Ideal Home 2023

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

IDEA<br />

HOME<br />

Special Edition<br />

New Developments<br />

& Construction<br />

<strong>2023</strong><br />

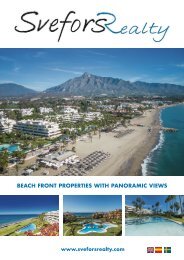

The best of the Costa del Sol<br />

Special Edition New Developments & Construction <strong>2023</strong><br />

P.30 MARKET REPORT <strong>2023</strong><br />

P.64 AREA DESIGN<br />

P.70 VOGT ADVOKATFIRMA P.76 GENERALI HOME

A dream A oasis oasis<br />

Spacious Spacious townhouses townhouses featuring featuring a a<br />

contemporary contemporary and functional and functional design design<br />

that perfectly that perfectly blends blends with its with natural its natural<br />

surroundings. surroundings.

EVERGREEN EVERGREEN HOMES HOMES • MIJAS • MIJAS COSTA<br />

COSTA<br />

900 900 11 00 1122<br />

00 22<br />

neinorhomes.com<br />

WORKS WORKS IN PROGRESS<br />

IN PROGRESS

MARKET REPORT <strong>2023</strong><br />

LOCAL MARKETS<br />

Q1 <strong>2023</strong> REPORT<br />

1 · EXECUTIVE SUMMARY<br />

General situation<br />

The average value of completed property (new and resale) rose by 6.3% in the year to Q1 <strong>2023</strong> and by 0.9% compared to Q4 2022. These<br />

figures reveal a slowdown in growth, backed up by the trend towards price stabilization seen in the early months of the year.<br />

PRICES AND YEAR-ON-YEAR CHANGE<br />

2,500<br />

25%<br />

2,000<br />

20%<br />

15%<br />

1,500<br />

10%<br />

1,000<br />

500<br />

1,750<br />

1,700<br />

1,650<br />

1,600<br />

1,550<br />

1,500<br />

1,450<br />

1,400<br />

1,350<br />

1,300<br />

-<br />

2000_Q1<br />

2000_Q4<br />

2019_Q1<br />

2019_Q2<br />

2019_Q3<br />

2019_Q4<br />

2001_Q3<br />

2002_Q2<br />

2003_Q1<br />

2003_Q4<br />

2004_Q3<br />

2005_Q2<br />

2006_Q1<br />

2006_Q4<br />

2007_Q3<br />

2008_Q2<br />

2009_Q1<br />

2009_Q4<br />

2010_Q3<br />

2020_Q1<br />

2020_Q2<br />

2011_Q2<br />

2012_Q1<br />

2012_Q4<br />

2013_Q3<br />

2014_Q2<br />

2015_Q1<br />

2015_Q4<br />

2016_Q3<br />

2017_Q2<br />

2018_Q1<br />

2018_Q4<br />

2019_Q3<br />

2020_Q2<br />

2021_Q1<br />

2021_Q4<br />

2022_Q3<br />

5%<br />

0%<br />

-5%<br />

-10%<br />

-15%<br />

Year-on-year change €/m 2<br />

PRICES AND QUARTERLY CHANGE<br />

3%<br />

2%<br />

2%<br />

1%<br />

1%<br />

0%<br />

-1%<br />

-1%<br />

2020_Q3<br />

2020_Q4<br />

2021_Q1<br />

2021_Q2<br />

2021_Q3<br />

2021_Q4<br />

2022_Q1<br />

2022_Q2<br />

2022_Q3<br />

2022_Q4<br />

<strong>2023</strong>_Q1<br />

The first available data for <strong>2023</strong> shows a continuation in the sales trend. The year-on-year decreases registered over the last few months<br />

reflect a return to sales volumes more in line with historic averages, lower than the sharp increase in activity seen in the second half of<br />

2021 and first half of 2022. Levels are still, however, robust.<br />

IDEA<br />

31

MARKET REPORT <strong>2023</strong><br />

LOCAL MARKETS<br />

Q1 <strong>2023</strong> REPORT<br />

RESIDENTIAL PROPERTY MARKET<br />

Change in main variables<br />

Nº sales, mortgages, new-building licences<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

EUR/m2<br />

-<br />

-<br />

2001_Q1<br />

2001_Q4<br />

2002_Q3<br />

2003_Q2<br />

2004_Q1<br />

2004_Q4<br />

2005_Q3<br />

2006_Q2<br />

2007_Q1<br />

2007_Q4<br />

2008_Q3<br />

2009_Q2<br />

2010_Q1<br />

2010_Q4<br />

2011_Q3<br />

2012_Q2<br />

2013_Q1<br />

2013_Q4<br />

2014_Q3<br />

2015_Q2<br />

2016_Q1<br />

2016_Q4<br />

2017_Q3<br />

2018_Q2<br />

2019_Q1<br />

2019_Q4<br />

2020_Q3<br />

2021_Q2<br />

2022_Q1<br />

2022_T4<br />

Nº sales (Notaries) Nº housing mortgages (Notaries) Nº new building licences (MITMA) Average price (Tinsa IMIE)<br />

The tightening of conditions for mortgage approvals and loan criteria lowers the volume of financing available for property purchase and<br />

contributes to a slowdown in transactions. Over the last few months, the number of purchases financed through a loan has gone down<br />

by 49%, as is shown in the ratio of new mortgage to purchases. Nevertheless, the fact that property continues to channel savings is also<br />

noticeable within a context of economic uncertainty.<br />

As regards the credit risk within the Spanish property sector, there are currently no signs of worrying rates. Household and company debt<br />

in Spain remains balanced compared to GDP, loans with mortgage guarantees are not held up by assets overvalued at bubble rates, and<br />

bank loans to the construction sector remain at very strict levels, constricting supply. At the same time, general employment levels are<br />

good, giving households certain income stability and maintaining their solvency. In addition, the doubtful loan rate associated with loans<br />

for property purchase continued to fall during the last quarter of 2022.<br />

However, in March a series of adjustments took place in some financial entities in the US and to a lesser extent, in Europe. This, together<br />

with the high exposure of US banks to the commercial real estate sector (with very low occupancy rates), has caused concern about the<br />

stability of the banking system and increased uncertainty about the changes in the global economy.<br />

