Download Shareholders - Reckitt Benckiser

Download Shareholders - Reckitt Benckiser

Download Shareholders - Reckitt Benckiser

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHAREHOLDERS’ REVIEW AND SUMMARY FINANCIAL STATEMENT 2005<br />

EXPANDING<br />

HORIZONS<br />

ENTERING NEW SEGMENTS, EXPANDING OUR BRANDS<br />

INTO NEW GEOGRAPHIES, ACQUIRING NEW CATEGORIES<br />

STRONG FINANCIAL RESULTS • DIVIDEND UP 15% • BHI ACQUISITION – NEW PLATFORM FOR GROWTH

<strong>Reckitt</strong> <strong>Benckiser</strong> continued to expand its business with<br />

good results in 2005. We further strengthened our brand<br />

and market positions behind successful new products,<br />

entered new segments and extended our portfolio into<br />

new geographic markets. We also substantially strengthened<br />

our core business by agreeing to acquire Boots Healthcare<br />

International, creating a new platform for profitable growth.<br />

2005 RESULTS<br />

I think the business performance, in the face of sharply<br />

higher prices for materials and energy, emphasises the<br />

resilience of our business: it was a major achievement<br />

to sustain margin growth by relentlessly reducing costs.<br />

Net revenues grew 8% (6% at constant exchange rates) to<br />

£4,179m. Operating profit increased 12% to £840m. Despite<br />

the significant increases in input costs, gross margins expanded<br />

by 10 basis points to 54.9%. Thanks to tight control of fixed<br />

costs, we achieved an 80 basis point increase in operating<br />

margins to 20.1%. Net income grew 16% to £669m, helped<br />

by higher interest received and non-recurring tax credits.<br />

We continue to strengthen our financial position. Dividends<br />

for the year increased 15% to 39p, and share buy backs<br />

totalled £300m. Even after returning over £550m of<br />

cash to shareholders in these ways, net funds increased<br />

by £255m to £887m.<br />

2<br />

CHIEF EXECUTIVE’S REVIEW<br />

ENTERING NEW SEGMENTS,<br />

EXTENDING INTO NEW<br />

GEOGRAPHIES AND BUILDING<br />

NEW GROWTH PLATFORMS<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

2005 ACHIEVEMENTS<br />

It is satisfying to deliver good financial results for shareholders<br />

but one year of results is not the only measure of success.<br />

I’m equally excited about the progress we made in<br />

strengthening our business for the long-term – building<br />

our brands, market positions and geographic spread.<br />

New product launches<br />

We launched a number of even better solutions for our<br />

consumers. Vanish Dual Power harnessed new technology<br />

with its dual chamber bottle to provide powerful, instant<br />

stain removal. We upgraded Vanish Oxi Action Max to<br />

tackle even tough dried-on stains. Finish 4in1 brought still<br />

more convenience to Automatic Dishwashing, combining<br />

detergent, rinse aid, salt and glass protection in a single<br />

tablet. In North America we launched Electrasol 3in1 with<br />

Jet Dry Action. Air Wick Freshmatic allowed users to<br />

choose the frequency of air freshener spray. Finally, we took<br />

world leadership in multi-purpose cleaners by rolling-out<br />

Bang globally. Launched in Europe as Cillit Bang and beyond<br />

Europe as Easy-Off Bang, it is now sold in 68 countries<br />

and makes a powerful new platform on which to build.<br />

BHI – an excellent add-on acquisition<br />

In October we announced agreement to acquire Boots<br />

Healthcare International (BHI) for £1,926m. We have been<br />

seeking suitable add-on acquisitions for our core business<br />

and BHI fits our criteria exactly.<br />

Over The Counter (OTC) Healthcare is a market with good<br />

growth and inherently attractive margins. We expect this<br />

growth to be sustained by the trends of increasing self<br />

medication, ageing populations and national health systems’<br />

growing need to pass the cost of minor ailments to<br />

consumers. Margins are attractive as brand loyalty is<br />

particularly strong in OTC Healthcare. Consequently, growing<br />

our healthcare business has the potential to enhance <strong>Reckitt</strong><br />

<strong>Benckiser</strong>’s overall operating margins, albeit this will take time<br />

due to the regulatory hurdles in expanding this business rapidly.<br />

BHI owns three particularly powerful multi-national brands:<br />

Nurofen, Europe’s No.2 analgesic, Strepsils, world No.1<br />

(outside the US) in sore throat and Clearasil, world No.1 in<br />

anti-acne. With Lemsip and Gaviscon we’ve already shown<br />

we can grow strong brands like these in healthcare –<br />

stimulating growth by choosing the right categories and<br />

segments, developing innovative products that meet real<br />

consumer needs, and expanding distribution into new<br />

geographical markets.<br />

Combining our healthcare business with BHI’s will create<br />

a platform for growth for RB’s Health & Personal Care both<br />

organically as well as through further acquisition.<br />

We paid a full price for BHI, reflecting its quality and<br />

growth record. But we believe this price is justified by<br />

the anticipated cost synergies of £75m and opportunities<br />

to reduce working capital by £130m.<br />

VISION AND STRATEGY<br />

Our vision is continuously to deliver better products to<br />

consumers that improve their lives at crucial moments.<br />

Our strategy is equally simple. Let me remind you of<br />

its key elements.<br />

DELIVER ABOVE INDUSTRY AVERAGE GROWTH<br />

IN NET REVENUES.<br />

We do this in five ways.<br />

Focus investment and innovation on ‘the right brands<br />

in the right categories’. That means categories with<br />

strong growth potential like Automatic Dishwashing and<br />

Fabric Treatment, where we can drive growth behind world<br />

leading brands such as Finish and Vanish. Most of our<br />

effort goes behind the 18 flagship powerbrands that will<br />

by the end of 2006 represent 60% of our net revenues.<br />

Reinforce our brands with an exceptional rate of product<br />

innovation. Offering consumers ever-better solutions<br />

stimulates them to purchase, helping to grow both the<br />

category and our market share. Almost 40% of our net<br />

revenues come from products launched in the past three years.<br />

Back our brands with consistent marketing<br />

investment. Our media spend rate, at around 12% of net<br />

revenues, is at the top of the industry. And we are now<br />

complementing media investment with more direct<br />

interaction with consumers through in-store demonstrations,<br />

sampling programmes and point-of-sale communication.<br />

Build our major brands by rolling them out into new<br />

geographies. Vanish (now in 48 countries) and, more<br />

recently, Bang (now in 68) demonstrate the scope for<br />

doing this. Few of our major brands are yet present in all<br />

territories, and we continue to roll them out as market<br />

opportunities develop.<br />

Finally, leverage our financial strength to enhance<br />

long-term growth by making add-on acquisitions that<br />

strengthen our core business.

CONVERT GROWTH INTO EVEN MORE ATTRACTIVE<br />

PROFIT AND CASH FLOW THROUGH CONTINUING<br />

MARGIN EXPANSION AND CASH CONVERSION.<br />

Most importantly, we expand margins through intensive<br />

work on cost optimisation – in goods and services, and in<br />

fixed costs. We find exciting rewards in the most<br />

unglamorous places: using less packaging, standardising<br />

product formulas, renegotiating supply contracts, simplifying<br />

processes. Margin expansion fuels the business, funding<br />

marketing investment and driving profit growth. In 2000,<br />

our operating margin was 14.4%. It is now over 20%,<br />

achieving our target for 2006 a year early.<br />

I like to tell my colleagues that I cannot invest profit,<br />

I can only invest cash. That is why we focus relentlessly<br />

on collecting cash – which allowed us to return over<br />

£550m to shareholders last year while making the £1,926m<br />

BHI bid on the strength of our own balance sheet.<br />

These are the principles of our strategy. In the following<br />

pages you will see examples of how we put it into practice<br />

to deliver results for shareholders.<br />

OUR PEOPLE AND CULTURE<br />

Our strategy will only work if we have the right people<br />

working together within the right corporate culture. Our<br />

people consistently achieve remarkable things through their<br />

passion for the business and determination to succeed.<br />

I thank them for their tremendous contribution.<br />

Our success does not depend on a few outstanding people,<br />

but on many good people working effectively together<br />

in a culture that shares a hunger for success, celebrates<br />

achievement, collaborates in powerful teams and takes<br />

intelligent risks together on behalf of the business. Internal<br />

politics waste time and dissipate effort. We aim to unite<br />

behind shared strategies to make a winning business.<br />

Our remuneration system is a key tool in driving culture,<br />

behaviour and performance. It is designed to reward<br />

success. We make no apology for paying well for excellent<br />

performance, nor for being unsympathetic to mediocrity.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> people like to work for a responsible company<br />

