Journal of African Business Issue 6

Welcome to the Journal of African Business, a unique guide to business and investment in Africa. The first issue of the journal was published in 2020 as an annual publication. Since then, the quarterly format has been adopted, giving our team more opportunities to bring to readers up-to-date information and opinions and offering our clients increased exposure at specific times of the year.

Welcome to the Journal of African Business, a unique guide to business and investment in Africa. The first issue of the journal was published in 2020 as an annual publication. Since then, the quarterly format has been adopted, giving our team more opportunities to bring to readers up-to-date information and opinions and offering our clients increased exposure at specific times of the year.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

JUL / AUG / SEPT 2023<br />

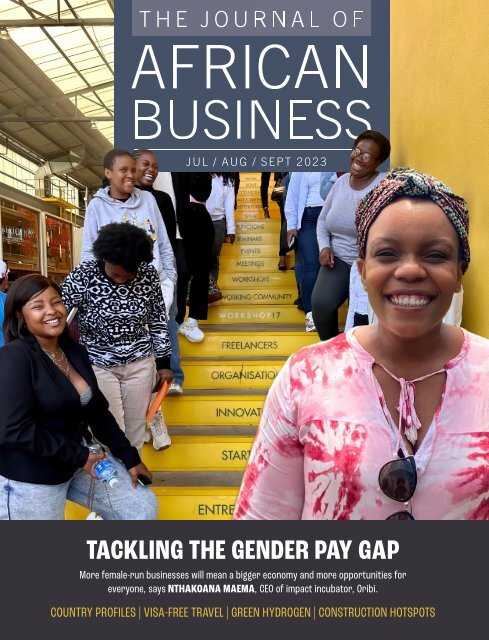

TACKLING THE GENDER PAY GAP<br />

More female-run businesses will mean a bigger economy and more opportunities for<br />

everyone, says NTHAKOANA MAEMA, CEO <strong>of</strong> impact incubator, Oribi.<br />

COUNTRY PROFILES | VISA-FREE TRAVEL | GREEN HYDROGEN | CONSTRUCTION HOTSPOTS

2023<br />

Future Fit –<br />

The year to be<br />

acknowledged<br />

The Gateway to learning is<br />

infinite… Get ahead <strong>of</strong> the<br />

curve and stand out from<br />

amongst the crowd through<br />

Executive Education at<br />

Wits <strong>Business</strong> School.<br />

Develop cutting-edge skills<br />

for revolutionary leaders.<br />

Be the change you wish to see! Join WBS – Executive Education Today!

EXECUTIVE<br />

EDUCATION<br />

Lead | Change | Transform<br />

C-Suite<br />

Management<br />

Development<br />

Leadership<br />

& coaching<br />

Executive<br />

Education<br />

Specialised<br />

Courses<br />

2 St Davids Place, Parktown, Johannesburg www.wbs.ac.za

FOREWORD<br />

<strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in Africa.<br />

Welcome to the <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong>. The first issue <strong>of</strong> the journal was<br />

published in 2020 as an annual publication. Since then, the quarterly format<br />

has been adopted, giving our team more opportunities to bring to readers upto-date<br />

information and opinions and <strong>of</strong>fering our clients increased exposure<br />

at specific times <strong>of</strong> the year.<br />

We continue to cover a broad range <strong>of</strong> topics, ranging from energy and mining<br />

to tourism and skills development. <strong>Issue</strong>s relating to the emerging green economy<br />

are becoming more relevant by the day. On a continent where large numbers<br />

continue to go without electricity, there is a special urgency to this debate. In this<br />

edition, a searching analysis is included<br />

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

JUL / AUG / SEPT 2023<br />

TACKLING THE GENDER PAY GAP<br />

More female-run businesses will mean a bigger economy and more opportunities for<br />

everyone, says NTHAKOANA MAEMA, CEO <strong>of</strong> impact incubator, Oribi.<br />

COUNTRY PROFILES | VISA-FREE TRAVEL | GREEN HYDROGEN | CONSTRUCTION HOTSPOTS<br />

on the prospects <strong>of</strong> green hydrogen for<br />

developing countries. Rod Crompton<br />

and Bruce Douglas Young <strong>of</strong> the Africa<br />

Energy Leadership Centre, University<br />

<strong>of</strong> the Witwatersrand, point out some<br />

<strong>of</strong> the potential potholes on the way to<br />

exploiting this greener power source,<br />

transport and cost being two big<br />

concerns. This article first appeared in<br />

The Conversation AFRICA.<br />

Where green hydrogen has future<br />

potential, the green minerals that<br />

Africa has in abundance are already<br />

driving investment as the world looks<br />

to make the transition away from fossil fuels. The mining team at legal alliance<br />

LEX Africa argue that Africa is well positioned to benefit. <strong>African</strong> women are<br />

benefitting from better access to financing through the medium <strong>of</strong> mobile<br />

phones, as Rashi Gupta, Group Chief Operating Officer at MFS Africa outlines,<br />

but Nthakoana Maema, CEO <strong>of</strong> impact incubator, Oribi, is clear that with regard<br />

to the gender pay gap, much still needs to be done.<br />

A snapshot <strong>of</strong> some <strong>of</strong> the continent’s busiest regions with regard to the<br />

construction sector highlights some <strong>of</strong> the factors underpinning projects, such<br />

as infrastructure spending. Travel and logistics are the focus <strong>of</strong> three articles.<br />

Trends shaping supply chains is the subject <strong>of</strong> one article. Another looks at how<br />

access to <strong>African</strong> countries has improved for travelling <strong>African</strong>s, as illustrated by<br />

the results <strong>of</strong> the seventh 2022 Africa Visa Openness Index. Finally, ride-hailer<br />

Bolt has established itself in several <strong>African</strong> countries, pointing the way to a new<br />

kind <strong>of</strong> mobility. An important survey <strong>of</strong> CEOs has been produced. We publish<br />

the executive summary <strong>of</strong> Africa CEO Trade Survey Report 2022 by the Pan<br />

<strong>African</strong> Private Sector Trade and Investment Committee (PAFTRAC).<br />

Th e tourism industry is in the spotlight as the Radisson Group, winners <strong>of</strong><br />

the Leading Hotel Group in Africa award, give details <strong>of</strong> their expansion plans<br />

for the continent.<br />

Global <strong>African</strong> Network is a proudly <strong>African</strong> company which has been<br />

producing region-specific business and investment guides since 2004, including<br />

South <strong>African</strong> <strong>Business</strong> and Nigerian <strong>Business</strong>, in addition to its online investment<br />

promotion platform www.globalafricanetwork.com.<br />

JOHN YOUNG<br />

Editor, <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong><br />

Email: john.young@gan.co.za<br />

Editor: John Young<br />

Publishing director: Chris Whales<br />

Managing director: Clive During<br />

Online editor: Christ<strong>of</strong>f Scholtz<br />

Design: Salmah Brown. Production: Yonella Ncaba<br />

Ad sales: Venesia Fowler, Tennyson Naidoo,<br />

Sam Oliver, Tahlia Wyngaard, Gavin van<br />

der Merwe, Graeme February, Shiko Diala,<br />

Gabriel Venter and Vanessa Wallace<br />

Administration & accounts: Charlene Steynberg,<br />

Kathy Wootton, Sharon Angus-Leppan<br />

Distribution & circulation manager: Edward MacDonald<br />

The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong> is<br />

published by Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Email: info@gan.co.za<br />

Website: www.globalafricanetwork.com<br />

No portion <strong>of</strong> this book may be reproduced without<br />

written consent <strong>of</strong> the copyright owner. The opinions<br />

expressed are not necessarily those <strong>of</strong> The <strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong> magazine, nor the publisher, none <strong>of</strong><br />

whom accept liability <strong>of</strong> any nature arising out <strong>of</strong>, or<br />

in connection with, the contents <strong>of</strong> this publication.<br />

The publishers would like to express thanks to those<br />

who support this publication by their submission <strong>of</strong><br />

articles and with their advertising. All rights reserved.<br />

Printing: FA Print<br />

Member <strong>of</strong> the Audit Bureau <strong>of</strong> Circulations<br />

4

CONTENTS<br />

CONTENTS<br />

FOREWORD<br />

From the editor’s desk.<br />

THE GENDER PAY GAP IS STILL AN UNCOMFORTABLE REALITY<br />

There’s much to be positive about, says Nthakoana Maema,<br />

CEO <strong>of</strong> impact incubator, Oribi, but still a lot more to be done.<br />