This situation opens the door to the possibility of scenarios of even tighter loan restrictions from banks, prioritizing their own liquidity,<br />

as well as lower interest rate increases than those announced by central banks. As a result, this situation could lead to a reduction in the<br />

latest forecasts of economic growth, which would have a negative effect on housing demand, but a positive one on real estate investment.<br />

Regions<br />

There was a general slowdown in price rises, with lower year-on-year growth, although figures were still high. Quarterly changes moderated<br />

with discreet and almost flat figures.<br />

In year-on-year terms, increases moderated compared to those registered in previous periods. At the top of the regional ranking were<br />

Cantabria (up 12.1%) and Aragon (up 10%). Most regions stood at 4 to 6%, including the Comunidad de Madrid (up 5.1%) and Catalonia<br />

(up 4.4%). La Rioja (up 8%) and Extremadura (up 7.5%) had higher upticks, while at the other end were the Canaries (up 3.9%) and Melilla<br />

(up 4.1%).<br />

Quarterly variations slowed down, with most regions in the range of -0.1 to +1%. Navarra was the exception with growth of 5.6%.<br />

32 IDEA

MARKET REPORT <strong>2023</strong><br />

LOCAL MARKETS<br />

Q1 <strong>2023</strong> REPORT<br />

Prices continued to gradually move away from their post financial crisis minimum. The Comunidad de Madrid (59.4% above) is the furthest<br />

away, followed by Catalonia (43.9% above) and the Balearics (40.5% above). At the opposite extreme, Melilla, Murcia, Extremadura and Galicia<br />

registered price increases of 15% higher than their minimum registered in the previous cycle. A total of 8 out of 19 regions are 20% below their<br />

post-crisis minimum.<br />

As regards the distance from the highest price registered in the 2007 bubble, the region closest was the Balearics, where prices in Q1<br />

climbed from 1.9 below to 1.4% below their highest registered ever. Madrid was second (12.3% to 11.6% below). Prices in a total of 4 of the 19<br />

regions remained 30% below their highest in 2007.<br />

Provinces<br />

The scenario of moderation in annual and quarterly price rises for residential property was mirrored at provincial level, with most provinces<br />

experiencing year-on-year growth of 4 to 7%. The highest increases were around 10% in Zaragoza, Valencia and Cantabria, while the<br />

lowest, 2 to 3%, were in Soria, Alicante and Lugo.<br />

Quarterly growth ranged from -1.3% in Teruel and 5.6% in Navarra, with most provinces falling between -0.1 and +1%. A total of 10<br />

provinces registered a slight decrease and 21 registered slight increases of less than 1%.<br />

Madrid province, with year-on-year growth of 5.1%, saw a quarterly increase of 0.9%. Barcelona province, with 4.3% annual growth,<br />

registered a slight contraction of 0.2% in Q1.<br />

There are still parts of Spain where provinces within the same region registered different average price behaviour, as was the case in<br />

Aragon, Castilla y León and the Comunidad Valenciana. For example, in Aragon, Zaragoza province showed growth, Huesca maintained<br />

the same rate and Teruel saw a decrease. In Castilla y León, prices in Soria and Salamanca went down in Q1, while they continued to rise<br />

somewhat in Segovia. In the Comunidad Valenciana, Valencia, with high price growth, stood ahead of the other provinces.<br />

The distance from record highs stood between 1.4 and 42.7% below. The Balearics had the most expensive prices and the least distance<br />

from the highest ever (1.4% below). Madrid province (11.6% below) kept its distance compared to Barcelona province (24.9% below). Lleida<br />

and Toledo provinces had prices that were 40% lower than their highest ever.<br />

The most expensive prices at provincial level were in Madrid province (€2,888 per square metre), the Balearics (€2,689 per square metre)<br />

and Guipúzcoa (€2,449 per square metre), followed by Barcelona province (€2,434 per square metre) and Vizcaya (€2,377 per square metre).<br />

At the opposite extreme with the lowest prices were Ciudad Real (€762 per square metre), Cuenca (€792 per square metre) and Zamora<br />

(€851 per square metre).<br />

PROVINCIAL PRICES<br />

3,500<br />

25%<br />

3,000<br />

20%<br />

€/m 2<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

15%<br />

10%<br />

5%<br />

Year-on-year change<br />

500<br />

0%<br />

0<br />

-5%<br />

Madrid<br />

Balearic Islands<br />

Guipuzcoa<br />

Barcelona<br />

Vizcaya<br />

Ceuta<br />

Malaga<br />

Alava<br />

Melilla<br />

Nacional<br />

Girona<br />

Navarra<br />

Cadiz<br />

Seville<br />

Las Palmas<br />

S. C. de Tenerife<br />

Cantabria<br />

Zaragoza<br />

Asturias<br />

Tarragona<br />

Alicante<br />

Valencia<br />

Pontevedra<br />

Valladolid<br />

Huelva<br />

A Coruña<br />

Huesca<br />

Guadalajara<br />

Granada<br />

Salamanca<br />

Burgos<br />

Cordoba<br />

Almeria<br />

Segovia<br />

La Rioja<br />

R.of Murcia<br />

Castellon<br />

Palencia<br />

Lleida<br />

Albacete<br />

Leon<br />

Toledo<br />

Badajoz<br />

Orense<br />

Lugo<br />

Avila<br />

Soria<br />

Teruel<br />

Jaen<br />

Caceres<br />

Zamora<br />

Cuenca<br />

Ciudad Real<br />

Provinces Spain - Maximum precrisis Spain Spain - Minimum fron 2008 (postcrisis) Year-on-year change<br />

