Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

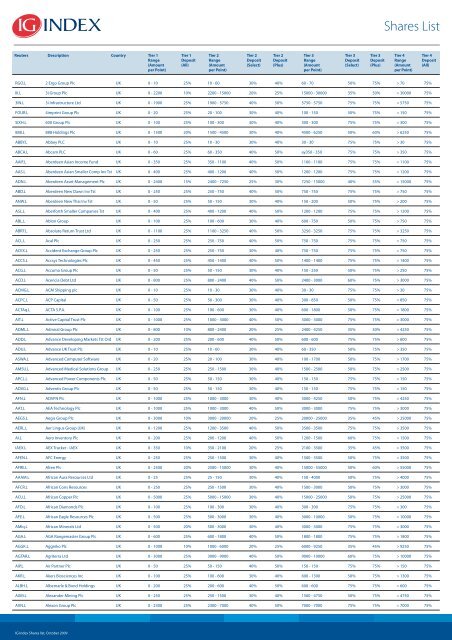

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009<br />

<strong>Shares</strong> <strong>List</strong><br />

RGO.L 2 Ergo Group Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 70 50% 75% > 70 75%<br />

III.L 3i Group Plc UK 0 - 2200 10% 2200 - 15000 20% 25% 15000 - 30000 35% 50% > 30000 75%<br />

3IN.L 3i Infrastructure Ltd UK 0 - 1900 25% 1900 - 5750 40% 50% 5750 - 5750 75% 75% > 5750 75%<br />

FOUR.L 4imprint Group Plc UK 0 - 20 25% 20 - 100 30% 40% 100 - 150 50% 75% > 150 75%<br />

SIXH.L 600 Group Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

888.L 888 Holdings Plc UK 0 - 1500 20% 1500 - 4500 30% 40% 4500 - 6250 50% 60% > 6250 75%<br />

ABBY.L Abbey PLC UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

ABCA.L Abcam PLC UK 0 - 60 25% 60 - 350 40% 50% ay350 - 350 75% 75% > 350 75%<br />

AAIF.L Aberdeen Asian Income Fund UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

AAS.L Aberdeen Asian Smaller Comp Inv Tst UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

ADN.L Aberdeen Asset Management Plc UK 0 - 2400 15% 2400 - 7250 25% 30% 7250 - 15000 40% 55% > 15000 75%<br />

ABD.L Aberdeen New Dawn Inv Tst UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

ANW.L Aberdeen New Thai Inv Tst UK 0 - 50 25% 50 - 150 30% 40% 150 - 200 50% 75% > 200 75%<br />

ASL.L Aberforth Smaller Companies Tst UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

ABL.L Ablon Group UK 0 - 100 25% 100 - 600 30% 40% 600 - 750 50% 75% > 750 75%<br />

ABRT.L Absolute Return Trust Ltd UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

ACL.L Acal Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

ACEX.L Accident Exchange Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

ACCS.L Accsys Technologies Plc UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

ACG.L Accuma Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

ACD.L Acencia Debt Ltd UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 3000 60% 75% > 3000 75%<br />

ACMG.L ACM Shipping plc UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

ACPC.L ACP Capital UK 0 - 50 25% 50 - 300 30% 40% 300 - 850 50% 75% > 850 75%<br />

ACTAq.L ACTA S.P.A. UK 0 - 100 25% 100 - 600 30% 40% 600 - 1800 50% 75% > 1800 75%<br />

AIT.L Active Capital Trust Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

ADML.L Admiral Group Plc UK 0 - 800 10% 800 - 2400 20% 25% 2400 - 4250 35% 50% > 4250 75%<br />

ADD.L Advance Developing Markets Tst Ord UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

ADU.L Advance UK Trust Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 350 50% 75% > 350 75%<br />

ASWA.L Advanced Computer Software UK 0 - 20 25% 20 - 100 30% 40% 100 - 1700 50% 75% > 1700 75%<br />

AMSU.L Advanced Medical Solutions Group UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2500 50% 75% > 2500 75%<br />

APCL.L Advanced Power Components Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

ADVG.L Adventis Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

AFN.L ADVFN Plc UK 0 - 1000 25% 1000 - 3000 30% 40% 3000 - 4250 50% 75% > 4250 75%<br />

AAT.L AEA Technology Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

AEGS.L Aegis Group Plc UK 0 - 3000 10% 3000 - 20000 20% 25% 20000 - 25000 35% 45% > 25000 75%<br />

AERL.L Aer Lingus Group (UK) UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

AI.L Aero Inventory Plc UK 0 - 200 25% 200 - 1200 40% 50% 1200 - 1500 60% 75% > 1500 75%<br />

IAEX.L AEX Tracker - IAEX UK 0 - 350 10% 350 - 2100 20% 25% 2100 - 3500 35% 45% > 3500 75%<br />

AFEN.L AFC Energy UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 3500 50% 75% > 3500 75%<br />

AFRE.L Afren Plc UK 0 - 2500 20% 2500 - 15000 30% 40% 15000 - 55000 50% 60% > 55000 75%<br />

AAAM.L African Aura Resources Ltd UK 0 - 25 25% 25 - 150 30% 40% 150 - 4000 50% 75% > 4000 75%<br />

AFCR.L African Cons Resources UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 3000 50% 75% > 3000 75%<br />

ACU.L African Copper Plc UK 0 - 5000 25% 5000 - 15000 30% 40% 15000 - 25000 50% 75% > 25000 75%<br />

AFD.L African Diamonds Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

AFE.L African Eagle Resources Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 10000 50% 75% > 10000 75%<br />

AMIq.L African Minerals Ltd UK 0 - 500 20% 500 - 3000 30% 40% 3000 - 3000 75% 75% > 3000 75%<br />

AGA.L AGA Rangemaster Group Plc UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

AGGK.L Aggreko Plc UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 9250 35% 45% > 9250 75%<br />

AGTAR.L Agriterra Ltd UK 0 - 3000 25% 3000 - 9000 40% 50% 9000 - 10000 60% 75% > 10000 75%<br />

AIP.L Air Partner Plc UK 0 - 50 25% 50 - 150 40% 50% 150 - 150 75% 75% > 150 75%<br />

AKR.L Akers Biosciences Inc UK 0 - 100 25% 100 - 600 30% 40% 600 - 1300 50% 75% > 1300 75%<br />

ALBH.L Albemarle & Bond Holdings UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

AXM.L Alexander Mining Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 4750 50% 75% > 4750 75%<br />

AXN.L Alexon Group Plc UK 0 - 2300 25% 2300 - 7000 40% 50% 7000 - 7000 75% 75% > 7000 75%

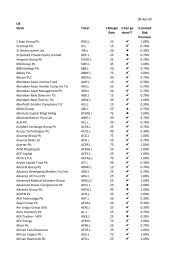

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

ALKN.L Alkane Energy Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2100 50% 75% > 2100 75%<br />

ALGP.L All Leisure Group UK 0 - 20 25% 20 - 100 30% 40% 100 - 150 50% 75% > 150 75%<br />

AGY.L Allergy Therapeutics Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1000 50% 75% > 1000 75%<br />

ALAPH.L Alliance Pharma plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 2400 50% 75% > 2400 75%<br />

ATST.L Alliance Trust Plc UK 0 - 2000 10% 2000 - 6000 20% 25% 6000 - 6000 75% 75% > 6000 75%<br />

AGLD.L Allied Gold Limited UK 0 - 100 25% 100 - 600 30% 40% 600 - 1400 50% 75% > 1400 75%<br />

ALBK.L Allied Irish Banks (LSE) UK 0 - 600 20% 600 - 3500 35% 50% 3500 - 25000 50% 75% > 25000 75%<br />

ALLA.L Allocate Software Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

ALPH.L Alpha Pyrenees Trust Ltd UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

ALQQ.L Alphameric Plc UK 0 - 1500 25% 1500 - 4500 40% 50% 4500 - 4500 75% 75% > 4500 75%<br />

ALN.L Alterian Plc UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

AIS.L Alternative Investment Strategies UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

ALTAN.L Alternative Networks Plc UK 0 - 25 25% 25 - 150 30% 40% 150 - 350 50% 75% > 350 75%<br />

ALRE.L Altona Resources Ltd UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 15000 50% 75% > 15000 75%<br />

ALUG.L Alumasc Group UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

AMBN.L Ambrian Capital Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 1600 50% 75% > 1600 75%<br />

AMEC.L Amec Plc UK 0 - 1300 10% 1300 - 7750 20% 25% 7750 - 8750 35% 50% > 8750 75%<br />

AMER.L Amerisur Resources Plc UK 0 - 1000 25% 1000 - 6000 30% 40% 6000 - 15000 50% 75% > 15000 75%<br />

AFS.L Amiad Filtration Systems UK 0 - 30 25% 30 - 90 30% 40% 90 - 90 75% 75% > 90 75%<br />

AMNX.L Aminex Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 4000 50% 75% > 4000 75%<br />

AMO.L Amino Technologies Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 300 50% 75% > 300 75%<br />

AML.L Amlin Plc UK 0 - 2500 10% 2500 - 7500 20% 25% 7500 - 10000 35% 45% > 10000 75%<br />

AMAMP.L Amphion Innovations Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

A7L.L Amur Minerals UK 0 - 300 25% 300 - 1800 30% 40% 1800 - 1800 75% 75% > 1800 75%<br />

AEN.L Andes Energia Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 350 50% 75% > 350 75%<br />

ANTE.L Andor Technology Ltd UK 0 - 10 25% 10 - 60 30% 40% 60 - 550 50% 75% > 550 75%<br />

ANSY.L Andrews Sykes Group Plc UK 0 - 1.5 25% 1.5 - 5 30% 40% 5 - 7 50% 75% > 7 75%<br />

AYM.L Anglesey Mining Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

AOT.L Anglo & Overseas Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

AAL.L Anglo American Plc UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 40000 35% 50% > 40000 75%<br />

AAZ.L Anglo Asian UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

APF.L Anglo Pacific Group Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

ANEA.L Anglo-Eastern Plantations UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

