Chapter 40 - Understanding Reinsurance

Chapter 40 - Understanding Reinsurance

Chapter 40 - Understanding Reinsurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

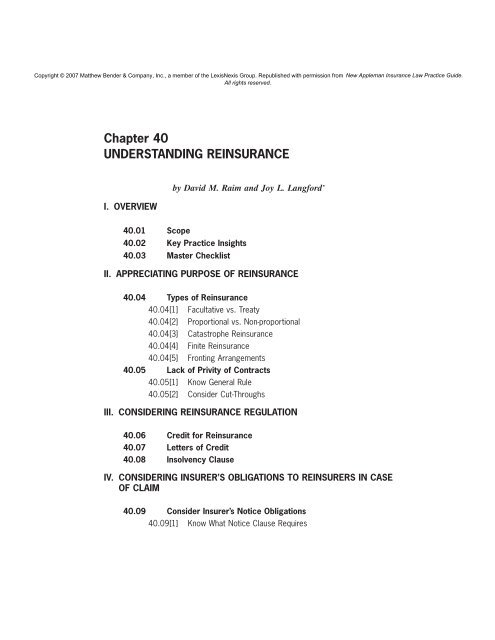

<strong>Chapter</strong> <strong>40</strong><br />

UNDERSTANDING REINSURANCE<br />

I. OVERVIEW<br />

<strong>40</strong>.01 Scope<br />

*<br />

by David M. Raim and Joy L. Langford<br />

<strong>40</strong>.02 Key Practice Insights<br />

<strong>40</strong>.03 Master Checklist<br />

II. APPRECIATING PURPOSE OF REINSURANCE<br />

<strong>40</strong>.04 Types of <strong>Reinsurance</strong><br />

<strong>40</strong>.04[1] Facultative vs. Treaty<br />

<strong>40</strong>.04[2] Proportional vs. Non-proportional<br />

<strong>40</strong>.04[3] Catastrophe <strong>Reinsurance</strong><br />

<strong>40</strong>.04[4] Finite <strong>Reinsurance</strong><br />

<strong>40</strong>.04[5] Fronting Arrangements<br />

<strong>40</strong>.05 Lack of Privity of Contracts<br />

<strong>40</strong>.05[1] Know General Rule<br />

<strong>40</strong>.05[2] Consider Cut-Throughs<br />

III. CONSIDERING REINSURANCE REGULATION<br />

<strong>40</strong>.06 Credit for <strong>Reinsurance</strong><br />

<strong>40</strong>.07 Letters of Credit<br />

<strong>40</strong>.08 Insolvency Clause<br />

IV. CONSIDERING INSURER’S OBLIGATIONS TO REINSURERS IN CASE<br />

OF CLAIM<br />

<strong>40</strong>.09 Consider Insurer’s Notice Obligations<br />

<strong>40</strong>.09[1] Know What Notice Clause Requires

New Appleman Insurance Practice Guide<br />

<strong>40</strong>.09[2] Reinsurer’s Assertion of Late Notice As Defense to Payment<br />

of Its <strong>Reinsurance</strong> Obligations<br />

<strong>40</strong>.09[2][a] Jurisdictions Requiring Proof of Prejudice<br />

<strong>40</strong>.09[2][b] Jurisdictions Recognizing Late Notice As Defense<br />

Regardless of Ability to Prove Prejudice<br />

<strong>40</strong>.10 Consider Reinsurer’s Right to Access Insurer’s Records<br />

<strong>40</strong>.10[1] Consider What Access to Records Clause Requires to Be<br />

Made Available to Reinsurer<br />

<strong>40</strong>.10[2] Consider Whether Insurer’s Disclosure of Privileged<br />

Documents to Its Reinsurer Constitutes Waiver As to Third<br />

Parties, Including Its Insureds<br />

<strong>40</strong>.10[2][a] Common Interest Doctrine<br />

<strong>40</strong>.10[2][b] Disclosure Made Prior To Insurance Coverage<br />

Litigation<br />

<strong>40</strong>.10[2][c] Disclosure Made During Course of Insurance<br />

Coverage Litigation<br />

<strong>40</strong>.10[2][d] Disclosure Made After Resolution of Insurance<br />

Coverage Litigation But Prior to Institution of<br />

Arbitration or Litigation Between Cedent And Reinsurer<br />

<strong>40</strong>.10[2][e] Disclosure Made During Course of <strong>Reinsurance</strong><br />

Litigation<br />

<strong>40</strong>.10[2][f] Use of Confidentiality and Common Interest<br />

Agreements<br />

<strong>40</strong>.10[3] Consider Reinsurer’s Ability to Compel Production of<br />

Cedent’s Privileged Documents<br />

<strong>40</strong>.10[3][a] Consider Whether Inclusion of Access to Records<br />

Clause Constitutes Waiver<br />

<strong>40</strong>.10[3][b] Know When Privileged Documents Are “In Issue”<br />

Therefore Requiring Production by Cedent<br />

<strong>40</strong>.10[3][c] Consider Application of Common Interest Doctrine to<br />

Compel Production of Cedent’s Privileged Documents<br />

<strong>40</strong>.10[3][c][i] Prior to Dispute Between Cedent and Reinsurer<br />

<strong>40</strong>.10[3][c][ii] During <strong>Reinsurance</strong> Dispute Between Cedent and<br />

Reinsurer<br />

<strong>40</strong>.10[4] Understand When Insured Is Entitled to Discover Its Insurer’s<br />

<strong>Reinsurance</strong> Information<br />

<strong>40</strong>.11 Consider Reinsurer’s Rights Under Right to Associate Clause<br />

or Claims Control Clause<br />

<strong>40</strong>-2

<strong>Understanding</strong> <strong>Reinsurance</strong><br />

V. CONSIDERING REINSURER’S OBLIGATIONS<br />

<strong>40</strong>.12 Determine Extent of Coverage<br />

<strong>40</strong>.13 Consider Obligation to Reimburse Insurer for Declaratory<br />

Judgment Expense<br />

<strong>40</strong>.14 Consider Obligation to Reimburse Insurer for Extra-<br />

Contractual Obligations and Excess of Policy Limits (“ECO/<br />

XPL”) Damages<br />

VI. CONSIDERING DUTY OF UTMOST GOOD FAITH OR UBERRIMAE<br />

FIDEI<br />

<strong>40</strong>.15 Consider Insurer’s Duty to Disclose to Reinsurer All Material<br />

Facts About Risk Being Reinsured<br />

<strong>40</strong>.16 Consider Application of Duty of Utmost Good Faith Beyond<br />

Disclosure at Inception of <strong>Reinsurance</strong> Relationship<br />

<strong>40</strong>.16[1] Application of Duty of Utmost Good Faith to Parties’<br />

Conduct During Life of <strong>Reinsurance</strong> Contract<br />

<strong>40</strong>.16[2] Application of Duty of Utmost Good Faith to Underwriting<br />

and Administration of Ongoing Business<br />

<strong>40</strong>.16[3] Application of Duty of Utmost Good Faith to Obligation to<br />

Give Notice of Claim<br />

<strong>40</strong>.16[4] Application of Duty of Utmost Good Faith to Reinsurer to<br />

Pay Under <strong>Reinsurance</strong> Agreement<br />

VII. CONSIDERING FOLLOW THE FORTUNES/FOLLOW THE<br />

SETTLEMENTS<br />

<strong>40</strong>.17 Understand Distinction Between Follow the Fortunes and<br />

Follow the Settlements<br />

<strong>40</strong>.18 Consider Reinsurer’s Preclusion from Second-Guessing<br />

Reinsured’s Good Faith Claims Decisions<br />

<strong>40</strong>.19 Consider Application of Follow the Fortunes/Follow the<br />

Settlements to Allocation Decisions<br />

VIII. CONSIDERING BROKERED MARKET<br />

<strong>40</strong>.20 Brokered vs. Direct Market<br />

<strong>40</strong>.21 Understand Which Entity Broker Represents<br />

<strong>40</strong>-3

IX. CONSIDERING REINSURANCE ARBITRATION<br />

<strong>40</strong>.22 Consider Obligation to Arbitrate<br />

<strong>40</strong>.23 Neutral Panel or Party Advocate System<br />

<strong>40</strong>.24 Strict Rule of Law vs. Obligations Pursuant to Honorable<br />

Engagement<br />

<strong>40</strong>.25 Discovery in Arbitration<br />

<strong>40</strong>.26 Summary Disposition in Arbitration<br />

<strong>40</strong>.27 Reasoned Awards<br />

<strong>40</strong>.28 Know When to Move to Vacate or Affirm Arbitration Award<br />

