The Pharm Exec 50 - Pharmaceutical Executive

The Pharm Exec 50 - Pharmaceutical Executive

The Pharm Exec 50 - Pharmaceutical Executive

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

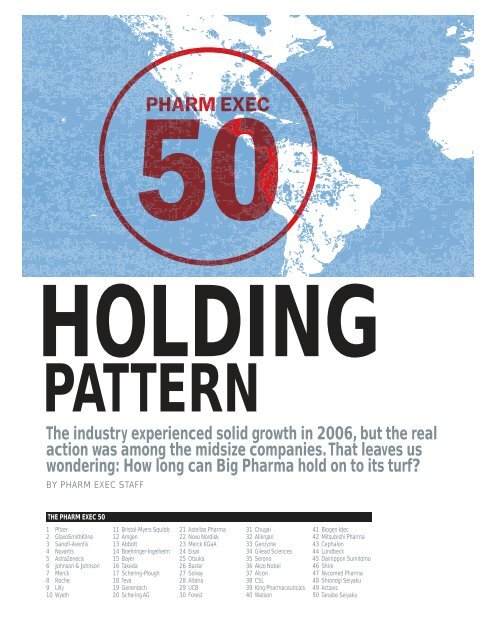

HOLDING<br />

PATTERN<br />

<strong>The</strong> industry experienced solid growth in 2006, but the real<br />

