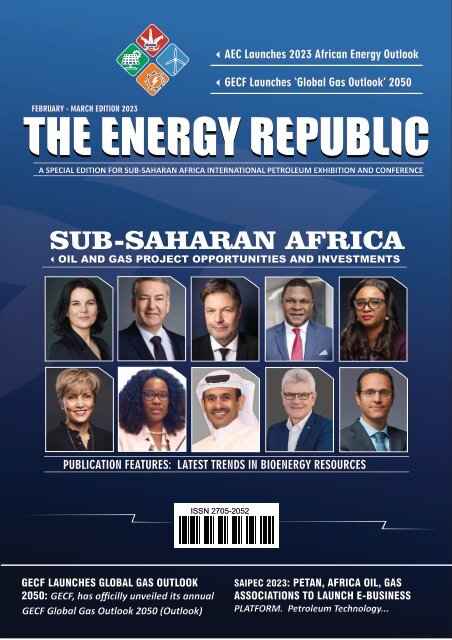

The Energy Republic February - March Edition 2023

A special publication focused on the Sub-Saharan Africa oil and gas industry with industry updates about the project and investment opportunities in the continent. In this edition, we also featured interesting stories about the energy sector as well as the role of bioenergy resources in the global energy transition agenda, with a spotlight on Germany's biofuel industry, coupled with stakeholders' commentaries and an exclusive interview with Elmar Baumann, Managing Director of the Association of the German Biofuel Industry (VDB).

A special publication focused on the Sub-Saharan Africa oil and gas industry with industry updates about the project and investment opportunities in the continent.

In this edition, we also featured interesting stories about the energy sector as well as the role of bioenergy resources in the global energy transition agenda, with a spotlight on Germany's biofuel industry, coupled with stakeholders' commentaries and an exclusive interview with Elmar Baumann, Managing Director of the Association of the German Biofuel Industry (VDB).

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3AEC Launches <strong>2023</strong> African <strong>Energy</strong> Outlook<br />

3GECF Launches ‘Global Gas Outlook’ 2050<br />

FEBRUARY - MARCH EDITION <strong>2023</strong><br />

A SPECIAL EDITION FOR SUB-SAHARAN AFRICA INTERNATIONAL PETROLEUM EXHIBITION AND CONFERENCE<br />

SUB-SAHARAN AFRICA<br />

3OIL AND GAS PROJECT OPPORTUNITIES AND INVESTMENTS<br />

PUBLICATION FEATURES: LATEST TRENDS IN BIOENERGY RESOURCES<br />

ISSN 2705-2052<br />

GECF LAUNCHES GLOBAL GAS OUTLOOK<br />

2050: GECF, has officilly unveiled its annual<br />

GECF Global Gas Outlook 2050 (Outlook)<br />

SAIPEC <strong>2023</strong>: PETAN, AFRICA OIL, GAS<br />

ASSOCIATIONS TO LAUNCH E-BUSINESS<br />

PLATFORM. Petroleum Technology...

EDITORIAL CONTENTS<br />

CREATING GLOBAL OPPORTUNITIES<br />

06<br />

NGC achieves Gold Standard status of repor ng<br />

under the Oil and Gas Methane Partnership...<br />

07<br />

NCDMB Emerges Best MDA in Efficiency,<br />

Transparency<br />

13<br />

15<br />

German Stakeholders Calls For Transparent<br />

Policy, Enabling Environment in Protec ng...<br />

REDCERT Provides Training and Cer fica on<br />

Schemes for Sustainable Bioenergy Resources...<br />

“Biofuels will be the biggest contribution to<br />

decarbonization in road transport” - Baumann<br />

09<br />

16<br />

<strong>Energy</strong> Companies Appeal to German Govt, List<br />

10 Agendas for Efficient Carbon Management...<br />

20<br />

BP <strong>Energy</strong> Outlook <strong>2023</strong>: ‘Modern Bioenergy’<br />

Resources to Decarbonize Hard-to-Abate...<br />

22<br />

COP28 President-Designate Emphasizes the<br />

Significance of the <strong>Energy</strong> Sector, Calls for...<br />

Shell Makes Positive Progress In Net-Zero<br />

Emissions, Achieves Its 2022 Climate Targets...<br />

40<br />

Qatar<strong>Energy</strong> and CPChem Celebrate the Ground<br />

Breaking for the Golden Triangle Polymers Plant...<br />

34<br />

Equinor Releases 2022 Financial Report,<br />

Reiterate Commitment To Invest In Oil, Gas...<br />

37<br />

17<br />

Germany “Gove Set To <strong>Energy</strong> Reset <strong>The</strong> has Pace a virile, For and Global strategic<br />

<strong>Energy</strong> technology Transition Agenda to eradicate At BETD oil <strong>2023</strong>... theft…”<br />

-Faith<br />

27<br />

30<br />

32<br />

52<br />

Catena-X to Showcase Industry Wide Data Show<br />

Room at Hannover Messe <strong>2023</strong><br />

Calgary set to host World Petroleum Congress in<br />

September <strong>2023</strong><br />

Fraunhofer Researchers Develop New Method to<br />

Extract Hydrogen from Waste<br />

PETAN, Africa Oil, Gas Associa ons To Launch<br />

e-Business Pla orm In <strong>2023</strong><br />

www.theenergyrepublic.com

THE ENERGY REPUBLIC<br />

CREATING GLOBAL OPPORTUNITIES<br />

Publisher by:<br />

<strong>The</strong> <strong>Energy</strong> <strong>Republic</strong> Marketing<br />

and Communications Limited<br />

(RC: 1919406)<br />

Editorial Director<br />

Bako Ambianda (USA)<br />

Managing Editor<br />

Ndubuisi Micheal Obineme<br />

Editor<br />

Tobi Owoyimika<br />

Legal Counsel<br />

Barr. Jackson Olagbaju<br />

Correspondents:<br />

Genevieve Aningo<br />

Ifeoma Ofole<br />

Samson Binutiri<br />

<strong>The</strong> <strong>Energy</strong> <strong>Republic</strong> (TER) is published by <strong>The</strong><br />

<strong>Energy</strong> <strong>Republic</strong> Marke ng and Communi ca ons<br />

Limited. TER provides an in-depth analysis about<br />

the oil industry, and opportuni es around clean<br />

energy sources such as Natural Gas, Hydrogen,<br />

Ammonia, Solar <strong>Energy</strong>, Wind <strong>Energy</strong>, Hydro<br />

<strong>Energy</strong>, Geothermal <strong>Energy</strong>, Biomass<br />

<strong>Energy</strong>, among others.<br />

Email: info@theenergyrepublic.com<br />

oilandgasrepublic@gmail.com<br />

Dear Execu ves,<br />

EDITOR’S NOTE<br />

On behalf of <strong>The</strong> <strong>Energy</strong> <strong>Republic</strong>, I'm pleased to unveil our latest<br />

edi on which is a special publica on focused on the Sub-Saharan<br />

Africa oil and gas industry with industry updates about the project<br />

and investment opportuni es in the con nent. With over 125 billion<br />

barrels of proven oil reserves and around 600 trillion cubic feet (tcf)<br />

of proven gas reserves, African countries are determined to claim<br />

their place in the global energy landscape, unwilling to abandon its<br />

hydrocarbon resources as the con nent has made it clear that they<br />

will con nue to maximize its abundant oil and gas resources in pursuit<br />

of allevia ng energy poverty and industrializing the en re African<br />

region.<br />

In a report tled: ‘<strong>The</strong> State of African <strong>Energy</strong>: <strong>2023</strong> Outlook,’<br />

published by the African <strong>Energy</strong> Chamber – the voice of the African<br />

energy sector, it projected that Africa would experience a posi ve<br />

turnaround in its energy sector, no ng that Africa is well posi oned to<br />

become Europe’s main supplier and contribu ng to global energy<br />

security, among others.<br />

In this edi on, we also featured interes ng stories about the energy<br />

sector as well as the role of bioenergy resources in the global energy<br />

transi on agenda, with a spotlight on Germany's biofuel industry,<br />

coupled with stakeholders' commentaries and an exclusive interview<br />

with Elmar Baumann, Managing Director of the Associa on of the<br />

German Biofuel Industry (VDB), who spoke about the role of biofuel in<br />

decarbonizing the energy industry.<br />

FEBRUARY - MARCH EDITION <strong>2023</strong><br />

3AEC Launches <strong>2023</strong> African <strong>Energy</strong> Outlook<br />