<strong>40</strong>.29 ARIAS Forms<br />

X. FORMS<br />

New Appleman Insurance Practice Guide<br />

<strong>40</strong>.30 BRMA Reinsuring Clause Form 44 C (Quota Share<br />

Agreement)<br />

<strong>40</strong>.31 BRMA Reinsuring Clause Form 44 B (Surplus Share<br />

Agreement)<br />

<strong>40</strong>.32 BRMA Reinsuring Clause Form 61 C (Excess of Loss<br />

Agreement)<br />

<strong>40</strong>.33 BRMA Unauthorized <strong>Reinsurance</strong> Clause Form 55 A<br />

<strong>40</strong>.34 BRMA Insolvency Clause Form 19 M<br />

<strong>40</strong>.35 BRMA Offset Clause Form 36 A<br />

<strong>40</strong>.36 BRMA Loss Notice Clause Form 26 B<br />

<strong>40</strong>.37 Notice of Loss Clause Incorporating Right to Associate<br />

<strong>40</strong>.38 BRMA Loss Notice Clause Form 26 A<br />

<strong>40</strong>.39 BRMA Access to Records Clause Form 1 B<br />

<strong>40</strong>.<strong>40</strong> BRMA Confidentiality Clause Form 69 D<br />

<strong>40</strong>.41 BRMA Claims Cooperation Clause Form 8 A<br />

<strong>40</strong>.42 BRMA Excess of Original Policy Limits Clause Form 15 A<br />

<strong>40</strong>.43 BRMA Extra Contractual Obligations Clause Form 16 D<br />

<strong>40</strong>.44 BRMA Intermediary Clause Form 23 A<br />

<strong>40</strong>.45 BRMA Arbitration Clause Form 6 A<br />

<strong>40</strong>.46 BRMA Arbitration Clause Form 6 E<br />

<strong>40</strong>.47 ARIAS-U.S. Umpire Questionnaire Sample Form 2.1<br />

<strong>40</strong>-4

I. OVERVIEW.<br />

<strong>40</strong>.01 Scope. In essence, reinsurance is insurance for insurance companies.<br />

It is a contractual arrangement under which an insurer secures<br />

coverage from a reinsurer for a potential loss to which it is exposed under<br />

insurance policies issued to original insureds. The risk indemnified<br />

against is the risk that the insurer will have to pay on the underlying<br />

insured risk. Because reinsurance is a contract of indemnity, absent specific<br />

cash-call provisions, the reinsurer is not required to pay under the contract<br />

until after the original insurer has paid a loss to its original insured.<br />

<strong>Reinsurance</strong> enhances the fundamental financial risk-spreading function<br />

of insurance and serves at least four basic functions for the direct<br />

insurance company: increasing the capacity to write insurance (under<br />

prevailing insurance-regulatory law); stabilizing financial results in the<br />

same manner that insurance protects any other purchaser against spikes<br />

from realized financial losses; protecting against catastrophic losses; and<br />

financing growth.<br />

The reinsurance relationship is structured in the following manner:<br />

original insured > insurer > reinsurer. The insurer is called, for reinsurance<br />

purposes, the cedent (or cedant). There is typically no contractual relationship<br />

between the reinsurer and the original insured. <strong>Reinsurance</strong> may,<br />

but need not, dovetail with the scope of the original insurance. Basically,<br />

all of the risks that are insured can be reinsured, unless contrary to public<br />

policy under the relevant governing law for the reinsurance contract.<br />

This chapter principally discusses how insurance claims and coverage<br />

litigation can evolve into reinsurance claims and in that context presents<br />

the most common legal issues that arise from reinsurance relationships.<br />

The coverage afforded insurers through the most commonly purchased<br />

types of reinsurance is explained to provide a context for most reinsurance<br />

claims. Certain aspects of reinsurance regulation are set forth to illustrate<br />

the role of reinsurance in the entire insurance scheme and the payment of<br />

policyholder claims. Also described are the special rights and obligations<br />

of cedents and reinsurers as between them and important aspects of<br />

reinsurance arbitration (the common form of dispute resolution), both of<br />

which strongly influence reinsurance recoveries. This chapter provides a<br />

background in reinsurance and explains how an insured’s relationship<br />

with its insurer fits within the context of the entire reinsurance scheme.<br />

<strong>Reinsurance</strong>, like many areas of business law, has a language of its own.<br />

The insurance company purchasing reinsurance is called the “ceding<br />

company” (or the “cedent” (or “cedant”), “reinsured” or “ceding insurer”)<br />

because it “cedes” or transfers part of the risk. The company selling<br />

<strong>40</strong>-5

<strong>40</strong>.01 New Appleman Insurance Practice Guide<br />

reinsurance is called the “reinsurer”. Typically, these are the only parties to<br />

the reinsurance agreement; all rights and obligations run only between<br />

them. The reinsurance contract does not change the direct, or original,<br />

insurer’s responsibility to its policyholder (the “original insured” or<br />

“policyholder”), and the insurer must fulfill the terms of its policy whether<br />

or not it has reinsurance or whether or not the reinsurer is rightly or<br />

wrongly refusing to perform. The liability or risk ceded is called a<br />

“cession,” and the original policy that the cedent issues to a policyholder<br />

is referred to as “direct” insurance. A reinsurer also can purchase its own<br />

reinsurance protection, and such reinsurance of reinsurance is called a<br />

“retrocession.” A reinsurer that transfers all or part of its assumed<br />

reinsurance is called a “retrocedent,” and the company reinsuring this risk<br />

is called the “retrocessionaire.” Retrocessions need not incorporate the<br />

original reinsurance and often do not. (Retrocessionaires in turn can<br />

purchase reinsurance again, ad infinitum.)<br />

<strong>Reinsurance</strong> relationships can be simple or complex. A cedent can cede<br />

certain loss exposures under one contract or purchase several contracts<br />

covering different aspects or portions of the same policy to achieve the<br />

desired degree of coverage. A layering process involving two or more<br />

reinsurance agreements is commonly employed to obtain sufficient monetary<br />

limits of reinsurance protection. When a claim is presented, the<br />

reinsurers respond in a predetermined order to cover the loss.<br />

The reinsurance relationship is evidenced by a written contract reflecting<br />

the negotiated terms. Although reinsurance contracts between different<br />

cedents and reinsurers can include clauses with similar purposes, the<br />

wording of particular provisions varies significantly, depending on the<br />

parties’ specific needs, customs and practices. Sample clauses are provided<br />

where instructive.<br />

Payments that are due pursuant to a reinsurance agreement are considered<br />

an asset of the cedent; in contrast to other types of contingent<br />

payments, the applicable regulatory regime may permit the cedent to<br />

count a reinsurance recoverable as a present asset on its own balance<br />

sheet. <strong>Reinsurance</strong> is payable only after the cedent has paid losses due<br />

under its own insurance agreements. However, most U.S. reinsurance<br />

contracts include an insolvency clause, which allows the receiver of an<br />

insolvent insurer to collect on reinsurance contracts as if the insolvent<br />

insurer had paid the claim in full even if it did not [see § <strong>40</strong>.08 below<br />

discussing the insolvency clause].<br />

<strong>Reinsurance</strong> should not be confused with other commercial arrangements.<br />

It is not co-insurance, where separate insurers assume shares of the same<br />

insurance risk. Nor is it a novation as between the original insured and its<br />

