!<br />

!

!<br />

Indep!Research!LTD!<br />

TABLE OF CONTENTS<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

COMPANY&PROFILE&.......................................................................................................&3!<br />

MARKET&OVERVIEW&......................................................................................................&4!<br />

Retail'Solutions'.........................................................................................................................................................'4'<br />

''''Groundbreaking!order''..........................................................................................................................................'5!<br />

Cash'Management'Retail'........................................................................................................................................'6!<br />

The!Competitive!Landscape!..................................................................................................................................................!9!<br />

Recent!order!activity!.............................................................................................................................................................!12!<br />

Cash'Management'CIT/ATM'..............................................................................................................................'14!<br />

Case!study:!The!Russian!saga!of!differing!cultures!&!customs!...........................................................................!16!<br />

Recent'M&A'activity'..............................................................................................................................................'19!<br />

ESTIMATES&..................................................................................................................&20!<br />

VALUATION&.................................................................................................................&28!<br />

Investment'Conclusion'........................................................................................................................................'30'<br />

!<br />

APPENDIX&…………………………………………………………………………………………………………………&31&<br />

2!

!<br />

Indep!Research!LTD!<br />

<strong>PSI</strong> GROUP:<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

THE CASH KING FROM RÆLINGEN<br />

COMPANY&PROFILE&<br />

The short story…<br />

<strong>PSI</strong> <strong>Group</strong>, a Rælingen-based company, is a leading manufacturer and<br />

distributor of cash handling solutions to the retail- and Security Transport<br />

(Cash in Transit) industry. Comprising the three business segments: Retail<br />

Solutions (<strong>PSI</strong>), Cash Management Retail (CashGuard) and Cash Management<br />

CIT/ATM (SQS), <strong>PSI</strong> <strong>Group</strong> offer integrated end-to-end solutions ensuring an<br />

efficient and safe operating environment wherever cash moves.<br />

!<br />

Figure 1.0: !<br />

Segment! What!they!do!<br />

Retail& Distributor!of!various!technological!solutions!such!as!CashGuard,!barcode!scanners!and!electronic!<br />

Solutions&<br />

Cash&<br />

shelf!labels!(ESL)!to!the!retail!segment!of!Norway!and!Sweden!<br />

Management& Comprises!the!production!and!sale!of!CashGuard,!a!POS/checkout!cash!handling!system!which!<br />

Retail&<br />

Cash&<br />

Management&<br />

increases!POS!efficiency!as!well!as!minimizes!the!risk!of!robbery!and!pilfering!<br />

CIT/ATM& Delivers!cash!protection!solutions!for!security!transports!and!ATMs!<br />

Source: <strong>PSI</strong> <strong>Group</strong>!<br />

SIGNIFICANT!EVENTS&<br />

2002….!Three-way!merger!between!i<strong>Group</strong>!<strong>ASA</strong>,!Cappit!<strong>ASA</strong>!and!Pinnås!Systems!International!AS!forming!<br />

today’s!<strong>PSI</strong>!<strong>Group</strong><br />

2003….!<strong>PSI</strong>!<strong>Group</strong>!secure!milestone!CashGuard!agreement!with!Norwegian!retail!group,!Norgesgruppen!<br />

2004….!<strong>PSI</strong>!<strong>Group</strong>!acquires!Swedish!retail!distributor,!Antonsen!Gruppen!AB!<br />

2006….&(1)!Divestment!of!handheld!PDA!business!Captura!<strong>ASA</strong>!<br />

&<br />

2006….&(2)!Distribution!operation!Symtech!sold!to!Ingram!Micro!<br />

2008….!<strong>PSI</strong>!<strong>Group</strong>!is!merged!with!CashGuard!AB!<br />

2010….!First!Russian!SQS!orders!are!received!following!extensive!customer!evaluation!<br />

2011….!Successful!completion!of!equity!issue!with!net!proceeds!of!62.6!mnok!<br />

3!

A potential<br />

game<br />

changer for<br />

slow-growing<br />

Norway/<br />

Sweden<br />

!<br />

Indep!Research!LTD!<br />

MARKET&OVERVIEW&<br />

&<br />

Retail Solutions<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Retail Solutions’ growth going forward will<br />

mostly be derived from its distribution<br />

agreement of the Electronic Shelf Label<br />

(ESL) producer, Pricer. Pricer has already<br />

installed over 80 million ESL units across<br />

the world with some 200 retail chains,<br />

and we believe the success could be<br />

replicated across the Norway/Sweden<br />

regions too. Our belief is strengthened by<br />

the recent groundbreaking order <strong>PSI</strong><br />

<strong>Group</strong> secured in May 2012 with a leading<br />

Nordic retailer.<br />

!<br />

Groundbreaking order<br />

We believe this retail group to be Nordic giant Rema 1000, which is a particularly<br />

significant player in Norway with its 497 grocery stores. Following this order, the<br />

whole of Rema 100 Norway will have Pricer’s ESLs installed in their stores. The<br />

order value was given to be over 100 mnok (116 msek), which would translate into<br />

0.18 msek worth of Pricer installations per store. <strong>PSI</strong> <strong>Group</strong> typically accumulates 20-<br />

40% of order values as distributor fees, and for this order we estimate it came to<br />

approximately 22%.<br />

Prior to the ESL order, Pricer installations numbered no more than roughly 120 stores<br />

in Norway and Sweden. The adoption of this ESL system as a mandatory concept<br />

requirement for all Rema 1000 Norway stores is therefore undoubtedly positive.<br />

We predict that this order may mark the eventual breakthrough for Pricer’s ESLs in<br />

both Norway and Sweden as other Nordic retail groups realize the great potential for<br />

significant cost savings.<br />

COOP Nordic is such a retail group, and one we believe could become the next<br />

‘mover’ within the ESL space. Having signed a framework agreement with <strong>PSI</strong> <strong>Group</strong><br />

in January 2011, Pricer ESLs have already undergone pilot installations in both<br />

Norwegian- and Swedish COOP stores. Typically pilot installations conclude after 1-2<br />

years with the customer deciding whether to deploy the system or not. It is therefore<br />

possible that something will happen in this space in a not too distant future. With over<br />

1700 stores, 955 of which are in Norway, COOP Nordic would undoubtedly<br />

contribute in making ESLs a more common sight in Norwegian- and Swedish grocery<br />

stores.<br />

We see large-scale installations within the COOP group’s Norwegian grocery retail<br />

chains as the most probable scenario. Full penetration rates across the 816 most<br />

fitting (realistic) stores would involve the installation of more than 3.7 million ESL<br />

4!<br />

Figure 1.1:<br />

Source: <strong>PSI</strong> <strong>Group</strong>!<br />

!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

units and order values could exceed 250 mSEK. <strong>PSI</strong> <strong>Group</strong> as a distributor would<br />

probably garner 60msek of these.<br />

#!of!<br />

products! Store!size! Turnover/store!<br />

!! #!of!stores! Retail!class!<br />

Super!<br />

on!offer! (square!m)! (mnok)!<br />

COOP!Extra! 43! Discount! 5500!<br />

3500-<br />

1000-2800! 83!<br />

COOP!Prix! 293! Discount! 3900!<br />

2200-<br />

450-1100! 13-96!!<br />

COOP!Marked! 336! Local!<br />

6000! 200-1000! 4-45!!<br />

COOP!Mega! 116! Supermarket! 7200! 800-2000! 45-350!!<br />

COOP!OBS!!Hypermarked! 28! Hypermarket! 30000! 4900! 170-760!!<br />

TOTAL& 816!<br />

Estimated&total&ESL&need&& 3.68m&units& ! ! ! !<br />

Source: COOP Norge, Indep Research estimates!<br />

! ! ! !<br />

Pricer ESLs<br />

are already<br />

well<br />

established<br />

in Europe, so<br />

why not<br />

Norway &<br />

Sweden too?<br />

Figure 1.2: COOP Market Picture for ESL in Norway (excluding prior pilot installations)<br />

As for the Norwegian- and Swedish grocery retail markets isolated it is clear<br />

that there is massive market potential for Pricer ESLs. With penetration rates<br />

significantly higher in high profile global grocery retailers such as Carrefour<br />

we see no reason why this cost efficiency system cannot be replicated in<br />

Norway and Sweden- with <strong>PSI</strong> <strong>Group</strong> as an important partner.<br />

Figure 1.3: General ESL Market Picture (before full scale Rema 1000 Norway roll-out)<br />

Installed!<br />

base!!<br />

(#!stores)!<br />

Potential!<br />

Market!<br />

Market!<br />

Penetration! Retail!class! Country!<br />

! Casino! 400! 549! 72.9%! Hyper-&!supermarkets! France!<br />

Carrefour! 266! 1401! 19.0%! Hypermarkets! France!<br />

Metro! 60! 700! 8.6%! Cash&Carry! Germany!<br />

Soriana! 250! 800! 31.3%! Hyper-&!supermarkets! Mexico!<br />

Norway& 70! 3975! 1.8%!<br />

Sweden& 50! 3500! 1.4%!<br />

Source: Pricer, Indep Research estimates!<br />

Even after full-scale installations of Pricer ESLs across Rema 100 stores,<br />

market penetration in Norway will still remain below 15 % within the grocery<br />

sector.<br />

Going forward we therefore expect a wave of new Norwegian/Swedish<br />

retailers deciding to follow the example of the larger multi-national European<br />

retailers.<br />

5!<br />

! !<br />

! !

