2023 CIFA Investment Funds Guide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

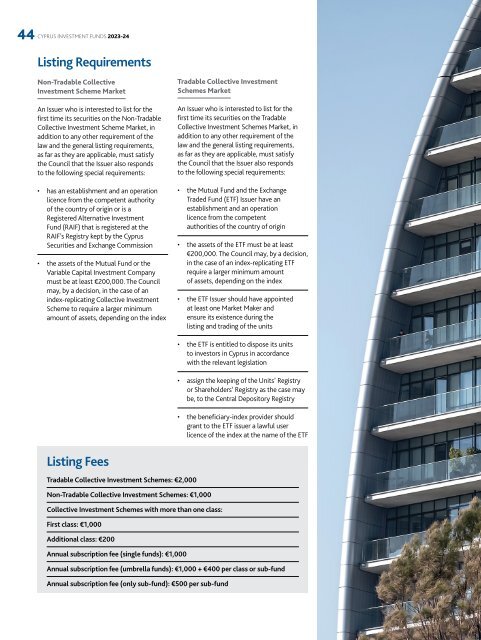

44 CYPRUS INVESTMENT FUNDS <strong>2023</strong>-24<br />

Listing Requirements<br />

Non-Tradable Collective<br />

<strong>Investment</strong> Scheme Market<br />

An Issuer who is interested to list for the<br />

first time its securities on the Non-Tradable<br />

Collective <strong>Investment</strong> Scheme Market, in<br />

addition to any other requirement of the<br />

law and the general listing requirements,<br />

as far as they are applicable, must satisfy<br />

the Council that the Issuer also responds<br />

to the following special requirements:<br />

• has an establishment and an operation<br />

licence from the competent authority<br />

of the country of origin or is a<br />

Registered Alternative <strong>Investment</strong><br />

Fund (RAIF) that is registered at the<br />

RAIF’s Registry kept by the Cyprus<br />

Securities and Exchange Commission<br />

• the assets of the Mutual Fund or the<br />

Variable Capital <strong>Investment</strong> Company<br />

must be at least €200,000. The Council<br />

may, by a decision, in the case of an<br />

index-replicating Collective <strong>Investment</strong><br />

Scheme to require a larger minimum<br />

amount of assets, depending on the index<br />

Tradable Collective <strong>Investment</strong><br />

Schemes Market<br />

An Issuer who is interested to list for the<br />

first time its securities on the Tradable<br />

Collective <strong>Investment</strong> Schemes Market, in<br />

addition to any other requirement of the<br />

law and the general listing requirements,<br />

as far as they are applicable, must satisfy<br />

the Council that the Issuer also responds<br />

to the following special requirements:<br />

• the Mutual Fund and the Exchange<br />

Traded Fund (ETF) Issuer have an<br />

establishment and an operation<br />

licence from the competent<br />

authorities of the country of origin<br />

• the assets of the ETF must be at least<br />

€200,000. The Council may, by a decision,<br />

in the case of an index-replicating ETF<br />

require a larger minimum amount<br />

of assets, depending on the index<br />

• the ETF Issuer should have appointed<br />

at least one Market Maker and<br />

ensure its existence during the<br />

listing and trading of the units<br />

• the ETF is entitled to dispose its units<br />

to investors in Cyprus in accordance<br />

with the relevant legislation<br />

• assign the keeping of the Units’ Registry<br />

or Shareholders’ Registry as the case may<br />

be, to the Central Depository Registry<br />

• the beneficiary-index provider should<br />

grant to the ETF issuer a lawful user<br />

licence of the index at the name of the ETF<br />

Listing Fees<br />

Tradable Collective <strong>Investment</strong> Schemes: €2,000<br />

Non-Tradable Collective <strong>Investment</strong> Schemes: €1,000<br />

Collective <strong>Investment</strong> Schemes with more than one class:<br />

First class: €1,000<br />

Additional class: €200<br />

Annual subscription fee (single funds): €1,000<br />

Annual subscription fee (umbrella funds): €1,000 + €400 per class or sub-fund<br />

Annual subscription fee (only sub-fund): €500 per sub-fund