action was among the midsize companies.That leaves us<br />

wondering: How long can Big <strong>Pharm</strong>a hold on to its turf?<br />

BY PHARM EXEC STAFF<br />

THE PHARM EXEC <strong>50</strong><br />

1 Pfizer<br />

2 GlaxoSmithKline<br />

3 Sanofi-Aventis<br />

4 Novartis<br />

5 AstraZeneca<br />

6 Johnson & Johnson<br />

7 Merck<br />

8 Roche<br />

9 Lilly<br />

10 Wyeth<br />

11 Bristol-Myers Squibb<br />

12 Amgen<br />

13 Abbott<br />

14 Boehringer-Ingelheim<br />

15 Bayer<br />

16 Takeda<br />

17 Schering-Plough<br />

18 Teva<br />

19 Genentech<br />

20 Schering AG<br />

21 Astellas <strong>Pharm</strong>a<br />

22 Novo Nordisk<br />

23 Merck KGaA<br />

24 Eisai<br />

25 Otsuka<br />

26 Baxter<br />

27 Solvay<br />

28 Altana<br />

29 UCB<br />

30 Forest<br />

31 Chugai<br />

32 Allergan<br />

33 Genzyme<br />

34 Gilead Sciences<br />

35 Serono<br />

36 Akzo Nobel<br />

37 Alcon<br />

38 CSL<br />

39 King <strong>Pharm</strong>aceuticals<br />

40 Watson<br />

41 Biogen Idec<br />

42 Mitsubishi <strong>Pharm</strong>a<br />

43 Cephalon<br />

44 Lundbeck<br />

45 Dainippon Sumitomo<br />

46 Shire<br />

47 Nycomed <strong>Pharm</strong>a<br />

48 Shionogi Seiyaku<br />

49 Actavis<br />

<strong>50</strong> Tanabe Seiyaku

<strong>The</strong> number that<br />

may be keeping<br />

new Pfizer CEO<br />

Jeffrey Kindler up<br />

at night is the<br />

2 percent growth<br />

in sales—a far cry<br />

from GSK’s 15<br />

percent, Sanofi’s<br />

16 percent, and the<br />

18 percent growth<br />

scored by Novartis<br />

SOME NOTES ON THE LIST<br />

Figures in virtually all cases are based on numbers<br />

found in companies’ annual reports or SEC filings.<br />

Companies are ranked by their human prescription<br />

drug sales.To the extent possible, we include<br />

prescription generics and vaccines.We exclude<br />

over-the-counter products, royalty income, animalhealth<br />

products, sales of bulk pharmaceuticals and<br />

active pharmaceutical ingredients, and revenue<br />

from contract manufacturing.This is a less-thanperfect<br />

process, since some companies break out<br />

their sales figures in other ways and because some<br />

major products are sold as Rx and OTC products in<br />

different countries.<strong>The</strong>re are handful of companies<br />

that may belong on the list but for which we have<br />

never been able to obtain reliable numbers. Most of<br />

them are privately held, like Menarini. Procter &<br />

Gamble probably also belongs on the list, but by<br />

policy it declines to divulge revenue figures for its<br />

pharmaceutical unit.When necessary, we have<br />

converted foreign currencies to US dollars.<strong>The</strong><br />

percentage growth figure is calculated based on<br />

US dollars. Because of changing currency exchange<br />

rates, this calculation exaggerates the growth of<br />

many European companies.<br />

A Special<br />

Report on the<br />

World’s Top <strong>50</strong><br />

<strong>Pharm</strong>a<br />

Companies<br />

Pfizer, Pfizer, Pfizer. Depending on your<br />

point of view, it’s ironic, inspiring, or<br />

merely interesting that the company that<br />

staggered out of 2006 with its every vulnerability<br />

and vanity exposed in the media glare<br />

nonetheless finishes in <strong>Pharm</strong> <strong>Exec</strong>’s winner’s<br />

circle for the eighth year running.<br />

A rat-a-tat of patent expirations on bigticket<br />

products and big-time blowouts in its<br />

late-stage pipeline have made Pfizer Exhibit A<br />

in the growing case against the industry’s<br />

blockbuster model, yet the drug juggernaut<br />

still raked in $45.08 billion in sales. That puts<br />

the feisty firm solidly ahead of its closest competitors:<br />

GlaxoSmithKline, with $39.21 billion,<br />

and Sanofi-Aventis, with $37.43 billion.<br />

<strong>The</strong> number that may be keeping new Pfizer<br />

CEO Jeffrey Kindler up at night, though, is the<br />

company’s 2 percent growth in sales—a far cry<br />

from GSK’s 15 percent, Sanofi’s 16 percent,<br />

and the 18 percent scored by Novartis.<br />

In fact, for all the doom-and-gloom ink<br />

spilled about pharma’s fortunes, the industry<br />

performed surprising well, with $643 billion in<br />

global sales. And, thanks mainly to Medicare<br />

Part D success, prescription revenues in the<br />

United States rose by 8.3 percent.<br />

As for company rankings, the keyword was<br />

stability, with Pfizer, GSK, Sanofi-Aventis, Novartis,<br />

AstraZeneca, J&J, and Merck all topping the<br />

charts for the fourth year, while Wyeth, Roche,<br />

Lilly, and Bristol-Myers Squibb juggled places<br />

just below. Roche grew 31 percent to nearly $17<br />

billion, jumping from 12th to eighth—without<br />

PHARMACEUTICAL EXECUTIVE 99<br />

counting revenue from its majority stake in<br />

Genentech. Equally notable was BMS’s fall from<br />

grace, down 9 percent in sales and out of the Top<br />

10 for the first time since this ranking began—<br />

thanks to the at-risk launch of generic Plavix and<br />

patent expiry on Pravachol.<br />

Still, there was evidence that the global market<br />

remains in the grip of trends that Big<br />

<strong>Pharm</strong>a has yet to master. As IMS analyst Murray<br />

Aitken says, “We continue to see a shift in<br />

growth away from mature markets to emerging<br />

ones, and from primary care classes to biotech<br />

and specialist-driven therapies.” In 2006, specialty<br />

drugs contributed 62 percent of total<br />

growth—a giant jump from its 2000 delivery of<br />

35 percent. <strong>The</strong> top news of our Top <strong>50</strong> may<br />

