2023-Cyprus-Country-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CYPRUSCOUNTRY REPORT <strong>2023</strong><br />

TAXATION<br />

Tax and Regulatory<br />

Regime of <strong>Cyprus</strong><br />

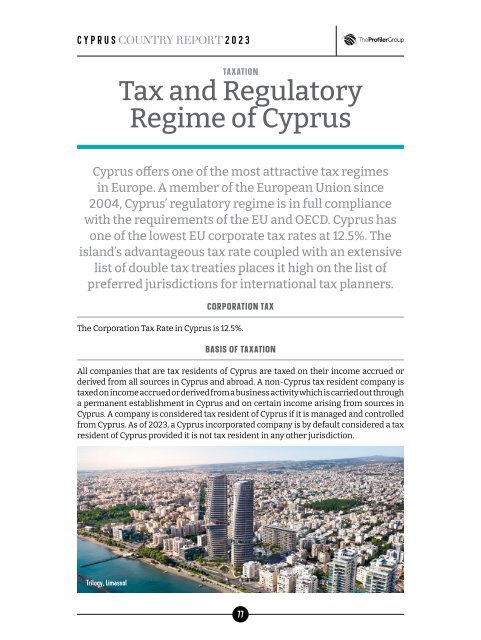

<strong>Cyprus</strong> offers one of the most attractive tax regimes<br />

in Europe. A member of the European Union since<br />

2004, <strong>Cyprus</strong>’ regulatory regime is in full compliance<br />

with the requirements of the EU and OECD. <strong>Cyprus</strong> has<br />

one of the lowest EU corporate tax rates at 12.5%. The<br />

island’s advantageous tax rate coupled with an extensive<br />

list of double tax treaties places it high on the list of<br />

preferred jurisdictions for international tax planners.<br />

CORPORATION TAX<br />

The Corporation Tax Rate in <strong>Cyprus</strong> is 12.5%.<br />

BASIS OF TAXATION<br />

All companies that are tax residents of <strong>Cyprus</strong> are taxed on their income accrued or<br />

derived from all sources in <strong>Cyprus</strong> and abroad. A non-<strong>Cyprus</strong> tax resident company is<br />

taxed on income accrued or derived from a business activity which is carried out through<br />

a permanent establishment in <strong>Cyprus</strong> and on certain income arising from sources in<br />

<strong>Cyprus</strong>. A company is considered tax resident of <strong>Cyprus</strong> if it is managed and controlled<br />

from <strong>Cyprus</strong>. As of <strong>2023</strong>, a <strong>Cyprus</strong> incorporated company is by default considered a tax<br />

resident of <strong>Cyprus</strong> provided it is not tax resident in any other jurisdiction.<br />

Trilogy, Limassol<br />

77