3GECF Launches ‘Global Gas Outlook’ 2050<br />

Please take your me to read through this magazine and feel free to<br />

send your feedback. It will be highly appreciated.<br />

A SPECIAL EDITION FOR SUB-SAHARAN AFRICA INTERNATIONAL PETROLEUM EXHIBITION AND CONFERENCE<br />

SUB-SAHARAN AFRICA<br />

3OIL AND GAS PROJECT OPPORTUNITIES AND INVESTMENTS<br />

Best regards,<br />

PUBLICATION FEATURES: LATEST TRENDS IN BIOENERGY RESOURCES<br />

ISSN 2705-2052<br />

Ndubuisi Micheal Obineme<br />

Managing Editor<br />

<strong>The</strong> <strong>Energy</strong> <strong>Republic</strong> Marke ng<br />

and Communica ons Limited<br />

GECF LAUNCHES GLOBAL GAS OUTLOOK<br />

2050: GECF, has officilly unveiled its annual<br />

GECF Global Gas Outlook 2050 (Outlook)<br />

SAIPEC <strong>2023</strong>: PETAN, AFRICA OIL, GAS<br />

ASSOCIATIONS TO LAUNCH E-BUSINESS<br />

PLATFORM. Petroleum Technology...<br />

www.theenergyrepublic.com

NGC SPECIAL REPORT<br />

To reach Gold Standard status, companies need<br />

to announce 2025 absolute reduc on or nearzero<br />

intensity targets. Target se ng is a complex<br />

exercise requiring a good understanding by<br />

companies of their emissions profile.<br />

NGC ’s achievement is an interna onal<br />

acknowledgement of the work that the company<br />

has commi ed to do over the next few years to<br />

reduce its emissions. This work is not just a<br />

priority for NGC, as reducing emissions is also<br />

high on the na onal agenda. <strong>The</strong> government of<br />

Trinidad and Tobago has agreed to cut<br />

greenhouse gas emissions by 15% by 2030 as part<br />

of the country ’s Na onally Determined<br />

Contribu ons to the Paris Climate Agreement.<br />

<strong>The</strong> country has also pledged to reduce methane<br />

emissions by at least 30 percent from 2020 levels<br />

by 2030 as part of the Global Methane Pledge,<br />

signed by more than 100 countries worldwide.<br />

ddressing the issue of climate<br />

change is one of the defining<br />

challenges of this decade. It is of<br />

par cular consequence to the Caribbean<br />

region, as Small Island Developing States<br />

(SIDS) are demonstrably vulnerable to the<br />

impacts of rising global temperatures and<br />

extreme weather events. With the<br />

prognosis that such events could become<br />

more frequent and severe as global<br />

warming intensifies, it is impera ve that<br />

ac on be taken to curb the greenhouse<br />

gas (GHG) emissions which are fuelling<br />

the phenomenon. Among the most<br />

potent of these GHGs is methane, which<br />

is the primary component of natural gas,<br />

and has 80 mes the warming poten al<br />

of carbon dioxide on a 20-year mescale.<br />

NGC’s Beachfield Facility<br />

NGC achieves Gold Standard status<br />

of reporting under the Oil and Gas<br />

Methane Partnership (OGMP)<br />

A<br />

<strong>The</strong> Na onal Gas Company of Trinidad and<br />

Tobago Limited (NGC) has made pioneering<br />

investments to track and reduce methane<br />

emissions from its opera ons. It also made a<br />

voluntary commitment to report on its<br />

progress a er joining the global Oil and Gas<br />

Methane Partnership 2.0 (OGMP 2.0) in 2021.<br />

<strong>The</strong> company’s resolve was made clear in its<br />

first report to the OGMP – submi ed in 2022 -<br />

wherein it outlined targets to reduce methane<br />

emissions by 2025. This led the company to<br />

achieve the Gold Standard status of repor ng<br />

under the OGMP 2.0 framework.<br />

This framework subsumes different ers of<br />

repor ng, based on declared targets and the<br />

r i g o u r o f m e a s u r e m e n t t o o l s a n d<br />

methodologies.<br />

NGC is the first state company in Trinidad and<br />

Tobago to report on its emissions and con nues<br />

to raise the bar of accountability within the local<br />

and regional energy sector. Having elaborated its<br />

own methane goals, the company is now working<br />

purposefully towards their realisa on by 2025.<br />

Along the way, the company intends to<br />

communicate and educate around the need to<br />

address methane emissions, to encourage<br />

greater industry par cipa on and increase the<br />

chances of success in this high-stakes fight.<br />

To view the Eye on Methane publica on:<br />

h ps://www.unep.org/resources/report/eyemethane-interna<br />

onal-methane-emissionsobservatory-2022-report<br />

06<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

NCDMB SPECIAL REPORT<br />

This latest award follows NCDMB’s emergence as<br />

“a Level 5 Pla num Level organiza on” in a<br />

summary report of the Bureau of Public Service<br />

Reforms (BPSR) Self-assessment Tool (SAT)<br />

released in January, a ra ng which translates as<br />

“Excep onal Performance with a performance<br />

level of 90.5%.”<br />

<strong>The</strong> BPSR had at a presenta on ceremony held at<br />

the NCDMB Conference in Yenagoa, Bayelsa State<br />

noted that NCDMB is structured to achieve its<br />

vision, mission and strategic objec ves, which<br />

have been effec vely communicated to relevant<br />

stakeholders and well understood by staff.<br />

Another accolade that came the way of the Board<br />

recently was the selec on of the Execu ve<br />

Secretary, NCDMB, Engr. Simbi Kesiye Wabote as<br />

the recipient of the Leadership Local Content<br />

Champion of the Year Award by the Board of<br />

Editors of the Leadership Group Limited. <strong>The</strong><br />

award will be conferred on the Execu ve<br />

Secretary at the 14th edi on of the Leadership<br />

Conference and Awards held on January 31,<br />

<strong>2023</strong>, in Abuja.<br />

Engr. Simbi Wabote (fNSE), Execu ve Secretary of NCDMB<br />

NCDMB Emerges Best MDA in<br />

Efciency, Transparency<br />

<strong>The</strong> Nigerian Content Development<br />

and Monitoring Board (NCDMB)<br />

has emerged as top performer in<br />

business efficiency and transparency in<br />

Federal Government ’s ranking of<br />

ministries, departments and agencies<br />

(MDAs) for the year 2022.<br />

This latest result is reminiscent of the<br />

Board’s 81.46 per cent score in Ease of<br />

Doing Business, which placed it top of all<br />

other MDAs for the period January – June<br />

2022.<br />

In the Execu ve Order 001 (EO1)<br />

Compliance Report released in Abuja by<br />

the Presiden al Enabling Business<br />

Environment Council (PEBEC), the<br />

NCDMB achieved a score of 81.11 per<br />

cent to beat 52 other MDAs captured in<br />

the evalua ve ranking.<br />

PEBEC explains that an “MDA’s EOI overall<br />

performance is a combina on of scores on the<br />

Efficiency and Transparency measures<br />

weighted at 70 per cent and 30 per cent of the<br />

overall score respec vely.” “<strong>The</strong> top<br />

performing MDAs differen ate themselves by<br />

achieving a balanced performance on both the<br />

Efficiency and Transparency scales….”<br />

Under Efficiency, the agency’s adherence to its<br />

service delivery melines is key. For<br />

Transparency, the chief considera on is<br />

existence and func onality of websites, as well<br />

as availability of detailed informa on on<br />

melines, costs, statutory requirements and<br />

customer service contact channels. In<br />

combina on, these would eliminate abuses in<br />

the system, including rent-seeking ac vi es.<br />

PEBEC has been consistent in publishing the<br />

EO1 Compliance Report since 2017, from<br />

monthly reports submi ed by MDAs.<br />

In October 2022, the Execu ve Secretary was<br />

c o n fe r re d t h e D i s n g u i s h e d C a p a c i t y<br />

Development Award by President Muhammadu<br />

Buhari (GCFR) at the Nigeria Excellence in Public<br />

Service Awards, reconfirming the Board’s<br />

excellent delivery of its mandate.<br />

Key func ons of the NCDMB include:<br />

3To review, assess and approve Nigerian<br />

Content plans developed by operators.<br />

3To set guidelines and minimum content levels<br />

for project related ac vi es across the oil and gas<br />

value chain.<br />

3To engage in targeted capacity building<br />

interven ons that would deepen indigenous<br />

capabili es- Human Capital Development,<br />

Infrastructure & Facili es, Manufactured<br />

Materials & Local Supplier Development.<br />

3To grow and manage the Nigerian Content<br />

Development Fund.<br />

3To establish, maintain and operate the Joint<br />

Qualifica on System (NOGICJQS) in conjunc on<br />

with industry stakeholders.<br />

3To monitor Nigerian Content Compliance by<br />

operators and service providers. This will be in<br />

terms of cumula ve spending, employment<br />

crea on and sources of local goods, service and<br />

materials u lized on projects and opera ons.<br />

3To award Cer ficate of Authoriza on for<br />

projects that complies with Nigerian Content<br />

provisions.<br />

3To conduct studies, research, inves ga on,<br />

workshops and trainings aimed at advancing the<br />

development of Nigerian Content.<br />

07<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

VDB EXCLUSIVE INTERVIEW<br />

“Biofuels will be the biggest contribution to decarbonization<br />

in road transport. It will evolve in maritime, aviation sector”<br />

- Elmar Baumann, VDB's Managing Director<br />

<strong>The</strong> <strong>Energy</strong> <strong>Republic</strong> talks to Elmar Baumann, Managing Director of the Associa on of the<br />