<strong>40</strong>-6

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.01<br />

insurer or substitution of one insurer for another. A reinsurance agreement<br />

does not establish a partnership between the insurer and the reinsurer or<br />

a separate joint venture as between them, although some pro rata contracts<br />

provide that the parties share proportionally in the premiums collected by<br />

the cedent and in losses paid by it. <strong>Reinsurance</strong> ordinarily does not confer<br />

third-party beneficiary status on the original insured. Absent a “cutthrough”<br />

clause or similar modification [see § <strong>40</strong>.05 below for discussion of<br />

these exceptions], there is no privity of contract between the insurance<br />

policyholder and the reinsurer. In the absence of language in the reinsurance<br />

agreement granting the original insured rights against the reinsurer<br />

or unusual factual circumstances, attempts by original insureds to sue<br />

reinsurers directly generally fail; claimants against the original insureds<br />

similarly are unsuccessful in bringing suit directly against reinsurers, even<br />

where, in direct-action states or in other circumstances, the claimant might<br />

be able to sustain an action against the original insurer (cedent).<br />

Underlying claims and coverage litigation can trigger reporting and notice<br />

obligations of cedents to reinsurers. Reinsurers that potentially owe<br />

indemnity may commence investigations, monitor claims, and establish<br />

claim reserves. Counsel for original insureds in coverage litigation sometimes<br />

seek production of communications generated between the cedent<br />

and reinsurer on the grounds that insurance covering a defendant is<br />

generally discoverable (even though in the circumstance the “insurance”<br />

is reinsurance), or for more narrowly tailored purposes such as to collect<br />

evidence that the original insurance policy existed at one time even if it is<br />

no longer is available. In some instances, the disclosure of cedent/<br />

reinsurer communications can potentially be detrimental to the cedent’s<br />

coverage position vis-a-vis its insured.<br />

Typical reinsurance claim issues that are discussed here include: reporting<br />

and notice obligations; defenses stemming from interpretation of the<br />

reinsurance wording to the indemnity sought; cooperation and claimhandling<br />

obligations; and defenses seeking rescission of the reinsurance<br />

contract including nondisclosure and misrepresentation with respect to<br />

the details of risk. The nature of the reinsurance relationship — especially<br />

the notion of “utmost good faith” or uberimae fidei — may provide a gloss<br />

on how certain issues get resolved in the reinsurance context that may<br />

differ from how similar issues are resolved in the ordinary insured-insurer<br />

context. Other common issues addressed here include the reinsurer’s<br />

obligations to indemnify the insurer for declaratory judgment expenses<br />

incurred in defending or prosecuting coverage litigation against the<br />

original insured, and payments by insurers in excess of policy limits or<br />

payments of extracontractual damages.<br />

<strong>40</strong>-7

<strong>40</strong>.02 New Appleman Insurance Practice Guide<br />

<strong>Reinsurance</strong> claims generate certain legal issues distinct from issues that<br />

typically arise in the context of direct insurance. Rules found in insurance<br />

law in different arenas may not apply or may apply with different nuances<br />

in the context of reinsurance disputes, and the duties and obligations<br />

between a cedent and reinsurer may differ from those between an original<br />

insurer and policyholder, considering some of the differences in the<br />

relative sophistication and bargaining power, custom and practice, or<br />

different aspects in which one party is largely dependent upon another.<br />

Several important distinctions between the resolution of insurance and<br />

reinsurance disputes are examined in this chapter, including the effect of<br />

the bilateral duty of utmost good faith, which is perhaps unique to<br />

reinsurance agreements. <strong>Reinsurance</strong> disputes also are distinguished by<br />

their typical resolution through arbitration, rather than courtroom litigation.<br />

Among other differences, in typical U.S. arbitrations, the availability<br />

and weight of legal precedent is less predictable and meaningful than in<br />

litigation in the courts. Arbitrators may not be bound by strict legal rules<br />

and do not always strictly apply contract law and other legal principles to<br />

reinsurance agreements; indeed, some reinsurance contracts eschew reliance<br />

upon legal rules in favor of construing the reinsurance relationship<br />

memorialized by the reinsurance contract as principally an honorable<br />

engagement pursuant to industry custom and practice.<br />

Lexis.com Searches: To find statistics on reinsurance premiums, try<br />

this source: RDS TableBase. Enter this search: PUB(<strong>Reinsurance</strong>).<br />

To find articles on specific cases involving reinsurance, try this source:<br />

<strong>Reinsurance</strong>: Mealey’s Litigation Report. Enter specific search terms or<br />

date ranges.<br />

<strong>40</strong>.02 Key Practice Insights. The parties to reinsurance contracts are<br />

typically sophisticated insurers transferring the financial risk assumed in<br />

insuring businesses, homes, cars and individuals. Note that sometimes<br />

reinsurers create the instrument that is to be sold to an insured and then<br />

look for a middleman (cedent) to (i) issue the policy to the insured and (ii)<br />

purchase the corresponding reinsurance. Indeed, in such transactions,<br />

sometimes the cedent will 100 percent reinsure the risk undertaken to the<br />

policyholder, in exchange for a ceding commission deducted from the<br />

premium collected from the direct insured, which is ultimately passed on<br />

to the reinsurer.<br />

There are no standard reinsurance contracts, although many include<br />

commonly used provisions and clauses sometimes required by state law.<br />

Each reinsurance treaty or facultative certificate reflects the special needs<br />

of the parties with respect to the type and amount of risk covered, the<br />

<strong>40</strong>-8

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.02<br />

calculation of the premium, the role of the reinsurance intermediary, the<br />

method and timing of notice and submission of claims, various reporting<br />

obligations, and resolution mechanisms for potential disputes. <strong>Reinsurance</strong><br />

contracts therefore are often complex and unique and must be<br />

carefully drafted and, in the event of dispute, carefully interpreted.<br />

Lawyers practicing in the reinsurance field must become familiar with the<br />

specialized business of reinsurance, including the purposes and types of<br />

reinsurance and the financial goals and consequences typically involved.<br />

Practitioners also must be knowledgeable about the meaning, use and<br />

legal effect of commonly employed reinsurance contract provisions,<br />

including insolvency, access to records, claims control, notice, extracontractual<br />

obligations (“ECO”), excess of policy limits (“XPL”), follow<br />

the fortunes/settlements, intermediary and arbitration provisions. Attorneys<br />

also should carefully review complete versions of reinsurance<br />

wordings, including endorsements and amendments. (Indeed, sorting out<br />

which is the governing wording particularly when insurers operating in<br />

different markets or in different countries are involved can prove tedious<br />

and time consuming.)<br />

Although regulation of the reinsurance industry in the United States is<br />

more limited than that of the insurance industry in general, lawyers<br />

should be mindful of the insurer’s statutory licensing, solvency and<br />

accounting requirements. Attorneys should understand how insurers<br />

must account for finite risk reinsurance, as this subject recently has<br />

attracted significant regulatory attention. Also of particular concern are<br />

“fronting” arrangements and cut-through endorsements, which may not<br />

be allowed or may be subject to special regulations in certain jurisdictions.<br />

<strong>Reinsurance</strong> disputes are typically resolved through arbitration, and<br />

practitioners should be familiar with arbitration law, particularly the<br />

Federal Arbitration Act (“FAA”) and statutory law applicable to nonadmitted<br />

reinsurers and the availability of pre-answer or pre-judgment<br />

security. Of course, counsel handling a dispute should be familiar with<br />

how reinsurance arbitrations are generally handled. A thorough knowledge<br />

of the reinsurance industry is needed as many issues are decided<br />

based upon the custom and practice in the industry (especially where the<br />

arbitration panel is comprised of non-lawyers, as is often the case).<br />

Lawyers also should know that leading industry and professional organizations<br />

offer practice guides, forms, and other resources useful for<br />

reinsurance arbitrations (such as lists of professional trained reinsurance<br />

