Executive Benefits Survey Results of the 2011 ... - Hay Group

Executive Benefits Survey Results of the 2011 ... - Hay Group

Executive Benefits Survey Results of the 2011 ... - Hay Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 <strong>Executive</strong> <strong>Benefits</strong> <strong>Survey</strong><br />

Nonqualified Deferred Compensation Programs<br />

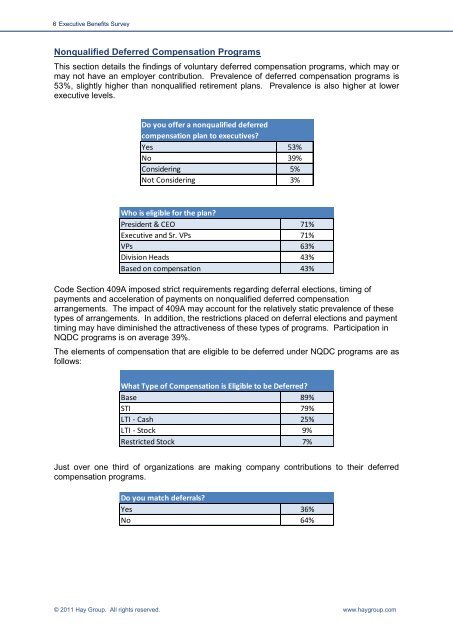

This section details <strong>the</strong> findings <strong>of</strong> voluntary deferred compensation programs, which may or<br />

may not have an employer contribution. Prevalence <strong>of</strong> deferred compensation programs is<br />

53%, slightly higher than nonqualified retirement plans. Prevalence is also higher at lower<br />

executive levels.<br />

Do you <strong>of</strong>fer a nonqualified deferred<br />

compensation plan to executives?<br />

Yes 53%<br />

No 39%<br />

Considering 5%<br />

Not Considering 3%<br />

Who is eligible for <strong>the</strong> plan?<br />

President & CEO 71%<br />

<strong>Executive</strong> and Sr. VPs 71%<br />

VPs 63%<br />

Division Heads 43%<br />

Based on compensation 43%<br />

Code Section 409A imposed strict requirements regarding deferral elections, timing <strong>of</strong><br />

payments and acceleration <strong>of</strong> payments on nonqualified deferred compensation<br />

arrangements. The impact <strong>of</strong> 409A may account for <strong>the</strong> relatively static prevalence <strong>of</strong> <strong>the</strong>se<br />

types <strong>of</strong> arrangements. In addition, <strong>the</strong> restrictions placed on deferral elections and payment<br />

timing may have diminished <strong>the</strong> attractiveness <strong>of</strong> <strong>the</strong>se types <strong>of</strong> programs. Participation in<br />

NQDC programs is on average 39%.<br />

The elements <strong>of</strong> compensation that are eligible to be deferred under NQDC programs are as<br />

follows:<br />

What Type <strong>of</strong> Compensation is Eligible to be Deferred?<br />

Base 89%<br />

STI 79%<br />

LTI - Cash 25%<br />

LTI - Stock 9%<br />

Restricted Stock 7%<br />

Just over one third <strong>of</strong> organizations are making company contributions to <strong>the</strong>ir deferred<br />

compensation programs.<br />

Do you match deferrals?<br />

Yes 36%<br />

No 64%<br />

© <strong>2011</strong> <strong>Hay</strong> <strong>Group</strong>. All rights reserved. www.haygroup.com