2012E:<br />

Pricer, 20%<br />

CashGuard,<br />

17%<br />

Digi scales,<br />

10%<br />

Repant/<br />

Vensafe, 5%<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

As such we expect Pricer’s ESL to surpass CashGuard in Retail Solutions’<br />

revenue split. Historically, Cashguard have accounted for the majority of all<br />

revenues from capital goods. For 2012, we believe Pricer and CashGuard may<br />

well swap places. Furthermore, segments- Service/Support as well as<br />

Consumables normally represent around 25% each of total Retail Solutions<br />

revenues.<br />

The swap in revenue splits does not only stem from increasing Pricer<br />

installations- it is also a factor of declining sales of CashGuard systems in<br />

Norway and Sweden in recent years. This comes as penetration rates are<br />

increasing and markets thereby further saturating (explained further in Cash<br />

Management Retail-section).<br />

Figure 1.4:<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Cash Management Retail<br />

Going forward, international markets will be<br />

of utmost interest to Cash Management<br />

Retail, as CashGuard’s penetration rates in<br />

Norway/Sweden have peaked. We expect<br />

CashGuard revenues to decline in line with<br />

the saturated, yet lucrative grocery markets<br />

of Sweden and Norway on a forward basis.<br />

In 2008 closed cash handling penetration<br />

rates in the grocery trade were considered to<br />

be 15 % and 12.5% for Norway and Sweden<br />

respectively.<br />

6!<br />

Figure 1.5:<br />

Source: <strong>PSI</strong> <strong>Group</strong><br />

!

CashGuard<br />

growth in<br />

Norway/<br />

Sweden<br />

seems<br />

unlikely<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

According to our estimates, this has now increased to around 77% and 62%<br />

respectively- 4 years later. Most of the large Norwegian/Swedish grocery<br />

retail chains have some compliance with closed cash handling systems and<br />

the descending market trends in Norway and Sweden are also exemplified by<br />

the saturating levels of cash circulation- especially in Sweden.<br />

Figure 1.6:<br />

Source: Riksbanken<br />

Figure 1.8: International market for closed cash handling systems within grocery retail (as of August 2012)<br />

!! NORWAY! SWEDEN! DENMARK!<br />

INTERNATIONAL!!<br />

(Scandies!+!Euro-market)!<br />

CashGuard! 7475! 9276! 100! 19390!<br />

Safepay! 1500! 1500! 1500! 6500!<br />

iCash/CINEO! 50! 50! 0! 4000!<br />

AxlonRS! 0! 50! 0! 50!<br />

CashComplete!! 100! 0! 0! 200!<br />

CashInfinity! 0! 0! 0! 600!<br />

Total& 9125! 10876! 1600! 30740!<br />

Pot.!Market! 11925! 17500! 15000! 1289425!<br />

Penetration.& 76.5%! 62.1%! 10.7%! 2.4%!<br />

CashGuard!<br />

Penetration! 62.7%! 53.0%! 0.7%! 1.5%!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Gunnebo, Wincor Nixdorf, Indep Research estimates!<br />

Important to note is that our market research is subjected to grocery retail<br />

checkout points only. Europe’s 11 largest countries boost a total of 4.4million<br />

retail checkout points, of which around 1.28 million we estimate to be grocery<br />

retail checkout points. Our assumptions come as closed cash handling<br />

systems have yet to gain a serious foothold with non-food retailers.<br />

7!<br />

Figure 1.7:<br />

Source: Norges Bank!

International<br />

CashGuard<br />

growth also<br />

looks<br />

challenging<br />

amid the<br />

current<br />

Eurozone<br />

crisis<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

<strong>PSI</strong> <strong>Group</strong> should be praised for their patient gradual build-up of a sound,<br />

international partner network.<br />

However, with the Eurozone crisis still looming large it will be difficult for <strong>PSI</strong><br />

<strong>Group</strong> to compensate for its declining CG revenues in Norway/Sweden with<br />

new customer wins on the European continent- as its stated market objective<br />

outlines.<br />

Par example Spain represents a country of great opportunity for CashGuard<br />

with high cash usage levels in the grocery trade. Several hundred CG pilot<br />

installations have gone down in Spain over recent years but these efforts will<br />

remain futile as long as the country struggles with its soaring debts and<br />

government deficits. Thus retail investments will remain low.<br />

This is also evidenced by the recent collapse in international exports of<br />

CashGuard in 1H-2012, and we predict no sudden upswing for some time.<br />

However, by 2014 we predict international revenues to exceed those of<br />

Norway /Sweden.<br />

Figure 1.9:<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

However looking isolated at cash usage levels, the Eurozone looks an<br />

opportunistic market as these have developed fairly strongly, and paints a<br />

picture far distant from the supposed cash ‘collapse’ dubbed by some industry<br />

observers. Since 2005, cash circulation has risen by over 57%.<br />

8!

!<br />

Indep!Research!LTD!<br />

Figure 2.0:<br />

Source: ECB<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

As emphasised from the penetration tables, CashGuard is the undisputed<br />

world provider of closed cash handling systems. Ever since its first large-scale<br />

installations with Posten Norge in Norway in 2000, CashGuard has been a<br />

market leader and today boosts an installed base of over 19000 systems<br />

across the globe. The CashGuard system comes with a RRP (Recommended<br />

Retail Price) of around 10 000 Euro per unit.<br />

However, CashGuard is far from the only provider of closed cash handling<br />

systems and competition in this niche area is becoming fiercer than ever<br />

before.<br />

The Competitive Landscape<br />

Axlon:<br />

Axlon is the absolute minnow in this segment with only one product on offer, the<br />

Axlon RS (Recycling System). In 2012 the company realigned its business model and<br />

now also takes care of the concrete cash collection process for their customers- in<br />

addition to the provision of its closed cash handling system. Today we estimate an<br />

installed base of around 50 systems- all in Sweden. Since its first R&D activity began<br />

in 2002, more than 230 msek have been recognized in the development of the Axlon<br />

RS module, albeit the company is yet to achieve profitable results.<br />

Notable customers: Filmkjedan, Esplanaden, VI Hornstull (Sweden)<br />

Figure 2.1: Axlon Financials<br />

MSEK! 2008A! 2009A! 2010A! 2011A!<br />

Revenue& 0.6! 1.8! 2! 0.6!<br />

Operating&<br />

profit& -7.8! -20.8! -10.9! -8.5!<br />

margin! NEG! NEG! NEG! NEG!!<br />

Source: Axlon<br />

9!<br />

!

SafePay have<br />

gained on<br />

CashGuard in<br />

recent years<br />

after a dismal<br />

start<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

GLORY LTD:<br />

Glory LTD is one of the true global giants in the field of cash management. However,<br />

the Japanese company derive most of their cash management revenues from the<br />

financial-, transportation and amusement park sector. Its presence in the retail sector<br />

was only felt in in 1996 when it launched its first cash recycler for cashiers.<br />

Today, Glory is highly active in the closed cash handling sector through the recent<br />

launch of the new system, CashInfinity. Per now, there are 300 closed cash handling<br />

systems installed in France across 150-200 bakeries, and for the whole of Europe we<br />

estimate a total of 600 installations. RRP for one fully integrated CashInfinity system<br />

is typically somewhere around 25K Euro.<br />

The key figures from the company’s “Overseas” segment comprise the sale of various<br />

cash handling products to all non-Japanese customers. The European retail sector<br />

typically represents around 10% of sales. It is also noteworthy that Glory’s<br />

management expects the “Overseas” segment to increase sales by 13.3% for FY2012<br />

YoY- making it the most growth-specced segment across the group’s four cash<br />

handling segments.<br />

Notable customers: N/A<br />

Figure 2.2: Glory Overseas Segment Financials<br />

billions!YEN! 2008A! 2009A! 2010A! 2011A!<br />

Revenue& 32784.0! 28712.0! 28753.0! 35306.0!<br />

Operating&<br />

profit& N/A! 1299.0! 1349.0! 1837.0!<br />

margin! N/A! 4.5%! 4.7%! 5.2%!<br />

Source: Glory<br />

SafePay:<br />

Safepay is the closed cash handling system developed by Swedish security company,<br />

Gunnebo. Safepay was formed in 2002 in a bid to compete with the then-only<br />

significant player, CashGuard. Initially the system went through several child hiccups,<br />

and was in 2009 a forbidden purchasing item for many Norwegian store managers.<br />