well be the success of the specialty firms.<br />

Cephalon, for example, makes its Top <strong>50</strong> debut,<br />

and Gilead, led by sales of Truvada, recorded<br />

43 percent growth. In 2006, Nycomed <strong>Pharm</strong>a<br />

also made the Top <strong>50</strong> list. Watch for additional<br />

growth next year: In December 2006, the company<br />

snatched up German pharma Altana, a<br />

company almost twice its size.<br />

At the same time, generics companies continued<br />

to benefit from the worldwide focus on<br />

cost cutting. Iceland-based Actavis recorded a<br />

whopping 219 percent growth, while Teva—<br />

buoyed by its six-month exclusivity on generic<br />

Zocor and Zoloft—grew 65 percent.<br />

With these dynamics, 2007 is shaping up as a<br />

decisive year. As the competition between large<br />

and midsize pharmas boils over, we can only<br />

wonder how long this stability will last.

100 PHARMACEUTICAL EXECUTIVE<br />

MAY 2007 www.pharmexec.com<br />

Rank Company & Headquarters 2006 Global <strong>Pharm</strong>a R&D 2006 Top-<br />

[’05 Rank] [Web site] Sales [change from 2005] Spend Selling Drugs [2006 sales]<br />

1[1]<br />

2[2]<br />

3[3]<br />

4[4]<br />

5[5]<br />

6[6]<br />

7[7]<br />

8[12]<br />

9[10]<br />

10 [8]<br />

Pfizer $45.08 B [2%] $7,599 M<br />

New York, NY [pfizer.com]<br />

GlaxoSmithKline $39.21 B [15%] $6,549 M<br />

London, England [gsk.com]<br />

Sanofi-Aventis $37.43 [16%] $5,844 M<br />

Paris, France [sanofi-aventis.com]<br />

Novartis $29.49 B [18%] $5,474 M<br />

Basel, Switzerland [novartis.com]<br />

AstraZeneca $26.48 B [11%] $3,902 M<br />

London, England [astrazeneca.com]<br />

Johnson & Johnson $23.27 B [4%] $5,000 M<br />

New Brunswick, NJ [jnj.com]<br />

Merck $22.64 B [3%] $4,783 M<br />

Whitehouse Station, NJ [merck.com]<br />

Roche $16.86 B [31%] $2,695 M<br />

Basel, Switzerland [roche.com]<br />

Lilly $15.69 B [7%] $3,129 M<br />

Indianapolis, IN [lilly.com]<br />

Wyeth $15.68 B [10%] $2,896 M<br />

Madison, NJ [wyeth.com]<br />

Key Insights on the Top 10<br />

GlaxoSmithKline » Tests<br />

HPV vaccine Cervarix head-tohead<br />

against Merck’s Gardasil.<br />

» Cuts marketing budget, consolidating<br />

professional advertising<br />

under one holding company.<br />

» Submits oral breast cancer<br />

drug Tykerb for FDA approval<br />

after promising results. »<br />

Launches first-line diabetes<br />

treatment Avandamet.<br />

Novartis » Completes<br />

acquisition of biotech Chiron,<br />

building strength in vaccines.<br />

» Launches two new drugs for<br />

hypertension, Exforge and<br />

Tekturna. » Faces setback<br />

when FDA requests more<br />

safety data on DPP-4 inhibitor<br />

Galvus. » Reaches agreement<br />

to sell medical nutrition unit,<br />

including Gerber, to Nestle. »<br />

Gleevec gets broader label.<br />

Merck » Slashes price of Zocor after<br />

LDL-lowerer goes off-patent. » Self-commissioned<br />

Martin Report absolves managers<br />

of any wrongdoing related to Vioxx<br />

marketing. » DTC ads for HPV vaccine<br />

Gardasil garner praise, but mandatory<br />