IDEA<br />

33

MARKET REPORT <strong>2023</strong><br />

LOCAL MARKETS<br />

Q1 <strong>2023</strong> REPORT<br />

3 · MARKET ACTIVITY INDICATORS<br />

DEVELOPMENT ACTIVITY AND SALES<br />

SALES AGAINST CURRENT SUPPLY<br />

Sales (year-to-date*) per 1,000 properties<br />

available in each province.<br />

BUILDING LICENCES AGAINST CURRENT SUPPLY<br />

Building licences over the last year-to-date* per 1,000 properties<br />

available in each province.<br />

0 5 10 15 20 25 30 35 0 1 2 3 4 5 6 7 8 9<br />

Orense<br />

Zamora<br />

Cuenca<br />

Lugo<br />

Pontevedra<br />

Leon<br />

Palencia<br />

Teruel<br />

A Coruña<br />

Salamanca<br />

Caceres<br />

Avila<br />

Soria<br />

Badajoz<br />

Ciudad Real<br />

Albacete<br />

Jaen<br />

Segovia<br />

Asturias<br />

Huesca<br />

Valladolid<br />

Burgos<br />

Cordoba<br />

Guipuzcoa<br />

Alava<br />

Navarra<br />

Biscay<br />

Lleida<br />

Zaragoza<br />

La Rioja<br />

Cantabria<br />

Barcelona<br />

Guadalajara<br />

Seville<br />

National<br />

Huelva<br />

Castellon<br />

Santa Cruz de Tenerife<br />

Toledo<br />

Granada<br />

Valencia<br />

Cadiz<br />

Comunidad de Madrid<br />

Balearic Islands<br />

Las Palmas<br />

Gerona<br />

Tarragona<br />

Region of Murcia<br />

Almeria<br />

Alicante<br />

Malaga<br />

10.8<br />

15.2<br />

15.4<br />

15.6<br />

16.4<br />

16.6<br />

17.2<br />

17.4<br />

17.5<br />

18.2<br />

18.8<br />

19.0<br />

19.1<br />

19.4<br />

20.6<br />

20.7<br />

20.7<br />

21.1<br />

22.0<br />

22.4<br />

22.6<br />

22.8<br />

22.9<br />

23.5<br />

23.9<br />

23.9<br />

24.1<br />

24.3<br />

25.0<br />

25.0<br />

25.3<br />

26.4<br />

27.0<br />

27.5<br />

27.6<br />

27.9<br />

28.0<br />

28.3<br />

28.9<br />

29.1<br />

29.1<br />

29.3<br />

29.3<br />

30.6<br />

30.9<br />

31.9<br />

32.2<br />

32.3<br />

39.3<br />

44.3<br />

45.4<br />

*Sales over the last four quarters, between Q1 2022 and Q4 2022<br />

Source: Mitma<br />

Avila<br />

Orense<br />

Lugo<br />

Tarragona<br />

Leon<br />

Teruel<br />

Soria<br />

Ciudad Real<br />

Albacete<br />

Jaen<br />

A Coruña<br />

Badajoz<br />

Huelva<br />

Palencia<br />

Salamanca<br />

Castellon<br />

Caceres<br />

Zamora<br />

Santa Cruz de Tenerife<br />

Toledo<br />

Gerona<br />

Huesca<br />

Pontevedra<br />

Asturias<br />

Lleida<br />

Cadiz<br />

La Rioja<br />

Segovia<br />

Granada<br />

Las Palmas<br />

Valencia<br />

Alicante<br />

Zaragoza<br />

Burgos<br />

Cuenca<br />

Cantabria<br />

Guipuzcoa<br />

Almeria<br />

Region of Murcia<br />

Cordoba<br />

National<br />

Navarra<br />

Barcelona<br />

Valladolid<br />

Seville<br />

Alava<br />

Balearic Islands<br />

Comunidad de Madrid<br />

Guadalajara<br />

Biscay<br />

Malaga<br />

1.2<br />

1.2<br />

1.4<br />

1.5<br />

1.7<br />

1.7<br />

1.8<br />

1.8<br />

1.9<br />

1.9<br />

1.9<br />

2.0<br />

2.1<br />

2.1<br />

2.3<br />

2.4<br />

2.4<br />

2.7<br />

2.8<br />

2.8<br />

2.8<br />

2.8<br />

2.9<br />

2.9<br />

2.9<br />

3.0<br />

3.0<br />

3.1<br />

3.2<br />

3.2<br />

3.3<br />

3.5<br />

3.5<br />

3.7<br />

3.7<br />

3.8<br />

3.8<br />

4.1<br />

4.1<br />

4.2<br />

4.2<br />

4.2<br />

5.0<br />

5.5<br />

6.0<br />

6.2<br />

6.8<br />

6.8<br />

7.0<br />

7.6<br />

9.3<br />

*Building licences approved over the last four quarters,<br />

between December 2021 and December 2022<br />

Source: Mitma<br />

36 IDEA

LOCAL MARKETS<br />

serviciodeestudios@tinsa.es<br />

Jose Echegaray, 9<br />

Parque empresarial<br />

28232-Las Rozas (MADRID)<br />

(+34) 91 336 43 36

www.taylorwimpey.es<br />

CALA DE MIJAS<br />

MARBELLA<br />

SAN PEDRO<br />

ISTÁN<br />

ESTEPONA<br />

C A S A R E S<br />

SAND ROQUE

Developments on Costa del Sol<br />

Estepona, Málaga<br />

New project of 69 flats with 2<br />

and 3 bedrooms and swimming<br />

pool. Situated on the front line<br />

golf course. West facing with<br />

wonderful open golf and<br />

mountain views and partial sea<br />

views. Two minutes walk to the<br />

clubhouse.<br />

Estepona, Málaga<br />

New phase 3 development<br />

from Taylor Wimpey Spain at<br />

Estepona Golf, at the heart of<br />

the Costa del Sol, with bright,<br />

spacious homes overlooking the<br />

golf course.<br />

The new development at Green<br />

Golf enjoys partial views over<br />

the golf course and to the sea.<br />

The homes have plenty of<br />

natural light as they face south<br />

or southwest.<br />

info@taylorwimpey.es +34 900 130 144

New quality homes<br />

Direct from developer<br />

San Roque, Cádiz<br />

An exclusive residential project with new apartments and penthouses with 2 and<br />