High service/repair costs have consequently lead to accumulated losses of 100msek<br />

since 2002. However, today these complications seem far gone, with Safepay being<br />

the most internationally established player. According to management, Safepay’s<br />

current losses owe only to expensive repair agreements for the old, unsuccessful<br />

Safepay product suite. Today’s Safepay system is usually priced at a 10% premium to<br />

CashGuard systems, ergo a RRP of around 11 000 Euro. Through its international<br />

sister-subsidiaries of Gunnebo, Safepay have struck many exciting customer<br />

agreements in Western Europe. One such example is the 2011 framework agreement<br />

to supply Italian DIY chain, Leroy Merlin, with over 500 Safepay systems by 2013. In<br />

March 2012 Safepay featured in Gunnebo’s 5-point strategic future agenda and as<br />

such forms an integral part of the future growth strategy for the whole of Gunnebo.<br />

This comes despite Safepay only representing 3.5% of Gunnebo’s total FY 2011<br />

revenues. As the marketing and development costs will come down somewhat in the<br />

next years Gunnebo expects Safepay to reach break-even in 2013, and profitability in<br />

10!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

2014.<br />

Notable customers: COOP (Denmark), La Poste (France), Leroy Merlin (Italy)<br />

Figure 2.3: Safepay Financials<br />

MSEK! 2008A! 2009A! 2010A! 2011A!<br />

Revenue& N/A! N/A! 160.0! 180.0!<br />

Operating&<br />

profit& N/A! N/A! -39.0! -36.0!<br />

margin! N/A! N/A! NEG! NEG!<br />

Source: Gunnebo<br />

Scan Coin:<br />

Have been in the cash management business since 1966- albeit closed cash handling<br />

is something of a new market area with its CashComplete model, which was officially<br />

started in 2008. Like Glory, Scan Coin derives most of its cash management revenues<br />

from the financial sector, which also explains Scan Coin’s wide product offering in the<br />

back office cash management area. Drawing on a large international partner network,<br />

Scan Coin has secured many interesting closed cash handling orders. In November<br />

2011 it signed an agreement with international German hypermarket chain, Kaufland,<br />

to provide the cash management solutions as part of Kaufland’s expansion program.<br />

The agreement calls for all new-built stores across Europe over the next years to be<br />

outfitted with various cash management systems by Scan Coin- most likely the<br />

CashComplete module. It is also the intention that existing stores will be retrofitted<br />

with similar solutions at some point in the future. Per 2009 around 100 systems had<br />

been installed in France, Norway and Germany. Today we estimate a total of 100<br />

systems in Norway alone (Rema 1000), and around 200 in non-Scandinavian<br />

markets. As with Glory, Scan Coin’s product suite is of a premium kind and hence its<br />

CashComplete module has a RRP of around 110 kSEK.<br />

Notable customers: Rema 100 (Norway), Edeka, Kaufland (Germany)<br />

Figure 2.4: SCAN COIN Financials<br />

MSEK! 2008A! 2009A! 2010A! 2011A!<br />

Revenue& N/A! 750.0! 727.0! 850.0!<br />

Operating&<br />

profit& N/A! N/A! N/A! N/A!<br />

margin! N/A! N/A! N/A! N/A!<br />

Source: Indep Research estimates<br />

Wincor Nixdorf:<br />

Along with Glory LTD an undisputable global cash management heavyweight.<br />

Similarly to Glory too, Germany-based Wincor Nixdorf relies more on the financial<br />

sector than the retail sector- in 2011 34% of total revenues were derived from the<br />

retail sector. For the whole group, Europe accounts for 75% of total revenues. Its<br />

current product line for the closed cash handling sector comprises coin/note recycler<br />

11!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

systems iCash and CINEO. The sale of these systems makes up a relatively small<br />

proportion of the Retail-segment’s sales as other payment terminal systems such as<br />

self-checkout-, pay tower- and all-in-one touch kiosk solutions are more significant.<br />

The company offers high quality products but at high premium: one complete iCash<br />

module is marketed at around 15k euro per system. One retail order for Wincor<br />

Nixdorf typically involves a wide range of all these solutions and is therefore a more<br />

‘payment’-hedged provider of retail solutions as opposed to its ‘cash-hedged’<br />

Scandinavian competitors. However, as Wincor Nixdorf’s retail segment is so largely<br />

directed towards POS technology it still paints a useful picture of the closed cash<br />

handling industry. Today we estimate an installed base of around 4000 systems.<br />

Notable customers: Shell (Germany), COOP (Switzerland), 7-Eleven (Sweden)<br />

Figure 2.5: Wincor Nixdorf Retail Segment Financials<br />

millions!<br />

EURO! 2008A! 2009A! 2010A! 2011A!<br />

Revenue&<br />

Operating&<br />

772.0! 718.0! 742.0! 801.0!<br />

profit& 44.0! 34.0! 36.0! 42.0!<br />

margin! 5.7%! 4.7%! 4.9%! 5.2%!<br />

Source: Indep Research estimates<br />

Recent order activity<br />

These competitors will do their utmost to dilute CashGuard’s strong market<br />

position, and recent events suggest that they already have taken many<br />

important steps in doing so;<br />

EXAMPLE 1: Apoteket<br />

WHEN: October 2011<br />

WHAT: Gunnebo announced that formerly CashGuard-loyal pharmacy chain,<br />

Apoteket, had selected SafePay as the supplier of closed cash handling systems.<br />

Installations would see 14 pharmacy stores throughout of Sweden be equipped with<br />

two SafePay units each, including a coin and a currency unit as well as the emptying<br />

device SCL.<br />

ORDER VALUE: We estimate the potential order value of the SafePay-agreement<br />

only to be around 2.2 msek, and as such represents nothing spectacular from a<br />

financial perspective.<br />

WHY THE CONCERN: This undoubtedly came as a blow to CashGuard having<br />

undertaken pilot installations with Apoteket back in 2001, and currenctly boosting an<br />

installed base of over 50 systems.<br />

However, it appears that Apoteket have yet to decide on its main systems provider as<br />

they still have around 270 fully-owned pharmacy stores that have no closed cash<br />

handling systems installed.<br />

12!

A significant<br />

blow to<br />

CashGuard<br />

but the<br />

preferred<br />

systems<br />

provider<br />

remains<br />

unknown<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

EXAMPLE 2: IKEA<br />

WHEN: January 2012<br />

WHAT: Wincor Nixdorf’s new CINEO product suite was selected as IKEA’s primary<br />

provider of automated cash management to stores across several European countries.<br />

The contract award came following a successful pilot period of two years in which the<br />

CINEO solution had been installed in more than 40 stores across 10 countries.<br />

However, the order was for back-office cash management, which involves solutions<br />

that automatically verify cash at the end of a shift period. Cash is stored in auditproof<br />

cassettes, which are then ready to be transported away by CIT (cash-intransit)-operators.<br />

ORDER VALUE: With 300 European IKEA stores seemingly in the focal point of this<br />

order, we estimate the full potential contract value to surpass 15 million euros making<br />

it one of the most valuable retail orders of a cash handling system in history.<br />

WHY THE CONCERN: <strong>PSI</strong> <strong>Group</strong> did undertake around 40 pilot installations in IKEA<br />

France in 2008 but these efforts now look fruitless.<br />

Even though the front office cash management systems are still undergoing a pilot<br />

phase with IKEA and no final decision has yet been made, we find it highly unlikely<br />

that anyone but Wincor Nixdorf’s CINEO/iCash systems will be selected for this order<br />

type due to simplified system integration.<br />

Ergo Wincor Nixdorf’s comprehensive products offering has ostensibly given them a<br />

significant edge in discussions with large European retailers.<br />

EXAMPLE 3: Axfood<br />

WHEN: June 2012<br />

WHAT: Swedish grocery retail group, Axfood, signed a framework agreement with<br />

fellow Swedish company Gunnebo for its closed cash handling system, SafePay.<br />

However this is not a conclusive agreement for Safepay as it only comprises an <strong>initial</strong><br />

order of 100 systems over 3 years, and most of Axfood’s grocery chains- Willys,<br />