– one whose products are a force for good in society and<br />

which helps to improve lives through wealth creation and<br />

community involvement. Our sustainability commitment is to<br />

operate ever more effectively today with as little environmental,<br />

social and ethical cost to the future as possible.<br />

We are making good progress in addressing our environmental<br />

and social impacts. For example, our new Automatic Dishwashing<br />

initiative, detailed in this report, shows how we can play a major<br />

role in making a positive impact on climate change. I hope<br />

you will find time to read more in our Sustainability Report.<br />

OUR FUTURE<br />

Our brands and market positions are stronger than they<br />

were last year. They benefit from a consistent stream of<br />

investment and continuous consumer-relevant innovation.<br />

Our financial strength continues to grow and the BHI<br />

acquisition will provide a new platform for us to develop<br />

at inherently higher margins. Our people are even more<br />

experienced and just as passionate. <strong>Reckitt</strong> <strong>Benckiser</strong><br />

is well placed to continue living its vision.<br />

Bart Becht Chief Executive Officer<br />

CHAIRMAN’S STATEMENT<br />

2005 was another year of very good progress in challenging<br />

circumstances. The results again exceeded targets, allowing<br />

us to deliver strong returns to shareholders.<br />

STRATEGY<br />

The Company’s strategy, set out in the Chief Executive’s<br />

review, remains unchanged. During the year the Board<br />

approved a successful offer for Boots Healthcare<br />

International (BHI), advancing the strategy of becoming<br />

a major player in Health & Personal Care.<br />

RETURNING CASH TO SHAREHOLDERS<br />

The Company has continued to return cash to shareholders<br />

through progressive dividends and share buy backs. The<br />

directors propose a total dividend for the year of 39p, an<br />

overall increase of 15%. In addition we met our commitment<br />

to buy back £300m of shares during the year. The Company<br />

has consistently strengthened its balance sheet over recent<br />

years. Following the BHI acquisition it will have proforma net<br />

borrowings of over £1 billion but will still have the financial<br />

strength to continue share buy backs. We are targeting £300m<br />

of buy backs in 2006, and dividend growth in line with earnings.<br />

MANAGEMENT AND COMPENSATION<br />

The strength of the management team is evident from the<br />

Company’s sustained performance. There were no major<br />

changes in the team over the year. The Board continues to<br />

review remuneration policy to ensure that it is appropriate<br />

in a competitive international market and that it incentivises<br />

managers to generate quality returns for shareholders.<br />

We believe it is an important contributor to the continuing<br />

success of the business. Some minor changes, disclosed<br />

in the Remuneration Report, are being made to bring<br />

it into line with best practice, for which we are seeking<br />

shareholder endorsement at the AGM.<br />

ANNUAL GENERAL MEETING<br />

The Board strongly recommends that shareholders support<br />

the resolutions at the AGM on 4 May 2006, endorsing the<br />

policies that have brought the Company continuing success.<br />

BOARD<br />

The Board reviewed various aspects of the business during<br />

2005 – in particular corporate governance, corporate<br />

responsibility and sustainability, and reputational risk<br />

especially in relation to product and manufacturing risks.<br />

The Board regularly reviews business performance and<br />

holds specific reviews with operational management<br />

on area and functional performance.<br />

In 2005 the Board was strengthened with the appointment<br />

of Graham Mackay, Chief Executive of SABMiller, and<br />

Gerard Murphy, Chief Executive of Kingfisher. Graham<br />

Mackay joined the Remuneration Committee and Gerard<br />

Murphy joined the Audit Committee. Ken Hydon assumed<br />

the role of senior Non-Executive Director. George Greener<br />

will not be standing for re-election at the AGM. I thank<br />

him for his significant contribution throughout his ten<br />

years as a director, latterly as senior Non-Executive<br />

Director and a member of the Remuneration Committee.<br />

Ana Maria Llopis and Hans van der Wielen retired at the<br />

2005 AGM; I thank them both for their contribution.<br />

THANKS<br />

I thank Bart Becht and his excellent team for another year<br />

of strong results and good strategic progress. I would also<br />

like to thank the Board for their important contribution.<br />

Adrian Bellamy Chairman<br />

3<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005

OUR BRANDS,<br />

OUR BUSINESS<br />

4<br />

AT A GLANCE<br />

REVENUE GROWTH* OPERATING PROFIT<br />

4%<br />

Growth came from key recent product introductions.<br />

In Fabric Treatment, growth was due to the success of<br />

Vanish with Vanish Oxi Action Max and Vanish Dual<br />

Power. In Surface Care, growth came from Cillit Bang.<br />

In Dishwashing, growth was due to Finish/Calgonit<br />

4in1. Home Care increased due to the successful<br />

launch of Air Wick Freshmatic. Health & Personal Care<br />

saw strong growth for the Health Care portfolio due<br />

to the roll-out of Gaviscon in Europe.<br />

OPERATING COUNTRIES<br />

Austria, Belgium, Bulgaria, Croatia, Czech Republic,<br />

Denmark, France, Germany, Greece, Hungary, Ireland,<br />

Israel, Italy, Latvia, Netherlands, Poland, Portugal,<br />

Romania, Russia, Slovakia, Slovenia, Spain,<br />

Switzerland, Turkey, UK and Ukraine.<br />

*at constant exchange rate<br />

COMPARISONS BY REGIONS<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

0000<br />

0000<br />

In Fabric Care, Spray ‘n Wash Dual Power Fabric<br />

Treatment and Resolve Dual Power carpet cleaner grew<br />

sales. In Surface Care increases came from growth for<br />

Lysol Disinfectant Spray, and the launch of Easy-Off<br />

Bam. In Dishwashing increases came due to the<br />

success of Electrasol with Jet Dry Action. In Home<br />

Care, Air Care grew following the launch of Air Wick<br />

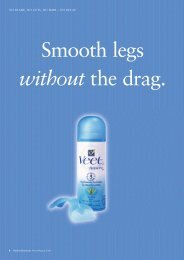

Freshmatic, and in Health & Personal Care, Veet<br />

depilatories and prescription drug Suboxone were the<br />

principal contributors to growth. Food increased net<br />

revenues due to the launch of Cattleman’s BBQ Sauce<br />

in retail and to continued growth for French’s yellow<br />

mustard and gains for Frank’s Red Hot Sauce.<br />

OPERATING COUNTRIES<br />

Australia, Canada, New Zealand and USA.<br />

WE ARE PASSIONATE ABOUT<br />

DELIVERING BETTER SOLUTIONS IN<br />

HOUSEHOLD CLEANING AND HEALTH &<br />

PERSONAL CARE TO CUSTOMERS AND<br />

CONSUMERS, WHEREVER THEY MAY BE,<br />

FOR THE ULTIMATE PURPOSE OF<br />

CREATING SHAREHOLDER VALUE.<br />

EUROPE NORTH AMERICA AND AUSTRALIA DEVELOPING MARKETS<br />

£502m 5%<br />

REVENUE GROWTH* OPERATING PROFIT<br />

*at constant exchange rate<br />

0000<br />

£270m 12%<br />

0000<br />

REVENUE GROWTH* OPERATING PROFIT<br />

There was strong growth in all categories. In Fabric<br />

Care, growth came following the roll-out of Vanish<br />

Oxi Action Fabric Treatment products. In Surface Care,<br />

increases came from the success of Easy-Off Bang. Pest<br />

Control grew strongly with the launch of Mortein Power<br />

Booster coils. Health & Personal Care grew due to the<br />

continuing roll-out of Veet in new markets and strong<br />

growth for the Dettol range of personal care products.<br />

OPERATING COUNTRIES<br />

Argentina, Bangladesh, Brazil, Chile, China, Colombia,<br />

Costa Rica, Egypt, Hong Kong, India, Indonesia, Japan,<br />

Kenya, Korea, Malaysia, Mexico, Nigeria, Pakistan,<br />

Philippines, Singapore, South Africa, Sri Lanka, Taiwan,<br />

Thailand, United Arab Emirates, Uruguay, Venezuela<br />

and Zambia.<br />

*at constant exchange rate<br />