AIE.L Anite Group Plc UK 0 - 1900 25% 1900 - 5750 40% 50% 5750 - 5750 75% 75% > 5750 75%<br />

ASM.L Antisoma Plc UK 0 - 3750 25% 3750 - 10000 40% 50% 10000 - 10000 75% 75% > 10000 75%<br />

ANTO.L Antofagasta Plc UK 0 - 800 5% 800 - 4750 10% 20% 4750 - 20000 25% 40% > 20000 75%<br />

ATV.L Antonov Plc UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

AEY.L Antrim Energy UK 0 - 25 25% 25 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

AOR.L AorTech International Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 150 50% 75% > 150 75%<br />

FTG.L Apace Media Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 1900 50% 75% > 1900 75%<br />

AQP.L Aquarius Platinum Ltd UK 0 - 1500 20% 1500 - 9000 30% 40% 9000 - 15000 50% 60% > 15000 75%<br />

ARBB.L Arbuthnot Banking Group Plc UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

ARCHu.L ARC Capital Holdings Ltd UK 0 - 100 25% 100 - 600 30% 40% 600 - 2750 50% 75% > 2750 75%<br />

ARL.L Archial Group Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 650 50% 75% > 650 75%<br />

AR.L Archipelago Resources Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2100 50% 75% > 2100 75%<br />

ARE.L Arena Leisure Plc UK 0 - 6250 25% 6250 - 20000 40% 50% 20000 - 20000 75% 75% > 20000 75%<br />

ARGOA.L Argo Group Limited UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

AGQ.L Arian Silver Corporation UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

AKT.L Ark Therapeutics Group Plc UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

ARM.L ARM Holdings Plc UK 0 - 4250 10% 4250 - 25000 20% 25% 25000 - 40000 35% 45% > 40000 75%<br />

ARI.L Arriva Plc UK 0 - 800 15% 800 - 2400 25% 30% 2400 - 4250 40% 55% > 4250 75%<br />

ATS.L Artemis Alpha Trust Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

ASCR.L Ascent Resources PLC UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 25000 50% 75% > 25000 75%<br />

ASPL.L Aseana Properties Ltd UK 0 - 300 25% 300 - 900 40% 50% 900 - 1000 60% 75% > 1000 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

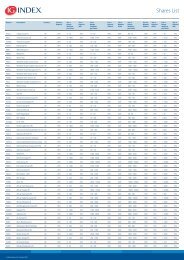

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

ASH.L Ashley House Plc UK 0 - 20 25% 20 - 100 30% 40% 100 - 950 50% 75% > 950 75%<br />

ASHM.L Ashmore Group UK 0 - 1000 20% 1000 - 3000 30% 40% 3000 - 4000 50% 60% > 4000 75%<br />

AHT.L Ashtead Group Plc UK 0 - 3750 15% 3750 - 10000 25% 30% 10000 - 15000 40% 55% > 15000 75%<br />

ADH.L Asia Digital Holdings Plc UK 0 - 1000 25% 1000 - 3000 30% 40% 3000 - 3000 75% 75% > 3000 75%<br />

ACHLA.L Asian Citrus Holdings Ltd UK 0 - 20 25% 20 - 100 30% 40% 100 - 350 50% 75% > 350 75%<br />

ASOS.L ASOS Plc UK 0 - 400 20% 400 - 2400 30% 40% 2400 - 3500 50% 60% > 3500 75%<br />

ASTO.L Assetco Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

ABF.L Associated British Foods Plc UK 0 - 1200 10% 1200 - 7250 20% 25% 7250 - 7250 75% 75% > 7250 75%<br />

AGRP.L Assura Group UK 0 - 2000 25% 2000 - 6000 40% 50% 6000 - 6000 75% 75% > 6000 75%<br />

ATD.L Asterand Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 700 50% 75% > 700 75%<br />

AZN.L AstraZeneca Plc UK 0 - 350 5% 350 - 2100 10% 20% 2100 - 25000 25% 40% > 25000 75%<br />

ATH.L ATH Resources UK 0 - 30 25% 30 - 200 30% 40% 200 - 500 50% 75% > 500 75%<br />

ATKW.L Atkins WS Plc UK 0 - 600 15% 600 - 1800 25% 30% 1800 - 2200 40% 55% > 2200 75%<br />

AJG.L Atlantis Japan Growth Fund UK 0 - 10 25% 10 - 60 30% 40% 60 - 70 50% 75% > 70 75%<br />

ATLE.L Atlas Estates Ltd UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

AUG.L Augean Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

AUL.L Aurelian Oil & Gas Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 3250 50% 75% > 3250 75%<br />

AURT.L Aurora Investment Trust UK 0 - 10 25% 10 - 60 30% 40% 60 - 300 50% 75% > 300 75%<br />

AURU.L Aurum Mining Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 1100 50% 75% > 1100 75%<br />

AUALG.L Autologic Holdings Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 350 50% 75% > 350 75%<br />

AUTN.L Autonomy Corp Plc UK 0 - 350 5% 350 - 2100 10% 20% 2100 - 7250 25% 40% > 7250 75%<br />

AVTG.L Avacta Group plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 8750 50% 75% > 8750 75%<br />

AVN.L Avanti Communications UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

ASG.L Avanti Screenmedia Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 850 50% 75% > 850 75%<br />

AVS.L Avesco Group Plc UK 0 - 25 25% 25 - 80 30% 40% 80 - 150 50% 75% > 150 75%<br />

AVV.L Aveva Group Plc UK 0 - 300 15% 300 - 900 25% 30% 900 - 1800 40% 55% > 1800 75%<br />

AVG.L Avingtrans PLC UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

AVE.L Avis Europe Plc UK 0 - 3500 25% 3500 - 10000 40% 50% 10000 - 10000 75% 75% > 10000 75%<br />

AVI.L Avisen Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 400 50% 75% > 400 75%<br />

AV.L Aviva Plc UK 0 - 2500 10% 2500 - 15000 20% 25% 15000 - 65000 35% 50% > 65000 75%<br />

AVM.L Avocet Mining Plc UK 0 - 600 25% 600 - 3500 40% 50% 3500 - 3750 60% 75% > 3750 75%<br />

AVON.L Avon Rubber Plc UK 0 - 20 25% 20 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

ASD.L Axis-Shield Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

BAB.L Babcock International Group UK 0 - 450 10% 450 - 2750 20% 25% 2750 - 5000 35% 45% > 5000 75%<br />

BAES.L BAE Systems Plc UK 0 - 3000 5% 3000 - 20000 10% 20% 20000 - 85000 25% 40% > 85000 75%<br />

BGFD.L Baillie Gifford Japan Trust Plc UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

BGS.L Baillie Gifford Shin Nippon UK 0 - 20 25% 20 - 100 30% 40% 100 - 300 50% 75% > 300 75%<br />

BALF.L Balfour Beatty Plc UK 0 - 2300 10% 2300 - 7000 20% 25% 7000 - 15000 35% 45% > 15000 75%<br />

BTC.L Baltic Oil Terminals Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1100 50% 75% > 1100 75%<br />

SANq.L Banco Santander UK 0 - 1100 15% 1100 - 3250 25% 30% 3250 - 3250 75% 75% > 3250 75%<br />

BGO.L Bango Plc UK 0 - 20 25% 20 - 60 30% 40% 60 - 60 75% 75% > 60 75%<br />

BKIR.L Bank Of Ireland (LSE) UK 0 - 1800 20% 1800 - 10000 35% 50% 10000 - 30000 50% 75% > 30000 75%<br />

BNKR.L Bankers Inv Tst UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

BARC.L Barclays Plc UK 0 - 2750 10% 2750 - 15000 20% 25% 15000 - 400000 35% 50% > 400000 75%<br />

BEE.L Baring Emerging Europe Plc UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

BAG.L Barr (A.G.) Plc UK 0 - 30 25% 30 - 90 40% 50% 90 - 90 75% 75% > 90 75%<br />

BDEV.L Barratt Developments Plc UK 0 - 2300 10% 2300 - 15000 20% 25% 15000 - 20000 35% 45% > 20000 75%<br />

BNLN.L Bateman Litwin NV UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

BVC.L Batm Advanced Communications UK 0 - 3000 25% 3000 - 9000 40% 50% 9000 - 9000 75% 75% > 9000 75%<br />

BBA.L BBA Group Plc UK 0 - 1300 15% 1300 - 7750 25% 30% 7750 - 7750 75% 75% > 7750 75%<br />

BCBH.L BCB Holdings Ltd UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

BEZG.L Beazley Group Plc UK 0 - 1900 20% 1900 - 5750 30% 40% 5750 - 9750 50% 60% > 9750 75%<br />

BEG.L Begbies Traynor Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 850 60% 75% > 850 75%<br />

BVM.L Belgravium Technologies Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

BWY.L Bellway Plc UK 0 - 450 10% 450 - 2750 20% 25% 2750 - 3750 35% 45% > 3750 75%<br />

BKGH.L Berkeley Group Holdings Plc UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 4750 35% 45% > 4750 75%<br />

BKY.L Berkeley Resources Limited UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

BZT.L Bezant Resources UK 0 - 300 25% 300 - 900 40% 50% 900 - 950 60% 75% > 950 75%<br />

BG.L BG Group Plc UK 0 - 900 5% 900 - 5500 10% 20% 5500 - 40000 25% 40% > 40000 75%<br />

BGBL.L Bglobal PLC UK 0 - 50 25% 50 - 300 30% 40% 300 - 1500 50% 75% > 1500 75%<br />

BHGGu.L BH Global Ltd - $ UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

BHGG.L BH Global Ltd - £ UK 0 - 150 20% 150 - 450 30% 40% 450 - 600 50% 60% > 600 75%<br />

BHGGx.L BH Global Ltd - Euro UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

BHMG.L BH Macro Ltd UK 0 - 400 20% 400 - 1200 30% 40% 1200 - 1200 75% 75% > 1200 75%<br />