THE LOGISTICS INDUSTRY NEEDS TO ADAPT TO NEW TRENDS<br />

Flexibility and agility are the key to servicing clients.<br />

AFRICA IS MAKING PROGRESS ON VISA-FREE TRAVEL<br />

Burundi, Djibouti and Ethiopia have shown the most progress in easing travel<br />

restrictions according to the seventh 2022 Africa Visa Openness Index.<br />

RIDING FORWARD TO A GREEN FUTURE IN AFRICA<br />

Regional Manager for East and Southern Africa at Bolt, Takura Malaba, argues that ridehailing<br />

has come a long way from the days when it was seen as a flash in the pan.<br />

GLOBAL DEMAND FOR GREEN MINERALS BOOSTS AFRICAN PROSPECTS<br />

Africa is well positioned to benefit from the green mineral boom.<br />

CAN GREEN HYDROGEN WORK FOR AFRICA?<br />

Big problems must be solved before green hydrogen can be extensively used, as Rod<br />

Crompton and Bruce Douglas Young <strong>of</strong> the Africa Energy Leadership Centre explain.<br />

CONSTRUCTION HOTSPOTS<br />

Infrastructure, renewable energy and hospitality are driving renewed<br />

growth in the <strong>African</strong> construction sector. By John Young<br />

MOBILE MONEY IS EMPOWERING WOMEN IN AFRICA<br />

Financial inclusion is the most effective way <strong>of</strong> reducing inequalities,<br />

writes Rashi Gupta, Group Chief Operating Officer at MFS Africa.<br />

AFRICAN CEOS ARE POSITIVE ABOUT THE AFCFTA<br />

The Pan <strong>African</strong> Private Sector Trade and Investment Committee (PAFTRAC) has published its<br />

Africa CEO Trade Survey Report 2022 assessing the impact <strong>of</strong> the AfCFTA on <strong>African</strong> trade.<br />

THE RADISSON HOTEL GROUP IS TARGETING AFRICAN GROWTH<br />

As Radisson celebrates winning the Leading Hotel Group in Africa Award, the group outlines its<br />

strategy in building its <strong>African</strong> footprint beyond the current capacity <strong>of</strong> nearly 8 000 rooms.<br />

COUNTRY PROFILE: BOTSWANA<br />

The Jwaneng Mine is the richest diamond mine in the world by value.<br />

COUNTRY PROFILE: ZAMBIA<br />

Copper’s importance to the global economy is good for investment.<br />

When e-hailing first launched, passengers were intrigued by the innovation.<br />

However, there are still many who were sceptical about driving with a stranger.<br />

And being unsure about the processes involved is also a communication challenge.<br />

These and many other hurdles need to be overcome for Bolt to be a fully-fledged<br />

complementary service in the transport ecosystem.<br />

By studying macro-trends like rising inflation and a much higher cost <strong>of</strong><br />

living, we can get a feel for what the future may hold. For instance, more people –<br />

especially the young generation – are moving away from buying vehicles and don’t<br />

necessarily want to own a car. They do however still need to get from A to B, safely<br />

and affordably. We believe that many will start using riding opportunities with<br />

e-hailing platforms instead <strong>of</strong> owning their own vehicles.<br />

DRIVERS ARE AN EQUALLY IMPORTANT PART OF E-HAILING<br />

DRIVERS ARE AN EQUALLY IMPORTANT PART OF E-HAILING<br />

At Bolt, the driver is an equally important part <strong>of</strong> the transport solution. It<br />

started with people seeing e-hailing as an opportunity to make additional<br />

income by driving, and now that’s changed. Today, countless businesses<br />

have grown out <strong>of</strong> it and there are many entrepreneurs who have turned one<br />

e-hailing car into a large fleet. Bolt has car owners who have decided to leave<br />

their current employment, whether they were truck operators or taxi drivers,<br />

simply because they prefer to work in a flexible environment with the potential<br />

to earn more and decide their own hours.<br />

RIDING WITH THE TIMES<br />

RIDING WITH THE TIMES<br />

Ten years ago, when Bolt first entered South Africa, we didn’t think we could move<br />

the needle on unemployment. But now we’re at a point where we have between<br />

RIDING<br />

RIDING FORWARD<br />

FORWARD TO A<br />

TO A<br />

GREEN FUTURE IN AFRICA<br />

GREEN FUTURE IN AFRICA<br />

Now established in cities across Africa in nations such<br />

as Ghana, Kenya, Nigeria, South Africa, Tanzania, Tunisia<br />

and Uganda, Bolt is proving that the phenomenon <strong>of</strong><br />

ride-hailing is far from being a flash in the pan. Regional<br />

Manager for East and Southern Africa at Bolt, Takura<br />

Malaba, argues that ride-hailing has come a long way. Its<br />

humble beginnings rooted in a curious and innovative option<br />

to get around, now e-hailing has evolved into a safe and<br />

convenient transport alternative for many. He says that as<br />

more people look for reliability without the fuss, Bolt is a<br />

popular choice, empowering both passengers and drivers.<br />

100 000 and 150 000 e-hailers on our roads. If South Africa can emulate mature<br />

markets where 1% <strong>of</strong> the employed population are e-hailing drivers, we’re looking<br />

at 500 000 to 600 000 people with gainful employment in the next couple <strong>of</strong> years,<br />

which is a significant number.<br />

FOCUSING ON THE PRODUCT<br />

FOCUSING ON THE PRODUCT<br />

E-hailing started with the bare minimum and was all about getting from one<br />

point to another. At the time, the team at Bolt probably thought the tech was<br />

quite sophisticated, but now we’re lightyears ahead <strong>of</strong> where we were. Safety is a<br />

cornerstone in our business, and there have been plenty <strong>of</strong> innovations in South<br />

Africa in that area. For example, we take full advantage <strong>of</strong> AI with driver-selfie<br />

verification, which combats people renting out their pr<strong>of</strong>iles to be impersonated<br />

by others. Using machine learning, these selfies go into government databases to<br />

be compared with the pictures found in documentation like ID photos. This means<br />

our drivers are vetted and all sign on to be safety ambassadors for our brand.<br />

CREATING EMPLOYMENT, ONE DRIVER AT A TIME<br />

E-hailing provides drivers with great earning potential while also <strong>of</strong>fering rural and<br />

township residents access to job opportunities in cities, a gap the traditional public<br />

transport simply isn’t able to fill.<br />

E-hailing is one <strong>of</strong> the pillars to solve or at least alleviate the transport challenges<br />

we face. If you look at South <strong>African</strong> transportation as an ecosystem, we’re simply<br />

plugging into it. It’s not here to replace other public transport, but rather to provide<br />

value in the form <strong>of</strong> reliability and safety and to ensure that the price point is<br />

relevant for the consumers in our market.<br />

LOOKING TO AFRICA<br />

LOOKING TO AFRICA<br />

One <strong>of</strong> our agendas at Bolt is to go green and initiate sustainability programmes.<br />

Depending on maturity, our markets have electric vehicle<br />

categories and we’re looking to introduce that to Africa. Each<br />

market is different, but we have our sights set on a green future.<br />

One area we are looking at is liquid petroleum gas kits for<br />

drivers to add to their vehicles. In essence, this allows them<br />

to run liquid petroleum alongside traditional petroleum gas,<br />

which converts to a 15-20% saving in both emissions and efficiency. And this is<br />

only the first step.<br />

It’s been an incredible journey so far with many exciting innovations. We<br />

are no longer a lifestyle convenience for a niche group <strong>of</strong> affluent people but<br />

now we are an important transportation option for many. We’ve only caught a<br />

glimpse <strong>of</strong> our potential to shape cities and empower people, and our eyes are<br />

set on the road ahead.<br />

ABOUT BOLT<br />

Bolt is the European super-app, with over 100-million customers in more than<br />

45 countries across the globe. We’re making cities for<br />

people, <strong>of</strong>fering better alternatives for every<br />

purpose a private car serves – including<br />

ride-hailing, shared cars, scooters, and<br />

food and grocery delivery.<br />

We believe that most trips in<br />

the city don’t require the use <strong>of</strong> a<br />

personal car. At Bolt, we’re building a<br />

future in which people are no longer<br />

forced to buy a car to get around.<br />

Where people have the freedom to<br />

use transportation on demand,<br />

choosing whatever vehicle<br />

is best for each occasion.<br />

Passengers enjoy the flexibility <strong>of</strong> ride-hailing services.<br />

point to another. At the time, the team at Bolt probably thought the tech was<br />

quite sophisticated, but now we’re lightyears ahead <strong>of</strong> where we were. Safety is a<br />

cornerstone in our business, and there have been plenty <strong>of</strong> innovations in South<br />