German Biofuel Industry (VDB), about the role of biofuel in decarbonising the transporta on<br />

sector and the related climate change impact in the energy industry.<br />

Interview by: Ndubuisi Micheal Obineme<br />

For over 15 years, Elmar Baumann has<br />

been working for the associa on. He<br />

began his professional career as a<br />

technical officer and in 2009, he became<br />

the managing director of VDB. Excerpts:<br />

TER: What's VDB's main interest in the<br />

energy industry?<br />

Baumann: VDB stands for Associa on of<br />

the German Biofuel Industry and our<br />

members are producers of biodiesel and<br />

biomethane. Today, biofuels are mainly<br />

used in road transport. We represent the<br />

interests of our members in Berlin and<br />

Brussels.<br />

VDB also represents the interests of<br />

German biofuel producers at the na onal<br />

and European levels. Its current 15<br />

ordinary and 3 extraordinary members<br />

produce about 2.4 million tons of<br />

biodiesel (and 900 GWh of biomethane)<br />

which represents 60 percent of German<br />

biodiesel produc on.<br />

VDB stands for the present and future of<br />

sustainable mobility in Germany. <strong>The</strong><br />

VDB's main objec ves are: to help shape<br />

compe on-oriented framework<br />

condi ons for biofuel development<br />

and to represent the industry externally.<br />

We are dealing with European legisla ve<br />

processes as well as German ones.<br />

We give informa on to poli cians in the<br />

Parliament and the administra on on what<br />

kind of framework our members need to have<br />

and we inform our members about new<br />

developments for example the Fit-for-55<br />

package from Brussels, RED III, and a separate<br />

ETS for road transport.<br />

On the German level, there have been serious<br />

disputes with German ministries this year<br />

about possible changes in the legisla ve<br />

framework and that's where we ar culate our<br />

posi on to poli cians and the public to lobby<br />

for the interest of our industry.<br />

Our member companies are based in several<br />

parts of Germany.<br />

TER: How is VDB developing innova ve<br />

solu ons for biofuel development; Are there<br />

new trends or new technology that your<br />

member companies have been able to produce<br />

so far?<br />

Baumann: Our members are developing and<br />

op mizing their technical processes for biofuel<br />

produc on. As an associa on, we're not involved<br />

in the technical development but inform them<br />

about the legal framework.<br />

We represent a huge produc on volume for cropbased<br />

biofuels. <strong>The</strong> biggest biofuel in Germany<br />

and Europe is biodiesel because Germany and<br />

Europe are diesel markets. As there's a lack of<br />

diesel fuel produced in German and EU mineral<br />

oil refineries, we import quite a bit of diesel fuel,<br />

mainly from Russia. <strong>The</strong> imports of Russian<br />

mineral oil and diesel fuel will be stopped at the<br />

end of this year. Biodiesel is a subs tute for fossil<br />

diesel, it helps to compensate for the diesel<br />

shortage and reduces GHG emissions.<br />

<strong>The</strong> most important feedstock for German<br />

biodiesel produc on is rapeseed oil.<br />

In second place is used cooking oil and tallow. So<br />

the second most important feedstock for German<br />

produc on is waste and residues. Soybean oil<br />

and palm oil are also used in German biodiesel<br />

produc on but to a lesser extent.<br />

09<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

VDB EXCLUSIVE INTERVIEW<br />

does not provide the necessary detailed<br />

regula ons which the biofuel industry needs.<br />

Elmar Baumann, Managing Director of the Associa on of the German Biofuels Industry (VDB)<br />