3 bedrooms with contemporary Mediterranean styling located at the heart of the<br />

famous San Roque Club resort.<br />

Taylor Wimpey España has designed this residential project with 80 apartments<br />

in 10 three storey buildings, spread over three phases that surround<br />

the 3 communal pools. Each building has 8 spacious apartments over three<br />

floors (ground, first and penthouse), two of these have 2 bedrooms and<br />

the rest have 3 bedrooms, and 2 bathrooms.<br />

www.taylorwimpey.es

La Cala Golf Resort, Mijas<br />

Incredible new construction<br />

of 105 apartments in one of<br />

the best areas of<br />

La Cala Golf Resort.<br />

Situated on the front line golf<br />

course, with large garden<br />

areas, lagoon type swimming<br />

pool and children's area.<br />

Only 5 minutes from the Club<br />

House as well as the sports<br />

facilities, hotel and spa.<br />

BREATHTAKING VIEWS<br />

La Cala Golf Resort, Mijas<br />

A private development offering<br />

a total of 56 homes with 2 or 3<br />

bedrooms and 19 exclusive<br />

3 bedroom penthouses and<br />

duplex distributed over 6<br />

buildings, surrounded by<br />

spacious communal gardened<br />

areas and with a shared pool.<br />

Large terraces with impressive<br />

views over the valley of<br />

La Cala de Mijas, the golf<br />

course and the sea.<br />

La Cala Golf Resort, Mijas<br />

A new project in La Cala<br />

Resort formed by 21 spacious<br />

townhouses in front line golf<br />

position with panoramic views<br />

of the resort and sea views.<br />

The homes are distributed<br />

over 3 levels in a private gated<br />

community with communal<br />

pool and gardens.<br />

Fully fitted and equipped<br />

kitchen, 3 spacious bedrooms,<br />

a large solarium measuring<br />

over 50 m2 and a garden.<br />

info@taylorwimpey.es +34 900 130 144

Marbella, Málaga<br />

Terra is a new residential of apartments of 2 to 3 bedrooms and penthouses<br />

of 4 bedrooms, only 4 minute walk away from the sea front promenade and 3<br />

minutes from the ancient part of San Pedro de Alcantara, in the new expanding<br />

area towards Marbella beach and near<br />

Puerto Banus called the NEW ALCANTARA.<br />

Terra offers homes designed to provide maximum comfort for their residents,<br />

with a selection of top-quality materials from prestigious brands, and a carefully<br />

considered design. They boast a perfect air conditioning system and optimal<br />

soundproofing between the homes and the exterior.<br />

www.taylorwimpey.es

New quality homes<br />

Direct from developer<br />

Marbella, Málaga<br />

Solemar is a gated development with a total of 58 apartments with 2 or 3<br />

bedrooms, distributed over 4 buildings which offer ground-floor homes with<br />

private gardens, first-floor apartments with sea views, and are crowned by the<br />

exclusive 3-bedroom penthouses with impressive terraces and stunning,<br />

unobstructed views of the Mediterranean Sea.<br />

Every home is south-east facing, and they all have spacious terraces to make<br />

the most of the natural light and wonderful sea views.<br />

The development has large, landscaped areas for families to enjoy and<br />

a beautifully designed communal pool.<br />

info@taylorwimpey.es +34 900 130 144

Istán, Marbella<br />

MARBELLA<br />

PUERTO BANUS<br />

www.taylorwimpey.es

Ayana Estepona<br />

modern luxury made for living<br />

The Costa del Sol has a long history of property development, yet until recently most<br />

new homes built here were designed specifically as second homes. Ayana, near the<br />

beachside of eastern Estepona, represents a new generation of homes created with<br />

the comfort, space and amenities of full-time living in mind.<br />

Words: Michel Cruz Photos: Courtesy of Ayana Estepona<br />

What would you do with a prime setting near the beach on the<br />

New Golden Mile? What would you do if it was a few minutes<br />

from downtown Estepona, 15 minutes from the Marbella area<br />

and covered almost 40,000m? Such a privileged plot of land<br />

offers both the location and size to create a residential area of<br />

distinction, and in doing so the team behind Ayana have also<br />

answered the growing demand for homes that are made for<br />

year-round living.<br />

Across the road are the five-star Kempinski resort hotel<br />

and the soon-to-open Pacha Club, an exciting new hub of<br />

restaurants, cafés, a beach club and entertainment options.<br />

“It’s an area that puts a lot of lifestyle at your fingertips while<br />

also being private and located near nature.” In fact, follow the<br />

private gated entrance into the complex, and you find yourself<br />

in a natural area close to everything but bordered by rustic<br />

country properties.<br />

Developed by Merlin Real Estates and designed by the<br />

prestigious architects, Villaroel Torrico, Ayana is a gated<br />

community of stylish modern apartments and penthouses<br />

distributed over 14 low-rise blocks of ten properties each, all set<br />

within 27,000 m2 of lush greenery – including almost a hectare<br />

of private parkland belonging to the complex and exclusive to<br />

its residents. “In many ways, it’s a perfect setting, 500 metres<br />

from the beach in rustic nature, close to town, access routes<br />

and sports facilities,” says Mark Strasek, Managing Director of<br />

Asset Folio EXCL, which is commercialising the project.<br />

A garden setting<br />

Gardens envelop the two and three-bedroom garden<br />

apartments in a community that is free of passing cars. Traffic<br />

goes straight from the entrance into spacious underground<br />

car parks, ensuring that Ayana is a living environment free<br />

of traffic. “The fact that it also features almost 10,000m2 of<br />

private parkland makes this a perfect setting for families and<br />

people seeking quality of life, not just a home near the beach<br />

and lifestyle amenities,” says Kathryn May, Sales Manager for<br />

AYANA.