Willys Hemma, Hemkop and PrisXtra- will be able to cancel their participation as<br />

semi-owned retailers.<br />

ORDER VALUE: We estimate this framework agreement’s order value of up to<br />

8MSEK.<br />

WHY THE CONCERN: <strong>PSI</strong> <strong>Group</strong>’s CashGuard has remained a well-established<br />

systems supplier since 2005 and reportedly has an installed base of several hundred<br />

systems with Axfood’s grocery chains. However, Axfood will not abandon its<br />

longstanding customer relationship with <strong>PSI</strong> <strong>Group</strong>, and will deploy both cash<br />

handling systems parallel with each other going forward.<br />

Nonetheless, it is slightly worrying that Axfood- Sweden’s second largest grocery<br />

group with 1057 wholly-and partially owned stores, decide to go with another system<br />

following over 7 years of prior customer experience with CashGuard. Reportedly, the<br />

reasons why they did so are twofold.<br />

I. Safepay’s system has better catered- and prepared for the 2015 introduction<br />

of the new Swedish 200kr-note as well as 2016’s 2kr-coin. These new system<br />

requirements have now been addressed by <strong>PSI</strong> <strong>Group</strong>, and should not pose<br />

significant challenges in the future.<br />

13!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

II. According to Axfood, Safepay’s cash handling system is more closed and<br />

integrated than CashGuard. This supposedly reduces the security risk as store<br />

personnel and security guards to a lesser extent need to take care of the<br />

actual cash transportation from the store to CIT transports.<br />

Cash Management CIT/ATM<br />

SQS’s potential market is global but today<br />

largely comprises certain areas of Europe.<br />

Regulated/mature CIT markets typically form<br />

the backbone of SQS’ core revenue streams<br />

such as Sweden, Belgium and France in<br />

which ‘intelligent’ security solutions are<br />

made obligatory by government legislation.<br />

Unregulated/immature markets such as<br />

Source: <strong>PSI</strong> <strong>Group</strong><br />

Russia and Australia also represent<br />

promising market opportunities in which<br />

armored security vehicles substitute for the ‘intelligent’ security solutions used<br />

in regulated markets. The reasons why a country’s CIT industry stays<br />

unregulated/immature are threefold.<br />

I. The Central Bank has to accept that notes with dye on can be destructed<br />

and replaced for a small charge.<br />

II. Insurance companies have to accept the technology in order to insure<br />

the bank notes under CIT and in the ATM. For example, SQS’ dye is<br />

certified in Sweden, France, Belgium and Germany.<br />

III. Some countries’ banknotes are of such quality that explosive dye will not<br />

make any visible impact on them. This could simply be down to poor<br />

quality, or the banknotes may contain polymer, which is more dyeresistant.<br />

In 2009, SQS management estimated the total market for ATM-and CIT<br />

products to be worth between 850- 1500 msek. Albeit CIT attacks are<br />

clearly plummeting there are two points one should bear in mind:<br />

I. If the UK is excluded from the calculations, there has been a 7%<br />

increase YoY in 2011 on the number of CIT attacks.<br />

14!<br />

Figure 2.6:

Regulated<br />

markets will<br />

continue to<br />

demand<br />

advanced<br />

security<br />

products<br />

Deliveries<br />

take place in<br />

Q4-2012, and<br />

expected<br />

gross margin<br />

is up to 80%<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

II. Even though attacks dropped 7% from 2000-2011, there has been a<br />

46% increase in the total value amount lost during the same period.<br />

Figure 2.7: (Russia not included)!<br />

Source: ESTA!<br />

Looking across Europe, it is mostly the regulated markets that struggle with<br />

the majority of CIT attacks.<br />

A country such as the UK have historically suffered greatly from numerous<br />

CIT attacks every year, and in 2009 it accounted for over 75% of total<br />

European CIT attacks.<br />

The widespread opportunities present in the regulated market are also<br />

exemplified by a recent customer acquisition in Sweden.<br />

In August 2012, SQS entered into an agreement with, Bankomat AB,<br />

regarding ATM cassette services and related logistics for Bankomat’s ATMs in<br />

Sweden. Bankomat AB handles the operation and management of all ATMs<br />

owned by Sweden’s five largest banks: Danske Bank, Nordea, SEB, Swedbank<br />

and Handelsbanken. The agreement extends over 5 years with a value of<br />

around 17 msek per yearand an option for 2 further years.<br />

Figure 2.9: Regulated Market for CIT products<br />

Country!<br />

#!of!CIT!<br />

companies!<br />

#!of!<br />

personnel!<br />

15!<br />

#!of!CIT!<br />

vehicles!<br />

Market!<br />

Potential!<br />

(MSEK)!<br />

Belgium& 2! 1300! 280! 9.8!<br />

Denmark& N/A! N/A! N/A! N/A!<br />

France& 12! 10000! 1500! 52.5!<br />

Germany& 56! 11000! 2500! 87.5!<br />

Italy& 160! 6800! 1450! 50.8!<br />

Luxembourg& 2! 210! 40! 1.4!<br />

Netherlands& 3! 2000! 400! 14.0!<br />

Norway& 2! 800! 250! 8.8!<br />

Sweden& 3! 1500! 400! 14.0!<br />

UK& 14! 11665! 3129! 109.5!<br />

Source: ! ESTA, Indep ! Research estimates !<br />

!<br />

Figure 2.8 (Russia not included)!<br />

Source: ESTA<br />

TOTAL:& 248.2&MSEK&<br />

!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Case study: The Russian saga of differing cultures & customs<br />

Russia represents one of the more exciting markets within the<br />

unregulated/immature market sphere. SQS have been present in this market<br />

since June 2010 but a definite breakthrough has been hampered by a wide<br />

range of challenges.<br />

<strong>PSI</strong> <strong>Group</strong>’s epic Russian saga is a tale of many events, which can be<br />

summarized as below;<br />

June 2010<br />

<strong>PSI</strong> <strong>Group</strong> receives an <strong>initial</strong> order of 100 units of its Q-case 400 for distribution to<br />

the Russian National Bank, Sberbank.<br />

The total order calls for 420 units to eventually be delivered.<br />

July 2010<br />

<strong>PSI</strong> <strong>Group</strong> indicates experience of contractual dispute with its Russian distributor<br />

partner regarding the Sberbank-order.<br />

October 2010<br />

“Contractual challenges” still a significant issue and as a result no deliveries have<br />

been made at this point- contrary to the original agreement.<br />

December 2010<br />

100 units of the Q-case 400 are shipped out to Sberbank (out of the 420 ordered in<br />

June). <strong>PSI</strong> <strong>Group</strong> receives a prepayment from the distributor.<br />

A further 580 units of the security case are also ordered with expected delivery<br />

sometime during 2011- pending the approval of the first shipment by Sberbank.<br />

<strong>PSI</strong> <strong>Group</strong> voice their frustration with their Russian partner- particularly Russian<br />

customs and price negotiations.<br />

February 2011 (1)<br />

The Russian distribution partner still remains a significant problem area for Cash<br />

Management CIT/ATM. A total of 106 SQS cases were delivered to Sberbank in the<br />

4th quarter. The segment posts a writedown of goodwill of 186.1 mnok.<br />

February 2011 (2)<br />

<strong>PSI</strong> <strong>Group</strong> divests its Cash Management CIT/ATM (SQS) segment to its Russian<br />

distribution partner, OOO CKC, based on an EV of SEK 190 million. The closing of the<br />

transaction is expected take place in the beginning of March 2011.<br />

March 2011<br />

The closing of the SQS-transaction delays and the completion is now expected to take<br />

place during April 2011.<br />

April 2011<br />

The buyer, OOO CKC, have not met its payment obligations and requests additional<br />

time. <strong>PSI</strong> <strong>Group</strong> engages financial consultants to look at the economics of a private<br />

placement in the event that the buyer fails to carry out the payment.<br />

June 2011<br />

The SQS transaction is still delaying and the company makes the decision to conduct<br />

a private placement regardless of whether the transaction is finalized or not.<br />

August 2011<br />

The SQS transaction with its Russian partner, OOO CKC, is officially cancelled and <strong>PSI</strong><br />

16!

All these<br />

traits make<br />

for an ideal<br />

SQS market<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

<strong>Group</strong> conducts its private placement in September 2011.<br />

May 2012<br />

Deliveries of security cases to Russian customer, Sberbank, are restarted. An order of<br />

700 cases expected to be produced and paid for on delivery in the 2 nd quarter.<br />

July 2012<br />

Deliveries to Russia continue but the market is yet typified by “considerable<br />

uncertainty”.<br />

Then, given all this uncertainty, why not just abandon the whole<br />

Russian market at once, and focus resources elsewhere?<br />

Because the Russian market is a one with promise;<br />

1) HIGH CASH USAGE: According to Russian finance minister Anton<br />

Siluanov, the share of cash stands at 25% of total money supply, which<br />

is 2x that of European countries and 1.5x that of other developing<br />

nations.<br />

2) ATTRACTIVE CUSTOMER: Sberbank is Russia’s largest bank and<br />

accounts for over 50% of all Russian retail deposits. Upon signing the<br />

<strong>initial</strong> agreement in June 2010, Sberbank expressed its goal of having<br />

all their 4600 CIT vehicles in compliance with the SQS technology by<br />

2014. Thus, Sberbank alone could easily be worth up to 138 msek as a<br />

customer to SQS (based on 30ksek per case), and would act as a great<br />

reference customer to other international players.<br />

3) WIDESPREAD USE OF YESTERDAY’S SOLUTIONS: Russia has a<br />

strong history of using heavily armored CIT vehicles with cash bags<br />

(only some of which have alarm mechanisms) instead of the more<br />

European and modern ‘soft cars’-concept with secure protection cases.<br />

These primitive cash bags cost between 5$-145$ apiece and pose no<br />

challenge to seasoned burglars and thieves.<br />

Russia’s heightened focus on CIT security does not come unfounded. Over the<br />

last 2 years alone, close to 14 Musd has been lost in many vicious armed<br />

robberies of CIT transports, ATMs and banks.<br />

17!