arbitrators).<br />

<strong>40</strong>-9

<strong>40</strong>.03 New Appleman Insurance Practice Guide<br />

<strong>40</strong>.03 Master Checklist.<br />

□ Understand whether the reinsurance contract at issue is a facultative<br />

certificate or a treaty.<br />

Discussion: § <strong>40</strong>.04[1]<br />

□ Understand whether the reinsurance at issue is proportional or<br />

non-proportional.<br />

Discussion: § <strong>40</strong>.04[2]<br />

Forms: §§ <strong>40</strong>.30-<strong>40</strong>.32<br />

□ Become familiar with specific types of reinsurance such as catastrophe<br />

reinsurance, clash cover and finite reinsurance.<br />

Discussion: §§ <strong>40</strong>.04[3]-<strong>40</strong>.04[4]<br />

□ Understand how insurers must account for finite risk reinsurance<br />

under applicable regulations.<br />

Discussion: § <strong>40</strong>.04[4]<br />

□ Determine all of the parties’ responsibilities and liabilities in a<br />

fronting arrangement, including any obligation to monitor a managing<br />

general agency.<br />

Discussion: § <strong>40</strong>.04[5]<br />

□ Confirm that fronting is permissible in the jurisdiction where the<br />

arrangement is executed.<br />

Discussion: § <strong>40</strong>.04[5]<br />

□ Determine if special circumstances exist which may provide<br />

grounds for a policyholder of the ceding insurer to assert a direct<br />

action against the reinsurer.<br />

Discussion: § <strong>40</strong>.05[1]<br />

□ Research the legality and enforceability of cut-through clauses (or<br />

assumption of liability endorsements) contained in insurance contracts<br />

covered by reinsurance.<br />

Discussion: § <strong>40</strong>.05[2]<br />

□ Understand the credit for reinsurance laws governing your reinsurance<br />

transaction.<br />

<strong>40</strong>-10

Discussion: § <strong>40</strong>.06<br />

□ Confirm that a letter of credit obtained by a ceding company that<br />

intends to take financial statement credit for reinsurance placed<br />

with a non-admitted reinsurer complies with statutory requirements.<br />

Discussion: § <strong>40</strong>.07<br />

□ Ensure that an adequate insolvency clause is included in the<br />

reinsurance contract if required in your jurisdiction. Most states<br />

require that the reinsurance contract include an insolvency clause<br />

for the ceding insurer to take credit for reinsurance on its financial<br />

statement.<br />

Discussion: § <strong>40</strong>.08<br />

Form: § <strong>40</strong>.34<br />

□ Understand the effect of an offset clause, or any applicable common<br />

law or statutory set-off rights, on the rights and obligations under<br />

the reinsurance agreement.<br />

Discussion: § <strong>40</strong>.08<br />

Form: § <strong>40</strong>.35<br />

□ Understand the requirements of the reinsurance contract’s notice<br />

provision.<br />

Discussion: § <strong>40</strong>.09[1]<br />

Forms: §§ <strong>40</strong>.36-<strong>40</strong>.38<br />

□ Determine whether, in your jurisdiction, the reinsurer must demonstrate<br />

prejudice in order to successfully assert a late notice<br />

defense.<br />

Discussion: § <strong>40</strong>.09[2]<br />

□ Understand the effect of an access to records clause in the reinsurance<br />

agreement.<br />

Discussion: § <strong>40</strong>.10[1]<br />

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.03<br />

Form: § <strong>40</strong>.39<br />

□ If your client is the ceding insurer, beware the consequences of<br />

<strong>40</strong>-11

<strong>40</strong>.03 New Appleman Insurance Practice Guide<br />

disclosing privileged information to reinsurers pursuant to an<br />

access to records clause.<br />

Discussion: § <strong>40</strong>.10[2]<br />

□ Research the applicability in your jurisdiction of the common<br />

interest doctrine to a cedent’s disclosure of privileged communications<br />

to its reinsurer.<br />

Discussion § <strong>40</strong>.10[2]<br />

□ Determine whether the parties to a reinsurance contract should<br />

execute a confidentiality or common interest agreement to try to<br />

preserve applicable privileges or immunities against disclosure to<br />

third parties.<br />

Discussion: § <strong>40</strong>.10[2][f]<br />

□ Understand the circumstances under which a reinsurer can compel<br />

disclosure of its cedent’s privileged communications.<br />

Discussion: § <strong>40</strong>.10[3]<br />

□ Understand the circumstances under which an insured will be<br />

entitled to discover its insurer’s reinsurance information.<br />

Discussion: § <strong>40</strong>.10[4]<br />

□ Become familiar with the rights and obligations presented by right<br />

to associate and claims control clauses in reinsurance contracts.<br />

Discussion: § <strong>40</strong>.11<br />

Forms: § <strong>40</strong>.41<br />

□ Draft the reinsuring or business covered clause of the reinsurance<br />

agreement carefully to avoid disputes concerning the scope of<br />

coverage.<br />

Discussion: § <strong>40</strong>.12<br />

□ Understand whether the reinsurance contract wording (in many<br />

cases the definition of “allocated loss expenses”) obligates the<br />

reinsurer to reimburse its cedent for declaratory judgment expenses.<br />

Discussion: § <strong>40</strong>.13<br />

□ Understand the coverage provided by excess of policy limits<br />

<strong>40</strong>-12

(“XPL”) and/or extra-contractual obligations (“ECO”) clauses in<br />

the reinsurance contract.<br />

Discussion: § <strong>40</strong>.14<br />

Forms: §§ <strong>40</strong>.42-<strong>40</strong>.43<br />

□ Understand the duty of utmost good faith that is central to the<br />

relationship between cedent and reinsurer.<br />

Discussion: § <strong>40</strong>.15<br />

□ If your client is the cedent, determine the facts that must be<br />

disclosed during the underwriting process.<br />

Discussion: § <strong>40</strong>.15<br />

□ If your client is the cedent, ensure that all proper and businesslike<br />

steps are taken in underwriting the underlying business and in<br />

settling claims.<br />

Discussion: § <strong>40</strong>.16[2]<br />

□ Understand the effect of follow the fortunes or follow the settlements<br />

wording in the reinsurance contract.<br />

Discussion: § <strong>40</strong>.17<br />

� Cross References: §§ <strong>40</strong>.18-<strong>40</strong>.19<br />

□ Determine the extent to which follow the fortunes or follow the<br />

settlements language in the reinsurance contract requires a reinsurer<br />

to follow its cedent’s allocation and aggregation decisions as<br />

respects it direct insurance obligations.<br />

Discussion: § <strong>40</strong>.19<br />

□ Understand the obligations of the reinsurance intermediary.<br />

Discussion: § <strong>40</strong>.20<br />

□ Determine whether, and for what purposes, the reinsurance broker<br />

or intermediary is the agent of the ceding company, the reinsurer,<br />

or both parties.<br />

Discussion: § <strong>40</strong>.21<br />

Form: § <strong>40</strong>.44<br />

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.03<br />

<strong>40</strong>-13

<strong>40</strong>.03 New Appleman Insurance Practice Guide<br />

□ Understand what disputes are arbitrable under the reinsurance<br />

contract’s arbitration clause.<br />

Discussion: § <strong>40</strong>.22<br />

Forms: §§ <strong>40</strong>.45-<strong>40</strong>.46<br />

□ In drafting reinsurance agreements, counsel should determine<br />

whether the scope of the arbitration clause in the reinsurance<br />

contract is intended to be broad or narrow.<br />

Discussion: § <strong>40</strong>.22<br />

Forms: §§ <strong>40</strong>.45-<strong>40</strong>.46<br />

□ Arbitration counsel should consider whether non-signatories to the<br />

arbitration agreement may be forced to arbitrate.<br />

Discussion: § <strong>40</strong>.22<br />

□ Consider whether or not to include consolidation and joinder<br />

provisions in an arbitration agreement, or whether to request<br />

consolidation once arbitration has commenced.<br />

Discussion: § <strong>40</strong>.22<br />

Form: § <strong>40</strong>.45<br />

□ Consider what procedures should be included in the arbitration<br />

provision concerning the selection of arbitrators and/or umpires,<br />

what qualifications the arbiters should have, and whether the<br />

arbiters should be neutral or non-neutral.<br />

Discussion: § <strong>40</strong>.23<br />

□ Make certain that your client appoints its arbiter on a timely basis.<br />

Discussion: § <strong>40</strong>.23<br />

□ Become familiar with the standards and procedures for selecting<br />

arbitrators and the lists of qualified individuals published by<br />

arbitration and reinsurance organizations.<br />

Discussion: § <strong>40</strong>.23<br />

Form: § <strong>40</strong>.47<br />

□ Understand the effect of any honorable engagement wording in the<br />

<strong>40</strong>-14

einsurance agreement.<br />

Discussion: § <strong>40</strong>.24<br />

Form: § <strong>40</strong>.46<br />

□ Counsel drafting a reinsurance contract should determine whether<br />

specific discovery procedures should be included in the reinsurance<br />

contract’s arbitration provision and, if so, whether they<br />

should incorporate any procedures published by reinsurance or<br />

arbitration organizations.<br />

Discussion: § <strong>40</strong>.25<br />

□ Counsel should determine how and whether a reinsurance intermediary<br />

can be required to participate in the discovery process in<br />

the event of a reinsurance arbitration.<br />

Discussion: § <strong>40</strong>.25<br />

□ Arbitration counsel should consider whether to submit a motion<br />

for summary disposition of a reinsurance claim or dispute.<br />

Discussion: § <strong>40</strong>.26<br />

□ Arbitration counsel should consider whether to move to confirm a<br />

favorable arbitration award in court.<br />

Discussion: § <strong>40</strong>.28<br />

□ Arbitration counsel should consider whether grounds exist to<br />

move to vacate an arbitration award in court.<br />

Discussion: § <strong>40</strong>.28<br />

□ Arbitration counsel should consider whether there are grounds to<br />

request a court to modify or correct an arbitral award.<br />

Discussion: § <strong>40</strong>.28<br />

□ Become familiar with the forms provided by ARIAS.<br />

Discussion: § <strong>40</strong>.29<br />

Form: § <strong>40</strong>.47<br />

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.03<br />

<strong>40</strong>-15

II. APPRECIATING PURPOSE OF REINSURANCE.<br />

<strong>40</strong>.04 Types of <strong>Reinsurance</strong>.<br />

<strong>40</strong>.04[1] Facultative vs. Treaty. There are two basic types of reinsurance:<br />