Africa in that area. For example, we take full advantage <strong>of</strong> AI with driver-selfie<br />

verification, which combats people renting out their pr<strong>of</strong>iles to be impersonated<br />

by others. Using machine learning, these selfies go into government databases to<br />

be compared with the pictures found in documentation like ID photos. This means<br />

our drivers are vetted and all sign on to be safety ambassadors for our brand.<br />

CREATING EMPLOYMENT, ONE DRIVER AT A TIME<br />

CREATING EMPLOYMENT, ONE DRIVER AT A TIME<br />

E-hailing provides drivers with great earning potential while also <strong>of</strong>fering rural and<br />

township residents access to job opportunities in cities, a gap the traditional public<br />

E-hailing is one <strong>of</strong> the pillars to solve or at least alleviate the transport challenges<br />

we face. If you look at South <strong>African</strong> transportation as an ecosystem, we’re simply<br />

plugging into it. It’s not here to replace other public transport, but rather to provide<br />

value in the form <strong>of</strong> reliability and safety and to ensure that the price point is<br />

One <strong>of</strong> our agendas at Bolt is to go green and initiate sustainability programmes.<br />

Depending on maturity, our markets have electric vehicle<br />

categories and we’re looking to introduce that to Africa. Each<br />

market is different, but we have our sights set on a green future.<br />

One area we are looking at is liquid petroleum gas kits for<br />

drivers to add to their vehicles. In essence, this allows them<br />

to run liquid petroleum alongside traditional petroleum gas,<br />

ABOUT BOLT<br />

ABOUT BOLT<br />

Bolt is the European super-app, with over 100-million customers in more than<br />

45 countries across the globe. We’re making cities for<br />

people, <strong>of</strong>fering better alternatives for every<br />

purpose a private car serves – including<br />

by others. Using machine learning, these selfies go into government databases to<br />

be compared with the pictures found in documentation like ID photos. This means<br />

our drivers are vetted and all sign on to be safety ambassadors for our brand.<br />

E-hailing provides drivers with great earning potential while also <strong>of</strong>fering rural and<br />

township residents access to job opportunities in cities, a gap the traditional public<br />

E-hailing is one <strong>of</strong> the pillars to solve or at least alleviate the transport challenges<br />

we face. If you look at South <strong>African</strong> transportation as an ecosystem, we’re simply<br />

plugging into it. It’s not here to replace other public transport, but rather to provide<br />

value in the form <strong>of</strong> reliability and safety and to ensure that the price point is<br />

One <strong>of</strong> our agendas at Bolt is to go green and initiate sustainability programmes.<br />

purpose a private car serves – including<br />

ride-hailing, shared cars, scooters, and<br />

food and grocery delivery.<br />

We believe that most trips in<br />

the city don’t require the use <strong>of</strong> a<br />

personal car. At Bolt, we’re building a<br />

future in which people are no longer<br />

forced to buy a car to get around.<br />

Where people have the freedom to<br />

use transportation on demand,<br />

choosing whatever vehicle<br />

is best for each occasion.<br />

Takura Malaba<br />

Dar es Salaam, Tanzania, where Bolt <strong>of</strong>fers its services.<br />

Bolt has more than three-million drivers and couriers worldwide.<br />

15<br />

14<br />

RIDE-HAILING<br />

RIDE-HAILING<br />

TThe Pan <strong>African</strong> Private Sector Trade and Investment Committee (PAFTRAC) has published its Africa CEO Trade<br />

Survey Report 2022 assessing the impact <strong>of</strong> the AfCFTA on <strong>African</strong> trade. The 2022 report is the second<br />

edition <strong>of</strong> the PAFTRAC CEO Trade Survey. What follows is the executive summary <strong>of</strong> that document.<br />

AFRICAN CEOS ARE POSITIVE ABOUT THE AFCFTA<br />

AFRICAN CEOS ARE POSITIVE ABOUT THE AFCFTA<br />

The scale <strong>of</strong> the research was greatly increased for this edition, with more indepth<br />

questions and far more chief executives taking part. When the survey<br />

was conducted, it was approaching 18 months since the start <strong>of</strong> trading under<br />

the <strong>African</strong> Continental Free Trade Area (AfCFTA) was announced, so <strong>African</strong><br />

businesses are gaining more insight about its potential benefits and challenges.<br />

As the world’s largest free-trade-area initiative, the AfCFTA is a much-needed<br />

project given that companies <strong>of</strong> all sizes across the continent are desperate to<br />

identify new markets and boost exports. Implementing the continental free trade<br />

area will be a long process that will be achieved by thousands <strong>of</strong> small steps. Making<br />

the required legislative and regulatory changes depends on the political will <strong>of</strong> all<br />

<strong>of</strong> the governments involved to make it a reality.<br />

However, mistrust could easily restrict implementation, particularly where<br />

businesses on one side <strong>of</strong> the border fear increased competition from perhaps more<br />

economically developed markets.<br />

One <strong>of</strong> the more surprising results <strong>of</strong> the survey was that 70% <strong>of</strong> respondents<br />

said that despite all the obstacles and the fact that intra-<strong>African</strong> trade accounts<br />

for just 16% <strong>of</strong> total <strong>African</strong> trade, they already export goods or services to<br />

other <strong>African</strong> countries. It is even more unexpected given that most <strong>of</strong> the<br />

survey participants lead small and medium-sized enterprises (SMEs) rather<br />

than large corporations. However, the vast majority export services rather than<br />

goods within Africa, underlining the fact that physical and regulatory obstacles<br />

continue to deter trade in goods.<br />

At present, the vast majority <strong>of</strong> <strong>African</strong> CEOs believe that the AfCFTA will have<br />

a positive impact on both levels <strong>of</strong> intra-<strong>African</strong> trade and on their own companies,<br />

with just 4% expecting it to have a negative impact. The AfCFTA is widely expected<br />

to help businesses open up new markets for goods and services, while reducing the<br />

cost and bureaucracy attached to exports.<br />

TRANSPORT NETWORKS MUST IMPROVE<br />

TRANSPORT NETWORKS MUST IMPROVE<br />

Some <strong>of</strong> the findings <strong>of</strong> the report are less surprising. For instance, the transport<br />

infrastructure required to trade goods between <strong>African</strong> states is lacking in most<br />

areas. Rail and road networks were developed on a national basis, with far too<br />

few cross-border links on which to carry freight. There are <strong>of</strong>ten too few customs<br />

posts, while many <strong>of</strong> those that do exist are slow and cumbersome. Regulations<br />

<strong>of</strong>ten demand that the same cargo is checked on each side <strong>of</strong> a border, while some<br />

countries have been slow to adopt digital bills <strong>of</strong> lading, letters <strong>of</strong> credit and other<br />

trade documents.<br />

Regulatory changes come down to a matter <strong>of</strong> political will and administrative<br />

competence but upgrading transport infrastructure requires financing that will be<br />

difficult to secure. The growing penetration <strong>of</strong> digital banking services should make<br />

paying for imports easier but it is vital that the digital transformation is supported<br />

by both regulators and governments. Half <strong>of</strong> the exporters surveyed said that their<br />

companies still required cash in advance on cross-border deals, although letters<br />

<strong>of</strong> credit are also fairly popular. This may be the result <strong>of</strong> a lack <strong>of</strong> trust as well as<br />

difficulty in securing hard currency, while many banking platforms still do not<br />

allow the use <strong>of</strong> <strong>African</strong> currencies.<br />

However, a solution is already on the horizon in the form <strong>of</strong> Afreximbank’s<br />

Pan-<strong>African</strong> Payment and Settlement System (PAPSS), so it will be interesting to<br />

see how quickly that is embraced by traders.<br />

CLEAR INFORMATION NEEDED<br />

CLEAR INFORMATION NEEDED<br />

The report clearly demonstrates that <strong>African</strong> businesses find it difficult to locate<br />

detailed information on the AfCFTA. Progress will be much slower if the rules on<br />

trade are not widely understood and kept up to date. Moreover, the results <strong>of</strong> the<br />

survey reveal that the lack <strong>of</strong> information on markets, opportunities and trading<br />

partners is the biggest constraint on exports. Indeed, 70% <strong>of</strong> respondents called for<br />

a fully functioning online one-stop information shop but sufficient resources need<br />

to be put in place to make such an undertaking operate effectively.<br />

Solutions to the information deficit could come in the form <strong>of</strong> digital platforms<br />

provided by the AfCFTA Secretariat or private sector information providers. Other<br />

constraints to increased levels <strong>of</strong> trade cited by the participants include unfair<br />

competition, subsidies, political stability in target markets and a lack <strong>of</strong> security.<br />