!<br />

Indep!Research!LTD!<br />

Figure 3.0: Financial Sector robberies, Russia<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Date! City! Assault!Victim! MISC! Casualties!<br />

Worth!of!<br />

cash!stolen!<br />

(K!USD)!<br />

Jan]08& Blagoveshchensk! JSC!Bank!of!Asia!Pacific! Bank!robbery! None! 943!<br />

Feb]08& Sterlitamak! N/A! Bank!robbery! None! 122!<br />

Mar]08& Dzerzhinsk! Sberbank! Bank!robbery! None! 531.8!<br />

Jun]08& St.!Petersburg! EEFC! Bank!robbery! None! 200!<br />

Apr]09& Chenlyabinskov! Chelindbank! Bank!robbery! None! 20.3!<br />

Jun]09& Perm! Sberbank! CIT!robbery! None! 7700!<br />

Jul]09& Nekrasovskoe! Sberbank! Bank!robbery! None! 15.4!<br />

Sep]09& Khimki! Office!Savings!Bank! Bank!robbery! None! 1.8!<br />

Dec]09& Nazran! Esid!Bank! CIT!robbery! 1!wounded! 1200!<br />

Jun]10& Moscow! Altayenergobanka! Bank!robbery! None! 185!<br />

Jun]10& Moscow! Rosbank! CIT!robbery! 3!dead! 4000!<br />

Jul]10& Moscow! Citibank! Bank!robbery! None! 83!<br />

Sep]10& Smolensk! Svyaz-Bank! Bank!robbery! None! 90!<br />

Oct]10& Soviet!Balashika! Sberbank! Bank!robbery! None! 154!<br />

Oct]10& Zamshina! Petrovsky! Bank!robbery! None! 16!<br />

Feb]11& Vladikavkaz! Bank!of!Moscow! Bank!robbery! None! 6160!<br />

May]11& Moscow! N/A! Bank!theft! None! 400!<br />

May]11& Perm! Sberbank! ATM!robbery! None! 154!<br />

Jun]11& St-Petersburg! N/A! Bank!robbery! None! 40!<br />

Sep]11& Moscow! N/A! ATM!robbery! None! 21.6!<br />

Oct]11& Elektrostal! N/A! Bank!theft! None! 771!<br />

Oct]11& Moscow! Sberbank! ATM!robbery!<br />

Bank!<br />

1!Several!injured! 3.1!<br />

Oct]11& Kabardino-Balkaria! Opening!Bank!<br />

Robbery! 2!severely!injured! 118!<br />

Dec]11& Moscow! N/A! Bank!theft! None! 679!<br />

Feb]12& Thule! N/A! Bank!theft!<br />

Bank!<br />

None! 61.7!<br />

Feb]12& St-Petersburg! Bank!Commercial!East! Robbery!<br />

Currency!<br />

None! 98.7!<br />

Feb]12& Rostov! N/A!<br />

Exchange! None! 92.5!<br />

Mar]12& Moscow! Sberbank! Bank!robbery! None! 586!<br />

May]12& Perm! N/A! ATM!robbery! None!<br />

!<br />

185.6!<br />

Total&lost:& 24.6&MUSD&<br />

! ! ! !<br />

Source: RIA Novosti, Indep Research estimates<br />

Furthermore, it is with great encouragement we note that cash usage in<br />

Russia is far from declining. Cash is still the preferred payment medium in<br />

Russia and such is also evidenced by the increasing no. of ATM’s in Russia-<br />

which have risen close to 19% year-on-year. Russia now boasts a total of<br />

over 60 000 ATMs.<br />

18!

The cash<br />

handling<br />

industry has<br />

become<br />

highly<br />

dynamic<br />

!<br />

Indep!Research!LTD!<br />

Recent M&A activity<br />

!<br />

Figure 3.1:<br />

Source: RIA Novosti<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

EXAMPLE 1:<br />

WHEN: Oct. 2010<br />

WHAT: Significant cash handling player, Scan Coin, was approached by Swedish buyout<br />

firm, Segulah IV, who acquired a 70% majority stake in the company.<br />

VALUE: Details of the transaction have remained undisclosed and relevant data have<br />

been near impossible to obtain. However, using a P/S multiple of 1.5, we estimate a<br />

purchasing price of around 760 msek, which would value the whole firm at around 1.1<br />

billion SEK.<br />

RESULT: Following Segulah’s investment in the company, Scan Coin’s capex<br />

spending has increased substantially in the form of extensive M&A activity. A common<br />

factor for all the acquired companies is their shared status as longstanding partners<br />

with Scan Coin in their respective geographic markets. As well-established distributors<br />

and suppliers within cash handling for the bank- and retail sectors all around Europe,<br />

Scan Coin has now become more geographically diversified. Since its first acquisition<br />

some 16 months ago we believe Scan Coin have reached acquired revenues of more<br />

than 130 msek: roughly 15% of its FY2010 revenue base.<br />

Figure 3.2: Scan Coin’s M&A Activity<br />

Annual!<br />

When! Target!<br />

revenues! What! Where!<br />

May-12! SoftOne! 5!msek! Software:!Hardware!integrator! Switzerland!<br />

Jan-12! Laurel!NGZ!SAS! 33.8!msek! Hardware:!Note!handling!<br />

Distributor:!Cash!handling!<br />

France!<br />

Jan-12! Money!Park!SARL! 8.5!msek! equipment! France!<br />

Sep-11! Sotremo! >60!msek! Distributor!Coin/note!handling!<br />

Distributor:!Coin/banknote!<br />

Switzerland!<br />

Apr-11! Sophus!Clausen!<br />

&<br />

4!msek! solutions!! Norway!<br />

Total&acquired&revenues&&&&&&111.3&MSEK&<br />

!<br />

%&of&FY2010&revenues& 15.3%&<br />

! !<br />

!<br />

! !<br />

Source: Scan Coin, Indep Research estimates<br />

19!

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

EXAMPLE 2:<br />

WHEN: December 2011<br />

WHAT: Cash handling giant, Loomis, purchased Spanish CIT company, Efectivox.<br />

Efectivox boasts an employee base of 500, 70 CIT vehicles and 11 branches. In 2010<br />

the company posted negative results on revenues of MSEK 130. However, for 2013,<br />

Loomis expects the company to have positive contribution on the group’s earnings<br />

through synergies.<br />

VALUE: The purchase price was appx 160 MSEK. Such levels yield a EV/Sales of<br />

1.23x. Loomis and its acquired companies offer interesting comparisons with <strong>PSI</strong><br />

<strong>Group</strong>’s Cash Management CIT/ATM (SQS).<br />

EXAMPLE 3:<br />

WHEN: February 2012<br />

WHAT: Japanese cash handling giant, Glory LTD,<br />

acquired UK based Talaris Topco LTD. Talaris is one of<br />

the world’s leading manufacturers of cash handling<br />

machines to banking, retail and gaming industries.<br />

With such machines as teller cash recyclers, desktop<br />

counters and ATMs on offer, Talaris draws on over<br />

1900 employees in 22 countries around the world.<br />

VALUE: Talaris was purchased for a cash<br />

consideration of 650 mGBP.<br />

The acquisition involved interesting pricing multiples-<br />

many of which largely outperform those of <strong>PSI</strong> <strong>Group</strong>.<br />

ESTIMATES&<br />

!<br />

Retail Solutions:<br />

Retail Solutions is by many accounts the safe haven within the <strong>PSI</strong> <strong>Group</strong> as it<br />

usually performs well, even during downturns. With high market exposure to<br />

the stable, yet mature markets of Norway and Sweden, Retail Solutions, is<br />

also the one segment with least growth prospects. It has widely been<br />

projected a significant revenue decline for this segment following high<br />

penetration rates for CashGuard.<br />

However, albeit the sale of CashGuard systems to these segments has<br />

reached its maturity stage, Retail Solutions will still gain from the powerful<br />

installed base in the form of Service/Support revenues.<br />

20!<br />

Figure 3.3: Details of Talaris-acquisition<br />

mGBP! 2010A! 2011A!<br />

Revenue! 305.6! 321.5!<br />

EBITDA! 63.7! 68.1!<br />

EBIT! 38.4! 37.5!<br />

EV/S! 2.1! 2.0&<br />

EV/EBITDA! 10.2! 9.5&<br />

EV/EBIT! 16.9! 17.3&<br />

Source: Glory LTD

!<br />

Indep!Research!LTD!<br />

!<br />

Figure 3.4:<br />

Revenue'(MNOK)'<br />

400!<br />

300!<br />

200!<br />

100!<br />

0!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Retail'Solutions:'Revenue'split'<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Further to this, we see many opportunities developing for Retail Solutions with<br />

its Pricer ESLs. We foresee that the escalated deployment of Pricer ESL in<br />

Norway and Sweden should compensate for the expected decline of<br />

CashGuard deliveries.<br />

Thus we deem it probable that Retail Solutions will grow its revenue base with<br />

a CAGR of 0.6%, whereas EBITDA margins will remain in the lower range<br />

around 7%.<br />

Figure 3.5: Retail Solutions- Earnings<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Revenue! 393.8! 406.4! 412.6! 405.4! 413.5! 420.9!<br />