GROUP FINANCIAL HIGHLIGHTS<br />

£68m<br />

2005 2004 change<br />

£M £M %<br />

Net revenues 4,179 3,871 8<br />

Operating profit 840 749 12<br />

Profit before tax 876 758 16<br />

Profit after tax 669 577 16<br />

Basic earnings per share 92.0p 80.7p 14<br />

Diluted earnings per share 90.0p 77.1p 17<br />

Declared dividend per share 39.0p 34.0p 15

OUR GLOBAL BRANDS<br />

16%<br />

HEALTH & PERSONAL CARE<br />

Net revenue £662m<br />

PROFILE OF CATEGORY<br />

Products that relieve or solve<br />

common personal or health<br />

problems, protecting against<br />

infection and improving<br />

wellbeing. Our personal care<br />

products include Clearasil<br />

anti-acne cream and Veet<br />

to remove unwanted body<br />

hair. Denture Care cleans and<br />

improves the performance<br />

of dentures. Our range of<br />

the over-the-counter health<br />

products includes analgesics,<br />

gastro-intestinal products<br />

and cough, cold and sore<br />

throat products. Suboxone<br />

(Buprenorphine) is the<br />

Company’s prescription drug<br />

against opiate dependence.<br />

KEY BRANDS<br />

Antiseptics Dettol Denture<br />

Care Kukident, Steradent<br />

Analgesics cold/flu Disprin,<br />

Lemsip, Nurofen*, Strepsils*<br />

Gastro-Intestinals Gaviscon,<br />

Senokot, Fybogel Personal<br />

Care Clearasil*, Veet<br />

MARKET POSITION<br />

Dettol is the world leader<br />

in antiseptics bought for use<br />

at home. Veet is the world<br />

leader in depilatories.<br />

Nurofen is the No.2 Analgesic<br />

in Europe. Strepsils is the No.1<br />

sore throat product outside<br />

the US. Clearasil is the No.1<br />

anti-acne treatment.<br />

*Acquired 31 January 2006<br />

27% 21% 14%<br />

15%<br />

OF NET REVENUES OF NET REVENUES<br />

FABRIC CARE<br />

Net revenue £1,113m<br />

PROFILE OF CATEGORY<br />

This category consists of<br />

five product groups used<br />

for cleaning and treating<br />

all fabrics. It covers products<br />

used before, during or after<br />

the main laundry wash cycle.<br />

Fabric Treatment products<br />

remove stains from clothes,<br />

carpets and upholstery.<br />

Garment Care products<br />

are specially formulated<br />

for washing delicate fabrics.<br />

Water Softeners protect<br />

the machine and laundry<br />

against the build-up<br />

of limescale and other<br />

deposits. Fabric Softeners<br />

are used for softening<br />

and freshening fabrics<br />

and ironing aids help make<br />

ironing more convenient.<br />

Laundry detergents clean<br />

fabrics in washing machines.<br />

KEY BRANDS<br />

Fabric Treatment Vanish,<br />

Spray ‘n Wash, Resolve,<br />

Napisan Garment Care<br />

Woolite Water Softener<br />

Calgon Fabric Softener<br />

Quanto, Flor Laundry<br />

Detergent Ava,<br />

Sole Colon, Dosia<br />

MARKET POSITION<br />

No.1 worldwide in Fabric<br />

Treatment and Water<br />

Softener categories.<br />

No.2 worldwide in<br />

Garment Care.<br />

SURFACE CARE<br />

Net revenue £871m<br />

PROFILE OF CATEGORY<br />

Five product groups.<br />

Disinfectant cleaners both<br />

clean and disinfect surfaces,<br />

killing 99.9% of germs.<br />

Lavatory cleaners offer<br />

specialised cleaning and<br />

disinfecting for the toilet<br />

bowl and cistern. All purpose<br />

cleaners are ideal for<br />

many household surfaces,<br />

particularly in the bathroom<br />

and kitchen. Specialty<br />

cleaners are designed<br />

for specific tasks – from<br />

cleaning ovens to removing<br />

limescale. Finally, polishes<br />

and waxes clean and shine<br />

hard surfaces such as<br />

furniture and floors.<br />

KEY BRANDS<br />

Disinfectant Lysol, Dettol,<br />

Sagrotan, Pine-O-Cleen<br />

Lavatory Harpic, Lysol<br />

All purpose Veja, St Marc,<br />

Cillit Bang, Easy-Off Bang<br />

Specialty Easy-Off Oven,<br />

Mop & Glo, Brasso,<br />

Lime-A-Way, Destop, Rid-X<br />

Polishes & waxes Poliflor,<br />

Old English, O’Cedar,<br />

Mr Sheen<br />

MARKET POSITION<br />

No.1 worldwide in<br />

Surface Care with leading<br />

positions across the five<br />

segments described above.<br />

DISHWASHING<br />

Net revenue £579m<br />

PROFILE OF CATEGORY<br />

Products used in automatic<br />

dishwashing machines and<br />

for washing dishes by hand.<br />

In automatic dishwashing<br />

the main product is detergent<br />

for cleaning dishes in the<br />

main wash cycle and sold<br />

in an increasing range of<br />

formats: powder, liquid,<br />

gels (standard and 2in1),<br />

gelcaps (standard and 2in1)<br />

and tabs (Double Action,<br />

PowerBall, 2in1, 3in1 and<br />

4in1). Other products include<br />

rinse agents, decalcifying salts,<br />

dishwasher cleaners,<br />

deodorisers and glass<br />

corrosion protectors.<br />

KEY BRANDS<br />

Finish, Calgonit, Electrasol,<br />

Jet Dry<br />

MARKET POSITION<br />

No.1 worldwide in<br />

Automatic Dishwashing.<br />

HEALTH & PERSONAL CARE<br />

FABRIC CARE<br />

SURFACE CARE<br />

DISHWASHING<br />

HOME CARE<br />

HOME CARE<br />

OF NET REVENUES OF NET REVENUES OF NET REVENUES<br />

HOME CARE<br />

Net revenue £628m<br />

PROFILE OF CATEGORY<br />

Consists of three categories.<br />

Air Care products freshen<br />

or add fragrance to the<br />

air and also create an<br />

ambience. Various formats<br />

include; aerosols, gels,<br />

liquids, electricals and<br />

candles. Pest Control<br />

products offer solutions<br />

to domestic infestation.<br />

The category includes<br />

rodenticide and insecticide<br />

products – in formats such<br />

as coils, mats, baits, traps,<br />

vapourisers and sprays –<br />

to prevent infestation<br />

and to kill pests. Shoe Care<br />

cleans and protects shoes.<br />

KEY BRANDS<br />

Air Care Air Wick Pest<br />

Control d-Con, Mortein,<br />

Shieldtox, Target, Rodasol,<br />

Pif Paf, Tiga Roda Shoe Care<br />

Nugget, Cherry Blossom<br />

MARKET POSITION<br />

No.2 worldwide in Air Care,<br />

Shoe Care and Pest Control.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

5

OUR FORMULA IS SIMPLE: RIGHT<br />

CATEGORY + CONSTANT INNOVATION<br />

+ CLEAR COMMUNICATION…<br />

Stain removal is an ideal category for us. There’s a real consumer<br />

need: stains are a worry, you can’t be sure if they’ll come out in the<br />

wash, and the wrong treatment can make matters worse. Consumers<br />

know their laundry detergents alone won’t do the trick – and there’s<br />

growing demand for specialised additives that can.<br />

The right product has real value to consumers, if it rescues a garment.<br />

And the market has plenty of room for further growth. In the past<br />

few years we’ve covered the world in pink, making Vanish global<br />

market leader. From nine countries in 1999, it’s now sold in 48.<br />

We’ve built a worldwide brand into which we can launch a stream<br />

of ever cleverer products.<br />

Consumers trust Vanish because it works. And we reinforce their<br />

trust through constant product innovation.<br />

For us, innovation does two things. It grows sales, as we improve<br />

our products or broaden the range of Vanish products for specific<br />

challenges such as carpet stains. And it protects our premium pricing,<br />

as consumers are willing to pay for better products.<br />

In 2005 we found ways to improve Vanish Oxi Action Max so it<br />

removes even tough dried-in stains in the wash. And we launched<br />

Vanish Dual Power pre-treater, with two active solutions in an<br />

eyecatching double-barrelled bottle: you squirt, they mix and you see<br />

them fizz as they activate. As always, we backed the brand with clear<br />

communication that demonstrates how Vanish makes stains disappear.<br />

Result: further market share growth virtually everywhere, and even<br />

stronger global brand leadership. Our formula works like magic.<br />

Like Vanish.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

TURNING<br />

STAINS<br />

INTO<br />

GAINS...

