citynews - City of Cape Town

citynews - City of Cape Town

citynews - City of Cape Town

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 CITYNEWS May 2012<br />

Rebates, grants and<br />

other relief measures<br />

The <strong>City</strong> provides relief for the indigent,<br />

aged, disabled and other vulnerable<br />

residents through a range <strong>of</strong><br />

rebates, grants and other measures.<br />

Indigent grants<br />

The first R200 000 <strong>of</strong> residential<br />

property value is not billed for rates.<br />

It is proposed that households with a<br />

total monthly household income <strong>of</strong><br />

between R3 000 and R4 000 receive<br />

a rates rebate <strong>of</strong> 50% while those<br />

households earning less than R3 000<br />

qualify for a 100% rates rebate.<br />

Properties valued up to and including<br />

R100 000 will receive a 100%<br />

rebate on their refuse removal service.<br />

This rebate reduces as valuation<br />

increases, and falls away when the<br />

valuation exceeds R400 000.<br />

The monthly indigent grant to residential<br />

properties valued up to<br />

R300 000 will increase from R40,50 to<br />

R53,27. These households will receive<br />

an additional 4,5 kℓ (150 litres per day)<br />

<strong>of</strong> free water in addition to the 6 kℓ<br />

per month (200 litres per day) provided<br />

free to all residential properties.<br />

Rates relief<br />

The effects <strong>of</strong> reduced interest rates<br />

on income and <strong>of</strong> inflation have an<br />

impact on many people, but the elderly<br />

and the disabled, who may be<br />

reliant on fixed or investment income,<br />

are particularly affected.<br />

To provide some relief for these<br />

residents, the <strong>City</strong> has adjusted rates<br />

and increased rebates.<br />

The maximum total monthly<br />

household income threshold will be<br />

increased for these groups from<br />

R10 000 to R10 500 per month.<br />

Households with an income <strong>of</strong><br />

R3 000 and below are eligible for a<br />

100% rates rebate, reducing to 10%<br />

for income between R10 001 and<br />

R10 500.<br />

• Residents who think they are eligible<br />

for grants or rebates should<br />

visit their local Council <strong>of</strong>fices or<br />

call the <strong>City</strong>’s contact centre on<br />

0860 103 089.<br />

Farewell, 5c coin<br />

The <strong>City</strong>’s cash <strong>of</strong>fices will soon no<br />

longer handle 5c coins.<br />

This decision follows an announcement<br />

by the South African Mint about<br />

discontinuing the coin in April.<br />

All cash payments will be rounded<br />

down to the nearest 10c.<br />

The cent balance on invoices will<br />

reflect as a ‘rounded-down amount<br />

b/f’ and will not attract interest.<br />

KORTLIKS<br />

Die Stad se konsepbegroting van R29,6 miljard<br />

vir die boekjaar 2012/13 bestaan uit ’n bedryfsbegroting<br />

van R24,3 miljard en ’n kapitaalbegroting<br />

van R5,3 miljard.<br />

Die bedryfsbegroting word gebruik vir<br />

lopende koste: salarisse en bedryfskoste, gekontrakteerde<br />

dienste, aankope, en hulp vir arm<br />

mense en ander kwesbare groepe.<br />

Altesaam 31,59% hiervan, <strong>of</strong> sowat R7,7<br />

miljard, is vir die personeelkoste van die Stad se<br />

24 644 werknemers.<br />

Ander groot uitgawes is massa-aankope, wat<br />

elektrisiteit en water insluit, teen R6,1 miljard<br />

(26,46%). Prysverhogings van dié aankope,<br />

veral elektrisiteit en brandst<strong>of</strong>, oorskry oor die<br />

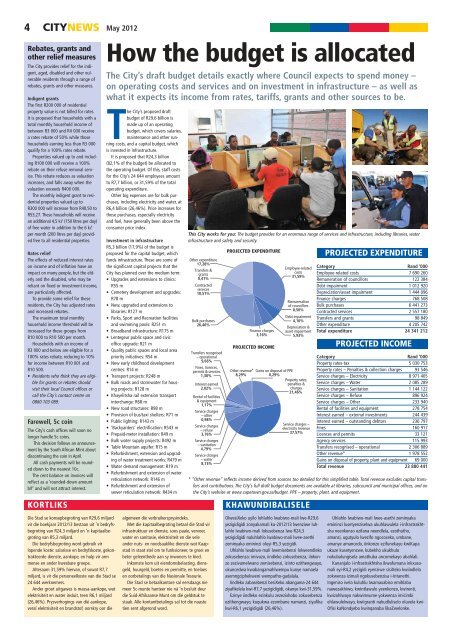

How the budget is allocated<br />

The <strong>City</strong>’s draft budget details exactly where Council expects to spend money –<br />

on operating costs and services and on investment in infrastructure – as well as<br />

what it expects its income from rates, tariffs, grants and other sources to be.<br />