Most of the agricultural feedstock is<br />

growing here and in Europe. <strong>The</strong><br />

categoriza on of feedstocks for biofuel<br />

produc on is carried out according to the<br />

European “Renewable <strong>Energy</strong> Direc ve”,<br />

abbreviated as RED - today, the RED II is in<br />

place, and RED III will be approved before<br />

this summer. <strong>The</strong>re are three categories:<br />

crop-based biofuels like biodiesel made<br />

from rapeseed oil or bioethanol from<br />

cereals, waste, and residue-based<br />

biofuels according to annex IX-part b from<br />

used cooking oil or animal fat and<br />

advanced biofuels as per annex IX-part a<br />

like biomethane from straw.<br />

Current investment ac vity in Germany<br />

and Europe is partly about op miza on<br />

for exis ng facili es such as energy<br />

consump on, yields, and adapta on to<br />

new feedstocks, and partly about<br />

construc ng new facili es for advanced<br />

biofuels.<br />

TER: You have talked about the various<br />

applica on processes of biofuel<br />

produc on. Moving forward, how have<br />

biofuels par cularly in transporta on<br />

developed over the past years?<br />

Baumann: <strong>The</strong>ir market development<br />

has not been without problems, caused<br />

by mul ple legisla ve changes on the<br />

European as well as on the na onal level.<br />

For example, in Germany in 2009, we had<br />

a decrease in the biofuel mandate which<br />

was set up retrospec vely. <strong>The</strong>n we had<br />

the debate on indirect land use change<br />

(iLUC) star ng in 2011, culmina ng in the<br />

iLUC-direc ve adopted in 2015, an<br />

amendment to the RED I.<br />

We managed to escape the threat of crop<br />

cased biofuels being phased out by 2016.<br />

<strong>The</strong>n the European Commission prepared the<br />

RED II, a con nua on of the RED with a 2030<br />

perspec ve. Our industry was interested in<br />

having a 2030 target for transport and<br />

sufficient demand for crop-based biofuels. <strong>The</strong><br />

RED II was approved end of 2018 - two years<br />

before the RED I expired -, and the outcome<br />

w a s a c c e p t a b l e : n o p h a s i n g o u t o r<br />

displacement of crop-based biofuels. And<br />

then, as you probably know, member states<br />

had to integrate this direc ve into na onal law<br />

which Germany did last year in 2021. Yes.<br />

<strong>The</strong> na onal transposi on of the RED II gave us<br />

an excellent pathway for 2030. This was an<br />

achievement of two years of work on the<br />

German level. Half a year later, three ministers<br />

of the new government started cri cizing the<br />

use of crops for biofuel produc on. <strong>The</strong>y<br />

started their ini a ve against biofuels on the<br />

occasion of the war in Ukraine claiming that<br />

food is in short supply. Indeed there was<br />

uncertainty about food deliveries from<br />

Ukraine. But the real cause is the nega ve<br />

posi on of the Green party concerning<br />

biofuels and the poli cal dispute with the<br />

Liberals.<br />

T h e d i s c u s s i o n a b o u t r e d u c i n g t h e<br />

contribu on of biofuels and phasing them out<br />

un l 2030 is s ll ongoing, which creates<br />

uncertainty in the biofuels market. So it's not<br />

exactly what we need when the industry is<br />

preparing for investments to secure the<br />

achievement of new targets, and it's difficult.<br />

On the other hand, there's sort of a parallel<br />

world in Brussels: <strong>The</strong> European Commission<br />

Those detailed regula ons are s ll missing for the<br />

RED II, which was passed in 2018 and is now<br />

amended to become the RED III in <strong>2023</strong>. Four<br />

years a er the adop on of the direc ve, the<br />

Commission did s ll not deliver important<br />

specifica ons. This makes it quite difficult to keep<br />

the overview, pursue a clear pathway, and make<br />

investment decisions.<br />

Another example: the European Commission has<br />

s ll not finished the process of extending the list<br />

of feedstocks in Annex IX Part A and B.<br />

As you can imagine, if you build a facility to<br />

process a certain feedstock, you need to know to<br />

which category your feedstock belongs, and does<br />

your product count as advanced biofuel or wastebased<br />

fuel. This is crucial for your marke ng.<br />

And if there are changes, then this makes your<br />

calcula on invalid because you thought of a<br />

certain market for waste-based and advanced<br />

biofuels but now with more feedstocks, the<br />

framework condi ons change. And all this is<br />

uncertain at the moment. <strong>The</strong> choice of<br />

feedstock is decisive for your process or how easy<br />

or how hard is it to process this feedstock.<br />

TER: Based on your perspec ve, What would<br />

you recommend as an appropriate legal<br />

framework to boost biofuel development in<br />

Germany and the European energy industry?<br />

B a u m a n n : I t ' s q u i te e a sy. T h e R E D 2<br />

transposi on into German law with the<br />

amendment of the GHG mandate was perfect. So<br />

we worked quite hard to get good framework<br />

condi ons for the German biofuel industry. <strong>The</strong><br />

regula on for advanced biofuels according to<br />

annex 9 part A provides a strong incen ve to use<br />

those biofuels and to invest in produc on<br />

facili es as volumes above the sub mandate<br />

count twofold. This means that even when<br />

mineral oil companies have fulfilled their sub<br />

mandate for advanced biofuels, the market can<br />

s ll take these biofuels at relevant prices. This<br />

makes the German market a magnet for<br />

advanced biofuels.<br />

10<br />

OIL AND GAS REPUBLIC I SPECIAL EDITION

VDB EXCLUSIVE INTERVIEW<br />

Most of the agricultural feedstock is<br />

growing here and in Europe. <strong>The</strong><br />

categoriza on of feedstocks for biofuel<br />

produc on is carried out according to the<br />

European “Renewable <strong>Energy</strong> Direc ve”,<br />

abbreviated as RED - today, the RED II is in<br />

place, and RED III will be approved before<br />

this summer. <strong>The</strong>re are three categories:<br />

crop-based biofuels like biodiesel made<br />

from rapeseed oil or bioethanol from<br />

cereals, waste, and residue-based<br />

biofuels according to annex IX-part b from<br />

used cooking oil or animal fat and<br />

advanced biofuels as per annex IX-part a<br />

like biomethane from straw.<br />

Current investment ac vity in Germany<br />

and Europe is partly about op miza on<br />

for exis ng facili es such as energy<br />

consump on, yields, and adapta on to<br />

new feedstocks, and partly about<br />

construc ng new facili es for advanced<br />

biofuels.<br />

TER: You have talked about the various<br />

applica on processes of biofuel<br />

produc on. Moving forward, how have<br />

biofuels par cularly in transporta on<br />

developed over the past years?<br />

Baumann: <strong>The</strong>ir market development<br />

has not been without problems, caused<br />

by mul ple legisla ve changes on the<br />

European as well as on the na onal level.<br />

For example, in Germany in 2009, we had<br />

a decrease in the biofuel mandate which<br />

was set up retrospec vely. <strong>The</strong>n we had<br />

the debate on indirect land use change<br />

(iLUC) star ng in 2011, culmina ng in the<br />

iLUC-direc ve adopted in 2015, an<br />

amendment to the RED I.<br />

We managed to escape the threat of crop<br />

cased biofuels being phased out by 2016.<br />

<strong>The</strong>n the European Commission prepared<br />

the RED II, a con nua on of the RED with<br />

a 2030 perspec ve. Our industry was<br />

interested in having a 2030 target for<br />

transport and sufficient demand for cropbased<br />

biofuels. <strong>The</strong> RED II was approved<br />

end of 2018 - two years before the RED I<br />

expired -, and the outcome was<br />

a c c e p t a b l e : n o p h a s i n g o u t o r<br />

displacement of crop-based biofuels. And<br />

then, as you probably know, member<br />

states had to integrate this direc ve into<br />

na onal law which Germany did last year<br />

in 2021.<br />

<strong>The</strong> na onal transposi on of the RED II<br />

gave us an excellent pathway for 2030.<br />

Elmar Baumann<br />

This was an achievement of two years of work<br />

on the German level. Half a year later, three<br />

ministers of the new government started<br />

cri cizing the use of crops for biofuel<br />

produc on. <strong>The</strong>y started their ini a ve against<br />

biofuels on the occasion of the war in Ukraine<br />

claiming that food is in short supply. Indeed<br />

there was uncertainty about food deliveries<br />

from Ukraine. But the real cause is the nega ve<br />

posi on of the Green party concerning<br />

biofuels and the poli cal dispute with the<br />

Liberals.<br />

T h e d i s c u s s i o n a b o u t r e d u c i n g t h e<br />

contribu on of biofuels and phasing them out<br />

un l 2030 is s ll ongoing, which creates<br />

uncertainty in the biofuels market. So it's not<br />

exactly what we need when the industry is<br />

preparing for investments to secure the<br />

achievement of new targets, and it's difficult.<br />

On the other hand, there's sort of a parallel<br />

world in Brussels: <strong>The</strong> European Commission<br />

does not provide the necessary detailed<br />

regula ons which the biofuel industry needs.<br />

Those detailed regula ons are s ll missing for<br />

the RED II, which was passed in 2018 and is<br />

now amended to become the RED III in <strong>2023</strong>.<br />

Four years a er the adop on of the direc ve,<br />

the Commission did s ll not deliver important<br />

specifica ons. This makes it quite difficult to<br />

keep the overview, pursue a clear pathway, and<br />

make investment decisions.<br />

Another example: the European Commission<br />

has s ll not finished the process of extending<br />

the list of feedstocks in Annex IX Part A and B.<br />

As you can imagine, if you build a facility to<br />

process a certain feedstock, you need to know<br />

to which category your feedstock belongs, and<br />

does your product count as advanced biofuel<br />

or waste-based fuel.<br />

This is crucial for your marke ng.<br />

And if there are changes, then this makes your<br />

calcula on invalid because you thought of a<br />

certain market for waste-based and advanced<br />

biofuels but now with more feedstocks, the<br />

framework condi ons change. And all this is<br />

uncertain at the moment. <strong>The</strong> choice of<br />

feedstock is decisive for your process or how easy<br />

or how hard is it to process this feedstock.<br />

TER: Based on your perspec ve, What would<br />

you recommend as an appropriate legal<br />

framework to boost biofuel development in<br />

Germany and the European energy industry?<br />

B a u m a n n : I t ' s q u i te e a sy. T h e R E D 2<br />

transposi on into German law with the<br />

amendment of the GHG mandate was perfect. So<br />

we worked quite hard to get good framework<br />

condi ons for the German biofuel industry. <strong>The</strong><br />

regula on for advanced biofuels according to<br />

annex 9 part A provides a strong incen ve to use<br />

those biofuels and to invest in produc on<br />

facili es as volumes above the sub mandate<br />

count twofold. This means that even when<br />

mineral oil companies have fulfilled their sub<br />

mandate for advanced biofuels, the market can<br />

s ll take these biofuels at relevant prices. This<br />

makes the German market a magnet for<br />

advanced biofuels.<br />

<strong>The</strong> amended German regula on delivers<br />

security for the exis ng products because there's<br />

enough space for those biofuels in the market<br />

un l 2030. <strong>The</strong> GHG mandate increases every<br />

year to make sure there is sufficient demand for<br />

every technological op on reducing GHG:<br />

electromobility, all sorts of biofuels, renewable<br />

hydrogen, and electricity-based fuels. <strong>The</strong>y all<br />

count against this GHG mandate.<br />

With the increasing GHG mandate, we avoid one<br />

renewable op on displacing another. If we could<br />

tell a wish, we would say we'd like to con nue this<br />

sort of legal framework beyond 2030. According<br />

to our es mates and other associa ons as well as<br />

scien fic studies, there will be a need for<br />

renewable fuels beyond 2030. When fuel sales go<br />

down at some me due to electrifica on, you<br />

could use the biofuel volumes as higher blends<br />

like B 20, B 30, or pure biodiesel 100. You can<br />

concentrate this in certain sectors like heavy-duty<br />

vehicles, that means buses and trucks or<br />

agriculture machinery.<br />

And there's also mari me transport which will<br />

s ll use liquid and gas fuels for combus on<br />

engines. So I could imagine we need all of our<br />

biofuels s ll more than one decade.<br />

11<br />

OIL AND GAS REPUBLIC I SPECIAL EDITION

VDB EXCLUSIVE INTERVIEW<br />

Elmar Baumann, German Biofuels Industry Associa on e. V. (VDB) & Artur Auernhammer, MP,<br />