WHILE DISHWASHER OWNERS<br />

ARE ‘VERY SATISFIED’, WE KEEP<br />

SURPRISING THEM...<br />

2IN1, 3IN1, 4IN1…<br />

WE’RE NEVER SATISFIED!<br />

To keep expanding our share of this growing market, we need to<br />

make dishwasher owners even happier – with even better solutions.<br />

What can we do, when they’re so happy already?<br />

Simple. Surprise them. Amaze them. Then delight them.<br />

We began in 1995, with the first two-layer dishwasher tablet. It sold very<br />

well and research said consumers were ‘very satisfied’ with it. So we<br />

improved its performance by adding the pre-soaker Powerball in 1999.<br />

Consumers loved this. So we made life simpler for them with Finish<br />

3in1, which had rinse aid and salt built-in.<br />

Research said they disliked the corrosion that makes glasses cloudy.<br />

So we launched Protector, to help stop it happening.<br />

Could life get much better? Consumers didn’t really think so. Until<br />

in 2005 we launched Finish 4in1 with Protector action built-in.<br />

Over the past year it’s been a real success, further strengthening<br />

our global leadership. In Germany, where strong local competition<br />

has been a challenge for several years, it’s returned our market<br />

share to growth. Worldwide, it’s taken our share to record levels<br />

– and brought private label share growth to a standstill.<br />

Finish 4in1 brought consumers our best-ever cleaning and stain<br />

removal, shine, limescale protection – plus glass and silver<br />

protection. So are they satisfied with it? Very, says the research.<br />

And are we going to improve on it? Absolutely.

IN ONE YEAR, ‘BANG!’ HAS TAKEN<br />

68 COUNTRIES BY STORM.<br />

Bang really has launched with a bang. In just a year we’ve rolled it<br />

out into 68 countries – and taken world leadership in multi-purpose<br />

cleaners. It takes a powerfully co-ordinated global marketing<br />

strategy to win friends on that scale. But it also takes real sensitivity<br />

to local conditions.<br />

In South Africa, for example, we used the global media campaign<br />

to reach the country’s three million more-affluent households.<br />

But for the other seven million households we used an altogether<br />

more down-home approach.<br />

The townships are a big market – Soweto alone has a population of<br />

six million. But TV commercials wouldn’t get us much visibility there.<br />

And as well as reaching consumers, we also had to reach the small<br />

independent stores where they shop. So we set up a roadshow<br />

to tour community halls and shopping centres.<br />

We brought music to draw the crowds, with big-name DJs to add<br />

excitement and credibility. We gave live demonstrations to convince<br />

people that Bang really works, and delivers great value. The theme<br />

was “Haikona” or “I can’t believe my eyes!”. Some 12,000 people<br />

came to see for themselves. And live tie-ups with radio stations<br />

broadcasting in 11 languages enabled us to reach 3.4 million listeners<br />

with just six events.<br />

To encourage retailers to stock the product, we gave them display<br />

cards of sample sachets. Within eight weeks we were in 2,500 stores,<br />

including 96% of the top 500.<br />

A year on, we’re still in all those stores – and they’re still selling out.<br />

Bang now has the top-selling trigger pack and two of the top-selling<br />

powder packs on the multi-purpose cleaner market. And on the back<br />

of Bang’s success, we’re now building distribution of other <strong>Reckitt</strong><br />

<strong>Benckiser</strong> brands in the townships. Looks like everyone’s cleaning up<br />

with Bang…<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

AND<br />

IT’S<br />

GONE<br />

GLOBAL...

BHI<br />

HITS<br />

THE<br />

SPOT...<br />

ACQUIRING BOOTS HEALTHCARE<br />

INTERNATIONAL (BHI) IS THE<br />

RIGHT PLATFORM TO EXPAND<br />

INTO HEALTHCARE.<br />

It’s an ideal marriage. BHI brings complementary strengths to our<br />

Health & Personal Care business, creating a platform for sustainable<br />

growth in a very attractive category. As we’ve already shown with<br />

Lemsip and Gaviscon, there’s major potential in over-the-counter<br />

(OTC) medicines if you know how to develop products and brands<br />

that meet real consumer needs.<br />

What’s more, we expect the overall OTC market to show good growth<br />

for many years to come. Why? Because ageing populations are more<br />

prone to minor ailments which they could treat themselves with OTC<br />

medicines. And because governments need to curb the rising cost<br />

of healthcare.<br />

Following the acquisition we’ll have strong positions in four of<br />

the key OTC medicine categories. In analgesics we’ll have Nurofen,<br />

the European brand leader, and Disprin. In cough, cold and flu Lemsip<br />

will be joined by Strepsils, the world’s leading sore throat brand.<br />

In gastro-intestinal we already have Gaviscon and Senokot. And in<br />

medicated skin care we’ll have Clearasil, the world’s leading anti-acne<br />

brand, as well as strong local brands such as E45 and Lutsine.<br />

Brand loyalty is strong in this sector, which is generally good for<br />

margins. And by exploiting synergies and reducing costs, we expect<br />

to build margins even further. As the business grows, we expect<br />

it to give the Group’s overall margins a healthy lift.<br />

Combining the brands and the infrastructure of BHI with our existing<br />

business in Health & Personal Care creates a strong platform across<br />

Europe and selected other markets in OTC. Our strength in grocery<br />

and mass market distribution will be complemented by BHI’s<br />

capability in medical detailing and pharmacy channels. This makes<br />

a powerful base for organic development or for further acquisitions<br />

to expand our portfolio and geographical reach.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005

RISING<br />

COSTS<br />

REALLY<br />

BUG US!<br />

OUR COST REDUCTION PROGRAMME<br />

ROUTINELY TAKES £30M OUT OF OUR<br />

COSTS EACH YEAR. BUT IN 2005 WE<br />

FACED A SWARM OF RAW MATERIAL<br />

PRICE HIKES.<br />

It wasn’t just the soaring oil price. High-priced oil drove up the cost of<br />

plastics and chemical feedstocks. And booming demand from growth<br />

economies such as China and India raised the price of materials like<br />

steel and tinplate.<br />

That was a serious challenge for our strategy of squeezing costs to<br />

drive up profits and cash flow even faster than sales. Just to stand<br />

still, we needed major savings – on top of our existing £30m cost<br />

reduction target.<br />

Undaunted, a SWAT team representing all spending departments<br />

looked at hundreds of cost-saving ideas. They filtered-out any<br />

that might affect product performance or consumer perceptions,<br />

and still found enough to offset all our input cost increases and<br />

keep margins growing. Mission accomplished.<br />

And we’re well placed to do it again this year, despite continuing<br />

cost pressures.<br />

How’s it done? Relentlessly reviewing everything we do, to get more<br />

cost out or more value in. In the US we switched from printing on<br />

cans to glossy plastic labels that look better and cost less – on millions<br />

and millions of cans a year. Europe follows suit in 2006. In Europe<br />

we optimised our distribution logistics and saved £1m.<br />

In India, sales of Mortein mosquito coils are growing very rapidly. We<br />

moved production to economically deprived areas in Northern India<br />

where the government provides fiscal incentives. And negotiated<br />

to introduce a more advanced active ingredient at lower cost.<br />

Rising costs won’t go away. So we’re focused on long-term, sustainable<br />

savings. We’re moving up the supply chain – helping suppliers cut<br />

their own costs, so they can curb their prices to us. That way,<br />

everyone wins: our suppliers, shareholders and consumers.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005

TAKING A LEAD IN ACTION FOR SUSTAINABILITY…<br />

CLICK YOUR<br />

DISHWASHER<br />

TO AN ENERGY<br />

SAVING PROGRAMME<br />

AND YOU’LL SAVE<br />

MORE THAN<br />

YOU THINK...<br />

OVER AND ABOVE THE CLEAR BENEFITS<br />

OF OUR PRODUCTS IN IMPROVING<br />

HYGIENE AND HEALTH, WE’RE INTENT<br />

ON DELIVERING THEM IN A SUSTAINABLE<br />

AND RESPONSIBLE WAY.<br />

We focus on sustainability issues both as distinct targets and as an<br />

everyday part of how we manage our business. How can we make our<br />

direct business performance more sustainable, and how can we influence<br />

others to do so too?<br />

ENVIRONMENTAL SUSTAINABILITY<br />

Our target is to achieve a 20% reduction in the ‘direct’ greenhouse gas<br />

emissions from our global manufacturing energy use by 31st December<br />

2010; in 2004 we beat our initial 10% reduction target, having achieved<br />

an 11% reduction since 2000; this is measured per unit of production.<br />

We seek a similar reduction in the ‘indirect’ greenhouse gas emissions<br />

that arise when consumers use our products in their home.<br />

So what progress have we made in 2005 to improve our environmental,<br />

social and ethical performance?<br />

Take the new industry initiative to cut climate change emissions and water<br />

use across Europe. The idea is simple: many people use higher temperature<br />

wash programmes on their dishwashers needlessly, because our<br />

dishwashing products work just as well on energy saving / Eco programmes.<br />

If we could persuade just half the EU households using higher temperature<br />

dishwashing programmes to switch to energy saving programmes, they’d<br />

save up to 388,000 tonnes of greenhouse gas emissions from their annual<br />

energy use; more than the total greenhouse gas emissions from energy<br />

use at all <strong>Reckitt</strong> <strong>Benckiser</strong> factories around the world. They’d also save<br />