“treaty” and “facultative.” Facultative reinsurance is a contract<br />

only covering all or part of a single specific policy of insurance. For<br />

each transaction sought to be reinsured, the reinsurer reserves the<br />

“faculty” to accept or decline all or part of any insurance policy<br />

presented, and the cedent chooses whether to secure reinsurance for<br />

a particular policy. The reinsurer and cedent negotiate the terms for<br />

each facultative certificate. Facultative reinsurance is commonly<br />

purchased for large, unusual or catastrophic risks. Reinsurers thus<br />

must have the necessary resources to underwrite individual risks<br />

carefully. (“Treaty” reinsurance, discussed further below, involves a<br />

preexisting commitment by the reinsurer to cover a predetermined<br />

class and amount of coverage that will be sold by the insurer-cedent.)<br />

Other uses of facultative reinsurance include:<br />

1. When an insurer is offered a risk that exceeds its standard<br />

underwriting or reinsurance limits for that class, facultative<br />

reinsurance can permit the ceding company to accept the risk.<br />

2. Insurers can fill gaps in coverage caused by reinsurance treaty<br />

exclusions by seeking separate facultative coverage for a<br />

specific policy or group of policies.<br />

3. A reinsurer can issue facultative reinsurance to participate in a<br />

market in the short term to minimize risk and take advantage<br />

of favorable rates.<br />

4. A treaty reinsurer may purchase facultative reinsurance to<br />

protect itself and its treaty reinsurers.<br />

Insurers sometimes purchase both facultative and treaty reinsurance<br />

to cover the same risk. Unless there are contract terms to the contrary,<br />

the facultative reinsurance will perform first and completely before<br />

any of the treaty reinsurance performs. Sometimes the facultative<br />

reinsurance only applies to the ceding company’s net retention; other<br />

times facultative coverage also inures to the benefit of the treaty<br />

reinsurers. Ideally, the wording of the facultative certificate will make<br />

this clear. As a general matter, whether the facultative reinsurance<br />

inures to the benefit of the treaty reinsurers will depend on whether<br />

the treaty reinsurers paid a portion of the premium for the facultative<br />

<strong>40</strong>-16

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.04[1]<br />

coverage. If not, the facultative reinsurance likely will not inure to the<br />

treaty reinsurers’ benefit.<br />

Facultative certificates are often one or two page documents. The<br />

front of a typical contract identifies the parties, the underlying<br />

policyholder and policy number reinsured, amounts of the policy<br />

ceded and retained, the type of reinsurance (proportional or nonproportional)<br />

and the premium. The back of each certificate usually<br />

contains the following provisions: notice of loss; net retention;<br />

coverage for loss adjustment expenses; claims handling; cancellation;<br />

insolvency; tax; offset and intermediaries. Many facultative certificates<br />

do not include an arbitration provision [see § <strong>40</strong>.22 below for a<br />

discussion of arbitration clauses in reinsurance agreements].<br />

Treaty reinsurance, the most common form of reinsurance, covers<br />

some portion of a defined class of an insurance company’s business<br />

(e.g., an insurer’s products liability or property book of business).<br />

<strong>Reinsurance</strong> treaties cover all of the risks written by the ceding<br />

insurer that fall within their terms unless exposures are specifically<br />

excluded. Thus, in most cases, neither the cedent nor the reinsurer<br />

has the “faculty” to exclude from a treaty a risk that fits within the<br />

treaty terms. Therefore, treaty reinsurers rely heavily on the cedent’s<br />

underwriting. Treaty relationships are often long-term; treaties sometimes<br />

are renewed automatically unless a change in terms is requested.<br />

A typical treaty can include thirty or forty articles or clauses<br />

which describe the class or classes of business covered, the type of<br />

treaty (proportional or non-proportional), the amount of reinsurance<br />

provided and details about the parties’ obligations with respect to<br />

treaty operation.<br />

� Cross Reference: For a thorough discussion of the distinction<br />

between facultative and treaty reinsurance, see Compagnie de<br />

Reassurance D’Ile de France v. New England <strong>Reinsurance</strong> Corp.,<br />

825 F. Supp. 370 (D. Mass. 1993), aff’d in part and rev’d in part, 57<br />

F.3d 56 (1st Cir. 1995).<br />

z Strategic Point: <strong>Reinsurance</strong> treaties that run consecutively for<br />

many years can present certain difficulties in terms of claims<br />

processing. Contracts are often amended by endorsements which<br />

can add or delete reinsurers, change premium or ceding commission<br />

rates or add, delete or alter important contract terms. These<br />

changes may be retroactive to contract inception or have a<br />

different effective date. Practitioners evaluating indemnity under<br />

reinsurance treaties must take care to review complete versions of<br />

<strong>40</strong>-17

<strong>40</strong>.04[2] New Appleman Insurance Practice Guide<br />

the wordings, including endorsements and amendments.<br />

<strong>40</strong>.04[2] Proportional vs. Non-proportional. Proportional or pro-rata<br />

reinsurance is characterized by a proportional division of liability<br />

and premium between the ceding company and the reinsurer. The<br />

cedent pays the reinsurer a predetermined share of the premium, and<br />

the reinsurer indemnifies the cedent for a like share of the loss and<br />

the expense incurred by the cedent in its defense and settlement of<br />

claims (the “allocated loss adjustment expense” or “LAE”). According<br />

to the percentage agreed, the cedent and reinsurer share the<br />

premium and losses from the business reinsured. Proportional reinsurance<br />

spreads the risk of loss and creates a broad identity of<br />

interests between the cedent and the reinsurer, which effectively<br />

co-venture in relationship to their relative shares of the risk, even<br />

though only the cedent has contractual privity with the direct<br />

insured.<br />

The two most common types of proportional reinsurance are “quota<br />

share” and “surplus share” reinsurance. Under quota share reinsurance,<br />

the reinsurer assumes an agreed percentage of each risk from<br />

the first dollar, up to any limit assigned. For example, if there is a $100<br />

loss under a <strong>40</strong> percent quota share reinsurance contract, the cedent<br />

would bear $60 of that loss and the reinsurer concurrently would bear<br />

$<strong>40</strong> of that loss. The percentage always reflects the percentage of loss<br />

