Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

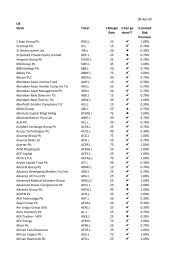

<strong>Shares</strong> <strong>List</strong><br />

(continued)<br />

Reuters Description Country Tier 1 Tier 1 Tier 2 Tier 2 Tier 2 Tier 3 Tier 3 Tier 3 Tier 4 Tier 4<br />

Range Deposit Range Deposit Deposit Range Deposit Deposit Range Deposit<br />

(Amount (All) (Amount (Select) (Plus) (Amount (Select) (Plus) (Amount (All)<br />

per Point) per Point) per Point) per Point)<br />

LCT.L Lincat Group Plc UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

LIO.L Liontrust Asset Management Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 850 60% 75% > 850 75%<br />

LIPX.L Lipoxen Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 3250 50% 75% > 3250 75%<br />

AUIV.L Livermore Investments Group Plc UK 0 - 4000 25% 4000 - 10000 40% 50% 10000 - 10000 75% 75% > 10000 75%<br />

LLOY.L Lloyds TSB Group Plc UK 0 - 9500 10% 9500 - 55000 20% 25% 55000 - 550000 35% 50% > 550000 75%<br />

LOG.L LogicaCMG Plc UK 0 - 6000 10% 6000 - 35000 20% 25% 35000 - 50000 35% 45% > 50000 75%<br />

LOK.L Lok’nStore Group Plc UK 0 - 50 25% 50 - 150 30% 40% 150 - 150 75% 75% > 150 75%<br />

LMMT.L Lombard Medical Tech UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 5000 50% 75% > 5000 75%<br />

LAS.L London & Associated Properties Plc UK 0 - 100 25% 100 - 300 30% 40% 300 - 300 75% 75% > 300 75%<br />

LSP.L London & Stamford Property Ltd UK 0 - 250 25% 250 - 1500 30% 40% 1500 - 2300 50% 75% > 2300 75%<br />

LCG.L London Capital Group Holdings Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 750 60% 75% > 750 75%<br />

LSE.L London Stock Exchange Plc UK 0 - 1200 20% 1200 - 3500 35% 50% 3500 - 6250 50% 75% > 6250 75%<br />

LMI.L Lonmin Plc UK 0 - 500 10% 500 - 3000 20% 25% 3000 - 7750 35% 50% > 7750 75%<br />

LONR.L Lonrho Africa Plc UK 0 - 4750 25% 4750 - 15000 40% 50% 15000 - 20000 60% 75% > 20000 75%<br />

LZM.L Lonzim Plc UK 0 - 50 25% 50 - 300 30% 40% 300 - 1600 50% 75% > 1600 75%<br />

LOOK.L Lookers Plc UK 0 - 1400 25% 1400 - 4250 40% 50% 4250 - 4250 75% 75% > 4250 75%<br />

LWB.L Low & Bonar Plc UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

LWI.L Lowland Investment Company Plc UK 0 - 100 25% 100 - 300 40% 50% 300 - 300 75% 75% > 300 75%<br />

LQDE.L LQDE USD Corporate Bond UK 0 - 150 10% 150 - 900 20% 25% 900 - 1500 35% 45% > 1500 75%<br />

LSL.L LSL Property UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1300 60% 75% > 1300 75%<br />

LMR.L Luminar Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1500 60% 75% > 1500 75%<br />

LUP.L Lupus Capital Plc UK 0 - 1300 25% 1300 - 4000 40% 50% 4000 - 4000 75% 75% > 4000 75%<br />

LNFT.L Lyxor ETF India S&P CNX NIFTY UK 0 - 60 10% 60 - 350 20% 25% 350 - 600 35% 45% > 600 75%<br />

GBSx.L Lyxor Gold Bullion Securities UK 0 - 150 10% 150 - 900 20% 25% 900 - 1500 35% 45% > 1500 75%<br />

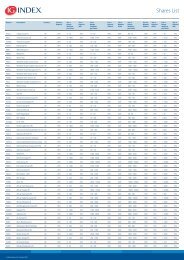

MEQ.L M&G Equity Inv Trust Plc UK 0 - 200 25% 200 - 600 30% 40% 600 - 600 75% 75% > 600 75%<br />

MPO.L Macau Property UK 0 - 100 25% 100 - 600 30% 40% 600 - 1100 50% 75% > 1100 75%<br />

