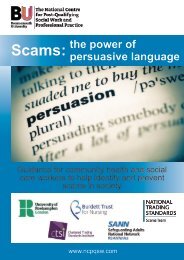

Financial Scamming and Fraud

Financial scamming and its impact have been receiving a higher public profile in recent months, yet though it is recognised as a growing problem, there is a lack of clear research and evidence into the scale of the problem, its causes and the impact on the public.

Financial scamming and its impact have been receiving a higher

public profile in recent months, yet though it is recognised as a

growing problem, there is a lack of clear research and evidence

into the scale of the problem, its causes and the impact on the

public.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2018 asks<br />

Challenge to financial institutions:<br />

All financial institutions should set out the steps they will<br />

take to identify customer susceptibility to fraud <strong>and</strong> scams <strong>and</strong><br />

implement appropriate protective measures.<br />

• Publishing performance data so customers can hold financial<br />

institutions to account.<br />

• Adoption of the British St<strong>and</strong>ards Institute’s code of practice.<br />

• Continuation of partnership work with the Joint <strong>Fraud</strong> Taskforce.<br />

<strong>and</strong> active pursuit of systems to stop fraudulent payments <strong>and</strong><br />

block fraudulent but authorised push payments.<br />

• A strong focus on prevention by all financial institutions through<br />

raising awareness <strong>and</strong> staff training on recognising signs of<br />

scam <strong>and</strong> fraud susceptibility<br />

• Adopting initiatives such as Friends Against Scams.<br />

Challenge to government:<br />

The government should publish a joint strategy on fighting<br />

fraud <strong>and</strong> reducing harm to the public from fraud <strong>and</strong> scams.<br />

This strategy should:<br />

• Be shared across all government departments that have<br />

responsibility for fraud, scams <strong>and</strong> financial abuse (including the<br />

Home Office, the BEIS <strong>and</strong> the DCMS).<br />

• Set out methods of sharing best practice <strong>and</strong> ensuring consistent<br />

messaging across all sectors.<br />

The aim: to reduce duplication <strong>and</strong> confusion <strong>and</strong> enable joint<br />

commitment to fight fraud.<br />

Challenge to local government:<br />

Local authorities should ensure they have strategies to tackle<br />

fraud which link relevant services, including Safeguarding Adult<br />

Boards <strong>and</strong> adult social care, trading st<strong>and</strong>ards public health.<br />

These strategies should include:<br />

• Action supporting individuals <strong>and</strong> improving their wellbeing.<br />

• Prevention of harm from abuse<br />

• Intelligence sharing, disruption of criminal activity <strong>and</strong> law<br />

enforcement<br />

Improve fraud awareness in the next generation:<br />

One of the fastest growing groups of people responding to<br />

scams is young people aged under 25.<br />

To upskill future generations we believe financial education should<br />

be a compulsory part of the school curriculum from Key Stage 3 to<br />

include:<br />

• <strong>Fraud</strong> <strong>and</strong> scam awareness<br />

• <strong>Financial</strong> literacy skills