up to 7,000 million litres of water a year – enough for over 200 million<br />

showers. Overall, a simple way to help the environment, save money<br />

and reduce climate change. Since March 2006 we’ve started to put<br />

“Save Energy and Water” advice on our automatic dishwashing<br />

products across Europe.<br />

We also introduced a major programme to improve plastic packaging<br />

recycling in 2005. Our plastic packaging does an important job, but too<br />

much of it ends up in landfill, a very visible waste of resources. We’ve<br />

already done much to make our packaging thinner and lighter,<br />

*<br />

but now we are sponsoring a number of projects to improve the amount<br />

of plastic packaging that is recycled, including three public recycling<br />

schemes in the US, France and South Africa – with more to come in 2006.<br />

SOCIAL & ETHICAL SUSTAINABILITY<br />

We judge our social and ethical sustainability in terms of making our<br />

company and supply chain a better place in which to work; and in terms<br />

of how we share some of our wealth creation with those parts of society<br />

most in need of support, who cannot generally afford to benefit from<br />

our products.<br />

In terms of improving social issues at work, we focus particularly on<br />

improving employee health & safety. In 2005 we cut our lost time<br />

accident rate by around 30%, bringing the total reduction since 2001<br />

to about 80%. We also work continuously on a more sustainable supply<br />

chain. In 2005 we audited more than 40% of our third-party product<br />

suppliers against our Global Manufacturing Standard, which requires<br />

compliance with local and international labour, health & safety and<br />

environmental standards. This was well ahead of our 20% target.<br />

We are also working actively on the sustainable sourcing of<br />

a number of our raw materials, including woods and palm oil.<br />

Our community programmes are designed to assist the most deprived<br />

parts of society with help on basic health and hygiene. In 2005 we gave<br />

more than £1.6m in cash and products to community projects worldwide<br />

(2004 £1m). We continued with our support for Médecins Sans Frontières<br />

programmes tackling HIV / AIDS in Thailand and Ethiopia. And in year<br />

two of our partnership with Save the Children we supported health and<br />

hygiene programmes in Bangladesh, China and India.<br />

We also responded to major natural catastrophes. The Company and its<br />

employees donated almost $500,000 in cash and products to help US<br />

victims of Hurricane Katrina. After the earthquake in Pakistan we gave<br />

over £75,000 in cash and products to help with immediate health and<br />

sanitation needs.<br />

For a full report on our policies, targets and progress on sustainability, please see<br />

our full Sustainability Report available at www.reckittbenckiser.com<br />

NB: our internal controls around Social, Environmental and Ethical (SEE) matters and<br />

reputational risk are outlined in our Annual Report and Financial Statements 2005 (p4).<br />

*All brands that carry this mark are from companies which are committed to the<br />

Industry programme “Charter for Sustainable Cleaning”.<br />

11<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005

2005 WAS ANOTHER YEAR OF<br />

SOLID PROGRESS EXCEEDING<br />

EARLIER TARGETS<br />

2005 was another year of solid progress exceeding our<br />

earlier targets. Growth came across all regions and was<br />

strongly driven by new products like Cillit / Easy-Off Bang,<br />

Finish 4in1, Air Wick Freshmatic and Vanish Oxi Action<br />

Max. Benefiting from strong cost containment, operating<br />

margin reached our 20% target.<br />

The Group has adopted IFRS for its financial reporting<br />

for the year ended 31 December 2005. Financial reporting<br />

for 2004 has been restated, but for 2001, 2002 and 2003<br />

it has not been restated.<br />

Net revenues grew by 8% (6% constant) to £4,179m.<br />

Operating profit increased 12% (10% constant) to £840m.<br />

Gross margin increased 10bps to 54.9% as a result of<br />

higher margin new products, and savings from ongoing<br />

cost optimisation programmes offsetting significantly<br />

higher input costs. Media investment increased 3% and<br />

represented 11.9% of net revenues (2004 12.4%). Other<br />

marketing investment increased ahead of the rate of net<br />

12<br />

FINANCIAL OVERVIEW<br />

CATEGORY GROWTH<br />

HEALTH & PERSONAL CARE<br />

NET REVENUES GREW 9%<br />

TO £662M<br />

FABRIC CARE<br />

NET REVENUES GREW 2%<br />

TO £1,113M<br />

Net revenues grew 9% to £662m Net revenues grew 2% to £1,113m<br />

with growth across all segments. Veet largely due to the success of Vanish<br />

depilatories continue to benefit from Oxi Action, the Company’s Fabric<br />

the continuing roll-out in Developing Treatment franchise, and Calgon<br />

Markets and growth in North America. water softener, offset to some<br />

Dettol antiseptics grew behind the extent by softness in laundry<br />

personal care range in Developing detergent and fabric softeners.<br />

Markets. Healthcare products Key drivers of growth included the<br />

benefited from the continuing roll-out roll-out of Vanish Oxi Action Max,<br />

of Gaviscon in Europe. Suboxone Vanish Dual Power and continued<br />

continues to grow strongly as<br />

distribution builds in North America.<br />

growth for Vanish carpet cleaners.<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

revenue growth due to a shift in marketing mix towards<br />

other forms of consumer marketing. Operating margins<br />

increased by 80bps to 20.1% due to gross margin<br />

expansion and particularly to tight control of fixed costs<br />

more than offsetting higher marketing investment.<br />

Net income for the year increased 16% (14% constant) to<br />

£669m. Net interest received of £36m (2004 £9m) was due<br />

to the strong cash inflow over the past year increasing the<br />

level of net funds after higher dividend payments and share<br />

buy back, and the conversion of the Convertible Capital<br />

Bond. The underlying tax rate for the period is 26% before<br />

non-recurring tax credits of £16m arising from favourable<br />

tax settlements.<br />

EPS diluted increased 17% to 90.0 pence.<br />

Colin Day Chief Financial Officer<br />

SURFACE CARE<br />

NET REVENUES GREW 9%<br />

TO £871M<br />

The major growth driver was the<br />

roll-out of Bang under the Cillit<br />

brand in Europe, and the Easy-Off<br />

brand in North America and<br />

Developing Markets. The Dettol<br />

and Lysol disinfecting range,<br />

particularly disinfectant spray,<br />

grew in Europe, North America<br />

and Developing Markets.<br />

FOR THE DETAILED FINANCIAL<br />

REVIEW, SEE OUR FULL ANNUAL<br />

REPORT – AVAILABLE ONLINE AT<br />

WWW.RECKITTBENCKISER.COM<br />

20<br />

19<br />

18<br />

17<br />

16<br />

15<br />

14<br />

13<br />

DISHWASHING<br />

NET REVENUES GREW 6%<br />

TO £579M<br />

Net revenues grew 6% to £579m<br />

due to strong growth in Automatic<br />

Dishwashing. Growth came from<br />

the success of Finish/Calgonit<br />

4in1 in Europe, initial sales of<br />

Finish/Calgonit Quantum in<br />

early launch markets and from<br />

Electrasol with Jet Dry Action<br />

in North America.<br />

01 02 03 04 05<br />

HOME CARE<br />

NET REVENUES GREW 8%<br />

TO £628M<br />

Net revenues grew 8% to £628m<br />

with strong growth for both Air<br />

Care and Pest Control. Air Care<br />

grew behind the launch of Air Wick<br />

Freshmatic in Europe, North<br />

America and certain Developing<br />

Markets. Pest Control growth was<br />

driven by Mortein Power Booster<br />

coils and a strong pest season<br />

in the Southern Hemisphere.