borne by the reinsurer. The portion of the risk that the reinsurer<br />

assumes is called the “ceded risk,” and the portion that the cedent<br />

keeps is referred to as the reinsurance “retention.” Although it is not<br />

a partnership, quota share reinsurance presents a greater identity of<br />

interests between the ceding insurer and the reinsurer than does<br />

excess of loss reinsurance (discussed below).<br />

Surplus share is similar to quota share reinsurance in that premiums<br />

and losses are shared on a proportional basis, but differs in that the<br />

portion of the reinsured policy the direct insurer retains is expressed<br />

as a fixed monetary amount, and the reinsurance may or may not<br />

apply from the first dollar (i.e., the reinsurance may apply only in<br />

excess of the fixed dollar amount or the cedent and reinsurer may<br />

together share losses as they are incurred until the cedent incurs an<br />

amount equal to its overall retention). Premium is shared based on<br />

the ratio of retained liability, and the reinsurer agrees to pay the same<br />

pro rata portion of any loss and expense incurred by the cedent.<br />

Examples: Where the policy limit is $150,000, and the cedent’s<br />

retention is $25,000, the amount ceded to the reinsurer is $125,000<br />

<strong>40</strong>-18

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.04[2]<br />

and the ratio of what is ceded to what is retained is 5:1. Losses<br />

therefore will be shared in that proportion. For a loss of $100,000,<br />

the cedent is responsible for $16,667 and the reinsurer pays five<br />

times more, or $83,333.<br />

In addition, in surplus share reinsurance contracts, the proportion of<br />

premium and liability ceded can vary, at the cedent’s option, from<br />

risk to risk. Although it can be advantageous for the direct insurer to<br />

vary the percentage of premium and liability ceded for each risk,<br />

these variations make a surplus share contract more difficult to<br />

administer than a simple quota share.<br />

Under non-proportional or excess of loss reinsurance (sometimes<br />

referred to as “XL” or “XOL”), the reinsurer’s liability is not triggered<br />

until the cedent’s losses exceed a specified monetary amount, called<br />

the “retention.” If losses to the ceding company are less than the<br />

retention, the reinsurer owes nothing. The reinsurance agreement<br />

will include a limit of liability for each claim above which the<br />

reinsurer is not obligated to pay. Excess of loss reinsurance can be<br />

provided on an individual risk, an occurrence or an aggregate basis,<br />

and is typically placed in layers. Non-proportional reinsurance tends<br />

to cost less than does quota share reinsurance because the reinsurer<br />

does not participate in every loss. However, because the level of risk<br />

under non-proportional reinsurance depends on the nature of the<br />

reinsurance undertaking, there is a great deal of uncertainty with this<br />

coverage. In addition to the underlying risk, reinsurers must consider<br />

the layer of coverage on which it will participate.<br />

Whether a potential cedent seeks to obtain or place coverage on a first<br />

dollar basis versus excess of loss reinsurance depends on several<br />

factors, including the cedent’s anticipated loss profile. For example, if<br />

the cedent expects to incur frequent losses at low levels, it may make<br />

economic sense for the cedent to secure quota share reinsurance, so it<br />

has some protection for even the smallest losses. In contrast, if the<br />

cedent expects to have infrequent losses at significant levels or wishes<br />

to guard against risk of a significant loss, it may choose to purchase<br />

excess of loss coverage.<br />

z Strategic Point — Reinsurer: Because non-proportional reinsurance<br />

is characterized by unpredictability and potentially high<br />

losses, XOL reinsurers may incur a disproportionate share of total<br />

losses. This is especially problematic with respect to “long tail”<br />

lines of insurance where the incidence of loss and determination<br />

of damages can extend well beyond the period in which the<br />

insurance or reinsurance is in force. In such cases, premiums may<br />

<strong>40</strong>-19

<strong>40</strong>.04[3] New Appleman Insurance Practice Guide<br />

be received long before liability is manifested or developed, and<br />

liability may be difficult to estimate because it is determined by<br />

the prevailing legal or economic environment in the future. (On<br />

the other hand, the reinsurer is able to hold on to the premium<br />

paid by the cedent for a longer period, offering it the opportunity<br />

to “earn out” losses through investment return.) Examples of<br />

long-tail lines of insurance include malpractice, products liability,<br />

and errors and omissions.<br />

� Cross Reference: For discussion of the advantages and disadvantages<br />

of proportional and non-proportional reinsurance contracts,<br />

see Eric Mills Holmes, Appleman on Insurance 2d § 102.3.<br />

� Cross References: For an example of a reinsuring clause for a<br />

quota share reinsurance agreement, see § <strong>40</strong>.30 below. For an<br />

example of a reinsuring clause for a surplus share reinsurance<br />

agreement, see § <strong>40</strong>.31 below. For an example of a reinsuring<br />

clause for an XOL reinsurance agreement, see § <strong>40</strong>.32 below.<br />

<strong>40</strong>.04[3] Catastrophe <strong>Reinsurance</strong>. Catastrophe reinsurance is a form<br />

of excess of loss reinsurance which, subject to a specific limit,<br />

indemnifies the cedent for the amount of loss in excess of its retention<br />

with respect to an accumulation of individual losses affecting multiple<br />

policies resulting from a catastrophic event. Rather than single<br />

large losses, even an unexpected number of such losses within the<br />

reinsurance policy term, catastrophe coverage principally provides<br />

protection for the cedent against the concentration of several losses,<br />

each of which may stem from different direct insureds but which<br />

altogether arise from a common event (or closely related series of<br />

events). The reinsurance contract is typically called a “catastrophe<br />

cover.” Catastrophe reinsurance can be provided on an aggregate<br />

basis with coverage for losses over a certain amount for each loss in<br />

excess of a second amount in the aggregate for all losses in all<br />

catastrophes occurring during a certain time period (often one year).<br />

Catastrophe cover is typically secured to protect the cedent against an<br />

intolerable accumulation of actual loss and to stabilize its underwriting<br />

experience.<br />

Another variant of reinsurance purchased by insurers is “clash<br />

cover,” which requires two or more coverages or policies issued by<br />

the reinsured to be involved in a loss, for coverage to apply. This<br />

reinsurance typically attaches above the limits of any one policy.<br />

Clash covers are often catastrophe covers.<br />

<strong>40</strong>-20

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.04[4]<br />

� Cross Reference: For discussion of the typical terms of catastrophe<br />

cover, see Eric Mills Holmes, Appleman on Insurance 2d<br />

§ 102.3[B][2].<br />

<strong>40</strong>.04[4] Finite <strong>Reinsurance</strong>. There is no generally accepted definition<br />

of finite risk (sometimes called “financial”) reinsurance. Broadly<br />

speaking, it is a form of reinsurance that carefully controls and limits<br />

the amount and type of risk transferred to the reinsurer, but often<br />

involves the transfer of money, a return premium from the reinsurer,<br />

to the cedent as a result of how losses developed under the<br />

reinsurance contract. Finite reinsurance can be distinguished from<br />

other non-finite or “traditional” types of reinsurance based on the<br />

extent to which there are limitations on the “underwriting risk,” the<br />

risk that the amount of losses will exceed premiums. Participants in<br />

finite risk reinsurance transactions tend to focus primarily on financial<br />

risks, such as timing risk (the risk that losses will need to be paid<br />

sooner than expected), investment risk (the risk that the reinsurer will<br />

earn less investment income than expected on the reinsurance<br />

premium) and credit risk (the risk that the cedent will not make the<br />

required premium payments).<br />

Finite risk reinsurance contracts are typically treaties that are closely<br />

tailored to meet the particular needs of a cedent. They can be quota<br />

share or excess of loss treaties and may cover losses that have yet to<br />

be quantified or to have occurred at all or losses that have already<br />

occurred in part but where the amount and timing of the loss is still<br />

uncertain. Finite risk reinsurance contracts often include some or all<br />

of the following:<br />

1. A ceiling on the amount of underwriting risk assumed by the<br />

reinsurer;<br />

2. An explicit recognition of the time value of money through the<br />

use of experience accounts funded by large reinsurance premiums,<br />

which accumulate investment income over time and<br />

fund the loss payments;<br />

3. Inclusion of a commutation clause that allows for profit<br />

sharing between the cedent and reinsurer based on the financial<br />

results of the reinsurance contract;<br />

4. Multi-year contracts that allow the cedent to mitigate volatility<br />

by recognizing a loss gradually, rather than all at once.<br />

Finite risk transactions are legitimate and widespread, though some<br />

forms of transactions have been criticized as being in substance<br />

<strong>40</strong>-21

<strong>40</strong>.04[4] New Appleman Insurance Practice Guide<br />

distinguished loans but which as something other than a loan obtains<br />

more favorable tax or accounting treatment (until challenged). The<br />

key issue is how to account for the transaction. If there has been<br />

sufficient risk transfer, the contract can be accounted for as reinsurance.<br />