BHMGx.L BH Macro Ltd - Euro UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

BLT.L BHP Billiton Plc UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 70000 35% 50% > 70000 75%<br />

BYG.L Big Yellow Group Plc UK 0 - 450 20% 450 - 2750 30% 40% 2750 - 3000 50% 60% > 3000 75%<br />

B4S.L Billing Service UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 2400 50% 75% > 2400 75%<br />

BII.L Biocompatibles International Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

BIIN.L Biofutures International Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1700 50% 75% > 1700 75%<br />

BIOQ.L Bioquell Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

BIOGW.L Biotech Growth Trust Plc UK 0 - 20 25% 20 - 100 30% 40% 100 - 200 50% 75% > 200 75%<br />

BLKA.L Black Arrow Group Plc UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

BKSA.L Black Sea Property Fund Ltd UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

BRCI.L Blackrock Commodities In UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

BRGE.L Blackrock Greater Euro Inv Tst UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

B8L.L Blackrock International Land (LSE) UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

BRLA.L Blackrock Latin American Tst UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

BRNS.L Blackrock New Energy Inv Trust UK 0 - 25 25% 25 - 150 30% 40% 150 - 2100 50% 75% > 2100 75%<br />

BRNE.L Blackrock New Energy Investment UK 0 - 2500 25% 2500 - 7500 40% 50% 7500 - 7500 75% 75% > 7500 75%<br />

BRSC.L Blackrock Smaller Comp Tst UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

BRWM.L Blackrock World Mining Trust UK 0 - 800 15% 800 - 2400 25% 30% 2400 - 3000 40% 55% > 3000 75%<br />

BSLA.L Blacks Leisure Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

BLCK.L Blackstar Investors Plc UK 0 - 20 25% 20 - 100 30% 40% 100 - 350 50% 75% > 350 75%<br />

BLVX.L Blavod Extreme Spirits Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 650 50% 75% > 650 75%<br />

BLNX.L Blinkx Plc UK 0 - 2100 25% 2100 - 6250 40% 50% 6250 - 6250 75% 75% > 6250 75%<br />

BLPU.L Bloomsbury Publishing Plc UK 0 - 150 25% 150 - 900 40% 50% 900 - 1000 60% 75% > 1000 75%<br />

BLP.L Blue Planet Euro Inv Trust UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

BBAY.L BlueBay Asset Management UK 0 - 250 25% 250 - 750 40% 50% 750 - 850 60% 75% > 850 75%<br />

BABS.L Bluecrest Allblue Fund Ltd UK 0 - 5500 25% 5500 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

BOY.L Bodycote International UK 0 - 600 20% 600 - 3500 30% 40% 3500 - 6250 50% 60% > 6250 75%<br />

BDI.L Bond International Software UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

BOK.L Booker Group UK 0 - 2400 15% 2400 - 15000 25% 30% 15000 - 60000 40% 55% > 60000 75%<br />

BHY.L Boot (Henry) Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 750 50% 75% > 750 75%<br />

BSTH.L Borders & Southern Petroleum Plc UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

BVS.L Bovis Homes Group Plc UK 0 - 700 20% 700 - 2100 30% 40% 2100 - 2500 50% 60% > 2500 75%<br />

BLVN.L BowLeven Plc UK 0 - 2100 25% 2100 - 6250 40% 50% 6250 - 10000 60% 75% > 10000 75%<br />

BP.L BP Plc UK 0 - 1800 5% 1800 - 10000 10% 20% 10000 - 200000 25% 40% > 200000 75%<br />

BPCB.L BPC Ltd UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 3500 50% 75% > 3500 75%<br />

BRDY.L Brady Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 200 50% 75% > 200 75%<br />

BRMS.L Braemar Seascope Group Plc UK 0 - 90 25% 90 - 250 40% 50% 250 - 250 75% 75% > 250 75%<br />

BRR.L Braemore Resources Plc UK 0 - 2500 25% 2500 - 15000 30% 40% 15000 - 20000 50% 75% > 20000 75%<br />

BXBq.L Brambles Ltd UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

BRAL.L Bramdean Alternatives UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

BRAM.L Brammer Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

BRW.L Brewin Dolphin Holdings Plc UK 0 - 800 20% 800 - 2400 30% 40% 2400 - 3250 50% 60% > 3250 75%<br />

BRT.L Brightside Group Plc UK 0 - 20 25% 20 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

BRM.L Brinkley Mining Plc UK 0 - 2500 25% 2500 - 7500 30% 40% 7500 - 7500 75% 75% > 7500 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

BRE.L Brit Insurance Holdings Plc UK 0 - 1200 15% 1200 - 3500 25% 30% 3500 - 6750 40% 55% > 6750 75%<br />

BAY.L British Airways Plc UK 0 - 4750 10% 4750 - 30000 20% 25% 30000 - 65000 35% 50% > 65000 75%<br />

BATS.L British American Tobacco Plc UK 0 - 500 5% 500 - 3000 10% 20% 3000 - 25000 25% 40% > 25000 75%<br />

BSET.L British Assets Trust Plc UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

BTEM.L British Empire Secs and General Tst UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

BLND.L British Land Co Plc UK 0 - 1200 5% 1200 - 7250 10% 20% 7250 - 30000 25% 40% > 30000 75%<br />

BRPI.L British Polythene Industries UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

BPTR.L British Portfolio Trust Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 200 50% 75% > 200 75%<br />

BSY.L British Sky Broadcasting Plc UK 0 - 1600 5% 1600 - 9500 10% 20% 9500 - 30000 25% 40% > 30000 75%<br />

BVIC.L Britvic UK 0 - 900 15% 900 - 2750 25% 30% 2750 - 4500 40% 55% > 4500 75%<br />

BRK.L Brook MacDonald Group Plc UK 0 - 5 25% 5 - 30 30% 40% 30 - 60 50% 75% > 60 75%<br />

BWNG.L Brown (N) Group UK 0 - 700 20% 700 - 2100 30% 40% 2100 - 2750 50% 60% > 2750 75%<br />

BRU.L Brulines Holdings Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 250 50% 75% > 250 75%<br />

BUT.L Brunner Inv Tst UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

BTSM.L BSS Group Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

BT.L BT Group Plc UK 0 - 7500 5% 7500 - 45000 10% 20% 45000 - 200000 25% 40% > 200000 75%<br />

BGC.L BTG Plc UK 0 - 700 20% 700 - 2100 30% 40% 2100 - 3000 50% 60% > 3000 75%<br />

BNZL.L Bunzl Plc UK 0 - 1300 10% 1300 - 7750 20% 25% 7750 - 8500 35% 50% > 8500 75%<br />

BRBY.L Burberry Group Plc UK 0 - 1700 5% 1700 - 10000 10% 20% 10000 - 15000 25% 40% > 15000 75%<br />

BRST.L Burst Media Corp UK 0 - 100 25% 100 - 300 30% 40% 300 - 450 50% 75% > 450 75%<br />

BPG.L Business Post Group Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

BYOT.L Byotrol Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 500 50% 75% > 500 75%<br />

GCC.L C&C Group (LSE) UK 0 - 400 10% 400 - 2400 20% 25% 2400 - 10000 35% 50% > 10000 75%<br />

CW.L Cable & Wireless Plc UK 0 - 5250 5% 5250 - 30000 10% 20% 30000 - 70000 25% 40% > 70000 75%<br />

CBRY.L Cadbury Schweppes Plc UK 0 - 1300 10% 1300 - 7750 20% 25% 7750 - 30000 35% 50% > 30000 75%<br />

CADP.L Cadogan Petroleum Plc UK 0 - 2300 25% 2300 - 7000 40% 50% 7000 - 7000 75% 75% > 7000 75%<br />

CNE.L Cairn Energy Plc UK 0 - 400 10% 400 - 2400 20% 25% 2400 - 4000 35% 50% > 4000 75%<br />

CDN.L Caledon Resources Plc UK 0 - 1800 25% 1800 - 5500 40% 50% 5500 - 6250 60% 75% > 6250 75%<br />

CLDN.L Caledonia Investments Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

TREE.L Cambium Global UK 0 - 50 25% 50 - 300 30% 40% 300 - 700 50% 75% > 700 75%<br />

CAMIN.L Camco International Ltd UK 0 - 100 25% 100 - 600 30% 40% 600 - 1800 50% 75% > 1800 75%<br />

CDI.L Candover Investments Plc UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

CIU.L Cape Plc UK 0 - 800 20% 800 - 4750 30% 40% 4750 - 5500 50% 60% > 5500 75%<br />

CPI.L Capita Group Plc UK 0 - 1000 5% 1000 - 6000 10% 20% 6000 - 10000 25% 40% > 10000 75%<br />

CAL.L Capital & Regional Plc UK 0 - 4250 25% 4250 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

CGT.L Capital Gearing Trust UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

CAPX.L CAP-XX Ltd UK 0 - 50 25% 50 - 300 30% 40% 300 - 800 50% 75% > 800 75%<br />

C1Y.L Carclo Plc UK 0 - 25 25% 25 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

CUK.L Care UK Plc UK 0 - 90 25% 90 - 250 40% 50% 250 - 450 60% 75% > 450 75%<br />

CARE.L Carecapital Group UK 0 - 50 25% 50 - 300 30% 40% 300 - 450 50% 75% > 450 75%<br />

CTH.L Caretech Holdings Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 500 60% 75% > 500 75%<br />

CLLN.L Carillion Plc UK 0 - 1300 15% 1300 - 7750 25% 30% 7750 - 8250 40% 55% > 8250 75%<br />

CLNC.L Carlton Resources Plc UK 0 - 750 25% 750 - 2300 30% 40% 2300 - 4250 50% 75% > 4250 75%<br />

CARL.L Carluccio UK 0 - 100 25% 100 - 600 30% 40% 600 - 750 50% 75% > 750 75%<br />

CCL.L Carnival Plc UK 0 - 350 5% 350 - 2100 10% 20% 2100 - 6250 25% 40% > 6250 75%<br />