The <strong>City</strong>’s proposed draft<br />

budget <strong>of</strong> R29,6 billion is<br />

made up <strong>of</strong> an operating<br />

budget, which covers salaries,<br />

maintenance and other running<br />

costs, and a capital budget, which<br />

is invested in infrastructure.<br />

It is proposed that R24,3 billion<br />

(82,1% <strong>of</strong> the budget) be allocated to<br />

the operating budget. Of this, staff costs<br />

for the <strong>City</strong>’s 24 644 employees amount<br />

to R7,7 billion, or 31,59% <strong>of</strong> the total<br />

operating expenditure.<br />

Other big expenses are for bulk purchases,<br />

including electricity and water, at<br />

R6,4 billion (26,46%). Price increases for<br />

these purchases, especially electricity<br />

and fuel, have generally been above the<br />

consumer price index.<br />

Investment in infrastructure<br />

R5,3 billion (17,9%) <strong>of</strong> the budget is<br />

proposed for the capital budget, which<br />

funds infrastructure. These are some <strong>of</strong><br />

the significant capital projects that the<br />

<strong>City</strong> has planned over the medium term:<br />

• Upgrades and extensions to clinics:<br />

R55 m<br />

• Cemetery development and upgrades:<br />

R78 m<br />

• New, upgraded and extensions to<br />

libraries: R127 m<br />

• Parks, Sport and Recreation facilities<br />

and swimming pools: R251 m<br />

• Broadband infrastructure: R175 m<br />

• Lentegeur public space and civic<br />

<strong>of</strong>fice upgrade: R21 m<br />

• Quality public spaces and local area<br />

priority initiatives: R54 m<br />

• New early childhood development<br />

centres: R14 m<br />

• Transport projects: R248 m<br />

• Bulk roads and stormwater for housing<br />

projects: R128 m<br />

• Khayelitsha rail extension transport<br />

interchange: R68 m<br />

• New road structures: R98 m<br />

• Provision <strong>of</strong> bus/taxi shelters: R71 m<br />

• Public lighting: R143 m<br />

• ‘Backyarders’ electrification: R543 m<br />

• Prepaid-meter installation: R49 m<br />

• Bulk water supply projects: R492 m<br />

• Table Mountain aquifer: R15 m<br />

• Refurbishment, extension and upgrading<br />

<strong>of</strong> water treatment works: R479 m<br />

• Water demand management: R19 m<br />

• Refurbishment and extension <strong>of</strong> water<br />

reticulation network: R146 m<br />

• Refurbishment and extension <strong>of</strong><br />

sewer reticulation network: R434 m<br />

Other expenditure<br />

17,28%<br />

Transfers &<br />

grants<br />

0,41%<br />

Contracted<br />

services<br />

10,51%<br />

Bulk purchases<br />

26,46%<br />

Transfers recognised<br />

– operational<br />

9,66%<br />

Fines, licences,<br />

permits & services<br />

1,30%<br />

Interest earned<br />

2,02%<br />

Rental <strong>of</strong> facilities<br />

& equipment<br />

1,17%<br />

Service charges<br />

– other<br />

0,98%<br />

Service charges<br />

– refuse<br />

3,76%<br />

Service charges<br />

– sanitation<br />

4,79%<br />

Service charges<br />

– water<br />

8,73%<br />

algemeen die verbruikersprysindeks.<br />

Met die kapitaalbegroting betaal die Stad vir<br />

infrastruktuur en dienste, soos paaie, vervoer,<br />

water en sanitasie, elektrisiteit en die vele<br />

ander nuts- en noodsaaklike dienste wat Kaapstad<br />

in staat stel om te funksioneer, te groei en<br />

beter geleenthede aan sy inwoners te bied.<br />

Inkomste kom uit eiendomsbelasting, diensgeld,<br />

huurgeld, boetes en permitte, en toelaes<br />

en oorbetalings van die Nasionale Tesourie.<br />

Die Stad se betaalkantore sal eersdaags nie<br />

meer 5c-munte hanteer nie ná ’n besluit deur<br />

die Suid-Afrikaanse Munt om dié geldstuk te<br />

staak. Alle kontantbetalings sal tot die naaste<br />

tien sent afgerond word.<br />

This <strong>City</strong> works for you: The budget provides for an enormous range <strong>of</strong> services and infrastructure, including libraries, water<br />