The ease <strong>of</strong> trade varies considerably across the continent, with East and<br />

Southern Africa considered to be the best places to do business. North Africa was<br />

rated almost as a difficult a region in which to trade as Central Africa. Despite the<br />

fact that Morocco, Tunisia and to some extent Egypt are thriving manufacturing<br />

centres, their economies are geared around exporting goods to Europe and<br />

elsewhere, rather than to the rest <strong>of</strong> Africa. Greatly improving trade flows in Central<br />

Africa could have a huge impact on the continent as a whole because it lies at the<br />

heart <strong>of</strong> the continent. In particular, new railways across the region would benefit<br />

not only local companies but would boost trade between West and East Africa.<br />

ABOUT PAFTRAC<br />

ABOUT PAFTRAC<br />

The Pan-<strong>African</strong> Private Sector Trade and Investment Committee<br />

(PAFTRAC) unites <strong>African</strong> leaders from the private sector and<br />

provides a unique advocacy platform, bringing together the <strong>African</strong><br />

private sector and <strong>African</strong> policymakers to support extra- and<br />

intra-<strong>African</strong> trade, investment and pan-<strong>African</strong> enterprise. The<br />

platform drives pan-<strong>African</strong> results by providing a framework for<br />

private sector engagement in trade and investment issues in Africa,<br />

including policy formulation and trade negotiations to support<br />

<strong>African</strong> economies in line with the ambitions <strong>of</strong> Agenda 2063:<br />

“The Africa We Want”. PAFTRAC enhances advocacy and supports<br />

policy actions and recommendations <strong>of</strong> the private sector on trade<br />

and investment issues at the national, trade corridor, regional and<br />

multilateral levels.<br />

Volumes are expected to increase with fewer<br />

tariffs being imposed on intra-<strong>African</strong> trade.<br />

Credit: Frank McKenna on Unsplash<br />

The implementation <strong>of</strong> the AfCFTA should bring an<br />

end to long queues <strong>of</strong> trucks at border posts<br />

Credit: SANRAL<br />

25<br />

24<br />

TRADE RESEARCH<br />

TRADE RESEARCH<br />

A<br />

THE RADISSON HOTEL<br />

THE RADISSON HOTEL<br />

GROUP IS TARGETING<br />

GROUP IS TARGETING<br />

AFRICAN GROWTH<br />

AFRICAN GROWTH<br />

As Radisson celebrates winning the Leading Hotel Group in<br />

Africa award, the group outlines its strategy in building<br />

its <strong>African</strong> footprint beyond the current capacity <strong>of</strong><br />

nearly 8 000 rooms.<br />

At the 2022 World Travel Awards held in Dubai, Radisson Blu took home the<br />

prestigious Leading Hotel Group in Africa award. The award is a validation <strong>of</strong> the<br />

work done by the group and its accelerated expansion across the continent over the<br />

past few years. But it’s also an important milestone in a journey that started more<br />

than 60 years ago and which has seen Radisson Blu become an iconic hospitality<br />

brand around the globe, including on the <strong>African</strong> continent.<br />

Along with the luxury Radisson Collection, Radisson, Radisson Red, Radisson<br />

Individual and several other brands, Radisson Blu forms part <strong>of</strong> the Radisson Hotel<br />

Group. The group’s journey began in 1960 with the opening <strong>of</strong> the world’s first<br />

designer hotel in Copenhagen, Denmark. That hotel, now the Radisson Collection<br />

Royal Hotel, Copenhagen, is still operating successfully.<br />

“From those early beginnings, we’ve always tried to ensure that the hotels within<br />

the group set themselves apart,” says Tim Cordon, COO Middle East and Africa –<br />

Radisson Hotel Group. “We always have, and will continue to, focus our work on<br />

delivering Memorable Moments, acting as a true host, and being the best partner.”<br />

The Radisson Blu brand, meanwhile, emerged after SAS International Hotels<br />

signed a franchise agreement with Carlson Hotels to manage the Radisson brand in<br />

Europe, the Middle East and Africa (EMEA) in 1994. Initially known as Radisson<br />

SAS, the Radisson Blu brand was birthed in 2009. A year later, it became the largest<br />

upscale hotel brand in Europe.<br />

Today, there are more than 380 Radisson Blu locations worldwide, all aiming to<br />

provide memorable moments by providing unparalleled service, comfort and style<br />

while creating meaningful and memorable experiences.<br />

AFRICAN PRESENCE IS GROWING<br />

AFRICAN PRESENCE IS GROWING<br />

The brand has an established presence in Africa, too, with what is now<br />

Radisson Blu Waterfront Hotel in Cape Town South Africa opening at the<br />

dawn <strong>of</strong> the new millennium. In the following years, it would continue to<br />

grow its presence across the continent, steadily building and expanding a<br />

substantial portfolio <strong>of</strong> properties.<br />

“Our goal is always to create ‘more meaningful and memorable experiences in a<br />

stylish environment’. In doing so, we recognise that our guests are travelling with a<br />

purpose and that it’s therefore important that we’re there to support them in even<br />

the smallest <strong>of</strong> ways. That commitment is as strong in Africa as it is in the rest <strong>of</strong><br />

the world”. says Cordon.<br />

“We also look to ensure that our guests are inspired and connected with likeminded<br />

individuals,” Tim adds. “We do so by creating and facilitating networking<br />

opportunities and keeping them mentally and physically nourished on a busy day.<br />

Our commitment to guests is also reflected in the design <strong>of</strong> our properties, creating<br />

a stylish environment that enables our great experiences. We’re always there to keep<br />

our guests inspired through our on-trend public space design features.”<br />

In more recent years, Radisson Blu has significantly grown its <strong>African</strong> presence.<br />

Currently, the Radisson Blu brand has nearly 40 hotels on the continent, either in<br />

operation or under development. From Casablanca in the north to Cape Town in<br />

the south, with almost 8 000 rooms.<br />

“Africa is critical to the next phase <strong>of</strong> growth for both Radisson Blu and the<br />

Radisson Hotel Group as a whole,” Tim says. “We are continuously inspired by the<br />

innovation and enterprise we see throughout the continent, and we look forward<br />

to opening more hotels in the near future.<br />

“Our category win in the World Travel Awards validates everything we have done<br />

in Africa to date,” Cordon concludes. “It has also strengthened our determination<br />

to keep delivering the magical moments that Radisson Blu is renowned for to new<br />

and existing customers alike.”<br />

ABOUT RADISSON BLU<br />

ABOUT RADISSON BLU<br />

Radisson Blu is an upper-upscale hotel brand that delivers positive and<br />

personalised service in stylish spaces. Radisson Blu hotels are designed to make a<br />

big difference and inspire unforgettable experiences with every stay. Radisson Blu<br />

hotels can be found in major cities, key airport gateways and leisure destinations.<br />

Radisson Blu is part <strong>of</strong> the Radisson family <strong>of</strong> brands, which operates under<br />

one commercial umbrella brand, Radisson Hotels, and can be found around the<br />

world in more than 120 countries, with currently over 1 700 hotels in operation<br />

and under development.<br />

Africa is critical to<br />

the next phase <strong>of</strong><br />

growth for both<br />

Radisson Blu and<br />

the Radisson Hotel<br />

Group as a whole<br />

Radisson Blu Mosi-Oa-Tunya, Livingstone Resort, is located<br />

within the Mosi-Oa-Tunya National Park in Zambia.<br />

Tim Cordon, Radisson Hotel Group<br />

COO, Middle East and Africa<br />

An artist’s impression <strong>of</strong> the Radisson Hotel Casablanca<br />

Gauthier La Citadelle, which is set to open in 2023<br />

27<br />

26<br />

HOTEL AWARDS<br />

HOTEL AWARDS<br />

D<br />

Burundi, Djibouti and Ethiopia have shown the most progress in easing travel restrictions according to the seventh<br />

2022 Africa Visa Openness Index, published by the <strong>African</strong> Development Bank Group and the <strong>African</strong> Union Commission.<br />

AFRICA IS MAKING PROGRESS ON VISA-FREE TRAVEL<br />

AFRICA IS MAKING PROGRESS ON VISA-FREE TRAVEL<br />

Despite Covid-19 lockdowns and travel disruptions, 93% <strong>of</strong> <strong>African</strong> countries have<br />

maintained or improved their score on the Africa Visa Openness Index (AVOI)<br />

relative to 2021. Two-thirds <strong>of</strong> <strong>African</strong> countries have adopted more liberal visa<br />

policies compared to six years ago.<br />

The 2022 Africa Visa Openness Index report shows <strong>African</strong> countries making<br />

progress in their freedom <strong>of</strong> travel policies, most <strong>of</strong> which had been severely<br />

curtailed by the Covid-19 crisis.<br />

The annual publication, prepared by the <strong>African</strong> Development Bank Group<br />

in collaboration with the <strong>African</strong> Union Commission, is now in its seventh<br />

edition and was launched on the sidelines <strong>of</strong> the 2022 <strong>African</strong> Economic<br />