GEOGRAPHICAL ANALYSIS FIGURES AT A GLANCE<br />

GEOGRAPHICAL ANALYSIS AT CONSTANT<br />

EXCHANGE (SEE CHARTS ON PAGE 4)<br />

51%<br />

EUROPE<br />

NET REVENUES GREW BY 4% TO £2,135M<br />

Growth came from key recent product introductions.<br />

In Fabric Treatment, growth was due to the success of<br />

Vanish with Vanish Oxi Action Max and Vanish Dual<br />

Power. In Surface Care, growth came from Cillit Bang.<br />

In Dishwashing, growth was due to Finish/Calgonit<br />

4in1. Home Care increased due to the successful<br />

launch of Air Wick Freshmatic. Health & Personal Care<br />

saw strong growth for the health care portfolio due to<br />

the roll-out of Gaviscon in Europe. Operating margins<br />

were 60bps ahead of last year at 23.5% due to tight<br />

control of costs offsetting higher marketing investment,<br />

resulting in operating profits increased by 6% to £502m.<br />

31%<br />

NORTH AMERICA & AUSTRALIA<br />

NET REVENUES INCREASED 5% TO £1,281M<br />

In Fabric Care, Spray ‘n Wash Dual Power Fabric Treatment<br />

and Resolve Dual Power carpet cleaner grew sales.<br />

In Surface Care increases came from growth for Lysol<br />

disinfectant spray, and the launch of Easy-Off Bam.<br />

In Dishwashing increases came due to the success of<br />

Electrasol with Jet Dry Action. In Home Care, Air Care<br />

grew following the launch of Air Wick Freshmatic, and in<br />

Health & Personal Care, Veet depilatories and prescription<br />

drug Suboxone were the principal contributors to growth.<br />

Food increased net revenues due to the launch of<br />

Cattleman’s BBQ sauce in retail and to continued growth<br />

for French’s yellow mustard and gains for Frank’s Red Hot<br />

sauce. Operating margins were 90bps higher at 21.1%,<br />

due to substantially higher input costs reducing gross<br />

margins offset by tight control of fixed costs. As a result<br />

operating profits increased 9% to £270m.<br />

18%<br />

DEVELOPING MARKETS<br />

NET REVENUES GREW 12% TO £763M<br />

There was strong growth in all categories. In Fabric Care,<br />

growth came following the roll-out of Vanish Oxi Action<br />

Fabric Treatment products. In Surface Care, increases came<br />

from the success of Easy-Off Bang. Pest Control grew<br />

strongly with the launch of Mortein Power Booster coils.<br />

Health & Personal Care grew due to the continuing rollout<br />

of Veet in new markets and strong growth for the<br />

Dettol range of personal care products. Operating margins<br />

expanded 250bps to 8.9%, resulting in operating profits<br />

increasing by 55% to £68m.<br />

CASH FLOW<br />

OF NET REVENUES<br />

OF NET REVENUES<br />

OF NET REVENUES<br />

Cash generated from operations increased to £946m<br />

due to higher operating profit. Net working capital<br />

improvements were lower than in 2004 as many<br />

of the Group’s businesses reached optimal levels.<br />

Net cash flow from operations (defined in the<br />

Annual Report and Financial Statements 2005;<br />

Group Cash Flow p22) increased to £758m.<br />

Net interest received was £34m (2004 £8m)<br />

while tax payments decreased by £32m.<br />

SUMMARY GROUP PROFIT AND LOSS ACCOUNT<br />

FOR THE YEAR ENDED 31 DECEMBER 2005<br />

2005 2004<br />

£M £M<br />

Net revenues 4,179 3,871<br />

Operating profit 840 749<br />

Net finance income 36 9<br />

(including coupon on convertible capital bonds)<br />

Profit on ordinary activities before taxation 876 758<br />

Tax on profit on ordinary activities (207) (181)<br />

Profit for the year 669 577<br />

Attributable to equity minority interests – –<br />

Profit for the year (attributable to ordinary equity holders of the parent) 669 577<br />

Dividends (262) (216)<br />

Profit for the year after dividends 407 361<br />

Earnings per ordinary share<br />

On profit for the year, basic 92.0p 80.7p<br />

On profit for the year, diluted 90.0p 77.1p<br />

Dividend paid on ordinary shares for the year is 36p per share (2004 30p) consisting of 2004 final 18p per share (2004 14p)<br />

and 2005 interim 18p per share (2004 16p). The Directors are proposing a final dividend in respect of the financial year<br />

ended 31 December 2005 of 21p per share to be paid, if approved at the AGM, on 25 May 2006.<br />

SUMMARY GROUP BALANCE SHEET<br />

AS AT 31 DECEMBER 2005<br />

2005 2004<br />

£M £M<br />

Non-current assets 2,343 2,212<br />

Current assets 1,870 1,640<br />

Total assets 4,213 3,852<br />

Current liabilities (1,523) (1,404)<br />

Non-current liabilities (834) (868)<br />

Total liabilities (2,357) (2,272)<br />

Net Assets 1,856 1,580<br />

Equity minority interests (1) (3)<br />

Total shareholders’ funds 1,855 1,577<br />

Approved by the Board on 20 March 2006<br />

Adrian Bellamy Bart Becht<br />

Director Director<br />

SUMMARY GROUP CASH FLOW STATEMENT<br />

FOR THE YEAR ENDED 31 DECEMBER 2005<br />

2005 2004<br />

£M £M<br />

Cash generated from operations 946 914<br />

Net interest received 34 8<br />

Tax paid (157) (189)<br />

Net cash generated from operating activities 823 733<br />

Capital expenditure (78) (83)<br />

Other investing activities 13 8<br />

Maturity of short-term investments 493 38<br />

1,251 696<br />

Proceeds for issuance of ordinary shares 36 30<br />

Share purchases (300) (283)<br />

Repayments of borrowings (66) (87)<br />

Dividends paid to the Company’s shareholders (262) (216)<br />

Net increase in cash and cash equivalents in year 659 140<br />

Exchange gains/(losses) 9 (2)<br />

Cash and cash equivalents at beginning of year 301 163<br />

Net cash and cash equivalents at end of year 969 301<br />

13<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005

SUMMARY DIRECTORS’, AUDITORS’ AND REMUNERATION REPORT<br />

THIS IS A SUMMARY OF INFORMATION FROM THE<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS 2005<br />

This Summary Financial Statement is a summary of<br />

information in the Report of the Directors and the Group’s<br />

accounts. The Summary Financial Statement does not contain<br />

sufficient information to allow for a full understanding of<br />

the results of the Group and of the state of affairs of the<br />

Company or of the Group. For further information, the<br />

Report of the Directors, the Directors’ Remuneration Report,<br />

the Annual Report and Financial Statements and the<br />

auditors’ report on those accounts should be consulted.<br />

<strong>Shareholders</strong> have the right to receive, free of charge,<br />

a copy of the Group’s Annual Report and Financial Statements.<br />

If shareholders wish to receive a copy of the Group’s Annual<br />

Report and Financial Statements for this and all future years,<br />

please write to the Registrar whose address appears on<br />

the back cover.<br />

SUMMARY REPORT OF THE DIRECTORS<br />

Review of the activities and the development<br />

of the Group’s business<br />

The Financial Review set out on pages 7 to 9 of the Annual<br />

Report and Financial Statements includes a review of the<br />

operations for the year. The Directors endorse the content<br />

of that Review.<br />

In the view of the Directors, the Group’s likely future<br />

development will continue to centre on the main product<br />

categories in which it now operates.<br />

Directors<br />

Information regarding the Directors of the Company who<br />

were serving on 31 December 2005 is set out on page 15.<br />

During the year there were the following changes to the<br />

Board of Directors. Ana Maria Llopis and Hans van der<br />

Wielen resigned at the conclusion of the AGM held on<br />

5 May 2005. Graham Mackay and Gerard Murphy joined<br />

the Board as Non-Executive Directors on 25 February 2005<br />

and 20 June 2005 respectively. As Gerard Murphy’s<br />

appointment was made subsequent to the date<br />

of the 2005 AGM, he will offer himself for election<br />

at this year’s AGM.<br />

Bart Becht and Peter Harf retire by rotation and, being eligible,<br />

offer themselves for re-election at the forthcoming AGM.<br />

George Greener has served on the Board for more than nine<br />

years and, under the Combined Code, is therefore obliged<br />

to offer himself for re-election on an annual basis. George<br />

Greener has advised that he will not be offering himself for<br />

re-election at the AGM in 2006 and will accordingly step<br />

down from the Board at the conclusion of the AGM.<br />

Corporate Governance<br />

The Company recognises the importance of high standards<br />

of Corporate Governance. It understands, supports and<br />

has applied throughout 2005 the principles set out in the<br />

Combined Code and has complied with the great majority<br />

of the detailed provisions contained in the Code. The ways<br />

in which the Company applies these principles, and the few<br />

provisions with which the Company does not consider that<br />

it is appropriate to comply, are set out in the appropriate<br />

sections of the Annual Report and Financial Statements.<br />

The application of the principles to matters related to<br />

the Board and its committees, to internal control and<br />

to relations with shareholders is included in the Report<br />

of the Directors and to Directors’ remuneration in the<br />

Directors’ Remuneration Report.<br />

Report of the auditors<br />

The report of the auditors on the annual accounts of<br />

the Group for the year ended 31 December 2005 is<br />

unqualified and does not contain a statement under either<br />

s.237 (2) or s.237 (3) of the Companies Act 1985.<br />

Annual General Meeting<br />

The notice convening the 53rd Annual General Meeting<br />

of the Company to be held on Thursday, 4 May 2006<br />

at The London Heathrow Marriott Hotel, Bath Road,<br />

Hayes, Middlesex, UB3 5AN is contained in a separate<br />

document for shareholders which accompanies this<br />

<strong>Shareholders</strong>’ Review.<br />

INDEPENDENT AUDITORS’ STATEMENT TO THE<br />

MEMBERS OF RECKITT BENCKISER PLC<br />

We have examined the Summary Financial Statement<br />

of <strong>Reckitt</strong> <strong>Benckiser</strong> plc.<br />

Respective responsibilities of Directors and auditors<br />

The Directors are responsible for preparing the Summary<br />

Financial Statement in accordance with applicable law.<br />

Our responsibility is to report to you our opinion on the<br />

14<br />

<strong>Reckitt</strong> <strong>Benckiser</strong> <strong>Shareholders</strong>’ Review 2005<br />

