programme - CFO Insight

programme - CFO Insight

programme - CFO Insight

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

17 OCTOBER<br />

Roundtable Session I 1.30 p.m.-2.30 p.m.<br />

Bonds vs. Loans – Pros and Cons<br />

from an Issuer's Perspective<br />

Deciding whether to raise large amounts of debt via loans or bonds<br />

may be one of the most crucial decisions for a <strong>CFO</strong> in terms of structuring<br />

a company’s funding. Hearing an experienced issuer’s opinion<br />

is of essential importance to making the right decision.<br />

PARTICIPANTS<br />

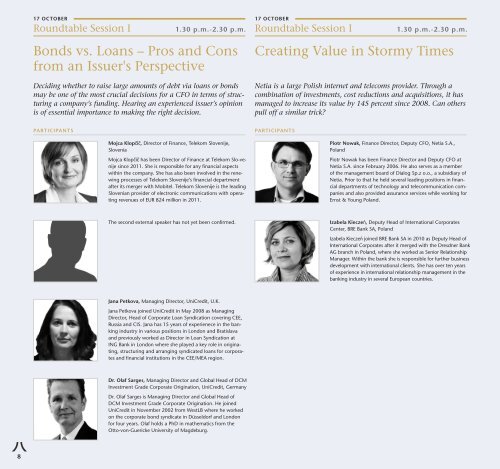

Mojca Klopčič, Director of Finance, Telekom Slovenije,<br />

Slovenia<br />

Mojca Klopčič has been Director of Finance at Telekom Slo-venije<br />

since 2011. She is responsible for any financial aspects<br />

within the company. She has also been involved in the renewing<br />

processes of Telekom Slovenije’s financial department<br />

after its merger with Mobitel. Telekom Slovenije is the leading<br />

Slovenian provider of electronic communications with operating<br />

revenues of EUR 824 million in 2011.<br />

The second external speaker has not yet been confirmed.<br />

Jana Petkova, Managing Director, UniCredit, U.K.<br />

Jana Petkova joined UniCredit in May 2008 as Managing<br />

Director, Head of Corporate Loan Syndication covering CEE,<br />

Russia and CIS. Jana has 15 years of experienece in the banking<br />

industry in various positions in London and Bratislava<br />

and previously worked as Director in Loan Syndication at<br />

ING Bank in London where she played a key role in originating,<br />

structuring and arranging syndicated loans for corporates<br />

and financial institutions in the CEE/MEA region.<br />

Dr. Olaf Sarges, Managing Director and Global Head of DCM<br />

Investment Grade Corporate Origination, UniCredit, Germany<br />

Dr. Olaf Sarges is Managing Director and Global Head of<br />

DCM Investment Grade Corporate Origination. He joined<br />

UniCredit in November 2002 from WestLB where he worked<br />

on the corporate bond syndicate in Düsseldorf and London<br />

for four years. Olaf holds a PhD in mathematics from the<br />

Otto-von-Guericke University of Magdeburg.<br />

17 OCTOBER<br />

Roundtable Session I 1.30 p.m.-2.30 p.m.<br />

Creating Value in Stormy Times<br />

Netia is a large Polish internet and telecoms provider. Through a<br />

combination of investments, cost reductions and acquisitions, it has<br />

managed to increase its value by 145 percent since 2008. Can others<br />

pull off a similar trick?<br />

PARTICIPANTS<br />

Piotr Nowak, Finance Director, Deputy <strong>CFO</strong>, Netia S.A.,<br />

Poland<br />

Piotr Nowak has been Finance Director and Deputy <strong>CFO</strong> at<br />

Netia S.A. since February 2006. He also serves as a member<br />

of the management board of Dialog Sp.z o.o., a subsidiary of<br />

Netia. Prior to that he held several leading positions in financial<br />

departments of technology and telecommunication companies<br />

and also provided assurance services while working for<br />

Ernst & Young Poland.<br />

Izabela Kieczeń, Deputy Head of International Corporates<br />

Center, BRE Bank SA, Poland<br />

Izabela Kieczeń joined BRE Bank SA in 2010 as Deputy Head of<br />

International Corporates after it merged with the Dresdner Bank<br />

AG branch in Poland, where she worked as Senior Relationship<br />

Manager. Within the bank she is responsible for further business<br />

development with international clients. She has over ten years<br />

of experience in international relationship management in the<br />

banking industry in several European countries.