If not, then contract deposit accounting is appropriate.<br />

t Warning: Significant regulatory attention has recently been<br />

directed at how insurers account for finite risk reinsurance and<br />

whether the principal objective of these transactions is untethered<br />

from an underlying business rationale but instead is designed to<br />

improve the appearance of the balance sheet of the cedent (and<br />

thus implicitly, or so the argument goes, to mislead investors and<br />

regulators as to the true financial condition of the cedent).<br />

Insurers and reinsurers in the United States and elsewhere have<br />

been investigated by the SEC, state Attorneys General, state<br />

Insurance Departments, and other law-enforcement officials with<br />

jurisdiction. A common element in many of the finite risk<br />

reinsurance transactions under attack by regulators is an allegation<br />

that the transactions were presented and accounted for as if<br />

they genuinely transferred material risk, when in fact the transactions<br />

did not do so and thus were more in the nature of loans<br />

or deposits on account. They were instead allegedly intended<br />

only to achieve a particular result on a company’s balance sheet<br />

— what is sometimes referred to as “financial engineering” or<br />

more commonly “smoothing” of earnings.<br />

Example: Effective in 2006 and 2007, the National Association of<br />

Insurance Commissioners (“NAIC”) amended the disclosure requirements<br />

for companies that purchase finite risk reinsurance,<br />

and the new requirements demand substantial and ongoing<br />

management attention. The new requirements include several<br />

new interrogatories (which are part of the “General Interrogatories”<br />

section of the Annual Statement) that apply to “ceded”<br />

reinsurance and are intended to identify reinsurance agreements<br />

that have characteristics of contracts which the regulators have<br />

identified as prone to abuse and which warrant closer review. For<br />

example, under Interrogatory 9.1, the reporting company is asked<br />

to identify any ceded reinsurance which meets three conditions:<br />

(1) the agreement alters surplus by more than 3% (positive or<br />

negative) or represents more than 5% of premiums or losses; (2)<br />

the contract was accounted for as reinsurance and not as a<br />

deposit; and (3) the contract has one or more of the following<br />

features “or other features that would have similar results”:<br />

<strong>40</strong>-22

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.04[4]<br />

• non-cancelable contract terms longer than two years;<br />

• a provision whereby cancellation triggers an obligation by<br />

the ceding company or an affiliate to enter into a new<br />

contract with the reinsurer or an affiliate;<br />

• aggregate stop loss reinsurance coverage;<br />

• an unconditional or unilateral right by either party to<br />

commute, unless triggered by a decline in the counterparty’s<br />

credit status;<br />

• a provision permitting reporting or payment of losses less<br />

frequently than quarterly;<br />

• payment schedule, accumulating retentions from multiple<br />

years or any features inherently designed to delay timing<br />

of cedent reimbursement (e.g. experience accounts).<br />

In the event conditions (1), (2) and (3) are satisfied, the reporting<br />

company must provide certain supplemental information including:<br />

(a) a summary of the terms of the responsive contracts; (b) a brief<br />

discussion of the principal objectives and “economic purpose” for<br />

entering into the contract; and (c) the aggregate financial statement<br />

impact of all such contracts on the balance sheet and income<br />

statement.<br />

A second interrogatory (9.2) is intended to ferret out additional<br />

arguably abusive reinsurance arrangements. Here, the reporting<br />

company must identify any ceded risks (other than to captives or<br />

under approved pooling arrangements) for which it recorded a<br />

positive or negative underwriting result greater than 5% of prior<br />

year-end surplus as regards policyholders or it reported calendar<br />

year written premium ceded or year-end loss and loss expense<br />

reserves ceded greater than 5% of prior year-end surplus as regards<br />

policyholders where: (1) the ceded written premium is 50% or more<br />

of the entire direct and assumed premium written by the assuming<br />

reinsurer, based on its most recent financial statement; or (2) twentyfive<br />

percent or more of the written ceded premium has been<br />

retroceded back to the ceding company in a separate reinsurance<br />

contract. Cessions by or to affiliates, including multiple contracts with<br />

the same reinsurer or its affiliates, are included in determining if the<br />

conditions are met. If either condition 1 or 2 of this interrogatory is<br />

met, the reporting company must provide the same supplemental<br />

information noted above.<br />

An additional interrogatory (9.4) requires the cedent to identify<br />

<strong>40</strong>-23

<strong>40</strong>.04[4] New Appleman Insurance Practice Guide<br />

contracts that it has accounted for as reinsurance for statutory<br />

accounting purposes yet accounted for as a deposit for GAAP<br />

purposes (or vice versa). For any such contract, an explanation for the<br />

differing treatment must be provided in a supplemental filing.<br />

The NAIC also now requires CEOs and CFOs to complete a “<strong>Reinsurance</strong><br />

Attestation Supplement” that is similar to provisions of the<br />

Sarbanes-Oxley Act (“SOX”), for “all reinsurance contracts for which<br />

the reporting entity is taking credit on its current financial statement.”<br />

The attestation includes the following four parts, which share<br />

in the common objectives to encourage transparency and auditability<br />

for reinsurance transactions of certain forms and to memorialize,<br />

preferably concurrent to entry into the reinsurance contract in<br />

question, the underlying business rationale and purpose for the<br />

transaction as a safeguard against market participants coopering up<br />

paper with or without oral side deals that negate the apparently<br />

legitimate business objective of the paperwork.<br />

Consider: Note that this regulatory purpose is not to preclude<br />

participants from making ill-considered, underpriced, or even<br />

foolish deals — shareholders may have other recourse for such<br />

non- or misfeasance; instead, preservation of the integrity of the<br />

largely self-reported financial and insurance regulatory systems is<br />

meant to be buttressed through these disclosure requirements.<br />

1. No side agreements exist, written or oral, that would “under<br />

any circumstances reduce, limit, mitigate or otherwise affect<br />

any actual or potential loss to the parties.” This prong of the<br />

attestation applies to every reinsurance contract, and not just<br />

to those that may be characterized as “finite” in nature or<br />

appearance. Verifying the absence of all such oral and written<br />

arrangements as to all contracts will likely require both<br />

documentary review and interviews of underwriting personnel,<br />

perhaps even including prior employees. Companies and<br />

their auditors should develop a plan for accomplishing this<br />

review and documenting its methodology and results.<br />

2. For reinsurance contracts entered into, renewed or amended<br />

after January 1, 1994, for which risk transfer is not reasonably<br />

considered to be self-evident, there is documentation evidencing<br />

proper accounting treatment under SSAP 62. Because<br />

Statement of Standard Accounting Practice (“SSAP”) 62 and<br />

Financial Accounting Standards Board (“FASB”) 113 (related to<br />

GAAP and statutory reinsurance accounting and risk transfer)<br />

did not apply until 1994, the NAIC recognizes that risk transfer<br />

<strong>40</strong>-24

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.04[5]<br />

analysis may not have been memorialized contemporaneously.<br />

In terms of which contracts have reasonably self-evident risk<br />

transfer, the ceding company may want to look back to the<br />

Interrogatories. Certainly, any contract reportable under the<br />

conditions delineated will be subject to this prong of the<br />

attestation. Companies will want to obtain guidance from<br />

counsel and auditors as to what constitutes sufficient “risk<br />

transfer analysis” in today’s environment.<br />

3. The reporting entity complies with all requirements of SSAP<br />

62. This deceptively simple sounding prong will require the<br />

careful exercise of “due diligence.” Each company will determine,<br />

perhaps based on consultation with accountants, lawyers<br />

and independent auditors, what constitutes sufficient due<br />

diligence to establish compliance with all of the risk transfer<br />

and accounting requirements of SSAP 62.<br />

4. The reporting entity has appropriate controls in place to<br />

monitor the use of reinsurance and adhere to the provisions of<br />

SSAP 62. This prong is the key to the ability to make the<br />

CEO/CFO attestations on an ongoing basis. Some companies<br />

will have sufficient controls already in place; others will need<br />

to develop such controls and put them in place as soon as<br />

possible.<br />

<strong>40</strong>.04[5] Fronting Arrangements. There is not a general agreement in<br />

the reinsurance industry as to how fronting is defined, and there are<br />

varying perceptions of whether the general duties and relationships<br />

between cedent and reinsurer change in the context of a “fronting”<br />

arrangement. At a minimum, fronting involves the reinsurance of all<br />

or substantially all of a book of business. The ceding company retains<br />

little or no net liability on the ceded business and receives a fee<br />

(through the ceding commission and perhaps other forms of compensation<br />

such as service fees) in exchange for allowing the business<br />

to be written on its paper. Sometimes, the goal of a fronted arrangement<br />

is to have the insurance that is sought to be brought to the<br />

marketplace sold through the auspices of an “admitted” carrier, even<br />

though the real party in interest — with underwriting expertise and<br />

per the reinsurance contract financial exposure vis-a-vis the cedent/<br />

front — is the reinsurer. In many fronting arrangements, a managing<br />

general agency (“MGA”) underwrites the business and handles<br />

claims on the reinsured policies. There is disagreement as to what<br />

extent responsibility for monitoring the MGA and responsibility for<br />

the MGA’s misdeeds lies with cedent or reinsurer. It is clear, however,<br />

<strong>40</strong>-25

<strong>40</strong>.04[5] New Appleman Insurance Practice Guide<br />

that a fronting insurer remains contractually liable to perform with<br />

respect to its insureds under the direct policies, whether or not it is<br />

indemnified by its reinsurer [Am. Special Risk Ins. Co. v. Delta Am.<br />

Re-Insurance Co., 836 F. Supp. 183, 185 (S.D.N.Y. 1993)]. The reinsurer,<br />

lacking privity with the direct insured, may be exposed to<br />

claims of tortious interference with contract or for prospective<br />

economic advantage if it directs the cedent/front not to pay a valid<br />

claim. At the same time, the cedent faces the risk that if it pays the<br />

direct claim without the support of its reinsurer a risk that it thought<br />

it may be only fronting may remain on its doorstep, for the reinsurer<br />

may assert that the payment to the direct insured was never owed in<br />

the first place under the direct insurance policy and thus represents<br />

an uncovered, ex gratia or gratuitous payment for which indemnification<br />

under the reinsurance arrangement is not owed.<br />

z Strategic Point: The reinsurance contract in a fronting arrangement<br />

should optimally specify who is responsible for oversight of<br />

the MGA and who is responsible if the MGA breaches its duties.<br />

Consider: Parties should confirm that fronting is allowed in their<br />

jurisdiction, and that there are no specific regulations that are<br />

relevant to their arrangements.<br />

z Strategic Point: Fronting arrangements enable reinsurers to<br />

accept 100 percent of the liability in states where they are not<br />

licensed to write such business on a direct basis [Reliance Ins. Co.<br />

v. Shriver, 224 F.3d 641, 642 (7th Cir. 2000); Union Sav. Am. Life<br />

Ins. Co. v. N. Central Life Ins. Co., 813 F. Supp. 481, 484 (S.D. Miss.<br />

1993); Equity Diamond Brokers, Inc. v. Transnational Ins. Co., 785<br />

N.E.2d 816, 818 (Ohio Ct. App. 2003)]. In some instances, fronting<br />

allows alien insurers to accept 100 percent of the exposure on<br />

risks it is prohibited by regulatory restrictions to write directly<br />

[Gallinger v. Vaaler Ins., 12 F.3d 127, 128 n.1 (8th Cir. 1994)<br />

(applying North Dakota law)]. It should be noted that fronting<br />

can be done as a retrocession also. Fronting allows ceding<br />

insurers to receive reinsurance credit that would not be available,<br />

at least without security, if the reinsurance was issued directly by<br />

an unauthorized reinsurer [see § <strong>40</strong>.06 below for a discussion of<br />