Conference in Mauritius.<br />

The report tracks visa policies adopted by <strong>African</strong> governments on three main<br />

criteria: whether entry to citizens from other <strong>African</strong> countries is visa-free, if a visa<br />

on arrival can be obtained, and whether travellers are required to obtain visas ahead<br />

<strong>of</strong> travelling to other <strong>African</strong> countries.<br />

The 2022 report underlines the impact <strong>of</strong> the Covid-19 pandemic in 2020 and<br />

2021, during which most countries restricted movement, both domestically and for<br />

international travel. Restrictions on international travel ranged from closing entire<br />

borders to quarantines, screening measures, and bans on visitors from countries<br />

deemed “high risk”.<br />

Domestic restrictions included a gamut <strong>of</strong> measures such as prohibitions on<br />

travelling between provinces, bans on non-essential movement, curfews and rules<br />

that limited gatherings.<br />

The 2022 report reflects on renewed signs <strong>of</strong> progress: 10 countries improved<br />

their visa openness score over the past year and visa openness on the continent<br />

now exceeds that recorded during the year prior to the Covid-19 pandemic and is<br />

in line with the peak score achieved in 2020.<br />

Progressive visa policies that increase visa-free entry or to visa on arrival policies<br />

will ensure that this positive trend continues. The use <strong>of</strong> technology and a greater<br />

adoption <strong>of</strong> eVisa systems will help fast-track the ease at which travellers can cross<br />

borders.<br />

HIGHLIGHTS OF THE 2022 AFRICA VISA OPENNESS INDEX<br />

HIGHLIGHTS OF THE 2022 AFRICA VISA OPENNESS INDEX<br />

• <strong>African</strong> travel has become more open to <strong>African</strong> citizens in 2022, with fewer<br />

restrictions overall. There is now an even split between travel that is visa-free,<br />

and travel where a visa may be obtained on arrival at the destination country.<br />

• Three countries, Benin, The Gambia and the Seychelles, <strong>of</strong>fer visa-free entry<br />

to <strong>African</strong>s <strong>of</strong> all other countries. In 2016 and 2017, only one country did so.<br />

• 24 <strong>African</strong> countries <strong>of</strong>fer an eVisa, five more than five years ago.<br />

• 36 countries have improved or maintained their Visa Openness Index score<br />

since 2016.<br />

• 50 countries have maintained or improved their Visa Openness Index score<br />

relative to 2021, usually after removing some <strong>of</strong> the visa policy restrictions<br />

implemented during the pandemic.<br />

• 48 countries out <strong>of</strong> 54, the vast majority <strong>of</strong> <strong>African</strong> countries, now <strong>of</strong>fer visa-free<br />

travel to the nationals <strong>of</strong> at least one other <strong>African</strong> country.<br />

• 42 countries <strong>of</strong>fer visa-free travel to the nationals <strong>of</strong> at least five other<br />

<strong>African</strong> countries.<br />

Interestingly, lower-income countries account for a large share <strong>of</strong> the countries<br />

that make up the top-20 ranked countries in 2022 with liberal visa policies: 45% <strong>of</strong><br />

countries in the top-20 on the index are classified as low-income countries, while<br />

a further 45% <strong>of</strong> countries are classified as lower middle-income.<br />

EVisas allow prospective travellers to apply for a<br />

visa from the comfort <strong>of</strong> their home or workplace<br />

ahead <strong>of</strong> travel, streamline the application process,<br />

reduce time at borders, provide a greater measure <strong>of</strong><br />

certainty ahead <strong>of</strong> travel, reduce the need to submit a<br />

passport for processing to consular <strong>of</strong>fices and make<br />

travel safer and more secure.<br />

<strong>African</strong> Union Commission Deputy Chairperson<br />

Dr Monique Nsazabaganwa, says <strong>of</strong> the report, “This<br />

edition links free movement to the development <strong>of</strong><br />

regional value chains, investments, trade in services<br />

and the AfCFTA. There is greater recognition that human mobility is key to Africa’s<br />

integration efforts.”<br />

<strong>African</strong> Development Bank Group Acting Vice President in charge <strong>of</strong> Regional<br />

Development, Integration and <strong>Business</strong> Delivery, Marie-Laure Akin-Olugbade,<br />

remarked, “The Africa Visa Openness Index has been tracking visa openness as a<br />

measure <strong>of</strong> the freedom <strong>of</strong> movement since 2016. This year’s edition shows many<br />

<strong>African</strong> countries having greatly simplified their visa regime over the past year.”<br />

The 2022 edition <strong>of</strong> the report showcases three countries that have made the<br />

most progress in their visa openness, namely Burundi, Djibouti and Ethiopia.<br />

Ethiopia in particular has risen several places on the index to retain its position<br />

in the continent’s top-20 performers after removing the temporary measures<br />

instituted in 2021.<br />

In an innovation, the report provides an analysis <strong>of</strong> free movement <strong>of</strong> persons at<br />

regional economic community level in Africa. The Economic Community <strong>of</strong> West<br />

<strong>African</strong> States (ECOWAS) and the East <strong>African</strong> Community are the most open<br />

communities, with ECOWAS hosting eight <strong>of</strong> the top 10 countries.<br />

Commenting on the report, <strong>African</strong> Development Bank Group Acting Director<br />

in charge <strong>of</strong> the Regional Integration Coordination Office Jean-Guy Afrika, said,<br />

“The Africa Visa Openness Index has tracked the evolution <strong>of</strong> visa regimes on<br />

the <strong>African</strong> continent from before the pandemic to today. As the 2022 report<br />

shows, <strong>African</strong> countries are dismantling many <strong>of</strong> the measures imposed during<br />

the pandemic. Indeed, on the whole, the continent has returned to a level <strong>of</strong> visa<br />

openness last seen just before the pandemic began.”<br />

SOME KEY STATISTICS<br />

SOME KEY STATISTICS<br />

+ For 27% <strong>of</strong> intra-Africa travel – travel by <strong>African</strong> citizens between <strong>African</strong><br />

countries – <strong>African</strong> citizens do not need a visa, up from 25% in 202.<br />

+ For 27% <strong>of</strong> intra-Africa travel, <strong>African</strong> citizens can obtain a visa on arrival, up<br />

from 24% in 2021.<br />

+ For 47% <strong>of</strong> intra-Africa travel, <strong>African</strong> citizens are still required to obtain a visa<br />

before travelling, an improvement on the 51% in 2021.<br />

ABOUT THE AFRICA VISA OPENNESS INDEX<br />

ABOUT THE AFRICA VISA OPENNESS INDEX<br />

The Africa Visa Openness Index measures the extent to which <strong>African</strong> countries<br />

are open to travellers from other <strong>African</strong> countries. Published yearly since 2016, the<br />

AVOI tracks changes in countries’ scores over time to show how national policies<br />

evolve on the freedom <strong>of</strong> movement across Africa.<br />

View the Africa Visa Openness Report at: www.VisaOpenness.org<br />

The seventh Africa Visa Openness Index was launched at the <strong>African</strong> Economic Conference in December 2022<br />

Credit: <strong>African</strong> Development Bank Group<br />

Credit: Nairobi National Park<br />

Check-in desks at Jomo Kenyatta International Airport<br />

Credit: Kenya Airports Authority<br />

13<br />

12<br />

TRAVEL RULES<br />

TRAVEL RULES<br />

Contents<br />

Contents<br />

The <strong>Journal</strong> <strong>of</strong><br />

The <strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

<strong>African</strong> <strong>Business</strong><br />

2<br />

4<br />

8<br />

12<br />

12<br />

14<br />

14<br />

16<br />

16<br />

18<br />

18<br />

20<br />

20<br />

22<br />

22<br />

24<br />

24<br />

26<br />

26<br />

28<br />

28<br />

29<br />

29<br />

ZAMBIA<br />

ZAMBIA<br />

Copper’s importance to the global economy is good for investment.<br />

Capital: Lusaka.<br />

Other towns/cities: Kitwe, Ndola, Kabwe.<br />

Population: 20.2-million (2023).<br />

GDP: $25.7-billion (2017).<br />

GDP per capita: $3 200 (2021).<br />

Currency: Kwacha.<br />

Regional Economic Community: Common Market for Eastern and South Africa<br />

(COMESA), Southern <strong>African</strong> Development Community (SADC).<br />

Land mass: 752 617km².<br />

Coastline: Landlocked.<br />

Resources: Beef, cassava, maize, milk, vegetables, soybeans, beef, tobacco,<br />

groundnuts, sugar cane, wheat. Copper, coal, cobalt, emeralds, gemstones, lead,<br />

silver, uranium, zinc.<br />

Main economic sectors: Copper mining and processing, emerald mining,<br />

chemicals, textiles, fertilizer.<br />

Other sectors: Construction, foodstuffs, beverages, horticulture.<br />

New sectors for investment: Agribusiness, energy, retail and tourism property,<br />

telecoms.<br />

Key projects: The International Finance Corporation has initiated the Multilateral<br />