vaccination push draws criticism. »<br />

Beats Novartis to market with first-inclass<br />

diabetes drug Januvia, a DPP-4<br />

inhibitor. » Admits to developing a CETPinhibitor<br />

in the same class as failed<br />

torcetrapib. » Acquires biotech Sirna<br />

<strong>The</strong>rapeutics to develop RNAi therapies.<br />

» Partners with Schering-Plough on<br />

Zetia/atorvastatin combo pill.<br />

Roche » Starts<br />

shopping spree to<br />

license or acquire<br />

biotech products. »<br />

Defends Tamiflu<br />

after fears raised<br />

about side effects,<br />

drug shortages.<br />

Lilly » NY Times<br />

accuses company<br />

of inappropriately<br />

marketing Zyprexa.<br />

» Acquires Cialis<br />

partner Icos. » Inks<br />

diabetic retinopathy<br />

deal with Alcon.<br />

J&J » Acquires<br />

Pfizer’s consumer<br />

brands. » Defends<br />

against lawsuits<br />

charging that birth<br />

control patch Ortho<br />

Evra raises clot risk.<br />

Lipitor $12.89 B<br />

Norvasc $4.87 B<br />

Zoloft $2.11 B<br />

Wyeth » HRT<br />

sales rebound<br />

despite cancer,<br />

cardio concerns. »<br />

365-day contraceptive<br />

Lybrel gets FDA<br />

approvable letter.<br />

Pfizer » In July, Jeff Kindler steps up as<br />

CEO, replacing Hank McKinnell. » Phase<br />

III results show that HDL-booster torcetrapib<br />

plus Lipitor causes more deaths<br />

than Lipitor alone. » Restructures operations<br />

into five business units and trims<br />

10 percent of its workforce. » Cuts 20<br />

percent of its sales force while pledging<br />

to ramp up communication with payers<br />

and patients. » Launches new consumer<br />

campaigns for products such as Lipitor,<br />

Celebrex, Chantix, and Caduet. » Sells<br />

consumer business to J&J to become<br />

pure-play pharma company. » Launches,<br />

and then relaunches, inhaled insulin product<br />

Exubera.<br />

Seretide/Advair $6.47 B<br />

Avandia/Avandament $3.22 B<br />

Lamictal $1.95 B<br />

Lovenox $3.21 B<br />

Plavix $2.94 B<br />

Stilnox/Ambien/Ambien CR $2.67 B<br />

Diovan $4.22 B<br />

Gleevec/Glivec $2.55 B<br />

Lotrel $1.35 B<br />

Nexium $5.18 B<br />

Seroquel $3.42 B<br />

Crestor $2.03 B<br />

Risperdal $4.18 B<br />

Eprex/Procrit $3.18 B<br />

Remicade $3.01 B<br />

Singulair $3.58 B<br />

Cozaar/Hyzaar $3.16 B<br />

Fosamax $3.13 B<br />

Mab<strong>The</strong>ra/Rituxan $3.95 B<br />

Herceptin $3.20 B<br />

Avastin $2.42 B<br />

Zyprexa $4.36 B<br />

Gemzar $1.41 B<br />

Cymbalta $1.32 B<br />

Effexor $3.72 B<br />

Prevnar $1.96 B<br />

Protonix $1.80 B<br />

AstraZeneca »<br />

Partners with<br />

Abbott on cholesterol<br />

drug combining<br />

a fibrate with<br />

Crestor. » Hit by<br />

late-phase setbacks<br />

on products<br />

like Galida, Exanta,<br />

and a stroke<br />

drug. » Purchases<br />

Cambridge Antibody<br />

Technology.<br />

Sanofi-Aventis<br />

» FDA further<br />

delays decision on<br />

Acomplia. » Heads<br />

to court to defend<br />

Plavix patent. »<br />

Updates safety<br />

data on both Ketek<br />

and Ambien labels.