CPTA.L Carpathian Plc UK 0 - 2500 25% 2500 - 7500 40% 50% 7500 - 7500 75% 75% > 7500 75%<br />

CATVU.L Carpetright Plc UK 0 - 350 20% 350 - 1100 30% 40% 1100 - 1100 75% 75% > 1100 75%<br />

CPW.L Carphone Warehouse Group Plc UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 15000 35% 45% > 15000 75%<br />

CARS.L Carr’s Milling Industries UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

CBOX.L Cashbox Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

CSH.L Caspian Holdings SA UK 0 - 1000 25% 1000 - 3000 30% 40% 3000 - 3000 75% 75% > 3000 75%<br />

CGS.L Castings Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

CACSU.L Castle Support Services Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 650 50% 75% > 650 75%<br />

CMX.L Catalyst Media Group Plc UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

CTI.L Cathay International Holdings UK 0 - 30 25% 30 - 200 30% 40% 200 - 300 50% 75% > 300 75%<br />

CGL.L Catlin Group Ltd UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 8500 35% 45% > 8500 75%<br />

CAEL_p.L Cazenove Absolute Equity Ltd UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

CLTV.L Cellcast Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

CCP.L Celtic Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 60 75% 75% > 60 75%<br />

CNKS.L Cenkos Securities Ltd UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

CEY.L Centamin Egypt Ltd UK 0 - 6750 20% 6750 - 20000 30% 40% 20000 - 20000 75% 75% > 20000 75%<br />

CAU.L Centaur Holdings Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

CFM.L Central African Mining & Exp UK 0 - 18750 20% 18750 - 55000 30% 40% 55000 - 85000 50% 60% > 85000 75%<br />

CRND.L Central Rand Gold Ltd UK 0 - 1800 25% 1800 - 5500 40% 50% 5500 - 7250 60% 75% > 7250 75%<br />

CNA.L Centrica Plc UK 0 - 4000 5% 4000 - 25000 10% 20% 25000 - 80000 25% 40% > 80000 75%<br />

CFU.L Ceramic Fuel Cells Ltd UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 15000 50% 75% > 15000 75%<br />

CWR.L Ceres Power Holdings Plc UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

CCT.L Character Group Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 800 50% 75% > 800 75%<br />

CHARC.L Chariot Oil and Gas Ltd UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3500 60% 75% > 3500 75%<br />

CHAR.L Charlemagne Capital Ltd UK 0 - 3500 25% 3500 - 10000 40% 50% 10000 - 10000 75% 75% > 10000 75%<br />

CAY.L Charles Stanley Group Plc UK 0 - 90 25% 90 - 250 40% 50% 250 - 250 75% 75% > 250 75%<br />

CHAT.L Charles Taylor Consulting Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

CHET.L Charter Pan-European Trust UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

CHTR.L Charter Plc UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6250 35% 45% > 6250 75%<br />

CHU.L Chaucer Holdings Plc UK 0 - 1400 20% 1400 - 8500 30% 40% 8500 - 15000 50% 60% > 15000 75%<br />

CHG.L Chemring Group Plc UK 0 - 200 15% 200 - 600 25% 30% 600 - 900 40% 55% > 900 75%<br />

CSN.L Chesnara Plc UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

CHW.L Chime Communications Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

FXC.L China 25 Tracker - FXC UK 0 - 150 10% 150 - 900 20% 25% 900 - 1500 35% 45% > 1500 75%<br />

CBI.L China BioDiesel UK 0 - 100 25% 100 - 600 30% 40% 600 - 1100 50% 75% > 1100 75%<br />

CGA.L China Gateway International UK 0 - 30 25% 30 - 90 30% 40% 90 - 90 75% 75% > 90 75%<br />

CGM.L China Goldmines PLC UK 0 - 30 25% 30 - 200 30% 40% 200 - 550 50% 75% > 550 75%<br />

CREO.L China Real Estate Opportunities UK 0 - 10 25% 10 - 60 30% 40% 60 - 250 50% 75% > 250 75%<br />

CHNS.L China Shoto Plc UK 0 - 30 25% 30 - 200 30% 40% 200 - 200 75% 75% > 200 75%<br />

CHLD.L Chloride Group UK 0 - 800 20% 800 - 4750 30% 40% 4750 - 5250 50% 60% > 5250 75%<br />

CHRX.L Chromex Mining Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

CHS.L Chrysalis Group Plc UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

CHLL.L Churchill Mining Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1200 50% 75% > 1200 75%<br />

CINE.L Cineworld Group Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

CINP.L Cinpart Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 1500 50% 75% > 1500 75%<br />

COPU.L Circle Oil Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 5500 50% 75% > 5500 75%<br />

CHY.L City Merchants High Yield Trust UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

CYNL.L City Natural Resources HI Y UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

CL<strong>IG</strong>.L City of London Investment GR UK 0 - 20 25% 20 - 100 30% 40% 100 - 200 50% 75% > 200 75%<br />

CTY.L City of London Investment Trust UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4250 75% 75% > 4250 75%<br />

CCGP.L Claimar Care Group Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 600 50% 75% > 600 75%<br />

CPH.L Clapham House Group Plc UK 0 - 20 25% 20 - 100 30% 40% 100 - 250 50% 75% > 250 75%<br />

CCS.L Clarity Commerce Solutions Plc UK 0 - 25 25% 25 - 80 30% 40% 80 - 100 50% 75% > 100 75%<br />

CTO.L Clarke (Thomas) UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

CLKH.L Clarkson Hill Group Plc UK 0 - 30 25% 30 - 200 30% 40% 200 - 200 75% 75% > 200 75%<br />

CKN.L Clarkson Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

CEB.L Clean Energy Brazil Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 300 50% 75% > 300 75%<br />

CLCRK.L Clerkenwell Ventures Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

CLIE.L Climate Exchange Plc UK 0 - 100 20% 100 - 600 30% 40% 600 - 950 50% 60% > 950 75%<br />

CLCA.L Clinton Cards Plc UK 0 - 1900 25% 1900 - 5750 40% 50% 5750 - 5750 75% 75% > 5750 75%<br />

CWPR.L Clipper Windpower PLC UK 0 - 100 25% 100 - 600 30% 40% 600 - 1300 50% 75% > 1300 75%<br />

CBRO.L Close Brothers Group Plc UK 0 - 500 15% 500 - 1500 25% 30% 1500 - 2200 40% 55% > 2200 75%<br />

CLEN.L Close Enhanced Commodities UK 0 - 30 25% 30 - 90 30% 40% 90 - 90 75% 75% > 90 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

CLSH.L CLS Holdings Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

CLUF.L Cluff Gold Ltd UK 0 - 50 25% 50 - 300 30% 40% 300 - 1900 50% 75% > 1900 75%<br />

CZA.L Coal of Africa UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4500 60% 75% > 4500 75%<br />

COB.L Cobham Plc UK 0 - 4750 10% 4750 - 15000 20% 25% 15000 - 30000 35% 50% > 30000 75%<br />

CBRA.L Cobra Holdings Plc UK 0 - 20 25% 20 - 60 30% 40% 60 - 60 75% 75% > 60 75%<br />

COHC.L Coffeheaven Plc UK 0 - 300 25% 300 - 1800 30% 40% 1800 - 2750 50% 75% > 2750 75%<br />

COLL.L Colliers CRE Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 350 50% 75% > 350 75%<br />

CLST.L Collins Stewart Plc UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2750 60% 75% > 2750 75%<br />

COLT.L Colt Telecom Group Plc UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 2300 60% 75% > 2300 75%<br />

CMM.L Commoditrade Inc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 3500 50% 75% > 3500 75%<br />

CMS.L Communisis Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

CPG.L Compass Group Plc UK 0 - 3000 5% 3000 - 20000 10% 20% 20000 - 50000 25% 40% > 50000 75%<br />

CCC.L Computacenter Plc UK 0 - 300 20% 300 - 1800 30% 40% 1800 - 1800 75% 75% > 1800 75%<br />

CNCT.L Concurrent Technologies Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 500 50% 75% > 500 75%<br />

CNT.L Connaught Plc UK 0 - 600 20% 600 - 1800 30% 40% 1800 - 2300 50% 60% > 2300 75%<br />

CSRT.L Consort Medical UK 0 - 70 25% 70 - 200 40% 50% 200 - 200 75% 75% > 200 75%<br />

CFL.L Contentfilm PLC UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

CIC.L Conygar Investment Company UK 0 - 50 25% 50 - 300 30% 40% 300 - 350 50% 75% > 350 75%<br />

CKSN.L Cookson Group Plc UK 0 - 1900 25% 1900 - 10000 40% 50% 10000 - 20000 60% 75% > 20000 75%<br />

CRAU.L Corac Group Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 2100 50% 75% > 2100 75%<br />

COCRG.L Corin Group Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 400 50% 75% > 400 75%<br />

CSLT.L Cosalt Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 3000 50% 75% > 3000 75%<br />

COSG.L Costain Group Plc UK 0 - 4750 25% 4750 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

COVE.L Cove Energy Plc UK 0 - 50 25% 50 - 300 40% 50% 300 - 1750 60% 75% > 1750 75%<br />

DQ5.L CPL Resources UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

CWK.L Cranswick Plc UK 0 - 80 25% 80 - 250 40% 50% 250 - 250 75% 75% > 250 75%<br />

CRAW.L Crawshaw Group UK 0 - 25 25% 25 - 80 30% 40% 80 - 90 50% 75% > 90 75%<br />

CRHL LN Creat Resources Holdings Ltd UK 0 - 200 25% 200 - 1200 30% 40% 1200 - 3250 50% 75% > 3250 75%<br />

CRCRE.L Creston Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 450 50% 75% > 450 75%<br />

CRH.L CRH (LSE) UK 0 - 600 5% 600 - 3500 10% 20% 3500 - 10000 25% 40% > 10000 75%<br />

CRDA.L Croda International UK 0 - 500 15% 500 - 1500 25% 30% 1500 - 2500 40% 55% > 2500 75%<br />