Investment Guarantee Agency for projects in agribusiness, manufacturing,<br />

financial and energy sectors.<br />

Chief exports: Copper, cement, gemstones, gold, tobacco.<br />

Top export destinations: Switzerland, China, Namibia, Democratic Republic <strong>of</strong><br />

the Congo, Singapore.<br />

Top import sources: South Africa, China, United Arab Emirates, Democratic<br />

Republic <strong>of</strong> the Congo, India.<br />

Main imports: Copper, fertilizers, medicines, petroleum, trucks.<br />

Infrastructure: Roads: 67 671km, <strong>of</strong> which 14 888km paved.<br />

Port: Mpulungu river port.<br />

Airports: 88, eight <strong>of</strong> which are paved.<br />

Railways: 3 126km, includes Tanzania-Zambia Railway Authority (TAZARA).<br />

ICT: Mobile subscriptions per 100 inhabitants: 104.<br />

Internet percentage <strong>of</strong> population: 21 (2021).<br />

ICT Development Index 2017 (ITU) world ranking: 146 (17th in Africa).<br />

Climate: Tropical climate modified by altitude and proximity to lakes. Lake Kariba<br />

is the world’s largest reservoir by volume and Lake Tanganyika is among other<br />

large lakes. The Congo and Zambezi are the major rivers. Rainy season is October<br />

to April.<br />

Religion: Mostly Christian, <strong>of</strong> which 20% Catholic.<br />

Modern history: Many <strong>of</strong> the population are poor and subsistence agriculture is<br />

widespread. Copper has underpinned Zambia’s export economy for many years.<br />

There has been a recent surge in interest because <strong>of</strong> copper’s importance to the<br />

cleaner industrial process that the world needs. Rapid growth has been experienced<br />

because <strong>of</strong> good copper prices on the global market but with the country’s<br />

population expected to triple by 2050, huge social challenges remain. In addition,<br />

being so dependent on copper can mean that the country’s economy, and its people,<br />

struggle when prices are depressed. The battle for independence culminated in<br />

Zambia being founded in 1964. The opening <strong>of</strong> the Tan-Zam railway line in 1975<br />

allowed Zambian copper to be exported without relying on then Rhodesia or what<br />

was then apartheid South Africa. Kenneth Kaunda ruled a one-party state from<br />

1972 to 1991, having been in power from independence. President Chiluba ruled<br />

from 1991 to 2001, after which a period <strong>of</strong> closely contested elections followed. In<br />

2021, Hakainde Hichilema won 59% <strong>of</strong> the vote with 70% <strong>of</strong> the eligible voting<br />

public registering their choices.<br />

Sentinel Copper Mine is Zambia’s biggest mine.<br />

Credit: First Quantum Minerals<br />

Copper’s importance to the global economy is good for investment.<br />

Copper’s importance to the global economy is good for investment.<br />

29<br />

COUNTRY<br />

COUNTRY PROFILE<br />

PROFILE<br />

5

THE GENDER PAY GAP IS<br />

STILL AN UNCOMFORTABLE REALITY<br />

There’s much to be positive about, says Nthakoana Maema, CEO <strong>of</strong> impact<br />

incubator, Oribi, but still a lot more to be done.<br />

#EmbraceEquity was the most popular hashtag on Twitter and Instagram around<br />

the world on 8 March 2023. The slogan was the tagline for International Women’s<br />

Day (IWD) and in the age <strong>of</strong> instantly shareable messages, it travelled far and wide.<br />

“What we’re seeing is a coordinated effort globally to make the lives <strong>of</strong> girls and<br />

women better,” says Nthakoana Maema, CEO <strong>of</strong> impact incubator, Oribi.<br />

The Oribi incubation model helps women discover economic freedom<br />

through collective networks and entrepreneurship development.<br />

Oribi also tackles long-lasting legacy issues and aims to foster a society<br />

where gender norms are challenged. “The income and pay gap still exists<br />

in South Africa and the world,” Maema says, “and we need to empower all<br />

stakeholders to take women’s issues seriously.” The gender pay gap remains<br />

a global issue that’s <strong>of</strong> particular concern in Africa and South Africa, where<br />

estimates put the median wage difference between men and women at a high <strong>of</strong><br />

35%. More female business owners mean a bigger economy with a greater number<br />

<strong>of</strong> opportunities for everyone.<br />

These businesses <strong>of</strong>ten benefit wider society as a whole. What challenges still<br />

need to be tackled for female employees and business owners?<br />

FUNDING IS A CHALLENGE<br />

More and more women are entering male-dominated spheres but their ability<br />

to attract funding for their business is <strong>of</strong>ten stymied. “Property ownership<br />

is typically used as collateral for a business loan, yet female entrepreneurs<br />

<strong>of</strong>ten don’t qualify,” Maema notes. “Banks can be rigid in their approach, and<br />

when credit is <strong>of</strong>fered, it’s <strong>of</strong>ten a reduced sum. This, despite the fact that female<br />

entrepreneurship creates jobs, lessens poverty and improves living standards.”<br />

Typically, female entrepreneurs might turn to the government for assistance, but<br />

the process tends to be less than positive with red tape the norm.<br />

Often, government agencies don’t understand what the money is needed for,<br />

responses lack a gendered lens and so female entrepreneurs are forced to use<br />

their own savings or look for the help <strong>of</strong> an angel investor. “Regulatory red tape<br />

is a reality for everyone,” Maema says, “but there’s an unspoken yet pervading<br />

assumption that female entrepreneurs might be less capable <strong>of</strong> handling the<br />

loan, and so even more stumbling blocks are put up in their way.”<br />

OUTDATED MODELS OF THINKING<br />

The goal is to stop signalling to children that they’re better at different things<br />

because <strong>of</strong> their gender, Maema notes, because all that does is limit people. In<br />

reality, while women entrepreneurs do sometimes choose jobs in the care economy,<br />

there are countless examples <strong>of</strong> female inventors, engineers and scientists who<br />

deserve a spotlight: incredible women like Dr Keabetswe Ncube, a Genomics<br />

Specialist at Inqaba Biotechnical, or Dr Sylvia Fanucchi, a Protein Biochemist and<br />

Senior Lecturer at Wits University.<br />

“It’s absolutely okay for a woman to want to work in the care economy – this<br />

work should be valued – but they should also feel free to enter a ‘male-dominated’<br />

field,” Maema says. “Yet we rarely publicise the women who do valuable work in<br />

the sciences and so this creates the misconception that there’s a neat little box<br />

for each gender.”<br />

6

GENDER PAY GAP<br />

STEM FIELDS NEED MORE WOMEN<br />

The STEM fields, science, technology, engineering and<br />

mathematics, are a hot topic. In South Africa, 13% <strong>of</strong><br />

STEM graduates from higher education are women,<br />

while globally, that figure is 35%. “There’s huge room to<br />

improve,” Maema says, “but the exciting thing is that it’s<br />

eminently fixable.<br />

“Look no further than the Inspiring <strong>African</strong> Women<br />

community, which was started to continue celebrating<br />

exceptional women in STEM fields, building on the<br />

successes <strong>of</strong> the Inspiring Fifty SA, which began life<br />

as a simple WhatsApp group. Now, after four years,<br />

there’s enough influence, intelligence and shared<br />

common purpose to require a formal platform for these<br />

changemakers to come together and thrive on.”<br />

These women do not lack knowledge, Maema says, but<br />

they do lack a platform. What if there were an advocacy<br />

drive that gave female STEM leaders their individual<br />

and collective voice in global reform? “That would be<br />

incredibly powerful, and it would be enormously helpful<br />

to the economy too.”<br />

GENDER-INCLUSIVE SPACES ARE A MUST<br />

“For too long, <strong>of</strong>fices have pandered to men and left<br />

women feeling they’re an afterthought,” Maema says.<br />

“People do their best work in an environment they feel<br />

comfortable in. By creating gender-inclusive spaces,<br />

women can build their own networks and design their<br />

own road to economic empowerment.” Change is afoot,<br />

however. In February, Spain was the first European<br />

country to pass a bill allowing unlimited menstrual<br />

leave for women from work. Spain follows on the heels<br />

<strong>of</strong> countries like Indonesia and Japan, who are taking<br />

women’s needs seriously. “It’s a sign that things are<br />

changing,” Maema adds. “To have blanket policies in<br />

the workplace that only enable men to thrive, and don’t<br />

reflect the huge numbers <strong>of</strong> women working full-time,<br />

would be a mistake.<br />

“These sorts <strong>of</strong> moves will empower women not only to<br />

become the best versions <strong>of</strong> themselves as an employee, but<br />

to have the confidence to strike out on their own and one<br />

day become an employer.”<br />

Women are in the room and increasingly making decisions, but are they being equitably paid? Credit: Christina Morillo on Pexels<br />