EBITDA! 14.9! 38.7! 36.9! 29.8! 31.0! 30.7!<br />

margin! 3.8%! 9.5%! 8.9%! 7.4%! 7.5%! 7.3%!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Cash Management Retail:<br />

Cash Management Retail is expected to have a disastrous year of 2012<br />

following maturity of Norwegian- and Swedish markets as well as worsening<br />

economic conditions across the Eurozone. For the 1 st Half 2012, Cash<br />

Management Retail has posted revenues of 40.9 mnok vis-à-vis 77.6 mnok 1 st<br />

Half 2011. That speaks volumes of a deteriorating market climate.<br />

We see no operational turning point arising in some time, and thus expect<br />

revenue CAGR to be -3.9% over the next 3 years.<br />

Year 2011 was a brilliant year for Cash Management Retail and we do not see<br />

the segment reaching those highs for some years. Margins will be under<br />

pressure in 2012 and following increased internationalization we expect these<br />

to remain under pressure from 2013 and onwards.<br />

21!<br />

NEW!SALES!<br />

SERVICE/REPAIRS!

Cash<br />

Management<br />

CIT/ATM will<br />

drive most of<br />

<strong>PSI</strong> <strong>Group</strong> ’s<br />

growth going<br />

forward<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Thus we anticipate a significant decline in the number of delivered CashGuard<br />

systems to the market. 1 st Half 2012 is down by 456 systems YoY: 377<br />

systems short in Norway/Sweden, and 79 short in the international market.<br />

That does not bode well, and our forward estimates are logically influenced by<br />

this. However, we do see international sales developing nicely and this should<br />

keep total systems deliveries stable and flat.<br />

Figure 3.6: Cash Management Retail- Earnings<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Revenue! 107.4! 124.5! 131.1! 89.5! 97.6! 108.3!<br />

EBITDA! 7.6! 13.6! 21! 5.5! 9.6! 11.0!<br />

margin! 7.1%! 10.9%! 16.0%! 6.2%! 9.8%! 10.2%!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Figure 3.7: No. of delivered CashGuard systems<br />

#!delivered!systems! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Norway!&!Sweden! 1560! 1466! 1278! 899! 765! 602!<br />

Other! 188! 557! 688! 453! 640! 832!<br />

TOTAL& 1748& 2023& 1966& 1352& 1404& 1435&<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Cash Management CIT/ATM<br />

Cash Management CIT is the best-performing segment of <strong>PSI</strong> <strong>Group</strong> thus far<br />

in 2012. As opposed to the other two segments, CM CIT/ATM has performed<br />

in line with 1 st Half 2011. We expect FY2012 revenue to come in 12.4% higher<br />

YoY with margins remaining similar to previous years. However, these should<br />

also pick up amid increased market activity from 2013 and onwards.<br />

On the back of the recent 17MSEK-a year agreement with Bankomat AB, we<br />

forecast 15.9% revenue CAGR through 2014. In the event that Russian<br />

deliveries escalate we would obviously adhere to revise our estimates further<br />

upwards. We also downplay the risk of running losses due to stable market<br />

conditions as well as a cost cutting program initiated in 2011.<br />

22!

We see<br />

potential for<br />

<strong>PSI</strong> <strong>Group</strong><br />

becoming a<br />

stable<br />

generator of<br />

dividends<br />

!<br />

Indep!Research!LTD!<br />

Figure 3.8: Cash Management CIT/ATM- Earnings<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Revenue! 173.7! 86.3! 90.3! 101.5! 112.6! 130.7!<br />

EBITDA! 28.7! -11.9! 2.4! 2.8! 7.1! 13.2!<br />

margin! 16.5%! NEG! 2.7%! 2.7%! 6.3%! 10.1%!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Dividend<br />

<strong>PSI</strong> <strong>Group</strong> shall pay out an extraordinary dividend of 0.25 NOK per share in<br />

2012 for the financial year of 2011. The group experienced strong operational<br />

cash flow as well as securing extra capital through its equity issue in 2011.<br />

The company’s board of directors have stated that they wish to “continue to<br />

pay dividends in the coming years” too.<br />

However, for 2012 we believe the situation is different. 2 nd Half 2012 free<br />

cash flow amounted to 8mnok compared to 10.8mnok for 2011. In addition<br />

the group has its dividend payment of 11.1mnok scheduled for Q3 2012. We<br />

take a cautious dividend stance and feel it would be too risky to pay dividends<br />

also in 2013. However, from 2014 and onwards we believe the company<br />

should return to its dividend policy on the back of strong 2013 cash flows. We<br />

estimate a FY2013 DPS of 0.3 NOK, which is 20% above the FY2011 dividend.<br />

Figure 3.9:<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Source: Indep Research estimates!<br />

!<br />

23!<br />

!

The<br />

drastically<br />

improved<br />

financials act<br />

as an<br />

important<br />

safety buffer<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Capital Structure<br />

We believe the 2011 equity issue will be instrumental in driving <strong>PSI</strong> <strong>Group</strong>’s<br />

growth in the future. Conducted in Q3-2011 the rights issue was highly<br />

successful in bringing in required capital for <strong>PSI</strong> <strong>Group</strong>. With over 62.6 mnok<br />

in increased capital the company got the funding it sought and dearly needed.<br />

<strong>PSI</strong> <strong>Group</strong> had been in breach with its main bank’s loan covenants for some<br />

time- and with a failed Cash Management CIT/ATM transaction- a share issue<br />

was the only way out. The net proceeds went towards reducing interestbearing<br />

debts by 56.5 mnok. The company has also heavily depreciated its<br />

goodwill posts stemming from the CashGuard acquisition in 2008.<br />

Today <strong>PSI</strong> <strong>Group</strong> generally generates strong and stable cash flows and, as a<br />

result, <strong>PSI</strong> <strong>Group</strong>’s financial structure is now considerably stronger than<br />

before.<br />

Figure 4.0:<br />

7!<br />

6!<br />

5!<br />

4!<br />

3!<br />

2!<br />

1!<br />

0!<br />

Financial'structure''<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

Figure 4.1:<br />

MNOK'<br />

350!<br />

300!<br />

250!<br />

200!<br />

150!<br />

100!<br />

50!<br />

0!<br />

176!<br />

450%!<br />

400%!<br />

350%!<br />

300%!<br />

250%!<br />

200%!<br />

150%!<br />

100%!<br />

50%!<br />

0%!<br />

Improved'Kinancial'position'<br />

133! 81!<br />

24!<br />

94!<br />

Q2!2011! Q2!2012!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

NIBD/EBITDA!<br />

(LHS)!<br />

Covenant!(LHS)!<br />

Debt/Equity!<br />

(RHS)!<br />

InterestZbearing!<br />

debt!<br />

Goodwill!<br />

Cash!

P&L<br />

!<br />

Indep!Research!LTD!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Sales& 565.6& 524.3& 537.2& 518.9& 545.9& 580.2&<br />

COGS! -240.9! -217.8! -239.4! -233.0! -241.3! -254.7!<br />

Gross!Profit! 324.7! 306.5! 297.8! 285.9! 304.6! 325.5!<br />

SG&A! 280.4! -276.5! -247.9! -257.1! -267.0! -280.7!<br />

EBITDA& 44.3& 30.0& 49.9& 28.8& 37.6& 44.8&<br />

Depreciation&Amortisation! 40.2! -27.0! -42.6! -22.6! -26.2! -28.4!<br />

Goodwill!impairment! 0.0! -194.4! -58.6! 0.0! 0.0! 0.0!<br />

EBIT& 4.0& ]191.5& ]51.3& 6.3& 11.4& 16.3&<br />

Net!financial!items! -12.7! -11.8! -6.1! -0.5! 0.6! 0.5!<br />

Pretax&Profit& ]8.7& ]203.3& ]57.4& 5.7& 12.0& 16.8&<br />

Tax!(28%)! 0.1! -1.8! 0.1! -1.2! -3.4! -4.7!<br />

Reported&after&tax&profit& ]8.6& ]205.1& ]57.3& 4.5& 8.6& 12.1&<br />

Extraord.!items! 0.0! 0.0! 0.0! 0.0! 0.0! 0.0!<br />

Net&Income& ]8.6& ]205.1& ]57.3& 4.5& 8.6& 12.1&<br />

EPS& ]0.42& ]9.71& ]2.03& 0.10& 0.19& 0.27&<br />

Balance Sheet<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Goodwill! 313.1! 140.8! 82.0! 81.0! 81.0! 81.0!<br />