The same thinking is also reflected in the design and layout<br />

of Ayana, where the four properties on ground and first floor<br />

level feature two-bedroom apartments on the inner section<br />

of the block, and three-bedroom ones making up the corner<br />

units. “All properties within Ayana are spacious in size, with a<br />

flowing open-plan layout and generous terraces, but the threebedroom<br />

apartments have the look and feel of a penthouse,<br />

complete with upper floor and expansive lifestyle terraces.”<br />

The three and four-bedroom penthouses on the top floor<br />

also feature an upper area with a comprehensive range of<br />

entertainment facilities and options, including optional private<br />

swimming pools and hot tubs. “They epitomise the choice of<br />

amenities, materials and finishing that is typical throughout<br />

Ayana,” says Kathryn, “including such details as the option of<br />

a walk-in shower or Cleopatra bath in the second bathroom.”<br />

No effort has been spared to ensure higher levels of comfort<br />

coupled with lower maintenance costs than you would<br />

normally find in these parts, and this is achieved through<br />

such quality inputs as top-of-the-range heat and acoustic<br />

insulation, anti-glare windows that keep out heat and cold<br />

extremes, super-effective Daikin air conditioning systems,<br />

under-floor heating throughout, smart home automation<br />

systems that optimise efficient use of resources, and beautiful<br />

kitchens with extra-large island/bars and American style<br />

fridges as standard.<br />

Residents at Ayana also have their own private gym, spa with<br />

heated indoor swimming pool, sauna, Hamman and changing<br />

room facilities, as well as a co-working space, concierge and<br />

administration office, and a clubhouse with cafe. “All of which<br />

have been designed to offer the experience of five star resortstyle<br />

living all year round,” adds Mark, who regards Ayana as<br />

one of the finest residential complexes of its kind on the coast.<br />

“Ayana is the culmination of many years of experience in<br />

Costa del Sol property development, as well as very careful<br />

consideration about how to take the lifestyle elements of this<br />

region and integrate them into full-time, year-round living in a<br />

way that celebrates the Marbella way of life. The homes also<br />

offer the kind of additional space, privacy, storage facilities,<br />

practical amenities and above all ambience needed for a<br />

permanent residence. These properties represent the best of<br />

both worlds – prime homes in a resort setting.”<br />

ayanaestepona.com<br />

ayana@assetfolio.com<br />

633 925 338<br />

Resort living<br />

While catering to year-round residents, it cannot be denied<br />

that Ayana is located within the Costa del Sol, and as such<br />

it offers far more lifestyle options than a property in more<br />

northern climes would. Set within the lush gardens planted<br />

in large part with endemic, drought-resistant species are two<br />

large swimming pools – one heated and one flanked by a<br />

children’s pool, but both surrounded by a sunbathing deck.

5 Star Living Experience<br />

Clubhouse<br />

Featuring a co-working<br />

lounge & café-bar<br />

Communal space<br />

Offering year round use<br />

Pool & Spa<br />

Carefully designed as a space<br />

to rest & recharge<br />

Gymnasium<br />

A well equipped gym for<br />

those looking to keep fit<br />

Call to schedule a tour: (+34) 952 908 120

Mane Residences is an exclusive & private development, located in a privileged position<br />

in Benalmádena, Málaga. Thanks to their elevated position all homes boast breath-taking<br />

panoramic views of the sea and the coastline.<br />

49 apartments · 2 townhouses · Beautifully landscaped gardens & pool<br />

info@primeinvest.es | primeinvest.es | +34 951 1000 77

Developed and commercialised by

Cassia<br />

ESTEPONA · MÁLAGA<br />

FROM 90 m 2 | 2 to 4 bed. | 1 to 3 bath. | Garage | Storage room<br />

Avant-garde design in a unique residential complex<br />

<br />

<br />

<br />

638 965 257

FROM 235.000 €

Solaris<br />

CALA MIJAS · MÁLAGA<br />

FROM 85 m 2 | 2 and 3 bed. | 2 bath. | Garage | Storage room<br />

Avant-garde architecture with wide open spaces.<br />

Surrounded by gardens, with swimming pool,<br />

paddle tennis pitch and children’s play area.<br />

685 050 568<br />

solaris@gilmar.es

FROM 191.000 €

About us<br />

Services:

Interior design<br />

CLIENTS WHO HAS TRUSTED US:

Construction<br />

presentations<br />

that impress<br />

The best solution for<br />

communicating and<br />

showcasing your<br />

construction progress.