SMALL BUSINESSES CONTINUE TO STRUGGLE<br />

Globally, SMEs have faced uncertainty since Covid-19<br />

while large corporate entities have been able to weather<br />

the storm and come out the other side better positioned<br />

than ever. On the ground in the community itself, local<br />

spending <strong>of</strong>ten ends up in the hands <strong>of</strong> corporate players<br />

that control the supply chain. And female-operated SMEs<br />

who do work in the area <strong>of</strong>ten spend all their time trying<br />

to keep their business afloat; they simply don’t have the<br />

time to coordinate with others to increase the economies <strong>of</strong><br />

scale. The result is a shrinking pool <strong>of</strong> players, with a small<br />

few controlling most <strong>of</strong> the stakes.<br />

7

BIOGRAPHY<br />

Nthakoana Maema has a strong commitment to creating financially thriving<br />

and inclusive economies in South Africa. She leverages her extensive<br />

experience as a development strategist spanning over 17 years. Passionate<br />

about sustainable cities, social entrepreneurship and promoting youth and<br />

gender inclusion, Nthakoana approaches complex challenges through the lens<br />

<strong>of</strong> equity and systems thinking. Her diverse educational background includes<br />

studies in <strong>Business</strong> Science with a focus on Finance, Design Thinking and<br />

NPO/SE Management. Recently, she furthered her expertise by completing a<br />

Postgraduate Diploma in Sustainable Development at Stellenbosch University.<br />

Nthakoana is the founder <strong>of</strong> FuturePro<strong>of</strong> Consultancy, where she empowers<br />

leaders and teams to build resilience and cultivate a culture <strong>of</strong> innovation.<br />

The girls on this page, and in the main image on the first page <strong>of</strong> this article, were<br />

attending a #Girlsin<strong>Business</strong> Innovation Bootcamp run by Oribi in Cape Town.<br />

THE GENDER PAY GAP IS STILL AN UNCOMFORTABLE REALITY<br />

There’s much to be positive about, Maema says, but still a lot more to be done. The<br />

gender pay gap remains a global issue that’s <strong>of</strong> particular concern in South Africa.<br />

What’s more, unemployment figures are high among women. As President Cyril<br />

Ramaphosa noted at the Second Women Economic Assembly in 2022, 47% <strong>of</strong><br />

South <strong>African</strong> women aged between 15 and 64 are deemed “economically inactive”.<br />

“Again, it’s a question <strong>of</strong> opportunity and ensuring all genders have equal access and<br />

shorter pathways to the heart <strong>of</strong> the value chain,” Maema says. Ultimately, despite<br />

these challenges, this is one <strong>of</strong> the few countries in the world where the number <strong>of</strong><br />

women starting their own business is actually growing, something that Maema says<br />

can only be a net positive. “More female business owners means a bigger economy<br />

with a greater number <strong>of</strong> opportunities for everyone.” And these businesses<br />

<strong>of</strong>ten benefit wider society as a whole. Look no further than Sibongile Mongadi’s<br />

Uku’hamba project, which is building prosthetic limbs from affordable materials or<br />

the SME-funding firm Akiba, co-founded by Tebogo Mokwena. “Going forward,”<br />

Maema says, “the key is to incubate and support budding entrepreneurs while<br />

ensuring marginalised groups are equipped to navigate South Africa’s corporate<br />

machinery.” Fostering talent this way is the Oribi vision through and through.<br />

Discover more about Oribi and its incubator model at https://www.oribi.org.za/<br />

ABOUT ORIBI<br />

Oribi is a non-pr<strong>of</strong>it incubator dedicated to catalysing high-impact<br />

entrepreneurship with, from and for marginalised people and places<br />

and fostering sustainable development in South Africa. We collaborate<br />

with many stakeholders to unlock individual and collective action and<br />

address social, economic and environmental challenges. Through a<br />

systems approach, we enable people to identify needs, prioritise solutions<br />

and implement impactful social enterprises. Our focus areas include<br />

community enablement, food systems, entrepreneurial support, inclusivefinancing<br />

support, access to networks and policy engagement. Thanks<br />

to technical support from Value for Women, we apply a gender lens in<br />

our actions. Join us in creating positive change for a brighter future.<br />

Visit www.oribi.org.za to learn more.<br />

8

GENDER PAY GAP<br />

AFRICAN WOMEN IN STEM<br />

Young <strong>African</strong> women who want to pursue careers in science,<br />

technology, engineering or mathematics (STEM) have increasing<br />

numbers <strong>of</strong> inspiring examples to help frame and fan their<br />

ambitions. There are also more organisations, social media groups<br />

and media outlets focussing on the subject <strong>of</strong> women in STEM.<br />

We focus here on three. WORDS THAT COUNT is a website<br />

which tells stories about women who are successful in STEM<br />

careers. The founder and content director is Winnie Nakiyingi, a<br />

Ugandan statistician who has worked in several <strong>African</strong> countries<br />

and Canada, but who describes most <strong>of</strong> her work as being in<br />

“academia and STEM advocacy”.<br />

Some examples <strong>of</strong> career stories that are featured on the website:<br />

+ Jordana Esther Muwanguzi, Uganda, computational biologist<br />

+ Papama Lose, South Africa, diagnostic radiographer<br />

+ Dr Jennifer Batamuliza, Rwanda, data scientist<br />

+ Dr Keabetswe Ncube, pictured with a small goat, is a<br />

genomics specialist works at Inqaba Biotechnical on genetic<br />

testing that can improve stock animals. She also has her own<br />

agricultural consulting company.<br />

INSPIRING WOMEN OF AFRICA<br />

Inspiring <strong>African</strong> Women bring together women in STEAM<br />

fields to celebrate our unique experiences and diverse<br />

perspectives. We aim to create an inclusive and empowering<br />

community by celebrating the unique experiences <strong>of</strong> women<br />

in these fields and providing them with opportunities to<br />

thrive and excel.<br />

INSPIRINGFIFTY<br />

InspiringFifty SA describes<br />

itself as a non-pr<strong>of</strong>it initiative<br />

that benchmarks and awards<br />

the 50 most inspiring women<br />

in #STEM in partnership with<br />

@cocreatesa<br />

9

LOGISTICS TRENDS<br />

THE LOGISTICS INDUSTRY NEEDS TO ADAPT<br />

TO NEW TRENDS IN SUPPLY CHAINS<br />

Flexibility and agility are the key<br />

to servicing clients, according<br />

to Bidvest International<br />

Logistics experts Rhett Oertel<br />

and Marcus Ellappan.<br />

TThe logistics industry battled a number <strong>of</strong> challenges in 2022, among which were<br />

the war in Ukraine and turmoil over China’s strict Covid-19 policies.<br />

Despite this turmoil, the world emerged from the worst <strong>of</strong> the pandemic,<br />

meaning that supply chains returned to some degree <strong>of</strong> normality despite the<br />

conflict in Eastern Europe.<br />

Within this context, a number <strong>of</strong> significant developments occurred within the<br />

industry itself, and the impact <strong>of</strong> these is anticipated to be felt this year and beyond.<br />