infrastructure and safety and security.<br />

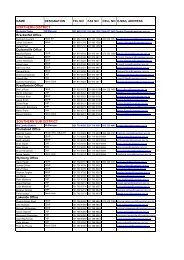

PROJECTED EXPENDITURE<br />

Finance charges<br />

3,16%<br />

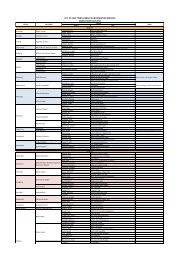

PROJECTED INCOME<br />

Employee-related<br />

costs<br />

31,59%<br />

Remuneration<br />

<strong>of</strong> councillors<br />

0,50%<br />

Debt impairment<br />

4,16%<br />

Depreciation &<br />

asset impairment<br />

5,93%<br />

Other revenue*<br />

Gains on disposal <strong>of</strong> PPE<br />

8,29%<br />

0,29%<br />

Property rates,<br />

penalties &<br />

charges<br />

21,46%<br />

Service charges –<br />

electricity revenue<br />

37,57%<br />

PROJECTED EXPENDITURE<br />

Category Rand ‘000<br />

Employee-related costs 7 690 260<br />

Remuneration <strong>of</strong> councillors 122 384<br />

Debt impairment 1 012 920<br />

Depreciation/asset impairment 1 444 096<br />

Finance charges 768 508<br />

Bulk purchases 6 441 273<br />

Contracted services 2 557 180<br />

Transfers and grants 98 849<br />

Other expenditure 4 205 742<br />

Total expenditure 24 341 212<br />

PROJECTED INCOME<br />

Category Rand ‘000<br />

Property rates-tax 5 030 753<br />

Property rates – Penalties & collection charges 93 546<br />

Service charges – Electricity 8 971 405<br />

Service charges – Water 2 085 289<br />

Service charges – Sanitation 1 144 122<br />

Service charges – Refuse 896 924<br />

Service charges – Other 233 940<br />

Rental <strong>of</strong> facilities and equipment 278 754<br />

Interest earned – external investments 244 439<br />

Interest earned – outstanding debtors 236 797<br />

Fines 160 917<br />

Licences and permits 33 121<br />

Agency services 115 993<br />

Transfers recognised – operational 2 306 889<br />

Other revenue* 1 978 552<br />

Gains on disposal <strong>of</strong> property, plant and equipment 69 000<br />

Total revenue 23 880 441<br />

* “Other revenue” reflects income derived from sources too detailed for this simplified table. Total revenue excludes capital transfers<br />

and contributions. The <strong>City</strong>’s full draft budget documents are available at libraries, subcouncil and municipal <strong>of</strong>fices, and on<br />

the <strong>City</strong>’s website at www.capetown.gov.za/budget. PPE – property, plant, and equipment.<br />

KHAWUNDIBALISELE<br />

OlwesiXeko uyilo lohlahlo lwabiwo-mali lwe-R29,6<br />

yezigidigidi zonyakamali ka-2012/13 lwenziwe luhlahlo<br />

lwabiwo-mali lokusebenza lwe-R24,3<br />

yezigidigidi naluhlahlo lwabiwo-mali lwee-asethi<br />

zeminyaka emininzi oluyi-R5,3 yezigidi.<br />

Uhlahlo lwabiwo-mali lwemisebenzi lolweendleko<br />

zokusebenza: imivuzo, iindleko zokusebenza, iinkonzo<br />

zezivumelwano zemisebenzi, izinto ezithengwayo,<br />

ukuncedwa kwabangamahlwempu kunye namaela<br />

asemngciphekweni wempatho-gadalala.<br />

Iindleko zabasebenzi besiXeko abangama-24 644<br />

ziyafikelela kwi-R7,7 yezigidigidi, okanye kwi-31,59%.<br />

Ezinye iindleko ezinkulu zezezixhobo zokusebenza<br />

ezithengwayo, kuqukwa ezombane namanzi, ziyafika<br />

kwi-R6,1 yezigidigidi (26,46%).<br />

Uhlahlo lwabiwo-mali lwee-asethi zeminyaka<br />

emininzi lusetyenziselwa ukuhlawulela i-infrastrakhtsha<br />

neenkonzo ezifana neendlela, ezothutho,<br />

amanzi, ugutyulo lwezifo ngococeko, umbane,<br />

amanye amancedo, iinkonzo ezifunekayo kwiKapa<br />

ukuze kusetyenzwe, kubekho ukukhula<br />

nokubalungisela amathuba ancomekayo abahlali.<br />

Kananjalo i-infrastrakhtsha ikwafumana inkxasomali<br />

eyi-R4,2 yezigidi eyenziwe sisiXeko kwiindlela<br />

zokwenza izimali ngokusebenzisa i-Intanethi.<br />

Ingeniso ivela kuluhlu lwamaxabiso emihlaba<br />

nawezakhiwo, kwintlawulo yeenkonzo, kwirenti,<br />

kwizohlwayo nakwimvume yokwenza imicimbi<br />

ehlawulelwayo, kwiigranti nakudluliselo oluvela kwi-<br />

Ofisi kaNondyebo kwinqanaba likaZwelonke.