consistency of the Summary Financial Statement within<br />

the <strong>Shareholders</strong>’ Review with the full Annual Report and<br />

Financial Statements, the Report of the Directors and the<br />

Directors’ Remuneration Report and its compliance with the<br />

relevant requirements of s.251 of the Companies Act 1985<br />

and the regulations made thereunder. We also read the<br />

other information contained in the <strong>Shareholders</strong>’ Review and<br />

consider the implications for our report if we become aware<br />

of any apparent misstatements or material inconsistencies<br />

with the Summary Financial Statement.<br />

This statement, including the opinion, has been prepared<br />

for and only for the Company’s members as a body in<br />

accordance with s.251 of the Companies Act 1985 and for<br />

no other purpose. We do not, in giving this opinion, accept<br />

or assume responsibility for any other purpose or to any<br />

other person to whom this statement is shown or into<br />

whose hands it may come save where expressly agreed<br />

by our prior consent in writing.<br />

Basis of opinion<br />

We conducted our work in accordance with Bulletin<br />

1999/6, ‘The auditors’ statement on the Summary Financial<br />

Statement’ issued by the Auditing Practices Board for use<br />

in the United Kingdom.<br />

Opinion<br />

In our opinion, the Summary Financial Statement is<br />

consistent with the full Annual Report and Financial<br />

Statements, the Report of the Directors and the Directors’<br />

Remuneration Report of <strong>Reckitt</strong> <strong>Benckiser</strong> plc for the year<br />

ended 31 December 2005, and complies with the<br />

applicable requirements of s.251 of the Companies Act<br />

1985, and the regulations made thereunder.<br />

PricewaterhouseCoopers LLP<br />

Chartered Accountants and Registered Auditors,<br />

London 20 March 2006<br />

SUMMARY OF POLICY ON REMUNERATION<br />

The full Directors’ Remuneration Report can be found<br />

on pages 10 to 15 of the 2005 Annual Report and<br />

Financial Statements.<br />

The Remuneration Committee of the Board (the ‘Committee’)<br />

is responsible for determining and reviewing the terms of<br />

employment and remuneration of the Executive Directors<br />

and senior executives. The Committee comprises three<br />

Non-Executive Directors under the Chairmanship of<br />

Judith Sprieser. The Committee’s overriding objective<br />

is to ensure that <strong>Reckitt</strong> <strong>Benckiser</strong>’s remuneration policy<br />

encourages, reinforces and rewards the delivery of<br />

outstanding shareholder value. The graph opposite<br />

shows that the Company has, over the last five years,<br />

outperformed the UK FTSE 100 in terms of Total<br />

Shareholder Return (TSR). The core principles on which<br />

the remuneration policy is based are described below.<br />

First, in order to attract and retain the best available people,<br />

the Committee has – and will continue to adopt<br />

– a policy of executive remuneration based on competitive<br />

practice. <strong>Reckitt</strong> <strong>Benckiser</strong> competes for management skills<br />

and talent in the same international market place as its<br />

main competitors, the vast majority of which are based<br />

in the US. In accordance with this policy principle, total<br />

remuneration for Executive Directors and other senior<br />

executives will be benchmarked against the upper quartile<br />

of a peer group comprising <strong>Reckitt</strong> <strong>Benckiser</strong>’s main<br />

competitors, together with a range of comparable<br />

companies in the US consumer goods industry.<br />

The second principle is to align the interests of Executive<br />

Directors and senior executives’ with those of shareholders<br />

through a variable, performance based compensation policy<br />

and the Company’s share ownership policy.<br />

In this context, variable pay is, and will continue to be,<br />

the major element of our current Executive Directors’ and<br />

senior Executives’ total compensation package. Accordingly,<br />

the Executive Directors’ compensation package comprises,<br />

in addition to base salary, an annual cash bonus and sharebased<br />

incentives. Highly leveraged annual cash bonuses,<br />

linked to the achievement of key business measures within<br />

the year, are designed to stimulate the achievement of<br />

outstanding annual results.<br />

To balance the management’s orientation between the<br />

achievement of short and long-term business measures,<br />

the Committee believes that longer-term share-based<br />

incentives are also appropriate.<br />

<strong>Shareholders</strong> will be asked at the 2006 AGM to approve<br />

a consolidation and simplification of the current plans<br />

rules under which grants for Executive Directors and<br />

other employees can be made.<br />

Pensions<br />

In line with the Committee’s emphasis on the importance<br />

of only rewarding the Executive Directors for creating<br />

shareholder value, <strong>Reckitt</strong> <strong>Benckiser</strong> operates a defined<br />

contribution pension plan, the <strong>Reckitt</strong> <strong>Benckiser</strong> Executive<br />

Pension Plan. Mr Becht and Mr Day are both members<br />

of this Plan.<br />

Bart Becht’s standard Company pension contribution was<br />

30% of pensionable pay during 2005. A further annual<br />

contribution of 20% of pensionable pay was also paid<br />

in 2005 to take account of the uncompetitive level of his<br />

pension contributions since his appointment as Chief Executive<br />

Officer. This additional contribution has now ceased.<br />

Colin Day’s standard Company pension contribution was<br />

25% of pensionable pay in 2005.<br />

In 2006, only Bart Becht is immediately affected by the<br />

new lifetime limit brought about by the proposed UK tax<br />

changes effective from April 2006. The Committee has<br />

decided that the most cost-effective approach is to maintain<br />

his current pension commitment, and to make a funded<br />

and unapproved pension arrangement.<br />

Service agreements<br />

For newly-appointed Executive Directors, termination<br />

payments, including compensation paid during any notice<br />

period, will not exceed 12 months’ pay. Service contracts<br />

will be rolling and terminable on six months’ notice.<br />

Contracts will also provide liquidated damages of six<br />

months’ base salary plus an amount equal to one times<br />

the average bonus paid (if any) in the two years up to<br />

termination. Any bonus earned will be included in the<br />

termination payment on the basis that a high proportion<br />

of pay is related to performance and that in the event of<br />

termination for poor performance it is unlikely that any<br />

bonus will have been paid.<br />

Non-Executive Directors do not have service agreements,<br />

but are subject to re-election by shareholders every<br />

three years.<br />

The remuneration for Non-Executive Directors consists of<br />

fees for their services in connection with Board and Board<br />

committee meetings.<br />

Historical TSR performance<br />

Growth in the value of a hypothetical £100 holding over<br />

five years.<br />

FTSE 100<br />

<strong>Reckitt</strong> <strong>Benckiser</strong><br />

Notes<br />

The graph above shows the performance of <strong>Reckitt</strong> <strong>Benckiser</strong><br />

in terms of TSR performances against the UK FTSE 100<br />

Index over a five-year period and conforms to the Directors’<br />

Remuneration Report Regulations 2002. The Index was<br />

selected on the basis of companies of a comparable size in<br />

the absence of an appropriate industry peer group in the UK.<br />

Directors’ remuneration<br />

The aggregate amount of Directors’ emoluments during the<br />

year was £5.3m (2004 £5.4m). The aggregate gains made by<br />

the Directors on the exercise of options and the vesting of<br />

restricted shares were £12.3m (2004 £5.0m). The aggregate<br />

amount of contributions made to money purchase pension<br />

schemes in respect of the Directors was £0.5m (2004 £0.5m).