credit for reinsurance]. A licensed reinsurer can front for an<br />

unauthorized reinsurer or a reinsurance syndicate, to permit the<br />

ceding insurer to take credit for the reinsurance without need for<br />

security [Am. Special Risk Ins. Co. v. Delta Am. Re-Insurance Co.,<br />

836 F. Supp. 183, 185 (S.D.N.Y. 1993)].<br />

<strong>40</strong>-26

<strong>40</strong>.05 Lack of Privity of Contracts.<br />

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.05[1]<br />

<strong>40</strong>.05[1] Know General Rule. A fundamental principle of reinsurance<br />

is that the reinsurer ordinarily is not liable to the original policyholder<br />

of the ceding insurer; it is not a co-signer of the policy issued<br />

to the original policyholder, and it is not jointly and severally<br />

obligated to make good on the benefits the policyholder sought to<br />

obtain under the insurance contract sold by the insurer/cedent.<br />

Many court decisions have recognized that the reinsurer is in<br />

contractual privity only with the ceding company and has no<br />

contractual obligation to the original insured, underlying claimants,<br />

or any third parties [Barhan v. Ry-Ron, Inc., 121 F.3d 198 (5th Cir.<br />

1997) (applying Texas law); Travelers Cas. & Sur. Co. v. Prudential<br />

<strong>Reinsurance</strong> Corp., 2001 U.S. Dist. LEXIS 10913 (N.D. Ohio 2001),<br />

citing Stickel v. Excess Ins. Co. of Am., 23 N.E.2d 839 (Ohio 1939);<br />

Prudential <strong>Reinsurance</strong> Co. v. Superior Court (Garamendi), 842 P.2d<br />

48 (Cal. 1992)]. Moreover, most courts have rejected claims brought<br />

by original policyholders against reinsurers based on agency and<br />

third-party beneficiary theories [Aetna Ins. Co. v. Glens Falls Ins. Co.,<br />

453 F.2d 687, 690 (5th Cir. 1972) (applying Georgia law); Reid v.<br />

Ruffin, 469 A.2d 1030 (Pa. 1983)].<br />

Exception: While the rule of lack of privity is generally respsected<br />

by the courts, there have been some cases, particularly arising out<br />

of the insolvency of the direct insurer/cedent, where a court has<br />

characterized the original policyholder as a third-party beneficiary<br />

of the reinsurance arrangement, thus possessing the rights<br />

to enforce a contract to which it is not a party in accordance with<br />

the ordinary contract-law rules governing third-party beneficiaries.<br />

Policyholders may seek to skip over the insurer with which<br />

it has privity by arguing that the reinsurer is the alter ego of the<br />

insurer, at least insofar as the particular policy or particular<br />

insurance program is concerned. For example, in the bankruptcy<br />

context, reinsurers were considered to be the true risk bearers<br />

where the ceding insurer merely acted as the fronting company,<br />

bore no underwriting risk, and left responsibility for claims<br />

handling and funding to the reinsurers [Koken v. Legion Ins. Co.,<br />

831 A.2d 1196, 1237-38 (Pa. Commw. Ct. 2003)]. In another case,<br />

the court found that an insured had third-party beneficiary status<br />

where the insurer acted as a fronting company and the reinsurers<br />

bore all responsibility for underwriting and claims handling and<br />

managed the defense of coverage claims [Venetsanos v. Zucker,<br />

Facher & Zucker, 638 A.2d 1333, 1339-<strong>40</strong> (N.J. Super. Ct. App. Div.<br />

<strong>40</strong>-27

<strong>40</strong>.05[2] New Appleman Insurance Practice Guide<br />

1994)]. [See § <strong>40</strong>.04[5] above for a discussion of fronting arrangements].<br />

However a federal district court in Missouri rejected the<br />

theory that a reinsurer’s conduct in paying claims alone can make<br />

the reinsurer liable directly to the original insured [Allendale<br />

Mut. Ins. Co. v. Crist, 731 F. Supp. 928, 932-33 (W.D. Mo. 1989)].<br />

Similarly, a federal district court in New Jersey rejected the<br />

policyholders’ assertion that a reinsurer’s involvement in the<br />

“adjustment and settlement of claims” (as is common where there<br />

is a claims-control clause) allowed the court to “pierce the alleged<br />

reinsurance veil” [G-I Holdings v. Hartford Fire Ins. Co., 2007 U.S.<br />

Dist. LEXIS 19060, at *<strong>40</strong>-41 (D.N.J. 2007)].<br />

Exception: It may be possible for an insured to bring a direct<br />

action against a reinsurer if the reinsurer allegedly induced the<br />

direct insurer to breach the underlying policy by denying the<br />

claims in question. For example, a tort claim based on this theory<br />

asserted by policyholders against a reinsurer recently survived a<br />

motion to dismiss in a federal district court in Florida [Law<br />

Offices of David J. Stern v. SCOR <strong>Reinsurance</strong> Corp., 354 F. Supp.<br />

2d 1338, 1341-42 (S.D. Fla. 2005)].<br />

� Cross Reference: For a general discussion of a reinsurer’s<br />

potential liability to the policyholder of the ceding insurer, see Eric<br />

Mills Holmes, Appleman on Insurance 2d § 106.7.<br />

<strong>40</strong>.05[2] Consider Cut-Throughs. A significant exception to the general<br />

rule that an insured may not seek payment directly from a<br />

reinsurer is present where a cut-through endorsement is contained in<br />

the original underlying policy. A cut-through provision gives an<br />

insured a contractual right to pursue a direct action against the<br />

reinsurer; it can be conceived of as an express grant of third-party<br />

beneficiary status of the putative non-party direct insured. Cutthroughs<br />

most often apply only when the direct insurer is insolvent<br />

and provide that the loss which the reinsurer would have paid to the<br />

estate of the insolvent insurer is instead paid directly to the original<br />

policyholder [compare Wilcox v. Anchor Wate, 2006 UT 6]. A cutthrough<br />

is similar to an “assumption reinsurance” arrangement,<br />

which effectively is the consensual substitution of the reinsurer for<br />

the cedent as the agent for performance, which in turn typically vests<br />

in the direct insured the right to pursue either the original direct<br />

insurer (with which it has contract privity) or the assumer of the<br />

direct insurer’s liability, at the insured’s election. One difference<br />

between a cut through and an assumption arrangement, is that cut<br />

<strong>40</strong>-28

<strong>Understanding</strong> <strong>Reinsurance</strong> <strong>40</strong>.05[2]<br />

throughs more often are agreed ex ante, that is, when the policy is<br />

placed, and assumptions occur when the cedent effects a lossportfolio<br />

transfer to a reinsurer by which the reinsurer steps into its<br />

shoes inter sese. The assumption must be an explicit written assumption<br />

of liability to the original policyholder who acquires a direct<br />

right of action against the reinsurer; note that since the assumption<br />

takes place on only one side of the transaction, it is not a “novation,”<br />

freeing the original contracting party from its contractual duties; it is<br />

not fictive, however, which is why the direct insured often will be<br />

permitted to elect to pursue either the original party in privity or the<br />

assumption reinsurer. Many state statutes permit reinsurers to enter<br />

into cut-through endorsements. [Cal. Ins. Code § 922.2; N.Y. Ins.<br />

Code § 1308(a)(2)(B); Tex. Ins. Code § 493.055]. This right has been<br />

recognized by many courts as well [Martin Ins. Agency, Inc. v.<br />

Prudential <strong>Reinsurance</strong> Co., 910 F.2d 252-53 (5th Cir. 1990) (interpreting<br />

Louisiana law); Bruckner-Mitchell, Inc. v. Sun Indem. Co., 82 F.2d<br />

434, 444 (D.C. Cir. 1936); Klockner Stadler Hurter, Ltd. v. Ins. Co. of<br />