Intangible!assets! 180.7! 186.0! 156.3! 139.7! 127.1! 115.7!<br />

Tangible!assets! 47.8! 44.4! 40.5! 37.7! 35.1! 32.6!<br />

Non-current!financial!<br />

assets! 0.0! 0.0! 0.0! 0.0! 0.0! 0.0!<br />

Account!receivables! 90.3! 84.3! 81.5! 84.3! 86.9! 89.1!<br />

Inventory! 75.1! 71.8! 66.3! 69.9! 72.4! 73.9!<br />

Other!current!assets! 16.2! 16.0! 13.4! 12.7! 12.1! 11.5!<br />

Cash!and!cash!<br />

equivalents! 9.7! 5.1! 4.2! 3.9! 13.1! 11.8!<br />

Total&assets& 733.0& 548.3& 444.3& 429.1& 427.5& 415.6&<br />

Equity! 364.1! 203.3! 210.4! 208.5! 226.3! 220.4!<br />

Minorities! 0.0! 0.0! 0.0! 0.0! 0.0! 0.0!<br />

Interest&bearing&debt& 197.3& 187.4& 99.2& 84.6& 70.1& 61.7&<br />

Accounts!payable! 51.1! 53.3! 38.7! 51.9! 54.6! 63.8!<br />

Pension!provisions! 0.0! 0.0! 0.0! 0.0! 0.0! 0.0!<br />

Other!liabilities! 120.5! 104.3! 96.0! 84.1! 76.5! 69.7!<br />

Total&equity&and&<br />

liabilities& 733.0& 548.3& 444.3& 429.1& 427.5& 415.6&<br />

Net!interest!bearing!<br />

debt! 187.6! 182.3! 95.0! 80.7! 57.0! 49.9!<br />

25!

Cash flow Statement<br />

!<br />

Indep!Research!LTD!<br />

!<br />

!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

MNOK! 2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

EBT! -8.7! -198.7! -51.4! 5.7! 12.0! 16.8!<br />

Other!income!! -1.8! -2.0! -2.0! -3.2! -2.2! -1.8!<br />

Depreciation&!amortisation! 40.3! 221.0! 95.2! 22.6! 26.2! 28.4!<br />

Net!financial!items! 7.7! 1.1! 6.7! 5.8! 0.6! 0.5!<br />

Paid!taxes! -0.4! 1.0! 2.1! -3.6! -3.4! -4.7!<br />

Changes!in!working!capital! 5.7! 3.6! -14.9! -6.8! 2.4! -5.5!<br />

Cash&flow&from&operations& 42.7! 26.1! 35.7! 37.1! 35.6! 33.8!<br />

!!<br />

CAPEX!<br />

Proceeds!from!other!<br />

!<br />

-20.8!<br />

!<br />

-12.1!<br />

!<br />

-2.4!<br />

!<br />

-8.8!<br />

!<br />

-12.0!<br />

!<br />

-13.3!<br />

investments! 3.2! 12.3! 9.2! 2.6! 0.0! 0.0!<br />

Cash&flow&from&investments& -17.5! 0.2! 6.8! -6.2! -12.0! -13.3!<br />

&&<br />

FREE&CASH&FLOW&<br />

!<br />

25.2!<br />

!<br />

26.3!<br />

!<br />

42.5!<br />

!<br />

30.9!<br />

!<br />

23.6!<br />

!<br />

20.5!<br />

!!<br />

Changes!in!interest!bearing! ! ! ! ! ! !<br />

debt! -34.8! -31.4! -105.6! -18.1! -14.5! -8.4!<br />

Issue/repurchase!of!shares! 0.0! 0.0! 62.3! -1.5! 0.0! 0.0!<br />

Paid!dividends! 0.0! 0.0! 0.0! -11.1! 0.0! -13.3!<br />

Other!non-cash!adjustments! 0.0! 0.0! 0.0! 0.0! 0.0! 0.0!<br />

Cash&flow&from&financing& -34.8! -31.4! -43.3! -30.7! -14.5! -21.7!<br />

!!<br />

Net&cash&flow&<br />

!<br />

-9.6!<br />

!<br />

-5.1!<br />

!<br />

-0.8!<br />

!<br />

0.2!<br />

!<br />

9.1!<br />

!<br />

-1.2!<br />

!!<br />

Net!IB!Debt!<br />

!<br />

187.6!<br />

!<br />

182.3!<br />

!<br />

95.0!<br />

!<br />

80.7!<br />

!<br />

57.0!<br />

!<br />

49.9!<br />

26!

!<br />

Segment Reporting<br />

!<br />

CASHGUARD&INSTALLATIONS&(#)&<br />

Indep!Research!LTD!<br />

&<br />

&<br />

&<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

2009A! 2010A! 2011A! 2012E! 2013E! 2014E!<br />

Norway!&!Sweden! ! 1560! ! 1466! ! 1278! ! 899! ! 765! ! 602!<br />

Other! 188! 557! 688! 453! 640! 832!<br />

TOTAL! 1748! 2023! 1966! 1352! 1404! 1435!<br />

RETAIL&SOLUTIONS&(MNOK)& !! !! !! !! !! !!<br />

Revenue! 393.8! 406.4! 412.6! 405.4! 413.5! 420.9!<br />

EBITDA! 14.9! 38.7! 36.9! 29.8! 31.0! 30.7!<br />

margin! 3.8%! 9.5%! 8.9%! 7.4%! 7.5%! 7.3%!<br />

CASH&MANAGEMENT&RETAIL&(MNOK)& !! !! !! !! !! !!<br />

Revenue! 107.4! 124.5! 131.1! 89.5! 97.6! 108.3!<br />

EBITDA! 7.6! 13.6! 21! 5.5! 9.6! 11.0!<br />

margin! 7.1%! 10.9%! 16.0%! 6.2%! 9.8%! 10.2%!<br />

CASH&MANAGEMENT&CIT/ATM&<br />

(MNOK)& !! !! !! !! !! !!<br />

Revenue! 173.7! 86.3! 90.3! 103.5! 119.1! 140.5!<br />

EBITDA! 28.7! -11.9! 2.4! 2.9! 7.5! 14.2!<br />

margin! 16.5%! -13.8%! 2.7%! 2.8%! 6.3%! 10.1%!<br />

ELIMINATIONS&(MNOK)& !! !! !! !! !! !!<br />

Revenue!El.! -111.1! -100.4! -103! -80.0! -84.3! -89.6!<br />

EBITDA!El.! 2.5! 1! 0.2! 0.0! 0.4! 0.4!<br />

27!

!<br />

Indep!Research!LTD!<br />

VALUATION&<br />

DCF Valuation<br />

!<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Base&case& 2012- 2017- Terminal!<br />

scenario&<br />

2016E! 2026E! Value! Scenario!Assessment!<br />

Revenue!growth!is!largely!driven!from!international!customer!wins!<br />

Revenue!CAGR! 3.2%! 3.0%! 611! for!CashGuard!and!SQS.!Norway/Sweden!revenues!decline!overall.!!!!<br />

!<br />

Margins!become!somewhat!subdued!following!changed!customer!<br />

exposure!from!high-yield!Norway/Sweden!to!international!markets.!<br />

EBITDA!<br />

However,!increased!service-!and!Pricer!ESL!revenues!for!<br />

margins! 7.8%! 9.0%!<br />

Norway/Sweden!compensate!somewhat.!!<br />

Capital!<br />

!<br />

Turnover!(x)! 1.86! 1.98!<br />

! !<br />

ROIC! 6.0%! 7.3%!<br />

!<br />

! !<br />

Best&case& 2012- 2017- Terminal!<br />

scenario& 2016E! 2026E! Value! Scenario!Assessment!!<br />

Norway/Sweden!gives!off!a!renewed!boost!to!CashGuard,!whilst!Pricer!<br />

installations!are!thriving.!CashGuard!is!also!becoming!well-established!with!<br />

Revenue!CAGR! 3.8%! 3.5%! 744.5! international!grocery!retailers.!!<br />

!<br />

Large!scale!CashGuard!installations!secure!greater!margins,!as!does!SQS!<br />

EBITDA!margins! 8.4%! 10.0%!<br />

which!has!established!itself!in!new!unregulated!markets!such!as!Russia.!!!<br />

Capital!<br />

!<br />

Turnover!(x)! 1.87! 1.98!<br />

ROIC! 7.0%! 9.0%! ! !<br />

!<br />

! !<br />

Worst&case& 2012- 2017- Terminal!<br />

scenario& 2016E! 2026E! Value! Scenario!Assessment!!<br />

International!CashGuard!demand!takes!a!hit!parallel!to!declining!revenues!in!<br />

Revenue!CAGR! 1.9%! 2.5%! 466.3! Norway/Sweden.!SQS!market!conditions!also!remain!tough!with!low!volumes.!!!!<br />

!<br />

Margins!remain!under!pressure!as!the!international!economic!climate!<br />

worsens.!Domestic-!as!well!as!International!retail-!and!CIT!companies!reduce!<br />

EBITDA!margins! 6.3%! 8.0%!<br />

their!expenditure.!!!!!<br />

Capital!Turnover!<br />

!<br />

(x)! 1.83! 1.98!<br />

ROIC! 2.9%! 4.7%! ! !<br />

! !<br />

28!