CSBq.L Crosby Capital Partners Inc UK 0 - 1500 25% 1500 - 4500 30% 40% 4500 - 4500 75% 75% > 4500 75%<br />

CRYG.L Cryo-Save Group NV UK 0 - 5 25% 5 - 30 30% 40% 30 - 80 50% 75% > 80 75%<br />

CSR.L CSR Plc UK 0 - 350 10% 350 - 2100 20% 25% 2100 - 5250 35% 45% > 5250 75%<br />

CSSS.L CSS Stellar Plc UK 0 - 300 25% 300 - 900 30% 40% 900 - 900 75% 75% > 900 75%<br />

CVSG.L CVS Group UK 0 - 250 25% 250 - 750 40% 50% 750 - 900 60% 75% > 900 75%<br />

CYAN.L Cyan Holdings UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 10000 50% 75% > 10000 75%<br />

CYHU.L Cybit Holding Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 450 50% 75% > 450 75%<br />

CSWG.L Cyril Sweett Group Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 750 50% 75% > 750 75%<br />

DOO.L D1 Oils Plc UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

DJAN.L Daejan Holdings Plc UK 0 - 25 25% 25 - 80 40% 50% 80 - 80 75% 75% > 80 75%<br />

DMGOa.L Daily Mail & General Trust UK 0 - 1300 10% 1300 - 7750 20% 25% 7750 - 10000 35% 45% > 10000 75%<br />

DCG.L Dairy Crest Group Plc UK 0 - 1200 20% 1200 - 3500 30% 40% 3500 - 3500 75% 75% > 3500 75%<br />

DAY.L Daisy Group Plc UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

DNX.L Dana Petroleum Plc UK 0 - 450 10% 450 - 2750 20% 25% 2750 - 3250 35% 45% > 3250 75%<br />

DAN.L Daniel Stewart Securities Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 4250 50% 75% > 4250 75%<br />

DTG.L Dart Group Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

DATA.L Datacash Group Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 350 60% 75% > 350 75%<br />

DTC.L DataTec Ltd UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

DAV.L Davenham Group Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1000 50% 75% > 1000 75%<br />

DVSG.L Davis Service Group Plc UK 0 - 1300 20% 1300 - 4000 30% 40% 4000 - 4000 75% 75% > 4000 75%<br />

TRVT.L Dawnay Day Treveria Plc UK 0 - 20500 25% 20500 - 60000 40% 50% 60000 - 60000 75% 75% > 60000 75%<br />

DWN.L Dawson Holdings Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 900 50% 75% > 900 75%<br />

DINT.L Dawson International Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

XGBP.L DB X-Trackers GBP MNY MRK UK 0 - 50 10% 50 - 300 20% 25% 300 - 500 35% 45% > 500 75%<br />

DCC.L DCC Plc (LSE) UK 0 - 80 10% 80 - 500 20% 25% 500 - 1200 35% 50% > 1200 75%<br />

DCD.L DCD Media Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

DLAR.L De La Rue Plc UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 4250 35% 45% > 4250 75%<br />

DEB.L Debenhams UK 0 - 4250 10% 4250 - 25000 20% 25% 25000 - 40000 35% 45% > 40000 75%<br />

DECP.L Dechra Pharmaceuticals Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 1100 60% 75% > 1100 75%<br />

DEEV.L Dee Valley Group Plc UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

DLTA.L Delta Plc UK 0 - 700 20% 700 - 2100 30% 40% 2100 - 3750 50% 60% > 3750 75%<br />

DEMG.L Deltex Medical Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 1000 50% 75% > 1000 75%<br />

DLN.L Derwent London Plc UK 0 - 450 20% 450 - 2750 30% 40% 2750 - 3000 50% 60% > 3000 75%<br />

DES.L Desire Petroleum Plc UK 0 - 1600 25% 1600 - 4750 40% 50% 4750 - 4750 75% 75% > 4750 75%<br />

DLD.L Deutsche Land Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 6750 50% 75% > 6750 75%<br />

DEDE.L Develica Deutchland Ltd UK 0 - 14250 25% 14250 - 45000 40% 50% 45000 - 45000 75% 75% > 45000 75%<br />

DSC.L Development Securities Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 450 60% 75% > 450 75%<br />

DVO.L Devro Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

DAB.L Dexion Absolute Ltd UK 0 - 4000 15% 4000 - 10000 25% 30% 10000 - 10000 75% 75% > 10000 75%<br />

DCL.L Dexion Commodities Ltd UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 3000 60% 75% > 3000 75%<br />

DEAL.L Dexion Equity Alternative LD UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

DTL.L Dexion Trading Ltd UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4250 75% 75% > 4250 75%<br />

DGE.L Diageo Plc UK 0 - 1000 5% 1000 - 6000 10% 20% 6000 - 35000 25% 40% > 35000 75%<br />

RXO.L Dialight Plc UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

D<strong>IG</strong>I.L Digital Marketing Group Plc UK 0 - 25 25% 25 - 150 30% 40% 150 - 450 50% 75% > 450 75%<br />

DTY.L Dignity Plc UK 0 - 350 20% 350 - 1100 30% 40% 1100 - 1400 50% 60% > 1400 75%<br />

DDT.L Dimension Data Holdings Plc UK 0 - 3750 20% 3750 - 10000 30% 40% 10000 - 20000 50% 60% > 20000 75%<br />

DPLM.L Diploma Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 1100 60% 75% > 1100 75%<br />

DISL.L Discover Leisure Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 6250 50% 75% > 6250 75%<br />

IDJG.L DJ Euro STOXX Growth - IDJG UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6000 35% 45% > 6000 75%<br />

DJMC.L DJ Euro STOXX Mid Cap - DJMC UK 0 - 350 10% 350 - 2100 20% 25% 2100 - 3500 35% 45% > 3500 75%<br />

IDVY.L DJ Euro STOXX Select Div - IDVY UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

DJSC.L DJ Euro STOXX Small Cap - DJSC UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

IDJV.L DJ Euro STOXX Value - IDJV UK 0 - 400 10% 400 - 2400 20% 25% 2400 - 4000 35% 45% > 4000 75%<br />

DMP1.L DM Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

DOLC.L Dolphin Capital Investors td UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 6500 50% 75% > 6500 75%<br />

DOPL.L Dominion Petroleum Ltd UK 0 - 100 25% 100 - 600 30% 40% 600 - 1900 50% 75% > 1900 75%<br />

DOPR.L Domino Printing Sciences UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

DOM.L Domino’s Pizza UK & IRL Plc UK 0 - 600 20% 600 - 1800 30% 40% 1800 - 3000 50% 60% > 3000 75%<br />

DGO.L Dragon Oil Plc UK 0 - 800 10% 800 - 4750 20% 25% 4750 - 8250 35% 45% > 8250 75%<br />

DUPD.L Dragon Ukrainian Properties UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

DRX.L Drax Group Plc UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 10000 35% 45% > 10000 75%<br />

DRV.L Driver Group Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 80 50% 75% > 80 75%<br />

SMDS.L DS Smith Plc UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 4750 60% 75% > 4750 75%<br />

DSGI.L DSG International UK 0 - 8250 15% 8250 - 50000 25% 30% 50000 - 80000 40% 55% > 80000 75%<br />

DTZ.L DTZ Holdings Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2300 60% 75% > 2300 75%<br />

D<strong>IG</strong>.L Dunedin Income Growth Inv Tst UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

DNDL.L Dunedin Smaller Companies Inv Tst UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

DNLM.L Dunelm Group UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1400 60% 75% > 1400 75%<br />

E2V.L E2V Technologies Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

EAGA.L EAGA Plc UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4250 75% 75% > 4250 75%<br />

DDIT.L Eaglet Investment Trust UK 0 - 200 25% 200 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

EPO.L Earthport Plc UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4250 75% 75% > 4250 75%<br />

EST.L Eastern European Trust UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

EMED.L Eastern Mediterranean Resources UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 6750 50% 75% > 6750 75%<br />

ELRq.L Eastern Platinum Ltd UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

EZJ.L easyJet Plc UK 0 - 1400 10% 1400 - 8500 20% 25% 8500 - 9750 35% 45% > 9750 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

ECK.L Eckoh Technologies Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

ECW.L Ecofin Water and Power Opp Plc UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

ECO.L EcoSecurities Group Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 4500 50% 75% > 4500 75%<br />

EDDR.L Edinburgh Dragon Trust Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

EDIN.L Edinburgh Inv Tst UK 0 - 1400 20% 1400 - 4250 30% 40% 4250 - 4250 75% 75% > 4250 75%<br />

EDNT.L Edinburgh New Income Trust UK 0 - 20 25% 20 - 60 30% 40% 60 - 80 50% 75% > 80 75%<br />

EUK.L Edinburgh UK Tracker Trust Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

EUS.L Edinburgh US Tracker Trust Plc UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

EWI.L Edinburgh Worldwide Inv Trust UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

EDD.L Education Development Int UK 0 - 50 25% 50 - 300 30% 40% 300 - 1700 50% 75% > 1700 75%<br />

EGRE.L Egdon Resources Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

ELCO.L Eleco UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

ELTA.L Electra Inv Tst UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

ELEG.L Electric and General Inv Tst UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

ELWO.L Electric Word PLC UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

ECM.L Electrocomponents Plc UK 0 - 1500 20% 1500 - 4500 30% 40% 4500 - 7500 50% 60% > 7500 75%<br />

ELDA.L Electronic Data Process UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

ELM.L Elementis Plc UK 0 - 1800 25% 1800 - 5500 40% 50% 5500 - 5500 75% 75% > 5500 75%<br />

EBLZ.L Emblaze Ltd UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

EMPR.L Empresaria Group Plc UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

EMEL.L Empyrean Energy Plc UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 10000 50% 75% > 10000 75%<br />

EO.L Encore Oil Plc UK 0 - 4250 25% 4250 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