Be ready for

COMING SOON

LEGAL<br />

DELAYS IN THE DELIVERY OF<br />

“OFF PLAN PROPERTIES”<br />

One of the main risks of buying an off-plan property is that the<br />

developer, or the construction company, does not meet the<br />

stipulated deadlines. This situation can cause a delay in the<br />

delivery of the property, causing the buyer a series of<br />

problems, both financial and personal, which makes it<br />

interesting to review the alternatives offered by the law to<br />

react in these cases.<br />

Once the off-plan home purchase contract has been signed,<br />

the main obligation assumed by the seller is to deliver the<br />

sold property within the term and conditions established<br />

by the parties, in such a way that the sold property will not be<br />

understood to have been delivered until it is placed in the<br />

possession of the buyer.<br />

Once the obligation to deliver is thus established, noncompliance<br />

with it is determined by the concept of default by<br />

the promoter, which is considered by our doctrine and case<br />

law as the culpable or malicious delay in the fulfilment of the<br />

obligation.<br />

VOGT ADVOKATFIRMA<br />

ESPAÑA SL SINCE 1999<br />

However, in the pruchase contract, where reciprocal<br />

obligations arise for both parties, neither of the obligors is in<br />

default if the other fails to perform. Therefore, the fulfilment by<br />

the buyer of his obligations (especially the payment of the<br />

agreed price according to the payment schedule established<br />

in the contract) in the face of the seller's failure to fulfil his<br />

obligation to deliver, will automatically and without the need for<br />

judicial or extrajudicial injunction, cause the seller to be in<br />

default, unless the delay in the fulfilment of the obligation is<br />

due to "unforeseeable circumstances" or "force majeure".<br />

The law establishes as the main effect of default the obligation<br />

of the defaulting seller to compensate the buyer for the<br />

damages caused as a consequence of the delay in the fulfilment<br />

of the obligation, compensation that is normally articulated in<br />

judicial proceedings by means of the exercise of the<br />

corresponding legal actions. The damages to be claimed will be<br />

those caused to the buyer as a consequence of the failure to<br />

dispose of the purchased property on the scheduled date.<br />

70 IDEA

LEGAL<br />

Finally, in sale and purchase contracts, once the seller's breach<br />

of contract has occurred as a result of the situation of default,<br />

the buyer may choose between demanding performance or<br />

termination of the contract, with compensation for damages<br />

and payment of interest in both cases, and may request<br />

termination, even after having opted for performance, when<br />

this proves impossible.<br />

THE CLAUSES ON THE DELIVERY OF THE PROPERTY IN<br />

THE OFF-PLAN PURCHASE CONTRACT.<br />

The obligation to deliver to the buyer the property built by<br />

the developer is an essential and principal obligation in the offplan<br />

purchase contract which, in the event of breach by the<br />

developer, is frequently examined by the courts in order to grant,<br />

where appropriate, due protection to the consumers affected.<br />

In this context, the wording of the delivery clause must be<br />

drafted with due care, clarity and rigour.<br />

There are two aspects to be taken into account in any delivery<br />

clause included in off-plan home purchase contracts:<br />

1.- The delivery date, which will normally be determined either<br />

by considering a delivery period (within the following X months);<br />

before a certain date (before day X of month Y of year Z); or<br />

even within a period after the fulfilment of a certain<br />

administrative requirement (within the month after obtaining the<br />

first occupancy licence).<br />

With regard to the date of delivery, clauses that reserve an<br />

excessively long or insufficiently determined period for the<br />

developer to satisfy the obligation owed, as well as those that<br />

provide for the automatic extension of a fixed-term contract, if<br />

the buyer does not object, are abusive. Likewise, clauses that<br />

include merely indicative delivery periods conditional on the will<br />

of the developer are also abusive.<br />

2.- The effects of non-compliance with the delivery<br />

obligation, which are usually articulated through penalty<br />

clauses included in the sales contract itself.<br />

However, the reality is quite different, as the tendency<br />

observed is the drafting of unclear clauses in which either<br />

the delivery date is not specified or, if it is, it is approximate and<br />

conditional on events subject to the exclusive control and will<br />

of the developer.<br />

Therefore, the first thing to be clear about is that the date of<br />

delivery of the new home must always appear in the<br />

purchase contract. As such, it is understood that, within the<br />

agreed period, the property is completely finished and has all<br />

the necessary licences and permits to be inhabited (licence of<br />

first occupation, certificate of occupancy, etc.). In addition, it is<br />

advisable to add a clause that establishes the penalty for the<br />

delay in the delivery of the work, reflecting your right to<br />

receive compensation for non-compliance with the delivery<br />

deadline, either through the payment of a certain amount of<br />

money, the rental of a home or the return of the amounts paid<br />

plus the corresponding interest and taxes in the event that it is<br />

never finished.<br />

COMPENSATION FOR DAMAGES, OR TERMINATION OF<br />

THE PURCHASE CONTRACT.<br />

A delay in the delivery of a property is a breach of contract by<br />

the seller/developer, which can give rise to different scenarios:<br />

A not too long delay (a few months): in this case, the buyer<br />

will normally be compensated for the damages caused by the<br />

developer.<br />

A serious delay that violates the essential clauses of the<br />

contract or that could even endanger the final delivery of the<br />

property: this case could lead to the termination of the<br />

contract and the return of the payments made up to that<br />

moment and the corresponding interest (in addition to the<br />

payment of the compensation for the delay in the delivery of<br />

the property or its non-delivery -if so stipulated in the<br />

purchase document-).<br />

The buyer can grant an extension to the seller, which will be<br />

included as an additional clause in the contract and will include<br />

the new date set for the completion of the works and the<br />

handover of the keys.<br />

Contrary to what some buyers think, the mere delay in the<br />

delivery of a new home is not always sufficient reason to<br />

cancel their purchase contract. In order for the delay in<br />

delivery to give rise to the termination of the contractual<br />

relationship, it must be "serious" and "essential", frustrating the<br />

legal transaction.<br />

In order to determine essentiality, parameters such as the<br />

importance for the economy of the contracting parties, the<br />

importance of the non-performance as an obstacle to prevent<br />

satisfaction or to cause the frustration to be predicated on the<br />

practical purpose of the contract must be taken into account.<br />

There are fewer doubts in those cases in which the purchase<br />

contract includes a specific clause that establishes the<br />

termination of the agreement in the event that the seller delays<br />

in the delivery of the property beyond the stipulated date.<br />

Here, case law is clearer and considers the fixed date as an<br />

essential element of the contract, and therefore cause for its<br />

annulment.<br />

If the delivery of the new flat exceeds the date stipulated in the<br />