Current<br />

valuation<br />

multiples in<br />

the lower end<br />

historically<br />

!<br />

Indep!Research!LTD!<br />

Historical Valuation<br />

!<br />

7!<br />

6!<br />

5!<br />

4!<br />

3!<br />

2!<br />

1!<br />

0!<br />

140!<br />

120!<br />

100!<br />

80!<br />

60!<br />

40!<br />

20!<br />

0!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Perpetuity&growth&&<br />

! ! ! 1.5%! 2.0%! ! 2.5%& 3.0%! ! 3.5%!<br />

! ! 7.4%! 6.10! 6.64! 7.28! 8.08! 9.08!<br />

!<br />

8.4%! 4.64! 4.98! 5.37! 5.85! 6.41!<br />

! WACC&& 9.4%& 3.60! 3.83! 4.09& 4.39! 4.17!<br />

!<br />

!<br />

Scenario! Fair!value! Probability!<br />

Base!Case! 4.09! 70%!<br />

Worst!Case! 2.55! 10%!<br />

Best!Case! 5.11! 20%!<br />

Weighted&Fair&Value&&&&&&&<br />

(per&share)& 4.14&<br />

!<br />

10.4%! 2.85! 3.00! 3.18! 3.38! 3.60!<br />

11.4%! 2.28! 2.39! 2.51! 2.65! 2.80!<br />

Source: <strong>PSI</strong> <strong>Group</strong>, Indep Research estimates<br />

29!<br />

EV/S!<br />

NIBD/EBITDA!<br />

P/BV!<br />

Debt/Equity!<br />

P/E!<br />

EV/EBITDA!<br />

WACC!calculation! !!<br />

Cost!of!Equity! 12.7%!<br />

Cost!of!Debt! 3.3%!<br />

Debt!ratio! 35.2%!<br />

WACC& 9.4%!<br />

EV/EBIT!adj!<br />

DCF!additions! MNOK!<br />

NPV!of!deferred!tax!asset! 13!<br />

Net!IB!Debt! 90!

!<br />

Indep!Research!LTD!<br />

!<br />

Relative Valuation<br />

Investment Conclusion<br />

NOK'per'share'<br />

HOLD.<br />

6!<br />

5!<br />

4!<br />

3!<br />

2!<br />

1!<br />

0!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

Company!<br />

RS&and&CM&<br />

!! P/E! !! !! EV/SALES! !! EV/EBITDA! !! EV/EBIT! P/BV!<br />

MCAP!<br />

(mEURO)!<br />

Retail& 2011A& 2012E& 2013E& 2011A& 2012E& 2013E& 2011A& 2012E& 2013E& 2011A& 2012E& 2013E& 2012E& 14/09-12!<br />

Glory!! 17.9! 14.3! 12.6! 0.40! 0.79! 0.71! 3.9! 6.3! 5.3! 6.0! 8.5! 7.8! 0.7! 1198!<br />

Gunnebo! 9.5! 11.1! 8.6! 0.54! 0.50! 0.46! 6.9! 6.8! 5.4! 8.7! 9.0! 6.7! 1.2! 252!<br />

NCR!Corp.! 73.3! 14.9! 11.7! 0.80! 0.77! 0.70! 7.4! 6.5! 5.7! 10.0! 9.7! 7.9! 3.1! 2966!<br />

Pricer! 8.9! 15.7! 13.3! 2.09! 1.96! 1.74! 13.5! 13.4! 11.0! 16.7! 13.6! 11.3! 1.7! 155!<br />

Wincor!Nixdorf! 10.4! 16.8! 12.9! 0.56! 0.56! 0.54! 5.8! 7.7! 6.5! 8.1! 12.2! 9.7! 2.7! 887!<br />

Sector!Median! 10.0! 15.0! 12.8! 0.55! 0.68! 0.62! 6.4! 7.3! 5.9! 8.4! 10.6! 8.8! 1.5! !!<br />

!!<br />

!!<br />

!!<br />

!!<br />

!!<br />

CM&CIT/ATM&<br />

! !<br />

!!<br />

! !<br />

!!<br />

! !<br />

!!<br />

! !<br />

!!<br />

! !<br />

Brinks! 15.6!<br />

!<br />

12.0! 11.0!<br />

!<br />

0.36!<br />

!<br />

0.45! 0.32!<br />

!<br />

4.0!<br />

!<br />

3.6! 3.2!<br />

!<br />

7.5!<br />

!<br />

6.0! 5.2!<br />

!<br />

2.1!<br />

!<br />

881!<br />

Loomis! 12.8! 10.5! 9.7! 0.80! 0.74! 0.70! 5.6! 4.9! 4.5! 9.6! 8.8! 7.8! 1.7! 737!<br />

Sector!Median! 14.2! 11.2! 10.3! 0.58! 0.59! 0.51! 4.8! 4.3! 3.8! 8.6! 7.4! 6.5! 1.9! !!<br />

!!<br />

!!<br />

!!<br />

!!<br />

!!<br />

Combined! ! !<br />

! !<br />

! !<br />

! !<br />

! !<br />

Median! 11.6! 13.1! 11.8! 0.5! 0.7! 0.6! 5.7! 6.5! 5.3! 8.4! 8.9! 7.8! 1.7! !!<br />

!!<br />

!!<br />

!!<br />

!!<br />

!!<br />

<strong>PSI</strong>!<strong>Group</strong>!<br />

!<br />

NEG!<br />

!<br />

40.0! 21.1!<br />

!<br />

0.51!<br />

!<br />

0.51! 0.44!<br />

!<br />

5.5!<br />

!<br />

9.1! 6.4!<br />

!<br />

NEG!<br />

!<br />

41.9! 21.0!<br />

!<br />

0.9!<br />

!<br />

24!<br />

Most<br />

earnings<br />

multiples are<br />

particularly<br />

high,<br />

whereas<br />

equity looks<br />

undervalued<br />

Valuation as<br />

a whole gives<br />

a mixed<br />

picture of<br />

<strong>PSI</strong> <strong>Group</strong><br />

30!

!<br />

Indep!Research!LTD!<br />

Appendix<br />

The long story…<br />

!<br />

Initiating!coverage:!<strong>PSI</strong>!<strong>Group</strong>!<br />

<strong>PSI</strong> <strong>Group</strong> originally came to be known as Pinnås Systems International (<strong>PSI</strong>)<br />

as it essentially only consisted of today’s business segment, Retail Solutions,<br />

marketing and distributing various products and services to the retail<br />

industry. Today’s company is therefore the result of considerable past M&A<br />

activity within the Norwegian and Swedish retail focused business segments.<br />

Retail Solutions<br />

Retail Solutions supply a wide range of technology solutions to the retail<br />

sector in Sweden and Norway. As opposed to <strong>PSI</strong> <strong>Group</strong>’s other two business<br />

units, Retail Solutions is the only pure-play distributor of products to the<br />

grocery retail industry. CashGuard, scales, packaging machines, electronic<br />

shelf labels (ESL) and reverse vending machines (Repant) represent the core<br />

of the most sold products in this ‘distributor’ business unit.<br />

CASHGUARD<br />

This comprises the distribution of <strong>PSI</strong> <strong>Group</strong>’s own product, CashGuard, to Norwegian<br />

and Swedish markets and therefore also includes all service/support orders. (see<br />

more thorough description under Cash Management Retail section)<br />

SCALES AND PACKAGING MACHINES<br />

The leading supplier in Norway/Sweden for this sub-segment, RS markets the Digi<br />

scales offering everything from control scales to price calculating scales, as well as its<br />

automated packaging machines. All of Teraoka’s Digi scales and packaging machines<br />

offer all the traits needed to comprehensively meet requirements to weighing,<br />

packaging, tracking and labeling in a fresh produce department as well as in the<br />

fruits/vegetables department.<br />

ELECTRONIC SHELF LABELS<br />

<strong>PSI</strong> <strong>Group</strong> offers a broad range of Pricer’s electronic shelf label<br />

systems. With easy integration to back office systems through<br />

Pricer’s File Interface, Pricer’s ESLs vastly enhance grocery<br />

stores’ efficiency. With such solutions installed retail chains can<br />