EDA.L Endace Ltd UK 0 - 15 25% 15 - 90 30% 40% 90 - 150 50% 75% > 150 75%<br />

EGX.L Energetix Group Plc UK 0 - 25 25% 25 - 150 30% 40% 150 - 800 50% 75% > 800 75%<br />

EBG.L Energybuild Group Plc UK 0 - 150 25% 150 - 450 30% 40% 450 - 700 50% 75% > 700 75%<br />

ETI.L Enterprise Inns Plc UK 0 - 2300 15% 2300 - 15000 25% 30% 15000 - 20000 40% 55% > 20000 75%<br />

ENRE.L Environmant Recycling Tech UK 0 - 300 25% 300 - 1800 30% 40% 1800 - 3250 50% 75% > 3250 75%<br />

ESOE.L EPE Special Opportunities UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

EROS.L Eros International Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1400 50% 75% > 1400 75%<br />

ESGq.L Eservglobal Ltd UK 0 - 50 25% 50 - 300 30% 40% 300 - 1100 50% 75% > 1100 75%<br />

A<strong>IG</strong>A.L ETC Agriculture DJ-A<strong>IG</strong>CSM UK 0 - 2750 10% 2750 - 15000 20% 25% 15000 - 30000 35% 45% > 30000 75%<br />

A<strong>IG</strong>C.L ETC All Commodities DJ-A<strong>IG</strong>SM UK 0 - 1200 10% 1200 - 7250 20% 25% 7250 - 10000 35% 45% > 10000 75%<br />

ALMN.L ETC Aluminium UK 0 - 1100 10% 1100 - 6500 20% 25% 6500 - 10000 35% 45% > 10000 75%<br />

OILB.L ETC Brent 1mth Oil Securities UK 0 - 400 10% 400 - 2400 20% 25% 2400 - 4000 35% 45% > 4000 75%<br />

COFF.L ETC Coffee UK 0 - 4500 10% 4500 - 25000 20% 25% 25000 - 45000 35% 45% > 45000 75%<br />

COPA.L ETC Copper UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

CORN.L ETC Corn UK 0 - 14250 10% 14250 - 85000 20% 25% 85000 - 150000 35% 45% > 150000 75%<br />

COTN.L ETC Cotton UK 0 - 5250 15% 5250 - 30000 25% 30% 30000 - 55000 40% 55% > 55000 75%<br />

CRUD.L ETC Crude Oil UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6000 35% 45% > 6000 75%<br />

A<strong>IG</strong>E.L ETC Energy DJ-A<strong>IG</strong>SM UK 0 - 1200 10% 1200 - 7250 20% 25% 7250 - 10000 35% 45% > 10000 75%<br />

A<strong>IG</strong>X.L ETC Ex-Energy DJ-A<strong>IG</strong>SM ETC UK 0 - 1700 10% 1700 - 10000 20% 25% 10000 - 15000 35% 45% > 15000 75%<br />

UGAS.L ETC Gasoline UK 0 - 350 10% 350 - 2100 20% 25% 2100 - 3500 35% 45% > 3500 75%<br />

BULL.L ETC Gold UK 0 - 1200 10% 1200 - 7250 20% 25% 7250 - 10000 35% 45% > 10000 75%<br />

GRNS.L ETC Grains DJ-A<strong>IG</strong>SM UK 0 - 3750 10% 3750 - 25000 20% 25% 25000 - 40000 35% 45% > 40000 75%<br />

HEAT.L ETC Heating Oil UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6000 35% 45% > 6000 75%<br />

A<strong>IG</strong>I.L ETC Industrial Metals DJ-A<strong>IG</strong>SM UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 10000 35% 45% > 10000 75%<br />

HOGS.L ETC Lean Hogs UK 0 - 7750 10% 7750 - 45000 20% 25% 45000 - 80000 35% 45% > 80000 75%<br />

LOIL.L ETC Lev Crude Oil UK 0 - 3000 15% 3000 - 20000 25% 30% 20000 - 30000 40% 55% > 30000 75%<br />

LBUL.L ETC Leveraged Gold UK 0 - 400 10% 400 - 2400 20% 25% 2400 - 4000 35% 45% > 4000 75%<br />

CATL.L ETC Live Cattle UK 0 - 1400 10% 1400 - 8500 20% 25% 8500 - 15000 35% 45% > 15000 75%<br />

A<strong>IG</strong>L.L ETC Livestock DJ-A<strong>IG</strong>SM UK 0 - 3500 10% 3500 - 20000 20% 25% 20000 - 35000 35% 45% > 35000 75%<br />

NGAS.L ETC Natural Gas UK 0 - 33250 10% 33250 - 200000 20% 25% 200000 - 350000 35% 45% > 350000 75%<br />

NICK.L ETC Nickel UK 0 - 800 10% 800 - 4750 20% 25% 4750 - 8000 35% 45% > 8000 75%<br />

A<strong>IG</strong>O.L ETC Petroleum DJ-A<strong>IG</strong>SM UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6000 35% 45% > 6000 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

PHAU.L ETC Physical Gold UK 0 - 150 10% 150 - 900 20% 25% 900 - 1500 35% 45% > 1500 75%<br />

PHPD.L ETC Physical Palladium UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

PHPT.L ETC Physical Platinum UK 0 - 150 10% 150 - 900 20% 25% 900 - 1500 35% 45% > 1500 75%<br />

PHPM.L ETC Physical PM Basket UK 0 - 200 10% 200 - 1200 20% 25% 1200 - 2000 35% 45% > 2000 75%<br />

PHAG.L ETC Physical Silver UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 10000 35% 45% > 10000 75%<br />

A<strong>IG</strong>P.L ETC Precious Metals DJ-A<strong>IG</strong>SM UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 10000 35% 45% > 10000 75%<br />

SOIL.L ETC Short Crude Oil UK 0 - 250 10% 250 - 1500 20% 25% 1500 - 2500 35% 45% > 2500 75%<br />

SLVR.L ETC Silver UK 0 - 800 10% 800 - 4750 20% 25% 4750 - 8000 35% 45% > 8000 75%<br />

A<strong>IG</strong>S.L ETC Softs DJ-A<strong>IG</strong>SM UK 0 - 1800 10% 1800 - 10000 20% 25% 10000 - 20000 35% 45% > 20000 75%<br />

SOYO.L ETC Soybean Oil UK 0 - 2500 10% 2500 - 15000 20% 25% 15000 - 25000 35% 45% > 25000 75%<br />

SOYB.L ETC Soybeans UK 0 - 1100 10% 1100 - 6500 20% 25% 6500 - 10000 35% 45% > 10000 75%<br />

SUGA.L ETC Sugar UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 9000 35% 45% > 9000 75%<br />

WEAT.L ETC Wheat UK 0 - 8750 10% 8750 - 55000 20% 25% 55000 - 90000 35% 45% > 90000 75%<br />

OILW.L ETC WTI 2mth Oil Securities UK 0 - 300 10% 300 - 1800 20% 25% 1800 - 3000 35% 45% > 3000 75%<br />

ZINC.L ETC Zinc UK 0 - 1200 10% 1200 - 7250 20% 25% 7250 - 10000 35% 45% > 10000 75%<br />

IDEM.L ETF Emerging Markets UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

IEEM.L ETF MSCI Emerging Markets UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

LNGA.L ETFS Leveraged Natural Gas UK 0 - 9750 15% 9750 - 60000 25% 30% 60000 - 100000 40% 55% > 100000 75%<br />

SUK2.L ETFX FTSE 100 UK 0 - 20 10% 20 - 120 20% 25% 120 - 200 35% 50% > 200 75%<br />

ENRC.L Eurasian Nat Res UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 10000 35% 50% > 10000 75%<br />

ERM.L Euromoney Institutional Investor UK 0 - 300 25% 300 - 900 40% 50% 900 - 900 75% 75% > 900 75%<br />

EOG.L Europa Oil and Gas Holdings Plc UK 0 - 150 25% 150 - 900 30% 40% 900 - 900 75% 75% > 900 75%<br />

EUNZ.L European Assets Trust NV UK 0 - 10 25% 10 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

EGUq.L European Goldfields Ltd UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

EIIB.L European Islamic Investment Bank UK 0 - 5500 25% 5500 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

ENK.L European Nickel Plc UK 0 - 4000 25% 4000 - 10000 40% 50% 10000 - 10000 75% 75% > 10000 75%<br />

MPE.L Evans (M.P.) Group UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

EVG.L Evolution Group Plc UK 0 - 1200 20% 1200 - 3500 30% 40% 3500 - 4750 50% 60% > 4750 75%<br />

EXPN.L Experian Group Ltd UK 0 - 1800 5% 1800 - 10000 10% 20% 10000 - 20000 25% 40% > 20000 75%<br />

FCAM.L F&C Asset Management Plc UK 0 - 2100 15% 2100 - 15000 25% 30% 15000 - 15000 75% 75% > 15000 75%<br />

FCI.L F&C Capital & Income Inv Tst UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

FCPTL.L F&C Commercial Property Trust Ltd UK 0 - 1700 25% 1700 - 5000 40% 50% 5000 - 5000 75% 75% > 5000 75%<br />

FPERx.L F&C Private Equity Trust UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

FCS.L F&C Smaller Companies Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

FUS.L F&C UK Select Trust Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 200 50% 75% > 200 75%<br />

FCSM.L F&C US Smaller Companies Plc UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

FRPG.L Fairpoint Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

FKL.L Falkland Island Holdings UK 0 - 10 25% 10 - 60 30% 40% 60 - 90 50% 75% > 90 75%<br />

FOGL.L Falkland Oil & Gas Ltd UK 0 - 75 25% 75 - 450 30% 40% 450 - 1300 50% 75% > 1300 75%<br />

FPM.L Faroe Petroleum Plc UK 0 - 300 25% 300 - 900 40% 50% 900 - 1300 60% 75% > 1300 75%<br />

FENR.L Fenner Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 3000 60% 75% > 3000 75%<br />