102 PHARMACEUTICAL EXECUTIVE<br />

MAY 2007 www.pharmexec.com<br />

Rank Company & Headquarters 2006 Global <strong>Pharm</strong>a R&D 2006 Top-<br />

[’05 Rank] [Web site] Sales [change from 2005] Spend Selling Drugs [2006 sales]<br />

11 [9]<br />

12 [13]<br />

13 [11]<br />

14 [14]<br />

15 [18]<br />

Bristol-Myers Squibb $13.86 B [-9%] $3,067 M Plavix $3.25 B<br />

New York, NY [bms.com]<br />

Amgen $13.86 B [15%] $3,366 M Aranesp $4.12 B<br />

Thousand Oaks, CA [amgen.com]<br />

TOP 10 US PRODUCTS OF 2006<br />

Product [Maker] 2006 Sales in billions Growth in Sales<br />

1. Lipitor [Pfizer] $8.6 3.6%<br />

2. Nexium [AstraZeneca] $5.1 18.6%<br />

3. Advair Diskus [GlaxoSmithKline] $3.9 11.4%<br />

4. Aranesp [Amgen] $3.9 44.4%<br />

5. Prevacid [TAP] $3.5 -7.9%<br />

6. Epogen [Amgen] $3.2 10.3%<br />

7. Zocor [Merck] $3.1 -29.5%<br />

8. Enbrel [Amgen/Wyeth] $3.0 11.1%<br />

9. Seroquel [AstraZeneca] $3.0 15.4%<br />

10. Singulair [Merck] $3.0 20%<br />

Aranesp Ara was<br />

UP UP 44 44% 4% 4%<br />

TOP 10 GLOBAL PRODUCTS OF 2006<br />

Product [Maker] 2006 Sales in billions Growth in Sales<br />

1. Lipitor [Pfizer] $13.6 4.2%<br />

2. Nexium [AstraZeneca] $6.7 16.9%<br />

3. Seretide/Advair [GlaxoSmithKline] $6.3 10.3%<br />

4. Plavix [Sanofi-Aventis/BMS] $5.8 -3.4%<br />

5. Norvasc [Pfizer] $5.0 -0.5%<br />

6. Aranesp [Amgen] $5.0 35.6%<br />

7. Zyprexa [Lilly] $4.7 -0.4%<br />

8. Risperdal [Janssen-Ortho] $4.6 12.3%<br />

9. Enbrel [Amgen/Wyeth] $4.5 18.4%<br />

10. Effexor [Wyeth] $4.0 2.7%<br />

A <strong>Pharm</strong><strong>Exec</strong> Graphic<br />

16 [15]<br />

17[17]<br />

18 [23]<br />

19 [20]<br />

20 [19]<br />

Abbott $12.40 B [-9%] $2,255 M Humira $2.04 B<br />

Abbott Park, IL [abbott.com]<br />

Boehringer-Ingelheim $10.96 B [29%] $2,015 M Spiriva $1.82 B<br />

Ingelheim, Germany [boehringer-ingelheim.com]<br />

Bayer $9.87 B [105%] $1,881 M Kogenate $1.04 B<br />

Leverkusen, Germany [bayer.com]<br />

Glo Global Glo o growth owth owth<br />

f Aranesp Aranesp Aranesp<br />

in 2006<br />

UP UP UP U 36 36 36 3 %%%%%<br />

in in in 22006<br />

20<br />

Takeda $8.68 B [2%] $1,444 M Actos $.02 B<br />

Osaka, Japan [takeda.com]<br />

Schering-Plough $8.56 B [13%] $2,188 M Remicade $1.24 B<br />

Kenilworth, NJ [sch-plough.com]<br />

Teva $7.82 B [65%] $495 M Copaxone $1.41 B<br />

Petach, Tikva, Israel [tevapharm.com]<br />

Genentech $7.64 B [39%] $1,773 M Rituxan $2.07 B<br />

South San Francisco, CA [gene.com]<br />

Schering AG $7.48 B [19%] $3,520 M Betaferon $1.31 B<br />

Berlin, Germany [schering.de]<br />

SOURCE: IMS MIDAS, MAT Dec 2006 SOURCE: IMS Heatlh

106 PHARMACEUTICAL EXECUTIVE<br />

MAY 2007 www.pharmexec.com<br />

Rank Company & Headquarters 2006 Global <strong>Pharm</strong>a R&D 2006 Top-<br />