MEET THE TEAM<br />

EXECUTIVE COMMITTEE THE BOARD<br />

1 4 7<br />

2 5 8<br />

3 6<br />

9<br />

1 ALAIN LE GOFF (53, FRENCH)<br />

Executive Vice President, Supply. Was<br />

appointed EVP for Operations at <strong>Benckiser</strong><br />

in October 1996. He joined the<br />

Company in 1986, serving as Industrial<br />

Director in France, Monaco, Germany<br />

and as Logistics Director for the Group.<br />

He was previously with Lesieur.<br />

Alain is responsible for the global<br />

supply chain including procurement,<br />

manufacturing, warehousing and logistics.<br />

Also responsible for management of<br />

Squeeze and X-trim gross margin<br />

enhancement programmes.<br />

2 TONY GALLAGHER (50, BRITISH)<br />

Senior Vice President, Information<br />

Services. Joined <strong>Benckiser</strong> in September<br />

1997. He was previously CEO of InfoSol,<br />

a systems integration and consulting<br />

company in the Middle East. Prior to<br />

that, he was at Integraph and Mitel.<br />

Tony is responsible for global<br />

information systems and services<br />

and telecommunications.<br />

Tony will retire from the Company in April 2006.<br />

3 FRANK RUETHER (53, GERMAN)<br />

Senior Vice President, Human Resources.<br />

Joined <strong>Benckiser</strong> in July 1996 as Personnel<br />

Director and was appointed SVP Human<br />

Resources in March 1997. He was previously<br />

with Mars, 1986–1996, as Director of<br />

Compensation & Benefits (Europe).<br />

Frank is responsible for human resources<br />

management, remuneration and benefits,<br />

and organisational development.<br />

4 ERHARD SCHOEWEL (57, GERMAN)<br />

Executive Vice President, Europe. Joined<br />

<strong>Benckiser</strong> in January 1979 and served<br />

as General Manager of Germany and<br />

of Propack Europe (private label).<br />

He was General Manager of Italy<br />

1995–1996. From 1996 to 1999,<br />

he was EVP, Central Europe. He was<br />

previously with PWA Waldhof.<br />

Erhard is responsible for all European<br />

markets, Western and Eastern.<br />

5 COLIN DAY (50, BRITISH)<br />

Chief Financial Officer. Joined <strong>Reckitt</strong><br />

<strong>Benckiser</strong> in September 2000 from Aegis<br />

Group plc where he was Group Finance<br />

Director from 1995. Prior to that he was<br />

at Kodak, British Gas, De La Rue Group<br />

plc and ABB Group.<br />

Colin is responsible for financial<br />

controls and reporting, treasury, tax,<br />

corporate development, legal affairs<br />

and internal audit.<br />

6 ELIO LEONI SCETI (40, ITALIAN)<br />

Executive Vice President, Category<br />

Development. Joined <strong>Benckiser</strong> in 1992<br />

serving in various marketing roles and as<br />

General Manager of Germany and Italy.<br />

Following the merger in 1999, Elio was<br />

promoted to Senior Vice President,<br />

North American Household and was<br />

appointed EVP, Category Development<br />

in July 2001. Elio was previously with<br />

Procter & Gamble in Italy and France.<br />

Elio is responsible for global category<br />

development, research & development,<br />

media and market research.<br />

COMBINING TALENTED PEOPLE<br />

FROM DIFFERENT PROFESSIONAL<br />

AND CULTURAL BACKGROUNDS IN<br />

ACTION-ORIENTATED TEAMS GIVES<br />

US A COMPETITIVE EDGE.<br />

7 JAVED AHMED (46, PAKISTANI)<br />

Executive Vice President, North America<br />

and Australia and Regional Director<br />

North American Household. Joined<br />

<strong>Benckiser</strong> in 1992 as General Manager,<br />

Canada and in 1995 became General<br />

Manager, UK. Appointed SVP North<br />

American Household in 2001 and EVP,<br />

North America and Australia in<br />

September 2003. Prior to joining<br />

<strong>Benckiser</strong>, he previously worked with<br />

Procter & Gamble and Bain & Company.<br />

Javed is responsible for North America<br />

and Australia/New Zealand.<br />

8 BART BECHT (49, DUTCH)<br />

Chief Executive Officer. Joined <strong>Benckiser</strong><br />

in 1988 and served as General Manager<br />

in Canada, the UK, France and Italy<br />

before being appointed Chief Executive<br />

of <strong>Benckiser</strong> Detergents, subsequently<br />

<strong>Benckiser</strong> N.V., in 1995. He was appointed<br />

Chief Executive Officer of <strong>Reckitt</strong> <strong>Benckiser</strong><br />

following the merger in December 1999.<br />

He was previously with Procter & Gamble<br />

both in the USA and Germany.<br />

Bart is Chairman of the Executive Committee.<br />

9 FREDDY CASPERS (45, GERMAN)<br />

Executive Vice President, Developing Markets.<br />

Joined <strong>Benckiser</strong> in September 1997 as<br />

EVP for Eastern Europe. He previously<br />

served in PepsiCo and Johnson & Johnson<br />

in a variety of international assignments<br />

in Europe, US, Eastern Europe and Turkey.<br />

Freddy is responsible for all companies<br />

in Asia Pacific, Latin America and Africa<br />

Middle East.<br />

ADRIAN BELLAMY (64, BRITISH) ‡ #<br />

Was appointed a Non-Executive Director of the<br />

Company in 1999 and became Non-Executive<br />

Chairman in May 2003. He is Executive Chairman of<br />

The Body Shop International Plc and a director<br />

of The Gap and Williams-Sonoma, Inc. He was<br />

formerly a director of Gucci Group NV and The<br />

Robert Mondavi Corporation.<br />

BART BECHT (49, DUTCH) #<br />

Joined the Board in 1999 on his appointment<br />

as Chief Executive Officer of the Company. He<br />

was Chief Executive of <strong>Benckiser</strong> Detergents,<br />

subsequently <strong>Benckiser</strong> N.V. since 1995 and Chairman<br />

of <strong>Benckiser</strong>’s Management Board from May<br />

1999. He holds no current external directorships.<br />

COLIN DAY (50, BRITISH)<br />

Joined <strong>Reckitt</strong> <strong>Benckiser</strong> in September 2000<br />

from Aegis Group plc where he was Group<br />

Finance Director from 1995. He was formerly<br />

a Non-Executive Director of easyJet plc (resigned<br />

September 2005) and the Bell Group plc<br />

(resigned June 2004). During 2005 he was<br />

appointed a Non-Executive Director of Imperial<br />

Tobacco plc and WPP Group plc.<br />

DR GEORGE GREENER, CBE (60, BRITISH)<br />

Was appointed a Non-Executive Director in<br />

1996 and was the Senior Non-Executive Director<br />

from May 2003 to February 2005. He was formerly<br />

Chairman of British Waterways and The Big<br />

Food Group Plc. He was appointed Chairman<br />

of Kellen Investments Limited in January 2006.<br />

He is also a Non-Executive Director of JP Morgan<br />

Fleming American Investment Trust plc.<br />

DR PETER HARF (59, GERMAN) #<br />

Joined the Board as a Non-Executive Director<br />

in 1999 and is the Deputy Chairman. He served<br />

as Chairman of the Remuneration Committee<br />

until June 2004. He is Chairman of Coty Inc.<br />

and a director of InBev and the Brunswick<br />

Corporation. He is Chief Executive Officer<br />

of Joh. A. <strong>Benckiser</strong> GmbH.<br />

KENNETH HYDON (61, BRITISH) *<br />

Was appointed a Non-Executive Director in<br />

December 2003 and the Senior Independent<br />

Non-Executive Director in February 2005.<br />

He retired as Financial Director of Vodafone<br />

Group plc in July 2005. He is a Non-Executive<br />

Director of Tesco plc, the Royal Berkshire & Battle<br />

Hospitals NHS Trust and Pearson plc.<br />

GRAHAM MACKAY<br />

(56, BRITISH/SOUTH AFRICAN) ‡<br />

Was appointed a Non-Executive Director in<br />

February 2005. He is the current Chief Executive<br />

of SABMiller plc, one of the world’s largest<br />

brewers with a brewing presence in over 40<br />

countries across four continents. He joined the<br />

then South African Breweries Limited in 1978<br />

and has held a number of senior positions<br />

within that group.<br />

DR GERARD MURPHY (50, IRISH) *<br />

Was appointed a Non-Executive Director in June<br />

2005. He is the current Chief Executive Officer<br />

of Kingfisher plc. He was previously Chief<br />

Executive Officer of Carlton Communications plc,<br />

Exel plc and Greencore Group plc. Earlier<br />

in his career, he held various senior positions<br />

within food and drink group Grand Metropolitan<br />

(now Diageo plc) in Ireland, UK and USA.<br />

JUDITH SPRIESER (52, AMERICAN) ‡ #<br />

Chairman of the Remuneration Committee.<br />

Was appointed a Non-Executive Director in<br />

August 2003. She was previously Chief Executive<br />