FXPO.L Ferrexpo Plc UK 0 - 1100 20% 1100 - 3250 30% 40% 3250 - 5000 50% 60% > 5000 75%<br />

FFA.L Ffastfill Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 3250 50% 75% > 3250 75%<br />

FWEB.L Fiberweb Plc UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 4500 60% 75% > 4500 75%<br />

FAS.L Fidelity Asian Values Plc UK 0 - 1200 25% 1200 - 3500 40% 50% 3500 - 3500 75% 75% > 3500 75%<br />

FEV.L Fidelity European Values Plc UK 0 - 250 20% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

FJV.L Fidelity Japanese Values Plc UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

FSV.L Fidelity Special Values Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

FDSA.L Fidessa Group PLC UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

FLTR.L Filtrona Plc UK 0 - 800 20% 800 - 2400 30% 40% 2400 - 3750 50% 60% > 3750 75%<br />

FTC.L Filtronic Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

FDL.L Findel Plc UK 0 - 1700 25% 1700 - 5000 40% 50% 5000 - 5000 75% 75% > 5000 75%<br />

FGT.L Finsbury Growth & Income Trust Plc UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 1800 75% 75% > 1800 75%<br />

FWP.L Finsbury Worldwide Pharm Tst UK 0 - 200 25% 200 - 600 40% 50% 600 - 650 60% 75% > 650 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

FWPx.L Finsbury Worldwide Pharm Tst UK 0 - 15 25% 15 - 50 40% 50% 50 - 50 75% 75% > 50 75%<br />

FDI.L Firestone Diamonds Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 2000 50% 75% > 2000 75%<br />

FIAR.L First Artist Corporation UK 0 - 25 25% 25 - 150 30% 40% 150 - 300 50% 75% > 300 75%<br />

FRST.L First Derivatives Plc UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

FSTP.L First Property Group PLC UK 0 - 100 25% 100 - 600 30% 40% 600 - 950 50% 75% > 950 75%<br />

FGP.L Firstgroup Plc UK 0 - 2200 10% 2200 - 15000 20% 25% 15000 - 15000 75% 75% > 15000 75%<br />

FCU.L Foreign & Colonial Eurotrust Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

FRCL.L Foreign & Colonial Investment Tst UK 0 - 1900 15% 1900 - 5750 25% 30% 5750 - 6000 40% 55% > 6000 75%<br />

FTEFE.L Forte Energy NL UK 0 - 7500 25% 7500 - 25000 40% 50% 25000 - 25000 75% 75% > 25000 75%<br />

FPT.L Forth Ports Plc UK 0 - 250 20% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

FOOI.L Fortune Oil Plc UK 0 - 7000 25% 7000 - 20000 40% 50% 20000 - 20000 75% 75% > 20000 75%<br />

FIT.L Framlington Innovative Growth Tst UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

FCCN.L French Connection Group Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

FRES.L Fresnillo Plc UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 5750 35% 50% > 5750 75%<br />

FP.L Friends Provident Plc UK 0 - 4500 10% 4500 - 25000 20% 25% 25000 - 40000 35% 50% > 40000 75%<br />

FRR.L Frontera Resources Corp UK 0 - 50 25% 50 - 300 30% 40% 300 - 2200 50% 75% > 2200 75%<br />

FMLq.L Frontier Mining Ltd UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 15000 50% 75% > 15000 75%<br />

BRIC.L FTSE BRIC 50 UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 5000 35% 45% > 5000 75%<br />

IUKP.L FTSE EPRA/NAREIT UK Property Fund UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 9000 35% 45% > 9000 75%<br />

IUKD.L FTSE UK Dividend Plus - IUKD UK 0 - 1500 10% 1500 - 9000 20% 25% 9000 - 15000 35% 45% > 15000 75%<br />

<strong>IG</strong>LT.L FTSE UK Gilt All Stocks - <strong>IG</strong>LT UK 0 - 1000 10% 1000 - 6000 20% 25% 6000 - 10000 35% 45% > 10000 75%<br />

IEUR.L FTSEurofirst 80 - IEUR UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 6000 35% 45% > 6000 75%<br />

FSTA.L Fuller Smith & Turner UK 0 - 70 25% 70 - 200 40% 50% 200 - 200 75% 75% > 200 75%<br />

FUM.L Futura Medical Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 600 50% 75% > 600 75%<br />

FGN.L Futuragene Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

FUTR.L Future Plc UK 0 - 1500 25% 1500 - 4500 40% 50% 4500 - 4500 75% 75% > 4500 75%<br />

FFY.L Fyffes UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

GAH.L Gable Holdings Inc UK 0 - 250 25% 250 - 750 30% 40% 750 - 800 50% 75% > 800 75%<br />

GAGO.L Galantas Gold Corp UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

GFRM.L Galiform Plc UK 0 - 1600 15% 1600 - 9500 25% 30% 9500 - 20000 40% 55% > 20000 75%<br />

GON.L Galleon Holdings Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

GFRD.L Galliford Try Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 1000 75% 75% > 1000 75%<br />

GMG.L Game Group Plc UK 0 - 2300 15% 2300 - 7000 25% 30% 7000 - 15000 40% 55% > 15000 75%<br />

GAW.L Games Workshop Group Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 150 50% 75% > 150 75%<br />

GVCq.L Gaming VC Holdings SA UK 0 - 25 25% 25 - 150 30% 40% 150 - 400 50% 75% > 400 75%<br />

ABAA.L Gartmore Asia Pacific Trust UK 0 - 10 25% 10 - 30 30% 40% 30 - 50 50% 75% > 50 75%<br />

GEU.L Gartmore European Investment Tst UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

GMF.L Gartmore Fledgling Trust Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

GGL.L Gartmore Global Trust Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

GGOR.L Gartmore Growth Opportunities Plc UK 0 - 5 25% 5 - 30 30% 40% 30 - 70 50% 75% > 70 75%<br />

GIR.L Gartmore Irish Growth Fund Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

GAST.L Gas Turbine Efficiency Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1200 50% 75% > 1200 75%<br />

GASL.L Gasol Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 15000 50% 75% > 15000 75%<br />

GBGP.L GB Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

INXG.L GBP <strong>Index</strong> Linked Gilt - INXG UK 0 - 900 10% 900 - 5500 20% 25% 5500 - 9000 35% 45% > 9000 75%<br />

GEMD.L Gem Diamonds UK 0 - 600 20% 600 - 1800 30% 40% 1800 - 2100 50% 60% > 2100 75%<br />

GEM.L Gemfields UK 0 - 100 25% 100 - 600 30% 40% 600 - 2000 50% 75% > 2000 75%<br />

GMX.L Genemedix Plc UK 0 - 200 25% 200 - 600 30% 40% 600 - 600 75% 75% > 600 75%<br />

GENE.L Genesis Emerging Markets Fund Ltd UK 0 - 5 25% 5 - 30 30% 40% 30 - 100 50% 75% > 100 75%<br />

GTX.L Genetix Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 200 50% 75% > 200 75%<br />

GENS.L Genus Plc UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

GNG.L Geong International Ltd. UK 0 - 50 25% 50 - 150 30% 40% 150 - 300 50% 75% > 300 75%<br />

GPK.L Geopark Holdings Ltd UK 0 - 15 25% 15 - 90 30% 40% 90 - 100 50% 75% > 100 75%<br />

GETM.L Getmobile UK 0 - 10 25% 10 - 30 30% 40% 30 - 30 75% 75% > 30 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

GKN.L GKN Plc UK 0 - 8500 15% 8500 - 50000 25% 30% 50000 - 60000 40% 55% > 60000 75%<br />

GPNG.L Gladstone Pacific Nickel UK 0 - 10 25% 10 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

GLAD.L Gladstone Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

GL9.L Glanbia (LSE) UK 0 - 150 20% 150 - 900 30% 40% 900 - 2000 50% 60% > 2000 75%<br />

GLS.L Glasgow Income Trust UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

GSK.L GlaxoSmithKline Plc UK 0 - 800 5% 800 - 4750 10% 20% 4750 - 60000 25% 40% > 60000 75%<br />

GCM.L Global Coal Management Plc UK 0 - 400 25% 400 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

GBLE.L Global Energy Development Plc UK 0 - 30 25% 30 - 90 30% 40% 90 - 90 75% 75% > 90 75%<br />

GBPq.L Global Petroleum Ltd UK 0 - 150 25% 150 - 900 30% 40% 900 - 2750 50% 75% > 2750 75%<br />

GO.L Globeop Financial Services UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

GLBS.L Globus Maritime Ltd UK 0 - 20 25% 20 - 60 30% 40% 60 - 70 50% 75% > 70 75%<br />

GMA.L GMA Resources Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 4000 50% 75% > 4000 75%<br />

GOG.L Go-Ahead Group Plc UK 0 - 150 15% 150 - 900 25% 30% 900 - 1000 40% 55% > 1000 75%<br />

GOAL.L Goals Soccer Centres Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

GOI.L GoIndustry Plc UK 0 - 1000 25% 1000 - 3000 30% 40% 3000 - 3000 75% 75% > 3000 75%<br />

GOO.L Gold Oil Plc UK 0 - 4750 25% 4750 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

GPRT.L GoldenPort Holdings Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

GSDO.L Goldman Sachs Dynamic Opps £ UK 0 - 5000 25% 5000 - 15000 40% 50% 15000 - 15000 75% 75% > 15000 75%<br />

GSDOx.L Goldman Sachs Dynamic Opps € UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

GLDP.L Goldplat Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 350 50% 75% > 350 75%<br />

GSD.L Goldshield Group Plc UK 0 - 70 25% 70 - 200 40% 50% 200 - 300 60% 75% > 300 75%<br />

GDWN.L Goodwin Plc UK 0 - 30 25% 30 - 90 40% 50% 90 - 90 75% 75% > 90 75%<br />

GRF_u.L Grafton Group (LSE) UK 0 - 200 20% 200 - 1200 35% 50% 1200 - 2750 50% 75% > 2750 75%<br />