[’05 Rank] [Web site] Sales [change from 2005] Spend Selling Drugs [2006 sales]<br />

21 [16]<br />

22 [21]<br />

23 [24]<br />

24 [22]<br />

25 [26]<br />

TOP 10 COMPANIES BY US SALES<br />

Company Total Sales US billions<br />

1. Pfizer $26.7<br />

2. GlaxoSmithKline $21.7<br />

3. Merck $16.5<br />

4. Johnson & Johnson $16.0<br />

5. AstraZeneca $14.6<br />

6. Amgen $14.5<br />

7. Novartis $13.8<br />

8. Sanofi-Aventis $10.9<br />

9. Roche $10.2<br />

10. Lilly $9.2<br />

[31]<br />

THE NUMBER<br />

OF NEW<br />

PRODUCTS<br />

THAT WERE<br />

LAUNCHED<br />

IN 2006<br />

26 [29]<br />

27[33]<br />

28 [31]<br />

29 [34]<br />

30 [27]<br />

Astellas <strong>Pharm</strong>a $7.09 B [-8%] $1,189 M Prograf $1.22 B<br />

Tokyo, Japan [astellas.com]<br />

Novo Nordisk $6.85 B [28%] $689 M Human Insulin $2.59 B<br />

Bagsvaerd, Denmark [novonordisk.com]<br />

Merck KGAA $4.91 B [6%] $797 M Concor family of products $0.46 B<br />

Darmstadt, Germany [merck.de]<br />

Eisai $4.85 B [2%] $1,328 M Aricept $1.64 B<br />

Tokyo, Japan [eisai.co.jp]<br />

Otsuka $4.14 B [25%] $883 M Abilify N/A<br />

Tokyo, Japan [otsuka.co.jp]<br />

With a growth rate<br />

of 20 percent in 2006,<br />

“biologics” is still the<br />

fastest-growing segment<br />

in the pharmaceutical<br />

market. It generated<br />

$40.3 billion in sales<br />

in 2006.<br />

[8.3%]<br />

AMOUNT SALES GREW<br />

IN THE US FOR 2006.<br />

TOTAL US SALES WERE<br />

$274.8 BILLION,<br />

COMPARED WITH<br />

$253.7 BILLION IN 2005<br />

TOP 10 MOVERS<br />

Company Total Sales US billions [Market Share]<br />

1. Actavis 219%<br />

2. Bayer 105%<br />

3. Nycomed <strong>Pharm</strong>a 70%<br />

4. Teva 65%<br />

5. Cephalon 48%<br />

6. Dainippon Sumitomo 44%<br />

7. Gilead 43%<br />

8. Genentech 39%<br />

9. Roche 31%<br />

10. Boehringer-Ingelheim 29%<br />

A <strong>Pharm</strong><strong>Exec</strong> Graphic<br />

Baxter $3.88 B [28%] $614 M Advate $0.85 B<br />

Deerfield, IL [baxter.com]<br />

Solvay $3.43 B [28%] $559 M TriCor/Lipanthyl $0.54 B<br />

Brussels, Belgium [solvay.com]<br />

Altana* $2.98 B [22%] $653 M Protonix $2.05 B<br />

Bad Homburg, Germany [altana.com]<br />

UCB $2.89 B [19%] $811 M Keppra $1.00 B<br />

Brussels, Belgium [ucb-group.com]<br />

Forest $2.79 B [-9%] $410 M Lexapro $1.87 B<br />

New York, NY [frx.com]<br />

*Altana and Nycomed merged in December 2006, but we reported the numbers as if they completed the year independently.<br />

SOURCE: IMS Heatlh, MIDAS, December 2006<br />

SOURCE: PHARM EXEC <strong>50</strong> (right); IMS (left)

108 PHARMACEUTICAL EXECUTIVE<br />

MAY 2007 www.pharmexec.com<br />

Rank Company & Headquarters 2006 Global <strong>Pharm</strong>a R&D 2006 Top-<br />