Chairman of the Board, German Bioenergy Associa on e. V. (BBE)<br />

<strong>The</strong>re's been a prospect for biofuels in<br />

transport for quite some me. In the long<br />

run, you can also use biofuels like ethanol,<br />

biodiesel, and biomethane as raw<br />

materials and building blocks for the<br />

chemical industry. Chemical Industry is<br />

also trying to reduce fossil feedstocks. So<br />

today, it's nearly 100% fossil oil, mineral<br />

oil, and natural gas, so this has to be<br />

changed.<br />

TER: What are the opportuni es for<br />

integra ng biofuels into the energy<br />

transi on plan in Europe?<br />

Baumann: Today, we are the only<br />

alterna ve fuel used in road traffic. So if<br />

you look today at the sta s cs, 95% of the<br />

decrease in GHG emissions in road<br />

transport is due to the use of biofuels.<br />

Electromobility will increase its share but<br />

un l 2029 or 2030, biofuels will be the<br />

biggest contribu on to decarboniza on<br />

and renewables in road transport. So<br />

that's a huge contribu on.<br />

We s ll have a rela vely low share of<br />

biofuels in the market, about 6 or 7% in<br />

Germany, but that's by far the biggest<br />

contribu on of renewables in road<br />

transport. So there's no way to do<br />

without biofuels.<br />

TER: Are there any ongoing projects you<br />

would like to share with us?<br />

Baumann: I would invite you to contact<br />

o u r m e m b e r c o m p a n i e s S e v e r a l<br />

companies that are planning to invest<br />

in advanced biofuel produc on. What we<br />

thought years ago was that advanced biofuels<br />

would be produced exclusively with new<br />

technologies. That's also ongoing, for sure.<br />

But our impression is that exis ng facili es are<br />

adapted to be able to use one of the feedstocks<br />

of annex IX-part A. So with minor modifica ons<br />

of the produc on process and the availability<br />

of advanced feedstocks, you can process it in<br />

your exis ng biofuel facility and you can try to<br />

increase the volume of those feedstocks.<br />

But one must be clear that it is s ll necessary to<br />

keep the volumes of crop-based biofuels<br />

because we s ll rely on their decarboniza on<br />

performance.<br />

Whereas there is some space for produc on<br />

increase for crop-based biofuels and biofuels<br />

made from waste and residues from<br />

feedstocks according to annex IX-part B, the<br />

lion’s share of the increase will come from<br />

advanced biofuels.<br />

Compared to the biodiesel sector, the<br />

produc on of biomethane for road transport is<br />

small in comparison but will con nue to<br />

increase. Most of this biomethane is based on<br />

agricultural residues like manure and straw<br />

which qualifies for annex IX-part a.<br />

<strong>The</strong>re is a tradi onal produc on of biogas in<br />

rural areas of Germany which is used for<br />

electricity produc on in combined heat and<br />

power plants. Germany is the biggest<br />

European producer in this field. More<br />

biomethane facili es will be built or exis ng<br />

biogas plants will be transformed so that<br />

they can deliver to the grids and from the grid to<br />

road transport.<br />

TER: Will bioenergy contribute to the fuels of<br />

the future in mobility, avia on, and shipping?<br />

Baumann: Biofuels can be used in different<br />

modes of transport. Today biofuels are used<br />

prac cally exclusively in road transport. It will<br />

evolve in the mari me sector as well as in<br />

avia on.<br />

It looks as if electromobility is rolled out a bit<br />

slower than we thought but several crises have<br />

happened such as the war, infla on, etc.<br />

Electromobility will gain its share in road<br />

transport and liquid and gas fuels will more and<br />

more focus on heavy-duty and off-road. <strong>The</strong> use<br />

of biofuels in Shipping will increase. And there's<br />

also provision on the European level for avia on,<br />

which will start by 2025. Biokerosene will<br />

contribute to this target.<br />

However, from our point of view, it doesn't make<br />

sense to shi exis ng biofuels or feedstock for<br />

biofuels from one transport carrier to the other.<br />

We will s ll need biofuels for more than 10 years<br />

in road transport. It doesn't make sense to switch<br />

these biofuels We need to make sure that new<br />

feedstocks are raised instead of moving the same<br />

feedstock from one use to another.<br />

12<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

“FUELS OF THE FUTURE”: German Stakeholders<br />

Calls For Transparent Policy, Enabling<br />

Environment in Protecting Biofuel Industry<br />

As the global energy transi on agenda and comba ng climate<br />

change forces the world to seek alterna ve energy sources, the<br />

German biofuel industry associa ons have called for a<br />

transparent policy and enabling environment in protec ng the biofuel<br />

industry.<br />

<strong>The</strong> German biofuel industry associa ons disclosed this at the 20th<br />

Interna onal Conference on Renewable Mobility for 'Fuels of the<br />

Future' held in Berlin from 23rd - 24th January <strong>2023</strong>, which was<br />

covered by <strong>The</strong> <strong>Energy</strong> <strong>Republic</strong>. At the event, biofuel resources are<br />

being promoted as alterna ve energy sources as they could help to<br />

reduce greenhouse gas (GHG) emissions and the related climate<br />

change impact from the transporta on sector.<br />

<strong>The</strong> Interna onal <strong>Energy</strong> Agency has forecasted that global demand<br />

for biofuels is set to grow by 41 billion liters (28%) between 2021-2026,<br />

while growth in renewable diesel and jet fuel consump on would<br />

increase mostly in advanced economies. According to the report,<br />

biofuel share in the global market in transport fuel consump on is<br />

increasing dras cally from 4.3% to 5.4% between 2022-2027.<br />

However, the German government under the Federal Ministry of<br />

Environment and Agriculture is dra ing a bill on the gradual phase-out<br />

of biofuels produc on from cul vated biomass. <strong>The</strong> bill, developed<br />

under the aegis of Federal Environment Minister Steffi Lemke and<br />

supported by Federal Agriculture Minister Cem Özdemir, stands in<br />

stark contradic on to the greenhouse gas reduc on gap in the<br />

transport sector.<br />

13<br />

6<br />

7<br />

By Ndubuisi Micheal Obineme<br />

KEY FACTS ABOUT BIOFUELS<br />

Biofuel can be produced from plants or from<br />

agricultural, domes c or industrial biowaste<br />

Biofuel is produced over a short me span from<br />

biomass, rather than by the very slow natural<br />

processes involved in the forma on of fossil fuels<br />

Biofuels is set to grow by 41 billion litres (28%)<br />

between 2021-2026<br />

Biofuels provides jobs and also helps in reducing<br />

GHG up to much extent by emi ng less pollu on<br />

Biofuels also offer a solu on to one of the challenges<br />

of solar, wind, and other alterna ve energy sources<br />

Government policies are the main driver of the<br />

growth opportuni es in biofuels industry<br />

Top countries for biofuel produc on include, USA,<br />

Brazil, Indonesia, China, Germany, France, Thailand,<br />

Argen na, Netherlands, Spain, etc<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