GRI.L Grainger Trust Plc UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1600 60% 75% > 1600 75%<br />

GPE.L Graphite Enterprise Trust Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

GEECq.L Great Eastern Energ-GDR REGS UK 0 - 25 25% 25 - 150 30% 40% 150 - 650 50% 75% > 650 75%<br />

GPOR.L Great Portland Estates Plc UK 0 - 1000 20% 1000 - 6000 30% 40% 6000 - 8000 50% 60% > 8000 75%<br />

GNC.L Greencore Group (LSE) UK 0 - 400 20% 400 - 2400 35% 50% 2400 - 2750 50% 75% > 2750 75%<br />

GNK.L Greene King Plc UK 0 - 600 10% 600 - 3500 20% 25% 3500 - 5500 35% 45% > 5500 75%<br />

GKO.L Greenko Group Plc UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

GRG.L Greggs Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1400 60% 75% > 1400 75%<br />

GHT.L Gresham Computing Plc UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

GFM.L Griffin Mining Ltd UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2300 50% 75% > 2300 75%<br />

GFS.L Group 4 Securicor Plc UK 0 - 4500 10% 4500 - 25000 20% 25% 25000 - 30000 35% 50% > 30000 75%<br />

GTL.L GTL Resources Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 450 50% 75% > 450 75%<br />

GKP.L Gulf Keystone Petroleum Ltd UK 0 - 2100 25% 2100 - 15000 40% 50% 15000 - 45000 60% 75% > 45000 75%<br />

GPX.L Gulfsands Petroleum Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2750 60% 75% > 2750 75%<br />

GWP.L GW Pharmaceuticals Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

HTGR.L H&T Group UK 0 - 150 25% 150 - 450 40% 50% 450 - 650 60% 75% > 650 75%<br />

HAIK.L Haike Chemical Group Ltd UK 0 - 50 25% 50 - 300 30% 40% 300 - 500 50% 75% > 500 75%<br />

HFD.L Halfords Group Plc UK 0 - 700 15% 700 - 4250 25% 30% 4250 - 4250 75% 75% > 4250 75%<br />

HMS.L Hallin Marine Subsea Intl UK 0 - 30 25% 30 - 200 30% 40% 200 - 500 50% 75% > 500 75%<br />

HLMA.L Halma Plc UK 0 - 1300 20% 1300 - 4000 30% 40% 4000 - 6000 50% 60% > 6000 75%<br />

HMB.L Hambledon Mining Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 6750 50% 75% > 6750 75%<br />

HMSO.L Hammerson Plc UK 0 - 2300 10% 2300 - 15000 20% 25% 15000 - 20000 35% 50% > 20000 75%<br />

HAMP.L Hampson Industries Plc UK 0 - 500 25% 500 - 3000 40% 50% 3000 - 3750 60% 75% > 3750 75%<br />

HAMW.L Hamworthy KSE UK 0 - 200 25% 200 - 600 40% 50% 600 - 1000 60% 75% > 1000 75%<br />

HAN.L Hansa Trust Plc UK 0 - 50 25% 50 - 150 40% 50% 150 - 150 75% 75% > 150 75%<br />

HSD.L Hansard Global Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

HWH.L Hanson Westhouse Holding Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

HSTN.L Hansteen Holdings Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

HDD.L Hardide UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 2000 50% 75% > 2000 75%<br />

HAOG.L Hardy Oil & Gas Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

HDU.L Hardy Underwriting Group Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

HRGV.L Hargreaves Lansdown Plc UK 0 - 800 20% 800 - 2400 30% 40% 2400 - 3750 50% 60% > 3750 75%<br />

HASE.L Hargreaves Services Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 500 60% 75% > 500 75%<br />

HARH.L Harvard International Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

HARV.L Harvey Nash Group Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 1200 50% 75% > 1200 75%<br />

HAVE.L Havelock Europa Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

HAYS.L Hays Plc UK 0 - 4750 10% 4750 - 30000 20% 25% 30000 - 40000 35% 45% > 40000 75%<br />

HEAD.L Headlam Group Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 850 60% 75% > 850 75%<br />

HCEG.L Healthcare Enterprise Group Plc UK 0 - 20 25% 20 - 60 30% 40% 60 - 70 50% 75% > 70 75%<br />

HLO.L Healthcare Locums Plc UK 0 - 600 20% 600 - 1800 30% 40% 1800 - 3250 50% 60% > 3250 75%<br />

HLS.L Helesi Plc UK 0 - 25 25% 25 - 150 30% 40% 150 - 250 50% 75% > 250 75%<br />

HLCL.L Helical Bar Plc UK 0 - 300 25% 300 - 900 40% 50% 900 - 1500 60% 75% > 1500 75%<br />

HEGY.L Helius Energy Plc UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

HCLL.L Hellenic Carriers Ltd UK 0 - 20 25% 20 - 60 30% 40% 60 - 100 50% 75% > 100 75%<br />

HHR.L Helphire Plc UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

HNE.L Henderson EuroTrust Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

HFEL.L Henderson Far East Income Trust Ltd UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

HGGH.L Henderson Group Plc UK 0 - 1000 15% 1000 - 6000 25% 30% 6000 - 10000 40% 55% > 10000 75%<br />

HHI.L Henderson High Income Trust Plc UK 0 - 500 25% 500 - 1500 40% 50% 1500 - 1500 75% 75% > 1500 75%<br />

HPEQ.L Henderson Private Equity Invest UK 0 - 20 25% 20 - 60 30% 40% 60 - 60 75% 75% > 60 75%<br />

HSL.L Henderson Smaller Companies Inv Tst UK 0 - 300 25% 300 - 900 40% 50% 900 - 1100 60% 75% > 1100 75%<br />

HPI.L Henderson TR Pacific Investment Tst UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 3250 75% 75% > 3250 75%<br />

HRI.L Herald Inv Tst UK 0 - 450 25% 450 - 1400 40% 50% 1400 - 1400 75% 75% > 1400 75%<br />

HOIL.L Heritage Oil Ltd UK 0 - 300 10% 300 - 1800 20% 25% 1800 - 7250 35% 45% > 7250 75%<br />

H<strong>IG</strong>P.L Hertford International Group UK 0 - 150 25% 150 - 450 30% 40% 450 - 450 75% 75% > 450 75%<br />

HHC.L Hexagon Human Capital PLC UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

HGT.L HgCapital Trust Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

HIF.L Hidefield Gold Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 2300 50% 75% > 2300 75%<br />

HGM.L Highland Gold Mining Ltd UK 0 - 600 25% 600 - 1800 40% 50% 1800 - 3500 60% 75% > 3500 75%<br />

HT<strong>IG</strong>.L Hightex Group Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 2400 50% 75% > 2400 75%<br />

HIK.L Hikma Pharmaceuticals UK 0 - 400 20% 400 - 1200 30% 40% 1200 - 1400 50% 60% > 1400 75%<br />

HILS.L Hill & Smith Holdings Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

HFG.L Hilton Food Group Ltd UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

HRCO.L Hirco PLC UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

HSX.L Hiscox Plc UK 0 - 1100 15% 1100 - 3250 25% 30% 3250 - 6250 40% 55% > 6250 75%<br />

HMV.L HMV Group Plc UK 0 - 2750 15% 2750 - 8250 25% 30% 8250 - 15000 40% 55% > 15000 75%<br />

HOCM.L Hochschild Mining Plc UK 0 - 600 15% 600 - 3500 25% 30% 3500 - 5000 40% 55% > 5000 75%<br />

HRG.L Hogg Robinson Group Plc UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4750 60% 75% > 4750 75%<br />

HBR.L Holidaybreak Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

HOME.L Home Retail Group UK 0 - 1400 5% 1400 - 8500 10% 20% 8500 - 35000 25% 40% > 35000 75%<br />

HSV.L Homeserve Plc UK 0 - 150 20% 150 - 450 30% 40% 450 - 700 50% 60% > 700 75%<br />

HRN.L Hornby Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />

HTT.L Hot Tuna International Plc UK 0 - 500 25% 500 - 3000 30% 40% 3000 - 20000 50% 75% > 20000 75%<br />

HCOP.L Hotel Corp Plc/The UK 0 - 5 25% 5 - 30 30% 40% 30 - 200 50% 75% > 200 75%<br />

HRO.L HR Owen Plc UK 0 - 10 25% 10 - 30 30% 40% 30 - 40 50% 75% > 40 75%<br />

HSBA.L HSBC Holdings Plc UK 0 - 1500 5% 1500 - 9000 10% 20% 9000 - 300000 25% 40% > 300000 75%<br />

HICL.L HSBC Infrastructure Co UK 0 - 4500 20% 4500 - 15000 30% 40% 15000 - 15000 75% 75% > 15000 75%<br />

HTG.L Hunting Plc UK 0 - 500 15% 500 - 1500 25% 30% 1500 - 2750 40% 55% > 2750 75%<br />

HNTS.L Huntsworth Plc UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

HCM.L Hutchison China Meditech Ltd UK 0 - 10 25% 10 - 60 30% 40% 60 - 450 50% 75% > 450 75%<br />

HVX.L Huveaux Plc UK 0 - 100 25% 100 - 600 30% 40% 600 - 700 50% 75% > 700 75%<br />

HYC.L Hyder Consulting Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

HYR.L Hydrodec Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 1400 50% 75% > 1400 75%<br />

IBCX.L IBCX Euro Corporate Bond UK 0 - 90 10% 90 - 550 20% 25% 550 - 900 35% 45% > 900 75%<br />

IAP.L ICAP Plc UK 0 - 1700 10% 1700 - 10000 20% 25% 10000 - 15000 35% 50% > 15000 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

IDLS.L Ideal Shopping UK 0 - 30 25% 30 - 200 30% 40% 200 - 350 50% 75% > 350 75%<br />

IDOX.L IDOX UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2000 50% 75% > 2000 75%<br />

IFP.L IFG Group Plc UK 0 - 400 25% 400 - 1200 40% 50% 1200 - 1200 75% 75% > 1200 75%<br />