MACF.L Macfarlane Group Plc UK 0 - 250 25% 250 - 750 30% 40% 750 - 750 75% 75% > 750 75%<br />

MAGM.L Maghreb Minerals Plc UK 0 - 150 25% 150 - 900 30% 40% 900 - 3250 50% 75% > 3250 75%<br />

MAJE.L Majedie Investments Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

MJW.L Majestic Wine Plc UK 0 - 350 25% 350 - 1100 40% 50% 1100 - 1100 75% 75% > 1100 75%<br />

EMG.L Man Group Plc UK 0 - 3750 10% 3750 - 25000 20% 25% 25000 - 55000 35% 50% > 55000 75%<br />

MSPS.L Managed Support Services Plc UK 0 - 500 25% 500 - 1500 30% 40% 1500 - 1500 75% 75% > 1500 75%<br />

NZX.L Management Consulting Group Plc UK 0 - 1100 25% 1100 - 3250 40% 50% 3250 - 4000 60% 75% > 4000 75%<br />

MNL.L Manchester & London Inv Trust UK 0 - 5 25% 5 - 20 30% 40% 20 - 20 75% 75% > 20 75%<br />

MNGS.L Manganese Bronze Hldgs Plc UK 0 - 200 25% 200 - 600 40% 50% 600 - 600 75% 75% > 600 75%<br />

MKS.L Marks & Spencer Group Plc UK 0 - 2750 5% 2750 - 15000 10% 20% 15000 - 55000 25% 40% > 55000 75%<br />

MSLH.L Marshalls Plc UK 0 - 700 25% 700 - 2100 40% 50% 2100 - 2100 75% 75% > 2100 75%<br />

MARS.L Marston’s Plc UK 0 - 1400 15% 1400 - 8500 25% 30% 8500 - 15000 40% 55% > 15000 75%<br />

MACP.L Martin Currie Pacific Trust Plc UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

MNP.L Martin Currie Portfolio Inv Tst UK 0 - 800 25% 800 - 2400 40% 50% 2400 - 2400 75% 75% > 2400 75%<br />

MRWN.L Marwyn Value Investors II Ltd UK 0 - 35 25% 35 - 200 30% 40% 200 - 450 50% 75% > 450 75%<br />

MWB.L Marylebone Warwick Balfour Group UK 0 - 1000 25% 1000 - 3000 40% 50% 3000 - 3000 75% 75% > 3000 75%<br />

MTEC.L Matchtech Group Plc UK 0 - 5 25% 5 - 30 30% 40% 30 - 200 50% 75% > 200 75%<br />

MPTR.L Matra Petroleum Plc UK 0 - 750 25% 750 - 4500 30% 40% 4500 - 30000 50% 75% > 30000 75%<br />

MERE_p.L Matrix European Real Estate Fund UK 0 - 900 25% 900 - 2750 40% 50% 2750 - 2750 75% 75% > 2750 75%<br />

MTWL.L Mattioli Woods Plc UK 0 - 10 25% 10 - 30 30% 40% 30 - 40 50% 75% > 40 75%<br />

MXP.L Max Petroleum Plc UK 0 - 4000 25% 4000 - 25000 40% 50% 25000 - 25000 75% 75% > 25000 75%<br />

MXM.L Maxima Holdings Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 250 50% 75% > 250 75%<br />

MAYG.L May Gurney UK 0 - 250 25% 250 - 750 40% 50% 750 - 750 75% 75% > 750 75%<br />

MUBL.L MBL Group Plc UK 0 - 25 25% 25 - 80 30% 40% 80 - 80 75% 75% > 80 75%<br />

MCB.L Mcbride Plc UK 0 - 1200 20% 1200 - 3500 30% 40% 3500 - 3500 75% 75% > 3500 75%<br />

MCKS.L Mckay Securities Plc UK 0 - 150 25% 150 - 450 40% 50% 450 - 450 75% 75% > 450 75%<br />

MDME.L MDM Engineering Group Ltd UK 0 - 20 25% 20 - 60 30% 40% 60 - 80 50% 75% > 80 75%<br />

MDY.L MDY Healthcare Plc UK 0 - 10 25% 10 - 60 30% 40% 60 - 90 50% 75% > 90 75%<br />

<strong>IG</strong> <strong>Index</strong> <strong>Shares</strong> list, October 2009