INDUSTRY NEWS<br />

legisla ve amendments announced by the<br />

German government, however, they are<br />

advoca ng for reliable biofuel policy and other<br />

alterna ve op ons to be used to mi gate climate<br />

change.<br />

Artur Auernhammer, Chair of the German Bioenergy Associa on (BBE)<br />

Speaking on this development, the<br />

German biofuel industry stakeholders<br />

and conference par cipants rejected the<br />

bill on the gradual phase-out of biofuels<br />

produc on from cul vated biomass<br />

which was announced at the conference.<br />

In his speech, <strong>The</strong> Chair of the German<br />

Bioenergy Associa on (BBE), Artur<br />

Auernhammer said, "Sustainable biofuels<br />

saved over 11 million tonnes of CO₂ in<br />

2021. Sustainable cer fied biofuels make<br />

a vital contribu on to efficient, impac ul<br />

climate change mi ga on in the<br />

transport sector and will con nue to do<br />

so in the future. A comprehensive<br />

strategy for alterna ve fuels is now<br />

crucial."<br />

Furthermore, the German biofuel<br />

associa ons and other conference<br />

par cipants stated that biofuels from<br />

cul vated biomass have an essen al role<br />

to play in reducing greenhouse gas<br />

emissions (GHG), no ng that the<br />

proposed bill if implemented would<br />

entrench the sector’s failure to meet its<br />

targets, par cularly as the share of<br />

renewable electricity is declining and it<br />

will take years to develop another<br />

re g u l a t o r y f ra m e w o r k a i m e d a t<br />

increasing more biofuels produc on to<br />

support the energy industry.<br />

<strong>The</strong>y also noted that biofuels play an<br />

important role in the energy industry as<br />

well as mi ga ng the diverse effect of<br />

climate change in the transport sector.<br />

In their words, "Biofuels make the largest<br />

real-world contribu on to greenhouse<br />

gas reduc on, as they are not suscep ble to<br />

inappropriate double-offse ng, in contrast to<br />

e-mobility and hydrogen. Ramping up of e-<br />

mobility is now stalling. A er a short holding<br />

period, most vehicles subsidized with<br />

taxpayers’ money are sold to customers<br />

abroad.<br />

"Alterna ve energy resources, such as<br />

biodiesel, bioethanol, and biomethane, are in<br />

great demand. <strong>The</strong> challenge of mi ga ng<br />

climate change means e-fuels produced from<br />

wind, solar and bioenergy will also play a major<br />

role in the transport sector to protect the<br />

climate.<br />

"Biodiesel, bioethanol, and biomethane form<br />

the sustainable backbone of greenhouse gas<br />

reduc on in the mobility sector. That makes it<br />

essen al to make consistent use of sustainable<br />

biofuels and other renewable fuels to ensure<br />

effec ve climate change mi ga on in the<br />

transport sector.<br />

"<strong>The</strong> planned legisla ve amendments would<br />

trigger massive uncertainty throughout the<br />

renewable mobility sector, as well as diver ng<br />

en re trade flows.<br />

"<strong>The</strong> Environment Ministry ’s planned<br />

amendments at the same me send a warning<br />

to investors keen to invest in biofuels from<br />

residues and waste. Implemen ng these plans<br />

would set back climate change mi ga on in<br />

the transport sector by years, despite the<br />

pressing need to slash greenhouse gas<br />

emissions rapidly.”<br />

Industry Stakeholders Recommenda ons<br />

<strong>The</strong> German biofuels industry associa ons and<br />

conference par cipants opposed the<br />

<strong>The</strong>y recommended adop ng more ambi ous<br />

statutory climate protec on targets for the<br />

transport sector, adding that there are already<br />

commercially available biofuels and synthe c<br />

fuels that can be deployed.<br />

<strong>The</strong>y also suggested priori zing the use of new<br />

technologies for the produc on of e-fuels or<br />

biofuels superfluous.<br />

"Technologies must con nue to be promoted and<br />

u lized; each has its par cular strengths and<br />

innova ve biofuels will con nue to be crucial in<br />

the future.<br />

"As a common consensus, sustainable mobility<br />

must be made easier and more user-friendly by<br />

expanding charging infrastructure and enhancing<br />

the availability of sustainable biofuels and<br />

renewable fuels in rural areas and for fleets," they<br />

added.<br />

<strong>The</strong> 20th Interna onal Conference on Renewable<br />

Mobility for 'Fuels of the Future' <strong>2023</strong> was<br />

organized by five German biofuel industry<br />

associa ons. Over 700 par cipants from 33<br />

countries a ended the two-day interna onal<br />

conference for “Fuels of the Future” in Berlin.<br />

Over the past two decades, the “Fuels of the<br />

Future” interna onal conference has become the<br />

top event for the European biofuels industry and<br />

likewise an important forum for discussions on<br />

developing renewable mobility in Germany,<br />

Europe and interna onally.<br />

<strong>The</strong> next edi on of the event will be held as an inperson<br />

event on the 22nd and 23rd of January<br />

2024 in Berlin.<br />

14<br />

OIL AND GAS REPUBLIC I SPECIAL EDITION

INDUSTRY NEWS<br />

REDCERT Provides Training<br />

and Certication Schemes for<br />

Sustainable Bioenergy<br />

Resources<br />

By Ndubuisi Micheal Obineme<br />

R<br />

EDcert GmbH, a German-based<br />

company, is providing training and<br />

cer fica on schemes for the<br />

development of sustainable bioenergy<br />

resources, including biomass, biofuels,<br />

and bioliquids that comply with the<br />

E u r o p e a n l e g a l f r a m e w o r k a n d<br />

opera onal specifica ons.<br />

REDCert's cer fica ons are accepted in<br />

Germany and Europe, and they can be<br />

applied in the produc on of biofuel and<br />

other forms of bioenergy produc on. <strong>The</strong><br />

cer fica on scheme is operated by<br />

REDcert Gesellscha zur Zer fizierung<br />

nachhal g erzeugter Biomasse mbH<br />

which is also the owner of the ‘REDcert”<br />

brand.<br />

In an exclusive interview with Ndubuisi<br />

Micheal Obineme, Managing Editor of<br />

<strong>The</strong> <strong>Energy</strong> <strong>Republic</strong>, REDCert Managing<br />