contract, the seller must compensate the buyer for damages<br />

directly caused by the delay. Among the most common<br />

payments to be paid by the developer to his client are the<br />

following (it is advisable to always keep the corresponding<br />

invoices or proof of payment):<br />

Rental instalments for another flat that buyers must pay until<br />

they have their own.<br />

Furniture storage.<br />

Removals.<br />

Utilities contracting costs (if necessary).<br />

Additional financial expenses caused by the delay in the<br />

payment date of the property.<br />

IDEA<br />

71

LEGAL<br />

On the other hand, those owners who do not need to rent<br />

another property despite the delay in receiving their own can<br />

also claim from the developer what is known as "use value":<br />

this is the amount corresponding to the rental price of a<br />

property of similar characteristics in the same area, multiplied<br />

by the number of months that the handover has been delayed.<br />

In order to determine the exact amount to be claimed from the<br />

developer, it will be necessary to use an expert opinion that<br />

calculates the economic amount that it would cost to rent a<br />

property with the same characteristics as the property<br />

purchased and in the same location.<br />

Finally, although they are not quantifiable, buyers affected by<br />

undelivered housing can also claim moral damages.<br />

It should be borne in mind that, on many occasions, the<br />

purchase contract itself stipulates the compensation to be paid<br />

for this type of situation; in fact, it is common that, instead of<br />

damages, the owner is paid a specific amount for each day of<br />

delay.<br />

FORCE MAJEURE AS A JUSTIFICATION FOR DELAY.<br />

Although the real estate developer must, as an expert,<br />

determine a realistic timeframe when calculating the delivery of<br />

the homes (even taking into account certain unforeseen<br />

events), there are certain uncontrollable and external factors<br />

that are at the same time unpredictable. These impediments<br />

are what the law calls force majeure.<br />

If these events give rise to difficulties that delay the delivery of<br />

the properties and are conveniently accredited by the seller,<br />

the seller will be exonerated from any fault (unless it is proven<br />

that he has not acted diligently or with sufficient planning).<br />

In legal proceedings initiated by buyers when there is a delay or<br />

default by the seller, developers follow a very similar pattern,<br />

which is to invoke that the delay should be considered as a nonculpable<br />

delay due to causes beyond their control (fortuitous<br />

event, force majeure or fault of a third party). However, the case<br />

law is constant in maintaining a very restrictive criterion when it<br />

comes to accepting the promoter's allegations.<br />

Cases of suspension of payments or bankruptcy of the<br />

construction company: In cases in which the developer invokes<br />

as a reason for the delay in delivery the stoppage of the works<br />

as a result of the builder being in a state of suspension of<br />

payments or bankruptcy, the court decisions consider that the<br />

delay would not be justified, given that with due diligence on<br />

the part of the developer, this event would have been<br />

foreseeable and avoidable.<br />

Meteorology or Inclement weather: Despite being a reason for<br />

justification constantly argued by the promoter, our judicial<br />

bodies require torrential rains and hurricane-force winds to be<br />

considered as grounds for justification, and this requirement is<br />

intensified in rainy areas, given in this case the need for<br />

foresight on the part of the promoter.<br />

Strikes: The existence of construction strikes is analysed on<br />

the basis of various parameters:<br />

The coincidence of the strike with the housing construction period.<br />

The duration of the strike.<br />

The sectoral or global nature of the strike and its effect on the<br />

entire construction site.<br />

The number of workers from the construction company and<br />

subcontractors who took part in the strike.<br />

72 IDEA

LEGAL<br />

Breaches by subcontractors: In cases in which the developer<br />

invokes as a reason for the delay in delivery the stoppage of<br />

the works as a result of one or more companies subcontracted<br />

by the construction company having incurred in breaches of<br />

any kind or even in bankruptcy proceedings, the court<br />

decisions consider that the delay would not be justified, given<br />

that with due diligence on the part of the developer, such an<br />

event would have been foreseeable and avoidable. As in cases<br />

of suspension of payments or bankruptcy of the construction<br />

company, these causes are considered to be foreseeable,<br />

preventable, avoidable and inherent to the business<br />

management of the developer.<br />

Existence of administrative or town planning problems that<br />

cause delays in delivery: In these cases, the Courts and<br />

Tribunals usually consider that these problems derive from<br />

non-compliance by the developer due to a lack of diligence and<br />

foresight in administrative management.<br />

Delays in the construction of the building and in obtaining the<br />

occupancy licence: An interesting case is the invocation of the<br />

contractual clause that makes delivery conditional upon<br />

completion of the work and obtaining the first occupancy<br />

licence. Faced with the delay, the developer tries to justify it by<br />

claiming that the conditions of completion of the work and<br />

obtaining the licence on time were not met due to causes linked<br />

to the excessive increase in construction activity and the lack of<br />

sufficient qualified personnel to be able to guarantee the<br />

production and quality rates, in addition to this circumstance<br />

the shortage of raw materials as important and impossible to<br />

replace as ceramic materials, glass, marble, etc., or due to<br />

logistical problems, such as the shortage of raw materials such<br />

as ceramic materials, glass, marble, etc., which are impossible<br />

to replace, or the lack of sufficient qualified personnel to be able<br />

to guarantee the production and quality rates, or else, due to<br />

logistical problems in the supply of materials during the COVID<br />

19 pandemic or the war in Ukraine. The case law considers that<br />

it is logical that such delivery should be preceded by both the<br />

completion of the construction of the building and the granting<br />

of the occupancy licence, although it is not admissible to make<br />

the deadline conditional on these two conditions, as this is<br />

considered implicit in the delivery, as it would then be difficult to<br />

deliver a dwelling. To make the agreed delivery period so<br />

clearly dependent on these two aforementioned conditions<br />

would mean leaving the delivery in the hands of the seller and<br />

at her discretion, which could be postponed indefinitely without<br />

consequences for her. to the seller. This is an obligation that all<br />

property developers assume and that they must comply with as<br />

agreed and cannot be left to their own free will.<br />

In order to assess whether the event that has affected the<br />

fulfilment of the obligations was unforeseeable or unavoidable,<br />

it is necessary to take into account the diligence required of the<br />

obligor by reason of his profession, knowledge, experience,<br />

etc.... For example, in the case of construction, the promoter<br />

must know how long it takes for a specific Town Hall to grant a<br />

First Occupancy Licence, so he cannot excuse the delay in the<br />

delivery of the property by saying that the Town Hall has taken<br />

a long time to grant it.<br />