[’05 Rank] [Web site] Sales [change from 2005] Spend Selling Drugs [2006 sales]<br />

31 [32]<br />

32 [37]<br />

33 [35]<br />

34 [39]<br />

35 [36]<br />

Chugai $2.73 B [-2%] $457 M Epogin $0.53 B<br />

Tokyo, Japan [chugai-pharm.co.jp]<br />

Allergan $2.64 B [16%] $476 M Botox $0.98 B<br />

Irvine, CA [allergan.com]<br />

GLOBAL PHARMACEUTICAL SALES BY REGION, 2006<br />

Percent of Global Sales Market 2006 Sales (US$B) % Growth from 2005<br />

North America $289.9 8.0%<br />

Europe $181.8 4.8%<br />

Japan $56.7 -.07%<br />

29.9% Asia*, Africa, and Australia $52.0 9.8%<br />

47.7%<br />

Latin America<br />

*Excluding Japan<br />

$27.5 12.9%<br />

9.3%<br />

8.6%<br />

4.5%<br />

<strong>The</strong> global pharmaceutical<br />

market grew by<br />

7 percent<br />

to approximately<br />

$643 billion,<br />

at constant<br />

exchange rates<br />

36 [30]<br />

37[40]<br />

Genzyme $2.63 B [20%] $6<strong>50</strong> M Cerezyme $1.01 B<br />

Cambridge, MA [genzyme.com]<br />

Gilead Sciences $2.59 B [43%] $384 M Truvada $1.19 B<br />

Foster City, CA [gilead.com]<br />

Serono $2.<strong>50</strong> B [7%] $560 M Rebif $1.45 B<br />

Geneva [merckserono.net]<br />

[62]<br />

PERCENT OF THE<br />

GROWTH IN THE<br />

MARKETPLACE<br />

FUELED BY<br />

SPECIALIST-<br />

DRIVEN<br />

PRODUCTS<br />

THE COMBINED R&D INVESTMENT<br />

OF PhRMA MEMBERS IN 2006<br />

SOURCE: IMS MIDAS, MAT December 2006<br />

(left) IMS (right); <strong>50</strong> EXEC PHARM SOURCE:<br />

TOP 10 R&D SPEND<br />

Company Total R&D Spend US billions<br />

1. Pfizer<br />

2. GlaxoSmithKline<br />

3. Sanofi-Aventis<br />

4. Novartis<br />

5. Johnson & Johnson<br />

6. Merck<br />

7. AstraZeneca<br />

8. Schering AG<br />

9. Amgen<br />

10. Lilly<br />

$7.599<br />

$6.549<br />

$5.844<br />

$5.474<br />

$5.0<br />

$4.783<br />

$3.902<br />

$3.520<br />

$3.366<br />

$3.129<br />

A <strong>Pharm</strong><strong>Exec</strong> Graphic<br />

[$43B]<br />

Akzo Nobel $2.24 B [22%] $639 M Puregon/Follistim $0.51 B<br />

Arnhem, Netherlands [akzonobel.com]<br />

Alcon $2.01 B [14%] $292 M Glaucoma products $0.69 B<br />

Hünenberg, Switzerland [alcon.com]<br />

38 CSL $1.97 B [8%] $120 M Helixate $0.39 B<br />

Victoria, Australia [csl.com.au]<br />

39 [46]<br />

40 [42]<br />

King <strong>Pharm</strong>aceutical $1.89 B [13%] $254 M Altace $0.65 B<br />

Bristol, TN [kingpharm.com]<br />

Watson $1.86 B [14%] $131 M Ferrlecit $0.13 B<br />

Corona, CA [watson.com]

110 PHARMACEUTICAL EXECUTIVE<br />

MAY 2007 www.pharmexec.com<br />

Rank Company & Headquarters 2006 Global <strong>Pharm</strong>a R&D 2006 Top-<br />