Director, Peter Jürgens stated that<br />

REDCert is focusing on the biofuel sector,<br />

while its affiliate company specialized in<br />

sustainable Cer fica on Scheme, is<br />

focusing on biomass fuels, electricity, and<br />

heat produc on.<br />

"We are offering the cer fica on scheme<br />

as it is required by the European<br />

Commission. We are recognized by the<br />

European Commission which means we<br />

have to provide the required training and<br />

cer fica on schemes recognized by the<br />

EU.<br />

"We also advise, train, monitor, and<br />

survey the opera ons in the cer fica on<br />

processes of the operators. This is our<br />

goal to provide a good service through<br />

training, informa on, presenta ons, and<br />

whatever is appropriate to support the<br />

implementa on of bioenergy produc on.<br />

"But we are not directly engaged as<br />

project partners in the project<br />

development. We are working as an<br />

independent cer fica on scheme<br />

provider and we don't engage in<br />

company projects, but, many project<br />

developers are calling us to get more<br />

i n fo r m a o n a b o u t t h e l e ga l<br />

frameworks and the requirements,<br />

such as greenhouse gas emissions<br />

c a l c u l a o n r e q u i r e m e n t s o r<br />

requirements on measurement<br />

facili es, which are taken into<br />

account for certain investments and<br />

which may be required for providing<br />

e v i d e n c e w h e n i t c o m e s t o<br />

greenhouse gas calcula on. So a lot<br />

of project developers get in touch<br />

with us to ensure that their<br />

investments will be based on the<br />

right assump ons and to make sure<br />

the project is future-oriented.<br />

"We only provide training and<br />

cer fica on programs. That's our<br />

product and services. We provide all<br />

t h e i n f o r m a o n , t r a i n i n g ,<br />

monitoring, assessment, etc. But we<br />

are not advising companies on how<br />

to implement this. We aren't an<br />

advisory service provider but we are<br />

an independent cer fica on scheme<br />

service provider".<br />

REDcert offers training courses<br />

covering various topics. <strong>The</strong> training<br />

sessions are held in person or as a<br />

webinar.<br />

With its in-house training courses,<br />

REDcert offers you the opportunity<br />

to explicitly tailor the topics covered<br />

to your company’s needs and<br />

processes. <strong>The</strong> company in-house<br />

training courses are held at your<br />

company or as webinars. This saves<br />

me, most importantly, but also<br />

travel expenses for your employees.<br />

REDCert works closely with industry<br />

stakeholders, shareholders, and all<br />

the experts from the bioenergy<br />

market in providing the company's<br />

cer fica on schemes for their<br />

opera ons.<br />

Peter Jürgens, Managing Director of REDcert GmbH<br />

<strong>The</strong> company focuses on the following ac vi es:<br />

3Development, evalua on, and modifica on of scheme<br />

requirements to comply with legal and opera onal<br />

specifica ons<br />

3Opera on of the cer fica on scheme (registering<br />

economic operators, cer fica on bodies, issuing<br />

cer ficates, etc.)<br />

3Measures to assure the integrity of the scheme and<br />

prevent misuse and fraud<br />

3Measures related to transparent scheme management<br />

3Measures for dealing with complaints<br />

3Support for producers (companies) and economic<br />

operators in scheme implementa on.<br />

REDcert offers cer fica on schemes for sustainable<br />

biomass, biofuels and bioliquids (REDcert-DE and REDcert-<br />

EU) as well as sustainable agricultural raw materials for use<br />

in the food/feed industry and biomass for material<br />

purposes respec vely material purposes in the chemical<br />

industry (REDcert²). REDcert's philosophy is to support the<br />

scheme par cipants in the implementa on of<br />

sustainability cer fica on and offer prac cally oriented<br />

schemes.<br />

15<br />

OIL AND GAS REPUBLIC I SPECIAL EDITION

<strong>Energy</strong> Companies Appeal to<br />

German Govt, List 10 Agendas<br />

for Efficient Carbon<br />

Management Strategy<br />

As Germany begins to develop a<br />

Na onal Carbon Management<br />

Strategy (CMS), TES, alongside<br />

MAN <strong>Energy</strong> Solu ons, CEMEX and 14<br />

other German industry players have<br />

submi ed a joint posi on paper to the<br />

German government urging it to<br />

priori se a comprehensive carbon<br />

management strategy and implement it<br />

swi ly. In the paper, ten areas for<br />

ac on have been outlined to lead a<br />

s u c c e s s f u l C M S a t b o t h t h e<br />

developmental and implementa on<br />

stages.<br />

<strong>The</strong> companies list among other things a<br />

close connec on between CMS and the<br />

Na onal Hydrogen and Biomass Strategy,<br />

the development of integrated networks<br />

and systems, the quick growth of a<br />

pipeline network, and a cer ficate of<br />

origin for CO2 as essen al points.<br />

<strong>The</strong> proposal is part of a broad-reaching<br />

collabora on in the private sector in<br />

Germany to iden fy the hurdles posed in<br />

the exis ng legal regula ons and market<br />

condi ons for the use and storage of<br />

captured CO₂ (CCU/S), preven ng the<br />

implementa on of CCU/S at the required<br />

speed and the necessary standard.<br />

Proper implementa on is of great<br />

importance in terms of loca on policy for<br />

the preserva on of Germany as an<br />

industrial loca on and a condi on for<br />

mee ng both Germany and Europe’s<br />

climate goals.<br />

Marco Alverà, Group CEO of TES said: "<br />

This paper addresses the urgent need for<br />

policy changes that align Germany's<br />

defossiliza on efforts with the necessary<br />

condi ons for sustainable economic<br />

growth. <strong>The</strong> U.S. Infla on Reduc on Act<br />

impressively demonstrates the poten al<br />

of an effec ve regulatory framework. A<br />

carbon management strategy is crucial<br />

for Germany's industrial future and<br />

climate goals. CO2 should be integrated into the<br />

market as the ideal and safest hydrogen carrier.<br />

When combined with hydrogen, it forms eNG<br />

(renewable natural gas) staying within a closedloop<br />

without being released into the air.”<br />

"Hydrogen and the raw material CO2 must be<br />

thought of together," said Uwe Lauber, CEO of<br />

MAN <strong>Energy</strong> Solu ons. "Shipping, avia on, the<br />

chemical industry, they all depend on synthe c<br />

fuels. And these are predominantly derived<br />

from H2 and CO2. Technologies for CO2 capture<br />

and u liza on are therefore indispensable for<br />

decarbonizing Germany as an industrial<br />

loca on. Only with their help can we ensure that<br />

Marco Alverà, Group CEO of TES<br />

German defossiliza on does not lead to<br />

deindustrializa on."<br />

Rüdiger Kuhn, Chairman of the Managing<br />

Board, CEMEX Deutschland AG, stated: "CO2<br />

emissions are to a large extent unavoidable in<br />

the cement industry. Without the use of<br />

capture technologies, the complete<br />

decarbonisa on of cement is simply not<br />

possible. We therefore need legal and poli cal<br />

clarity quickly."<br />

Ten Points for an Efficient National Carbon Management Strategy<br />

1. CCU and CCS are equal paths to climate neutrality and complement the expansion of<br />

renewable energies.<br />

2. A Na onal Carbon Management Strategy (CMS) is trend-se ng and must be linked to<br />

the Na onal Hydrogen Strategy and the Na onal Biomass Strategy.<br />

3. CO2 Infrastructure is an essen al part of an integrated Climate Neutrality Network.<br />

4. <strong>The</strong> rapid construc on of a CO2 Pipeline Network is required for scaling.<br />

5. Cer fica on of CO2 is crucial for reliability and business cases along the CO2 Value<br />

chain.<br />

6. CCU technologies need full recogni on in the EU Emissions Trading System (ETS).<br />

7. Opportuni es should be opened up for CCS outside the EU and EEA.<br />

8. <strong>The</strong> requirements of the London Protocol on offshore CCS must be met as quickly as<br />

possible.<br />

9. New infrastructure requires consistent adapta on and accelera on of approvals.<br />

10. CCU/S must be recognized as breakthrough technologies for climate protec on and<br />

must be the focus of government funding programmes.<br />

16

INDUSTRY NEWS<br />

Germany Set To Reset <strong>The</strong> Pace For Global <strong>Energy</strong><br />

Transition Agenda At BETD <strong>2023</strong> In Berlin<br />

With recent events such as Russia - Ukraine War and <strong>Energy</strong><br />

Security which are highligh ng the vulnerability of the global<br />

energy system, the German government is set to reset the pace<br />

for the global energy transi on agenda at Berlin <strong>Energy</strong> Transi on<br />

Dialogue (BETD) scheduled to hold from 28-29 <strong>March</strong> <strong>2023</strong> in Berlin,<br />

Germany.<br />

With the theme, ‘Energiewende – Securing a Green Future’, BETD<br />

<strong>2023</strong> stands as a unique forum to exchange ideas, strengthen<br />

partnerships and develop strategies on how the world can move<br />

forward with the global energy transi on.<br />

Current Russia - Ukraine war has emphasized the importance of<br />

energy independence and of expanding locally available energy<br />

sources. <strong>The</strong> interna onal community has shown that it is capable of<br />

moving resolutely and decisively. Now the ques on is What role can<br />

energy efficiency and renewable energies play in crea ng a poli cally<br />

stable and economically prosperous world? <strong>The</strong>se ques ons will take<br />

center stage at the Berlin <strong>Energy</strong> Transi on Dialogue (BETD), as well as<br />

in the planned policy discussions. Other ques ons will focus on the<br />

possibili es and need for strategic investments, in par cular in the<br />

area of renewable energies. This dialogue also involves tradi onal<br />

exporters of fossil fuels, who are now facing the challenge of adap ng<br />

their economic systems to a changing environment. For many<br />

countries, the situa on creates new opportuni es for diversifying<br />

their economies and increasing trade and investments between<br />

various countries globally.<br />

German Foreign Minister Annalena Baerbock said: "<strong>The</strong> Berlin <strong>Energy</strong><br />

Transi on Dialogue is a unique forum to exchange ideas, strengthen<br />

partnerships and develop strategies together on how we can move<br />

forward with the global energy transi on.<br />

<strong>The</strong> global energy transi on and comba ng the climate crisis are now<br />

hard geopoli cs. <strong>The</strong> interna onal community is watching Germany’s<br />

path even more closely and the interest in interna onal coopera on is<br />

even greater. <strong>The</strong> task is now to make ourselves independent from<br />

Russian energy imports as quickly as possible.”<br />

German Minister for Economic Affairs and Climate Ac on Dr. Robert<br />

Habeck commented: "<strong>The</strong> war of aggression waged by Russia against<br />

Ukraine, in clear breach of interna onal law, has brought the ques on<br />

of energy security to the forefront of interna onal discussions as well.<br />

We must free ourselves from the grip of Russian imports so that we<br />

are longer suscep ble to blackmail. We in the German Government<br />

are sparing no effort to achieve this. <strong>The</strong> key to energy sovereignty,<br />

however, lies in the expansion of renewable energies. This ques on is<br />

of utmost relevance to na onal, European, and interna onal<br />

security".<br />

At BETD <strong>2023</strong>, high-level policymakers, and representa ves from<br />

industry, science, and civil society are allowed to share their<br />

experiences and ideas on a safe, affordable, and environmentally<br />

responsible global energy transi on.<br />

<strong>The</strong> event is hosted and supported by the German Federal<br />

Government and is a joint ini a ve of the German Renewable <strong>Energy</strong><br />

Federa on (BEE), the German Solar Associa on (BSW), the German<br />

<strong>Energy</strong> Agency (dena), and eclareon.<br />

17<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

INDUSTRY NEWS<br />

BP <strong>Energy</strong> Outlook <strong>2023</strong>: ‘Modern Bioenergy’<br />

