Financial Scamming and Fraud

Financial scamming and its impact have been receiving a higher public profile in recent months, yet though it is recognised as a growing problem, there is a lack of clear research and evidence into the scale of the problem, its causes and the impact on the public.

Financial scamming and its impact have been receiving a higher

public profile in recent months, yet though it is recognised as a

growing problem, there is a lack of clear research and evidence

into the scale of the problem, its causes and the impact on the

public.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

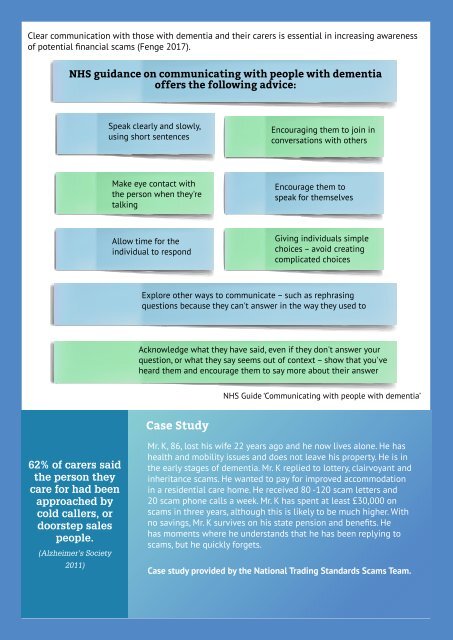

Clear communication with those with dementia <strong>and</strong> their carers is essential in increasing awareness<br />

of potential financial scams (Fenge 2017).<br />

NHS guidance on communicating with people with dementia<br />

offers the following advice:<br />

Speak clearly <strong>and</strong> slowly,<br />

using short sentences<br />

Encouraging them to join in<br />

conversations with others<br />

Make eye contact with<br />

the person when they're<br />

talking<br />

Encourage them to<br />

speak for themselves<br />

Allow time for the<br />

individual to respond<br />

Giving individuals simple<br />

choices – avoid creating<br />

complicated choices<br />

Explore other ways to communicate – such as rephrasing<br />

questions because they can't answer in the way they used to<br />

Acknowledge what they have said, even if they don't answer your<br />

question, or what they say seems out of context – show that you've<br />

heard them <strong>and</strong> encourage them to say more about their answer<br />

NHS Guide ‘Communicating with people with dementia’<br />

Case Study<br />

62% of carers said<br />

the person they<br />

care for had been<br />

approached by<br />

cold callers, or<br />

doorstep sales<br />

people.<br />

(Alzheimer’s Society<br />

2011)<br />

Mr. K, 86, lost his wife 22 years ago <strong>and</strong> he now lives alone. He has<br />

health <strong>and</strong> mobility issues <strong>and</strong> does not leave his property. He is in<br />

the early stages of dementia. Mr. K replied to lottery, clairvoyant <strong>and</strong><br />

inheritance scams. He wanted to pay for improved accommodation<br />

in a residential care home. He received 80 -120 scam letters <strong>and</strong><br />

20 scam phone calls a week. Mr. K has spent at least £30,000 on<br />

scams in three years, although this is likely to be much higher. With<br />

no savings, Mr. K survives on his state pension <strong>and</strong> benefits. He<br />

has moments where he underst<strong>and</strong>s that he has been replying to<br />

scams, but he quickly forgets.<br />

Case study provided by the National Trading St<strong>and</strong>ards Scams Team.