Modifications to the Project: In such cases, the doctrine of<br />

diligence and foresight of the developer is, if possible, even<br />

more intense, given that questions such as, for example,<br />

modifications to the urbanisation project relating to the public<br />

road, pedestrian accesses, car parks, etc., are not acceptable,<br />

as any project requires the prior determination of such<br />

questions, as they are a prerequisite for the granting of the<br />

building permit.<br />

IDEA<br />

73

LEGAL<br />

BREACHES BY THE SELLER AND EXECUTION OF THE<br />

GUARANTEES.<br />

If the developer fails to comply with the delivery term, the buyer<br />

may do nothing and limit himself to waiting, tacitly extending<br />

the term; he may expressly extend the unfulfilled term; or he<br />

may terminate the contract and claim the return of the total<br />

amount advanced, including applicable taxes and increased<br />

with the legal interest of the money.<br />

Tacit extension. If the property has not been delivered on the<br />

indicated date and the buyer does not terminate the contract,<br />

he will be tacitly extending the term until he decides to<br />

terminate the contract or until he is required by the developer<br />

to take delivery of the property. Failure by the seller to comply<br />

with the stipulated deadline for the completion and delivery of<br />

the property justifies the termination of the contract at the<br />

request of the buyer, provided that the right to terminate is<br />

exercised by the buyer before being required by the seller to<br />

execute the public deed because the property has already<br />

been completed and is ready to be delivered even after the<br />

stipulated date for its delivery. In readiness for delivery means<br />

that it has a certificate of occupancy and that a title deed can<br />

be granted in favour of the buyer under the terms of the<br />

contract (registration, encumbrances, etc.).<br />

In the event of tacit extension, the guarantees that the law<br />

obliges the developer to provide in favour of the buyer,<br />

especially in relation to the amounts paid by the buyer on<br />

account of the price, will remain in force until they are cancelled<br />

or until the statute of limitations or expiry of the contract<br />

expires. In this case, it is very important for the buyer to be<br />

informed of the period of validity of these guarantees.<br />

Express extension. In the event that the buyer extends the<br />

terms, by means of an additional clause in the contract<br />

granted, the promoter may extend the insurance contract or the<br />

guarantee. However, the developer is not legally obliged to<br />

extend the guarantee if the purchaser, instead of terminating<br />

the contract, grants an express extension. Therefore, it will<br />

have to be the diligent purchaser who will have to require the<br />

developer to extend the insurance contract or the guarantee as<br />

a sine qua non condition for an express extension of the<br />

delivery period.<br />

Termination and return of sums. The buyer must make a<br />

reliable request to the developer for the refund. If after 30<br />

calendar days have elapsed, or if it is impossible to do so, the<br />

buyer may contact the insurer or guarantor, as the case may<br />

be. The claim will only be for the amounts actually paid on<br />

account, taxes and legal interest. The claim must be<br />

accompanied by proof of having provided the amounts, proof of<br />

having reliably requested the Promoter or of having tried to do<br />

so without effect and the settlement of the legal interest.<br />

If the claim is addressed to the insurer, the latter will have 30<br />

calendar days to pay the compensation to the purchaser. If<br />

after this period has elapsed, the insurer does not compensate<br />

the purchaser, he will be in default and interest will accrue. If<br />

the claim is addressed to the guarantor, the regulation does not<br />

grant the guarantor any period of time to pay the amounts<br />

claimed, and therefore the legal interest will begin to count as<br />

from the claim.<br />

FINAL RECOMMENDATION.<br />

After this quick analysis of some of the most interesting<br />

aspects that may arise in this type of case, the final<br />

recommendation to any buyer affected by a delay in<br />

delivery is to contact a lawyer so that, once the date<br />

stipulated in the contract has been exceeded, he/she<br />

notifies the developer of the non-compliance with the<br />

deadline in order to avoid it being argued later that there<br />

has been a tacit acceptance by the buyer of the delay<br />

suffered. In this same notification, mention must be made of<br />

the intention to claim damages that are caused until the<br />

property is handed over, regardless of whether a rental income<br />

is paid or whether it is intended to claim the "value in use" at a<br />

later date.<br />

In this regard, VOGT Advokatfirma España, S.L. has<br />

extensive experience in drafting off-plan purchase contracts,<br />

reviewing the fulfilment of the developer's legal obligations,<br />

managing the relationship between buyers and developers<br />

during the construction process, and supervising the correct<br />

handover of the property.<br />

74 IDEA

SPORT MARKETING<br />

SPORT MARKETING FOR<br />

REAL ESTATE COMPANIES<br />

If you think of MARKETING FOR REAL ESTATE COMPANIES, you normally think of topics like Social Media Campaigns,<br />

Website SEO or Exhibitions but not normally of Sport Marketing. In this article we will show you, how Real Estate companies can<br />

benefit from local sport marketing and what to avoid.<br />

Broadly speaking Sport Marketing means any kind of support or sponsorship for individual athletes or teams. In general terms<br />

the companies get certain rights or visibility in exchange for a monetary support.<br />

Many companies in the real estate industry are likely to have have already been approached or are supporting a local sport entity<br />

but is it more a charity contribution or a real sponsorship? Are they getting a real value in exchange for their support?<br />

Companies should consider their goals when entering a serious sponsorship agreement with a team or an individual athlete. What<br />

do you want to achieve with your sponsorship? Most likely you will sponsor a local team which is known in your city but not<br />

nationally or international. One possible aim for a Real Estate company could be to establish themselves as the local experts and<br />

convincing the members of the club and their fans to choose your real estate when selling or buying. Another aim is connecting<br />

to other companies who sponsor the club and taking advantage of synergies. Most of the time the local town hall is also present,<br />

and the sport environment can help you establish valuable relations with the local authorities.<br />

78 IDEA

Coming soon!,<br />

project for 3 new contemporary<br />

villas in Marbella<br />

JUST TWO MINUTES FROM THE CENTRE OF MARBELLA IN THE RENOWNED URBANIZATION EL MIRADOR.<br />

INDEPENDENT MODERN LUXURY VILLAS BUILT TO THE HIGHEST STANDARDS.<br />

LARGE TERRACES AND AMPLE GARDEN WITH SWIMMING POOL AND BBQ.<br />

3 SPACIOUS BEDROOMS WITH EN-SUITE BATHROOMS.<br />

PRELIMINARY PROJECT INCLUDED TO APPLY FOR A BUILDING LICENCE<br />

PLOTS FOR IMMEDIATE BUILDING<br />

TAILOR-MADE ARCHITECTURE PROJECTS<br />

TURN-KEY CONSTRUCTION<br />

INVESTMENT<br />

SANTINI<br />

LAND BROKER<br />

info@miguelsantini.com<br />

Tel: +34 609 542 908

EVERGREEN EVERGREEN HOMES HOMES • MIJAS • MIJAS COSTA COSTA<br />

900 900 11 00 11 22 00 22<br />

neinorhomes.com<br />

WORKS WORKS IN PROGRESS IN PROGRESS<br />

info@lijomi.eu Lijomi.eu Lijomi_marbella<br />

Blvd. Alfonso de Hohenlohe s/n, Marbella Club Hotel, 29602 Marbella

Design Publishing Photography Video Strategy<br />

info@adsmarketing.es +34 951 775 790 www.adsmarketing.es