Resources to Decarbonize Hard-to-Abate Industries<br />

Modern bioenergy resources will help to<br />

decarbonize hard-to-abate sectors such<br />

as buildings, transport, hydrogen, heat<br />

and power, and other industrial sectors<br />

for the long term, according to BP <strong>Energy</strong><br />

Outlook <strong>2023</strong>.<br />

With updated projec ons on the energy<br />

resources that will play a significant role<br />

in the 2050 Net-Zero emission target, the<br />

"BP <strong>Energy</strong> Outlook <strong>2023</strong>" analyses the<br />

important trends and uncertain es<br />

underlying the global energy transi on<br />

agenda.<br />

<strong>The</strong> report also revealed that there will be<br />

a decline in the use of hydrocarbons and a<br />

rapid increase in renewable energy<br />

sources, including an increase in<br />

electrifica on, and a rise in the use of lowcarbon<br />

hydrogen.<br />

Low-carbon hydrogen plays a cri cal role<br />

in decarbonizing the energy system,<br />

especially in hard-to-abate processes and<br />

ac vi es in major industry and transport.<br />

Low-carbon hydrogen is dominated by<br />

green and blue hydrogen, with green<br />

hydrogen growing in importance over<br />

me.<br />

In addi on, the war between Russia and<br />

Ukraine and growing worries about<br />

energy security, par cularly in Europe,<br />

have sparked a shi toward a more<br />

regional, lower-carbon energy mix,<br />

pu ng bioenergy resources in the<br />

limelight.<br />

Spencer Dale, BP's Chief economist said:<br />

"Any successful and enduring energy<br />

transi on needs to address these three<br />

dimensions of the energy system –<br />

security, affordability, and sustainability.<br />

<strong>The</strong> past year has been dominated by the<br />

terrible consequences of the Russia-<br />

Ukraine war and<br />

its awful toll on lives and communi es. Our<br />

thoughts and hopes are with all those affected.<br />

<strong>The</strong> scenarios in Outlook <strong>2023</strong> have been<br />

updated to take account of the war, as well as<br />

the passing of the Infla on Reduc on Act in<br />

the US.<br />

"<strong>The</strong> desire of countries to bolster their energy<br />

security by reducing their dependency on<br />

imported energy – dominated by fossil fuels –<br />

and instead have access to more domes cally<br />

produced energy – much of which is likely to<br />

come from renewables and other non-fossil<br />

energy sources – suggests that the war is likely<br />

to accelerate the pace of the energy<br />

transi on".<br />

According to the BP <strong>Energy</strong> Outlook <strong>2023</strong>,<br />

there has been a major transi on from<br />

tradi onal to modern bioenergy resources.<br />

<strong>The</strong> usage of biofuels, biomethane and<br />

modern solid biomass (such as wood pellets)<br />

has all increased drama cally and replaced<br />

tradi onal biomass.<br />

<strong>The</strong> report also stated that modern bioenergy<br />

would steadily rise to reach about 65 EJ by<br />

2 0 5 0 , w h i c h w o u l d u n q u e s o n a b l y<br />

counterbalance the phase-out of tradi onal<br />

biomass, such as waste wood and agricultural<br />

wastes used for cooking and hea ng, which<br />

will also be phased out by 2050.<br />

Bioenergy Growth Opportuni es<br />

Modern bioenergy resources have great<br />

poten al for expansion, but they haven't yet<br />

received enough a en on or been properly<br />

u lized. Government ini a ves on transparent<br />

p o l i c i e s , t h e c r e a o n o f f a v o r a b l e<br />

environments for land use, as well as regional<br />

collabora on in procuring these resources<br />

through residues (from agriculture and<br />

forestry) and waste products, will enable the<br />

spread of modern bioenergy.<br />

Biomass<br />

Furthermore, by 2050, emerging economies<br />

By Ndubuisi Micheal Obineme<br />

would account for around three-quarters of the<br />

development prospects in modern bioenergy. In<br />

emerging economies, biomass is used in the<br />

power sector in both coal cogenera on plants<br />

and biomass cogenera on plants.<br />

While solid biomass, which is mostly u lized in<br />

the power industry, has seen the highest increase<br />

in demand for modern bioenergy, other<br />

bioenergy resources are used to help<br />

decarbonize hard-to-abate industrial processes,<br />

especially in cement and steel manufacturing.<br />

In the power and industrial sectors, biomass can<br />

be used in conjunc on with carbon capture and<br />

storage (BECCS). <strong>The</strong> use of BECCS globally for the<br />

Net-Zero target would reach 13 EJ by 2050,<br />

around half of which is deployed in the power<br />

sector, with much of the remainder used to<br />

produce hydrogen.<br />

Biomass can be u lized in conjunc on with<br />

carbon capture and storage (BECCS) in the<br />

industrial and electricity sectors. By 2050, 13 EJ<br />

would be required globally for the Net-Zero<br />

target, with the majority of the remaining BECCS<br />

being used to produce hydrogen. Around half of<br />

this amount would be used in the power sector.<br />

Rapid decarboniza on pathways are made<br />

possible by carbon capture, u liza on, and<br />

storage, which reduces emissions from the<br />

burning of fossil fuels while also removing carbon<br />

dioxide from the atmosphere.<br />

For the world to decarbonize deeply and quickly,<br />

a variety of carbon dioxide removal techniques<br />

will be required, including direct air carbon<br />

capture and storage, natural climate solu ons,<br />

and bioenergy coupled with carbon capture and<br />

storage.<br />

Biofuels<br />

By 2050, the produc on of biofuels will reach<br />

about 10 EJ, with the majority of these fuels going<br />

20<br />

OIL AND GAS REPUBLIC I SPECIAL EDITION

INDUSTRY NEWS<br />

t o w a r d t h e av i a o n i n d u s t r y.<br />

Bioethanol, o en known as ethanol, and<br />

biodiesel are the biofuels that are most<br />

frequently produced and consumed.<br />

In contrast to the extremely slow natural<br />

processes involved in the produc on of<br />

fossil fuels, biofuel is a fuel that is<br />

created from renewable biological<br />

sources, such as plants and crops, or<br />

agricultural, residen al, or industrial<br />

biowaste, over a short period.<br />

Biofuels can be split up into three<br />

categories, namely:<br />

3Solid biofuels (fuelwood, wood<br />

residues, wood pellets, animal waste, vegetal<br />

material, etc)<br />

3Liquid biofuels (biogasoline, biodiesel, bio jet<br />

kerosene, etc)<br />

3Biogases (from anaerobic fermenta on and thermal<br />

processes).<br />

Moreover, biofuels used for non-energy applica ons<br />

like the wood used in construc on or as furniture,<br />

biolubricant used in engine lubrica on, and bio<br />

bitumen used as road surface are not included in the<br />

purview of energy sta s cs. <strong>The</strong> United States of<br />

America, Brazil, Indonesia, China, Germany, France,<br />

Thailand, Argen na, Netherlands, Spain, and others<br />

are among the top producers of biofuels globally.<br />

By 2050, bio-derived sustainable<br />

avia on fuel (biojet), which must be<br />

supported by governmental incen ves<br />

and policy, will account for 30% of all<br />

avia on demand and 45% of the Net<br />

Zero emission target. <strong>The</strong> US and<br />

Europe will contribute 50% to 60% of<br />

the growth in biojet.<br />

Government policies are the primary<br />

forces behind the rapid development of<br />

the biofuel industry to fully realize the<br />

poten al of biofuels, but other<br />

elements such as the overall demand<br />

for transporta on fuel, costs, and the<br />

design of specific policies affect where<br />

growth occurs and which fuels will grow<br />

quickly.<br />

Biomethane<br />

Biomethane is blended into the natural<br />

gas grid as a direct subs tute for natural<br />

gas and is shared broadly<br />

equally across industry, buildings, and<br />

transport. In all scenarios, biomethane<br />

will increase drama cally from less<br />

than 0.2 EJ in 2019 to between 6-7 EJ by<br />

2050.<br />

Other <strong>Energy</strong> Sources<br />

Other renewable energies such as wind<br />

and solar power will con nue to<br />

increase rapidly, but, it requires a<br />

significant investment in financing new<br />

projects and expanding exis ng<br />

capacity.<br />

Wind, solar, bioenergy, geothermal,<br />

and other forms of renewable energy<br />

make up a major por on of the energy<br />

sector. By 2050, between 35 and 65% of<br />

the world's primary energy will come<br />

from renewable sources, up from<br />

around 10% in 2019. This increase will<br />

be fueled by renewable energy sources'<br />

be er cost compe veness as well as<br />

the rising prevalence of policies that<br />

support the switch to low-carbon<br />

energy.<br />

<strong>The</strong> BP <strong>Energy</strong> Outlook noted that the<br />

demand for hydrocarbons will drop as<br />

the world transi ons to low-carbon<br />

energy sources, adding that the<br />

propor on of fossil fuels in primary<br />

energy declines from over 80% in 2019<br />

to between 55-20% by 2050.<br />

21<br />

THE ENERGY REPUBLIC I SPECIAL EDITION

INDUSTRY NEWS<br />

COP28 President-Designate Emphasizes the<br />

Signicance of the <strong>Energy</strong> Sector, Calls for Solidarity<br />

and Action at COP28<br />

At his keynote address at<br />

CERAWeek <strong>2023</strong>, which was held<br />

from <strong>March</strong> 6–10, <strong>2023</strong>, in<br />

Houston, Texas, USA, Dr. Sultan Al Jaber,<br />

COP28 UAE President-Designate,<br />

emphasized the crucial role that the oil<br />

and gas industry plays in resolving the<br />

climate crisis.<br />

<strong>Energy</strong> leaders have the knowledge,<br />

experience, exper se, and resources<br />

necessary to handle the dual challenge<br />

of advancing sustainability while<br />

containing emissions, according to Dr. Al<br />

Jaber, who spoke at the plenary session.<br />

He said, “Let me call on you today to<br />

decarbonise quicker, future-proof<br />

sooner and create the energy system of<br />

the future, today... Alongside all<br />

industries, the oil and gas sector needs to<br />

up its game, do more and do it faster.”<br />

Dr. Al Jaber summed up the complexity<br />

of the challenge saying, “By 2030, there<br />

will be an extra half a billion people living<br />

on this planet, demanding more energy<br />

every year. And at the same me, the<br />