From a shipping perspective, acquisitions by shipping lines last year changed the<br />

landscape to some extent. These companies were highly pr<strong>of</strong>itable between 2019<br />

and 2022 and many used some <strong>of</strong> these pr<strong>of</strong>its to enter various landside logistics<br />

businesses – from warehousing to transport and IT-related services.<br />

Going forward, this shake-up is expected to create new alliances within the<br />

industry, with old alliances becoming new competitors.<br />

Another major development last year was the increased adoption <strong>of</strong> technology<br />

and automation to drive efficiencies and reduce costs.<br />

According to Bidvest International Logistics (BIL) Head <strong>of</strong> Sales Rhett Oertel,<br />

in 2023 technology adoption will keep driving supply-chain companies in the<br />

direction <strong>of</strong> automation while increasing visibility, improving predictive analytics<br />

and optimising supply chains.<br />

“The impact <strong>of</strong> blockchain, artificial intelligence (AI) and electric vehicles in<br />

the supply-chain industry will be ongoing. Blockchain is in use in trade financing<br />

and contract execution and is even tracking AI use in the supply chain to help with<br />

forecasting,” says Oertel.<br />

It is a view shared by Oertel’s colleague and BIL Director Marcus Ellappan,<br />

who says that with the logistics industry under constant pressure to reduce costs,<br />

businesses increasingly will be looking at automating processes.<br />

Another trend that emerged in 2022 and should become even more prevalent is<br />

Environmental, Social and Governance (ESG) compliance.<br />

“ESG will remain for years to come as companies focus on reducing their<br />

carbon footprint and reducing their overall impact on the environment. The<br />

emphasis on ESG is at the forefront <strong>of</strong> a lot <strong>of</strong> discussions nowadays as companies<br />

look to partner with people who, like them, invest in green technologies and<br />

initiatives,” Oertel says.<br />

This will entail companies needing to be more involved in the entire lifecycle <strong>of</strong><br />

products and packaging.<br />

For South <strong>African</strong> businesses, loadshedding and high fuel prices remain a huge<br />

problem. As a result, Ellappan expects to see them focusing a lot more on efficient<br />

management <strong>of</strong> fuel usage and renewable energies. As he puts it, “Burning fuel<br />

in generators is not the way to go.”<br />

The industry is <strong>of</strong> course keeping a<br />

watchful eye on tensions between<br />

certain countries. In the event <strong>of</strong><br />

these escalating, new policies that<br />

will have an impact on trade could<br />

be introduced. Trade agreements<br />

or changes in tariffs, for example,<br />

will affect the flow <strong>of</strong> goods and the<br />

cost <strong>of</strong> doing business.<br />

Oertel concludes, “I do believe<br />

as a company one needs to be<br />

aware <strong>of</strong> these developments and<br />

strategically apply the required<br />

focus on the aspects that will<br />

impact your market in the most<br />

effective way.<br />

“All in all, supply-chain business<br />

models seem to be changing and<br />

the need for flexibility and agility is<br />

becoming key to servicing clients.<br />

Marcus Ellappan<br />

E-commerce is continually growing. This in the end leads to the demand for faster<br />

and more flexible and reliable supply chains.”<br />

Ellappan confirms this assessment: “Coming out <strong>of</strong> Covid, together with various<br />

global supply-chain issues, businesses are forced to become more efficient. The<br />

benefits <strong>of</strong> digital transformation, risk management and ESG will most certainly<br />

talk back to a business’s bottom-line results and sustainability.”<br />

ABOUT BIDVEST INTERNATIONAL LOGISTICS (BIL)<br />

BIL is one <strong>of</strong> South Africa’s largest logistics businesses, owned by services,<br />

trading and distribution powerhouse Bidvest. BIL provides an end-to-end<br />

supply-chain solution across a number <strong>of</strong> different industries. It <strong>of</strong>fers<br />

international import and export services, using road, sea and air. BIL is able<br />

to clear, warehouse, fulfil and distribute through final-mile distributing<br />

services. The company has massive coverage and access to a worldwide<br />

forwarding network. Its leading technological capability gives customers full<br />

visibility <strong>of</strong> their orders 24/7, whether they’re single items or bulk, express<br />

or deferred.<br />

10

PROFILE<br />

POLOKWANE INTERNATIONAL AIRPORT<br />

The Gateway Airport Authority Limited has ambitious plans<br />

for Limpopo’s most important airport, writes Mokgadi Matli, Acting CEO.<br />

With the appointment <strong>of</strong> a new management team, a focus on<br />

restoration and improvements in infrastructure, the new face <strong>of</strong><br />

Polokwane International Airport (PIA) is rapidly taking shape.<br />

PIA is situated 9km north <strong>of</strong> the City <strong>of</strong> Polokwane and like<br />

some <strong>of</strong> the more-established airports in South Africa, it was<br />

previously an airforce base. The Limpopo Provincial Government<br />

took ownership <strong>of</strong> the converted facility in 1995. The Gateway<br />

Airport Authority Limited (GAAL) manages and operates the<br />

airport, together with other selected airports entrusted to the<br />

Limpopo Provincial Government.<br />

The Limpopo government taking over the airport was the start <strong>of</strong><br />

its journey towards a competitive civil-aviation infrastructure to be<br />

reckoned with. Although troubled with infrastructure failures and<br />

non-compliance issues in the past, the airport is now on its way to<br />

full recovery and becoming a true destination <strong>of</strong> choice for both<br />

passenger and cargo traffic.<br />

The board quickly realised it was critical to appoint new senior<br />

management and fill critical key positions to enable maintenance<br />

<strong>of</strong> infrastructure and improving compliance with SACAA and<br />

ICAO requirements.<br />

INFRASTRUCTURE IMPROVEMENTS<br />

Polokwane International Airport is equipped with two runways<br />

sufficient to accommodate large aircraft <strong>of</strong> the size <strong>of</strong> Boeing 747<br />

and Airbus A346.<br />

In the medium term, GAAL is planning to refurbish both<br />

runways 05/23 and 01/19 to improve the friction and strength <strong>of</strong> the<br />

runways. Runway 01/19 will also be extended by 1km to complete<br />

and join it with the taxiway and threshold that has already been built<br />

in anticipation <strong>of</strong> this extension. This will allow the airport to handle<br />

heavy cargo operations, which is the ultimate business objective set<br />

for 2024-2029.<br />

The airport has an apron facility <strong>of</strong> 74 000 square metres <strong>of</strong><br />

parking space and is able to accommodate nine B747-type aircraft<br />

and 13 B737/A321-type aircraft. Furthermore, the airport has 16<br />

hangers <strong>of</strong> 540m² and one 6 450m² hangar, with the immediate<br />

potential <strong>of</strong> setting up multi-functional cargo facility.<br />

Runway 05/23 is equipped with a runway-lighting system and it<br />

will soon be converted from halogen to LED lights, thereby reducing<br />

maintenance costs and improving reliability and availability.<br />

This instrument runway is also equipped with a simple<br />

approach-lighting system to complement the RNAV procedure<br />

and to enable access to the airport in bad weather conditions.<br />

Plans are at an advanced stage to replace the current Precision<br />

Approach Path Indicator (PAPI)<br />

system with an advanced LED PAPI<br />

system. This system enables the<br />

pilots to observe their approach<br />

path towards the runway and is<br />

critical in ensuring a safe landing.<br />

Compared to the old system, the<br />

new LED PAPI system has lower<br />

power consumption, clearer white/<br />

red transition and an electronic<br />

angle display, thereby enhancing<br />

monitoring by ground electrical<br />

personnel without requiring<br />

sophisticated additional systems, a<br />

reduced calibration frequency and<br />

fail-safe built-in functionality to<br />

ensure out-<strong>of</strong>-tolerance automatic<br />

switch <strong>of</strong>f.<br />

Availability <strong>of</strong> aviation fuel is critical<br />

for airport operations. Currently the airport has outsourced the<br />

provision <strong>of</strong> JETA1 and AVGAS fuel. Furthermore, GAAL is in the<br />

process <strong>of</strong> refurbishing the one-million-litre-JetA1 Fuel Farm, with<br />

an associated 30 000-litre-AVGAS facility at the airport.<br />

Airport Rescue and Fighting protection level is currently at<br />

category 7, meaning the airport can regularly service aircraft in<br />

the categories B737-800 and A320. GAAL has appointed a service<br />

provider to repair two <strong>of</strong> its additional major trucks, which will<br />

guarantee availability <strong>of</strong> the protection level ARFFS CAT 7 and<br />

enable the airport to meet the requirements <strong>of</strong> CAT 9, similar to<br />

airports such as Cape Town and OR Tambo.<br />

PROPELLING AVIATION ACTIVITIES<br />

Aviation activities are the core and heart <strong>of</strong> the airport and propelling<br />

and regenerating these activities talks to the existence and survival<br />

<strong>of</strong> an airport. Current aviation activity in both passenger and cargo<br />

terms is low. Short-term interventions which are in progress include:<br />