[’05 Rank] [Web site] Sales [change from 2005] Spend Selling Drugs [2006 sales]<br />

41 [43]<br />

Biogen Idec<br />

Cambridge, MA [biogen.com]<br />

$1.78 B [10%] $718 M Avonex $1.71 B<br />

42 [38]<br />

Mitsubishi <strong>Pharm</strong>a<br />

Osaka, Japan [www.m-pharma.co.jp]<br />

$1.73 B [-9%] $408 M NA N/A<br />

43 Cephalon Frazer, PA [cephalon.com]<br />

$1.72 B [48%] $403 M Provigil $0.74 B<br />

44 [41]<br />

Lundbeck<br />

Copenhagen, Denmark [lundbeck.com]<br />

$1.66 B [.3%] $351 M Cipralex $0.63 B<br />

45 Dainippon Sumitomo<br />

Osaka, Japan [ds-pharma.co.jp]<br />

$1.64 B [44%] $252 M Amiodin $0.48 B<br />

TOP THERAPEUTIC CLASSES BY US SALES<br />

<strong>The</strong>rapeutic Class 2006 Sales in Billions*<br />

*Represents prescription pharmaceutical<br />

Lipid regulators $21.6 purchases including insulin at wholesale<br />

Proton pump inhibitors<br />

Antidepressants<br />

Antipsychotics<br />

Erythropoietins<br />

Seizure disorders<br />

Monoclonal antibodies<br />

$13.6<br />

$13.5<br />

$11.5<br />

$10.0<br />

$8.9<br />

$5.8<br />

prices by retail, food stores and chains,<br />

mass merchandisers, independent<br />

pharmacies, mail services, non-federal<br />

and federal hospitals, clinics, closed-wall<br />

HMOs, long-term care pharmacies, home<br />

healthcare, and prisons/universities.<br />

Excludes co-marketing agreements.<br />

Angiotensin II antagonists $5.7<br />

Joint-ventures assigned to product owner.<br />

Insulin sensitizer $4.8<br />

Data run by redesign to include completed<br />

Calcium blockers $4.7 mergers and acquisitions.<br />

A <strong>Pharm</strong><strong>Exec</strong> Graphic<br />

[22]<br />

PERCENT<br />

THAT GLOBAL<br />

SALES OF<br />

GENERICS GREW<br />

IN 2006<br />

46 [44]<br />

THE NUMBER OF<br />

PRODUCTS IN<br />

CLINICAL DEVELOPMENT<br />

GREW 7 PERCENT TO<br />

[2,075]<br />

[6.5]<br />

PERCENT THAT<br />

VOLUME OF<br />

PRESCRIPTION<br />

SALES ROSE<br />

ONCOLOGICS WAS THE<br />

FASTEST-GROWING<br />

CATEGORY, UP 20.5<br />

PERCENT. ERBITUX,<br />

AVASTIN, RITUXAN, AND<br />

HERCEPTIN EMERGED AS<br />

WINNERS<br />

Shire $1.54 B [16%] $387 M Adderall XR $0.86 B<br />

Hampshire, England [shire.com]<br />

47 Nycomed <strong>Pharm</strong>a* $1.<strong>50</strong> B [70%] $49 M Calcichew $0.12 B<br />

Luxembourg [nycomed.com]<br />

48 [45]<br />

Shionogi Seiyaku $1.43 B [-9%] $0 M Flomox $0.29 B<br />

Osaka, Japan [shionogi.co.jp]<br />

49 Actavis $1.40 B [219%] $88 M Gabapentin $0.06 B<br />

Hafnarfjordur, Iceland [actavis.com]<br />

<strong>50</strong> [47]<br />

Tanabe Seiyaku $1.35 B [-9%] $2 M Herbesser $0.16 B<br />

Osaka, Japan [tanabe.co.jp]<br />

*Altana and Nycomed merged in December 2006, but we reported the numbers as if they completed the year independently.<br />

SOURCE: IMS Health<br />

SOURCE: IMS Health